2024年10月17日日期的初步发行简章

根据《A法规》,涉及这些证劵的发行声明已向证券交易委员会提交。此预售发行说明书中的信息尚待补充或修订。在获得证券交易委员会批准之前,这些证劵不得出售,亦不得接受购买要约。本预售发行说明书不构成要约出售或征求购买要约,亦不得在任何州以未在该州的法律下注册或获得资格的情况下出售这些证劵。我们可选择通过发送通知来履行发送正式发行说明书的义务,在我们向您销售完成后的两个工作日内,通知内含有正式发行说明书的URL,或者包含有正式发行说明书的申报书的URL。

发售简章

cyngn inc.

最多7142857股普通股

最多7,142,857个预先资助权证

最多7142857股普通股,根据这些预先赞助的认股权

根据本发售说明书(“发售说明书”),cyngn inc,一家特拉华州公司,以“尽力而为”的方式,最多发售7,142,857股其普通股,每股面值为$0.00001(“股份”),以每股$3.50的价格,根据美国证券交易委员会(“SEC”)第二层的A规定进行。

我们还提供多达7,142,857张预先资助认股权,以“尽最大努力”方式(“预先资助认股权”,与股份合称为“有价证券”)。每一份预先资助认股权可行使一股我们的普通股。每份预先资助认股权的购买价格为$3.49,每股预先资助认股权的行使价格为每股$0.01。预先资助认股权可以立即行使,并可在所有预先资助认股权全部行使完毕前的任何时间行使。

丙前无交易市场进行预资warrants的交易,我们也无意申请在任何证券交易所上市或在任何间经纪报价系统中挂牌预资warrants。此次发售与可按预资warrants行使所发行的普通股相关。

此次发行以「尽力而为」的方式进行,这意味著我们无需出售最低数量的证券即可结束此次发行;因此,我们可能从此次发行中收到很少或没有收益。此次发行对投资者并无最低购买要求。我们有权全面或部分审核并接受或拒绝订阅,无论出于何种原因或无故。所得款项将不会存入托管或信托账户。此次发行的所有款项将立即对我们可用,可根据需要使用。证券购买者将没有权利要求退款,并可能损失全部投资。请参阅位于第7页开始的「风险因素」部分,以了解与购买证券相关的风险。

我们估计此发售将在内开始 美国证券交易委员会获得资格两天;此发行将于最早 (a) 出售最高发售日期终止; (b) 自 SEC 获得资格之日起一年,或 (c) 我们自行决定我们提前终止此发行的日期。 (请参阅「分配计划」)。

| 每股价格 分享 普通 股票 | 每股价格 预付款 认股权证。 | 总计 | ||||||||||

| 公开发行价格 | $ | 3.50 | $ | 3.49 | $ | 49,928,571.43 | ||||||

| 佣金(2) | $ | 0.175 | $ | 0.1745 | $ | 2,496,428.57 | ||||||

| 收益分给cyngn inc(3) | $ | 3.325 | $ | 3.3155 | $ | 47,432,142.86 | ||||||

| (2) | 公司已聘请Maxim Group LLC(FINRA/SIPC会员)(下称「配售代理商」)作为本次发行的配售代理商,作为本次发行筹集总金额的5%费用。 |

| (3) | 不包括预估的本次发行支出,约为230,000美元。请参阅「分销计划」。 |

我们的普通股在纳斯达克资本市场(“纳斯达克”)上市,标的为“CYN”。截至2024年10月16日,我们的普通股最后报价为每股4.19美元。

投资有风险,投资证券属于投机性购买,而且涉及重大风险。只有在您能够承担投资的全部损失时,您才应该购买证券。在购买任何证券之前,请参阅第7页开始的“风险因素”部分,讨论您应考虑的某些风险。

美国证券交易委员会并未就所提供的证券或发行条款提供意见或批准,也未对任何发行传单或其他招揽材料的准确性或完整性进行审查,这些证券是根据豁免注册条例发行,但委员会并未独立确定所发行的证券是否免登记。

本提案禁止使用预测或预测。 任何人不得对您在证券投资中将获得的利益进行任何口头或书面预测。

本次发售不得向您进行销售,如果您不符合本发售说明书第15页“分销计划-州法豁免和向「合格购买者」发售”中描述的投资者适格标准。在声明您符合建立的投资者适格标准之前,我们鼓励您查阅A规则251(d)(2)(i)(C)。有关投资的一般资讯,我们建议您参考 www.investor.gov.

本说明书遵循Form S-1的披露格式,根据Form 1-A的第II部分(a)(1)(ii)的一般说明。

本招股说明书日期为_______________, 2024年。

目 录

| 页面 | |

| 有关前瞻性陈述的警语性声明 | ii |

| 募资摘要 | 1 |

| 风险因素 | 7 |

| 募集款项用途 | 13 |

| 配售计划 | 14 |

| 资本股份的描述 | 17 |

| 本次发行的证券描述 | 21 |

| 专家 | 23 |

| 法律问题 | 23 |

| 参照内容注册。 | 24 |

| 您可以在哪里找到更多资讯? | 24 |

i

本要项内容中包含一些非属历史事实且被视为前瞻性的陈述。这些前瞻性陈述包括但不限于我们业务的发展计划;我们的策略与业务前景;预期我们公司的发展;以及其他各种事项(包括条件性负债和义务以及会计政策、标准和解读的变化)。这些前瞻性陈述表达了我们对未来的期望、希望、信念和意图。此外,不限制前述规定,任何提及对未来事件或情况的预测、预测或其他特征的陈述,包括任何基本假设,均属前瞻性陈述。 “预计”、“相信”、“持续”、“可能”、“估计”、“期待”、“打算”、“可能”、“或许”、“计划”、“可能性”、“预测”、“项目”、“寻求”、“应该”、“将”、“将会”、“将会”以及类似表达和变体,或可比喻的术语,或任何前述话语的否定,可能识别前瞻性陈述,但缺席这些字词并不表示该陈述不是前瞻性。

本发行文件中包含的前瞻性声明基于目前对未来发展的预期和信念,这些发展难以预测。我们无法保证未来的表现,或者未来可能影响我们公司的发展是否如目前预期。这些前瞻性声明涉及多项风险、不确定性(其中一些超出我们的控制范围)或其他假设,可能导致实际结果或表现与这些前瞻性声明所表达或暗示的结果有实质不同。

All forward-looking statements attributable to us are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties, along with others, are also described below in the section entitled “Risk Factors”. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

ii

以下摘要突出了本发行说明书中包含的重要信息。此摘要并不包含您在购买我们证券之前应该考虑的所有信息。在作出投资决策之前,您应该仔细阅读本发行说明书,包括标题为“风险因素”的部分以及合并财务报表和相关附注。Cyngn Inc. 及其子公司在本文件中被称为“Cyngn”,“公司”,“我们”,“我们”和“我们的”,除非背景说明了其他含义。

除非本文明确规定,此处提供的所有股票分红和每股数字均已调整,以反映我们普通股于2024年7月3日进行的1对100的股票合并的效应。

概述

我们是一家专注于解决自主车辆(AV)技术公司,专注于为自动驾驶车辆的工业用途寻找解决方案。我们认为,技术创新是必需的,以实现自动工业车辆的采用,从而解决今天存在的重大行业挑战。这些挑战包括劳动力短缺、高劳动力成本和工作安全。

我们将全套自动驾驶软件DriveMod 集成到原始设备制造商(“OEM”)制造的车辆上,或通过对现有车辆进行改装,或直接集成到车辆组装中。我们设计了Enterprise Autonomy Suite(“EAS”),以与领先的硬件技术提供商的传感器和元件兼容,并集成我们的专有AV软件,生产差异化的自动驾驶车辆。

自动驾驶具有保持跨车辆和应用程序相似的常见技术基础组件。通过利用这些基础组件,DriveMod 旨在通过简化的硬件/软件集成为新车辆提供自主性。这种与车辆无关的方法使DriveMod 能够扩展到新车辆和新的操作设计领域(“ODD”)。简而言之,几乎每种工业车辆,无论用途如何,都可以使用我们的技术实现自主移动。

我们的方法实现了几个主要的价值主张:

| 1. | 为已经得到客户信任的知名制造商打造的工业车辆提供自主能力。 | |

| 2. | 通过利用自动驾驶车辆和数据的协同关系持续为客户创造价值。 | |

| 3. | 为各种车队开发一致的自动驾驶车辆操作和用户界面。 | |

| 4. | 通过引入人工智能(AI)、机器学习(ML)、云/连接性、传感器融合、高清晰度地图、实时动态路径规划和决策等领先技术,辅助现有行业参与者的核心能力。 |

我们相信作为车辆制造商的技术合作伙伴,与已经建立销售、分销和维护服务渠道的现有供应商形成协同效应。通过专注于工业用例并与这些市场上的现有原始设备制造商合作,我们相信我们可以更快地找到并执行创收机会。

我们的长期愿景是EAS成为一个全面的自主驾驶解决方案,使企业采用新车辆并在新部署中扩展自主车队的边际成本最小化。我们已经在十多种不同的车辆形态上部署了DriveMod软件,范围从库存车和站立式地板洗地机到14座穿梭巴士和电动叉车,作为原型和概念验证项目的一部分,展示了我们AV构建模块的可扩展性。

1

我们最近的进展有助于与OEm合作伙伴和最终客户验证EAS。我们还在继续发展我们的产品规模能力,并产生新颖的技术创新。DriveMod Stockchaser于2023年初开始商业化推出,首先由我们的合作伙伴客户US Continental部署,后者是总部位于加利福尼亚的高品质皮革和织物护理产品制造商。我们还推出了DriveMod Forklift和DriveMod Tugger,通过与比亚迪和Motrec的OEm合作伙伴关系,扩展了我们的车辆类型组合车队。

我们与Arauco等全球领先客户签订了付费项目,还与全球500强和财富100强的大品牌签订了额外项目。我们的专利组合在2023年新增了16项美国专利授权,使总授权数达到19项。

我们打算继续与那些高度依赖于物料处理车辆并都意识到需要自动化以 i) 在当今经济中竞争,ii) 应对重大劳动力短缺和不断上升的成本,iii) 提高安全性的公司继续寻求并赢得额外的许可协议。我们获得这些机会的途径将继续是直接销售努力,同时增加我们的工业车辆经销商网络,这些经销商已经在工业车辆销售中占据重要地位。

我们的产品

EAS是一个由三个互补类别组成的技术和工具套件:DriveMod、Cyngn Insight和Cyngn Evolve。

DriveMod:工业自动驾驶车辆系统

我们将DriveMod构建为一个模块化软件产品,与广泛应用于自动驾驶车辆行业的各种传感器和电脑硬件兼容。我们的软件与行业领先技术提供商提供的传感器和元件相结合,涵盖了使车辆能够使用领先技术自主运行的端到端需求。DriveMod的模块化使我们的AV技术能够跨越车辆平台以及室内和室外环境兼容。DriveMod可以应用于现有车辆资产的翻新,也可以集成到制造合作伙伴的车辆中,以装配提供便捷的选项供客户整合领先技术,无论他们的AV采纳策略是进化还是革命性的。

核心面向车辆的DriveMod软件堆栈是针对不同车辆定位和部署的 DriveMod套件,这些是AV硬件系统,考虑了在特定目标车辆上操作DriveMod软件的特定需求。然后,在原型制作和产品化后,DriveMod套件简化了AV硬件和软件集成到规模车辆上。Columbia Stockchasers的DriveMod套件已经商业发布并可大规模使用。随后,我们预计将创建不同的DriveMod套件实例,以支持在EAS平台上发布新车辆的商业推出,例如电动叉车和其他工业车辆。

2

图1:Cyngn自主车辆技术(DriveMod)概览

DriveMod的灵活性与我们的制造和服务合作伙伴网络相结合,支持客户在自动驾驶技术集成的不同阶段。这使客户能够随着业务转型不断扩大其工业自治部署的复杂性和范围,同时在过渡到完全自治过程中持续获得回报。EAS还将为客户提供空中软件升级、特定客户支持以及根据使用和运营规模的灵活消费。通过减轻传统车辆自动化和工业机器人投资的商业和技术负担,工业AV可以普遍面向市场,甚至可以覆盖那些可能难以采用工业4.0和5.0技术的中小型企业。

Cyngn洞察:智能控制中心

Cyngn Insight是面向客户的工具套件,用于管理AV车队并汇总数据以提取业务见解。分析仪表板展示有关系统状态、车辆遥测和性能指标的数据。Cyngn Insight还提供了在需要时在自主、手动和远程操作之间切换的工具。这种灵活性允许客户根据自己的运营环境使用系统的自主能力。客户可以根据自身业务需求选择何时让他们的DriveMod动力车辆自主运行,何时让人员操作员手动或远程操作车辆。综合这些功能和工具,形成了Cyngn Insight智能控制中心,从任何位置实现灵活的车队管理。

Cyngn Insight的工具套件包括可配置的云仪表板,以不同粒度级别(即站点、车队、车辆、模块和组件)聚合各种数据流。我们可以在“开环”车辆运行期间收集数据,意味着车辆可以在手动操作的同时仍然收集先进车载传感器和计算机提供的丰富数据。数据可用于预测性维护、运营改进、培训员工进行数字化转型等。

3

Cyngn Evolve: 数据优化工具

Cyngn Evolve是我们内部工具套件,支撑着自动驾驶车辆和数据之间的关系。通过统一的基于云的数据基础设施,我们的专有数据工具增强了自动驾驶车辆产生的宝贵新数据所带来的积极网络效应。Cyngn Evolve及其数据管道促进了人工智能/机器学习的训练和部署,管理数据集,并支持驾驶模拟和评分,以测试和验证新的DriveMod发布,同时使用真实世界和模拟数据。

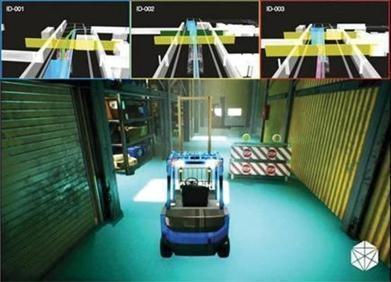

图2: Cyngn“AnyDrive”模拟是Cyngn Evolve工具链的一部分。模拟环境创建了物理世界的数字版本,这使得客户数据集可以被利用和增强,以在发布新的自动驾驶功能之前进行测试和验证。

随着自动驾驶技术专业化全球范围内不断成熟,可能存在机会将Cyngn Evolve的复杂自动驾驶车辆工具商业化。目前,我们认为自动驾驶车辆开发仅限于少数专家团体。因此,Cyngn Evolve目前是我们用来推进DriveMod和面向客户的EAS产品Cyngn Insight的内部工具。

知识产权组合

我们在自主工业车辆市场内产生影响和增长的能力在很大程度上取决于我们获取、维护和保护与我们的产品和技术相关的知识产权和其他财产权利的能力。为了实现这一目标,我们利用专利、商标、版权和商业秘密以及员工和第三方保密协议、许可证和其他合同义务的组合。除了保护我们的知识产权和其他资产之外,我们的成功还取决于我们在开发技术和运营过程中避免侵犯、盗用或违反第三方、客户和合作伙伴的知识产权和财产权利的能力。

我们的软件栈包括超过30个子系统,包括为感知、地图制作和定位、决策制定、规划和控制而设计的子系统。截至本发行通知书日期,我们拥有19项已授权的美国专利并提交了6项待批准的美国专利和20项国际专利申请,并预计将来继续就我们的技术提交额外的专利申请。

我们的公司信息

该公司最初于2013年2月1日在特拉华州成立,名称为Cyanogen, Inc.或Cyanogen。公司起初是一家由位于西雅图和帕洛阿尔托的创业公司创办的公司,旨在将CyanogenMod 商业化,直接面向消费者并通过与手机制造商的合作。CyanogenMod是基于安卓移动平台的开源移动设备操作系统。从2013年到2015年,Cyanogen推出了多个版本的移动操作系统,并与包括手机原始设备制造商、内容提供商以及领先的技术伙伴在内的一系列公司合作。

4

In 2016 the Company’s management and board of directors, determined to pivot its product focus and commercial direction from the mobile device and telecom space to industrial and commercial autonomous driving with the hiring of Lior Tal in June 2016 to serve as the company’s chief operating officer. Mr. Tal, a seasoned executive of startup firms where prior to joining the company, co-founded Snaptu which later was acquired by Facebook (currently known as Meta Platforms, Inc.), as well as held various leadership roles at Actimize, DiskSites and Odigo; all of these companies which were also later acquired. Mr. Tal was promoted to chief executive officer in October 2016 and continues to serve in this role along with chairman of the board. In May 2017, the Company changed its name to CYNGN Inc.

Available Information

Our principal business address is 1015 O’Brien Dr., Menlo Park, CA 94025, and our telephone number is (650) 924-5905. We maintain our corporate website at https://cyngn.com (this website address is not intended to function as a hyperlink and the information contained on our website is not intended to be a part of this Offering Circular). Information on our website does not constitute a part of, nor is it incorporated in any way, into this Offering Circular and should not be relied upon in connection with making an investment decision. We make available free of charge on https://investors.cyngn.com/ our annual, quarterly, and current reports, and amendments to those reports if any, as soon as reasonably practical after we electronically file such material with, or furnish it to, the SEC. We may from time to time provide important disclosures to investors by posting them in the Investor Relations section of our website.

Our common stock is quoted on the Nasdaq under the symbol “CYN”. We file annual, quarterly, and current reports, proxy statements and other information with the U.S. Securities Exchange Commission (the “SEC”) and are subject to the requirements of the Securities and Exchange Act of 1934, as amended (the Exchange Act). These filings are available to the public on the Internet at the SEC’s website at http://www.sec.gov.

Offering Summary

| Securities Offered | 7,142,857 Shares and 7,142,857 Pre-Funded Warrants are being offered in a “best-efforts” offering. | |

| The Pre-Funded Warrants will be exercisable immediately and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. | ||

| Offering Price Per Security | $3.50 per Share and $3.49 per Pre-Funded Warrant. | |

| Shares Outstanding Before This Offering | 2,026,617 shares of common stock issued and outstanding as of October 15, 2024. |

5

| Shares Outstanding After This Offering | 9,169,474 shares of common stock issued and outstanding, assuming all of the Shares are sold in this offering and no Pre-Funded Warrants are sold and 16,312,331assuming all of the Shares and Pre-Funded Warrants are sold and the Pre-Funded Warrants are exercised in full. The number of shares to be outstanding after this offering is based on 2,026,617 shares outstanding as of October 15, 2024 and excludes: |

| ● | 167,589 shares of common stock issuable upon the exercise of outstanding stock options with a weighted-average exercise price of $96.85 per share; | |

| ● | 2,442 shares of common stock issuable upon vesting of restricted stock unit awards with a weighted-average exercise of $0 per share; | |

| ● | 86,879 shares of common stock reserved for future issuance under our 2021 Equity Incentive Plan; and | |

| ● | 72,369 shares of common stock issuable upon exercise of warrants to purchase common stock with a weighted-average exercise price of $283.80 per share. |

| Minimum Number of Securities to Be Sold in This Offering | None | |

| Investor Suitability Standards | The Securities are being offered and sold to “qualified purchasers” (as defined in Regulation A under the Securities Act of 1933, as amended (the “Securities Act”). “Qualified purchasers” include any person to whom securities are offered or sold in a Tier 2 offering pursuant to Regulation A under the Securities Act. | |

| Market for our Common Stock | Our common stock is listed on Nasdaq under the symbol “CYN.” | |

| No Public Market for Pre-Funded Warrants | There is no public market for the Pre-Funded Warrants, and none is expected to develop. We do not intend to apply for the listing of the Pre-Funded Warrants offered in this offering on any stock exchange. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited. See “Risk Factors-Risks Related to Pre-Funded Warrants; There is no public market for the Pre-Funded Warrants.” | |

| Termination of this Offering | This offering will terminate at the earliest of (a) the date on which all of the Shares and Pre-Funded Warrants have been sold, (b) the date which is one year from this offering being qualified by the SEC and (c) the date on which this offering is earlier terminated by us, in our sole discretion. (See “Plan of Distribution”). | |

| Use of Proceeds | We will use the proceeds of this offering for marketing and advertising expenses and general corporate purposes, including working capital. See “Use of Proceeds”. | |

| Risk Factors | An investment in the Securities involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investments. You should carefully consider the information included in the Risk Factors section of this Offering Circular, as well as the other information contained in this Offering Circular, prior to making an investment decision regarding the Securities. |

Continuing Reporting Requirements Under Regulation A

We are required to file periodic and other reports with the SEC, pursuant to the requirements of Section 13(a) of the Exchange Act. Our continuing reporting obligations under Regulation A are deemed to be satisfied as long as we comply with our Section 13(a) reporting requirements.

6

An investment in the Securities involves substantial risks. You should carefully consider the following risks and all of the other information contained or incorporated by reference in this Offering Circular before deciding whether to invest in our securities, including the risks and uncertainties described below and under the caption “Risk Factors” in Items 1A in our most recently filed Annual Report on Form 10-K filed with the SEC on March 7, 2024 and Quarterly Report on Form 10-Q filed with the SEC on August 8, 2024, in each case as these risk factors are amended or supplemented by subsequent Annual Reports on Form 10-K or Quarterly Reports on Form 10-Q. The occurrence of any of the following risks and the Rish Factors incorporated herein by reference might cause you to lose a significant part of your investment. The risks and uncertainties discussed below are not the only ones we face, but do represent those risks and uncertainties that we believe are most significant to our business, operating results, prospects and financial condition. Some statements in this Offering Circular, including statements in the following risk factors, constitute forward-looking statements. See “Cautionary Statement Regarding Forward-Looking Statements”.

Risks Related to this Offering and Ownership of our Common Stock

We have incurred significant losses, have limited cash on hand and there is substantial doubt as to our ability to continue as a going concern.

The Company has incurred losses from operations since inception. The Company incurred net losses of approximately $11.8 million and $12.0 million for the six months ended June 30, 2024 and 2023, respectively. In addition, the Company had accumulated deficits of approximately $171.8 million and $160.0 million as of June 30, 2024 and December 31, 2023, respectively, and net cash used in operating activities was $10.2 million for both six month periods ended June 30, 2024 and 2023. As of June 30, 2024, the Company’s unrestricted cash balance was $5.9 million, and its short-term investments balance was $1.1 million. Based on cash flow projections from operating and financing activities and the existing balance of cash and short-term investments, management is of the opinion that the Company has insufficient funds for sustainable operations, and it may not be able to meet its payment obligations from operations and related commitments, if the Company is not able to complete the required funding transactions to allow the Company to continue as a going concern. Based on these factors, the Company has substantial doubt that it will continue as a going concern for the next 12 months.

The Company’s plan to alleviate the going concern issue is to increase revenue while controlling operating costs and expenses and obtaining funds from outside sources of financing to generate positive financing cash flows. While management is optimistic about its ability to raise substantial funds to continue as a going concern for the next 12 months, there can be no assurance that any such measures will be successful. We currently do not generate substantial revenue from product sales. Accordingly, we expect to rely primarily on equity and/or debt financings to fund our continued operations. The Company’s ability to raise additional funds will depend, in part, on the success of our product development activities, and other events or conditions that may affect the share value or prospects, as well as factors related to financial, economic and market conditions, many of which are beyond our control. There can be no assurances that sufficient funds will be available to us when required or on acceptable terms, if at all. Accordingly, management has concluded that these plans do not alleviate substantial doubt about the Company’s ability to continue as a going concern. Our failure to achieve or maintain profitability could negatively impact the value of our common stock.

If we are not able to comply with the applicable continued listing requirements or standards of The NASDAQ Capital Market, The NASDAQ Capital Market could delist and adversely affect the market price and liquidity of our common stock.

Our common stock is currently traded on The NASDAQ Capital Market under the symbol “CYN”. We have in the past been, and may in the future be, unable to comply with certain of the listing standards that we are required to meet to maintain the listing of our common stock on The NASDAQ Capital Market. If we fail to meet any of the continued listing standards of The NASDAQ Capital Market, our common stock will be delisted from The NASDAQ Capital Market.

You may experience future dilution as a result of future equity offerings or acquisitions.

In order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any future offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock, or securities convertible or exchangeable into our common stock, in future transactions or acquisitions may be higher or lower than the price per share paid by investors in this offering.

In addition, we may engage in one or more potential acquisitions in the future, which could involve issuing our common stock as some or all of the consideration payable by us to complete such acquisitions. If we issue common stock or securities linked to our common stock, the newly issued securities may have a dilutive effect on the interests of the holders of our common stock. Additionally, future sales of newly issued shares used to effect an acquisition could depress the market price of our common stock.

7

This is a “best efforts” offering; no minimum amount of Securities is required to be sold, and we may not raise the amount of capital we believe is required for our business.

There is no required minimum number of Securities that must be sold as a condition to completion of this offering. Because there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth in this Offering Circular. We may sell fewer than all of the Securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do not sell an amount of Securities sufficient to pursue the business goals outlined in this Offering Circular. Thus, we may not raise the amount of capital we believe is required for our business and may need to raise additional funds, which may not be available or available on terms acceptable to us. Despite this, any proceeds from the sale of the Securities offered by us will be available for our immediate use, and because there is no escrow account and no minimum offering amount in this offering, investors could be in a position where they have invested in us, but we are unable to fulfill our objectives due to a lack of interest in this offering.

Our management will have broad discretion over the use of the net proceeds from this offering.

We currently intend to use the net proceeds from the sale of Securities under this offering for marketing and advertising expenses and general corporate purposes, including working capital. We have not reserved or allocated specific amounts for any of these purposes and we cannot specify with certainty how we will use the net proceeds. See “Use of Proceeds”. Accordingly, our management will have considerable discretion in the application of the net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. We may use the net proceeds for corporate purposes that do not increase our operating results or market value.

There is a limited market for our common stock that may make it more difficult to dispose of your stock.

Our common stock is currently listed on the Nasdaq Capital Market under the symbol “CYN”. There is a limited trading market for our common stock. Accordingly, there can be no assurance as to the liquidity of any markets that may develop for our common stock, the ability of holders of our common stock to sell shares of our common stock, or the prices at which holders may be able to sell their common stock.

Future sales of our common stock in the public market could cause the market price of our common stock to decline.

Sales of a substantial number of shares of our common stock in the public market, or the perception that these sales might occur, could depress the market price of our common stock and could impair our ability to raise capital through the sale of additional equity securities. Many of our existing equity holders have substantial unrecognized gains on the value of the equity they hold based upon the price of our initial public offering, and therefore, they may take steps to sell their shares or otherwise secure the unrecognized gains on those shares. We are unable to predict the timing of or the effect that such sales may have on the prevailing market price of our common stock.

Our stock price may be volatile, and the value of our common stock may decline.

The market price of our common stock may fluctuate or decline significantly in response to numerous factors, many of which are beyond our control, including:

| ● | actual or anticipated fluctuations in our financial condition or results of operations; | |

| ● | variance in our financial performance from expectations of securities analysts; | |

| ● | changes in the pricing of the solutions on our platforms; | |

| ● | changes in our projected operating and financial results; | |

| ● | changes in laws or regulations applicable to our technology; |

8

| ● | announcements by us or our competitors of significant business developments, acquisitions or new offerings; | |

| ● | sales of shares of our common stock by us or our shareholders; | |

| ● | significant data breaches, disruptions to or other incidents involving our technology; | |

| ● | our involvement in litigation; | |

| ● | future sales of our common stock by us or our stockholders; | |

| ● | changes in senior management or key personnel; | |

| ● | the trading volume of our common stock; | |

| ● | changes in the anticipated future size and growth rate of our market; | |

| ● | general economic and market conditions; and | |

| ● | other events or factors, including those resulting from war, incidents of terrorism, global pandemics or responses to these events. |

Broad market and industry fluctuations, as well as general economic, political, regulatory and market conditions, may also negatively impact the market price of our common stock. In addition, technology stocks have historically experienced high levels of volatility. In the past, companies who have experienced volatility in the market price of their securities have been subject to securities class action litigation. We may be the target of this type of litigation in the future, which could result in substantial expenses and divert our management’s attention.

Future securities issuances could result in significant dilution to our stockholders and impair the market price of our common stock.

Future issuances of shares of our common stock could depress the market price of our common stock and result in dilution to existing holders of our common stock. Also, to the extent outstanding options and warrants to purchase our shares of our common stock are exercised or options or other equity-based awards are issued or become vested, there will be further dilution. The amount of dilution could be substantial depending upon the size of the issuances or exercises. Furthermore, we may issue additional equity securities that could have rights senior to those of our common stock.

We anticipate that we will need to raise additional capital, and our issuance of additional capital stock in connection with financings, acquisitions, investments, our equity incentive plans or otherwise will dilute all other stockholders.

We expect to issue additional capital stock in the future that will result in dilution to all other stockholders. We expect to grant equity awards to employees, directors and consultants under our equity incentive plans. We may also raise capital through equity financings in the future. As part of our business strategy, we may acquire or make investments in companies, products or technologies and issue equity securities to pay for any such acquisition or investment. We may not be able to obtain additional capital if and when needed on terms acceptable to us, or at all. Further, if we do raise additional capital, it may cause stockholders to experience significant dilution of their ownership interests and the per share value of our common stock to decline.

We do not intend to pay cash dividends for the foreseeable future and, as a result, your ability to achieve a return on your investment will depend on appreciation in the price of our common stock.

We have never declared or paid any cash dividends on our capital stock, and, subject to the discretionary dividend policy described in the section entitled “Dividend” of this Offering Circular, we do not intend to pay any cash dividends in the foreseeable future. On September 29, 2023, our board of directors declared a one-time special dividend of 10% on our issued and outstanding shares of our common stock to holders of record on October 23, 2023. Any determination to pay dividends in the future will be at the discretion of our board of directors. Accordingly, you may need to rely on sales of our common stock after price appreciation, which may never occur, as the only way to realize any future gains on your investment.

9

We are an “emerging growth company,” and we cannot be certain if the reduced reporting and disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging-growth company,” as defined in the JOBS Act, and we have elected to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, or Section 404, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. Pursuant to Section 107 of the Jumpstart Our Business Startups (“JOBS”) Act, as an emerging growth company, we have elected to use the extended transition period for complying with new or revised accounting standards until those standards would otherwise apply to private companies. As a result, our consolidated financial statements will not be comparable to the financial statements of issuers who are required to comply with the effective dates for new or revised accounting standards that are applicable to public companies, which may make our common stock less attractive to investors. In addition, if we cease to be an emerging growth company, we will no longer be able to use the extended transition period for complying with new or revised accounting standards.

We will remain an emerging-growth company until the earliest of: (1) the last day of the fiscal year following the fifth anniversary of our initial public offering; (2) the last day of the first fiscal year in which our annual gross revenue is $1.07 billion or more; (3) the date on which we have, during the previous rolling three-year period, issued more than $1 billion in non-convertible debt securities; and (4) the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates.

We cannot predict if investors will find our common stock less attractive as a result of choosing to rely on these exemptions. For example, if we do not adopt a new or revised accounting standard, our future results of operations will not be as comparable to the results of operations of certain other companies in our industry that adopted such standards. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock, and our stock price may be more volatile.

Anti-takeover provisions in our charter documents may discourage our acquisition by a third party, which could limit our stockholders’ opportunity to sell their shares, at a premium.

Our amended and restated certificate of incorporation includes provisions that could limit the ability of others to acquire control of our company. These provisions could have the effect of depriving our stockholders of an opportunity to sell their shares at a premium over prevailing market prices by discouraging third parties from seeking to obtain control in a tender offer or similar transaction. Among other things, the charter documents will provide:

| ● | certain amendments to our bylaws that will require the approval of two-thirds of the combined vote of our then-outstanding shares of our common stock; and | |

| ● | our board of directors has the authority, without further action by our stockholders, to issue preferred stock in one or more series and to fix their designations, powers, preferences, privileges, and relative participating, optional, or special rights, and the qualifications, limitations, or restrictions, including dividend rights, conversion rights, voting rights, terms. |

10

Our amended and restated certificate of incorporation designates the Court of Chancery of the State of Delaware and federal court within the State of Delaware as the exclusive forum for certain types of actions and proceedings that our stockholders may initiate, which could limit a stockholder’s ability to obtain a favorable judicial forum for disputes with us or our directors, officers or employees.

Our amended and restated certificate of incorporation provides that, subject to limited exceptions, the Court of Chancery of the State of Delaware will be exclusive forums for any:

| ● | derivative action or proceeding brought on our behalf; | |

| ● | action asserting a claim of breach of a fiduciary duty owed by any of our directors, officers or other employees to us or our stockholders; | |

| ● | action asserting a claim against us, our directors or officers or employees arising pursuant to any provision of the DGCL, our amended and restated certificate of incorporation or amended and restated bylaws; or | |

| ● | other action asserting a claim against us, our directors or officers or employees that is governed by the internal affairs doctrine. |

This choice of forum provision does not apply to actions brought to enforce a duty or liability created under the Exchange Act. Our amended and restated certificate of incorporation to be in effect after this offering also provides that the federal district courts of the United States are the exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act. We intend for this provision to apply to any complaints asserting a cause of action under the Securities Act despite the fact that Section 22 of the Securities Act creates concurrent jurisdiction for the federal and state courts over all actions brought to enforce any duty or liability created by the Securities Act or the rules and regulations promulgated thereunder. There is uncertainty as to whether a court would enforce such a provision with respect to claims under the Securities Act, and our stockholders will not be deemed to have waived our compliance with the federal securities laws and the rules and regulations thereunder. Any person or entity purchasing or otherwise acquiring any interest in shares of our capital stock shall be deemed to have notice of and to have consented to the provisions of our amended and restated certificate of incorporation described above.

These choice of forum provisions may limit a stockholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes with us or our directors, officers, or other employees, which may discourage such lawsuits against us and our directors, officers and employees. Alternatively, if a court were to find these provisions of our amended and restated certificate of incorporation inapplicable to, or unenforceable in respect of, one or more of the specified types of actions or proceedings, we may incur additional costs associated with resolving such matters in other jurisdictions, which could adversely affect our business and financial condition.

Risks Related to Pre-Funded Warrants

There is no public market for the Pre-Funded Warrants.

The Pre-Funded Warrants offered pursuant to this Offering Circular are not and will not be listed on any securities exchange. Also, we do not intend to apply to have the Pre-Funded Warrants listed on any securities exchange. Consequently, there is no public trading market for the Pre-Funded Warrants, and we do not expect a market to develop. Accordingly, investors may find it difficult to dispose of, or to obtain accurate quotations as to the market value of, the Pre-Funded Warrants. This lack of a trading market could result in investors being unable to liquidate their investment in the Pre-Funded Warrants or to sell them at a price that reflects their value. The absence of a public market for these securities could also reduce the liquidity and market price of our common stock to which these warrants are exercisable. Investors should be prepared to bear the risk of investment in the Pre-Funded Warrants indefinitely.

11

Lack of Voting Rights.

Holders of Pre-Funded Warrants will not have the same voting rights as those associated with our common stock and may have no voting rights with respect to the shares underlying the Pre-Funded Warrants until such shares are acquired upon exercise of the Pre-Funded Warrants. As a result, if such holders do not exercise their Pre-Funded Warrants, they will not have any influence over matters requiring stockholder approval during the period they hold the Pre-Funded Warrants.

Exercise and Conversion Dilution.

The exercise of Pre-Funded Warrants will increase the number of shares of common stock issued and outstanding, which will dilute the ownership interests of existing stockholders. The amount of dilution, or the reduction in value to existing shares of common stock, is determined by the amount of shares ultimately obtained upon the exercise of the Pre-Funded Warrants relative to the number of shares of common stock outstanding at the time of exercise.

Adjustments to Terms of Pre-Funded Warrants.

The terms of the Pre-Funded Warrants, including the exercise price and the number of shares of common stock issuable upon exercise, may be adjusted in certain circumstances, including in the event of stock dividends, stock splits, and similar transactions. While adjustments are generally intended to prevent dilution for holders of Pre-Funded Warrants, there is no assurance that such adjustments will fully protect the value of the Pre-Funded Warrants.

Pre-Funded Warrants have beneficial ownership limitations.

An investment in our Pre-Funded Warrants involves a significant risk due to the 4.99% (or 9.99%) beneficial ownership limitation. The terms of the Pre-Funded Warrants prohibit any single holder from exercising the warrants if such exercise would result in the holder beneficially owning more than 4.99% (or 9.99%) of our outstanding common stock immediately after the exercise, as elected by the holder at the time of issuance of the Pre-Funded Warrants. This limitation may also hinder the holder’s ability to sell or exercise the Pre-Funded Warrants when it may be most advantageous to do so, which could affect the value of their investment.

12

The table below sets forth the estimated proceeds we would derive from this offering, assuming the sale of 25%, 50%, 75% and 100% of the Shares at a public offering price of $3.50 and the Pre-Funded Warrants at a public offering price of $3.49 and exercise of the Pre-Funded Warrants in full. There is, of course, no guaranty that we will be successful in selling any of the Shares and Pre-Funded Warrants in this offering.

| Assumed Percentage of the Securities Sold in This Offering | ||||||||||||||||

| 25% | 50% | 75% | 100% | |||||||||||||

| Securities sold | 3,571,429 | 7,142,857 | 10,714,286 | 14,285,714 | ||||||||||||

| Gross proceeds | $ | 12,500,000 | $ | 25,000,000 | $ | 37,500,000 | $ | 50,000,000 | ||||||||

| Offering expenses (1) | 855,000 | 1,480,000 | 2,105,000 | 2,730,000 | ||||||||||||

| Net proceeds | $ | 11,645,000 | $ | 23,520,000 | $ | 35,395,000 | $ | 47,270,000 | ||||||||

| (1) | Represents placement agent fees, legal and accounting fees and expenses (See “Plan of Distribution”). |

The table below sets forth the manner in which we intend to apply the net proceeds derived by us in this offering, assuming the sale of 25%, 50%, 75% and 100% of the Securities at a public offering price of $3.50 per Share and $3.49 per Pre-Funded Warrants and exercise of the Pre-Funded Warrants in full. All amounts set forth below are estimates.

Use

of Proceeds for Assumed Percentage | ||||||||||||||||

| 25% | 50% | 75% | 100% | |||||||||||||

| General Corporate Expenses, including Working Capital | $ | 11,645,000 | $ | 23,520,000 | $ | 35,395,000 | $ | 47,270,000 | ||||||||

We reserve the right to change the foregoing use of proceeds, should our management believe it to be in the best interest of our company. The allocations of the proceeds of this offering presented above constitute the current estimates of our management and are based on our current plans, assumptions made with respect to the industry in which we currently or, in the future, expect to operate, general economic conditions and our future revenue and expenditure estimates.

Investors are cautioned that expenditures may vary substantially from the estimates presented above. Investors must rely on the judgment of our management, who will have broad discretion regarding the application of the proceeds of this offering. The amounts and timing of our actual expenditures will depend upon numerous factors, including market conditions, cash generated by our operations (if any), business developments and the rate of our growth. We may find it necessary or advisable to use portions of the proceeds of this offering for other purposes.

In the event we do not obtain the entire offering amount hereunder, we may attempt to obtain additional funds through private offerings of our securities or by borrowing funds. Currently, we do not have any committed sources of financing.

13

In General

Our company is offering a maximum of up to 7,142,857 Shares on a “best-efforts” basis, at a fixed price of $3.50 per Share. The Company is also offering up to 7,142,857 Pre-Funded Warrants on a on a “best-efforts” basis, at a fixed price of $3.49 per Pre-Funded Warrant.

This offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering being qualified by the SEC or (c) the date on which this offering is earlier terminated by us, in our sole discretion.

There is no minimum number of Securities that we are required to sell in this offering and no minimum purchase requirement for investors in this offering. All funds derived by us from this offering will be immediately available for use by us, in accordance with the uses set forth in the section entitled “Use of Proceeds” of this Offering Circular. No funds will be placed in an escrow account during the offering period and no funds will be returned once an investor’s subscription agreement has been accepted by us.

The Securities will be offered by Maxim Group LLC, a broker-dealer registered with the SEC and a member of FINRA (“Maxim,” or the “Placement Agent”), on a “best efforts” basis pursuant to the placement agency agreement to be entered into between us and Maxim, which we refer to as the “Placement Agent Agreement”. Pursuant to the Placement Agent Agreement, we will pay the Placement Agent, concurrently with each closing of this offering, a cash placement fee equal to 5.0% of the gross proceeds of such closing. In addition, we will also pay the Placement Agent up to $50,000 for fees and expenses of legal counsel and other out-of-pocket expenses out of the proceeds of the initial closing and up to $10,000 for fees and expenses of legal counsel and other out-of-pocket expenses out of each subsequent closing.

We or the Placement Agent may also ask other FINRA member broker-dealers that are registered with the SEC to participate as soliciting dealers for this offering.

We may also sell the Securities in this offering through the efforts of our management. Our management will not receive any compensation for offering or selling the Securities. We believe that Mr. Tal is exempt from registration as a broker-dealer under the provisions of Rule 3a4-1 promulgated under the Exchange Act. In particular, none of our management:

| ● | is not subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Securities Act; and | |

| ● | is not to be compensated in connection with his participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and | |

| ● | is not an associated person of a broker or dealer; and | |

| ● | meets the conditions of the following: |

| ● | primarily performs, and will perform at the end of this offering, substantial duties for us or on our behalf otherwise than in connection with transactions in securities; and | |

| ● | was not a broker or dealer, or an associated person of a broker or dealer, within the preceding 12 months; and | |

| ● | did not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on paragraphs (a)(4)(i) or (iii) of Rule 3a4-1 under the Exchange Act. |

At each Closing, the Company and Maxim may mutually agree upon a standstill on the Company from making subsequent equity sales, subject to certain customary carve-outs.

14

Procedures for Subscribing

If you are interested in subscribing for Securities in this offering, please submit a request for information by e-mail to Syndicate Department at Maxim Group LLC at: syndicate@maximgrp.com; all relevant information will be delivered to you by return e-mail. Thereafter, should you decide to subscribe for Securities, you are required to follow the procedures described in the subscription agreement included in the delivered information, which are:

| ● | Electronically execute and deliver to us a subscription agreement; and | |

| ● | Deliver funds directly by check or by wire or electronic funds transfer via ACH to our specified bank account. |

Right to Reject Subscriptions

After we receive your complete, executed subscription agreement and the funds required under the subscription agreement have been transferred to us, we have the right to review and accept or reject your subscription in whole or in part, for any reason or for no reason. We will return all monies from rejected subscriptions immediately to you, without interest or deduction.

Acceptance of Subscriptions

Conditioned upon our acceptance of a subscription agreement, we will countersign the subscription agreement and issue the Securities subscribed. Once you submit the subscription agreement and it is accepted, you may not revoke or change your subscription or request your subscription funds. All accepted subscription agreements are irrevocable.

This Offering Circular will be furnished to prospective investors upon their request via electronic PDF format and will be available for viewing and download 24 hours per day, 7 days per week on our company’s page on the SEC’s website: www.sec.gov.

An investor will become a shareholder of the Company and the Shares will be issued, as of the date of settlement. Settlement will not occur until an investor’s funds have cleared and we accept the investor as a shareholder.

By executing the subscription agreement and paying the total purchase price for the Securities subscribed, each investor agrees to accept the terms of the subscription agreement and attests that the investor meets certain minimum financial standards.

An approved trustee must process and forward to us subscriptions made through IRAs, Keogh plans and 401(k) plans. In the case of investments through IRAs, Keogh plans and 401(k) plans, we will send the confirmation and notice of our acceptance to the trustee.

State Law Exemption and Offerings to “Qualified Purchasers”

The Securities are being offered and sold to “qualified purchasers” (as defined in Regulation A under the Securities Act). As a Tier 2 offering pursuant to Regulation A under the Securities Act, this offering will be exempt from state “Blue Sky” law review, subject to certain state filing requirements and anti-fraud provisions, to the extent that the Securities offered hereby are offered and sold only to “qualified purchasers”.

“Qualified purchasers” include any person to whom securities are offered or sold in a Tier 2 offering pursuant to Regulation A under the Securities Act. We reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine, in our sole and absolute discretion, that such investor is not a “qualified purchaser” for purposes of Regulation A. We intend to offer and sell the Securities to qualified purchasers in every state of the United States.

15

Issuance of Securities

Upon settlement, that is, at such time as an investor’s funds have cleared and we have accepted an investor’s subscription agreement, we will either issue such investor’s purchased Shares in book-entry form or issue a certificate or certificates representing such investor’s purchased Shares.

The Pre-Funded Warrants will be issued in book-entry form. Upon the Holder’s decision to exercise the Pre-Funded Warrants, the Holder shall execute the Exercise Notice form attached to the Pre-Funded Warrant, completing all required fields in accordance with the instructions provided therein. The completed Exercise Notice must be delivered to the Company as specified in the Pre-Funded Warrant to effectively initiate the exercise process.

Transferability of the Shares and Shares of Common Stock underlying the Pre-Funded Warrants

The Shares will be generally freely transferable, subject to any restrictions imposed by applicable securities laws or regulations. The shares of Common Stock issuable upon the exercise of the Pre-Funded Warrants, when issued pursuant to the terms of the Pre-Funded Warrants, will generally also be freely transferable, subject to any restrictions imposed by applicable securities laws or regulations. Subject to applicable laws, a Pre-Funded Warrant may be transferred at the option of the holder upon surrender of the Pre-Funded Warrant to us together with the appropriate instruments of transfer and exercise price.

Listing of the Securities

The Shares will be listed on The Nasdaq Capital Market under the symbol “CYN.” There is no public market for the Pre-Funded Warrants and none is expected to develop. We do not intend to apply for the listing of the Pre-Funded Warrants offered in this offering on any stock exchange. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited.

16

General

Our authorized capital stock consists of 200,000,000 shares of common stock, $.00001 par value per share, and 10,000,000 shares of preferred stock, $.00001 par value per share.

As of the date of this Offering Circular, there were 2,026,617 shares of our common stock issued and outstanding held by approximately 55 holders of record, and no shares of our preferred stock issued and outstanding.

Common Stock

Our certificate of incorporation, as amended and restated (“Certificate of Incorporation”) authorize us to issue up to 200,000,000 shares of common stock, $0.00001 par value. Each holder of our common stock is entitled to one (1) vote for each share held of record on all voting matters we present for a vote of stockholders, including the election of directors. Holders of common stock have no cumulative voting rights or preemptive rights to purchase or subscribe for any stock or other securities, and there are no conversion rights or redemption or sinking fund provisions with respect to our common stock. All shares of our common stock are entitled to share equally in dividends from sources legally available when, and if, declared by our Board of Directors.

Our Board of Directors is authorized to issue additional shares of common stock not to exceed the amount authorized by the Certificate of Incorporation, on such terms and conditions and for such consideration as the Board may deem appropriate without further stockholder action.

In the event of our liquidation or dissolution, all shares of our common stock are entitled to share equally in our assets available for distribution to stockholders. However, the rights, preferences and privileges of the holders of our common stock are subject to, and may be adversely affected by, the rights of the holders of shares of preferred stock that have been issued or shares of preferred stock that our Board of Directors may decide to issue in the future.

Preferred Stock

Our Certificate of Incorporation authorize us to issue up to 10,000,000 shares of preferred stock, $0.00001 par value. Our Board of Directors is authorized, without further action by the stockholders, to issue shares of preferred stock and to fix the designations, number, rights, preferences, privileges, and restrictions thereof, including dividend rights, conversion rights, voting rights, terms of redemption, liquidation preferences and sinking fund terms. We believe that the Board of Directors’ power to set the terms of, and our ability to issue preferred stock, will provide flexibility in connection with possible financing or acquisition transactions in the future. The issuance of preferred stock, however, could adversely affect the voting power of holders of common stock and decrease the amount of any liquidation distribution to such holders. The presence of outstanding preferred stock could also have the effect of delaying, deterring, or preventing a change in control of our Company.

Outstanding Warrants

As of October 15, 2024, we had 72,369 outstanding warrants with a weighted average exercise price of $283.80 per share, with a weighted average remaining life of 5 years.

17

Outstanding Options

As of October 15, 2024, we have 167,589 outstanding options with a weighted average exercise price of $96.85 per share, with a weighted average remaining contractual life of 6.57 years.

Restricted Stock Units (RSU)

As of October 15, 2024, we have 2,442 outstanding RSUs.

Anti-Takeover Provisions

Certificate of Incorporation and Bylaw Provisions

Our amended and restated certificate of incorporation and our amended and restated bylaws will include a number of provisions that may have the effect of deterring hostile takeovers or delaying or preventing changes in control of our management team, including the following:

Classified Board. Our fifth amended and restated certificate of incorporation and amended and restated bylaws provide that our board of directors will be classified into three classes of directors, each of which will hold office for a three-year term. In addition, directors may only be removed from the board of directors for cause and only by the approval of two-thirds of the combined vote of our then outstanding shares of common stock. A third party may be discouraged from making a tender offer or otherwise attempting to obtain control of us as it is more difficult and time consuming for stockholders to replace a majority of the directors on a classified board of directors.

Supermajority Approvals. Our amended and restated bylaws require the approval of two-thirds of the combined vote of our then-outstanding shares of our common stock to amend our bylaws. This will have the effect of making it more difficult to amend our amended and restated bylaws to remove or modify certain provisions.

Advance Notice Requirements for Stockholder Proposals and Director Nominations. Our amended and restated bylaws provide advance notice procedures for stockholders seeking to bring business before our annual meeting of stockholders, or to nominate candidates for election as directors at any meeting of stockholders. Our amended and restated bylaws will also specify certain requirements regarding the form and content of a stockholder’s notice. These provisions may preclude our stockholders from bringing matters before our annual meeting of stockholders or from making nominations for directors at our meetings of stockholders.

Issuance of Undesignated Preferred Stock. Our board of directors has the authority, without further action by the holders of our common stock, to issue up to 10,000,000 shares of undesignated preferred stock with rights and preferences, including voting rights, designated from time to time by the board of directors. The existence of authorized but unissued shares of preferred stock will enable our board of directors to render more difficult or discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest, or otherwise.

Issuance of Unissued Stock. Our shares of unissued common stock are available for future issuance without stockholder approval, subject to certain protections afforded to our preferred stock pursuant to our certificate of incorporation, as amended and restated. We may utilize these additional shares for a variety of corporate purposes, including future public offerings to raise additional capital, to facilitate corporate acquisitions, payment as a dividend on the capital stock or as equity compensation to our service providers under our equity compensation plans. The existence of unissued and unreserved common stock may enable our board of directors to issue shares to persons friendly to current management thereby protecting the continuity of our management. Also, if we issue additional shares of our authorized, but unissued, common stock, these issuances will dilute the voting power and distribution rights of our existing common stockholders.

18

Delaware Law

We are governed by the provisions of Section 203 of the DGCL. In general, Section 203 prohibits a public Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period of three years after the date of the transaction in which the person became an interested stockholder, unless:

| ● | the business combination or transaction which resulted in the stockholder becoming an interested stockholder was approved by the board of directors prior to the time that the stockholder became an interested stockholder; |

| ● | upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding shares owned by directors who are also officers of the corporation and shares owned by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

| ● | at or subsequent to the time the stockholder became an interested stockholder, the business combination was approved by the board of directors and authorized at an annual or special meeting of the stockholders, and not by written consent, by the affirmative vote of at least two-thirds of the outstanding voting stock which is not owned by the interested stockholder. |

In general, Section 203 defines a “business combination” to include mergers, asset sales and other transactions resulting in financial benefit to a stockholder and an “interested stockholder” as a person who, together with affiliates and associates, owns, or within three years did own, 15% or more of the corporation’s outstanding voting stock. These provisions may have the effect of delaying, deferring or preventing changes in control of our company.

Choice of Forum

Our amended and restated certificate of incorporation provide that unless the Company consents in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware will be the exclusive forum for any derivative action or proceeding brought on our behalf; any action asserting a breach of fiduciary duty by any of our directors, officers or other employees to us or our stockholders; any action asserting a claim against the Company, our directors or officer or employees directors arising pursuant to any provision of the DGCL, our amended and restated certificate of incorporation or amended and restated bylaws or any other action asserting a claim against us our directors or officers or employees that is governed by the internal affairs doctrine. This choice of forum provision does not apply to actions brought to enforce a duty or liability created by the Exchange Act or any other claim for which federal courts have exclusive jurisdiction.

Furthermore, unless we consent in writing to the selection of an alternative forum, the federal district courts of the United States shall be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act. We intend for this provision to apply to any complaints asserting a cause of action under the Securities Act despite the fact that Section 22 of the Securities Act creates concurrent jurisdiction for the federal and state courts over all actions brought to enforce any duty or liability created by the Securities Act or the rules and regulations promulgated thereunder. The enforceability of similar choice of forum provisions in other companies’ certificates of incorporation has been challenged in legal proceedings, and it is possible that a court could find these types of provisions in our certificate of incorporation to be inapplicable or unenforceable.

19

Limitations of Liability and Indemnification

Our Certificate of Incorporation limits the liability of directors to the maximum extent permitted by the DGCL. The DGCL provides that directors of a corporation will not be personally liable for monetary damages for breach of their fiduciary duties as directors.

Our bylaws, as amended, provide that we will indemnify our directors and officers to the fullest extent permitted by law, and may indemnify employees and other agents. Our bylaws also provide that we are obligated to advance expenses incurred by a director or officer in advance of the final disposition of any action or proceeding.

Our bylaws, as amended, subject to the provisions of the DGCL, contain provisions which allow the corporation to indemnify any person against liabilities and other expenses incurred as the result of defending or administering any pending or anticipated legal issue in connection with service to us if it is determined that person acted in good faith and in a manner which he or she reasonably believed was in the best interest of the corporation. Insofar as indemnification for liabilities arising under the Securities Act of 1933 as amended, or the Securities Act, may be permitted to our directors, officers and controlling persons, we have been advised that in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

The limitation of liability and indemnification provisions in our bylaws may discourage stockholders from bringing a lawsuit against directors for breach of their fiduciary duties. They may also reduce the likelihood of derivative litigation against directors and officers, even though an action, if successful, might provide a benefit to us and our stockholders. Our results of operations and financial condition may be harmed to the extent we pay the costs of settlement and damage awards against directors and officers pursuant to these indemnification provisions.

At present, there is no pending litigation or proceeding involving any of our directors or officers as to which indemnification is required or permitted, and we are not aware of any threatened litigation or proceeding that may result in a claim for indemnification.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Continental Stock Transfer & Trust Company. Its fax number is (801) 274-1099. Investors may reach our transfer agent at info@actionstocktransfer.com.

20

DESCRIPTION OF THE SECURITIES OFFERED IN THIS OFFERING

Common Stock

See “Common Stock” in “Description of Capital Stock.”

Pre-Funded Warrants

The following summary of certain terms and provisions of the Pre-Funded Warrants that are being offered hereby is not complete and is subject to, and qualified in its entirety by, the provisions of the Pre-Funded Warrant, the form of which is filed as an exhibit to the offering statement of which this Offering Circular forms a part. Prospective investors should carefully review the terms and provisions of the form of Pre-Funded Warrant for a complete description of the terms and conditions of the Pre-Funded Warrants.

Duration, Exercise Price and Form

Each Pre-Funded Warrant will be sold in this offering at a purchase price equal to $3.49 (equal to the purchase price per Share, minus $0.01). Each Pre-Funded Warrant will have an initial exercise price per share equal to $0.01. The Pre-Funded Warrants will be immediately exercisable and will not expire prior to exercise. The exercise price and number of shares of common stock issuable upon exercise are subject to appropriate adjustment in the event of stock dividends, stock splits, reorganizations or similar events affecting our common stock. The Pre-Funded Warrants will be issued in electronic form.

Exercisability

The Pre-Funded Warrants will be exercisable, at the option of each holder, in whole or in part by delivering to us a duly executed exercise notice and, at any time a registration statement registering the issuance of the shares of common stock underlying the Pre-Funded Warrants under the Securities Act, is effective and available for the issuance of such shares, or an exemption from registration under the Securities Act is available for the issuance of such shares, by payment in full in immediately available funds for the number of shares of common stock purchased upon such exercise. A holder (together with its affiliates) may not exercise any portion of the Pre-Funded Warrant to the extent that the holder would own more than 4.99% (or, at the election of the holder, 9.99%) of the outstanding common stock immediately after exercise, except that upon notice from the holder to us, the holder may increase or decrease the beneficial ownership limitation in the holder’s Pre-Funded Warrants up to 9.99% of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Pre-Funded Warrants provided that any increase in the beneficial ownership limitation shall not be effective until 61 days following notice to us. If, at the time of exercise there is no effective registration statement registering, or the prospectus contained therein is not available for the issuance of, the shares of common stock underlying the Pre-Funded Warrants, then the Pre-Funded Warrants may also be exercised, in whole or in part, at such time by means of a cashless exercise, in which case the holder would receive upon such exercise the net number of shares of common stock determined according to the formula set forth in the Pre-Funded Warrant.

The Pre-Funded Warrants will be issued in book-entry form. Upon the Holder’s decision to exercise the Pre-Funded Warrants, the Holder shall execute the Exercise Notice form attached to the Pre-Funded Warrant, completing all required fields in accordance with the instructions provided therein. The completed Exercise Notice must be delivered to the Company as specified in the Pre-Funded Warrant to effectively initiate the exercise process.

Transferability

Subject to applicable laws, a Pre-Funded Warrant may be transferred at the option of the holder upon surrender of the Pre-Funded Warrant to us together with the appropriate instruments of transfer.

Fractional Shares

No fractional shares of common stock will be issued upon the exercise of the Pre-Funded Warrants. Rather, the number of shares of common stock to be issued will be rounded up to the nearest whole number.

21

Trading Market

There is no established public trading market for the Pre-Funded Warrants, and we do not expect a market to develop. In addition, we do not intend to apply to list the Pre-Funded Warrants on any national securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited.

Right as a Stockholder

Except as otherwise provided in the Pre-Funded Warrants or by virtue of such holder’s ownership of shares of our common stock, the holders of the Pre-Funded Warrants do not have the rights or privileges of holders of our common stock with respect to the shares of common stock underlying the Pre-Funded Warrants, including any voting rights, until they exercise their Pre-Funded Warrants. The Pre-Funded Warrants will provide that holders have the right to participate in distributions or dividends paid on our common stock.

Fundamental Transaction

In the event of a fundamental transaction, as described in the Pre-Funded Warrants and generally including any reorganization, recapitalization or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding common stock, or any person or group becoming the beneficial owner of 50% of the voting power represented by our outstanding common stock, the holders of the Pre-Funded Warrants will be entitled to receive upon exercise of the Pre-Funded Warrants the kind and amount of securities, cash or other property that the holders would have received had they exercised the Pre-Funded Warrants immediately prior to such fundamental transaction, and the successor entity will succeed to, and be substituted for us, and may exercise every right and power that we may exercise and will assume all of our obligations under the Pre-Funded Warrants with the same effect as if such successor entity had been named in the Pre-Funded Warrant itself. If holders of our common stock are given a choice as to the securities, cash or property to be received in a fundamental transaction, then the holder shall be given the same choice as to the consideration it receives upon any exercise of the Pre-Funded Warrant following such fundamental transaction.

Amendment and Waiver

The Pre-Funded Warrants may be modified or amended or the provisions thereof waived with the written consent of our company and the respective holder.

Governing Law

The Pre-Funded Warrants are governed by Delaware law.

Transfer Agent

The transfer agent and registrar for our common stock is Continental Stock Transfer & Trust Company.

22

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION

FOR SECURITIES ACT LIABILITIES

Our Certificate of Incorporation and our Bylaws generally eliminates director and officer liability for any act or failure to act in his or her capacity as a director or officer. An indemnitee is entitled to advances, to the fullest extent permitted by applicable law, solely upon the execution and delivery to us of an undertaking providing that the indemnitee agrees to repay the advance to the extent it is ultimately determined that he or she was not entitled to be indemnified by us under the provisions of the Bylaws, the Certificate of Incorporation, or an agreement between us and the indemnitee. Additionally, we have entered into Indemnification Agreements with each of our directors and officers that largely mirror the indemnification rights provided for in our Bylaws.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the Company pursuant to the foregoing provisions, the Company has been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

The consolidated balance sheets of the Company as of December 31, 2023 and 2022, the related consolidated statements of operations, stockholders’ equity and cash flows for each of the two years in the period ended December 31, 2023 and the related notes, have been audited by Marcum LLP, the independent registered public accounting firm of the Company, as stated in their report, which includes an explanatory paragraph as to the Company’s ability to continue as a going concern, which is incorporated herein by reference. Such financial statements have been incorporated herein by reference in reliance on the report of such firm given upon their authority as experts in accounting and auditing.

Certain legal matters with respect to the Securities offered by this Offering Circular will be passed upon by Sichenzia Ross Ference Carmel LLP, New York, New York. Ellenoff Grossman & Schole LLP, New York, New York, is counsel to the placement agent in connection with this offering.

23

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” documents that we previously submitted or filed on Edgar. Incorporation by reference allows us to disclose important information to you by referring you to those other documents. In particular, the Company incorporates by reference the information contained in Items 1- 13 of its Form 10-K filed with the SEC on March 7, 2024, which can be accessed at https://investors.cyngn.com/sec-filings and on the SEC’s website at www.sec.gov. The Company’s financial statements incorporated herein are included in Item 8 of the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2023, and Item 1 of the Company’s quarterly report on Form 10-Q for the period ended June 30, 2024 filed with the SEC on August 8, 2024, which can be accessed at https://investors.cyngn.com/sec-filings or at www.sec.gov.

We filed an Offering Circular on Form 1-A under the Securities Act with the SEC with respect to the securities being offered pursuant to this Offering Circular. This Offering Circular omits certain information, as permitted by the SEC. You should refer to the offering Circular, including the exhibits and schedules attached to the Offering Circular and the information incorporated by reference, for further information about us and the securities being offered pursuant to this Offering Circular. Statements in this Offering Circular regarding the provisions of certain documents filed with, or incorporated by reference in, the Offering Circular are not necessarily complete, and each statement is qualified in all respects by that reference. Copies of all or any part of the Offering Circular, including the documents incorporated by reference or the exhibits, may be obtained as indicated below. The documents we are incorporating by reference into this Offering Circular are:

| ● | Our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 7, 2024. |

| ● | Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 9, 2024. |

| ● | Our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, filed with the SEC on August 8, 2024. |

| ● | Our Current Reports on Form 8-K filed on February 21, 2024, April 24, 2024, May 10, 2024, May 17, 2024, June 25, 2024 and July 9, 2024. |

| ● | The description of our common stock contained in our Registration Statement on Form 8-A, registering our common stock under Section 12(b) under the Exchange Act, filed with the SEC on October 19, 2021. |

You may request a copy of these filings, including the financial statements of the Company included in the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2023 and the Company’s quarterly report on Form 10-Q for the period ended June 30, 2024, at no cost, by writing or telephoning us at the following address: Cyngn Inc., Attention: Corporate Secretary, 1015 O’Brien Dr., Menlo Park, CA 94025, phone number (650) 924-5905.

WHERE YOU CAN FIND MORE INFORMATION

We have filed an offering statement on Form 1-A with the SEC under the Securities Act with respect to the common stock offered by this Offering Circular. This Offering Circular, which constitutes a part of the offering statement, does not contain all of the information set forth in the offering statement or the exhibits and schedules filed therewith. For further information with respect to us and our common stock, please see the offering statement and the exhibits and schedules filed with the offering statement. Statements contained in this Offering Circular regarding the contents of any contract or any other document that is filed as an exhibit to the offering statement are not necessarily complete, and each such statement is qualified in all respects by reference to the full text of such contract or other document filed as an exhibit to the offering statement. The offering statement, including its exhibits and schedules, may be accessed at the SEC’s website http://www.sec.gov. These filings will be available as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

We are subject to the reporting requirements of the Exchange Act, and file annual, quarterly and current reports, proxy statements and other information with the SEC. You can read our SEC filings, including the registration statement, over the Internet at the SEC’s website. We also maintain a website at http://www.cyngn.com, at which you may access these materials free of charge as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The information contained in, or that can be accessed through, our website is not part of this Offering Circular. You may also request a copy of these filings, at no cost, by writing or telephoning us at: 1015 O’Brien Dr., Menlo Park, CA 94025, phone number (650) 924-5905.

24

EXHIBITS

25

| * | Incorporated by reference, as indicated |

| ** | Previously filed |

| # | A contract, compensatory plan or arrangement to which a director or executive officer is a party or in which one or more directors or executive officers are eligible to participate. |

| + | Filed herewith |

26

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form 1-A and has duly caused this offering statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Menlo Park, State of California, on October 17, 2024.

| CYNGN INC. | ||

| By: | /s/ Lior Tal | |

| Lior Tal | ||

| Chief Executive Officer (Principal Executive Officer) | ||

This Offering Statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature | Title | Date | ||

| /s/ Lior Tal | Chairman of the Board, | October 17, 2024 | ||

| Lior Tal | Chief Executive Officer, Chairman and Director | |||

| (Principal Executive Officer) | ||||

| /s/ Donald Alvarez | Chief Financial Officer and Director | October 17, 2024 | ||