Many companies in the technology sector do not rely particularly on strong economic demand for profit growth.

On Tuesday (Feb. 15), the US stock market broke a three-day losing streak, with all three major stock indexes rising across the board. The technology-heavy NASDAQ composite index rose the most, reaching 2.5%, the S & P 500 index closed up 1.6%, and the Dow Jones Industrial average closed up 1.2%.

On February 15th Russia announced that it would withdraw some of its troops from the Ukrainian border, easing market concerns about geopolitical tensions. The Russian Defense Ministry said it had withdrawn some of its troops to the base. A day earlier, the Russian government hinted that it was willing to resolve the conflict through diplomatic channels.

Some officials, including British Prime Minister Johnson and US President Joe Biden, remain skeptical of Russia's softening stance, warning that "Russia is still likely to invade Ukraine." However, judging from the market reaction yesterday, investors still regained some optimism.

Yesterday's A-share gem also ushered in a big rebound, up more than 3%, the biggest increase so far this year. Some analysts believe that this year, the gem index and the Shanghai Composite Index trend differentiation, growth stocks and value stocks appear tug-of-war market is one of the reasons. After the sharp fall in growth stocks, recently began to show signs of capital flows back to growth stocks, market sentiment is gradually recovering.

For A-shares, in addition to their own factors, the biggest macro factors are the conflict between Russia and Ukraine and the prospect of interest rate hikes by the Federal Reserve. Barron Weekly believes that while the extent of the Fed's rate hike is still unknown and Russia's next move is unclear, now is a good time for long-term investors to start buying at a time when valuations of technology stocks are falling.

Market sentiment may have hit bottom

Barron Weekly pointed out that the geopolitical crisis and the prospect of the Fed raising interest rates are the main reasons for the recent downturn in US stocks, especially technology stocks, where institutional investors' positions in technology stocks have fallen to the lowest level in more than a decade.

According to a survey of fund managers conducted by Bank of America Corporation (Bank of America) this month, among mutual funds and hedge funds, the proportion of underholdings of technology stocks is 10 percentage points higher than that of overholdings. Fund managers' allocation of technology stocks is the lowest since August 2006.

Investor sentiment may have bottomed out by now. According to a survey by the American individual investors Association, only about 21% of investors are now bullish on the stock market, the lowest during the epidemic, and investor confidence tends to rise when bullish sentiment is so low. As investors' expectations for the economy and earnings of listed companies have fallen, the stock market will rise as long as there is a little bit of better-than-expected news.

Keith Lerner, co-chief investment officer and chief market strategist at Truist, said: the decline in investor expectations shows that the threshold for the stock market to be boosted by optimistic news has been lowered.

Royal Bank of Canada (RBC) also points out that from historical data, when market sentiment hits bottom, the S & P 500 usually returns 20% or more over the next 12 months.

Barron Weekly believes that now is a good time for long-term investors to start buying.

Falling valuations of technology stocks bring buying opportunities

The Nasdaq price-to-earnings ratio has now fallen to 27.4 times earnings from 32.7 times on November 19 last year, and Barron Weekly believes that lower valuations will attract investors to reinvest their money in technology stocks. Only a small portion of fund managers' portfolios are currently invested in technology stocks, which have increased their cash holdings while reducing their holdings.

Cash holdings now account for an average of 5.3 per cent of the portfolio, up from 5 per cent in January, according to Bank of America Corporation's survey. Fund managers now have more room to take the risk of buying technology stocks. "investors should be long US technology stocks now," said Michael Michael Hartnett, chief investment strategist at Bank of America Corporation, which he called "reverse trading".

Barron Weekly points out that it makes sense to be long technology stocks at this stage of the economic cycle, because one of the purposes of the Fed's interest rate hike is to slow inflation by reducing demand in the economy. and many companies in the technology sector do not particularly rely on strong economic demand for profit growth, so it makes sense to buy while valuations fall.

In addition, after the slowdown in demand and inflation, there will be less room for bond yields to rise, which in turn will support the valuations of technology stocks. Technology stocks in the S & P 500 have outperformed the S & P by an average of 8 percentage points in the six months after the Fed's first rate hike since 1994 and 13 percentage points in the 12 months after the first rate hike, according to Evercore.

Barron Weekly also pointed out that it is undeniable that bond yields may still rise slightly from their current levels, so another sell-off in technology stocks will be expected, but investor interest in technology stocks will soon pick up again.

10 technology stocks that have fallen into "value stocks"

After technology stocks fell this year, some technology stocks were classified as value stocks.

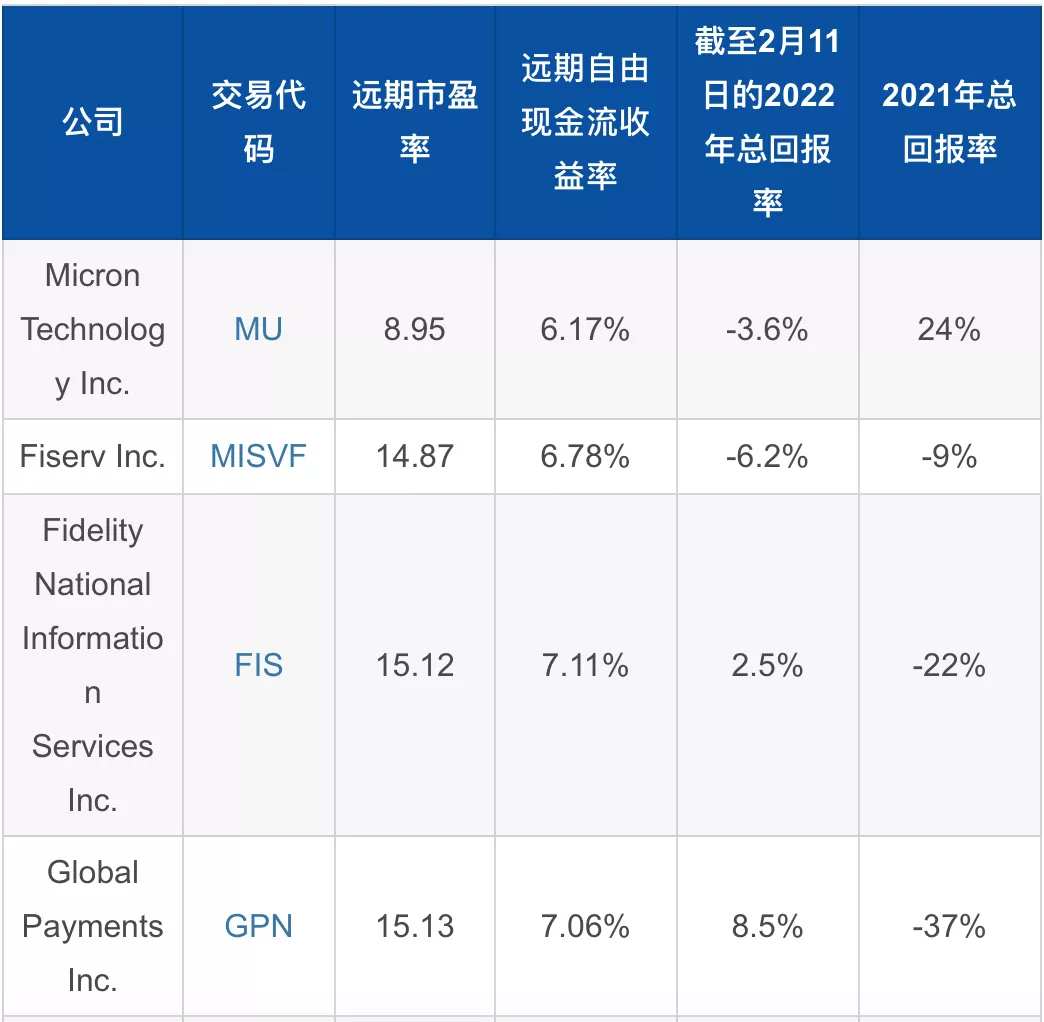

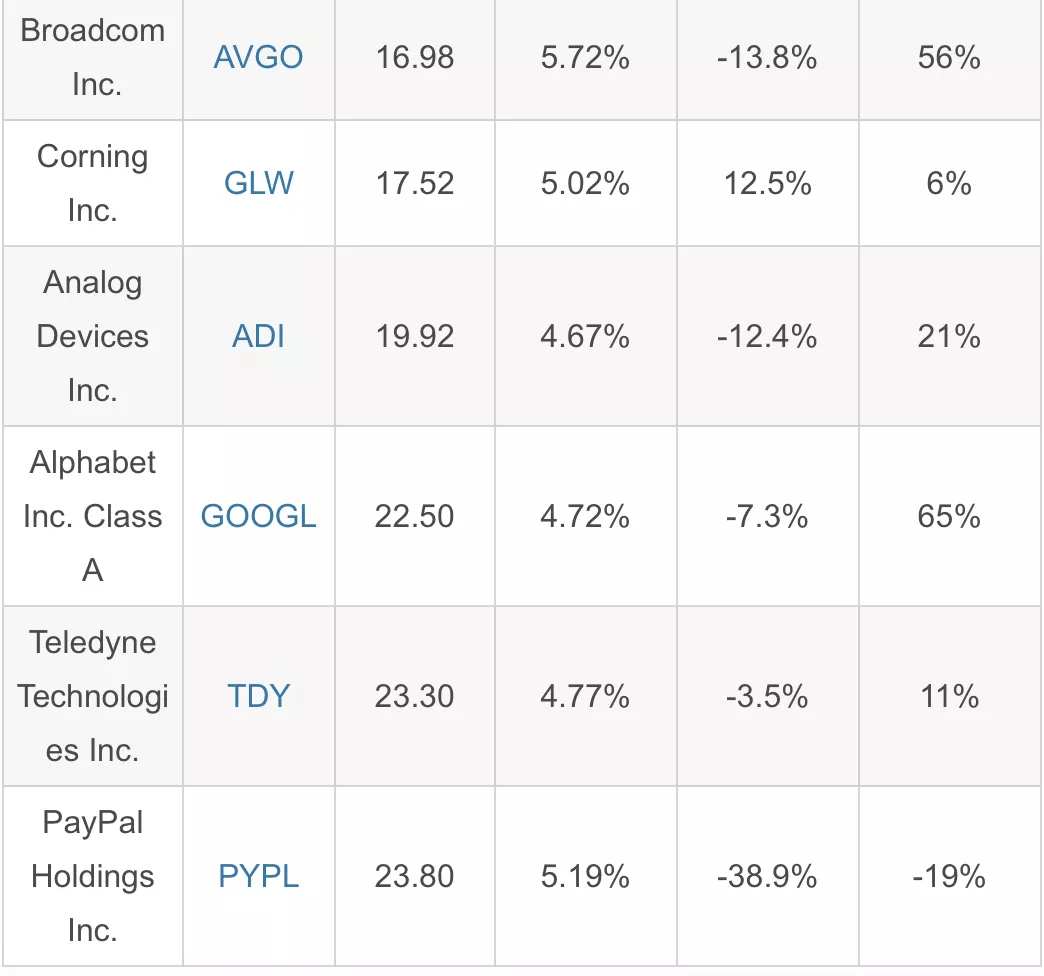

Based on two conditions and FactSet data, MarketWatch looked for value stocks among 76 companies in the S & P 500 information technology sector that had fallen 11%. The search also included technology-oriented companies classified by the S & P Dow Jones Indices in other sectors, including several video game developers, Alphabet Inc-CL C parent company Alphabet (GOOGL), Facebook Inc parent company Meta Platform (FB) and Amazon.Com Inc (AMZN), a total of 83 companies.

The 83 companies all meet two conditions: 1. The forward price-to-earnings ratio is lower than the average price-to-earnings ratio of the S & P 500 information technology sector. 2. The rate of return on forward free cash flow is higher than the average rate of return on free cash flow in the S & P 500 information technology sector. The average forward price-to-earnings ratio of 83 companies is 28.1 times, and the average forward free cash flow return is 4.54%.

MarketWatch then selected the following 10 companies with a "buy" rating ratio of at least 75 per cent. For the indicators of the 10 companies, please see the following two charts.

Source: FactSet

Edit / Charlotte