Stock speculation to see Jin Kirin analyst research report, authoritative, professional, timely, comprehensive, to help you tap the potential of the theme opportunity!

Source: Kingfisher Capital

Recently, a debt acquisition has attracted market attention.

Step-by-step pharmaceuticals(603858.SH) start the epitaxial acquisition, and the target of the acquisition has been established for only one year.

Step-by-step pharmaceuticals(603858.SH) start the epitaxial acquisition, and the target of the acquisition has been established for only one year.

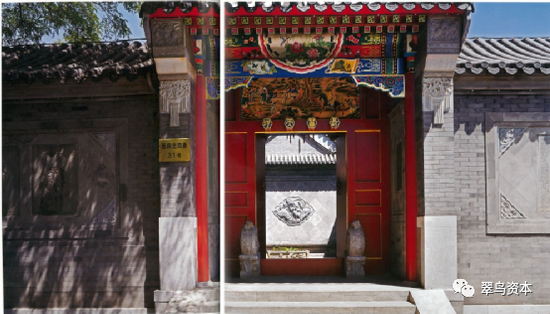

Step Pharmaceuticals described the acquisition as follows: the company's acquisition of Beijing Cheng Rui is to acquire a historic courtyard property in the central urban area of Beijing, which has a superior location and rich history. This acquisition will help the company to build a traditional Chinese medicine culture platform on this basis, and the company plans to build a museum of traditional Chinese medicine culture.

The capital operation of a "beauty" is full of questions.

In the face of the foreign acquisition inquiry letter issued by the Shanghai Stock Exchange, step Pharmaceutical's reply raised more questions.

Start with the "poor performance company"

Throughout the announcement of step Pharmaceutical, we can always see the plan of "Johnson & Johnson of China, the step of the world".

It can be seen that the strategic goal of the company is to "become the Chinese version of Johnson & Johnson". Public data show that Buchang Pharmaceutical is mainly engaged in the research and development, production and sale of proprietary Chinese medicine, and its main products are related to the field of proprietary Chinese medicine for cardiovascular and cerebrovascular diseases, as well as other fields such as gynecological medicine. and is marching and expanding into bio-pharmaceuticals, vaccines and other medical high-tech fields. According to the annual report, the company's main business is tablets, hard capsules, granules, pills (honey pills, concentrated pills, water pills, honey pills), oral liquid.

Recently, the company issued an acquisition announcement that the company and its wholly-owned subsidiary Shenzhou Pharmaceutical intend to acquire a 100% stake in Beijing Chengrui Technology Co., Ltd. (hereinafter referred to as "Beijing Chengrui").

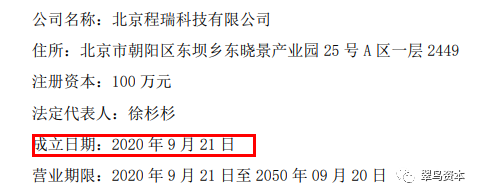

However, the Beijing-based company was established in September 2020 and has been established for only one year, with a wide range of operations, such as technology development, consulting and transfer, application software services, and undertaking exhibition activities. The business contents related to pharmaceutical manufacturing are natural science research and experimental development, medical research (excluding diagnosis and treatment activities).

According to Sky Eye, the company was labeled as a computer technology developer.

Let's take a look at the financial data of this company.

The announcement revealed that as of August 31, 2021, Beijing Cheng Rui had total assets of 221 million yuan, total liabilities of 256 million yuan and net assets of-34.6521 million yuan.

Looking at the data for the year, Cheng Rui in Beijing had an operating income of 0 yuan in the first eight months of this year, while a net profit loss of 35.6421 million yuan in the same period.

Seeing this, investors inevitably wonder why they should buy a new company with poor performance.

The underlying asset involves a huge amount of debt

Reading through this announcement, there are other questions about the acquisition of step Pharmaceuticals.

The acquisition actually involves a debt transfer: Cheng Rui of Beijing, the subject of the acquisition, and Tian Wenlong, a creditor, signed the creditor's Rights transfer Agreement and its supplementary agreements on September 22 and 23, 2020.

Regardless of the amount, the above time point is quite sensitive.

This means that the debt issue was involved the day after Cheng Rui was founded in Beijing.

According to the announcement, Beijing Cheng Rui now assumes a total debt of 252 million yuan to its creditors Tian Wenlong, of which the principal of the debt is 219 million through consultation. Beijing Cheng Rui's debt to Tian Wenlong is transferred to step Pharmaceutical at the time of the equity transfer, which is borne by step Pharmaceutical.

On the eve of the disclosure of the acquisition announcement, Beijing Cheng Rui repaid 1.07 million yuan to its creditor Tian Wenlong in September 2021.

Take over the "nested debt" in disguise

The 252 million yuan debt mentioned above has a complicated history.

It is unusual for Cheng Rui in Beijing to have debt on the second day of its establishment, but the acquisition announcement did not explain the source of the debt after penetration.

Step Pharmaceutical's latest reply to the announcement of the exchange revealed that the 252 million yuan of debt owed by the underlying company to its creditor Tian Wenlong was derived from Beijing Cheng Rui's assignment of Tian Wenlong's creditor's rights to Sun Pengcheng and Yu Xiuqing.

In other words, Tian Wenlong "sold" his debt directly to Beijing Cheng Rui.

The transferred debt originated in 2018. Tian Wenlong enjoys loan principal, interest, liquidated damages and other claims to Sun Pengcheng and Yu Xiuqing.

At that time, it even went directly to court, and the "Civil Mediation statement" issued by the third Intermediate people's Court of Beijing revealed a lot of information.

It is worth noting that although Tian Wenlong is a creditor, he occupies the house during the occupation fee of 3.069 million yuan to offset the interest and liquidated damages of this dispute.

On September 23, 2020, Beijing Cheng Rui and Tian Wenlong signed a "Supplementary Agreement" ("creditor's Rights assignment Agreement"). Both sides made it clear that Sun Pengcheng and Yu Xiuqing, the original debtors of the case actually being executed, in addition to the above-mentioned transfer amount, also owed Tian Wenlong 4 million yuan in debt, and the debt belongs to Tian Wenlong.

However, at that time, Beijing Cheng Rui had just been established, but according to the transfer agreement, Beijing Cheng Rui paid interest to Tian Wenlong at the highest annual interest rate allowed by law (15.4%) for the transfer of creditor's rights not paid to Tian Wenlong.

But oddly enough, as of October 15, 2021, Beijing Cheng Rui will not be able to repay its debts, but after the acquisition is completed, Beijing Cheng Rui will still have to repay its debts to Tian Wenlong.

The announcement revealed that in the course of negotiations between step Pharmaceutical and Tian Wenlong, a creditor of Beijing Cheng Rui, Tian Wenlong agreed that all debts owed by Beijing Cheng Rui to Tian Wenlong would no longer bear interest from August 31, 2021, but the company should repay all debts owed to Tian Wenlong on behalf of Beijing Cheng Rui.

Torture of debt acquisition

There is another detail that needs to be clarified, that is, the true identity of the creditor Tian Wenlong.

According to Tianyan investigation, the major shareholder of Beijing Cheng Rui, the underlying asset, is Longle Zhixin Group, and Tian Wenlong is the actual controller of Longle Zhixin Group.

Judging from the business scope of Longle Zhixin Group, the company does not have the genes of medical biology. It can be seen that step Pharmaceuticals acquired a company that did not overlap with its business, and it was a debt-bearing acquisition.

Equity acquisitions can be divided into two categories: debt acquisition and non-debt acquisition. According to the transaction consideration composition of debt acquisition, that is, total transaction consideration = debt transfer consideration + equity transfer consideration. Among them, debt acquisition means that under the condition that assets and debts are equivalent, the company accepts its assets on the condition of assuming the debts of the merged party, and realizes zero-cost acquisition.

In this deal, Longle Zhixin Group has a 99% stake in the underlying assets. The transfer of equity is 20.4441 million yuan, the debt is 251 million yuan, and the total transaction price is 271 million yuan (excluding taxes and fees).

Step Pharmaceutical described the acquisition as follows: "the purpose of the company's acquisition of Beijing Cheng Rui is to acquire a historic courtyard real estate located in the central urban area of Beijing, which has a superior geographical location and rich history. This acquisition will help the company to build a traditional Chinese medicine culture platform on this basis, and the company plans to build a traditional Chinese medicine culture museum to facilitate the company to carry out traditional Chinese medicine culture, business publicity activities and academic exchange activities. "

Is step Pharmaceutical really just to buy a siheyuan in Xisi, Beijing? Do I have to buy it? Can't I rent it? By the way, if this courtyard house is bought, can the majority of minority shareholders of step Pharmaceutical go?