The three major US stock indexes hit five new highs, and the energy sector continued to lead the decline against the market. Tesla, Inc. rose more than 3 per cent, hit five new highs in six days, Lyft rose more than 8 per cent, and Gao Gao rose 7 per cent after the overall trading. After the Fed's decision, the S & P Dow rose, and the dollar index, which was close to its highest level in more than two weeks, plunged below 94 yuan and the yield on 10-year Treasuries rose as much as 1.60% in intraday trading. The pan-European stock index hit three new highs, Lufthansa rose 7%, and the oil and gas sector fell nearly 3%. The daytime upsurge of thermal coal and coke closed lower in the inner market. Crude oil closed down more than 3%, the biggest drop in three months, and cloth oil hit a three-month low. Natural gas in Europe rose by more than 10%, the biggest increase in a month. Gold fell the most in nearly three weeks and hit a three-week low. Lun copper nearly four weeks new low, Lun tin nearly two weeks new high.

The Federal Reserve Taper as scheduled, but Fed Chairman Powell sent a dove signal, acting as the white horse knight who rescued U. S. stocks on Wednesday.

Before the end of the Fed monetary policy meeting, the three major US stock indexes fell at one point in midday trading on Wednesday, led by the energy sector. Before the announcement of the resolution after the meeting, only the Nasdaq rose, and the overall fluctuation was relatively small. At midday, Fed officials announced that they would start Taper this month, buying 15 billion dollars less bonds each month. Powell said after the meeting that the start of Taper does not mean that the Fed "can be patient" in terms of the timing of rate increases, and stressed that now is not the time to raise interest rates.

After the Federal Reserve announced the decision, US stocks jumped, the S & P and the Dow rose one after another, and the dollar index, which was close to its high in more than two weeks, plunged and quickly fell below the 94 mark. The yield on the benchmark 10-year US bond rose, once again above 1.60%.

After the Federal Reserve announced the decision, US stocks jumped, the S & P and the Dow rose one after another, and the dollar index, which was close to its high in more than two weeks, plunged and quickly fell below the 94 mark. The yield on the benchmark 10-year US bond rose, once again above 1.60%.

European stocks, which closed before the Fed's decision, continued to be supported by positive corporate earnings, and the pan-European stock index continued to hit record highs, but the oil and gas sector affected by the plunge in crude oil led the decline. Shares in Lufthansa, the German airline that posted its first quarterly profit since the outbreak of COVID-19, and TeamViewer, a software company that confirmed third-quarter results and full-year guidance, surged in Raiffeisen Bank International, an Austrian bank with strong revenues and better-than-expected quarterly net profit.

Among commodities, international crude oil futures suffered a double whammy on Wednesday. First, the US Department of Energy announced that EIA crude oil inventories rose more than expected last week, rising for two consecutive weeks. Crude oil production for six consecutive weeks was higher than expected. International crude oil futures fell more than 3% in one day. Brent crude fell to a nearly three-month low. Us WTI crude oil fell below $80 at one point after the day, and the intraday decline widened to more than 5%. But natural gas in Europe and the United States continued to rise, with European natural gas rising by more than 10% a day for the first time in nearly a month.

Among other commodities, ADP added more private jobs than expected in October, and gold futures fell sharply, closing down more than 1% a day for the first time in nearly three weeks. After the announcement of the Fed's decision, gold's decline narrowed as the dollar weakened. Most industrial metals, such as Lun copper, continued to fall, but Lunxi rebounded, rising above the $37000 mark for the first time in nearly two weeks.

Among domestic commodities, after the National Development and Reform Commission issued a document saying that Shanxi, Inner Mongolia and Shaanxi severely cracked down on illegal coal storage sites and a number of coal enterprises took the initiative to reduce coal prices at pit head, the night market of the "three coal brothers", which soared during the day, fell, and thermal coal and coking coal closed down. Coking coal, which rose nearly 13% during the day, closed up nearly 3%.

The S & P Dow rose in intraday trading and the energy sector continued to lead the decline against the market. Tesla, Inc. hit five new highs in six days and the pan-European stock index hit three new highs, but the oil and gas sector fell.

The three major US stock indexes opened mixed. The s & p 500 and the Dow Jones industrial average both opened lower, with the s & p down about 0.2% in early trading and the Dow down about 160 points, or more than 0.4%, at midday lows. The high-opening Nasdaq composite index fell for a short time at the beginning of the session and generally maintained its upward trend after the rally, but even when it hit a new intraday high at the end of the morning session, it rose only 0.2% on the day.

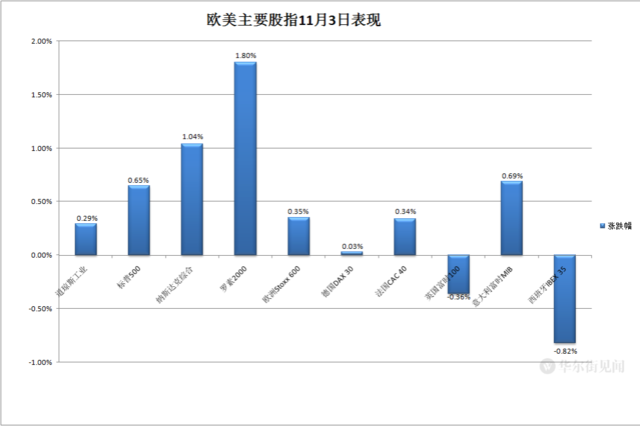

After the announcement of the Fed's decision, the S & P and the Dow rose one after another, and the three major indexes all refreshed their intraday highs in late trading. The Dow rose more than 120 points, the S & P rose nearly 0.7%, and the Nasdaq rose more than 1%. In the end, the three major indexes rose for the fifth day in a row and closed at a new high. The Dow closed up 104.95 points, or 0.29%, at 36157.58. The S & P 500 closed up 0.65% at 4660.57. The Nasdaq closed up 1.04% at 15811.58.

Small-cap stocks outperformed the market on the second day of the week after Monday, with the value-dominated small-cap stock index Russell 2000 up 1.8 per cent. The tech-heavy Nasdaq 100 index closed up 1.08%, barely keeping up the trend of outperforming the market.

Only three of the major sectors of the S & P 500 closed down on Wednesday, while the energy sector, which fell more than 0.8%, led the decline for the second day in a row. Among the eight sectors in which public utilities and industry fell by about 0.3% and 0.2%, respectively, consumer discretionary goods rose by more than 1.8%, followed by materials which also rose more than 1% and essential consumer goods which rose nearly 0.9%, while the financial sector with the smallest increase rose nearly 0.4%.

Leading technology stocks closed higher across the board, while Tesla, Inc. closed up nearly 3.6%, not only erasing Tuesday's decline, but also closing at a record high on the fifth day of the last six trading days. Among FAANMG's six largest technology stocks, Amazon.Com Inc rose more than 2%, Facebook Inc and Netflix Inc, who have changed their names to Meta, both rose more than 1%, Apple Inc rose nearly 1%, Alphabet Inc-CL C's parent company Alphabet rose 0.8%, and Microsoft Corp rose nearly 0.3%.

Among the stocks that reported results, Lyft (LYFT), which surprised the market that EPS did not lose money but made a profit in the third quarter, closed up about 8.2%; CVS Health Corp (CVX), whose third-quarter profit was higher than expected and raised its annual guidance, rose 5.7%; T-Mobile (TMUS), whose third-quarter revenue was lower than expected but made a profit higher than expected, rose more than 5%; despite higher-than-expected third-quarter earnings, video game company Activision Blizzard (ATVI) fell more than 14%. Qualcomm Inc's shares rose sharply in after-hours trading, rising as much as 7 per cent at one point after the announcement of a higher-than-expected surge in EPS earnings and revenue in the third quarter.

Among the more volatile stocks, online real estate platform Zillow (ZG) closed down nearly 23% after it announced on Tuesday that it would withdraw from the "real estate" business, resulting in a 1/4 reduction in staff. 3B Home (BBBY) rose more than 15% after announcing on Tuesday various strategic changes such as a partnership with Kroger, the largest grocery supermarket chain in the United States. Cameco Corp (CCJ), which was upgraded to buy by Bank of America Corporation, rose more than 8%. Gap (GPS) rose more than 5 per cent after reaching an agreement to sell 11 stores in Italy to Italian retailer OVS; Generac (GNRC), which was downgraded by Bank of America Corporation and UBS, closed down more than 6.2 per cent; and Deere & Co (DE) fell more than 3 per cent after employees at its 12 factories refused temporary labour contracts and went on strike.

Most popular US-listed stocks rose, with ETF KWEB and CQQQ closing up more than 1.3 per cent and 0.6 per cent, respectively. Education rose more than 6%, Dingdong rose more than 4%, Tencent ADR rose more than 3.8%, RLX Technology rose nearly 3%, Alibaba, Weibo Corp, Xunlei, Zhihu Inc., Senmiao Technology, Baidu rose nearly 2%, HUYA Inc., LUCKN COFFEE DRC, NetEase, Inc youdao rose more than 1%, LAIX Inc. and JD.com rose more than 0.8%, NIO Inc cars rose more than 0.5%, while Full Truck Alliance fell more than 3.5%, Kaixin Auto fell more than 3.4%. Li Auto Inc. and TAL Education Group fell more than 0.7%, XPeng Inc. fell more than 0.5%.

In terms of European stocks, the pan-European stock index rose for the fifth day in a row, and the European Stoxx 600 index hit a new high for the third day in a row. Stock indexes of major European countries continued to rise and fall, with French and German stocks rising for five days and three days in a row, Italian stocks rebounding and British and western stocks falling for two days in a row.

Among the Stoxx 600 sectors, only three stocks fell on Wednesday: oil and gas, which fell nearly 3%, retail, which fell more than 1%, and utilities, which fell more than 0.7%. Technology led the rise by nearly 1%. Among the stocks, Lufthansa rose 7 per cent, Vestas Bank International rose 11 per cent, BMW, which had higher-than-expected quarterly profits but reiterated warnings of a global lack of core, rose 1.5 per cent, and Vestas, the world's largest wind turbine maker, fell 18.2 per cent when its operating profit fell below expectations in the third quarter and lowered its full-year profit guidance.

Crude oil closed down at night in thermal coal and coke, the biggest closing decline in three months. Cloth oil hit a new low in nearly three months. European natural gas rose more than 10% after the US oil market fell.

Among the domestic black commodities, the "three coal brothers" soared during the day, coking coal rose nearly 13%, thermal coal rose more than 8%, coke rose nearly 8%, hot coil rose 1.6%, iron ore closed down 0.42%, thread closed down 0.07%; iron ore closed down 2.41% in night trading, power coal closed down 1.48%, thread closed down 0.99%, hot coil closed down 0.53%, coke closed down 0.21%, while coking coal closed up 2.92%.

Natural gas in Europe rose for the third day in a row, further expanding. On Wednesday, ICE UK gas futures closed up 13.53% at 196.72 pence per kcal, while TTF benchmark Dutch gas futures rose 11.74% to 79.500 euros per megawatt-hour in late trading, the biggest gain since Oct. 5.

Us gasoline and natural gas futures are mixed. NYMEX November gasoline futures closed down nearly 4.6% at $2.339 a gallon, giving up Tuesday's gains, while NYMEX December natural gas futures closed up nearly 2.31% at $5.6700 per million British thermal units for two consecutive days.

International crude oil futures fell sharply. Us WTI crude oil futures closed down 3.63% at US $80.86 per barrel. The monthly contract closed below US $81 for the first time since Oct. 13, falling for two days. Brent January crude oil futures closed down 3.22%, and US Oil closed the biggest closing decline since Aug. 2, to 81.99 US dollars per barrel. The main contract closed below 82 US dollars for the first time since Oct. 7.

After trading, US oil fell below US $80, and the intraday decline widened to more than 5%. At one point, cloth oil fell to US $81.1, down more than 4% during the day.

The yield on 10-year US bonds rose once again to 1.60% in intraday trading, and the yields on European bonds rose alone.

The prices of European government bonds continued to rebound and yields continued to fall on Wednesday, but gilts rebounded ahead of the Bank of England's decision on Thursday. By late European trading, the yield on UK benchmark 10-year bonds rose 3.5 basis points to 1.075 per cent, while German bunds fell 0.3 basis points to-0.168 per cent over the same period, continuing to stay away from the highest level since May 2019, which rose above-0.07 per cent on Friday. Greek bond yields fell 2.9 basis points over the same period, the largest decline among European countries.

Before the announcement of the Fed's decision, the yield on the US 10-year benchmark Treasury note was about 1.57%. After the announcement of the resolution, US stocks rose short-term above 1.60% at midday, and rose about 5 basis points in the day since Monday. By the end of the day, US stocks closed at about 1.59%, up 4 basis points on the day.

After the Fed announced the decision, the yield on two-year US Treasuries rebounded quickly, with 0.49 per cent refreshing day highs and rising about 5 basis points within the day, but gave up most of the gains during Powell's press conference, with US stocks closing above 0.46 per cent and up more than 1 basis point on the day. The yields on long-term bonds rose the most among all maturity bonds, while the yields on two-year short-term bonds rose at the bottom.

The dollar index, which is nearing a two-week high, dived below 94 in intraday trading.

The ICE dollar index (DXY), which tracks a basket of the dollar's six major currencies, rose above 94.20 in early trading, approaching the intraday high set on Oct. 13 on Monday, up more than 0.1%. After the Fed announced its decision, it quickly fell below 94.00. at one point, it fell to a fresh session low of 93.82 and fell nearly 0.3% on the day.

By Wednesday's close, the dollar index was below 93.90, down more than 0.2% on the day, while the Bloomberg dollar spot index fell about 0.3%, also falling off a three-week high.

Lunxi, a new low for nearly four weeks, gold reached a new high in nearly two weeks, the biggest closing decline in nearly three weeks, and a new after-hours decline narrowed in three weeks.

Most London base metal futures continued to fall. Copper, aluminum and nickel all fell for two days in a row. Luntu Copper, which fell back to its lowest level in more than two weeks on Tuesday, hit a nearly one-month low; Lomalco hit its lowest level since Aug. 27 a week later; and Lenny hit a three-week low. Lun zinc fell for three days in a row, hitting a two-week low.

Lunxi rebounded, erasing Tuesday's decline, closing at $37000 for the first time in nearly two weeks. Lun lead reversed three days of continuous decline, breaking away from the trough of nearly three weeks.

Precious metals fell across the board on Wednesday, with New York gold, silver, platinum and palladium futures all down for two days in a row. COMEX December gold futures closed down 1.4%, the biggest closing decline since Oct. 15, at $1763.90 an ounce, the lowest since Oct. 12. After the announcement of the Fed's decision, US stocks rose as high as $1770 at midday, narrowing their intraday losses to less than 0.9 per cent.

Edit / somer

美联储公布决议后,美股跳涨,标普和道指先后转涨,原本逼近两周多来高位的美元指数跳水,迅速跌穿94关口;基准10年期美债收益率拉升,一度重上1.60%。

美联储公布决议后,美股跳涨,标普和道指先后转涨,原本逼近两周多来高位的美元指数跳水,迅速跌穿94关口;基准10年期美债收益率拉升,一度重上1.60%。