0001383312 2024 FY false P3Y http://fasb.org/us-gaap/2024#OtherAssetsCurrent http://fasb.org/us-gaap/2024#OtherAssetsCurrent http://fasb.org/us-gaap/2024#OtherAssetsNoncurrent http://fasb.org/us-gaap/2024#OtherAssetsNoncurrent http://fasb.org/us-gaap/2024#AccountsPayableAndAccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#AccountsPayableAndAccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrent http://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrent P3Y http://fasb.org/us-gaap/2024#OtherAssetsNoncurrent http://fasb.org/us-gaap/2024#OtherAssetsNoncurrent http://fasb.org/us-gaap/2024#AccountsPayableAndAccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#AccountsPayableAndAccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#CostsAndExpenses http://fasb.org/us-gaap/2024#CostsAndExpenses 2.5 2.5 381 184 iso4217:USD xbrli:shares iso4217:USD xbrli:shares br:Segment br:country xbrli:pure br:acquisition br:renewal_term iso4217:EUR 0001383312 2023-07-01 2024-06-30 0001383312 2023-12-31 0001383312 2024-08-01 0001383312 2022-07-01 2023-06-30 0001383312 2024-06-30 0001383312 br:InformationTechnologyServicesAgreementMember 2023-07-01 2024-06-30 0001383312 br:IBMPrivateCloudAgreementMember 2023-07-01 2024-06-30 0001383312 br:InformationTechnologyServicesAgreementMember 2023-06-30 0001383312 br:OtherDataCenterAgreementsMember 2023-06-30 0001383312 br:DataCenterAgreementsMember 2023-06-30 0001383312 br:OtherDataCenterAgreementsMember 2023-07-01 2024-06-30 0001383312 br:DataCenterAgreementsMember 2023-07-01 2024-06-30 0001383312 br:InformationTechnologyServicesAgreementMember 2024-06-30 0001383312 br:OtherDataCenterAgreementsMember 2024-06-30 0001383312 br:DataCenterAgreementsMember 2024-06-30 0001383312 br:AWSCloudAgreementMember 2023-07-01 2024-06-30 0001383312 2021-07-01 2022-06-30 0001383312 2023-06-30 0001383312 2022-06-30 0001383312 2021-06-30 0001383312 us-gaap:CommonStockMember 2021-06-30 0001383312 us-gaap:AdditionalPaidInCapitalMember 2021-06-30 0001383312 us-gaap:RetainedEarningsMember 2021-06-30 0001383312 us-gaap:TreasuryStockCommonMember 2021-06-30 0001383312 us-gaap:AccumulatedOtherComprehensiveIncomeMember 2021-06-30 0001383312 us-gaap:RetainedEarningsMember 2021-07-01 2022-06-30 0001383312 us-gaap:AccumulatedOtherComprehensiveIncomeMember 2021-07-01 2022-06-30 0001383312 us-gaap:AdditionalPaidInCapitalMember 2021-07-01 2022-06-30 0001383312 us-gaap:TreasuryStockCommonMember 2021-07-01 2022-06-30 0001383312 us-gaap:CommonStockMember 2022-06-30 0001383312 us-gaap:AdditionalPaidInCapitalMember 2022-06-30 0001383312 us-gaap:RetainedEarningsMember 2022-06-30 0001383312 us-gaap:TreasuryStockCommonMember 2022-06-30 0001383312 us-gaap:AccumulatedOtherComprehensiveIncomeMember 2022-06-30 0001383312 us-gaap:RetainedEarningsMember 2022-07-01 2023-06-30 0001383312 us-gaap:AccumulatedOtherComprehensiveIncomeMember 2022-07-01 2023-06-30 0001383312 us-gaap:AdditionalPaidInCapitalMember 2022-07-01 2023-06-30 0001383312 us-gaap:TreasuryStockCommonMember 2022-07-01 2023-06-30 0001383312 us-gaap:CommonStockMember 2023-06-30 0001383312 us-gaap:AdditionalPaidInCapitalMember 2023-06-30 0001383312 us-gaap:RetainedEarningsMember 2023-06-30 0001383312 us-gaap:TreasuryStockCommonMember 2023-06-30 0001383312 us-gaap:AccumulatedOtherComprehensiveIncomeMember 2023-06-30 0001383312 us-gaap:RetainedEarningsMember 2023-07-01 2024-06-30 0001383312 us-gaap:AccumulatedOtherComprehensiveIncomeMember 2023-07-01 2024-06-30 0001383312 us-gaap:AdditionalPaidInCapitalMember 2023-07-01 2024-06-30 0001383312 us-gaap:TreasuryStockCommonMember 2023-07-01 2024-06-30 0001383312 us-gaap:CommonStockMember 2024-06-30 0001383312 us-gaap:AdditionalPaidInCapitalMember 2024-06-30 0001383312 us-gaap:RetainedEarningsMember 2024-06-30 0001383312 us-gaap:TreasuryStockCommonMember 2024-06-30 0001383312 us-gaap:AccumulatedOtherComprehensiveIncomeMember 2024-06-30 0001383312 us-gaap:EquipmentMember srt:MinimumMember 2024-06-30 0001383312 us-gaap:EquipmentMember srt:MaximumMember 2024-06-30 0001383312 srt:MinimumMember us-gaap:BuildingAndBuildingImprovementsMember 2024-06-30 0001383312 srt:MaximumMember us-gaap:BuildingAndBuildingImprovementsMember 2024-06-30 0001383312 us-gaap:FurnitureAndFixturesMember srt:MinimumMember 2024-06-30 0001383312 us-gaap:FurnitureAndFixturesMember srt:MaximumMember 2024-06-30 0001383312 us-gaap:SoftwareAndSoftwareDevelopmentCostsMember srt:MinimumMember 2024-06-30 0001383312 us-gaap:SoftwareAndSoftwareDevelopmentCostsMember srt:MaximumMember 2024-06-30 0001383312 us-gaap:CustomerConcentrationRiskMember us-gaap:SalesRevenueNetMember br:LargestCustomerMember 2023-07-01 2024-06-30 0001383312 us-gaap:CustomerConcentrationRiskMember us-gaap:SalesRevenueNetMember br:LargestCustomerMember 2022-07-01 2023-06-30 0001383312 us-gaap:CustomerConcentrationRiskMember us-gaap:SalesRevenueNetMember br:LargestCustomerMember 2021-07-01 2022-06-30 0001383312 br:RecurringFeeRevenueRegulatoryMember br:InvestorCommunicationSolutionsMember 2023-07-01 2024-06-30 0001383312 br:RecurringFeeRevenueRegulatoryMember br:InvestorCommunicationSolutionsMember 2022-07-01 2023-06-30 0001383312 br:RecurringFeeRevenueRegulatoryMember br:InvestorCommunicationSolutionsMember 2021-07-01 2022-06-30 0001383312 br:RecurringFeeRevenueDataDrivenFundSolutionsMember br:InvestorCommunicationSolutionsMember 2023-07-01 2024-06-30 0001383312 br:RecurringFeeRevenueDataDrivenFundSolutionsMember br:InvestorCommunicationSolutionsMember 2022-07-01 2023-06-30 0001383312 br:RecurringFeeRevenueDataDrivenFundSolutionsMember br:InvestorCommunicationSolutionsMember 2021-07-01 2022-06-30 0001383312 br:RecurringFeeRevenueIssuerMember br:InvestorCommunicationSolutionsMember 2023-07-01 2024-06-30 0001383312 br:RecurringFeeRevenueIssuerMember br:InvestorCommunicationSolutionsMember 2022-07-01 2023-06-30 0001383312 br:RecurringFeeRevenueIssuerMember br:InvestorCommunicationSolutionsMember 2021-07-01 2022-06-30 0001383312 br:RecurringFeeRevenueCustomerCommunicationsMember br:InvestorCommunicationSolutionsMember 2023-07-01 2024-06-30 0001383312 br:RecurringFeeRevenueCustomerCommunicationsMember br:InvestorCommunicationSolutionsMember 2022-07-01 2023-06-30 0001383312 br:RecurringFeeRevenueCustomerCommunicationsMember br:InvestorCommunicationSolutionsMember 2021-07-01 2022-06-30 0001383312 br:RecurringFeeRevenueInvestorCommunicationSolutionsMember br:InvestorCommunicationSolutionsMember 2023-07-01 2024-06-30 0001383312 br:RecurringFeeRevenueInvestorCommunicationSolutionsMember br:InvestorCommunicationSolutionsMember 2022-07-01 2023-06-30 0001383312 br:RecurringFeeRevenueInvestorCommunicationSolutionsMember br:InvestorCommunicationSolutionsMember 2021-07-01 2022-06-30 0001383312 br:InvestorCommunicationSolutionsMember br:EventDrivenRevenueEquityAndOtherMember 2023-07-01 2024-06-30 0001383312 br:InvestorCommunicationSolutionsMember br:EventDrivenRevenueEquityAndOtherMember 2022-07-01 2023-06-30 0001383312 br:InvestorCommunicationSolutionsMember br:EventDrivenRevenueEquityAndOtherMember 2021-07-01 2022-06-30 0001383312 br:EventDrivenRevenueMutualFundsMember br:InvestorCommunicationSolutionsMember 2023-07-01 2024-06-30 0001383312 br:EventDrivenRevenueMutualFundsMember br:InvestorCommunicationSolutionsMember 2022-07-01 2023-06-30 0001383312 br:EventDrivenRevenueMutualFundsMember br:InvestorCommunicationSolutionsMember 2021-07-01 2022-06-30 0001383312 br:InvestorCommunicationSolutionsMember br:EventDrivenRevenueInvestorCommunicationSolutionsMember 2023-07-01 2024-06-30 0001383312 br:InvestorCommunicationSolutionsMember br:EventDrivenRevenueInvestorCommunicationSolutionsMember 2022-07-01 2023-06-30 0001383312 br:InvestorCommunicationSolutionsMember br:EventDrivenRevenueInvestorCommunicationSolutionsMember 2021-07-01 2022-06-30 0001383312 br:DistributionRevenueMember br:InvestorCommunicationSolutionsMember 2023-07-01 2024-06-30 0001383312 br:DistributionRevenueMember br:InvestorCommunicationSolutionsMember 2022-07-01 2023-06-30 0001383312 br:DistributionRevenueMember br:InvestorCommunicationSolutionsMember 2021-07-01 2022-06-30 0001383312 br:InvestorCommunicationSolutionsMember 2023-07-01 2024-06-30 0001383312 br:InvestorCommunicationSolutionsMember 2022-07-01 2023-06-30 0001383312 br:InvestorCommunicationSolutionsMember 2021-07-01 2022-06-30 0001383312 br:GlobalTechnologyAndOperationsMember br:RecurringFeeRevenueCapitalMarketsMember 2023-07-01 2024-06-30 0001383312 br:GlobalTechnologyAndOperationsMember br:RecurringFeeRevenueCapitalMarketsMember 2022-07-01 2023-06-30 0001383312 br:GlobalTechnologyAndOperationsMember br:RecurringFeeRevenueCapitalMarketsMember 2021-07-01 2022-06-30 0001383312 br:GlobalTechnologyAndOperationsMember br:RecurringFeeRevenueWealthAndInvestmentManagementMember 2023-07-01 2024-06-30 0001383312 br:GlobalTechnologyAndOperationsMember br:RecurringFeeRevenueWealthAndInvestmentManagementMember 2022-07-01 2023-06-30 0001383312 br:GlobalTechnologyAndOperationsMember br:RecurringFeeRevenueWealthAndInvestmentManagementMember 2021-07-01 2022-06-30 0001383312 br:RecurringFeeRevenueGlobalTechnologyAndOperationsMember br:GlobalTechnologyAndOperationsMember 2023-07-01 2024-06-30 0001383312 br:RecurringFeeRevenueGlobalTechnologyAndOperationsMember br:GlobalTechnologyAndOperationsMember 2022-07-01 2023-06-30 0001383312 br:RecurringFeeRevenueGlobalTechnologyAndOperationsMember br:GlobalTechnologyAndOperationsMember 2021-07-01 2022-06-30 0001383312 br:RecurringFeeRevenueMember 2023-07-01 2024-06-30 0001383312 br:RecurringFeeRevenueMember 2022-07-01 2023-06-30 0001383312 br:RecurringFeeRevenueMember 2021-07-01 2022-06-30 0001383312 br:EventDrivenRevenueMember 2023-07-01 2024-06-30 0001383312 br:EventDrivenRevenueMember 2022-07-01 2023-06-30 0001383312 br:EventDrivenRevenueMember 2021-07-01 2022-06-30 0001383312 br:DistributionRevenueMember 2023-07-01 2024-06-30 0001383312 br:DistributionRevenueMember 2022-07-01 2023-06-30 0001383312 br:DistributionRevenueMember 2021-07-01 2022-06-30 0001383312 us-gaap:EmployeeStockOptionMember 2023-07-01 2024-06-30 0001383312 us-gaap:EmployeeStockOptionMember 2022-07-01 2023-06-30 0001383312 us-gaap:EmployeeStockOptionMember 2021-07-01 2022-06-30 0001383312 br:AdvisorTargetMember 2024-05-01 2024-05-31 0001383312 br:AdvisorTargetMember 2024-05-31 0001383312 us-gaap:FairValueInputsLevel1Member 2024-06-30 0001383312 us-gaap:FairValueInputsLevel2Member 2024-06-30 0001383312 us-gaap:FairValueInputsLevel3Member 2024-06-30 0001383312 us-gaap:FairValueInputsLevel1Member 2023-06-30 0001383312 us-gaap:FairValueInputsLevel2Member 2023-06-30 0001383312 us-gaap:FairValueInputsLevel3Member 2023-06-30 0001383312 srt:MaximumMember 2024-06-30 0001383312 us-gaap:LandAndBuildingMember 2024-06-30 0001383312 us-gaap:LandAndBuildingMember 2023-06-30 0001383312 us-gaap:EquipmentMember 2024-06-30 0001383312 us-gaap:EquipmentMember 2023-06-30 0001383312 br:FurnitureAndLeaseholdImprovementsMember 2024-06-30 0001383312 br:FurnitureAndLeaseholdImprovementsMember 2023-06-30 0001383312 br:InvestorCommunicationSolutionsMember 2022-06-30 0001383312 br:GlobalTechnologyAndOperationsMember 2022-06-30 0001383312 br:GlobalTechnologyAndOperationsMember 2022-07-01 2023-06-30 0001383312 br:InvestorCommunicationSolutionsMember 2023-06-30 0001383312 br:GlobalTechnologyAndOperationsMember 2023-06-30 0001383312 br:GlobalTechnologyAndOperationsMember 2023-07-01 2024-06-30 0001383312 br:InvestorCommunicationSolutionsMember 2024-06-30 0001383312 br:GlobalTechnologyAndOperationsMember 2024-06-30 0001383312 br:AdvisorTargetMember 2023-07-01 2024-06-30 0001383312 us-gaap:ComputerSoftwareIntangibleAssetMember 2024-06-30 0001383312 us-gaap:ComputerSoftwareIntangibleAssetMember 2023-06-30 0001383312 br:AcquiredSoftwareTechnologyMember 2024-06-30 0001383312 br:AcquiredSoftwareTechnologyMember 2023-06-30 0001383312 us-gaap:CustomerListsMember 2024-06-30 0001383312 us-gaap:CustomerListsMember 2023-06-30 0001383312 us-gaap:IntellectualPropertyMember 2024-06-30 0001383312 us-gaap:IntellectualPropertyMember 2023-06-30 0001383312 us-gaap:SoftwareAndSoftwareDevelopmentCostsMember 2024-06-30 0001383312 us-gaap:SoftwareAndSoftwareDevelopmentCostsMember 2023-06-30 0001383312 us-gaap:OtherIntangibleAssetsMember 2024-06-30 0001383312 us-gaap:OtherIntangibleAssetsMember 2023-06-30 0001383312 br:AcquiredSoftwareTechnologyMember 2023-07-01 2024-06-30 0001383312 us-gaap:ComputerSoftwareIntangibleAssetMember 2023-07-01 2024-06-30 0001383312 us-gaap:CustomerListsMember 2023-07-01 2024-06-30 0001383312 us-gaap:SoftwareAndSoftwareDevelopmentCostsMember 2023-07-01 2024-06-30 0001383312 us-gaap:OtherIntangibleAssetsMember 2023-07-01 2024-06-30 0001383312 us-gaap:SoftwareAndSoftwareDevelopmentCostsMember srt:MaximumMember 2024-06-30 0001383312 us-gaap:EmployeeSeveranceMember 2024-06-30 0001383312 us-gaap:EmployeeSeveranceMember 2023-06-30 0001383312 br:Fiscal2021TermLoanMember us-gaap:NotesPayableToBanksMember 2024-06-30 0001383312 br:Fiscal2021TermLoanMember us-gaap:NotesPayableToBanksMember 2023-06-30 0001383312 us-gaap:NotesPayableToBanksMember 2024-06-30 0001383312 us-gaap:NotesPayableToBanksMember 2023-06-30 0001383312 us-gaap:RevolvingCreditFacilityMember br:Fiscal2021RevolvingCreditFacilityUSDollarTrancheMember 2024-06-30 0001383312 us-gaap:RevolvingCreditFacilityMember br:Fiscal2021RevolvingCreditFacilityUSDollarTrancheMember 2023-06-30 0001383312 br:Fiscal2021RevolvingCreditFacilityMulticurrencyTrancheMember us-gaap:RevolvingCreditFacilityMember 2024-06-30 0001383312 br:Fiscal2021RevolvingCreditFacilityMulticurrencyTrancheMember us-gaap:RevolvingCreditFacilityMember 2023-06-30 0001383312 us-gaap:RevolvingCreditFacilityMember 2024-06-30 0001383312 us-gaap:RevolvingCreditFacilityMember 2023-06-30 0001383312 us-gaap:NotesPayableToBanksMember br:Fiscal2024AmendedTermLoansMember 2024-06-30 0001383312 us-gaap:NotesPayableToBanksMember br:Fiscal2024AmendedTermLoansMember 2023-06-30 0001383312 br:Fiscal2016SeniorNotesMember us-gaap:SeniorNotesMember 2024-06-30 0001383312 br:Fiscal2016SeniorNotesMember us-gaap:SeniorNotesMember 2023-06-30 0001383312 br:Fiscal2020SeniorNotesMember us-gaap:SeniorNotesMember 2024-06-30 0001383312 br:Fiscal2020SeniorNotesMember us-gaap:SeniorNotesMember 2023-06-30 0001383312 br:Fiscal2021SeniorNotesMember us-gaap:SeniorNotesMember 2024-06-30 0001383312 br:Fiscal2021SeniorNotesMember us-gaap:SeniorNotesMember 2023-06-30 0001383312 us-gaap:SeniorNotesMember 2024-06-30 0001383312 us-gaap:SeniorNotesMember 2023-06-30 0001383312 br:Fiscal2021RevolvingCreditFacilityMember us-gaap:RevolvingCreditFacilityMember 2021-04-30 0001383312 br:Fiscal2021RevolvingCreditFacilityMember us-gaap:RevolvingCreditFacilityMember 2021-04-01 2021-04-30 0001383312 us-gaap:RevolvingCreditFacilityMember br:Fiscal2019RevolvingCreditFacilityMember 2019-03-31 0001383312 us-gaap:RevolvingCreditFacilityMember br:Fiscal2019RevolvingCreditFacilityMember 2019-03-01 2019-03-31 0001383312 us-gaap:RevolvingCreditFacilityMember br:Fiscal2021RevolvingCreditFacilityUSDollarTrancheMember 2021-04-30 0001383312 br:Fiscal2021RevolvingCreditFacilityMulticurrencyTrancheMember us-gaap:RevolvingCreditFacilityMember 2021-04-30 0001383312 br:RevolvingCreditFacilitiesMember us-gaap:RevolvingCreditFacilityMember 2023-07-01 2024-06-30 0001383312 br:RevolvingCreditFacilitiesMember us-gaap:RevolvingCreditFacilityMember 2022-07-01 2023-06-30 0001383312 br:RevolvingCreditFacilitiesMember us-gaap:RevolvingCreditFacilityMember 2021-07-01 2022-06-30 0001383312 br:Fiscal2021RevolvingCreditFacilityMember us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember us-gaap:RevolvingCreditFacilityMember 2023-07-01 2024-06-30 0001383312 br:Fiscal2021RevolvingCreditFacilityMember br:SecuredOvernightFinancingRateSOFROvernightIndexSwapRateStepUpsMember us-gaap:RevolvingCreditFacilityMember 2023-07-01 2024-06-30 0001383312 br:Fiscal2021RevolvingCreditFacilityMember us-gaap:RevolvingCreditFacilityMember br:SecuredOvernightFinancingRayeSOFROvernightIndexSwapRateStepDownsMember 2023-07-01 2024-06-30 0001383312 br:Fiscal2021RevolvingCreditFacilityMember us-gaap:RevolvingCreditFacilityMember br:SterlingOvernightInterbankAverageRateSONIAMember 2023-07-01 2024-06-30 0001383312 br:Fiscal2021RevolvingCreditFacilityMember us-gaap:RevolvingCreditFacilityMember br:SterlingOvernightInterbankAverageRateSONIAStepUpMember 2023-07-01 2024-06-30 0001383312 br:Fiscal2021RevolvingCreditFacilityMember br:SterlingOvernightInterbankAverageRateSONIAStepDownMember us-gaap:RevolvingCreditFacilityMember 2023-07-01 2024-06-30 0001383312 br:Fiscal2021RevolvingCreditFacilityMember us-gaap:RevolvingCreditFacilityMember 2023-07-01 2024-06-30 0001383312 br:Fiscal2021TermLoansMember us-gaap:NotesPayableToBanksMember 2021-03-31 0001383312 us-gaap:NotesPayableToBanksMember br:Fiscal2021TermLoansTranche1Member 2021-03-31 0001383312 us-gaap:NotesPayableToBanksMember br:Fiscal2021TermLoansTranche2Member 2021-03-31 0001383312 us-gaap:NotesPayableToBanksMember br:Fiscal2021TermLoansTranche1Member 2021-03-01 2021-03-31 0001383312 us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember us-gaap:NotesPayableToBanksMember br:Fiscal2021TermLoansTranche2Member 2021-03-01 2021-03-31 0001383312 br:SecuredOvernightFinancingRateSOFROvernightIndexSwapRateStepUpsMember us-gaap:NotesPayableToBanksMember br:Fiscal2021TermLoansTranche2Member 2021-03-01 2021-03-31 0001383312 us-gaap:NotesPayableToBanksMember br:SecuredOvernightFinancingRayeSOFROvernightIndexSwapRateStepDownsMember br:Fiscal2021TermLoansTranche2Member 2021-03-01 2021-03-31 0001383312 us-gaap:NotesPayableToBanksMember br:Fiscal2024AmendedTermLoansMember 2023-08-17 0001383312 us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember us-gaap:NotesPayableToBanksMember br:Fiscal2024AmendedTermLoansMember 2023-08-17 2023-08-17 0001383312 br:SecuredOvernightFinancingRateSOFROvernightIndexSwapRateStepUpsMember us-gaap:NotesPayableToBanksMember br:Fiscal2024AmendedTermLoansMember 2023-08-17 2023-08-17 0001383312 us-gaap:NotesPayableToBanksMember br:SecuredOvernightFinancingRayeSOFROvernightIndexSwapRateStepDownsMember br:Fiscal2024AmendedTermLoansMember srt:MaximumMember 2023-08-17 2023-08-17 0001383312 us-gaap:NotesPayableToBanksMember br:SecuredOvernightFinancingRayeSOFROvernightIndexSwapRateStepDownsMember br:Fiscal2024AmendedTermLoansMember srt:MinimumMember 2023-08-17 2023-08-17 0001383312 br:Fiscal2016SeniorNotesMember us-gaap:SeniorNotesMember 2016-06-30 0001383312 br:Fiscal2016SeniorNotesMember us-gaap:SeniorNotesMember 2016-06-01 2016-06-30 0001383312 br:LongTermDebtExcludingCurrentPortionMember br:Fiscal2016SeniorNotesMember us-gaap:SeniorNotesMember 2024-06-30 0001383312 br:LongTermDebtExcludingCurrentPortionMember br:Fiscal2016SeniorNotesMember us-gaap:SeniorNotesMember 2023-06-30 0001383312 br:Fiscal2020SeniorNotesMember us-gaap:SeniorNotesMember 2019-12-31 0001383312 br:Fiscal2020SeniorNotesMember us-gaap:SeniorNotesMember 2019-12-01 2019-12-31 0001383312 br:Fiscal2021SeniorNotesMember us-gaap:SeniorNotesMember 2021-05-31 0001383312 br:Fiscal2021SeniorNotesMember us-gaap:SeniorNotesMember 2021-05-01 2021-05-31 0001383312 br:LongTermDebtExcludingCurrentPortionMember br:Fiscal2021SeniorNotesMember us-gaap:SeniorNotesMember 2023-06-30 0001383312 us-gaap:ShareBasedCompensationAwardTrancheOneMember us-gaap:EmployeeStockOptionMember 2023-07-01 2024-06-30 0001383312 us-gaap:ShareBasedCompensationAwardTrancheTwoMember us-gaap:EmployeeStockOptionMember 2023-07-01 2024-06-30 0001383312 br:ShareBasedCompensationAwardTrancheSixMember us-gaap:EmployeeStockOptionMember 2023-07-01 2024-06-30 0001383312 us-gaap:ShareBasedCompensationAwardTrancheThreeMember us-gaap:EmployeeStockOptionMember 2023-07-01 2024-06-30 0001383312 br:ShareBasedCompensationAwardTrancheFiveMember us-gaap:EmployeeStockOptionMember 2023-07-01 2024-06-30 0001383312 br:ShareBasedCompensationAwardTrancheFourMember us-gaap:EmployeeStockOptionMember 2023-07-01 2024-06-30 0001383312 us-gaap:EmployeeStockOptionMember 2023-07-01 2024-06-30 0001383312 br:TimeBasedRestrictedStockMember 2023-07-01 2024-06-30 0001383312 br:PerformanceBasedRestrictedStockUnitsMember 2023-07-01 2024-06-30 0001383312 us-gaap:EmployeeStockOptionMember 2021-06-30 0001383312 br:TimeBasedRestrictedStockMember 2021-06-30 0001383312 br:PerformanceBasedRestrictedStockUnitsMember 2021-06-30 0001383312 us-gaap:EmployeeStockOptionMember 2021-07-01 2022-06-30 0001383312 br:TimeBasedRestrictedStockMember 2021-07-01 2022-06-30 0001383312 br:PerformanceBasedRestrictedStockUnitsMember 2021-07-01 2022-06-30 0001383312 us-gaap:EmployeeStockOptionMember 2022-06-30 0001383312 br:TimeBasedRestrictedStockMember 2022-06-30 0001383312 br:PerformanceBasedRestrictedStockUnitsMember 2022-06-30 0001383312 us-gaap:EmployeeStockOptionMember 2022-07-01 2023-06-30 0001383312 br:TimeBasedRestrictedStockMember 2022-07-01 2023-06-30 0001383312 br:PerformanceBasedRestrictedStockUnitsMember 2022-07-01 2023-06-30 0001383312 us-gaap:EmployeeStockOptionMember 2023-06-30 0001383312 br:TimeBasedRestrictedStockMember 2023-06-30 0001383312 br:PerformanceBasedRestrictedStockUnitsMember 2023-06-30 0001383312 us-gaap:EmployeeStockOptionMember 2024-06-30 0001383312 br:TimeBasedRestrictedStockMember 2024-06-30 0001383312 br:PerformanceBasedRestrictedStockUnitsMember 2024-06-30 0001383312 br:VestedStockOptionsMember 2024-06-30 0001383312 br:OutstandingOptionsMember br:ExercisePriceRangeRangeOneMember 2023-07-01 2024-06-30 0001383312 br:OutstandingOptionsMember br:ExercisePriceRangeRangeOneMember 2024-06-30 0001383312 br:ExercisePriceRangeRangeTwoMember br:OutstandingOptionsMember 2023-07-01 2024-06-30 0001383312 br:ExercisePriceRangeRangeTwoMember br:OutstandingOptionsMember 2024-06-30 0001383312 br:ExercisePriceRangeRangeThreeMember br:OutstandingOptionsMember 2023-07-01 2024-06-30 0001383312 br:ExercisePriceRangeRangeThreeMember br:OutstandingOptionsMember 2024-06-30 0001383312 br:OutstandingOptionsMember br:ExercisePriceRangeRangeFourMember 2023-07-01 2024-06-30 0001383312 br:OutstandingOptionsMember br:ExercisePriceRangeRangeFourMember 2024-06-30 0001383312 br:OutstandingOptionsMember br:ExercisePriceRangeRangeFiveMember 2023-07-01 2024-06-30 0001383312 br:OutstandingOptionsMember br:ExercisePriceRangeRangeFiveMember 2024-06-30 0001383312 br:OutstandingOptionsMember br:ExercisePriceRangeRangeSixMember 2023-07-01 2024-06-30 0001383312 br:OutstandingOptionsMember br:ExercisePriceRangeRangeSixMember 2024-06-30 0001383312 br:OutstandingOptionsMember br:ExercisePriceRangeSevenMember 2023-07-01 2024-06-30 0001383312 br:OutstandingOptionsMember br:ExercisePriceRangeSevenMember 2024-06-30 0001383312 br:ExercisePriceRangeEightMember 2023-07-01 2024-06-30 0001383312 br:OutstandingOptionsMember br:ExercisePriceRangeEightMember 2024-06-30 0001383312 br:OutstandingOptionsMember br:ExercisePriceRangeEightMember 2023-07-01 2024-06-30 0001383312 br:OutstandingOptionsMember br:ExercisePriceRangeNineMember 2023-07-01 2024-06-30 0001383312 br:OutstandingOptionsMember br:ExercisePriceRangeNineMember 2024-06-30 0001383312 br:OutstandingOptionsMember 2024-06-30 0001383312 br:OutstandingOptionsMember 2023-07-01 2024-06-30 0001383312 br:ExercisableOptionsMember br:ExercisePriceRangeRangeOneMember 2023-07-01 2024-06-30 0001383312 br:ExercisableOptionsMember br:ExercisePriceRangeRangeOneMember 2024-06-30 0001383312 br:ExercisePriceRangeRangeTwoMember br:ExercisableOptionsMember 2023-07-01 2024-06-30 0001383312 br:ExercisePriceRangeRangeTwoMember br:ExercisableOptionsMember 2024-06-30 0001383312 br:ExercisePriceRangeRangeThreeMember br:ExercisableOptionsMember 2023-07-01 2024-06-30 0001383312 br:ExercisePriceRangeRangeThreeMember br:ExercisableOptionsMember 2024-06-30 0001383312 br:ExercisableOptionsMember br:ExercisePriceRangeRangeFourMember 2023-07-01 2024-06-30 0001383312 br:ExercisableOptionsMember br:ExercisePriceRangeRangeFourMember 2024-06-30 0001383312 br:ExercisableOptionsMember br:ExercisePriceRangeRangeFiveMember 2023-07-01 2024-06-30 0001383312 br:ExercisableOptionsMember br:ExercisePriceRangeRangeFiveMember 2024-06-30 0001383312 br:ExercisableOptionsMember br:ExercisePriceRangeRangeSixMember 2023-07-01 2024-06-30 0001383312 br:ExercisableOptionsMember br:ExercisePriceRangeRangeSixMember 2024-06-30 0001383312 br:ExercisableOptionsMember br:ExercisePriceRangeSevenMember 2023-07-01 2024-06-30 0001383312 br:ExercisableOptionsMember br:ExercisePriceRangeSevenMember 2024-06-30 0001383312 br:ExercisableOptionsMember br:ExercisePriceRangeEightMember 2023-07-01 2024-06-30 0001383312 br:ExercisableOptionsMember br:ExercisePriceRangeEightMember 2024-06-30 0001383312 br:ExercisableOptionsMember br:ExercisePriceRangeNineMember 2023-07-01 2024-06-30 0001383312 br:ExercisableOptionsMember br:ExercisePriceRangeNineMember 2024-06-30 0001383312 br:ExercisableOptionsMember 2024-06-30 0001383312 br:ExercisableOptionsMember 2023-07-01 2024-06-30 0001383312 us-gaap:SegmentContinuingOperationsMember 2023-07-01 2024-06-30 0001383312 us-gaap:SegmentContinuingOperationsMember 2022-07-01 2023-06-30 0001383312 us-gaap:SegmentContinuingOperationsMember 2021-07-01 2022-06-30 0001383312 br:OpportunisticBuyBacksMember 2023-07-01 2024-06-30 0001383312 br:OpportunisticBuyBacksMember 2022-07-01 2023-06-30 0001383312 br:GradedVestingMember 2023-07-01 2024-06-30 0001383312 br:GradedVestingMember 2022-07-01 2023-06-30 0001383312 br:GradedVestingMember 2021-07-01 2022-06-30 0001383312 br:GradedVestingMember 2024-06-30 0001383312 br:GradedVestingMember 2023-06-30 0001383312 br:GradedVestingMember 2022-06-30 0001383312 br:SavingsPlan401kMember 2023-07-01 2024-06-30 0001383312 br:SavingsPlan401kMember 2022-07-01 2023-06-30 0001383312 br:SavingsPlan401kMember 2021-07-01 2022-06-30 0001383312 br:ExecutiveRetirementAndSavingsPlanMember 2023-07-01 2024-06-30 0001383312 br:ExecutiveRetirementAndSavingsPlanMember 2022-07-01 2023-06-30 0001383312 br:ExecutiveRetirementAndSavingsPlanMember 2021-07-01 2022-06-30 0001383312 us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember br:SupplementalOfficerRetirementPlanMember 2023-07-01 2024-06-30 0001383312 us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember br:SupplementalOfficerRetirementPlanMember 2022-07-01 2023-06-30 0001383312 us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember br:SupplementalOfficerRetirementPlanMember 2021-07-01 2022-06-30 0001383312 us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember br:SupplementalExecutiveRetirementPlanMember 2023-07-01 2024-06-30 0001383312 us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember br:SupplementalExecutiveRetirementPlanMember 2022-07-01 2023-06-30 0001383312 us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember br:SupplementalExecutiveRetirementPlanMember 2021-07-01 2022-06-30 0001383312 us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember br:SupplementalOfficerRetirementPlanMember 2024-06-30 0001383312 us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember br:SupplementalOfficerRetirementPlanMember 2023-06-30 0001383312 us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember br:SupplementalOfficerRetirementPlanMember 2022-06-30 0001383312 us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember br:SupplementalExecutiveRetirementPlanMember 2024-06-30 0001383312 us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember br:SupplementalExecutiveRetirementPlanMember 2023-06-30 0001383312 us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember br:SupplementalExecutiveRetirementPlanMember 2022-06-30 0001383312 us-gaap:DefinedBenefitPostretirementHealthCoverageMember 2023-07-01 2024-06-30 0001383312 us-gaap:DefinedBenefitPostretirementHealthCoverageMember 2022-07-01 2023-06-30 0001383312 us-gaap:DefinedBenefitPostretirementHealthCoverageMember 2021-07-01 2022-06-30 0001383312 us-gaap:DefinedBenefitPostretirementHealthCoverageMember 2024-06-30 0001383312 us-gaap:DefinedBenefitPostretirementHealthCoverageMember 2023-06-30 0001383312 us-gaap:DefinedBenefitPostretirementHealthCoverageMember 2022-06-30 0001383312 br:PostemploymentBenefitObligationsMember 2023-07-01 2024-06-30 0001383312 br:PostemploymentBenefitObligationsMember 2022-07-01 2023-06-30 0001383312 br:PostemploymentBenefitObligationsMember 2021-07-01 2022-06-30 0001383312 br:PostemploymentBenefitObligationsMember 2024-06-30 0001383312 br:PostemploymentBenefitObligationsMember 2023-06-30 0001383312 br:PostemploymentBenefitObligationsMember 2022-06-30 0001383312 us-gaap:ForeignCountryMember 2024-06-30 0001383312 us-gaap:DomesticCountryMember 2024-06-30 0001383312 us-gaap:OtherLiabilitiesMember 2024-06-30 0001383312 us-gaap:SubsequentEventMember 2024-07-01 2024-07-31 0001383312 2024-01-01 2024-03-31 0001383312 2024-03-31 0001383312 us-gaap:CurrencySwapMember 2022-01-31 0001383312 us-gaap:CurrencySwapMember 2024-06-30 0001383312 us-gaap:TreasuryLockMember br:ItivitiMember 2021-05-01 2021-05-31 0001383312 us-gaap:TreasuryLockMember br:ItivitiMember 2023-07-01 2024-06-30 0001383312 us-gaap:AccumulatedTranslationAdjustmentMember 2021-06-30 0001383312 us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember 2021-06-30 0001383312 us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember 2021-06-30 0001383312 us-gaap:AccumulatedTranslationAdjustmentMember 2021-07-01 2022-06-30 0001383312 us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember 2021-07-01 2022-06-30 0001383312 us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember 2021-07-01 2022-06-30 0001383312 us-gaap:AccumulatedTranslationAdjustmentMember 2022-06-30 0001383312 us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember 2022-06-30 0001383312 us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember 2022-06-30 0001383312 us-gaap:AccumulatedTranslationAdjustmentMember 2022-07-01 2023-06-30 0001383312 us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember 2022-07-01 2023-06-30 0001383312 us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember 2022-07-01 2023-06-30 0001383312 us-gaap:AccumulatedTranslationAdjustmentMember 2023-06-30 0001383312 us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember 2023-06-30 0001383312 us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember 2023-06-30 0001383312 us-gaap:AccumulatedTranslationAdjustmentMember 2023-07-01 2024-06-30 0001383312 us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember 2023-07-01 2024-06-30 0001383312 us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember 2023-07-01 2024-06-30 0001383312 us-gaap:AccumulatedTranslationAdjustmentMember 2024-06-30 0001383312 us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember 2024-06-30 0001383312 us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember 2024-06-30 0001383312 us-gaap:OperatingSegmentsMember br:InvestorCommunicationSolutionsMember 2023-07-01 2024-06-30 0001383312 br:GlobalTechnologyAndOperationsMember us-gaap:OperatingSegmentsMember 2023-07-01 2024-06-30 0001383312 us-gaap:CorporateNonSegmentMember 2023-07-01 2024-06-30 0001383312 us-gaap:OperatingSegmentsMember br:InvestorCommunicationSolutionsMember 2024-06-30 0001383312 br:GlobalTechnologyAndOperationsMember us-gaap:OperatingSegmentsMember 2024-06-30 0001383312 us-gaap:CorporateNonSegmentMember 2024-06-30 0001383312 us-gaap:OperatingSegmentsMember br:InvestorCommunicationSolutionsMember 2022-07-01 2023-06-30 0001383312 br:GlobalTechnologyAndOperationsMember us-gaap:OperatingSegmentsMember 2022-07-01 2023-06-30 0001383312 us-gaap:CorporateNonSegmentMember 2022-07-01 2023-06-30 0001383312 us-gaap:OperatingSegmentsMember br:InvestorCommunicationSolutionsMember 2023-06-30 0001383312 br:GlobalTechnologyAndOperationsMember us-gaap:OperatingSegmentsMember 2023-06-30 0001383312 us-gaap:CorporateNonSegmentMember 2023-06-30 0001383312 us-gaap:OperatingSegmentsMember br:InvestorCommunicationSolutionsMember 2021-07-01 2022-06-30 0001383312 br:GlobalTechnologyAndOperationsMember us-gaap:OperatingSegmentsMember 2021-07-01 2022-06-30 0001383312 us-gaap:CorporateNonSegmentMember 2021-07-01 2022-06-30 0001383312 us-gaap:OperatingSegmentsMember br:InvestorCommunicationSolutionsMember 2022-06-30 0001383312 br:GlobalTechnologyAndOperationsMember us-gaap:OperatingSegmentsMember 2022-06-30 0001383312 us-gaap:CorporateNonSegmentMember 2022-06-30 0001383312 country:US 2023-07-01 2024-06-30 0001383312 country:CA 2023-07-01 2024-06-30 0001383312 country:GB 2023-07-01 2024-06-30 0001383312 br:OthersMember 2023-07-01 2024-06-30 0001383312 country:US 2024-06-30 0001383312 country:CA 2024-06-30 0001383312 country:GB 2024-06-30 0001383312 br:OthersMember 2024-06-30 0001383312 country:US 2022-07-01 2023-06-30 0001383312 country:CA 2022-07-01 2023-06-30 0001383312 country:GB 2022-07-01 2023-06-30 0001383312 br:OthersMember 2022-07-01 2023-06-30 0001383312 country:US 2023-06-30 0001383312 country:CA 2023-06-30 0001383312 country:GB 2023-06-30 0001383312 br:OthersMember 2023-06-30 0001383312 country:US 2021-07-01 2022-06-30 0001383312 country:CA 2021-07-01 2022-06-30 0001383312 country:GB 2021-07-01 2022-06-30 0001383312 br:OthersMember 2021-07-01 2022-06-30 0001383312 country:US 2022-06-30 0001383312 country:CA 2022-06-30 0001383312 country:GB 2022-06-30 0001383312 br:OthersMember 2022-06-30 0001383312 br:QuarterlyDividendDeclaredMember us-gaap:SubsequentEventMember 2024-08-05 2024-08-05 0001383312 br:QuarterlyDividendDeclaredMember us-gaap:SubsequentEventMember 2024-08-05 0001383312 br:AnnualDividendDeclaredMember us-gaap:SubsequentEventMember 2024-08-04 0001383312 br:AnnualDividendDeclaredMember us-gaap:SubsequentEventMember 2024-08-05 0001383312 us-gaap:AllowanceForCreditLossMember 2023-06-30 0001383312 us-gaap:AllowanceForCreditLossMember 2023-07-01 2024-06-30 0001383312 us-gaap:AllowanceForCreditLossMember 2024-06-30 0001383312 us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember 2023-06-30 0001383312 us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember 2023-07-01 2024-06-30 0001383312 us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember 2024-06-30 0001383312 br:SECSchedule1209ValuationAllowanceOtherReceivablesMember 2023-06-30 0001383312 br:SECSchedule1209ValuationAllowanceOtherReceivablesMember 2023-07-01 2024-06-30 0001383312 br:SECSchedule1209ValuationAllowanceOtherReceivablesMember 2024-06-30 0001383312 us-gaap:AllowanceForCreditLossMember 2022-06-30 0001383312 us-gaap:AllowanceForCreditLossMember 2022-07-01 2023-06-30 0001383312 us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember 2022-06-30 0001383312 us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember 2022-07-01 2023-06-30 0001383312 br:SECSchedule1209ValuationAllowanceOtherReceivablesMember 2022-06-30 0001383312 br:SECSchedule1209ValuationAllowanceOtherReceivablesMember 2022-07-01 2023-06-30 0001383312 us-gaap:AllowanceForCreditLossMember 2021-06-30 0001383312 us-gaap:AllowanceForCreditLossMember 2021-07-01 2022-06-30 0001383312 us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember 2021-06-30 0001383312 us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember 2021-07-01 2022-06-30 0001383312 br:SECSchedule1209ValuationAllowanceOtherReceivablesMember 2021-06-30 0001383312 br:SECSchedule1209ValuationAllowanceOtherReceivablesMember 2021-07-01 2022-06-30 0001383312 br:ChristopherPerryMember 2023-07-01 2024-06-30 0001383312 br:ChristopherPerryMember 2024-04-01 2024-06-30 0001383312 br:ChristopherPerryMember 2024-06-30 0001383312 br:TimothyC.GokeyMember 2023-07-01 2024-06-30 0001383312 br:TimothyC.GokeyMember 2024-04-01 2024-06-30 0001383312 br:TimothyC.GokeyMember 2024-06-30 0001383312 2024-04-01 2024-06-30

美利坚合众国

证券交易委员会

华盛顿特区20549

表格 10-K

(标记一)

☒ 根据证券交易所第13或15(d)款提交的年度报告 1934年证券交易法

截至财年结束的年度报告 6月30日 , 2024

或者

☐ 根据1934年证券交易法第13或15(d)节的转型报告书

佣金档案号 001-33220

broadridge金融解决方案, INC.

(根据其章程规定的注册人准确名称)

特拉华州 33-1151291 (设立或组织的其他管辖区域) (纳税人识别号码) 5 DAKOTA DRIVE 11042 LAKE SUCCESS 纽约 ,(主要行政办公地址) (邮政编码)

(516 ) 472-5400

(注册人电话号码,包括区号)

每个交易所的名称

每个类的标题: 交易代码 所有交易所的名称: 普通股,每股面值0.01美元 BR 请使用moomoo账号登录查看New York Stock Exchange

根据法案第12(g)条注册的证券: 无

如果注册人是《证券法》第405条规定的知名 seasoned 发行人,请用复选标记表示。 是 ý 否 ¨

如果注册人根据《法案》第13或第15(d)条规定无需提交报告,则请用勾号标明。 是 ¨ 不 ý

请勾选以下内容。申报人是否(1)在过去12个月内(或申报人需要报告这些报告的时间较短的期间内)已提交证券交易法规定的第13或15(d)条要求提交的所有报告;以及(2)过去90天内已被要求提交此类报告。 是 ý 否 ¨

请勾选符合规定S-T条例405规定的每份互动数据文件是否已在过去12个月内(或更短的时间内,即注册人请求提交此类文件所需的时间)被提交的标记。是 ý 否 ¨

请用复选标记表示公司是一家大型高速提交者,一家加速提交者,一家非加速提交者,一家较小的报告公司,还是新兴成长公司。请查看《交易所法》第120亿.2条对“大型高速提交者”、“加速提交者”、“较小的报告公司”和“新兴成长公司”的定义。(只能选一项):

大型加速存取器 ý 加速归档者 ¨ 非加速归档者 ¨ 较小报告公司☐ 新兴增长公司 ☐

如果是新兴成长公司,请打勾表示注册人已选择不使用根据交易所法第13(a)节提供的任何新的或修订后的财务会计准则延长过渡期符合要求。 ¨

请使用勾号标示,报告是否已根据《萨班斯 -豪利 法》(15 U.S.C. 7262(b))提交了内部控制有效性评估的报告和陈述(由已准备或发表其审计报告的注册会计师事务所提供)。 ☒

如果证券根据《证券法》第12(b)条登记,请勾选印记,以表示注册人包括在文件中的财务报表反映了对之前发布的财务报表的更正。☐

请用勾选标记表示,这些错误更正中是否有要求对公司执行官在相关恢复期内按照§240.10D-1(b)进行奖励性报酬的恢复分析。 ☐

请勾选以下内容。申报人是否是外壳公司(根据证券交易法规则12b-2定义)。 是 ☐ 否 ý

截至2023年12月31日,注册公司非关联方持有的普通股市值为$24,045,781,479 .

截至2024年8月1日,有 116,708,830 公司的普通股流通股数为(不包括公司自留的37,752,297股),每股面值为$0.01。

参考文件被引用

在2024年6月30日财政年度结束后的120天内将提交给证券交易委员会的公司定向代理声明书的部分内容将被参照列入第三部分。

目录

页码 项目1。 项目1A。 项目1B。 项目1C. 项目2。 第三项。 第四项。 第五项。 第六项。 项目 7。 项目7A。 项目 8。 项目 9。 项目 9A。 项目9B.其他信息。 项目9C。 项目10。 第11项。 第12项。 第13项。 第14项。 项目15。 项目16。

第I部分

前瞻性声明

broadridge金融解决方案公司的10-k表格年度报告(下文简称“Broadridge”或“公司”)可能包含根据1995年《私人证券诉讼改革法》的含义而进行的“前瞻性声明”。那些非历史性质的声明可能通过诸如“预计”,“假定”,“计划”,“预期”,“估计”,“我们相信”,“可能是”,“在轨道上”及其他类似意义的词语来识别,属于前瞻性声明。特别是,“业务”,“风险因素”和“管理层讨论和财务状况及运营结果分析”下的信息包含前瞻性声明。这些声明基于管理层的期望和假设,并受到可能导致实际结果与表达不一的风险和不确定性的影响。可能导致实际结果与前瞻性声明中所考虑的结果不一的因素包括:

• 影响Broadridge客户或Broadridge提供的服务的法律法规变化;

• Broadridge对相对较少客户的依赖,这些客户持续的财务健康状况,以及这些客户持续使用Broadridge服务并享有有利定价条款;

• 一次影响Broadridge客户信息的材料安防-半导体漏洞或网络安全概念攻击;

• 证券市场参与度和活动量下降;

• Broadridge的核心服务提供商未能提供预期水平的服务;

• Broadridge系统发生灾难或其他重大减缓或故障,或Broadridge服务性能的错误;

• 整体市场、经济和地缘政治状况及其对证券市场的影响;

• Broadridge在保留现有客户和向他们销售额外服务,以及获得新客户方面的成功;

• Broadridge未能跟上科技的变化和客户的需求;

• 竞争条件;

• Broadridge吸引和留住关键人员的能力;以及

• 新收购和剥离的影响。

可能还有其他因素导致我们的实际结果与前瞻性声明存在重大差异。我们的实际结果、表现或成就可能与前瞻性声明中表达或暗示的内容有重大不同。我们无法保证前瞻性声明中预期的任何事件将会发生,或者如果发生,它们对我们的经营结果和财务状况将产生何种影响。您应仔细阅读本年度报告10-K表格中“风险因素”部分描述的因素,以了解可能导致我们的实际结果与这些前瞻性声明存在差异的某些风险。

所有前瞻性声明仅代表本年度10-k表格报告日期的观点,并且完全受限于本年度10-k表格报告中包含的警示性声明。我们不承担更新或修订前瞻性声明的义务,这些声明可能会反映声明日期后出现的事件或情况,或反映未预见事件的发生,法律要求外。

项目 1. 业务

Broadridge 业务

Broadridge是一家特拉华州公司,属于S&P 500指数(“S&P”)。 ® Broadridge是全球领先的金融科技公司,支持投资、公司治理和通信。 我们为银行、经纪商、资产和财富管理公司、上市公司、投资者和所有基金类型提供技术驱动的解决方案,使我们的客户能够运营、创新和成长。我们的可信专业知识和变革性技术提供了制造行业和数据,以帮助改善客户的业务绩效和运营效率,并现代化投资者体验。

我们的业务分为两个可报告的部分:投资者沟通解决方案和全球科技与运营。

投资者沟通解决方案

我们的监管解决方案、数据驱动基金解决方案、公司发行人解决方案以及客户通信解决方案作为投资者通信解决方案部分提供。投资者通信解决方案部分是我们两个业务部分中规模较大的一部分,其收入在2024和2023财政年度分别占我们总收入的约75%和75%,包括来自于除美国(“U.S.”)以外其他货币产生的收入的汇率影响。请参阅“可报告部门的分析——收入”下的“第7项。管理层的讨论与财务状况及经营结果分析。”我们通过投资者通信解决方案部分提供以下服务和解决方案:

监管解决方案

我们为银行、经纪交易商、企业发行人和基金客户处理整个代理材料分发和投票流程。我们提供电子和传统的硬拷贝服务,用于向投资者交付代理材料和征集同意;维护包含客户交付方式偏好的规则引擎和数据库;在其网站上发布文件;向投资者发送电子邮件提醒他们代理材料可用;通过纸张、电话、在线或移动应用程序进行代理投票。我们有能力合并居住在同一地址的多位股东的股东通信,这是通过确定投资者的交付偏好来完成的。我们还为基金公司的注册客户提供代理投票征集服务,有效管理整个代理活动。 此外,我们为所有国际机构和零售代理的处理提供完整的外包解决方案,包括股东披露管理。

大多数上市公司的股票并没有以最终受益所有者的名义注册在公司的记录中。相反,所有上市公司股票的绝大多数都是以“街名”持有,意味着它们的记录由经销商或银行通过其存托机构持有。大多数街名股票都以“Cede & Co.”的名义注册,该名称由存托信托与结算公司(“DTCC”)使用,它代表其参与的经销商和银行持有股票。这些参与的经销商和银行(因其仅以名义持有证券而被称为“提名人”)又代表其客户,即个人受益所有者持有股票。提名人应要求提供不反对将其姓名、地址和股份信息提供给公司的受益所有者的信息,这些被称为“无异议受益所有者”(或“NOBOs”)。反对的受益所有者(或“OBOs”)只能由经销商或银行直接联系。由于DTCC的角色仅限于保管人,因此已经制定了一些机制,以便将其作为记录所有者所持有的法律权利(例如投票权)传递给受益所有者。传递投票权的第一步是“综合代理”,DTCC执行该代理将其投票权转移给其参与的提名人。根据适用的规则,提名人必须向受益所有者传递代理材料并请求投票指示。

由于涉及大量受益股东的受益代理程序中有许多提名人,我们在确保受益代理程序对提名人、公司、基金和投资者顺利进行中扮演着独特、核心和不可或缺的角色。许多提名人已将分发代理材料和汇总投票指示的流程委托给我们。提名人通过与Broadridge签订协议,并通过授权书将代理执行的权限转让给我们,这一权力是提名人通过综合代理从DTCC获得的。通过我们与提名人签订的提供受益代理服务的协议,我们承担了确保提名人账户持有人及时以数字方式或纸质方式收到代理材料的责任,同时确保他们的投票指示传达给进行征集的公司和基金,并根据他们特定征集的要求履行这些服务。为了有效提供受益代理服务,我们直接与每个公司和/或基金进行接口和协调,以确保服务的准确和及时执行。由于公司和基金与其受益持有股份的所有提名人合作将增加成本,因此公司和基金与我们合作,执行确保及时向所有受益所有者分发代理材料以及准确报告其投票的所有任务和流程。

SEC的规则要求公开公司向提名人报销分发股东通信给以街名持有证券的实益拥有者的费用。报销费率在自律组织(“SRO”)的规则中列出,包括纽约证券交易所(“纽交所”)。我们向公开公司收取代理服务费,收取费用,并将提名人应得的费用部分汇出。此外,纽交所规则为中介(例如Broadridge)在代理过程中提供的某些服务设定费用。NOBO信息的准备和交付由请求该信息的企业发行人报销。报销费率基于根据纽交所或其他SRO规则制作的NOBO数量。这些规则还判断应支付给作为提名人代表编写NOBO信息的第三方中介(如Broadridge)的费用。

我们为机构投资者提供一系列服务,以管理和跟踪整个代理投票流程,包括满足他们的报告需求。ProxyEdge ® (“ProxyEdge”)是我们为机构投资者和财务顾问提供的创新电子代理投递和投票解决方案,集成了跨多个保管人的持仓选票,并将其呈现为单一代理。投票可以针对整个持仓、按账户投票组或单独账户进行指示,分为手动或基于参与的治理研究提供商建议的自动投票。ProxyEdge还提供客户报告和监管报告。ProxyEdge可用于美国和加拿大公司的会议,也适用于许多非北美国家基于我们全球保管客户的持股情况。ProxyEdge支持多种语言,目前全球有超过7000名ProxyEdge用户。

除了我们的代理服务外,我们还提供监管通信解决方案,使全球资产管理者能够通过一个资源有效而可靠地与大量投资者沟通,集中管理所有投资者通信。我们提供监管报告、招股说明书和代理材料的撰写、印刷、归档和分发服务,以及共同基金代理征集服务。我们管理整个通信流程,与注册股东和受益股东进行沟通,并提供一个完整的平台,用于在多个渠道(包括印刷、电子传递、在线和移动)中创建和分发监管投资者通信。这些服务包括招股说明书的交付和年度及半年度股东报告的分发。我们的客户可以通过印刷、电子交付、在线和移动来创建和分发这些通信。除了我们的基金解决方案外,我们还提供其他一系列监管通信解决方案,包括通知投资者美国重组或公司行动事件(如收购要约、合并和收购、破产)以及全球集体诉讼服务,以识别、归档和恢复涉及证券和其他金融产品的集体诉讼和集体补救程序的相关事项。

我们的通过投票解决方案为基金客户提供了让个人投资者参与代理投票过程的能力,帮助他们扩大投资者参与的努力并获得重要投资决策的宝贵意见。Broadridge的机构解决方案帮助资产管理公司在投资组合公司中分裂投票,并按照比例直接传递给机构投资者。对于零售投资者,我们的解决方案允许基金对其投资者进行投票偏好调查,并为投资者提供投票指示、设定标准投票偏好,或在预定会议上进行投票的能力。

此外,我们提供针对客户在欧洲、中东、非洲("EMEA")和亚太("APAC")地域板块需求的国际公司治理解决方案。 这些解决方案包括机构和零售全球代理服务,以及股东数据和分析。 我们的国际解决方案帮助客户将重心聚焦于核心业务,同时帮助他们维持全球监管合规,降低成本,提高效率,并获得数据洞察。

数据驱动的基金解决方案

我们提供全方位的数据驱动解决方案,帮助我们的资产管理和养老服务提供商客户增长营业收入、高效运营,并保持合规。我们的数据和分析解决方案提供投资产品分销数据、预测建模、分析工具,以及洞察和研究,帮助资产管理者优化全球零售和机构渠道的产品分销。我们还为顾问、机构和资产管理者提供以受托责任为重点的学习与发展、软件和科技,以及数据和分析服务,覆盖整个退休和财富生态系统。

通过我们的基金沟通解决方案业务,我们为基金经理提供一个单一、一体化的服务提供商,以管理数据、进行计算、撰写文档、管理合规性,并在多个辖区内传播信息。我们的解决方案帮助基金经理增加分销机会,遵守英国和欧盟的法规,例如偿付能力 II 和 MiFID II,并使投资者能够以数字格式轻松获取信息。我们还支持基金经理在欧洲市场上的文档和数据传播。这使得分销商和投资者能够接收到完整、准确和及时的信息,以支持基金销售。

通过我们的养老和工作场所解决方案业务(“Broadridge养老和工作场所”),我们为金融机构提供自动化的共同基金和交易所交易基金交易处理服务,这些金融机构代表其客户提交交易,包括合格和非合格的退休计划以及个人财富账户。 我们的信托、交易和结算服务融入到我们的产品系列中,从而加强了Broadridge作为资产管理、财富以及养老行业的洞察、科技和业务外包服务提供商的角色。此外,我们的市场和交易通信解决方案为资产管理者、保险提供商和养老服务提供商提供了内容管理和全渠道分发平台,以进行市场营销和销售通信。

企业发放者解决方案

我们为企业发行人提供治理和通信服务,支持全面的上市公司职能,包括股东年会、SEC报告、资本市场交易、过户代理、股东互动和ESG解决方案。我们的服务为企业发行人提供了一站式解决方案,涵盖整个企业信息披露和股东沟通的生命周期。

我们的治理和通信服务包括一整套年度会议和股东互动解决方案:

• 代理服务 – 我们提供完整的项目管理服务,涵盖整个年度会议流程,包括注册和受益代理材料的分发、投票处理和通过我们的ShareLink进行数据汇总。 ® 解决方案。

• 虚拟股东大会™ - 通过网络广播进行电子年度会议,可以单独进行,也可以与现场年度会议结合进行,包括股东验证和投票服务,以及股东在会议期间提问和管理层回答的能力。

• 我们为企业发行人提供工具,以帮助他们更好地与股东和其他相关方在年度会议流程中进行沟通,并在全年持续互动。这些服务提供了汇总的股东数据和分析、股东投递偏好以及投票趋势。

• 我们的ESG服务为发行人及其ESG之旅提供咨询。服务包括同行ESG披露基准比较、ESG策略和政策开发、温室气体排放评估以及ESG和可持续发展报告内容开发。我们还提供一个ESG特斯拉-仪表,提供ESG共识评级,以帮助企业发行人评估其ESG评级和披露相较于所选同行公司的进展。

我们的披露解决方案为上市公司提供合规报告和交易报告服务,包括以下内容:

• SEC文件服务:代理和年度报告设计与数字化、SEC文件提交、打印和网络托管服务,以及全年SEC报告,包括文件编写、EDGAR化和XBRL标记。

• 资本市场交易服务:为资本市场交易提供排版、编排、打印和SEC备案服务,例如首次公开募股、分拆、收购和证券发行。此外,我们还提供交易压力位服务,例如虚拟交易室和翻译服务。

我们还通过我们的转让代理服务提供登记、股票转仓和记录保存服务。我们的转让代理服务满足上市公司对更高效和可靠的股东记录维护与沟通服务的需求。此外,我们还提供企业行为服务,包括作为交易所代理、支付代理或投标代理,以支持收购、首次公开募股和其他重大企业交易。我们还提供被遗弃财产合规和报告服务。

客户通信-半导体解决方案

我们支持金融服务、医疗保健、保险、消费金融、通信-半导体、公用事业和其他服务行业的全渠道客户通信管理策略,包括交易通信,如对账单和账单,营销通信,如个性化微网站和活动,以及合规通信,如交易确认和福利说明。

这些服务包括关键通信的数字和实体交付。我们的实体交付服务通过北美的七个高度自动化的设施网络进行运营。Broadridge通信云 SM 是一个全渠道平台(“通信云”),为我们的客户提供灵活性,只实施满足其特定通信需求的模块和交付渠道。该平台的开放应用程序编程接口和自助服务工具帮助我们的客户提高其通信系统的效率和生产力。通过通信云,我们的客户可以:

• 开发与相关自助内容有关的交易、监管和市场通信,以激励客户行动;

• 通过一个连接在打印、数字、电子邮件、开空信息服务(“SMS”)以及新兴渠道(如互动微网站和个人云服务)中传达客户通信;并且

• 获得全面的报告和分析,以改善通信-半导体并根据客户行为增加互动。

全球货币科技与运营

涉及证券和其他金融市场工具的交易,例如,可以由机构或散户投资者发起,该投资者向经纪人下订单,随后经纪人将该订单发送到适当的市场进行执行。此时,交易各方通过清算所协调交易的支付和结算。参与各方的记录必须更新,以反映交易的完成。交易必须遵守税务、保管、会计和记录保持要求,客户的账户信息必须正确反映交易。从交易的初始发起到保管活动的准确处理需要有效的自动化和信息流,这涉及到公司内部多个系统和职能之间的协调,以及参与交易执行的各方系统之间的协调。

我们的全球科技和运营业务为全球金融市场提供非差异化但至关重要的基础设施。作为一个领先的SaaS-云计算提供商,我们为资本市场以及财富和投资管理公司提供现代科技,以促进增长、简化他们的技术堆栈,并实现成本共享。 我们高度可扩展、弹性强、基于组件的解决方案自动化股票、共同基金、固收、汇率期货和交易所交易衍生品的前端到后端交易生命周期,包括订单获取和执行、交易确认、保证金、现金管理、清算和结算、参考数据管理、对账、证券融资和抵押品管理、资产服务、合规和监管报告、投资组合会计和保管相关服务。我们的财富管理业务为顾问和投资者提供解决方案,并通过提供关键的发帖活动系统来简化经纪商的后台和中台操作,包括账簿和记录、交易处理、清算和结算以及报告。 我们的投资管理业务为传统和另类资产管理者提供投资组合和订单管理解决方案,提供对交易、投资组合建设、风险和分析的深入洞察。我们的解决方案将资产管理者与全球经销商网络连接,以实现交易执行和发帖匹配与确认。此外,我们还为我们的买方和卖方客户的业务提供业务流程外包服务。这些服务将我们的科技与运营专业知识相结合,以支持整个交易生命周期,包括证券清算和结算、对账、记录保持、财富管理资产服务和保管相关功能。

全球科技和运营部门的收入在2024财年和2023财年分别占我们总收入的约25%和25%,这反映了来源于其他货币而非美元的收入所带来的汇率影响。请参见“可报告部门分析 - 收入”在“第7项 管理层讨论与财务状况及经营成果分析”下。通过全球科技和运营部门提供的服务和解决方案包括以下内容:

资本市场解决方案

我们的资本市场科技和解决方案在整个交易生命周期中提供简化和创新,从订单发起到结算。大多数在大型用户社区中以SaaS-云计算的形式提供,Broadridge的科技是一个全球解决方案,处理超过100个国家的交易、清算和结算。我们的科技使客户能够满足市场变化的要求,例如T+1证券结算周期。我们的解决方案使全球资本市场公司能够获取市场流动性,推动更有效的市场做市和高效的前后端交易处理。这些服务包括参考数据管理、证券融资、证券抵押贷款、抵押品管理、交易和交易报告、对账、金融信息传递以及资产服务。我们的解决方案可以作为完整的解决方案部署,也可以作为支持金融机构的分立器件-半导体。

通过Broadridge交易和连接解决方案, 我们提供一套全球前台交易订单和执行管理系统及连接解决方案,使市场参与者能够连接和交易。我们的前台解决方案、发帖产品套件及其他资本市场能力使我们的客户能够简化前到后技术平台和运营,提高跨股票、固收、交易所交易衍生品及其他资产类别的直通处理效率。我们还提供一套多资产、多实体和多货币的交易、连接和发帖解决方案,以支持股票、期权、固收证券、汇率期货、交易所交易衍生品和所有基金类型的证券交易处理。

此外,我们提供全面的固收交易处理能力,以支持国内外固收工具的清算、结算、保管、损益报告和监管报告。我们的解决方案包括对抵押担保证券和其他结构化产品的广泛支持。它是一个多货币、多实体的解决方案,提供头寸和余额信息,以及详细的会计、融资、抵押管理和回购协议功能。该解决方案提供直通处理能力、企业级集成以及强大的科技基础设施,专注于支持专注于固收市场的公司。

财富与投资管理解决方案

我们的财富管理业务提供科技解决方案、关键数据和数字营销服务,以便让全方位、区域型和独立的经销商以及投资顾问更好地与客户互动,帮助他们发展业务。我们的财富解决方案旨在帮助优化顾问的生产力,改善投资者的结果,数字化运营,减少投资摩擦,提升金融素养,并提供更个性化的建议和洞察。

在科技解决方案方面,我们提供一个集成的现代开放架构财富管理平台,通过这一平台,我们提供增强的数据驱动能力,以改善整个前台、中台和后台财富管理生命周期中的客户体验,包括顾问、投资者和操作工作流程。这个全面的财富管理平台简化了服务模型的各个方面,使我们的客户能够数字化地引入客户,管理多种产品和服务模型的顾问薪酬,并无缝转移和服务账户。

此外,我们为经纪商、金融顾问、保险公司及其他拥有大型分布式销售团队的公司提供数据驱动的数字化解决方案。 我们的数据聚合解决方案通过提供客户账户数据聚合、业绩报告、家庭分组、自动报告创建、文档存储和与流行的财务规划及生产力应用程序集成,帮助金融顾问管理和建立客户关系。

我们的数字营销和内容能力利用分析和机器学习,使金融顾问和财富管理公司能够发展业务并深化与客户的关系。金融顾问和财富管理公司可以利用我们的数字工具和全渠道内容库,根据客户和潜在客户在网站、社交媒体、电子邮件和移动设备等数字渠道上的接触点进行个性化互动。

我们的资产管理商业服务满足全球资产管理行业的需求,提供一系列买入端科技解决方案。我们的资产管理解决方案包括投资组合管理、合规、费用结算以及操作支持解决方案,例如订单管理、数据仓储、报告、参考数据管理、风险管理和对冲基金、家族办公室、另类资产管理公司、传统资产管理公司的投资组合会计,以及服务这一领域的提供商,包括主经纪商、基金管理人和托管人。这些服务的客户基础包括机构资产管理人、公共基金、初创或新兴管理公司,通过一些最大的全球对冲基金综合体和全球基金管理人。

我们的战略

我们每天通过提供真正的业务价值而赢得客户的信任,这些价值通过领先的科技驱动解决方案来实现,帮助我们的客户超越当今的挑战,并利用未来的增长机遇。我们的解决方案利用人、科技和洞察力来帮助转变客户的业务,提升客户参与度,规避风险,优化效率,并增加营业收入。

随着金融机构寻求转型并将其关键但非差异化的运营和支持功能进行共同化,我们拥有经过验证的科技、规模、创新、经验,最重要的是,拥有实现这一目标及满足其需求的网络。 我们的策略通过利用我们领先的平台能力来解决行业的关键需求。具体而言,我们的增长策略集中在三个关键主题上:(i) 推动治理的民主化和数字化,(ii) 简化和创新资本市场的交易,以及(iii) 现代化财富和投资管理业务。

我们的业务模型

我们通过共同的SaaS-云计算操作平台提供多客户科技和业务流程外包服务。我们利用网络效益、提供深入的数据和分析,并提供全面的数字能力,在单一平台上为客户创造价值层次。我们的SaaS-云计算产品使客户能够共享关键功能,从而降低成本。所有这些都转化为我们的核心价值主张,即成为一 trusted的技术和服务提供商,覆盖多个分析、运营和报告功能的区间。

在一个庞大且快速增长的金融服务市场中占据强势地位

我们的科技和合作伙伴促进了投资、投资治理和投资者通信背后的关键制造行业和服务。Broadridge使我们的客户更强大,通过他们,我们为全球投资者提供更好的财务生活。我们深厚的行业板块知识使我们的客户能够成功解决复杂的科技和运营挑战,同时适应最新的科技趋势和监管标准。虽然金融服务公司历史上将大量科技基础设施工作留在内部,但有一些显著的趋势对Broadridge有利。具体来说,全球金融服务公司在科技上的支出不断增加,分配给这些科技的预算每年都在持续增长。此外,这些公司越来越多地将这部分支出用于第三方科技、运营和服务。作为一个值得信赖的外部服务提供商,Broadridge可以简化并更好地整合我们客户的基础设施和业务流程。我们预计,Broadridge所采取的这种措施所带来的效率将促进我们解决方案市场的增长。

三个吸引人的增长平台

我们的增长平台满足关键客户需求,具体如下。通过我们的综合解决方案和可扩展的制造行业,我们相信我们处于最佳位置为他们提供服务。

• 治理 . 我们通过治理平台运营一个广泛的行业网络,连接经销商、上市公司、共同基金、股东和监管机构。通过我们的平台,我们继续通过转变内容和交付以及改善电子产品能力来推动更高的投资者参与,进而发展我们的治理解决方案。我们旨在成为经销商、资产管理者和养老服务提供商的关键合作伙伴,通过提供数据驱动的解决方案,帮助他们增加营业收入,降低成本并维持合规性。我们还在帮助简化上市公司的治理过程,提供一套不断扩展的能力,使他们能够更好地应对与股东沟通的复杂性。我们继续作为投资者通信的领先提供商,并在提供更丰富的沟通体验方面处于前沿,无论是通过数字形式还是优化的印刷和邮寄服务。

• 资本市场。 全球机构迫切需要简化其复杂的科技环境,而我们的基于SaaS-云计算的全球多资产类别技术平台满足了这一需求。作为全球交易生命周期管理的领导者,我们正在推动下一代解决方案,以简化客户的运营,提高绩效和韧性,适应全球运营模式,适应新技术,并帮助我们的客户更好地管理他们的数据。例如,我们在2021年收购Itiviti,拓展了我们在股票和交易所交易衍生品的交易生命周期服务,并扩大了我们的国际覆盖范围。我们继续利用新兴技术,如区块链和人工智能(“人工智能”),为我们的客户提供创新解决方案。我们的区块链支持的分布式账本回购(“DLR”)平台将分布式账本技术与现有市场结算基础设施相结合,为客户提供了更大的灵活性,以便管理他们的流动性需求,并通过我们的DLR网络执行跨境日内回购交易。此外,我们还推出了一些基于人工智能的解决方案,如BondGPt,并继续开发新的人工智能应用程序,以为我们的客户创造更高效的交易流程。我们还继续开发符合监管、风险、数据和分析需求的组件解决方案,同时帮助推动我们服务的公司的流动性、价格发现和执行效率。我们计划继续建立全球平台能力,使我们的客户能够简化并改善其在现金、股票证券和其他资产类别中的全球运营。

• 财富与投资管理。 财富和投资管理客户,包括全方位服务、区域型和独立经销商、投资顾问、保险公司,以及养老解决方案提供商,正经历前所未有的变革。这些公司需要合作伙伴来帮助他们应对顾问和投资者的人口结构变化,创造更具吸引力的客户体验,并交付对其业务至关重要的运营科技。这些市场动态推动了对更为无缝集成科技的需求,以及更好地为顾问和投资者服务的数据驱动数字财富解决方案。这可以通过简化和现代化他们复杂交织的遗留系统来实现。为了满足这些需求,我们开发了一种整体财富管理平台解决方案,提供无缝的系统和数据集成功能。我们的平台使公司能够提高顾问的生产力,提供更加个性化的投资者体验,并实现运营流程的高效。

下一代技术的入门渠道

在金融服务领域,变革的速度正在加快。我们的客户意识到下一代科技是变革和效率的关键驱动力,客户群体中需要利用这些科技来解决其关键的业务挑战。然而,他们在进行必要投资时面临障碍,更重要的是,在应用合适的人才和智力资本上,可能更多关注于他们最具差异化的职能。这继续为Broadridge创造了机会,以协助我们具备规模和领域专业知识的领域,包括人工智能、区块链、云技术、数字化和其他新技术等领域。通过利用我们的服务,企业可以受益于具备深厚行业专业知识的高技能、高经验的人才,同时共同分担科技创新的成本和风险。我们通过三项行动来推动创新:实验、合作和参与。进而,我们帮助客户保持在前沿技术,并以更快的速度实现数字化转型的好处。

高度参与和以客户为中心的文化

Broadridge以客户为中心,创建并发展了多实体基础设施,涵盖多种职能,并获得了高客户满意度。我们每年对每个主要业务单位进行客户满意度调查,调查结果成为我们所有员工薪酬的一部分,因为客户保留对达成我们的营业收入目标至关重要。

我们建立了一支专注于积极参与和知识丰富的员工网络,致力于为客户提供优质服务,这为我们的业务创造了真正可持续的竞争优势。支持这种卓越的客户交付需要积极参与的员工,我们热衷于创造一个让每位员工都能蓬勃发展并提升其知识和技能的环境。所有这些都创造了一个对我们的员工、客户和股东都有利的文化。

客户

我们为大型且多样化的客户群体服务,包括银行、券商、共同基金、养老服务提供商、企业发行人以及财富和资产管理公司。我们在金融服务行业的客户包括零售和机构券商、全球银行、共同基金、资产管理公司、保险公司、年金公司、机构投资者、专业交易公司、结算公司、第三方管理机构、对冲基金以及金融顾问。我们的企业发行人客户通常是上市公司。除了金融服务公司外,我们还为医疗保健、保险、消费金融、电信、公用事业和其他服务行业的企业客户提供必要的通信服务。我们接受服务利润链的概念,这一概念直接连接了员工参与、客户满意度以及股东价值的创造。为了进一步实现这一原则,客户满意度是每位全职Broadridge员工薪酬的重要组成部分。

在2024财年,我们:

• 管理超过80000万股权代理职位的代理投票;

• 通过印刷和数字渠道处理超过70亿投资者和客户通信。

• 平均每天处理超过$10万亿的美国和加拿大证券的股票和固收交易;

• 向美国24个主要的固定收益证券经销商中的20家提供了固收交易处理服务;以及

• 为15家最大的美国财富管理公司中的14家提供服务。

竞争

我们在一个竞争激烈的行业中运作。我们的投资者沟通解决方案业务与提供投资者沟通和公司治理解决方案的公司以及客户的内部运营竞争。这包括独立的代理分发服务提供商、转让代理、代理咨询公司、代理征求公司、处理代理投票的公司和金融印刷公司。我们还面临与多家公司在汇编、印刷和电子分发报表、账单及其他客户沟通资料方面的竞争。在我们的全球科技和运营业务中,我们的资本市场解决方案与内部运营和提供交易处理、后台记录以及卖方订单和执行管理系统的供应商竞争。同样,我们的财富管理解决方案与提供数据、科技解决方案和营销服务给财富顾问的服务提供商竞争。最后,我们的投资管理解决方案与提供资产管理者和对冲基金的投资组合管理、合规和运营支持解决方案的公司竞争。

科技

我们为金融服务行业提供产品和平台,并拥有几个信息处理系统,这些系统是我们科技平台的核心基础。我们致力于通过技术熟练的员工和在追求持续改进的环境中使用我们的科技,保持高水平的服务质量。我们的策略集中在四个关键支柱上:架构、数据、网络和数据安防,以及人工智能。 .

Broadridge的科技策略旨在提供高水平的可用性、可扩展性、可靠性和灵活性,利用包含私有和公共云服务的混合模型以及传统的IDC概念服务。我们的科技架构由在数据中心运行的系统和应用组成,数据中心采用多个活跃的电力和冷却分配路径以及冗余元件。此外,这些数据中心提供的基础设施能力和功能可以在不干扰关键负载的情况下进行计划活动,总体而言,旨在能够承受至少一次最坏情况的意外故障或事件,而对关键负载没有重大影响。我们分布在不同地理位置的处理中心还提供灾难恢复和业务连续性处理。我们的应用程序整合了云科技,运行在行业标准的企业架构平台上,为水平和垂直扩展提供了显著的机会。这种可扩展性和冗余允许我们为客户提供高程度的系统可用性。

我们的科技连接金融服务生态系统中的行业参与者,形成一个包括资本市场公司、经销商、资产管理公司、上市公司和投资者的网络。通过这些连接获得的数据为参与者提供了价值,是我们方法的核心——我们利用这些数据生成洞察,推动创新,解决行业普遍挑战,加速产品开发,并为决策提供信息。

我们每年与许多客户进行关于我们的网络安全概念和数据安全政策、实践与控制的审查,这与我们与全球监管机构的持续互动相结合,帮助我们跟上网络安全概念和数据安全标准及最佳实践,并为我们的产品开发和科技决策提供信息。有关我们信息安全计划的更多信息,请参阅本年度报告第10-K表格的第1.C. 网络安全概念。

我们的多管齐下的人工智能方法旨在推出下一代功能,同时考虑到保护我们客户和Broadridge的数据隐私及知识产权。我们已将人工智能功能集成到我们的多个解决方案中,并为我们的员工提供访问内部人工智能工具的权限,这些工具旨在现代化我们的产品开发方法,提高整体生产力和效率。

产品开发

我们管理着一个多样化的产品和服务组合,涵盖我们的核心业务。我们的产品和服务的设计注重韧性、可扩展性和灵活性,以便我们能够充分满足客户的关键需求。这些产品和服务旨在以高效的方式满足客户的多种复杂要求。

我们的产品组织致力于帮助Broadridge增长、扩展和创新。 我们通过为产品经理提供工具、流程和能力,及时交付满足关键客户需求的解决方案。这使产品经理能够获得所需的洞察,做出数据驱动的决策,有效地优先分配资源。我们通过与客户和其他第三方建立战略关系来进一步加速创新,以加快产品开发或获取与我们产品开发努力互补的能力。为了培养这些产品背后的人才,我们在培育高度熟练的产品专员的繁荣社区上进行了大量投资。这一承诺反映在我们多元化的招聘实践、加速的领导力发展计划和持续的培训机会中。

我们也专注于企业转型,关注下一代科技。我们的核心优势在于可扩展、可重用的平台元件,赋能开发人员,加速公司内应用的交付。这种对统一产品纪律的强调确保了业务部门可以无缝接触到顶级专业知识。此外,我们利用人工智能来解锁新的商业机会,提高整体生产力。为了推动这一持续创新,我们正在构建一个强大的基础,采用以工作负载为中心的托管平台,优化安防-半导体、可扩展性和效率。这个标准化的科技技术栈,由行业领先的企业工具驱动,是我们以更快的速度提供最佳解决方案的策略基础。

我们不断升级、提升和扩展现有的产品和服务,考虑到客户的反馈、行业内的举措和影响我们客户的监管变化。通过关注这些关键领域,我们旨在通过我们的产品和服务提供满足客户不断变化的需求。

知识产权

我们拥有超过155项美国及非美国的专利和专利申请组合。我们还拥有我们的商标注册,并对我们许多服务和产品的商标注册进行了申请。我们将我们的产品和服务视为专有,并在与员工、客户及其他各方的合同中采用内部安防-半导体措施和保密限制来进行保护。我们相信,我们拥有或在某些情况下是所有进行业务所需的知识产权和其他专有权利的许可人。

规定

证券和金融服务行业在美国及其他司法管辖区受到广泛的监管。作为公共政策的一部分,美国及全球其他地区的监管机构负责维护证券和其他金融市场的完整性,并保护参与这些市场的投资者的利益。由于我们的服务性质和服务的市场,这些监管机构以多种方式影响我们的业务。

在美国,证券和金融服务行业受联邦和州法律的监管。在联邦层面,证券交易委员会(SEC)监管证券行业,此外还有金融行业监管局(FINRA)、各大交易所和其他自律组织(SRO)。此外,SEC的规则要求上市公司向银行和经纪商报销将某些股东通信分发给以街名持有的证券的实益所有者的费用,这些报销费率以及可以收取的代理服务费用由纽交所(NYSE)设定。劳动部(DOL)执法1974年《员工退休收入保障法》(ERISA)对计划受托人和向合格退休计划提供服务的组织的规定。作为金融机构和证券发行人的服务提供商,我们的服务,例如我们的代理和股东报告处理及分发服务,以帮助我们的客户遵守他们所受法律和规定的方式提供。因此,我们提供的服务可能需要随着适用法律和规定的采纳或修订而改变。我们监测SEC、FINRA、DOL和美国国税局(IRS)的立法和规则制定活动,以及可能影响我们服务的证券交易所和其他监管机构,如果新的法律或规定被采用或对适用于我们的服务的现有法律或规定进行了更改,我们期望调整我们的业务实践和服务产品,以继续帮助我们的客户履行在新的或修改后的要求下的义务。

我们业务的某些方面受到监管合规或监督。作为金融机构的科技服务提供商,我们在美国的某些业务操作受到联邦金融机构检查委员会(“FFIEC”)的监管和审查,该委员会是联邦存款保险公司、货币监理署、联邦储备系统董事会、国家信用合作社管理局以及消费者金融保护局的跨机构机构。FFIEC的定期审查一般包括内部审计、风险管理、业务连续性规划、信息安全、系统开发和第三方供应商管理等领域,以识别与我们的服务相关的潜在风险,这些风险可能对我们的银行和金融服务客户产生不利影响。

此外,我们的业务流程外包、共同基金处理和转账代理解决方案,以及提供这些服务的实体,均受到监管监督。我们的业务流程外包和共同基金处理服务由经纪自营商Broadridge Business Process Outsourcing, LLC(“BBPO”)执行。BBPO已在SEC注册,是FINRA的成员,并需要参与证券投资者保护公司(“SIPC”)。尽管BBPO的FINRA会员协议允许其从事清算以及除共同基金零售外的公司证券零售业务,但BBPO不清算客户交易,不处理任何零售业务,也不持有客户账户。BBPO必须遵守与其业务的许多方面相关的法规,包括交易惯例、资本要求、记录保存、防止洗钱、保护客户资金和客户证券,以及对董事、官员和员工行为的监督。不遵守任何这些法律、规则或法规可能会导致谴责、罚款、发出停止令或撤销SEC或FINRA授权以允许其业务运作,或者使其董事、官员或员工失去资格。证券行业,包括公司外包业务或职能,持续受到监管审查。这种监督可能导致未来实施更严格的有关业务流程外包的法律或规则。作为注册经纪商和FINRA成员,BBPO受1934年证券交易法第15c3-1号统一净资本规则的约束,该规则要求BBPO保持最低净资本金额。截至2024年6月30日,BBPO已符合这一资本要求。

Matrix Trust Company(“Matrix Trust”)是一家科罗拉多州特许的非存款信托公司和国家证券清算公司信托成员,其主要业务是为机构客户提供现金代理、保管和指定受托人服务,以及为其集体投资信托基金(“CITs”)提供投资管理服务。因此,Matrix Trust 需要遵守由科罗拉多银行部门和亚利桑那州保险和金融机构部以及国家证券清算公司管理的各种监管资本要求。必须满足涉及资产、负债和某些表外项目的具体资本指南,具体情况适用。截至2024年6月30日,Matrix Trust 符合其资本要求。此外,与CITs的发行相关,Matrix Trust 充当自由裁量受托人和ERISA受托人。CITs 受IRS、SEC、联邦和州银行监管机构以及DOL的监管,这些机构对作为ERISA下受托人的人员施加了一定的职责。Matrix Trust 还受到科罗拉多银行部门和亚利桑那州金融机构部门的监管,这些机构根据货币监理署发布的指导方针对CITs进行监管。Matrix Trust 为其某些服务维护身份盗窃预防计划。

我们的转移代理业务,Broadridge Corporate Issuer Solutions,受某些SEC规则和法规的约束,包括年度报告、检查、内部控制、适当保护发行人和股东的资金和证券、维护书面的身份盗窃预防计划以及与其运营相关的义务。我们的转移代理业务还受某些纽交所对作为纽交所上市公司转移代理人或注册人运营标准的要求,以及IRS法规的约束。此外,Broadridge Corporate Issuer Solutions遵守所有适用的交易控制法律和法规,包括美国及其他我们开展业务的司法管辖区的基于国家/地区的制裁和基于名单的制裁。最后,某些由我们的转移代理业务执行的服务受州法律的管辖。

此外,我们需要遵守反洗钱法律法规,例如,在美国,依据2001年美国爱国者法案修订的银行保密法(统称为“BSA”),以及美国财政部下属的金融犯罪执法网络(“FinCEN”)的BSA实施规定。其他国家也有各种类似的反洗钱要求。我们还须遵循FinCEN发布的相关法规和指导(如下所述),包括FinCEN颁布的了解您的客户(“KYC”)要求。

隐私和信息安防-半导体条例

处理和转移个人信息是提供我们某些服务所必需的。美国及外国的隐私法律和法规适用于个人信息的访问、收集、转移、使用、存储和销毁。在美国,我们的金融机构客户必须遵守《格拉姆-里奇-布莱利法》(“GLBA”)下施加的隐私规定,以及其他规定。作为金融机构服务提供者的个人信息处理者,我们必须遵守联邦贸易委员会(“FTC”)的安全规则,该规则实施GLBA关于信息安全保障维护的某些条款。

我们为医疗保健公司提供服务,因此必须遵守关于医疗信息的法律和法规,包括美国的1996年健康保险可携带性和责任法案(“HIPAA”)。我们还提供与信贷相关的服务,并同意遵守支付卡标准,包括支付卡行业数据安全标准。此外,适用于收集或处理个人信息的企业的联邦和州隐私及信息安全法律和消费保护法律也适用于我们的业务。

隐私法律和法规可能要求在发生安全漏洞,导致对某些个人信息的未经授权访问或披露时,通知受影响的个人、联邦和州监管机构,以及消费报告机构。美国以外的隐私法律可能更为严格,可能要求与美国法律和法规不同的合规要求,并可能在我们提供服务时对我们施加额外的义务。

该领域的法律仍在不断发展,美国、欧洲联盟及其他地方隐私法的变化可能会影响我们对员工个人信息的处理以及我们代表客户的处理。例如,欧洲联盟议会通过了全面的通用数据保护条例(“GDPR”),而美国几个州也最近通过了新的隐私法,或提出通过本州的隐私法,包括加利福尼亚隐私权法案(“CPRA”)。

我们持续关注隐私和信息安全法律法规,并相信我们符合监管责任,但信息安全威胁仍在不断发展,导致风险和暴露增加。此外,立法、法规、诉讼、法院裁决或其他事件可能导致Broadridge面临更高的成本、责任以及对我们声誉的潜在损害。

法律合规

美国财政部外国资产控制办公室(“OFAC”)发布的法规对所有美国公民和实体,包括公司,在与指定国家及在OFAC制裁名单及特别指定国民和被阻止人员名单上列明的个人和实体进行交易方面施加了禁止和限制。这是一个包含某些经济和贸易制裁下的国家所拥有或控制的个人和公司的完整名单,以及被OFAC在非特定国家的项目中认定的恐怖分子、恐怖组织和毒品贩子。与其他国家维护的名单中规定的个人和实体进行交易和往来也适用类似的要求。我们已经制定了程序和控制措施,旨在监测和应对法律和监管要求及其发展,以保护自身不与这些被禁止的国家、个人或实体进行直接业务往来。

遵循适用于我们国际业务的法律法规

可能很复杂,可能会增加我们在国际辖区内开展业务的成本。如果我们未能遵守这些法规,我们的国际业务可能会使我们面临罚款和处罚。这些法律法规包括进口和出口要求、 交易限制和禁运、数据隐私要求、劳动法、税法、反竞争法规、如《外国腐败行为法》的美国法律,以及禁止贿赂和其他不当支付或诱导的地方性法律,例如英国《反贿赂法》。尽管我们已经实施了旨在确保遵守适用法律法规的政策、程序和培训,但不能保证我们的员工、承包商、供应商和代理不会采取违反我们政策或适用法律法规的行动,特别是在我们扩展业务时,包括收购那些以前不受适用法律法规监管且可能不熟悉我们或类似合规政策的业务。任何违反制裁或出口管制法规或其他法律的行为可能会使我们面临民事或刑事处罚,包括征收巨额罚款和利息,或限制我们向一个或多个国家提供产品和服务的能力,也可能损害我们的声誉、我们的国际扩展努力和我们的业务,并对我们的经营结果产生负面影响。

人力资本管理

截至2024年6月30日,我们大约有14,600名全职员工,其中约45%在美国工作。大约55%在美国以外的员工中,40%位于亚太地区,那里有相当数量的员工在印度,11%在欧洲,4%在加拿大。我们在美国的员工没有工会代表。在美国以外的一些国家,我们设有职工委员会,或者根据当地法律,我们需要签署和/或遵守行业板块的集体谈判协议。我们相信我们的员工关系良好。

我们以每位员工的成功为动力,并认识到正是因为他们的努力、才华和承诺,我们才能持续为客户提供出色的成果。这就是为什么我们努力提供一个促进协作和支持文化的工作环境,使每个人都感到受欢迎、被接纳,并能够充分发挥自己的最佳状态。在我们员工参与工作的努力中,服务-利润链的概念是中心,参与的员工提供世界一流的服务,这带来了满意的客户,进而为股东创造了强劲的长期价值。

我们的人力资本策略由首席人力资源官制定和管理,首席人力资源官向首席执行官报告,并由公司的董事会及董事会的薪酬委员会监督。我们的董事会认为,人力资本管理和继任计划对我们的成功至关重要。董事会每年审查公司的领导力储备和继任计划。此外,董事会定期收到关于人才及其他人力资本事务的更新,如文化、流失率、留任、以及多样性、公平性和包容性(“DEI”)倡议和实践,包括来自我们首席多样性官的年度更新。薪酬委员会的监督包括涉及我们文化、人才、招聘、留任和员工参与的倡议和项目。

员工参与度

我们相信员工参与度与客户满意度以及股东价值创造之间存在直接联系,因此我们定期进行调查,以评估员工参与度并判断观点是否以及如何随时间改变。我们的调查允许员工分享他们对工作环境的看法、工作生活各个方面的重要性,以及其他话题。我们员工反馈中的主题和洞察与我们的执行领导层分享,并在塑造我们的工作环境方面发挥了重要作用。在2024财年,我们在年度“伟大的工作场所”调查中获得了82%的整体满意度评级。此外,85%的员工表示Broadridge是一个“伟大的工作场所”,我们在13个国家获得了“伟大的工作场所”认证,表彰我们杰出的工作文化:美国、加拿大、印度、英国、爱尔兰、罗马尼亚、波兰、新加坡、日本、德国、香港、瑞典和菲律宾。我们被公认为2024年爱尔兰和英国最佳工作场所,以及爱尔兰科技领域最佳工作场所和英国发展领域最佳工作场所。伟大的工作场所研究所是高信任、高绩效工作场所的全球权威。

多样性、公平与包容

我们致力于营造一个多元、公平、包容和健康的环境。作为全球领先的科技、通信-半导体以及数据和分析解决方案提供商,我们必须理解、接受并在多元文化环境中运作。每位员工都有独特的优势,当这些优势得到充分重视和接受时,能够使每个人都发挥最佳表现,从而实现我们的成功。我们的目标是确保组织各级别的员工代表我们所服务客户和我们工作社区的多样性。我们致力于在我们的文化中推动DEI倡议和价值观。我们在发展多元化劳动力方面的承诺体现在我们的执行领导团队薪酬的一部分是基于DEI目标的实现。

我们有一个由总裁主持的执行多样性委员会,该委员会每季度召开一次,提供关于重要的多样性、公平性和包容性(DEI)相关机会和挑战的见解和建议。此外,我们支持几个由员工主导的员工资源小组(我们的员工网络),员工可以在这里找到同行支持,塑造公司文化,获得高级成员的导师指导和赞助,并发展他们的职业生涯。Broadridge 的员工网络目前包括:b.Pride、残疾公平员工网络(DEAN)、下一个领导(LFN)、多元文化员工网络(MCAN)、退伍军人+急救人员网络(VFN)、女性领导论坛(WLF)、家庭护理网络(FCN)和 BeGreen。这些网络共同支持 LGBTQ+ 社区、残疾员工、年轻专业人士、多元文化背景的员工、退伍军人和急救人员、女性、负责照顾的员工以及对可持续发展充满热情的员工。

我们有一位首席多样性官,他实施全面的多样性、平等与包容(DEI)策略,并与我们的业务部门合作,开发推动该策略所需的资源和能力。我们的首席多样性官向我们的总裁报告,是执行多样性委员会和执行领导团队的成员,并定期向我们的首席执行官和董事会提供更新。此外,首席多样性官还担任全球倡议的顾问,例如我们的员工网络、招聘和合规工作。

我们继续推进我们的DEI倡议,基于在2022年进行的首次DEI调查中识别的机遇,该调查在全球范围内进行,共有来自19个国家的7000多名员工参与。首次调查的结果显示,绝大多数员工认为:1)DEI的重要性反映在Broadridge业务的优先事项中;2)我们在过去一年成功推动了DEI倡议;3)我们创造了一个身体和心理上安全的环境,让员工感到归属,他们被包容并受到公平对待。我们致力于收集员工反馈,以提供对我们组织文化的全面了解,识别可以改善的领域,以创造一个更友好和包容的环境,以便所有员工都能感到舒适,并衡量我们随着时间的推移所取得的进展。

人才与发展

我们相信,我们的员工是我们最重要的资产之一。鼓励职业发展机会是我们文化的核心部分。我们为员工提供的一项重要资源是布罗德里奇大学,这是一套全面的在线课程以及虚拟和现场培训。我们提供来自顶尖商学院的职业发展计划、领导力发展和指导计划,制定学费报销计划,并支持参与外部学习机会。这些计划旨在为公司不同级别的员工提供机会,以扩大他们的网络,获得宝贵的技能和知识,以在当前的职位上脱颖而出,并增强他们的领导能力。我们为技术员工提供资源以补充他们的工作经验,并提供技术专家职业发展轨迹,这是一种透明的双重职业道路流程,使员工能够成长为组织中的领导者和专家。我们还使员工能够学习和成长为金融市场的主题专家。反过来,这使我们的员工能够利用他们的专业知识为客户提供帮助,并为我们的员工自己的职业发展和技能组合增加价值。除了以职业为导向的教育外,我们还要求所有员工每年完成各种培训,这些培训侧重于我们对高道德标准以及诚实、正直和合规文化的承诺。

健康、安全和保健

我们致力于提供安全的工作场所。我们不断努力达到或超过与工作场所安全有关的所有法律、法规和公认惯例。我们制定了广泛的安全政策、标准和程序,所有员工都必须遵守这些政策、标准和程序。我们的政策以美国职业安全与健康管理局的标准和特定场所的指导方针为基础,以确保员工在安全健康的环境中工作。在我们位于纽约埃奇伍德的工厂,我们的现场健康中心配备了医生、执业护士和医师助理,他们免费为我们的员工提供医疗服务。

此外,我们致力于为员工提供有竞争力的健康和保健福利。我们认识到平衡工作与生活的重要性,并设计了我们的工作场所,为员工提供灵活的线上和异地工作选择。我们的其他健康和保健福利包括某些类型医疗保健的差旅津贴和为我们在美国的员工提供补贴的紧急备用护理服务、各种教育健康和保健计划和网络研讨会,以及提供免费咨询和其他心理健康服务的员工援助计划。

员工薪酬和福利

我们通过提供有竞争力的薪水和工资,展示了投资员工队伍的历史。此外,我们提供各种类型的薪酬,这些薪酬因员工职位和国家/地区而异,可能包括年度奖金、股票奖励和退休储蓄计划。此外,每位员工的激励性薪酬的一部分与客户满意度目标挂钩,这强化了我们对服务利润链的承诺,并奖励了员工对Broadridge整体客户满意度表现的贡献。此外,我们还提供以下福利,可能因国家/地区而异:医疗和保险福利、节税或储蓄计划,例如健康和受抚养人护理灵活支出账户、健康储蓄账户和税前通勤福利或绿色交通税储蓄计划、带薪休假,包括志愿者休假、带薪育儿假和病假、人寿和伤残保险、商务旅行意外保险、慈善礼物配对、学费补助等。

可用信息

我们的总部位于纽约州成功湖达科他大道5号11042,我们的电话号码是 (516) 472-5400。

我们在www.broadridge-ir.com上维护着一个投资者关系网站。我们在本网站上或通过本网站免费提供我们的年度、季度和当前报告,以及在以电子方式向美国证券交易委员会提交报告或向美国证券交易委员会提供这些报告后在合理可行的情况下尽快对这些报告进行的任何修订。要访问这些报告,只需点击我们投资者关系页面顶部的 “美国证券交易委员会申报” 链接。您还可以通过我们的主网站www.broadridge.com访问我们的投资者关系页面,点击我们主页顶部的 “投资者关系” 链接。我们网站上包含的信息未以引用方式纳入本10-k表年度报告或向美国证券交易委员会提交或提供给美国证券交易委员会的任何其他报告中。

此外,美国证券交易委员会还维护一个网站 (http://www.sec.gov),其中包含有关以电子方式向美国证券交易委员会提交的发行人的报告、代理和信息声明以及其他信息。

第 1A 项。风险因素

您应仔细考虑以下每种风险以及本10-k表年度报告中列出的或此处以引用方式纳入的所有其他信息。根据我们目前所知的信息,我们认为以下信息确定了影响我们公司的最重要因素。但是,我们目前不知道或我们目前认为不重要的其他风险和不确定性也可能对我们的业务产生不利影响。

如果以下任何风险和不确定性演变为实际事件,它们可能会对我们的业务、财务状况或经营业绩产生重大不利影响。

我们的客户受复杂的法律法规约束,新的法律法规和/或现行法律或法规的变更可能会影响我们的客户,进而对我们的业务产生不利影响或可能降低我们的盈利能力。

我们为在美国和其他司法管辖区通常受到广泛监管的金融服务公司提供技术解决方案。作为向金融机构和证券发行人提供产品和服务的提供商,我们的产品和服务旨在帮助我们的客户遵守他们所遵守的法律法规。法律法规的变化可能需要改变我们提供的服务、我们提供服务的方式、我们为服务收取的费用,或者它们可能导致对我们服务的需求减少或消除。例如,如果修改适用的美国证券交易委员会或证券交易所规章制度,或者通过新的法律或法规,更改代理材料、监管披露或其他通信发行人必须发送的通信信息或发送方式,我们的投资者通信服务以及我们向客户收取的某些服务费用可能会发生变化。法律或法规的此类变化可能会对我们的业务和财务业绩产生重大的负面影响。因此,我们的服务,例如我们的代理、股东报告和招股说明书分发以及客户通信服务,对法律和法规,包括管理金融服务行业和证券市场的法律法规的变化特别敏感。

此外,管理客户的新法规可能导致巨额支出,可能导致他们减少对我们服务的使用,试图重新谈判现有协议,或停止或削减业务,所有这些都可能对我们的业务产生不利影响。此外,改变客户业务或对其财务状况产生不利影响的负面监管行动可能会降低他们购买我们产品和服务的能力或对我们的产品和服务的需求。我们的任何大客户的业务损失都可能对我们的收入和经营业绩产生重大的不利影响。

金融服务行业的整合可能会淘汰一些现有和潜在的客户,从而对我们的收入产生不利影响,并可能使我们越来越依赖数量有限的客户。

金融服务行业已经存在并可能继续进行整合活动。金融机构的这些合并或合并可能会减少我们的客户和潜在客户的数量。例如,仅在过去的几年中,就有几次涉及我们的客户的重大合并。当我们的客户与非我们客户的其他公司或较少使用我们服务的公司合并或被收购时,他们可能会停止或减少对我们的服务的使用。此外,合并或整合产生的大型金融机构有可能决定在内部提供我们目前提供或可能提供的部分或全部服务。如果我们无法减轻客户整合造成的业务损失或减少的影响,我们可能会对我们的业务和经营业绩产生重大不利影响。

我们的收入中有很大一部分来自金融服务行业的少数客户,任何此类客户的流失、他们对我们服务的需求减少或我们提供服务的方式的改变都可能会对我们的财务业绩产生重大影响。

在2024财年,我们的最大客户约占我们合并收入的8%。虽然我们的客户通常与多个业务领域合作,但由于合并或合并、财务困难或破产或合同的终止或不续签而导致任何大型客户的业务损失,都可能对我们的收入和经营业绩产生重大不利影响。 此外,延迟让客户使用我们的技术将导致我们延迟确认来自该客户的收入。 此外,如果客户的业务损失、客户对我们服务的需求减少或我们的服务交付方式发生变化,那么除了损失该客户的收入外,我们还可能被要求注销全部或部分相关的客户投资或加快某些成本的摊销,包括为吸引客户或将客户的系统转换为使用我们的技术而产生的成本。截至2024年6月30日,所有客户的此类成本约占我们总资产的11%,其中一位客户占该金额的很大一部分。有关更多信息,请参阅我们的合并财务报表附注3 “收入确认” 和附注11 “递延客户转换和启动成本”。

安全漏洞或网络安全事件可能会对我们的财务业绩和运营能力产生不利影响,可能导致个人、机密或专有信息被盗用,并可能导致我们承担责任或声誉受到损害。

我们处理和传输敏感数据,包括我们的客户(包括金融机构、上市公司、共同基金和医疗保健公司)提供给我们的个人信息、宝贵的知识产权和其他专有或机密数据。我们还处理员工与其工作有关的个人信息。我们的一些服务是通过互联网提供的,这增加了我们面临潜在网络安全事件的风险。信息安全威胁不断演变,导致风险和风险增加,并增加防范信息安全漏洞威胁或应对或缓解此类漏洞造成的问题的成本。

由于我们产品和服务的性质,我们面临信息安全事件的风险,包括那些影响我们的客户和第三方供应商的事件。如果我们的客户或第三方供应商未能及时通知我们影响其运营的网络安全事件,可能会导致未经授权访问我们的系统和数据,并对我们的业务、运营和财务业绩产生重大影响。在某些情况下,我们的第三方供应商也可能访问敏感数据,包括个人信息。第三方供应商也有可能故意或无意中披露此类敏感数据。此外,未经授权的个人可能会不当访问我们的系统或供应商的系统,或者不当获取或披露敏感数据,包括我们或我们的供应商处理或处理的个人信息。

我们的信息技术基础设施面临持续的网络安全威胁,包括数据丢失、数据泄露、拒绝服务和勒索软件等。我们经历过非实质性的网络安全事件、企图入侵我们的系统以及其他类似的攻击,包括影响我们的客户和第三方供应商的事件,如果此类攻击或尝试在未来取得成功,这些事件可能会损害我们的业务和声誉,挑战我们提供可靠服务的能力,并对我们的经营业绩和财务状况产生负面影响。对我们的经营业绩和财务状况的任何影响都可能是重大的,具体取决于事件的范围。先前事件的示例包括但不限于社会工程、网络钓鱼和拒绝服务攻击。此外,我们的保险范围可能不足以支付与网络安全事件或此类事件造成的中断有关的所有费用。

如果我们未能维持适当的信息安全计划或实施足够的安全标准、技术或控制措施来防范信息安全事件或隐私泄露,并识别和适应新出现的安全威胁和风险,则可能导致我们损失收入、失去客户和/或我们的声誉受损。

此外,任何未经授权访问我们的信息技术系统都可能导致使用、盗窃或泄露机密、敏感或个人数据,破坏或修改记录,中断我们的运营和服务和产品的交付,安装恶意软件,并可能需要支付赎金。因此,我们可能会花费巨额费用来调查和补救此类事件,并防范未来对我们的信息安全和信息技术系统的威胁。此外,此类事件可能会导致我们的客户和/或其客户提起法律诉讼,并导致监管调查和/或巨额处罚和罚款。

如果我们不遵守适用于我们的服务或业务的法律和监管要求,我们的业务和经营业绩可能会受到不利影响,而新的法律或法规和/或我们所遵守的现行法律或法规的变更可能会对我们开展业务的能力产生不利影响或可能降低我们的盈利能力。

金融服务行业的立法和监管环境在不断变化。美国证券交易委员会、FINRA、DOL、各证券交易所以及其他美国和外国政府或监管机构不断审查立法和监管举措,并可能通过新的或修订后的法律法规,或提供修订后的解释,或者他们可能会改变其优先事项,包括与执法相关的现有法律和法规。这些立法和监管举措影响了我们开展业务的方式,需要改变我们提供服务的方式或进行额外投资,这可能会降低我们的业务利润。此外,作为向金融机构提供技术服务的提供商,我们在美国的业务的某些方面受到FFIEC的监管监督和审查。来自FFIEC的足够不利的审查可能会对我们的业务产生重大不利影响。随着对网络安全和供应商风险管理的日益关注,FFIEC和其他监管机构为监督技术服务提供商、提高与客户的合同要求以及提供服务的成本提供了指导方针。

我们的业务流程外包、共同基金处理和过户代理解决方案以及提供这些服务的实体都受到监管监督。我们提供这些服务必须遵守美国证券交易委员会、FINRA、DOL、各证券交易所和其他监管机构的适用规章制度,这些监管机构负责维护证券市场和其他金融市场的完整性,保护参与这些市场的投资者的利益。如果我们在提供这些服务时未能遵守任何适用法规,我们可能会因违约而受到诉讼或政府诉讼、谴责和罚款。此外,我们可能会失去客户,我们的声誉可能会受到损害,从而对我们吸引新客户的能力产生负面影响。

作为数据和业务处理解决方案的提供商,我们的系统包含大量敏感数据,包括与我们的客户、客户的客户和我们的员工相关的个人信息。因此,我们受联邦、州和国外隐私和信息安全法律规定的合规义务的约束,包括美国的GLBA、HIPAA和CPRA以及欧盟的GDPR,并且我们必须遵守各种客户行业标准,例如PCI DSS以及与客户相关的医疗保险和医疗补助计划。如果不遵守此类法规和要求,我们将受到处罚,此类处罚可能会对我们的财务状况、经营业绩或现金流产生重大不利影响。公众对个人信息的使用越来越关注,同时出台了旨在加强数据保护、信息安全以及消费者和个人隐私的立法和法规。这些领域的法律继续发展,通过此类法律的司法管辖区的数量继续增加,这些法律可能因司法管辖区而异。此外,美国、欧盟和其他地方隐私法性质的变化可能会影响我们对员工和代表客户的个人信息的处理。

此外,包括政府、监管机构、我们的投资者、员工、客户和其他利益相关者在内的各方越来越关注可持续发展问题,这导致了新的或额外的法律和监管要求,可能需要增加合规和运营成本。此外,如果我们未能遵守适用的法规并维持符合利益相关者不断变化的期望的做法,则可能会损害我们的声誉,对我们吸引和留住员工或客户的能力产生不利影响,并使我们面临投资者和监管机构的严格审查。

我们遵守适用法律和法规的能力在很大程度上取决于维持有效的合规体系,这可能既耗时又昂贵,也取决于我们吸引和留住合格合规人员的能力。我们的员工未能遵守我们的政策以及适用于我们业务的任何法律法规,即使是无意的,也可能对我们的业务产生负面影响。

由于证券市场参与水平和活动水平的下降,我们的收入可能会减少。

我们从服务中获得的交易处理费中获得了可观的收入。这些收入来源在很大程度上取决于证券市场的参与和活动水平。投资者通过我们的客户和客户的客户交易量持有的独特证券头寸的数量反映了市场的参与程度和活动水平,这些水平受市场价格、证券市场流动性等因素的影响。证券市场的波动以及市场参与度和活动的突然急剧或渐进但持续的下降可能导致投资者沟通活动减少,包括减少代理和事件驱动的通信处理,例如共同基金代理、并购和其他特殊公司活动通信处理,以及交易量减少。此外,我们以活动为导向的费用收入基于我们处理的特殊公司活动和交易的数量。事件驱动的活动受到金融市场状况和监管合规要求变化的影响,导致事件驱动的费用收入的时间和水平出现波动。因此,事件驱动活动的时间和水平及其对我们收入和收益的潜在影响难以预测。任何此类事件的发生都可能导致收入减少和业务运营盈利能力下降。

第三方服务提供商未能履行其职能可能会对我们产生不利影响。

我们依赖与第三方的关系,包括我们的服务提供商和其他供应商来履行某些职能。如果我们无法有效管理我们的第三方关系和第三方供应商运营所依据的协议,我们的财务业绩或声誉可能会受到影响。我们依赖这些第三方(包括提供某些数据中心和云服务)来及时、准确地提供服务,并充分应对自身风险,包括与网络安全相关的风险。这些第三方未能按预期充分提供服务可能会导致我们的运营出现重大中断,并对我们的服务产生负面影响,从而对我们的业务和财务业绩产生重大不利影响。

我们的某些业务依赖于单一或有限数量的服务提供商或供应商。这些服务提供商或供应商的业务状况(财务或其他方面)的变化可能会影响他们向我们提供的服务,或者他们可能根本无法向我们提供服务,这可能会对我们的业务和财务业绩产生重大不利影响。在这种情况下,鉴于我们的一些服务提供商承担的责任范围、他们的经验深度以及他们对我们总体业务的熟悉程度等原因,我们无法确定我们能否及时或按照商业上合理的条件更换我们的主要第三方供应商。

如果我们更换一家重要的供应商,一家现有服务提供商对其运营方式进行重大改变或被收购,或者我们试图将目前由第三方提供的某些服务引入内部,我们的解决方案提供可能会出现意想不到的中断和开支的增加,这可能会对我们的业务、盈利能力和财务业绩产生重大不利影响。此外,某些第三方服务提供商或供应商可能有权访问敏感数据,包括个人信息、宝贵的知识产权和其他专有或机密数据,包括我们的客户提供给我们的数据。第三方供应商可能会故意或无意中披露包括个人信息在内的敏感数据,这可能会对我们的业务和财务业绩产生重大不利影响,并损害我们的声誉。

我们依靠美国邮政总局(“USPS”)和其他第三方承运人来提供通信,我们与这些承运人的关系变更或邮政费率或运费的上涨可能会对我们的产品和服务的需求产生不利影响,并可能对我们的业务和经营业绩产生不利影响。

我们依靠美国邮政和包括联合包裹服务在内的第三方承运人代表我们的客户及时交付通信。因此,由于员工罢工、恶劣天气和燃料成本上涨等我们无法控制的因素,我们可能会受到承运人中断的影响。任何未能及时、准确地向客户或代表客户提供通信的行为都可能损害我们的声誉和品牌,并可能导致我们失去客户。此外,美国邮政近年来蒙受了巨大的财务损失,因此可能会对其邮件投递的广度或频率进行重大调整,从而导致服务中断。如果我们与这些第三方运营商中的任何一家的关系终止或受损,或者这些第三方中的任何一个无法分发通信,我们将需要使用替代的、可能更昂贵的承运人来代表我们的客户完成我们的分发。我们可能无法及时或以可接受的条件(如果有的话)聘请其他承运人,这可能会对我们的业务产生不利影响。此外,未来邮政费率或运费的上涨以及客户偏好的变化可能会导致对我们传统印刷和邮寄通信的需求减少,从而对我们的业务、财务状况和经营业绩产生不利影响。

发生灾难时,我们的灾难恢复和业务连续性计划可能会失败,这可能导致客户数据丢失并对运营造成不利影响。

我们的运营取决于我们保护基础设施免受灾难、自然灾害或恶劣天气以及因未经授权的安全漏洞、电力中断、电信故障、恐怖袭击、疫情或其他可能对我们的运营造成重大破坏性影响的事件而造成的事件破坏的能力。我们制定了灾难恢复和业务连续性计划,以防由于任何此类事件导致系统故障,并且我们会定期测试我们的计划。此外,我们的数据中心服务提供商还制定了灾难恢复计划和程序。但是,我们无法确定我们的计划或数据中心服务提供商的计划在发生灾难时能否成功。如果我们的灾难恢复或业务连续性计划在灾难恢复情况下不成功,我们可能会丢失客户数据,或者我们的运营或向客户交付的服务受到严重的不利影响,我们可能会对因这些故障而遭受经济损害的各方承担责任。此外,此类失败可能导致我们损失收入、失去客户或损害我们的声誉。

我们的计算机或通信系统的任何减速或故障都可能影响我们为客户提供服务和支持内部运营的能力,并可能使我们对客户或其客户遭受的损失承担责任。

我们的服务取决于我们存储、检索、处理和管理重要数据库的能力,以及通过各种电子系统接收和处理交易和投资者通信的能力。我们的系统、我们的数据中心和云服务提供商的系统,或与我们的系统交互的任何其他系统,可能会由于各种原因而显著减速或出现故障,包括:

• 内部软件程序或计算机系统中的恶意软件或未检测到的错误;

• 直接或间接的黑客攻击或拒绝服务网络安全攻击;

• 无法快速监控所有系统活动;

• 一旦发现内部软件程序或计算机系统中的任何错误,就无法有效解决这些错误;

• 未能维持适当的操作系统和基础设施,或未能遵守内部政策和程序;

• 在高峰时段或由于高容量或波动性而对系统施加的沉重压力;或

• 电力或电信故障、火灾、洪水、流行病或任何其他自然灾害或灾难。

虽然我们监控系统负载和性能并实施系统升级以应对交易量和波动性的预期增长,但我们可能无法准确预测未来的交易量增长或波动性,也无法准确预测我们的系统以及数据中心服务和云服务提供商的系统将能够适应这些交易量的增加或波动而不会出现故障或降级。此外,我们可能无法防止对我们系统的网络安全攻击。

此外,由于我们已将数据中心运营外包并使用第三方云服务提供商来存储某些数据,因此数据中心和云系统的运营、性能和安全功能涉及我们无法控制的因素,我们无法保证我们的第三方提供商能够以令人满意的水平提供服务。我们或我们的第三方提供商的计算机系统、通信系统或任何其他系统在履行我们的服务时出现任何严重的退化或故障,都可能导致我们的客户或其客户延迟接受我们的服务。这些延误可能会给我们的客户或其客户造成重大损失,我们可能会对因这些失败而遭受经济损害的各方承担责任。此外,此类失败可能导致我们损失收入、失去客户或损害我们的声誉。

无法正确执行我们的服务或在履行服务时出现操作错误,可能会导致索赔责任、客户损失并导致声誉损失。

我们的客户在高度监管的行业中经营,并依靠我们的服务来满足他们的某些监管要求。无法或未能正确提供我们的服务可能导致我们的客户和/或经营受监管业务的某些子公司遭受损失,包括相关监管机构的谴责、罚款或其他制裁,我们可能会对因这些错误而遭受财务损害的各方承担责任。此外,无法正常提供我们的服务或在履行服务时出现错误可能会导致我们对产品和服务的信心下降,并导致我们产生包括服务罚款在内的费用、收入损失、客户流失或声誉受损。

此外,我们的一些产品、服务和流程利用了机器学习和人工智能。使用此类技术存在风险,并可能导致信息不足或不准确。这些缺陷可能会破坏向客户提供的这些产品和服务的质量,使我们承担法律责任和声誉损失。

全球经济和政治状况,包括全球健康危机和地缘政治不稳定,以及我们无法控制的商业和金融的总体趋势,已经并可能对我们和客户的业务运营产生重大影响,并导致证券市场活动水平降低,这可能会对我们的业务和经营业绩产生不利影响。

作为一家跨国公司,我们的业务和向客户提供服务的能力可能会受到全球总体经济和政治状况的不利影响。 我们的业务高度依赖全球金融服务行业以及世界各地的交易所和市场中心。 此外,近年来,我们扩大了业务,建立了战略联盟,并收购了美国以外的业务。 遵守适用于我们国际业务的外国和美国法律法规可能会导致我们承担的费用高于预期,而保护知识产权等法律或政策的执行不力,可能会影响我们的业务和公司的整体经营业绩。

这些因素可能包括:

• 经济、政治和市场状况;

• 立法和监管变革;

• 社会和健康状况,包括疾病或大流行的广泛爆发,例如Covid-19大流行;

• 战争或恐怖主义行为和国际冲突,例如俄罗斯和乌克兰之间的冲突;

• 自然或人为灾害或其他灾难;

• 气候变化引起的极端或不寻常的天气模式;

• 短期和长期资金和资本的可得性;

• 利率的水平和波动性;

• 货币价值和通货膨胀;

• 我们客户的财务状况;以及

• 影响证券交易的税收水平。

这些因素是我们无法控制的,可能会对我们提供服务的能力或对服务的需求产生负面影响,或者可能增加我们的成本,从而对我们的业务和经营业绩产生不利影响。 例如,我们的服务受到投资者通过客户持有的独特证券头寸数量、我们代表客户处理的投资者沟通活动水平、交易量、市场价格和证券市场流动性的影响,而证券市场的流动性反过来又受到国内和国际总体经济和政治状况以及可能导致证券市场参与和活动变化的商业和金融广泛趋势的影响。因此,证券市场参与度和活动的任何大幅减少都可能对我们的业务和经营业绩产生不利影响。

如果我们无法响应现有和新客户的需求,或者无法适应技术变革或进步,我们的业务和未来的增长可能会受到影响。

全球金融服务行业的特点是基础设施和产品日益复杂和集成,新的和不断变化的商业模式以及快速的技术和监管变化。我们的客户对我们产品和服务的需求随着这些变化而变化。我们未来的成功将部分取决于我们是否有能力及时和具有成本效益地响应客户对新服务、能力和技术的需求。我们还需要适应人工智能、机器学习、量子计算、数字和分布式账本以及云计算等技术进步,并与不断变化的监管标准保持同步,以满足客户日益复杂的需求。过渡到这些新技术可能需要与客户的密切协调,会破坏我们的资源和我们提供的服务,并可能增加我们对第三方服务提供商(例如我们的云服务提供商)的依赖。

此外,由于新兴技术、金融科技初创企业和新的市场进入者,我们面临去中介化的风险。如果我们未能及时适应新技术或跟上新技术的步伐,可能会损害我们的竞争能力,降低我们的产品和服务对客户的价值,损害我们的业务并影响我们的未来增长。

如果我们所依赖的运营系统和基础设施无法跟上我们的增长步伐,我们可能会遇到运营效率低下、客户不满和失去收入机会的情况。

我们业务的增长和客户群的扩大可能会给我们的管理和运营带来压力。我们认为,我们当前和预期的未来增长将需要实施新的和增强的通信和信息系统,培训操作这些系统的人员以及扩展和升级核心技术。尽管我们的许多系统都旨在适应额外的增长,无需重新设计或更换,但我们可能需要在额外的硬件和软件上进行大量投资以适应增长,这可能会影响我们的盈利能力和业务运营。此外,我们可能无法准确预测这种增长的时间或速度,也无法及时扩展和升级我们的系统和基础设施。

我们的增长要求并将继续要求增加对管理人员和系统、财务系统和控制以及办公设施的投资。我们无法向您保证,我们将能够成功管理或继续管理我们未来的增长。如果我们无法管理增长,我们可能会遇到运营效率低下、客户群不满和失去收入机会的情况。

激烈的竞争可能会对我们维持或增加业务、财务状况和经营业绩的能力产生负面影响。

我们的产品和服务的市场不断发展,竞争激烈。我们与许多提供类似产品和服务的公司竞争。此外,我们的证券处理解决方案与客户执行类似职能的内部能力竞争。我们的竞争对手可能能够更快地响应新的或不断变化的机会、技术和客户需求,并可能能够开展更广泛的促销活动,向客户提供更具吸引力的条款,并采取比我们所能提供或采用的更激进的定价政策。此外,我们预计,我们竞争的市场将继续吸引新的竞争对手和新技术。无法保证我们将能够与当前或未来的竞争对手进行有效竞争。如果我们未能有效竞争,我们的业务、财务状况和经营业绩可能会受到重大损害。

我们可能无法吸引和留住关键人员。

我们的持续成功取决于我们吸引和留住关键人员(例如高级管理人员)和其他合格人员(包括高技能技术员工)来开展业务的能力。在我们竞争的领域,对熟练和经验丰富的人员需求量很大,对他们人才的竞争非常激烈。无法保证我们在招聘和留住所需关键人员的努力中会取得成功。如果我们无法吸引和留住合格的人员,或者我们的招聘和留用成本大幅增加,我们的运营和财务业绩可能会受到重大不利影响。

无法识别、获取、保留、执行和保护重要的知识产权可能会损害我们的业务。

第三方可能会侵犯或盗用我们的知识产权,包括专利、商标、服务标志、版权、域名和商业秘密的组合。我们无法保护我们的知识产权和商标可能会对我们的业务产生不利影响。为了保护我们的知识产权,我们与员工、顾问和其他第三方签订保密和发明转让协议,并控制对我们的服务、软件和专有信息的访问权限。此外,我们许可或收购纳入我们的服务和产品中的技术。可能需要采取其他行动来保护我们的知识产权,包括法律诉讼,这可能既耗时又昂贵,并可能对我们的业务、财务状况和经营业绩产生负面影响。

尽管我们努力识别、获取、保留、执行和保护我们的知识产权和专有信息,但我们无法确定它们是否有效或足以防止出于各种原因未经授权的访问、使用、复制、盗窃或逆向工程我们的知识产权和专有信息,包括:(a) 我们无法发现第三方盗用我们的知识产权;(b) 不同国家对知识产权的法律保护各不相同;(c) 不同国家对知识产权的法律保护各不相同;(c))不断关于保护范围、有效性、非侵权、可执行性和侵权辩护的知识产权法律标准不断变化;(d)未能维持适当的合同限制和其他措施来保护我们的专业知识和商业秘密,或他人违反合同;(e)未能识别和获得可专利创新的专利;(f)可能通过诉讼和行政程序宣告无效、不可执行、范围缩小、稀释和异议我们的知识产权在美国和国外权利;以及 (g) 对第三方知识产权执法的其他业务或资源限制。

我们的产品和服务以及第三方向我们提供的产品和服务可能会侵犯第三方的知识产权,任何侵权索赔,无论是由我们提起还是针对我们,都可能要求我们承担巨额费用,分散我们的管理注意力或阻止我们开展业务。

为了执行我们的知识产权,或质疑第三方知识产权的声称有效性或范围,可能需要进行昂贵、复杂、耗时和不可预测的诉讼。此外,尽管我们努力避免侵犯第三方的已知所有权,但我们仍面临指控侵犯第三方所有权的索赔的风险。所有知识产权诉讼,即使是毫无根据的索赔,都会导致大量开支和资源、我们的管理和时间的流失。知识产权诉讼中的任何不利结果都可能阻止我们出售我们的产品或服务,或要求我们以不利的条件许可他人的技术,这可能会对我们的品牌、业务、运营和财务状况产生重大不利影响。此外,向我们提供对我们业务行为不可或缺的产品或服务的第三方也可能受到其他人的类似侵权指控,这可能会阻止此类第三方继续向我们提供这些产品或服务。因此,我们可能需要对我们的产品或服务采取变通办法或进行实质性重新设计才能继续提供这些产品或服务,但我们可能无法成功。此外,提出此类侵权索赔的一方可以确保对我们作出判决,要求我们支付巨额赔偿金,向该方提供禁令救济,或授予法院下令的其他补救措施,以阻止我们开展业务。

我们在产品和服务中使用第三方开源软件。我们有可能将带有繁琐的许可条款的开源软件纳入我们的产品和服务,据称这些条款要求我们在此类许可下提供专有代码的源代码以及此类开源软件。此外,美国法院尚未解释各种开源许可证的条款,但可能会对我们的产品和服务施加意想不到的条件或限制来解释这些条款。与使用第三方商业软件相比,使用开源软件可能带来更大的风险,因为许可方通常会拒绝对其开源软件的所有担保,而且黑客经常利用开源软件中的漏洞。任何不符合其许可证或政策的开源软件的使用都可能损害我们的业务、运营和财务状况。

收购和整合此类收购会带来某些风险,并可能影响经营业绩。

作为我们整体业务战略的一部分,我们可能会对公司、技术或产品进行收购和战略投资,或者成立合资企业。实际上,在过去的三个财政年度中,我们已经完成了四次收购,并对七家公司进行了战略投资。这些交易和收购整合涉及许多风险。核心风险在以下领域:

• 估值 : 寻找合适的企业以可承受的估值或其他可接受的条件进行收购;与其他潜在收购方竞争收购,并在本质上有限的尽职调查审查基础上谈判企业的公平价格;

• 一体化 : 管理整合被收购公司的人员、产品、技术和其他资产的复杂过程,并转换其财务、信息安全、隐私和其他系统和控制措施以符合我们的标准,从而实现预期的战略目标,实现与收购相关的预期价值、协同效应和其他收益;以及

• 遗留问题 : 防范与前身业务相关的诉讼、索赔、监管调查、损失和其他责任。

此外,整合这些业务的过程可能既困难又昂贵,会干扰我们的业务并转移我们的资源。这些风险可能由于多种原因而产生,例如:

• 与此类收购相关的不可预见的债务或责任;

• 将意想不到的财务和管理资源用于收购的业务;

• 向贷款人借钱或向公众出售股票或债务证券,以可能对我们不利的条件为未来的收购融资;

• 为收购融资而产生的额外债务可能会影响我们的流动性,并可能导致信贷评级下调;

• 收购业务的客户损失;

• 进入我们先前经验最少的市场;以及

• 由于非现金减值费用,收益下降。

此外,国际收购通常涉及额外或更高的风险,例如:

• 地理上分离的组织、系统和设施;

• 整合具有不同业务背景和组织文化的人员;

• 遵守非美国监管要求;

• 在一些非美国国家执行知识产权;以及

• 总体经济和政治状况。

我们现有和未来的债务水平以及对偿债义务的遵守情况可能会对我们的融资选择和流动性状况产生负面影响,这可能会对我们的业务产生不利影响。

截至2024年6月30日,我们的总债务账面金额为33.551亿美元。此外,截至2024年6月30日,我们的循环信贷额度的剩余借款能力为15.00亿美元。我们的整体杠杆率和融资安排的条款可以:

• 限制我们未来为营运资金、资本支出或收购、为增长提供资金或一般公司用途获得额外融资的能力,即使在维持充足的流动性所必需的情况下也是如此;

• 使我们更难履行债务的条款;

• 限制我们以我们可接受的条件或完全可以接受的条件为债务再融资的能力;

• 限制我们在规划和适应不断变化的业务和市场条件以及实施业务战略方面的灵活性;

• 要求我们将运营现金流的很大一部分用于偿还债务的利息和本金,从而限制了我们的现金流可用于为未来投资、资本支出、营运资金、业务活动和其他一般公司需求提供资金;以及

• 增加我们对不利经济或行业条件的脆弱性。

我们的流动性状况可能会受到总体经济状况、监管要求和资本市场准入变化的负面影响,如果我们未能在续订日期续订任何信贷额度或未能达到某些比率,资本市场准入可能会受到限制。我们履行开支和还本付息义务的能力将取决于我们未来的表现,这可能会受到金融、商业、经济和其他因素的影响。如果我们无法偿还债务或遵守有关优先票据或信贷额度的契约中包含的财务或其他限制性契约,我们可能需要立即偿还全部或部分债务或为其再融资、出售资产、借入额外资金或筹集额外股权资本,这也可能导致信用评级下调。此外,如果我们未偿债务的信用评级被下调,或者如果评级机构表示可能降级,我们的业务、财务状况和经营业绩可能会受到不利影响,对我们财务实力的看法可能会受到损害。降级还将增加我们的借贷成本,并可能减少我们能够借入的资金的可用性,从而对我们的业务、财务状况和经营业绩产生不利影响。此外,降级可能会对我们与客户的关系产生不利影响。

未来我们可能会产生与包括商誉在内的无形资产投资组合相关的非现金减值费用。

由于过去的收购,我们在资产负债表上拥有大量商誉和其他收购的无形资产。此外,我们还将某些费用推迟到客户入职或将客户的系统转换为使用我们的技术运行的费用。截至2024年6月30日,商誉、无形资产、净和延期客户转换和启动成本约占我们资产负债表上总资产的69%。自3月31日起,我们每年对商誉进行减值测试,如果事件发生或情况表明此类资产的账面价值可能不再可收回,我们会在其他时间测试商誉、无形资产、净和延期客户转换以及启动成本的减值情况。未来我们可能会产生减值费用,尤其是在经济长期衰退或失去一个或多个主要客户的情况下。重大的非现金减值可能会对我们的经营业绩产生重大不利影响。

我们的某些服务可能会受到来自交易对手和第三方的风险。

我们的共同基金和交易所交易基金处理服务以及我们的过户代理服务涉及代表客户和第三方进行交易结算。在这些活动中,如果我们的客户、经纪交易商、银行、清算机构或存管机构无法履行合同义务,我们可能会面临风险。未能结算交易可能会影响我们提供这些服务的能力,或者由于未能达成和解所带来的声誉风险,可能会降低其盈利能力。

第 10 项。未解决的员工评论

无。

第 1C 项网络安全

我们的信息安全计划旨在满足委托我们提供敏感信息的客户的需求。我们的大多数业务部门和核心应用程序及设施均维持国际标准化组织(“ISO”)27001认证,并在适用的情况下与其他行业标准或框架保持一致,包括云安全联盟的云控制矩阵(“CSA CCM”)、支付卡行业数据安全标准(“PCI DSS”)、健康保险流通与责任法案(“HIPAA”)和HitRust通用安全框架(“HIPAA”)(“HitRust”)CSF”)。

网络安全风险管理和战略

我们认识到识别、评估和管理与网络安全威胁相关的重大风险的重要性。我们的网络安全风险管理计划已整合到我们的整体企业风险管理(“ERM”)流程中,该流程提供了一种持续的程序,适用于公司的各个业务部门和公司职能,以识别和评估风险,监控风险并采取适当的缓解措施。风险管理流程的核心是风险委员会,它是一个管理委员会,负责监督对影响我们运营的关键风险的识别和评估,并审查针对这些风险建立的控制措施。风险委员会由管理层的关键成员组成,包括公司总裁、首席财务官、首席法务官、首席信息安全官、首席隐私官和其他高级管理人员。我们的风险委员会根据需要与主题专家合作,收集见解,以识别和评估重大网络安全风险、其严重程度和潜在的缓解措施。

除其他外,我们采取以下行动来表明我们致力于维护最高水平的信息安全,提供关键数据和系统的可用性,维护监管合规性,管理网络安全威胁带来的重大风险,以及识别、防范、检测、应对网络安全事件并从中恢复:

• 利用加密、数据屏蔽技术、数据丢失防护技术、身份验证技术、授权管理、访问控制、网络和应用程序分段、反恶意软件和通过专用网络传输数据,以及其他旨在防止未经授权访问信息的系统和程序;

• 对我们的许多客户进行年度审查,以了解我们的网络安全和数据安全政策、做法和控制措施,并与世界各地的监管机构接触,以随时了解网络安全和数据安全标准和最佳实践;

• 利用美国政府发布的国家标准与技术研究所改善关键基础设施网络安全框架(“NiST 框架”)作为指导方针来管理我们的网络安全相关风险。我们目前正在根据新发布的 NiST 框架 2.0 评估我们的计划。NiST 框架概述了五项功能的安全控制和结果:识别、保护、检测、响应和恢复;

• 进行网络和端点监控、漏洞评估和网络渗透测试;

• 每季度进行信息安全管理和事件培训,并定期对所有员工进行网络钓鱼电子邮件模拟,以提高对可能威胁的认识和响应能力;

• 进行桌面练习,模拟对网络安全事件的响应,并利用研究结果来改进我们的政策和程序;

• 进行 对主要服务提供商进行信息安全审查和尽职调查,以识别、评估、缓解和监控与我们使用第三方软件和服务相关的风险;以及

• 维护全球信息安全政策和程序,包括事件应对和危机管理计划,其中包括分类、评估、调查、上报、遏制和修复网络安全事件的流程。

在 “安全漏洞或网络安全事件可能对我们的运营能力产生不利影响,可能导致个人、机密或专有信息被盗用,并可能导致我们承担责任或声誉受损” 标题下,我们将进一步描述来自已确定的网络安全威胁的风险,包括以前的任何网络安全事件造成的风险是否以及如何对我们产生重大影响,包括我们的业务战略、经营业绩或财务状况。,”在本10-k表年度报告第1A项中列为风险因素披露的一部分,这些披露以引用方式纳入此处。

我们的执行管理团队连同我们的受管信息技术服务提供商一起,负责评估和管理公司包括机密信息和关键系统在内的网络安全威胁的风险。

我们的信息安全计划和团队目前由我们的首席信息安全官(“CISO”)管理,他向我们的首席技术官报告。 我们的首席信息安全官在管理和领导网络安全职能方面拥有超过25年的经验,其中包括美国、拉丁美洲、英国、东欧、新加坡和中国的信息技术和安全风险、合规和审计职责。我们的 CISO 负责制定、实施和监督我们的整体信息安全计划,包括网络安全风险管理、治理与合规、安全政策和培训,以及我们的网络、系统和机密数据的整体保护和防御。在风险管理方面,CISO与董事总经理、风险管理部门以及风险委员会其他成员密切合作,包括总裁、首席财务官、首席法务官和首席技术官,他们负责在必要时审查和质疑我们信息安全团队的活动。

公司董事会(“董事会”)的职责包括监督我们的风险管理流程。委员会有两种主要的监督方法。第一种方法是通过eRm流程,董事会通过该流程定期收到管理层关于公司面临的最重大风险的报告。第二是通过董事会各委员会的运作。审计委员会协助董事会监督公司的信息安全计划,包括网络安全和数据隐私风险和控制。我们的 CISO 提供有关公司网络安全的报告 每季度向包括董事会所有成员在内的审计委员会提供安全计划。此外,我们的内部审计职能部门定期审计我们的技术和网络安全计划,并向审计委员会报告其调查结果。

第 2 项。属性

我们的业务主要由 43 个设施运营。我们在纽约埃奇伍德、加利福尼亚州埃尔多拉多山、康涅狄格州南温莎、密苏里州堪萨斯城、德克萨斯州达拉斯、德克萨斯州科佩尔和加拿大万锦市租赁了10个生产相关设施,总空间为230万平方英尺,用于我们的投资者沟通解决方案业务。我们还在新泽西州纽瓦克租赁了一处工厂,用于容纳我们的主要全球技术和运营业务。我们在另外32个地点租赁空间,但须遵守惯例租赁安排,并且会错开到期。我们认为,我们的设施目前足以满足其预期用途,并且维护得当。

第 3 项。法律诉讼

目前,除了公司作为当事方或公司任何财产作为标的的业务附带的普通例行诉讼外,没有任何重大法律诉讼待决。在正常业务过程中,公司面临索赔和诉讼。尽管任何索赔或诉讼的结果本质上都是不可预测的,但公司认为,这些问题的最终解决方案,无论是个人还是总体而言,都不会对其财务状况、经营业绩或现金流造成重大影响。 有关公司法律诉讼的信息,请参阅本10-k表年度报告第二部分第8项下的合并财务报表附注19,“合同承诺、意外开支和资产负债表外安排”。

第 4 项。矿山安全披露

不适用。

第二部分。

第 5 项。注册人普通股市场、相关股东事项和发行人购买股权证券

我们的普通股于2007年4月2日开始在纽约证券交易所 “定期” 交易,股票代码为 “BR”。截至2024年8月1日,公司普通股的登记股东共有8,492人。该数字不包括经纪公司和清算机构可能在记录中持有的股份的受益持有人。

股息政策

我们预计将为普通股支付现金分红。2024 年 8 月 5 日,我们董事会将季度现金股息提高了每股 0.08 美元,至每股 0.88 美元,将我们预期的年度股息金额从每股 3.20 美元增加到 3.52 美元。未来向普通股持有人申报和支付股息将由董事会自行决定,并将取决于许多因素,包括我们的财务状况、收益、企业资本要求、法律要求、监管限制、行业惯例以及董事会认为相关的其他因素。

作为控股公司,我们几乎所有的资产都由子公司的股本组成;因此,我们支付股息的能力将取决于我们从运营子公司获得的股息。我们提供业务流程外包和共同基金处理服务的子公司受到监管,向我们支付股息的能力可能会受到限制。我们认为这些限制措施的严重程度不足以影响公司的股息支付能力。

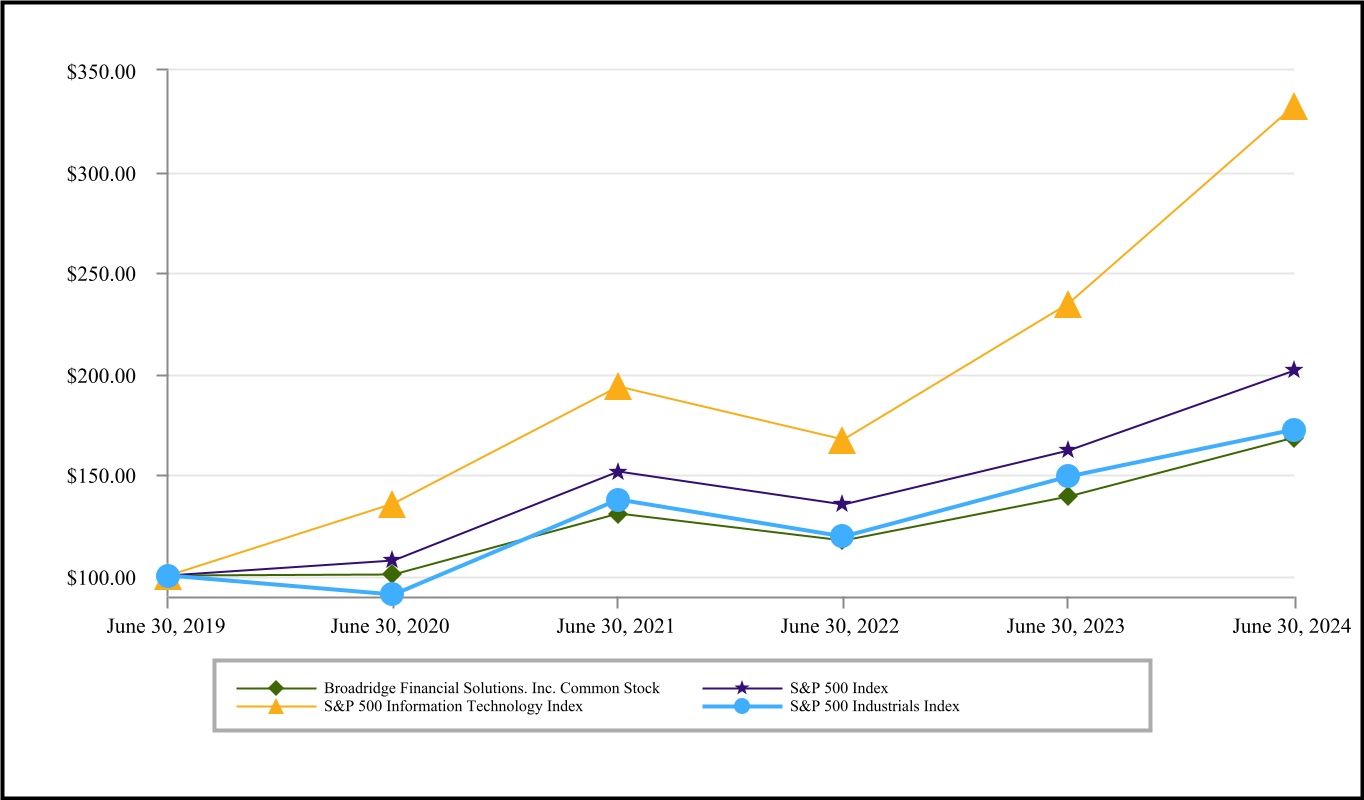

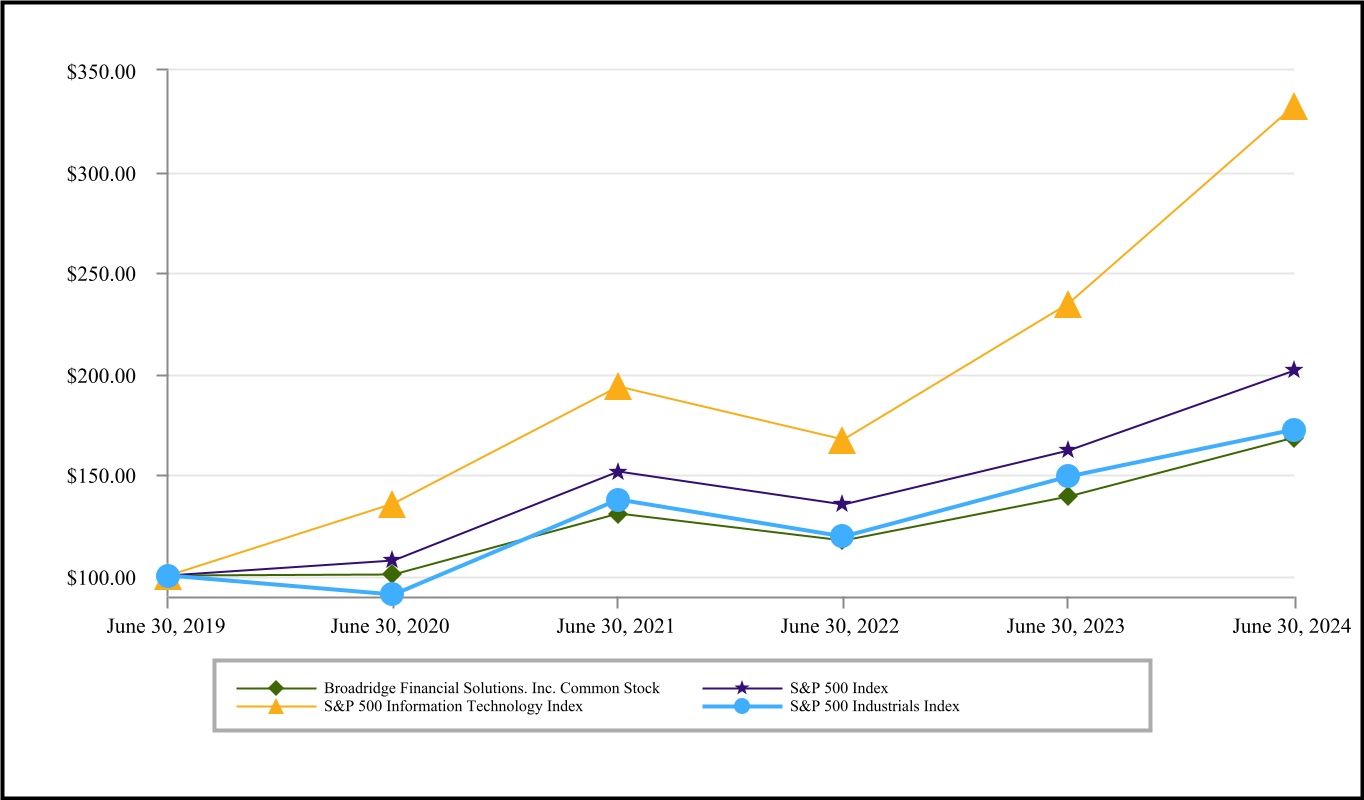

性能图

下图将2019年6月30日至2024年6月30日的Broadridge普通股累计总回报率与以下指数的可比累积回报率进行了比较:(i)标普500指数,(ii)标准普尔500指数信息技术指数和(iii)标准普尔500工业指数。该图假设在2019年6月30日向我们的普通股和每个指数投资了100美元,并假设所有现金分红都进行了再投资。图表下方的表格显示了截至图表中日期这些投资的美元价值。图表中的比较是美国证券交易委员会要求的,无意预测或表明我们普通股的未来表现。

以下业绩图表和相关信息不应被视为 “征集材料” 或 “提交” 给美国证券交易委员会,也不得将此类信息以引用方式纳入未来根据1933年《证券法》或经修订的《交易法》提交的任何文件中,除非Broadridge特别以引用方式将其纳入此类申报中。

Broadridge Financial Solutions, Inc.、标准普尔500指数、标准普尔500指数和标准普尔500工业指数五年累计总回报率的比较(以美元计)

2019 年 6 月 30 日 2020 年 6 月 30 日 2021 年 6 月 30 日 2022年6月30日 2023 年 6 月 30 日 2024 年 6 月 30 日 Broadridge 金融解决方案。Inc. 普通股 $ 100.00 $ 100.73 $ 130.98 $ 117.52 $ 139.21 $ 168.33 标普500指数 $ 100.00 $ 107.49 $ 151.32 $ 135.23 $ 161.69 $ 201.37 标普500信息技术指数 $ 100.00 $ 135.88 $ 193.48 $ 167.24 $ 234.58 $ 332.58 标普500工业指数 $ 100.00 $ 90.95 $ 137.72 $ 119.22 $ 149.17 $ 172.25

我们选择增加标普500工业指数,以符合标准普尔在工业领域根据全球行业分类标准(GICS®)对Broadridge的分类。

发行人及其关联购买者的股票证券购买

下表包含有关我们在截至2024年6月30日的第四财季中每三个月购买股票证券的信息:

时期 总数 平均价格 股票总数 尚未购买的最大股票数量 2024 年 4 月 1 日 — 2024 年 4 月 30 日 114,335 $ 203.23 — 8,755,125 2024 年 5 月 1 日 — 2024 年 5 月 31 日 1,505,502 199.52 1,503,778 7,251,347 2024 年 6 月 1 日 — 2024 年 6 月 30 日 — — — 7,251,347 总计 1,619,837 $ 199.78 1,503,778

(1) 包括从员工那里购买的116,059股股票,用于缴纳与限制性股票单位的归属相关的税款。

(2) 在截至2024年6月30日的财政季度中,公司根据其股票回购计划,平均价格为199.52美元,回购了1,503,778股普通股。截至2024年6月30日,该公司根据其股票回购计划有7,251,347股股票可供回购。根据适用的法律要求和其他因素,任何股票回购都将在公开市场或私下谈判的交易中进行。

第 6 项。[已保留]

第 7 项。管理层对财务状况和经营业绩的讨论和分析

本讨论总结了影响Broadridge在截至2024年6月30日和2023年6月30日的财政年度中经营业绩和财务状况的重要因素,应与本文其他地方的合并财务报表及其附注一起阅读。根据1995年《私人证券诉讼改革法》,“管理层对财务状况和经营业绩的讨论和分析” 中包含的某些信息是 “前瞻性陈述”。本质上不是历史性的,可以通过使用 “期望”、“假设”、“项目”、“预期”、“估计”、“我们相信”、“可能”、“走上正轨” 等词语来识别的陈述是前瞻性陈述。这些陈述基于管理层的预期和假设,存在风险和不确定性,可能导致实际业绩与所表达的结果存在重大差异。由于各种因素,包括本文其他地方列出的因素,我们的实际业绩、业绩或成就可能与本第7项中讨论的结果存在重大差异。参见本10-k表年度报告第1部分中包含的 “前瞻性陈述” 和 “风险因素”。

第二部分 “第7项” 中总结了影响Broadridge在截至2023年6月30日的财政年度中经营业绩和财务状况的重要因素的讨论。我们于2023年8月8日向美国证券交易委员会提交的2023财年10-k表年度报告(“2023年年度报告”)中管理层对财务状况和经营业绩的讨论和分析”。

公司和业务部门的描述

Broadridge,一家特拉华州公司,也是标准普尔500指数的一部分 ® Index是一家全球金融科技领导者,为银行、经纪交易商、资产和财富管理公司、上市公司、投资者和共同基金提供投资者通信和技术驱动的解决方案。我们的服务包括投资者沟通、证券处理、数据和分析以及客户沟通解决方案。我们拥有超过60年的经验,包括作为独立上市公司的15年以上的经验,我们提供综合解决方案和重要的基础设施,为金融服务行业提供动力。我们的解决方案通过推动投资、治理和沟通来改善财务生活,并帮助减少客户对运营基础设施进行大量资本投资的需求,从而使他们能够更加专注于核心业务活动。我们的业务分为两个可报告的领域:投资者传播解决方案和全球技术与运营。

收购

收购的资产和企业合并中承担的负债根据当时的估计公允价值记录在截至相应收购日的公司合并资产负债表中。自相应收购之日起,公司收购业务的经营业绩已包含在公司的合并收益表中。收购价格超过所收购标的资产和负债的估计公允价值的部分将分配给商誉。

2024 财年收购:

顾问目标

2024年5月,公司收购了AdvisorTarget,该公司是为资产管理和财富管理公司提供数据产品的市场领导者,以帮助推动针对财务顾问的数字营销、销售和参与计划。AdvisorTarget包含在该公司的ICS可报告细分市场中。总收购价格包括3,430万美元的现金、100万美元的延期付款、用于结算先前关系的160万美元以及可能支付的最高3,050万美元的或有对价。在收购的业务实现某些确定的收入目标后,应在2028财年之前支付或有对价。交易中假设的净有形负债为310万美元,产生的或有负债价值1,400万美元。此次收购带来了4180万美元的商誉,可抵税。收购的无形资产总额为1,210万美元,主要包括软件技术和客户关系,将在五年期内摊销。

宣布的收购:

Kyndryl 证券行业服务(“Kyndryl SIS”)

2024年5月,Broadridge宣布拟议收购Kyndryl SIS,为加拿大金融服务行业提供财富管理、资本市场和信息技术解决方案,从而扩大我们在全球技术和运营领域的产品供应。总收购价格约为2亿美元。此次收购须遵守惯例成交条件,包括监管部门的批准。

演示基础

合并财务报表是根据美国公认会计原则(“GAAP”)和美国证券交易委员会对10-k表年度报告的要求编制的。这些财务报表列报了公司的合并状况,包括公司直接或间接拥有控股权益的实体,以及公司按权益会计法记录投资的各种实体以及某些有价和非有价证券。公司间余额和交易已被清除。由于四舍五入,所列金额的总和可能不一致。某些前期金额已酌情重新分类,以符合本年度的列报方式。

在提交合并财务报表时,管理层做出的估计和假设会影响报告金额和相关披露。管理层不断评估用于编制合并财务报表的会计政策和估计。就其性质而言,这些估计基于判断、可用信息和历史经验,被认为是合理的。但是,实际金额和结果可能不同于管理层的估计。管理层认为,合并财务报表包含公允列报业绩所必需的所有正常经常性调整。所列期间报告的经营业绩不一定代表以后各期的经营业绩。

从2023财年第一季度开始,公司更改了分部收入、所得税前分部收益(亏损)以及收购的无形资产和已购买知识产权的分部摊销报告,以反映适用于所列个别期间的实际外汇汇率的影响。本10-k表格中提供的前期指标的列报方式已更改,以符合本期的列报方式。合并总收入和所得税前收益没有受到影响。请参阅本10-k表年度报告第二部分第8项下的合并财务报表附注3 “收入确认” 和附注21 “按分部划分的财务数据”。

季节性

处理和向投资者分发代理材料和年度报告是我们投资者沟通解决方案业务的很大一部分。在第三和第四财季中,我们处理和分发的代理材料和年度报告数量最多。该业务的周期性活动与法律对公开报告公司规定的重要申报截止日期有关。这导致我们在第三和第四财季的收入、营业收入、净收益和经营活动现金流增加。我们收入的季节性使我们很难根据任何特定财季的业绩估算未来的经营业绩,并可能影响投资者逐个财季比较我们的财务状况、经营业绩和现金流的能力。

关键会计估计

我们不断评估用于编制合并财务报表的会计政策和估算。就其性质而言,这些估计基于判断、可用信息和历史经验,被认为是合理的。但是,实际金额和结果可能不同于管理层的这些估计。下文将讨论某些需要大量管理估算并被认为对我们的经营业绩或财务状况至关重要的会计政策。

善意 . 我们通过将申报单位的账面价值与其公允价值进行比较来审查所有商誉的账面价值。如果情况表明可能出现减损,我们需要至少每年进行一次或更频繁地进行这种比较。在确定申报单位的公允价值时,我们采用收益法,该方法使用各种假设来考虑折现的未来现金流分析,包括基于假设的长期增长率的收入预测、估计成本和基于特定报告单位的加权平均资本成本的适当贴现率。贴现现金流分析中使用的需要判断的主要因素是基于利息和税前预测收益的预计未来运营现金流,以及终值增长率和贴现率假设的选择。加权平均资本成本考虑了我们合并资本结构中每个组成部分(股权和长期债务)的相对权重。我们对长期增长和成本的估算基于历史数据、各种内部估计和各种外部来源,是作为我们常规长期规划流程的一部分制定的。影响这些假设的经济和运营条件的变化可能会导致未来时期的商誉减值。如果申报单位的账面金额超过其公允价值,则减值损失的确认金额应等于该超出部分,但不得超过分配给该申报单位的商誉总额。截至2024年6月30日,我们的商誉为34.694亿美元。鉴于我们商誉的重要性,我们的一个申报单位公允价值的负面变化可能会导致减值费用,这可能对我们的收益产生重大影响。

公司根据商誉减值测试进行敏感性分析,假设我们的申报单位的公允价值有所减少。我们在计算申报单位公允价值时对预计未来运营现金流、贴现率或终值增长率的估计发生10%变化不会导致我们的商誉减值。