来源:追寻价值之路

作者:燕翔、许茹纯、朱成成、金晗

近期美国长端国债利率持续上行,再度成为市场关注的焦点。我们认为联储议Taper提上日程是近期美债利率上行的重要原因,目前市场对于美联储在11月议息会议后宣布开启Taper存有较强的共识。

实际上历史经验也显示,美债利率上行往往都伴随着美国经济的复苏、通胀的走高以及美联储货币政策的收紧。1982年来美国10年期共在七个阶段均出现过较大幅度的上行,从历次美债利率上行的美股历史经验来看,标普500指数在利率上行期收涨概率较大。从A股市场表现来看,wind全A在美债利率上行期同样收涨概率较大,结构上看,美债利率上行期内A股市场中信息技术和消费等板块表现相对较好。

实际上历史经验也显示,美债利率上行往往都伴随着美国经济的复苏、通胀的走高以及美联储货币政策的收紧。1982年来美国10年期共在七个阶段均出现过较大幅度的上行,从历次美债利率上行的美股历史经验来看,标普500指数在利率上行期收涨概率较大。从A股市场表现来看,wind全A在美债利率上行期同样收涨概率较大,结构上看,美债利率上行期内A股市场中信息技术和消费等板块表现相对较好。

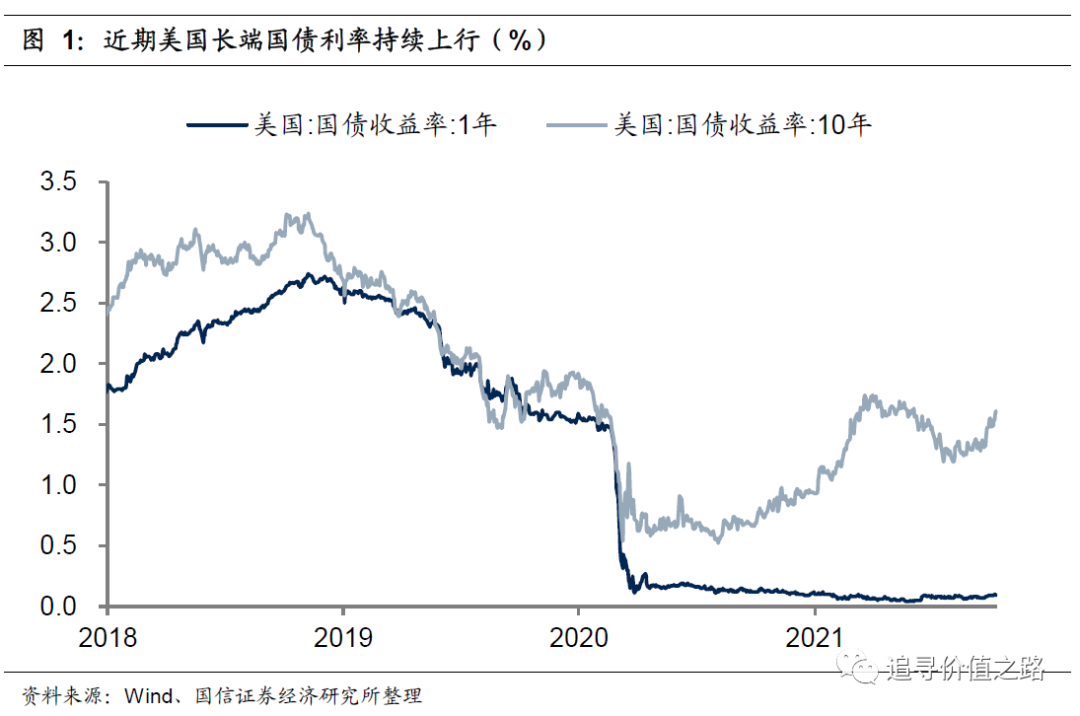

近期美国长端国债利率持续上行,再度成为市场关注的焦点。9月份以来,美国长短端国债利率走势出现分化,其中美国1年期国债利率仍在低位徘徊,而10年期国债利率则持续走高,截至10月8号,美国10年期国债利率录得1.61%,已经十分逼近今年3月份的年内高点。与此同时,9月份以来美股三大指数走势震荡,小幅收跌,因此美债利率大幅走高对权益市场的影响也再度成为市场关注的焦点。

我们认为联储议Taper提上日程是近期美债利率上行的重要原因。9月22日,美联储公布了9月FOMC会议声明,继续维持联邦基金利率(0-0.25%)和资产购买规模(每月800亿美元国债和400亿美元MBS)不变。随后鲍威尔接受采访表示明年年中结束Taper,目前市场对于美联储在11月议息会议后宣布开启Taper存有较强的共识。

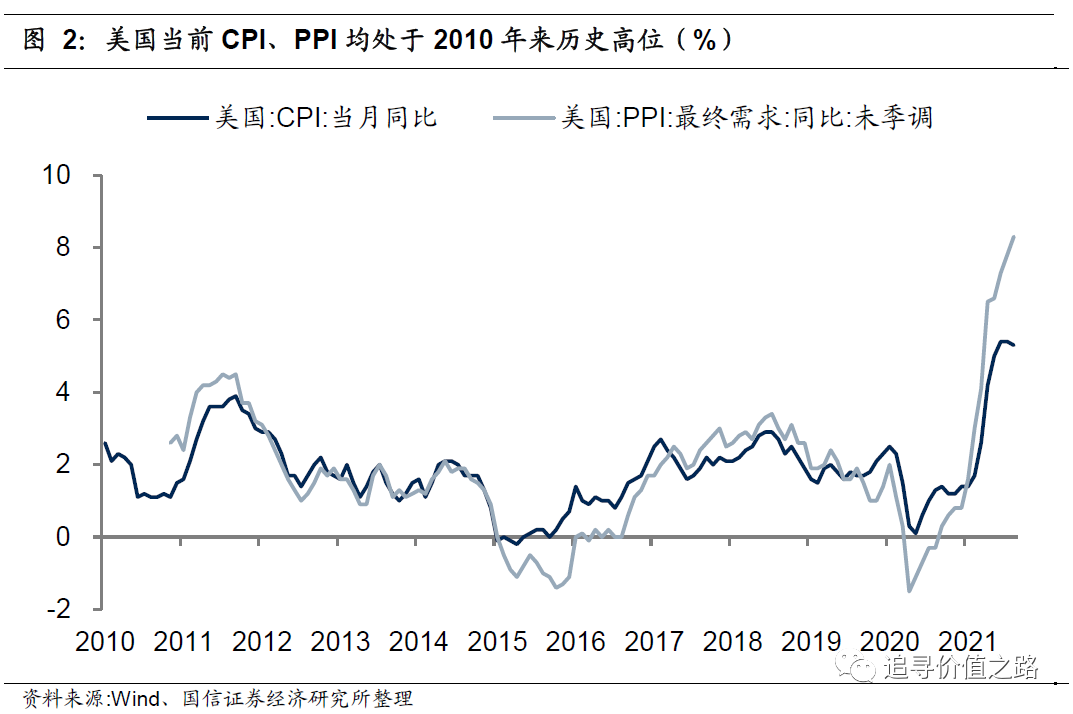

此外商品价格攀升、美国通胀走高也是美债利率上行的重要支撑。去年受新冠疫情的影响,全球经济大幅下挫,大宗商品价格同样在去年上半年达到了低点。不过去年下半年来,随着疫情逐渐得到控制,全球经济开始持续复苏,大宗商品价格也出现了大幅的攀升。在商品价格走高的同时美国通胀也开始走高,最新的美国8月份CPI和PPI同比分别为5.3%和8.3%,均处于2010年以来的历史高位。

实际上历史经验也显示,美债利率上行往往都伴随着美国经济增长的复苏、通货膨胀率的走高以及美联储货币政策有所收紧。1982年来美国10年期在以下七个阶段均出现过较大幅度的上行:(1)1983年4月至1984年6月;(2)1986年8月至1987年9月;(3)1994年1月至1994年11月;(4)1998年9月至2000年5月;(5)2008年12月至2010年3月;(6)2012年7月至2013年12月;(7)2016年7月至2018年10月。并且在大多数情况下,我们发现美债利率上行往往都伴随着美国经济的复苏、通胀的走高以及美联储货币政策的收紧。

从上世纪80年代以来历次美债利率上行的美股历史经验来看,标普500指数在利率上行期收涨概率较大。在我们统计的7次美债利率上行期内,标普500指数仅有2次出现小幅下跌,其余5次均出现较大程度的上涨,并且在美债利率见顶后的1个月、3个月以及6个月时间里,标普500指数同样表现不算差。

从历次美债利率上行的A股市场表现来看,wind全A在利率上行期同样收涨概率较大,结构上看,信息技术和消费等板块表现相对较好。在我们统计的4次美债利率上行期内,wind全A仅有1次出现小幅下跌,其余3次均出现较大程度的上涨,并且在美债利率见顶后的1个月、3个月以及6个月时间里,wind全A同样表现不算差。

美债利率上行期的市场表现

近期美国长端国债利率持续上行,再度成为市场关注的焦点。9月份以来,美国长短端国债利率走势出现分化,其中美国1年期国债利率仍在低位徘徊,而10年期国债利率则持续走高,截至10月8号,美国10年期国债利率录得1.61%,已经十分逼近今年3月份的年内高点。与此同时,9月份以来美股三大指数走势震荡,小幅收跌,因此美债利率大幅走高对权益市场的影响也再度成为市场关注的焦点。

我们认为联储议Taper提上日程是近期美债利率上行的重要原因。9月22日,美联储公布了9月FOMC会议声明,继续维持联邦基金利率(0-0.25%)和资产购买规模(每月800亿美元国债和400亿美元MBS)不变。随后鲍威尔接受采访表示明年年中结束Taper,目前市场对于美联储在11月议息会议后宣布开启Taper存有较强的共识。

此外商品价格攀升、美国通胀走高也是美债利率上行的重要支撑。去年受新冠疫情的影响,全球经济大幅下挫,大宗商品价格同样在去年上半年达到了低点。不过去年下半年来,随着疫情逐渐得到控制,全球经济开始持续复苏,大宗商品价格也出现了大幅的攀升。在商品价格走高的同时美国通胀也开始走高,最新的美国8月份CPI和PPI同比分别为5.3%和8.3%,均处于2010年以来的历史高位。

实际上历史经验也显示,美债利率上行往往都伴随着美国经济增长的复苏、通货膨胀率的走高以及美联储货币政策有所收紧。1982年来美国10年期在以下七个阶段均出现过较大幅度的上行:(1)1983年4月至1984年6月;(2)1986年8月至1987年9月;(3)1994年1月至1994年11月;(4)1998年9月至2000年5月;(5)2008年12月至2010年3月;(6)2012年7月至2013年12月;(7)2016年7月至2018年10月。并且在大多数情况下,我们发现美债利率上行往往都伴随着美国经济增长的复苏、通货膨胀率的走高以及美联储货币政策的收紧。

从上世纪80年代以来历次美债利率上行的美股历史经验来看,标普500指数在利率上行期收涨概率较大。在我们统计的7次美债利率上行期内,标普500指数仅有2次出现小幅下跌,其余5次均出现较大程度的上涨,并且在美债利率见顶后的1个月、3个月以及6个月时间里,标普500指数同样表现不算差。

从历次美债利率上行的A股市场表现来看,wind全A在利率上行期同样收涨概率较大。在我们统计的4次美债利率上行期内,wind全A仅有1次出现小幅下跌,其余3次均出现较大程度的上涨,并且在美债利率见顶后的1个月、3个月以及6个月时间里,wind全A同样表现不算差。

结构上看,美债利率上行期内A股市场中信息技术和消费等板块表现相对较好。2008年12月至2010年3月A股市场中信息技术(153%)、可选消费(150%)和原材料(113%)三个板块大幅领涨。2012年7月至2013年12月A股市场中信息技术(60%)、医疗保健(41%)和可选消费(35%)三个板块大幅领涨。2016年7月至2018年10月A股市场中金融板块(12%)逆势收红,必需消费(-2%)和能源(-4%)表现同样较为抗跌。

编辑/tina