Source: Xue Tao's macroscopic notes

To put it simply, there are three questions about the downside of US stocks: how fast will interest rates on US debt rise and where will they peak? How much room is there for a mean return to U. S. stock valuations relative to rising interest rates? Can earnings growth in US stocks withstand the contraction in valuations?

To put it simply, there are three problems for US stocks to fall: Treasuries, valuations and profits. (1) We use the four-factor model to predict that the high of the monthly center of US debt is 1.8% Mo 1.9%, and it will fall back after the second quarter, and the interest rate center of Chinese and US bonds will be about 1.75%. (2) there is a good chance that the EPS of the S & P 500 will still achieve high single-digit growth this year, and the profit risk comes from the impact of excessive tightening on demand by the Fed. (3) in an optimistic scenario, the expected return of SPX in its current position is 7%. If two of the above three occur: tight currency, weak growth and falling mood, the expected rate of return is likely to be negative. In a worst-case scenario, SPX still has 23% room to fall. (4) at present, the style interpretation of large-cap stocks has been relatively extreme, and the future excess return is not obvious. PMI and inflation expectations have peaked and fallen, and the suppression of interest rates on growth stocks ended after the second quarter. It is recommended to configure defense industries, such as communications, public utilities, essential consumption, and so on.

Expectations of raising interest rates have been fermenting since the beginning of the year. Long-end US bonds have risen rapidly since the end of last year, and US stocks have fallen rapidly after the Fed's sharp turn. The S & P 500s, NASDAQ and Dow Jones have retreated 9.2%, 14.7% and 6.8% respectively from their highs. The valuation of the S & P 500 has fallen to 23.66X (a 10-year average of 22.33X). How much room for the index to fall further?

(1) how fast will interest rates on US debt rise and where will they peak?

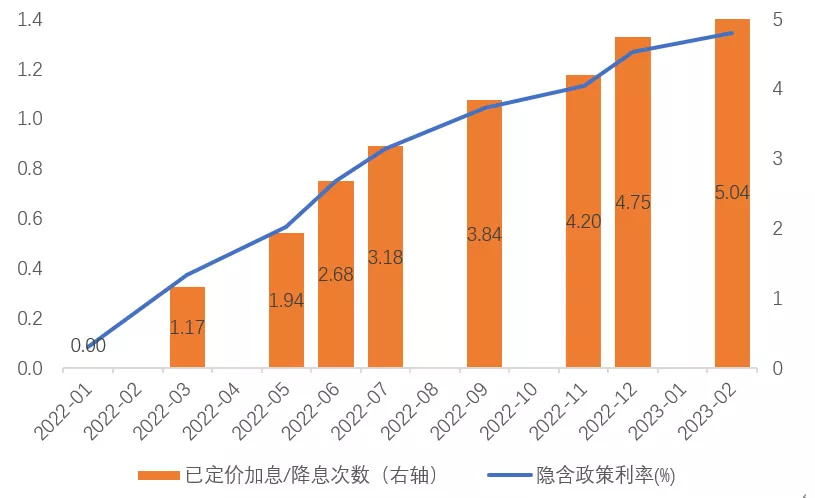

The market expects the Fed to raise interest rates 4.8 times for the whole year, and the current expectations of raising interest rates have been taken into account too much.

In the medium to long term, US bond yields are still dominated by fundamentals, while economic growth and falling inflation will dominate the policy path to dovish narrative. Under the circumstances that "the Fed did raise interest rates four times this year, the contraction table was opened in March, and inflation expectations remained high," we used a four-factor model to predict that the monthly high of US debt was 1.8%, 1.9%, and then fluctuated back down after the second quarter. The central interest rate center for US debt was about 1.75% in the middle of the year, and the slowdown in economy and inflation offset the impact of the contraction on long-end interest rates to some extent.

Figure 1: the current implied rate increases for federal futures are 1.2 in March, 2.7 in June, 3.8 in September and 4.8 in December.

Source: Bloomberg, Tianfeng Securities Research Institute

Source: Bloomberg, Tianfeng Securities Research Institute

(2) relative to rising interest rates, how much room is there for a mean return to US stock valuations?

For US stocks, the rise in real interest rates is relatively low, mainly led by a fall in inflation expectations, with little liquidity risk. However, the margin of liquidity has tightened, valuations are difficult to rise significantly, and the trend is mainly driven by profits, resulting in greater volatility.

The current valuations of the S & P 500, NASDAQ and Dow Jones are not extreme, with risk premiums at 29.3%, 49.4% and 14.3%, respectively. In contrast, when us stocks pulled back sharply due to rising interest rates in February and October 2018, valuations were at their most expensive level since 2011 (the risk premium was close to 0 per cent).

The pendulum of market sentiment drives the cycle of stock risk premium. Although the risk premium of US stocks still has room for a mean return from the median level, after a rapid decline, there is less room for US stock valuations to continue to contract sharply.

Figure 2:SPX, NASDAQ and DJONES have risk premiums of 29.3%, 49.5% and 14.3%, respectively.

Source: Bloomberg, Tianfeng Securities Research Institute

Source: Bloomberg, Tianfeng Securities Research Institute

(3) can the earnings growth of US stocks withstand the contraction of valuations?

In our "biggest disagreement overseas", we expect US economic growth to slow to 3 per cent this year but not stall, and FACTSET expects S & P 500EPS growth of 8.2 per cent in 2022, slightly higher than our estimate of nominal GDP growth (3 per cent real GDP+4.8%CPI). Given rising labour costs, the share of corporate profits in national income (or nominal GDP) is likely to fall from its all-time high in 2021, but companies are flush with cash on hand and listed companies will thicken EPS through buybacks. Therefore, we believe that the EPS of the S & P 500 is still likely to achieve high single-digit growth this year, and the profit risk comes from the impact of excessive Fed tightening on economic demand and corporate earnings.

Figure 3: EPS of the S & P 500 will reach $222.32 in 2022, according to stock analysts

Source: Factset, Tianfeng Securities Research Institute

Source: Factset, Tianfeng Securities Research Institute

Figure 4: profit margins of the S & P 500 may decline slightly

Source: Bloomberg, Tianfeng Securities Research Institute

Source: Bloomberg, Tianfeng Securities Research Institute

Figure 5: companies with abundant cash flow on hand can support stock buybacks and consumer credit has rebounded rapidly since the beginning of 2021 (in US $1 billion)

Source: Federal Reserve Board, Tianfeng Securities Research Institute

Source: Federal Reserve Board, Tianfeng Securities Research Institute

(4) how much more can SPX fall?

The different trend of economic fundamentals is reflected in the difference of performance growth, the different degree of loosening of monetary policy is reflected in the difference of interest rate center, and the position of market sentiment pendulum is reflected in the difference of risk premium. We measure the SPX point under different US bond yields and EPS growth assumptions.

In the benchmark case, assuming that market sentiment returns from optimism to neutrality, the risk premium rebounds from the current position to the historical median, EPS is expected to grow by 8 per cent, and the expected yield of the S & P 500 at the current position is-4 per cent, 9 per cent and 13 per cent under the three scenarios of low / medium / high US debt interest rates (1.75 per cent, 2.0 per cent and 2.25 per cent).

In an optimistic scenario, expectations of higher interest rates do not drive US bond yields higher (the interest rate hub remains 1.75 per cent), market sentiment is optimistic (risk premiums remain unchanged), corporate earnings expand moderately (EPS growth 8 per cent), SPX corresponds to PE of 24.3X, and the expected yield of the S & P 500 is 7 per cent at its current position.

If the interest rate hub rises to 2% (the currency is tight), the expected yield falls to 1%. If the risk premium returns to the historical median (sentiment falls), the expected yield falls to-4 per cent. If EPS does not grow (growth is weak), the expected return falls to-1 per cent.

If two of the above three factors occur at the same time, then the rate of return will be negative. For example, the US bond yield center reached 2%, and the risk premium returned to the median level of the past three years. The SPX corresponds to a PE of 20.7X, and the S & P 500 still has 16% room to fall.

In the most pessimistic scenario, if the currency is too tight (the Fed has raised interest rates more than five times, and the central yield center for US debt has reached 2.25%), the recession (the EPS has fallen by 5%) and pessimistic mood (the risk premium has returned to more than 1 standard deviation of the median of the past three years), the corresponding PE is 17.1x, and the S & P 500 still has 23% room to fall from its current position.

Table S & P 500 returns with 1:EPS growth of 8%

Source: Bloomberg, Tianfeng Securities Research Institute * there are some factors such as the assumption that the assumption is not valid and the market development exceeds expectations, which leads to the deviation of the measurement results.

Source: Bloomberg, Tianfeng Securities Research Institute * there are some factors such as the assumption that the assumption is not valid and the market development exceeds expectations, which leads to the deviation of the measurement results.

Table S & P 500 returns with 0% 2:EPS growth

Source: Bloomberg, Tianfeng Securities Research Institute * there are some factors such as the assumption that the assumption is not valid and the market development exceeds expectations, which leads to the deviation of the measurement results.

Table the yield of the S & P 500 with 3:EPS growth of-5%

Source: Bloomberg, Tianfeng Securities Research Institute * there are some factors such as the assumption that the assumption is not valid and the market development exceeds expectations, which leads to the deviation of the measurement results.

Source: Bloomberg, Tianfeng Securities Research Institute * there are some factors such as the assumption that the assumption is not valid and the market development exceeds expectations, which leads to the deviation of the measurement results.

(5) which side will the style favor?

Although US stocks performed well and outperformed growth in value in the six months after the first interest rate hike in history, the core reason behind it is that the economic fundamentals (PMI) corresponding to the first interest rate hike are mostly upside, which will benefit the financial and industrial sectors, which are economically sensitive and undervalued. But in this cycle, the Fed's monetary tightening lags behind by anchoring the labour market, the economic peak occurs in the second quarter of 2021, and inflation tends to fall, so the style judgment of US stocks still has to return to the economy itself.

Figure 6: the ratio of the value index to the growth index and the federal funds rate: the first round of interest rate increases is often accompanied by a split of the value index performing better than the growth index 2022 US economic growth forecast.

Source: Bloomberg, Tianfeng Securities Research Institute

Source: Bloomberg, Tianfeng Securities Research Institute

Stylistically speaking, during the economic downturn (PMI downturn), large-cap stocks tend to perform better than small-cap stocks, but the current interpretation of the style of large-cap stocks has been more extreme, the future excess returns may not be obvious. Judging from the time points of the previous five style reversals (that is, the RUSSEL 1000 value/growth index from downside to upside), nominal interest rates, CPI, inflation expectations peaked and fell roughly as inflection points synchronized or leading indicators (defense of US stock style), PMI and inflation expectations have peaked and fallen, and the suppression of interest rates on growth stocks may not end until after the second quarter. In the industry, it is recommended to allocate defense stocks, including communications, public utilities and essential consumer goods.

Figure 7: economic cycle (manufacturing PMI) determines size and size style

Source: Bloomberg, Tianfeng Securities Research Institute

Source: Bloomberg, Tianfeng Securities Research Institute

Figure 8: relative performance of inflation expectations and nominal interest rate determination and value / growth

Source: Bloomberg, Tianfeng Securities Research Institute

Source: Bloomberg, Tianfeng Securities Research Institute

Edit / Charlotte