发行人免费书面意向书 2023年12月6日

根据1933年修正的《证券法》第433条规定提交

关于2023年11月30日的初步招股说明书

注册声明书 编号333-270741

发行人自由书面招股说明书日期为2023年12月[ ● ],根据1933年证券法第433条修正案规定进行文件提交,与2023年11月30日初步招股说明书相关的注册声明编号333 - 270741投资者演示CCSC科技国际控股有限公司

本免费撰写招股说明书与CCSC Technology International Holdings Limited(“我们”、“我们”或“我们的”)拟议的普通股(“普通股”)公开发行有关,应与我们向证券交易委员会(“SEC”)提交的与本演示相关的发行注册声明一起阅读,可通过以下网址访问:https://www.sec.gov/Archives/edgar/data/1931717/000121390023091161/ff12023a3_ccsctechnology.htm 该注册声明尚未生效。在投资前,您应阅读注册声明中的招股说明书(包括其中描述的风险因素)以及我们向SEC提交的其他文件,以获取有关我们和本次发行的更全面信息。您可以免费访问SEC网站上的EDGAR获取这些文件,网址为http://www.sec.gov。或者,我们或我们的承销商将安排发送给您招股说明书,如果您联系Revere Securities LLC的电子邮件地址:contact@reveresecurities.com,或通过电子邮件联系CCSC Technology International Holdings Limited:ir@ccsc-interconnect.com。

本招股说明书包含了关于我们当前期望和对未来事件的看法的前瞻性陈述,这些主要包含在“招股说明书摘要”、“风险因素”、“募集资金用途”、“管理对财务状况和经营业绩的讨论与分析”、“行业概况”和“业务”等章节中。这些前瞻性陈述涉及涉及已知风险、不确定性和可能导致我们的实际结果、业绩或成果与这些陈述所表达或暗示的大相径庭的其他因素的事件。您可以通过诸如“可能”、“将”、“可能”、“期望”、“预测”、“目标”、“估计”、“打算”、“计划”、“相信”、“很可能”,“提议”,“潜力”,“继续”或其他类似表述的词或短语来识别一些这些前瞻性陈述。我们在很大程度上基于我们对未来事件和我们认为可能影响我们的财务状况、经营业绩、业务策略和资金需求的未来事件和财务趋势的看法和预测,制定了这些前瞻性陈述。本招股说明书中包含的前瞻性陈述涉及,但不限于:我们的目标和策略;我们的业务和运营策略以及现有和新业务发展计划、实施这些策略和计划的能力和预期时间;我们未来业务发展、财务状况和经营业绩;我们预期的营收、成本或支出变化;我们的股息政策;我们对产品和服务需求及市场接受情况的期望;我们对客户、业务合作伙伴和第三方之间关系的期望;中国和全球互联产品行业的趋势、预期增长和市场规模;我们能够维护和加强市场地位的能力;我们继续开发新技术和/或升级现有技术的能力;我们业务运营受到的法律、法规、政府政策、激励措施和税收的发展和变化;与我们业务和行业相关的相关政府政策和法规;我们行业中的竞争环境、竞争格局和潜在竞争者行为;我们行业整体前景;我们吸引、培训和留住高管和其他员工的能力;我们从这次发行中拟使用的募集资金;全球金融和资本市场的发展;通货膨胀、利率和汇率波动;中国和我们开展业务的境外市场的总体商业、政治、社会和经济状况;COVID-19大流行对我们业务和行业的未来发展的影响;以及涉及或与前述任何事项有关的假设。这些前瞻性陈述涉及各种风险和不确定性。尽管我们认为我们在这些前瞻性陈述中表达的期望是合理的,但我们的期望和实际结果可能与我们的期望有很大差异。此外,我们在不断发展的环境中运营。新的风险因素和不确定性时不时出现,我们的管理人员无法预测所有风险因素和不确定性,也无法评估所有因素对我们业务的影响,或任何因素或组合因素可能导致实际结果与任何前瞻性陈述所载内容有实质性不同的程度。您应该仔细阅读本招股说明书以及我们所引用的文件,了解我们的实际未来结果可能会与我们期望的截然不同且可能更糟。我们通过这些警示性陈述对我们所有的前瞻性陈述做出约束。本招股说明书包含了来自政府和私人出版物的信息。这些出版物包括前瞻性陈述,可能存在风险、不确定性和假设。尽管我们认为数据和信息可靠,但我们未独立验证这些出版物中数据和信息的准确性或完整性。这些出版物中的统计数据还包括基于若干假设的预测。互联产品行业可能不会按照市场数据预测的速度增长,甚至根本不会增长。这些市场未按照预测速度增长可能对我们的业务和普通股市场价格产生重大负面影响。此外,互联产品行业快速发展的性质导致对市场增长前景或未来状况的任何预测或估算存在重大不确定性。此外,如果支撑市场数据的任何假设后来被发现是错误的,实际结果可能与基于这些假设的预测有所不同。参见“风险因素 — 与我们业务相关的风险”。您不应将前瞻性陈述视为对未来事件的预测。本招股说明书中的前瞻性陈述基于本招股说明书日期以前的事件和信息制定。除法律规定外,我们不承担更新或公开修订任何前瞻性陈述的义务,无论是因为新信息、未来事件或其他情况,自该陈述发布之日起,或反映出乎意料的事件。您应该仔细阅读本招股说明书以及我们在本招股说明书中引用并作为注册声明附件提交的文件,充分理解我们的实际未来结果或表现可能与我们的预期有实质性差异。

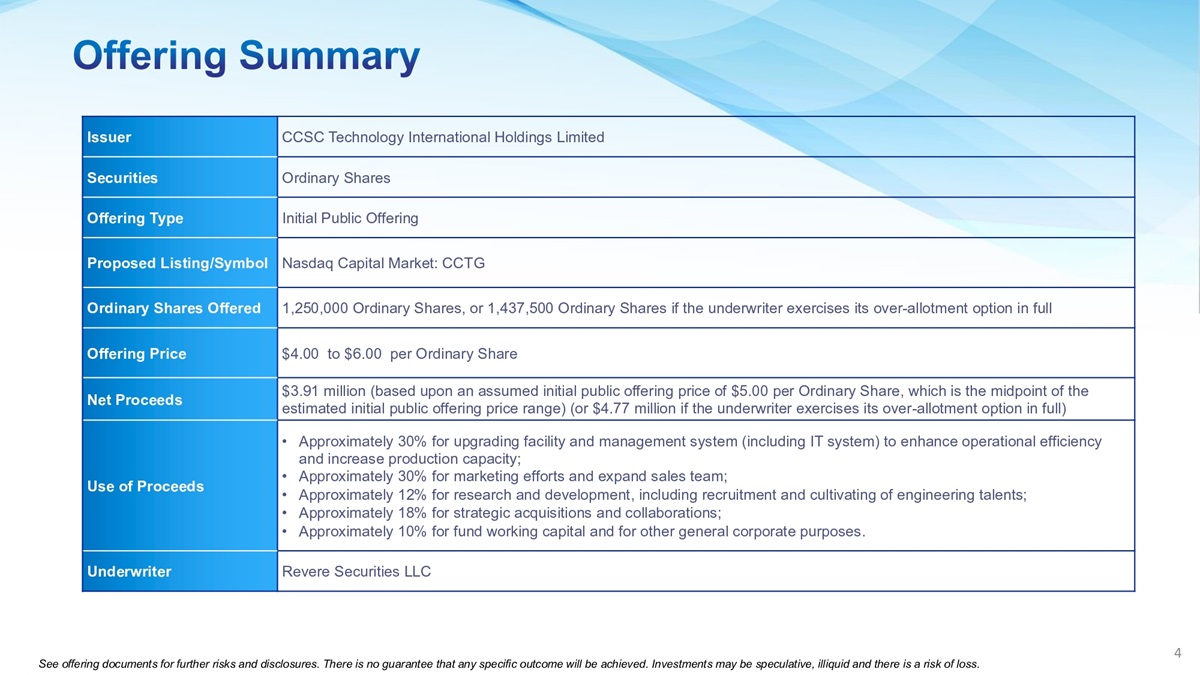

CCSC Technology International Holdings Limited Issuer Ordinary Shares Securities Initial Public Offering Offering Type Nasdaq Capital Market: CCTG Proposed Listing/Symbol 1,250,000 Ordinary Shares, or 1,437,500 Ordinary Shares if the underwriter exercises its over - allotment option in full Ordinary Shares Offered $ 4.00 to $ 6.00 per Ordinary Share Offering Price $ 3.91 million (based upon an assumed initial public offering price of $5.00 per Ordinary Share, which is the midpoint of the estimated initial public offering price range) (or $ 4.77 million if the underwriter exercises its over - allotment option in full) Net Proceeds • Approximately 30% for upgrading facility and management system (including IT system) to enhance operational efficiency and increase production capacity; • Approximately 30% for marketing efforts and expand sales team; • Approximately 12% for research and development, including recruitment and cultivating of engineering talents; • Approximately 18% for strategic acquisitions and collaborations; • Approximately 10% for fund working capital and for other general corporate purposes. Use of Proceeds Revere Securities LLC Underwriter See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 4

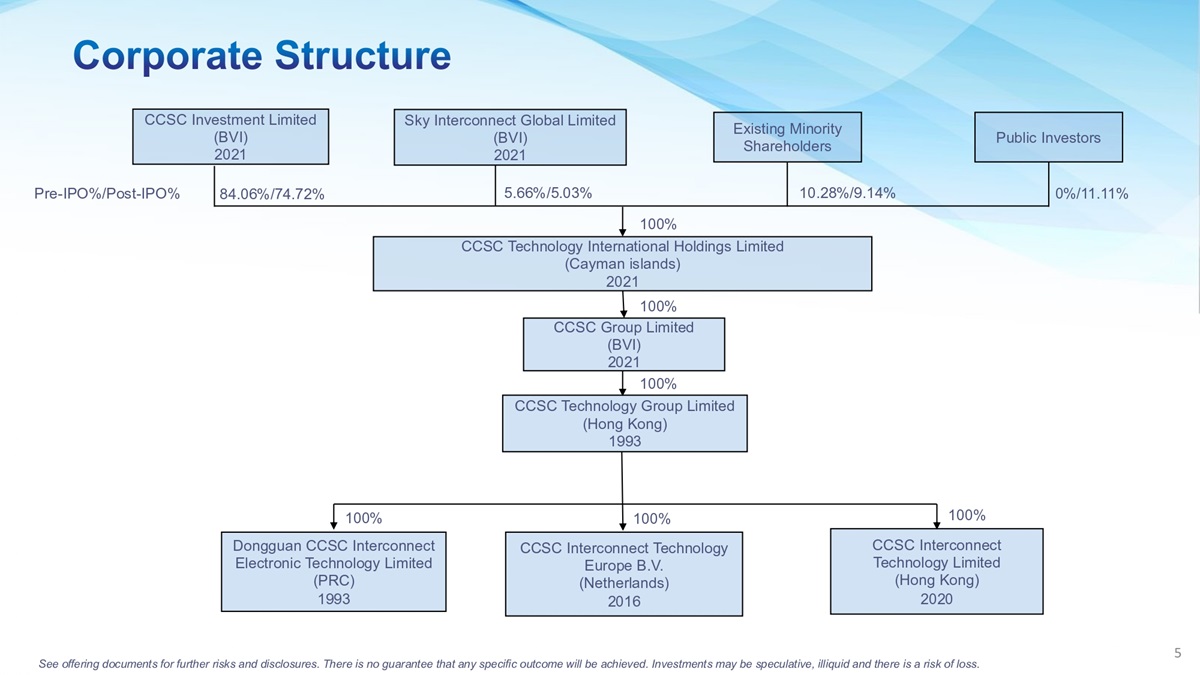

CCSC Investment Limited (BVI) 2021 Public Investors Existing Minority Shareholders Sky Interconnect Global Limited (BVI) 2021 CCSC Technology International Holdings Limited (Cayman islands) 2021 CCSC Group Limited (BVI) 2021 CCSC Technology Group Limited (Hong Kong) 1993 Dongguan CCSC Interconnect Electronic Technology Limited (PRC) 1993 CCSC Interconnect Technology Europe B.V. (Netherlands) 2016 CCSC Interconnect Technology Limited (Hong Kong) 2020 Pre - IPO%/Post - IPO% 84.06%/74.72% 5.66%/5.03% 0%/11.11% 10.28%/9.14% 100% 100% 100% 100% 100% 100% See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 5

See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 25 Countries Customer Base Throughout Asia, Europe, and the Americas OEM and ODM Interconnect Products For Manufacturing Companies that Produce End Products and Electronic Manufacturing Services (“EMS”) Close Relationships With Our Customers in Developing Products and Providing Solutions Strong R&D Capabilities Experienced Mechanical and Electrical Engineers Quality Products At Competitive Prices through a Vertically Integrated Production Process 68 Patents Registered with the PRC Intellectual Property Agency 6

See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Experienced Management Team and Dedicated Workforce Strong Focus on Customers’ Needs and Value - added Services High Standard and Commitment to Quality Control Established Long - term Relationships with Customers and Key Suppliers Vertically Integrated Production 7

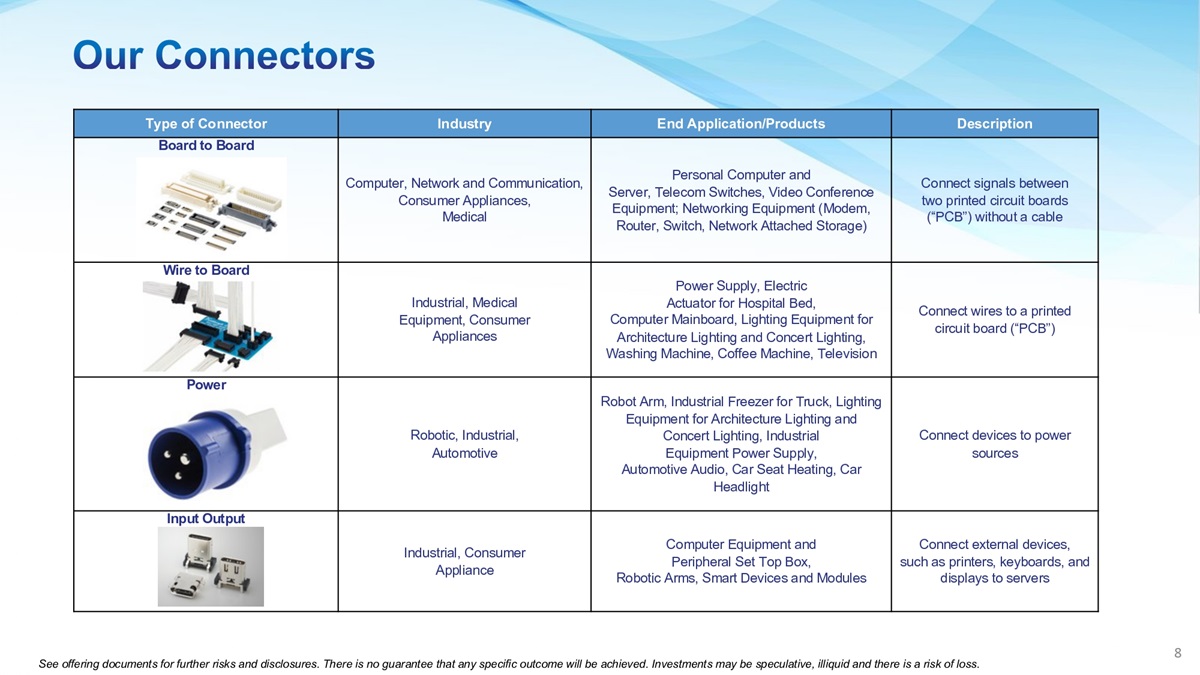

Description End Application/Products Industry Type of Connector Connect signals between two printed circuit boards (“PCB”) without a cable Personal Computer and Server, Telecom Switches, Video Conference Equipment; Networking Equipment (Modem, Router, Switch, Network Attached Storage) Computer, Network and Communication, Consumer Appliances, Medical Board to Board Connect wires to a printed circuit board (“PCB”) Power Supply, Electric Actuator for Hospital Bed, Computer Mainboard, Lighting Equipment for Architecture Lighting and Concert Lighting, Washing Machine, Coffee Machine, Television Industrial, Medical Equipment, Consumer Appliances Wire to Board Connect devices to power sources Robot Arm, Industrial Freezer for Truck, Lighting Equipment for Architecture Lighting and Concert Lighting, Industrial Equipment Power Supply, Automotive Audio, Car Seat Heating, Car Headlight Robotic, Industrial, Automotive Power Connect external devices, such as printers, keyboards, and displays to servers Computer Equipment and Peripheral Set Top Box, Robotic Arms, Smart Devices and Modules Industrial, Consumer Appliance Input Output See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 8

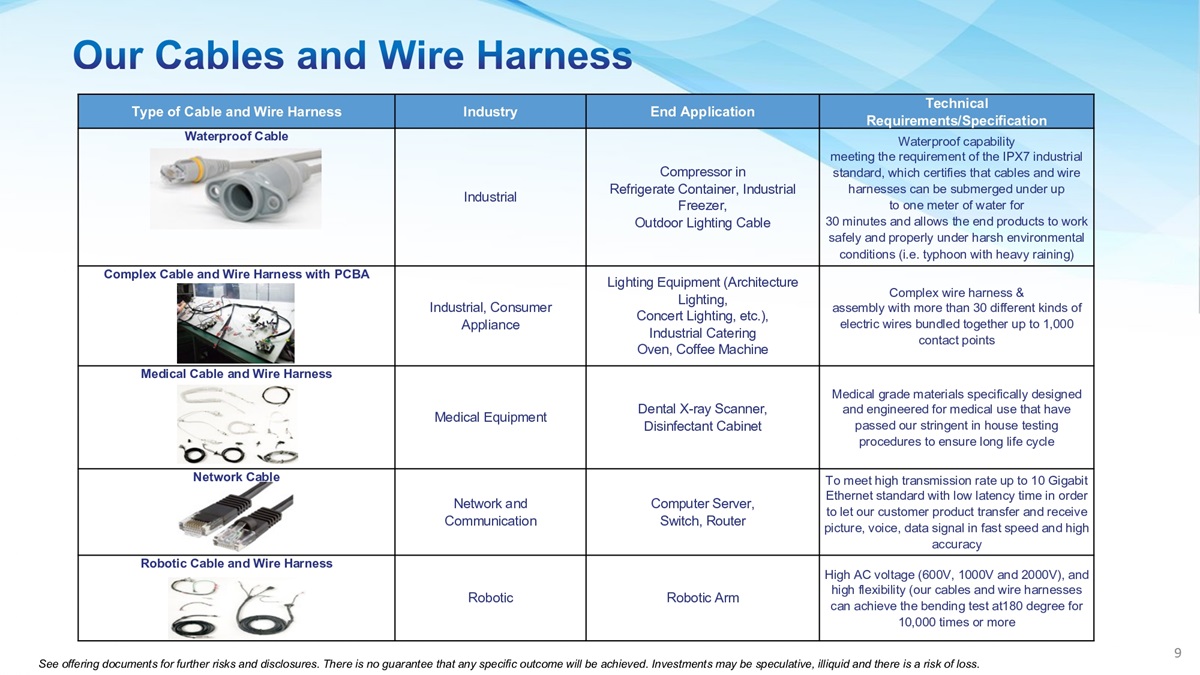

Technical Requirements/Specification End Application Industry Type of Cable and Wire Harness Waterproof capability meeting the requirement of the IPX7 industrial standard, which certifies that cables and wire harnesses can be submerged under up to one meter of water for 30 minutes and allows the end products to work safely and properly under harsh environmental conditions (i.e. typhoon with heavy raining) Compressor in Refrigerate Container, Industrial Freezer, Outdoor Lighting Cable Industrial Waterproof Cable Complex wire harness & assembly with more than 30 different kinds of electric wires bundled together up to 1,000 contact points Lighting Equipment (Architecture Lighting, Concert Lighting, etc.), Industrial Catering Oven, Coffee Machine Industrial, Consumer Appliance Complex Cable and Wire Harness with PCBA Medical grade materials specifically designed and engineered for medical use that have passed our stringent in house testing procedures to ensure long life cycle Dental X - ray Scanner, Disinfectant Cabinet Medical Equipment Medical Cable and Wire Harness To meet high transmission rate up to 10 Gigabit Ethernet standard with low latency time in order to let our customer product transfer and receive picture, voice, data signal in fast speed and high accuracy Computer Server, Switch, Router Network and Communication Network Cable High AC voltage (600V, 1000V and 2000V), and high flexibility (our cables and wire harnesses can achieve the bending test at180 degree for 10,000 times or more Robotic Arm Robotic Robotic Cable and Wire Harness See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 9

See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. ISO 9001 ISO 14001 ISO 45001 ISO 13485 IATF 16949 Stringent Standards: Quality Control Technical Managerial Capabilities o f our Subcontractors Vertically - Integrated Manufacturing Process: Manufacturing Processes: • Molding • Wire C utting • Stripping/Crimping/Termination • Assembly (including surface mounting) • Soldering Initial Design Stage Final Production 10

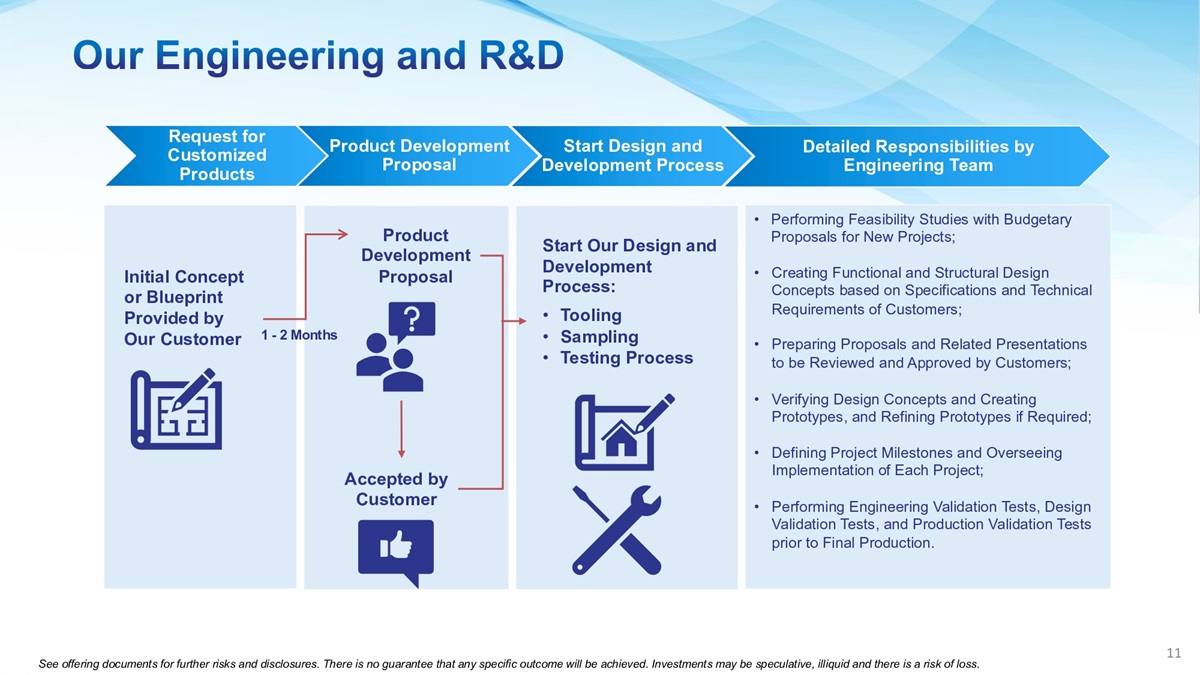

Request for Customized Products Product Development Proposal • Performing Feasibility Studies with Budgetary Proposals for New Projects; • Creating Functional and Structural Design Concepts based on Specifications and Technical Requirements of Customers; • Preparing Proposals and Related Presentations to be Reviewed and Approved by Customers; • Verifying Design Concepts and Creating Prototypes, and Refining Prototypes if Required; • Defining Project Milestones and Overseeing Implementation of Each Project; • Performing Engineering Validation Tests, Design Validation Tests, and Production Validation Tests prior to Final Production. Start Our Design a nd Development Process : • Tooling • Sampling • Testing Process Initial Concept or Blueprint Provided by Our Customer Product Development Proposal Accepted by Customer Start Design and Development Process Detailed Responsibilities by Engineering Team 1 - 2 Months See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 11

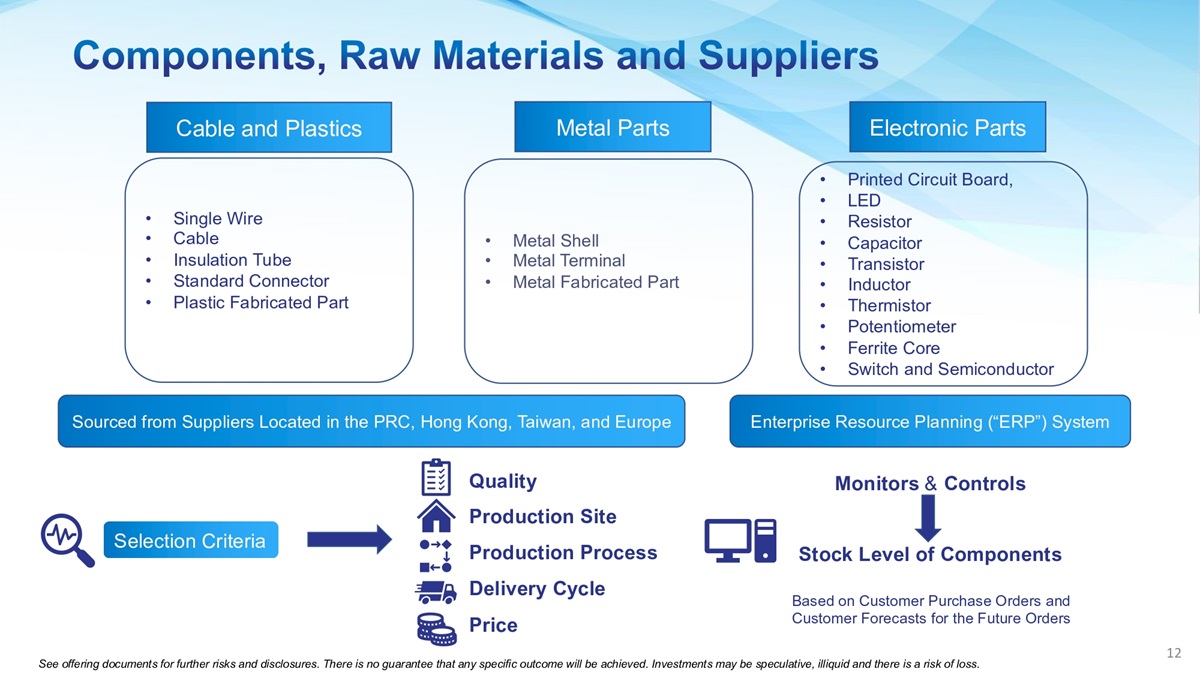

See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. • Single Wire • Cable • Insulation Tube • Standard Connector • Plastic Fabricated Part Cable and Plastics • Metal Shell • Metal Terminal • Metal Fabricated Part Metal Parts • Printed Circuit Board, • LED • Resistor • Capacitor • Transistor • Inductor • Thermistor • Potentiometer • Ferrite Core • Switch and Semiconductor Electronic Parts Sourced from Suppliers Located in the PRC, Hong Kong, Taiwan, and Europe Selection Criteria Quality Production Site Production Process Delivery Cycle Price Enterprise Resource Planning (“ERP”) System Monitors & Controls Stock Level of Components Based on Customer Purchase Orders and Customer Forecasts for t he Future Orders 12

See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Dongguan, Guangdong Province, China Aggregated 189,983 Square Feet Quality Control Quality Control and Testing 13

• An Electromechanical Device Used to Join Electrical Conductors and Create an Electrical Circuit. • Bridges the C ommunication between Blocked or Isolated Electrical Circuits so that the Current Flows and the Electrical C ircuit may Achieve its Intended Function. • Devices Used to Transmit Electric or Magnetic Energy, Exchange Information, Generate Electromagnetic Energy Conversion, and Form Automated Control Route. Interconnect Products Connector Cable and Wire Harnesses Industries Applied • Automobiles • Telecommunications • Electronic Products • Industrial Manufacturing • Healthcare • Aerospace and Defense See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Source : Frost & Sullivan 14

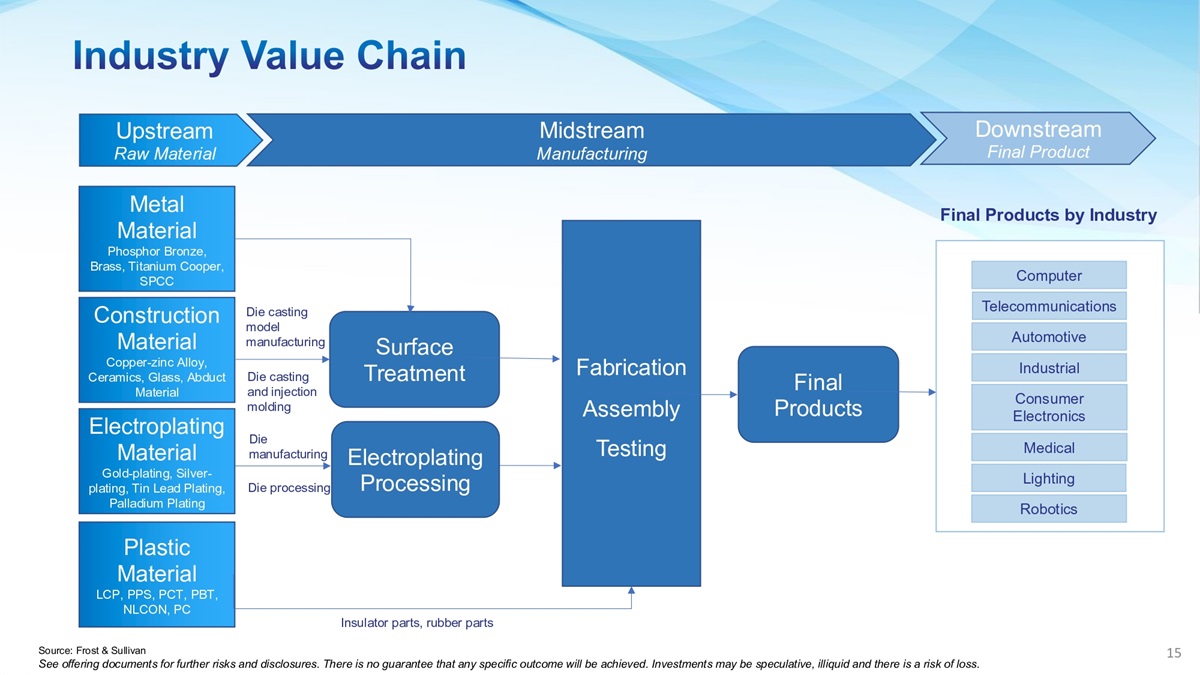

See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Final Products by Industry Computer Telecommunications Automotive Industrial Consumer Electronics Medical Lighting Robotics Upstream Raw Material Metal Material Phosphor Bronze, Brass, Titanium Cooper, SPCC Construction Material Copper - zinc Alloy, Ceramics, Glass, Abduct Material Electroplating Material Gold - plating, Silver - plating, Tin Lead Plating, Palladium Plating Plastic Material LCP, PPS, PCT, PBT, NLCON, PC Midstream Manufacturing Surface Treatment Electroplating Processing Fabrication Assembly Testing Final Products Downstream Final Product Die casting model manufacturing Die casting and injection molding Die manufacturing Die processing Insulator parts, rubber parts Source : Frost & Sullivan 15

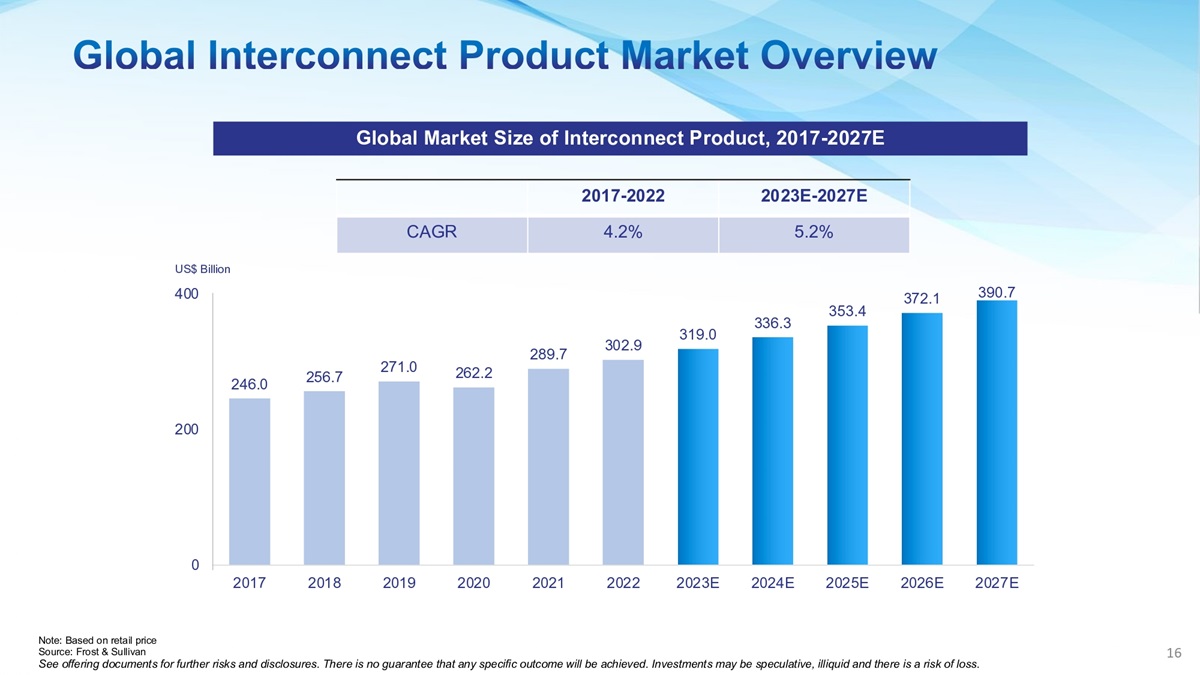

See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 246.0 256.7 271.0 262.2 289.7 302.9 319.0 336.3 353.4 372.1 390.7 0 200 400 2017 2018 2019 2020 2021 2022 2023E 2024E 2025E 2026E 2027E Global Market Size of Interconnect Product , 2017 - 2027E 2023E - 2027E 2017 - 2022 5.2% 4.2% CAGR US$ Billion Note : Based on retail price Source : Frost & Sullivan 16

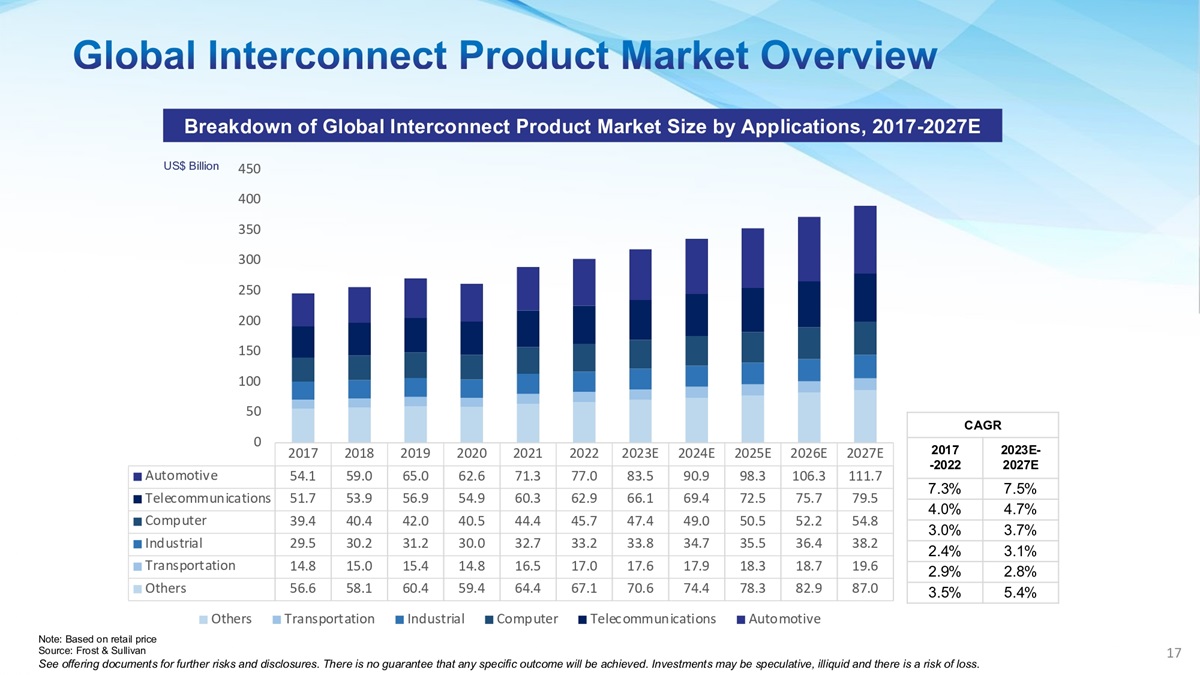

See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 2017 2018 2019 2020 2021 2022 2023E 2024E 2025E 2026E 2027E Automotive 54.1 59.0 65.0 62.6 71.3 77.0 83.5 90.9 98.3 106.3 111.7 Telecommunications 51.7 53.9 56.9 54.9 60.3 62.9 66.1 69.4 72.5 75.7 79.5 Computer 39.4 40.4 42.0 40.5 44.4 45.7 47.4 49.0 50.5 52.2 54.8 Industrial 29.5 30.2 31.2 30.0 32.7 33.2 33.8 34.7 35.5 36.4 38.2 Transportation 14.8 15.0 15.4 14.8 16.5 17.0 17.6 17.9 18.3 18.7 19.6 Others 56.6 58.1 60.4 59.4 64.4 67.1 70.6 74.4 78.3 82.9 87.0 0 50 100 150 200 250 300 350 400 450 Others Transportation Industrial Computer Telecommunications Automotive US$ Billion CAGR 2023E - 2027E 2017 - 2022 7.5% 7.3% 4.7% 4.0% 3.7% 3.0% 3.1% 2.4% 2.8% 2.9% 5.4% 3.5% Note : Based on retail price Source : Frost & Sullivan Breakdown of Global Interconnect Product Market Size by Applications, 2017 - 2027E 17

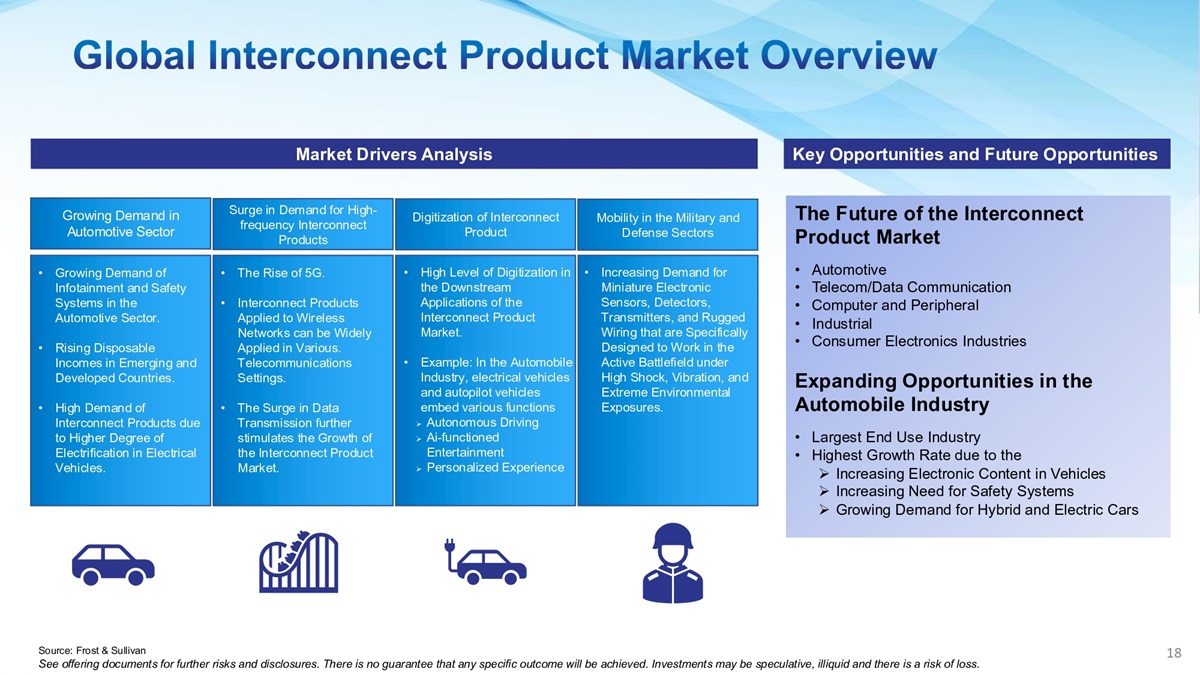

See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. The Future of the Interconnect P roduct M arket • Automotive • Telecom/Data Communication • Computer and Peripheral • Industrial • Consumer Electronics Industries Expanding O pportunities in t he Automobile I ndustry • Largest End Use Industry • Highest Growth Rate due t o t he » Increasing Electronic Content in Vehicles » Increasing Need for Safety Systems » Growing Demand for Hybrid and Electric Cars Growing Demand in Automotive Sector Surge in Demand for High - frequency Interconnect Products Digitization of Interconnect Product Mobility in the Military and Defense Sectors Key Opportunities and Future Opportunities Source : Frost & Sullivan Market Drivers Analysis • Growing Demand of Infotainment and Safety Systems in the Automotive Sector. • Rising Disposable Incomes in Emerging and Developed Countries. • High Demand of Interconnect Products due to Higher Degree of Electrification in Electrical Vehicles. • The Rise of 5G. • Interconnect Products Applied to Wireless Networks can be Widely Applied in Various. Telecommunications Settings. • The Surge in Data Transmission further stimulates the Growth of the Interconnect Product Market. • High Level of Digitization in the Downstream Applications of the Interconnect Product Market. • Example: In the Automobile Industry, electrical vehicles and autopilot vehicles embed various functions » Autonomous Driving » Ai - functioned Entertainment » Personalized Experience • Increasing Demand for Miniature Electronic Sensors, Detectors, Transmitters, and Rugged Wiring that are Specifically Designed to Work in the Active Battlefield under High Shock, Vibration, and Extreme Environmental Exposures. 18

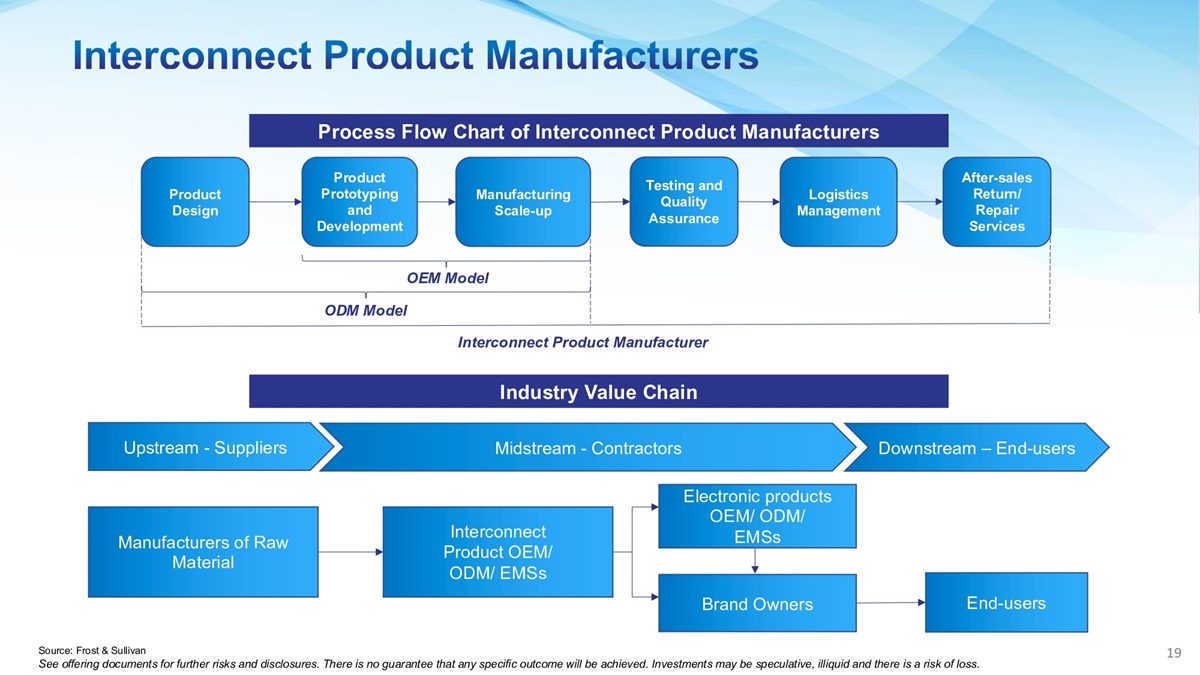

See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Product Design After - sales Return/ Repair Services Product Prototyping and Development Manufacturing Scale - up Logistics Management Testing and Quality Assurance OEM Model ODM Model Interconnect Product Manufacturer Upstream - Suppliers Midstream - Contractors Downstream – End - users Manufacturers of Raw Material Interconnect Product OEM/ ODM/ EMSs Electronic products OEM/ ODM/ EMSs Brand Owners End - users Industry Value Chain Source : Frost & Sullivan Process Flow Chart of Interconnect Product Manufacturers 19

See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 429.2 463.1 452.7 478.1 503.5 542.1 573.5 602.4 632.9 666.1 699.4 0.0 100.0 200.0 300.0 400.0 500.0 600.0 700.0 2017 2018 2019 2020 2021 2022E 2023E 2024E 2025E 2026E 2027E 2023E - 2027E 2017 - 2022 CAGR 5.1% 4.8% Total RMB Billion Market Size of Interconnect Product OEM Industry by Revenue in the PRC, 2017 - 2027E Note : Based on ex - factory price Source : Frost & Sullivan 20

See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Upgrade Facility and Management System to Enhance Operational Efficiency and Increase Production Capacity Accelerate Our Sales a nd Marketing Efforts Continue to Invest in Research & Development and Cultivate Engineering Talents Pursue Expansion through Strategic Acquisitions and Collaboration Expand New Customer Base and Increase Product Offering to Existing Customers 21

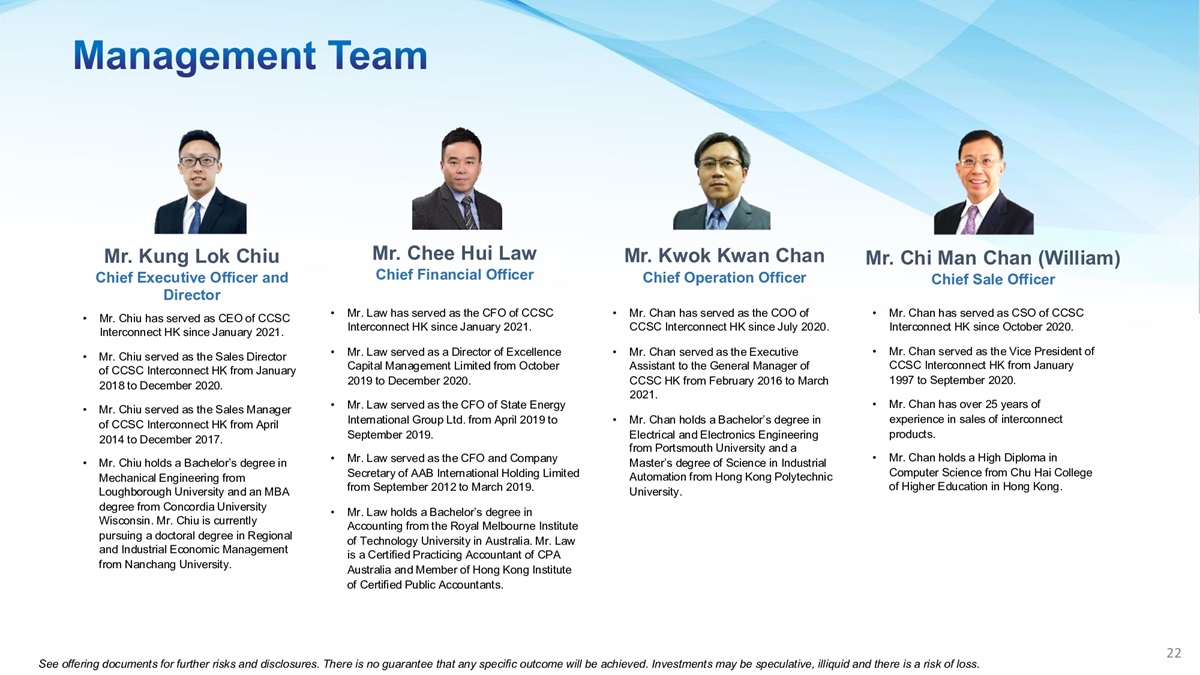

See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Mr. Chi Man Chan (William) Chief Sale Officer Mr. Kwok Kwan Chan Chief Operation Officer Mr. Chee Hui Law Chief Financial Officer Mr. Kung Lok Chiu Chief Executive Officer and Director • Mr. Chiu has served as CEO of CCSC Interconnect HK since January 2021. • Mr. Chiu served as the Sales Director of CCSC Interconnect HK from January 2018 to December 2020. • Mr. Chiu served as the Sales Manager of CCSC Interconnect HK from April 2014 to December 2017. • Mr. Chiu holds a Bachelor’s degree in Mechanical Engineering from Loughborough University and an MBA degree from Concordia University Wisconsin. Mr. Chiu is currently pursuing a doctoral degree in Regional and Industrial Economic Management from Nanchang University . • Mr. Law has served as the CFO of CCSC Interconnect HK since January 2021. • Mr. Law served as a Director of Excellence Capital Management Limited from October 2019 to December 2020. • Mr. Law served as the CFO of State Energy International Group Ltd. from April 2019 to September 2019. • Mr. Law served as the CFO and Company Secretary of AAB International Holding Limited from September 2012 to March 2019. • Mr. Law holds a Bachelor’s degree in Accounting from the Royal Melbourne Institute of Technology University in Australia. Mr. Law is a Certified Practicing Accountant of CPA Australia and Member of Hong Kong Institute of Certified Public Accountants. • Mr. Chan has served as the COO of CCSC Interconnect HK since July 2020. • Mr. Chan served as the Executive Assistant to the General Manager of CCSC HK from February 2016 to March 2021. • Mr. Chan holds a Bachelor’s degree in Electrical and Electronics Engineering from Portsmouth University and a Master’s degree of Science in Industrial Automation from Hong Kong Polytechnic University. • Mr. Chan has served as CSO of CCSC Interconnect HK since October 2020. • Mr. Chan served as the Vice President of CCSC Interconnect HK from January 1997 to September 2020. • Mr. Chan has over 25 years of experience in sales of interconnect products . • Mr. Chan holds a High Diploma in Computer Science from Chu Hai College of Higher Education in Hong Kong. 22

Mr. Kung Lok Chiu Chief Executive Officer and Director • Mr. Chiu has served as CEO of CCSC Interconnect HK since January 2021. • Mr. Chiu served as the Sales Director of CCSC Interconnect HK from January 2018 to December 2020. • Mr. Chiu served as the Sales Manager of CCSC Interconnect HK from April 2014 to December 2017. • Mr. Chiu holds a Bachelor’s degree in Mechanical Engineering from Loughborough University and an MBA degree from Concordia University Wisconsin. • Mr. Chiu is currently pursuing a doctoral degree in Regional and Industrial Economic Management from Nanchang University . Dr. Chi Sing Chiu Founder, Chairman of the Board and Director • Dr. Chiu served as Chairman of CCSC Interconnect HK from January 2021 to September 2021. • Dr. Chiu served as the CEO of CCSC Interconnect HK from March 1993 to December 2020. • Dr. Chiu has over 30 years of experience in the interconnect products industry. • Dr. Chiu has been awarded for a Medal of Honor from Austrian Albert Schweitzer Association in June 2020 and Elite of Commerce from the Economic of French Collection Metropolis Prosperity in each of 2011 and 2012. • Dr. Chiu holds an Honorary Doctorate degree in Business Administration from Sabi University, and received a post - doctoral fellowship from California State University. Dr. Chiu is currently pursuing a doctoral degree of Regional and Industrial Economic Management from Nanchang University. Ms. Sin Ting Chiu Director Dr. Wai Chun Tsang Independent Director Nominee Dr. Tsz Fai Shiu Independent Director Nominee Mr. Kenneth Wang Independent Director Nominee Dr. Pak Keung Chan Independent Director Nominee • Ms. Chiu has served as a Director of the Company since October 2021. • Ms. Chiu served as the Manager of the finance department of CCSC Interconnect HK from May 2016 to September 2021 . • Ms. Chiu holds a Bachelor’s degree in Bioscience (Nutrition) from the University of Nottingham. • Dr. Tsang founded TWC Corporate Services Ltd in April 2000 and has since served as a Managing Director. • Dr. Tsang currently serves as a Director of ten companies, including a Hong Kong listed company, Timeless Software Ltd. • Dr. Tsang holds a Diploma in Secretarial Management from Hong Kong Baptist College, an MBA from Heriot - Watt University, an Honorary Doctorate degree in Business Administration from Sabi University in France, and a Doctorate degree from International American University. • Dr. Shiu has been working for Knowing Management Consultancy since 2005 and serves as the Principal Consultant and Training Director. • Dr. Shiu holds a Bachelor’s degree in Social Service and Social Work from Hong Kong Polytechnic University, a Master’s degree in Business Administration from Sheffield Hallam University in United Kingdom, and a Doctorate degree in Business Administration from Bulacan State University in Philippines. • Mr. Wang has served as the President of Synergy Turfs Co., Ltd. s ince September 2009 . • Mr. Wang served as the Managing Director of Best Interlink Group f rom March 1993 to September 2009 . • Mr. Wang served as the head of the Sr. technical staff of Hughes Aircraft Company in Fullerton f rom June 1981 to March 1993 . • Mr. Wang holds a Bachelor’s degree in Electrical Engineering from California State University and an MBA from the National University (La Jolla, CA). • Dr. Chan has been working as an Independent Advisor for aerospace and military industries since April 2016. • Dr. Chan served as an Emeritus Consultant to the Chairman and CEO of the Integrated Manufacturing Solutions, Greater China, from April 2015 to March 2016. • Dr. Chan served as the President, of Sanmina Corporation from March 1999 to March 2015. • Dr. Chan holds a Bachelor’s degree in Mechanical Engineering and Automation from Tianjin University; and Postgraduate degree in Applied Electronic Engineering from Hong Kong University; and Honorary Doctorate degree of Philosophy in Business Administration from Tarlac State University. Dr. Chan also received post - doctoral fellowship in Art Management and Technology from University of Quebec, and post - doctoral fellowship in Business and Technology Management from China National School of Administration. See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 23

See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 27.2 24.1 7.5 7.9 2.3 2.2 0.0 5.0 10.0 15.0 20.0 25.0 30.0 FY2022 FY2023 Revenue Gross Profit Net Income US$ Million 27.5% 32.7% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% FY2022 FY2023 Gross Profit Margin Revenue, Gross Profit, and Net Income Gross Profit Margin Note : Fiscal Year Ended March 31 24

63% 31% 7% See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. US$ Million 24.5 22.2 2.7 1.8 0.0 5.0 10.0 15.0 20.0 25.0 30.0 FY2022 FY2023 Cable and Wire Harnesses Connectors 61% 32% 7% Europe Asia Americas Revenue by Product Type 16.4 15.0 8.7 7.4 2.0 1.6 0.0 5.0 10.0 15.0 20.0 25.0 30.0 FY2022 FY2023 Americas Asia Eurpoe Revenue by Regions US$ Million FY2022 FY2023 Note : Fiscal Year Ended March 31 25

Email: ir@ccsc - interconnect.com Tel: +852 2687 0272 Address: 1301 - 03, 13/f Shatin Galleria, 18 - 24 Shan Mei St, Fotan , Shatin, Hong Kong Issuer CCSC Technology International Holdings Limited Email: contact@reveresecurities.com Tel: +1 (212) 688 - 2238 Address: 650 Fifth Avenue, 35th Floor, New York, NY 10019 USA Underwriter Revere Securities LLC