美国

证券交易委员会

华盛顿特区20549

表格

1934年法案

截至截止季度

或

1934年法案

过渡期从________到________

委员会档案编号

由景顺专业产品有限责任公司赞助

(依凭章程所载的完整登记名称)

|

|

(依据所在地或其他管辖区) 的注册地或组织地点) |

(国税局雇主身份识别号码) |

(总部办公地址) |

(邮政编码) |

( (注册人电话号码,包括区号) |

根据法案第12(b)条规定注册的证券:

每种类别的名称 |

交易标的(s) |

每个注册交易所的名称 |

请勾选以下选项以表示申报人(1)已提交证券交易法1934年第13条或15(d)条所要求提交的所有报告,且在过去12个月中(或申报人需要提交此类报告的较短期间)已提交;(2)已受到过去90天内此类提交要求的限制。

请打勾号表明注册人是否根据《S-t条例405条规定(本章节232.405号)的规定,在过去12个月内(或注册人需要提交此类文件的更短期限内),已提交每个交互数据文件。

请勾选该申报者是否为大型快速申报者、快速申报者、非快速申报者、小型报告公司或新兴成长公司。请参阅交易所法案第1202条中“大型快速申报者”、“快速申报者”、“小型报告公司”和“新兴成长公司”的定义。

大型加速归档人 |

☐ |

加速归档人 |

☐ |

|

|

|

|

|

☒ |

小型报告公司 |

|

|

|

|

|

|

|

新兴成长型企业 |

如属新兴成长型企业,请勾选表示公司未选择使用根据《交易所法》第13(a)条提供的任何新的或修订的财务会计标准进行遵从的延长过渡期。 ☐

请勾选是否属于外壳公司(根据交易所法案第120亿2条的定义)。是 ☐ 否

请指示2024年9月30日所持有的可赎回资本股份数量。:

景顺货币股票® 欧元指数 trust

至2024年9月30日结束的季度

目录

|

|

|

|

|

|

页面 |

第一部分 |

|

|

1 |

|||

|

|

|

|

|

|

|

|

|

项目一。 |

|

|

1 |

|

|

|

|

|

|

6 |

|

|

|

第二项。 |

|

|

10 |

|

|

|

第三项 |

|

|

13 |

|

|

|

第四项 |

|

|

13 |

|

|

|

|

|

|

|

|

第二部分 |

|

|

15 |

|||

|

|

|

|

|

|

|

|

|

项目一。 |

|

|

15 |

|

|

|

项目 1A。 |

|

|

15 |

|

|

|

项目二。 |

|

|

15 |

|

|

|

第三项目。 |

|

|

15 |

|

|

|

第四项。 |

|

|

15 |

|

|

|

第五项。 |

|

|

15 |

|

|

|

第六项 |

|

|

15 |

|

|

|

|

|

|

|

|

|

17 |

|||||

第一部分 - 财务北卡罗来纳州财务资讯

项目一。网路不社会 声明。

景顺CurrencyShares® 欧元指数

财务控制项声明财务状况

2024年9月30日和2023年12月31日

(未经查核)

|

|

2024年9月30日 |

|

|

2023年12月31日 |

|

||

资产 |

|

|

|

|

|

|

||

欧元存款,带息 |

|

$ |

|

|

$ |

|

||

欧元存款,无息 |

|

|

|

|

|

— |

|

|

待收订阅费 |

|

|

|

|

|

|

||

存款机构应付现金 |

|

|

|

|

|

|

||

应收帐款来自应计利息 |

|

|

|

|

|

|

||

总资产 |

|

$ |

|

|

$ |

|

||

负债 |

|

|

|

|

|

|

||

欧元指数存款,无息负债 |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|||

总负债 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

可赎回普通股和股东权益 |

|

|

|

|

|

|

||

可赎回普通股,按赎回价值, , |

|

|

|

|

|

|

||

股东权益: |

|

|

|

|

|

|

||

保留收益 |

|

|

|

|

|

|

||

总负债、可赎回的资本股份和股东权益 |

|

$ |

|

|

$ |

|

||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

1

Invesco CurrencyShares® Euro Trust

Statements of Comprehensive Income

For the Three and Nine Months Ended September 30, 2024 and 2023

(Unaudited)

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

||||||||||

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Income |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Interest Income |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Total Income |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Sponsor's fee |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Total Expenses |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Net Comprehensive Income (Loss) |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Basic and Diluted Earnings (Loss) per Share |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Weighted-average Shares Outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

||||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

2

Invesco CurrencyShares® Euro Trust

Statements of Changes in Shareholders’ Equity and Redeemable Capital Shares

For the Three Months Ended September 30, 2024 and 2023

(Unaudited)

|

|

Retained Earnings |

|

|

Total Shareholders' Equity |

|

|

Shares |

|

|

Redeemable Capital Shares |

|

||||

Balance at June 30, 2024 |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

$ |

|

||

Purchases of Shares |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

||

Redemption of Shares |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Net Increase (Decrease) due to Share Transactions |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

||

Distributions |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

— |

|

|

Net Comprehensive Income (Loss) |

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

||

Adjustment of Redeemable Capital Shares to |

|

|

|

|

|

|

|

|

— |

|

|

|

( |

) |

||

Adjustment of Redeemable Capital Shares to |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

Balance at September 30, 2024 |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

$ |

|

||

|

|

Retained Earnings |

|

|

Total Shareholders' Equity |

|

|

Shares |

|

|

Redeemable Capital Shares |

|

||||

Balance at June 30, 2023 |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

$ |

|

||

Purchases of Shares |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

||

Redemption of Shares |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Net Increase (Decrease) due to Share Transactions |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Distributions |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

— |

|

|

Net Comprehensive Income (Loss) |

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

||

Adjustment of Redeemable Capital Shares to |

|

|

( |

) |

|

|

( |

) |

|

|

— |

|

|

|

|

|

Adjustment of Redeemable Capital Shares to |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Balance at September 30, 2023 |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

$ |

|

||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

3

Invesco CurrencyShares® Euro Trust

Statements of Changes in Shareholders’ Equity and Redeemable Capital Shares

For the Nine Months Ended September 30, 2024 and 2023

(Unaudited)

|

|

Retained Earnings |

|

|

Total Shareholders' Equity |

|

|

Shares |

|

|

Redeemable Capital Shares |

|

||||

Balance at December 31, 2023 |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

$ |

|

||

Purchases of Shares |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

||

Redemption of Shares |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Net Increase (Decrease) due to Share Transactions |

|

$ |

— |

|

|

$ |

— |

|

|

|

( |

) |

|

$ |

( |

) |

Distributions |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

— |

|

|

Net Comprehensive Income (Loss) |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|||

Adjustment of Redeemable Capital Shares to |

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|||

Adjustment of Redeemable Capital Shares to |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

||

Balance at September 30, 2024 |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

$ |

|

||

.

|

|

Retained Earnings |

|

|

Total Shareholders' Equity |

|

|

Shares |

|

|

Redeemable Capital Shares |

|

||||

Balance at December 31, 2022 |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

$ |

|

||

Purchases of Shares |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

||

Redemption of Shares |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Net Increase (Decrease) due to Share Transactions |

|

$ |

— |

|

|

$ |

— |

|

|

|

( |

) |

|

$ |

( |

) |

Distributions |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

— |

|

|

Net Comprehensive Income (Loss) |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|||

Adjustment of Redeemable Capital Shares to |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

||

Adjustment of Redeemable Capital Shares to |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

( |

) |

|

Balance at September 30, 2023 |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

$ |

|

||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

4

Invesco CurrencyShares® Euro Trust

Statements of Cash Flows

For the Nine Months Ended September 30, 2024 and 2023

(Unaudited)

|

|

Nine Months Ended September 30, |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Cash flows from operating activities |

|

|

|

|

|

|

||

Net Comprehensive Income (Loss) |

|

$ |

|

|

$ |

|

||

Adjustments to reconcile net comprehensive income |

|

|

|

|

|

|

||

Change in operating assets and liabilities: |

|

|

|

|

|

|

||

Receivable from accrued interest |

|

|

|

|

|

( |

) |

|

Accrued Sponsor's fee |

|

|

( |

) |

|

|

( |

) |

Cash due from Depository |

|

|

|

|

|

|

||

Net cash provided by (used in) operating activities |

|

|

|

|

|

|

||

Cash flows from financing activities |

|

|

|

|

|

|

||

Distributions paid to shareholders |

|

|

( |

) |

|

|

( |

) |

Proceeds from purchases of redeemable capital Shares |

|

|

|

|

|

|

||

Redemptions of redeemable capital Shares |

|

|

( |

) |

|

|

( |

) |

Increase (decrease) in payable for Euro deposits overdrawn |

|

|

( |

) |

|

|

|

|

Net cash provided by (used in) financing activities |

|

|

( |

) |

|

|

( |

) |

Effect of exchange rate on cash |

|

|

|

|

|

( |

) |

|

Net change in cash |

|

|

( |

) |

|

|

( |

) |

Cash at beginning of period |

|

|

|

|

|

|

||

Cash at end of period |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

Supplemental disclosure of cash flow information |

|

|

|

|

|

|

||

Cash paid for interest |

|

$ |

|

|

$ |

|

||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

5

Invesco CurrencyShares® Euro Trust

Notes to Unaudited Financial Statements

September 30, 2024

Note 1 – Background

On September 28, 2017, Guggenheim Capital, LLC (“Guggenheim”) and Invesco Ltd. entered into a Transaction Agreement (the “Transaction Agreement”), pursuant to which Guggenheim agreed to transfer all of the membership interests of Guggenheim Specialized Products, LLC (the “Sponsor”) to Invesco Capital Management LLC (“Invesco Capital Management”).

The Transaction Agreement was consummated on April 6, 2018 (the “Closing”) and immediately following the Closing, Invesco Capital Management changed the name of the Sponsor to Invesco Specialized Products, LLC.

Note 2 – Organization

The Invesco CurrencyShares® Euro Trust (the “Trust”) was formed under the laws of the State of New York on

The investment objective of the Trust is for the Trust’s shares (the “Shares”) to reflect the price in U.S. Dollars (“USD”) of the euro plus accrued interest, if any, less the Trust’s expenses and liabilities. The Shares are intended to provide investors with a simple, cost-effective means of gaining investment benefits similar to those of holding euro. The Trust’s assets primarily consist of euro on demand deposit in

This Quarterly Report (the “Report”) covers the three and nine months ended September 30, 2024 and 2023. The accompanying unaudited financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions for Form 10-Q and the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”). In the opinion of management, all material adjustments, consisting only of normal recurring adjustments, considered necessary for a fair statement of the interim period financial statements have been made. Interim period results are not necessarily indicative of results for a full-year period. These financial statements and the notes thereto should be read in conjunction with the Trust’s financial statements included in its Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on February 23, 2024.

Note 3 – Summary of Significant Accounting Policies

The financial statements of the Trust have been prepared using U.S. GAAP.

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates by a significant amount. In addition, the Trust monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are issued.

For Net Asset Value (“NAV”) calculation purposes, euro deposits (cash) are translated at the Closing Spot Rate, which is the USD/euro exchange rate as determined and published by The WM Company at 4:00 PM (London time/London fixing) on each day that NYSE Arca, Inc. (“NYSE Arca”) is open for regular trading.

The Trust maintains its books and records in euro. For financial statement reporting purposes, the USD is the reporting currency. As a result, the financial records of the Trust are translated from euro to USD. The Closing Spot Rate on the last day of the period is used for translation in the statements of financial condition. The average Closing Spot Rate for the period is used for translation in the statements of comprehensive income and the statements of cash flows. The redeemable capital Shares are adjusted to redemption value and these adjustments are recorded against retained earnings.

6

Interest on the primary deposit account, if any, accrues daily as earned and is received or paid on a monthly basis. Any interest below zero for the period is reflected as interest expense on currency deposits. The Depository may change the rate at which interest accrues, including reducing the interest rate to zero or below zero, based upon changes in market conditions or based on the Depository’s liquidity needs.

To the extent that the interest earned by the Trust, if any, exceeds the sum of the Sponsor’s fee for the prior month plus other Trust expenses, if any, the Trust will distribute, as a dividend (herein referred to as dividends or distributions), the excess interest earned in euro effective on the first business day of the subsequent month. The Trustee (as defined below) will direct that the excess euro be converted into USD at the prevailing market rate and the Trustee will distribute the USD as promptly as practicable to Shareholders on a pro-rata basis (in accordance with the number of Shares that they own).

The table below shows distributions per Share and in total for the periods presented:

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

||||||||||

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Distributions per Share |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Distributions paid |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

An income distribution for the month ended September 30, 2024 was paid on

The Sponsor is responsible for all routine operational, administrative and other ordinary expenses of the Trust, including, but not limited to, the Trustee's monthly fee, NYSE Arca listing fees, SEC registration fees, typical maintenance and transaction fees of the Depository, printing and mailing costs, audit fees and expenses, up to $

In certain cases, the Trust will pay for some expenses in addition to the Sponsor’s fee. These exceptions include expenses not assumed by the Sponsor (i.e., expenses other than those identified in the preceding paragraph), expenses resulting from negative interest rates, taxes and governmental charges, expenses and costs of any extraordinary services performed by the Trustee or the Sponsor on behalf of the Trust or action taken by the Trustee or the Sponsor to protect the Trust or the interests of Shareholders, indemnification of the Sponsor under the Depositary Trust Agreement, audit fees and legal expenses in excess of $

The Trust is treated as a “grantor trust” for federal income tax purposes and, therefore,

Shareholders generally will be treated, for U.S. federal income tax purposes, as if they directly owned a pro-rata share of the assets held in the Trust. Shareholders also will be treated as if they directly received their respective pro-rata portion of the Trust’s income, if any, and as if they directly incurred their respective pro-rata portion of the Trust’s expenses. The acquisition of Shares by a U.S. Shareholder as part of a creation of a Basket will not be a taxable event to the Shareholder.

The Sponsor’s fee accrues daily and is payable monthly. For U.S. federal income tax purposes, an accrual-basis U.S. Shareholder generally will be required to take into account as an expense its allocable portion of the USD-equivalent of the amount of the Sponsor’s fee that is accrued on each day, with such USD-equivalent being determined by the currency exchange rate that is in effect on the respective day. To the extent that the currency exchange rate on the date of payment of the accrued amount of the Sponsor’s fee differs from the currency exchange rate in effect on the day of accrual, the U.S. Shareholder will recognize a currency gain or loss for U.S. federal income tax purposes.

The Trust does not expect to generate taxable income except for interest income (if any) and gain (if any) upon the sale of euro. A non-U.S. Shareholder generally will not be subject to U.S. federal income tax with respect to gain recognized upon the sale or other disposition of Shares, or upon the sale of euro by the Trust, unless: (1) the non-U.S. Shareholder is an individual and is present in the United States for

7

A non-U.S. Shareholder’s portion of any interest income earned by the Trust generally will not be subject to U.S. federal income tax unless the Shares owned by such non-U.S. Shareholder are effectively connected with the conduct by the non-U.S. Shareholder of a trade or business in the United States.

Note 4 – Euro Deposits

Euro principal deposits are held in a euro-denominated, interest-bearing demand account. The interest rate in effect as of September 30, 2024 was an annual nominal rate of

Net interest, if any, associated with creation and redemption activity is held in a euro-denominated non-interest-bearing account, and any balance is distributed in full as part of the monthly income distributions, if any.

Note 5 – Concentration Risk

All of the Trust’s assets are euro, which creates a concentration risk associated with fluctuations in the price of the euro. Accordingly, a decline in the euro to USD exchange rate will have an adverse effect on the value of the Shares. Factors that may have the effect of causing a decline in the price of the euro include national debt levels and trade deficits, domestic and foreign inflation rates, domestic and foreign interest rates, investment and trading activities of institutions and global or regional political, economic or financial events and situations. Substantial sales of euro by the official sector (central banks, other governmental agencies and related institutions that buy, sell and hold euro as part of their reserve assets) could adversely affect an investment in the Shares.

All of the Trust’s euro are held by the Depository. Accordingly, a risk associated with the concentration of the Trust’s assets in accounts held by a single financial institution exists and increases the potential for loss by the Trust and the Trust’s beneficiaries in the event that the Depository becomes insolvent.

Note 6 – Service Providers and Related Party Agreements

The Trustee

The Bank of New York Mellon (the “Trustee”), a banking corporation with trust powers organized under the laws of the State of New York, serves as the Trustee. The Trustee is responsible for the day-to-day administration of the Trust, including keeping the Trust’s operational records.

The Sponsor

The Sponsor of the Trust generally oversees the performance of the Trustee and the Trust’s principal service providers. The Sponsor is Invesco Specialized Products, LLC, a Delaware limited liability company and a related party of the Trust. The Trust pays the Sponsor a Sponsor’s fee, which accrues daily at an annual nominal rate of

Note 7 – Share Purchases and Redemptions

Shares are issued and redeemed continuously in Baskets in exchange for euro. Individual investors cannot purchase or redeem Shares in direct transactions with the Trust. Only Authorized Participants (as defined below) may place orders to create and redeem Baskets. An Authorized Participant is a Depository Trust Company (“DTC”) participant that is a registered broker-dealer or other institution eligible to settle securities transactions through the book-entry facilities of the DTC and which has entered into a contractual arrangement with the Trust and the Sponsor governing, among other matters, the creation and redemption process. Authorized Participants may redeem their Shares at any time in Baskets.

Due to expected continuing creations and redemptions of Baskets and the

8

The Trustee calculates the Trust’s NAV each business day. To calculate the NAV, the Trustee subtracts the Sponsor’s accrued fee through the previous day from the euro held by the Trust (including all unpaid interest, if any, accrued through the preceding day) and calculates the value of the euro in USD based upon the Closing Spot Rate. If, on a particular evaluation day, the Closing Spot Rate has not been determined and announced by 6:00 PM (London time), then the most recent Closing Spot Rate will be used to determine the NAV of the Trust unless the Trustee, in consultation with the Sponsor, determines that such price is inappropriate to use as the basis for the valuation. If the Trustee and the Sponsor determine that the most recent Closing Spot Rate is not an appropriate basis for valuation of the Trust’s euro, they will determine an alternative basis for the valuation. The Trustee also determines the NAV per Share, which equals the NAV of the Trust, divided by the number of outstanding Shares. Shares deliverable under a purchase order are considered outstanding for purposes of determining NAV per Share; Shares deliverable under a redemption order are not considered outstanding for this purpose.

Note 8 – Commitments and Contingencies

The Trust’s organizational documents provide for the Trust to indemnify the Sponsor and any affiliate of the Sponsor that provides services to the Trust to the maximum extent permitted by applicable law, subject to certain exceptions for disqualifying conduct by the Sponsor or such an affiliate. The Trust's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Further, the Trust has not had prior claims or losses pursuant to these contracts. Accordingly, the Sponsor expects the risk of loss to be remote.

9

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Cautionary Statement Regarding Forward-Looking Information

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “outlook” and “estimate” and other similar words. Forward-looking statements are based upon our current expectations and beliefs concerning future developments and their potential effects on us. Such forward-looking statements are not guarantees of future performance. Various factors may cause our actual results to differ materially from those expressed in our forward-looking statements. These factors include fluctuations in the price of the euro, as the value of the Shares relates directly to the value of the euro held by the Trust and price fluctuations could materially adversely affect an investment in the Shares. Readers are urged to review the “Risk Factors” section contained in the Trust’s most recent annual report on Form 10-K for a description of other risks and uncertainties that may affect an investment in the Shares.

Neither Invesco Specialized Products, LLC (the “Sponsor”) nor any other person assumes responsibility for the accuracy or completeness of forward-looking statements contained in this report. The forward-looking statements are made as of the date of this report, and will not be revised or updated to reflect actual results or changes in the Sponsor’s expectations or predictions.

Overview/Introduction

The Invesco CurrencyShares® Euro Trust (the “Trust”) is a grantor trust that was formed on December 5, 2005. The Shares began trading on the New York Stock Exchange under the ticker symbol “FXE” on December 12, 2005. The primary listing of the Shares was transferred to NYSE Arca, Inc. (“NYSE Arca”) on October 30, 2007. The Trust issues shares (the “Shares”) in blocks of 50,000 (a “Basket”) in exchange for deposits of euro and distributes euro in connection with the redemption of Baskets.

The investment objective of the Trust is for the Shares to reflect the price in USD of euro plus accrued interest, if any, less the expenses of the Trust’s operations. The Shares are intended to offer investors an opportunity to participate in the market for the euro through an investment in securities. The Shares are intended to provide institutional and retail investors with a simple, cost-effective means of gaining investment benefits similar to those of holding the euro. The Shares are bought and sold on NYSE Arca like any other exchange-listed security. The Shares are backed by the assets of the Trust, which does not hold or use derivative products. The Trust is a passive investment vehicle and does not have any officers, directors or employees. The Trust does not engage in any activities designed to obtain profit from, or ameliorate losses caused by, changes in the price of the euro. Investing in the Shares does not insulate the investor from certain risks, including price volatility. The value of the holdings of the Trust is reported on the Trust’s website, www.invesco.com/etfs, each business day.

Definition of Net Asset Value

The Trustee calculates, and the Sponsor publishes, the Trust’s Net Asset Value (“NAV”) each business day. To calculate the NAV, the Trustee adds to the amount of euro in the Trust at the end of the preceding day accrued but unpaid interest, if any, euro receivable under pending purchase orders and the value of other Trust assets, and subtracts the accrued but unpaid Sponsor’s fee, euro payable under pending redemption orders and other Trust expenses and liabilities, if any. The NAV is expressed in USD based on the euro/USD exchange rate as determined by The WM Company at 4:00 PM (London time / London fixing) (the “Closing Spot Rate”) on each day that NYSE Arca is open for regular trading. If, on a particular evaluation day, the Closing Spot Rate has not been determined and announced by 6:00 PM (London time), then the most recent Closing Spot Rate is used to determine the NAV of the Trust unless the Trustee, in consultation with the Sponsor, determines that such price is inappropriate to use as the basis for the valuation.

The Trustee also determines the NAV per Share, which equals the NAV of the Trust divided by the number of outstanding Shares. The NAV of the Trust and the NAV per Share are published by the Sponsor on each day that NYSE Arca is open for regular trading and are posted on the Trust’s website, www.invesco.com/etfs.

10

Movements in the Price of the Euro

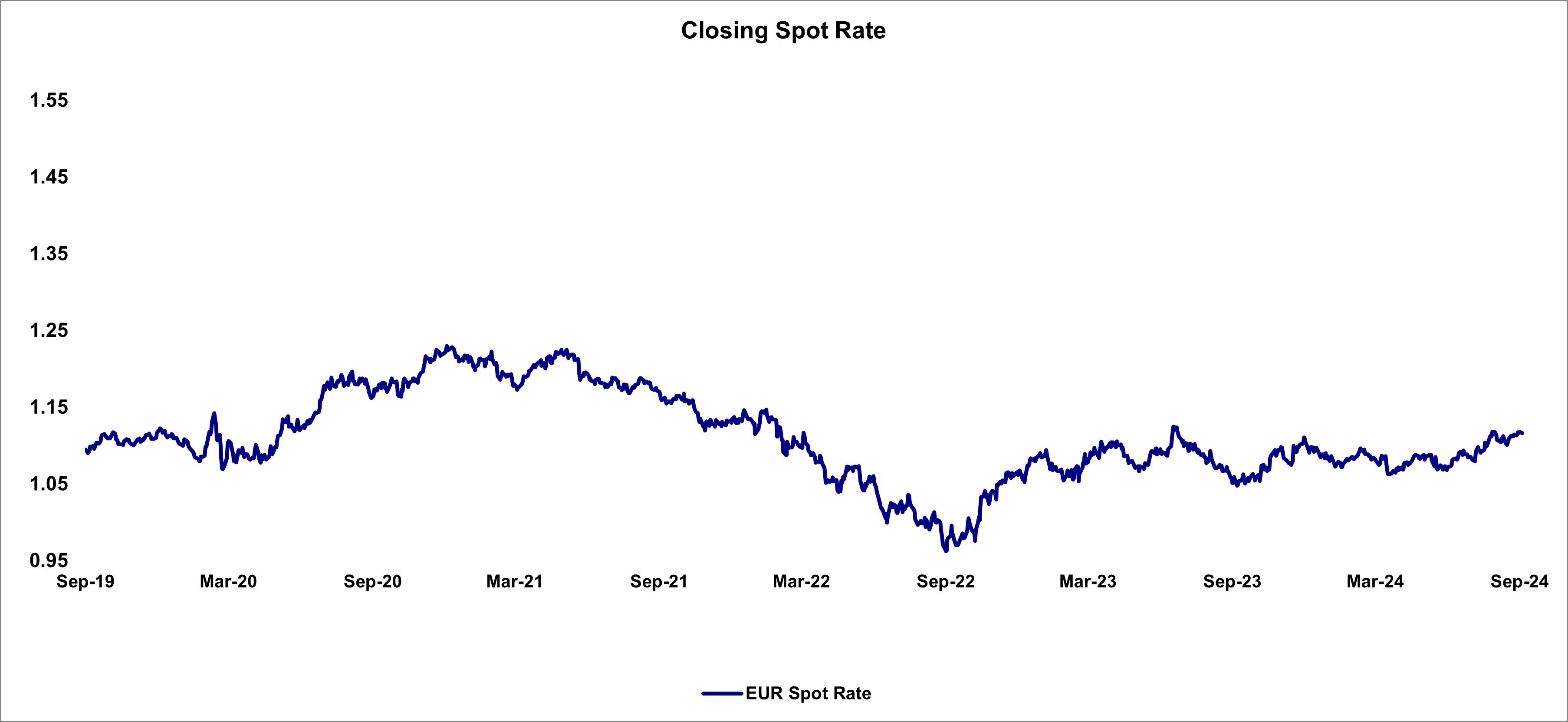

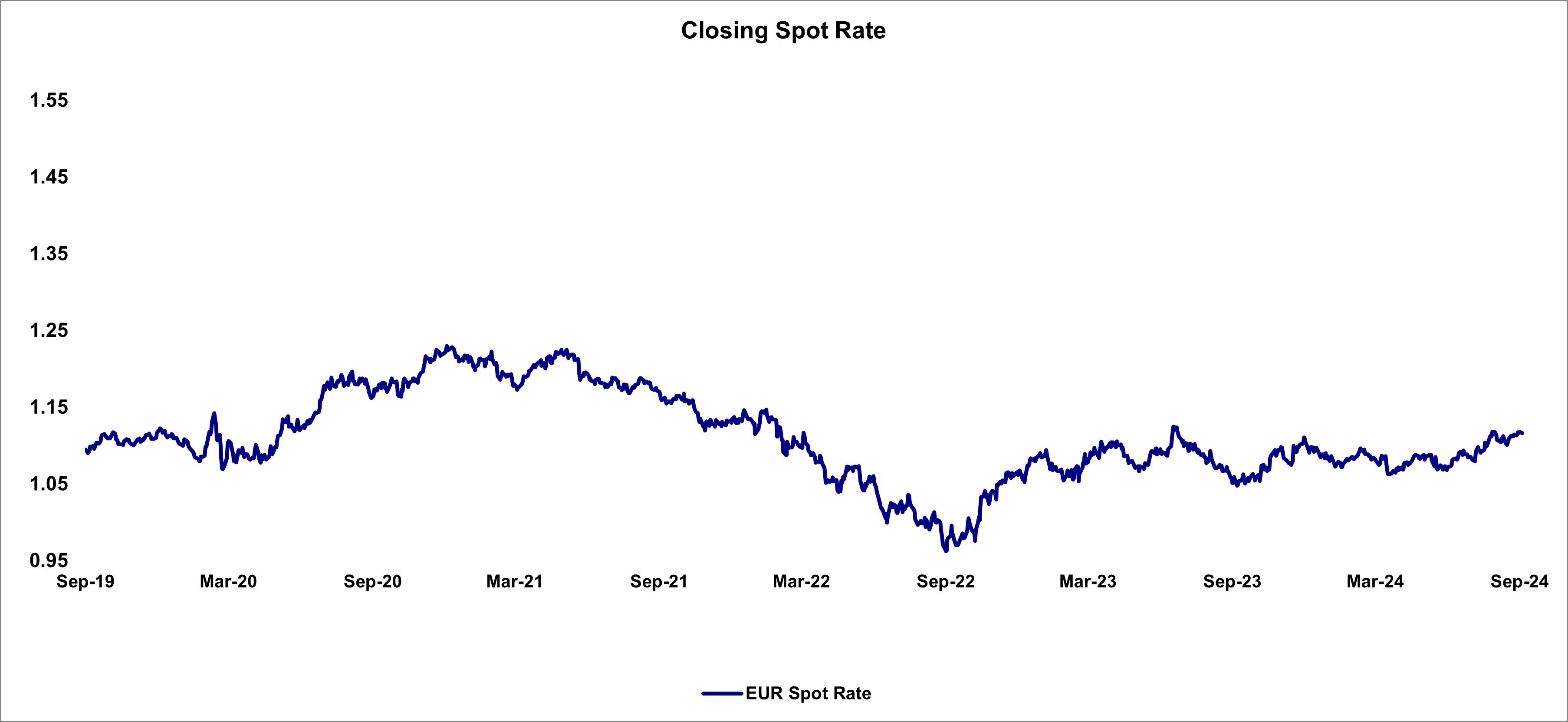

The investment objective of the Trust is for the Shares to reflect the price in USD of the euro plus accrued interest, if any, less the expenses of the Trust’s operations. The Shares are intended to provide institutional and retail investors with a simple, cost-effective means of gaining investment benefits similar to those of holding euro. Each outstanding Share represents a proportional interest in the euro held by the Trust. The following chart provides recent trends on the price of euro. The chart illustrates movements in the price of euro in USD and is based on the Closing Spot Rate:

NAV per Share; Valuation of the Euro

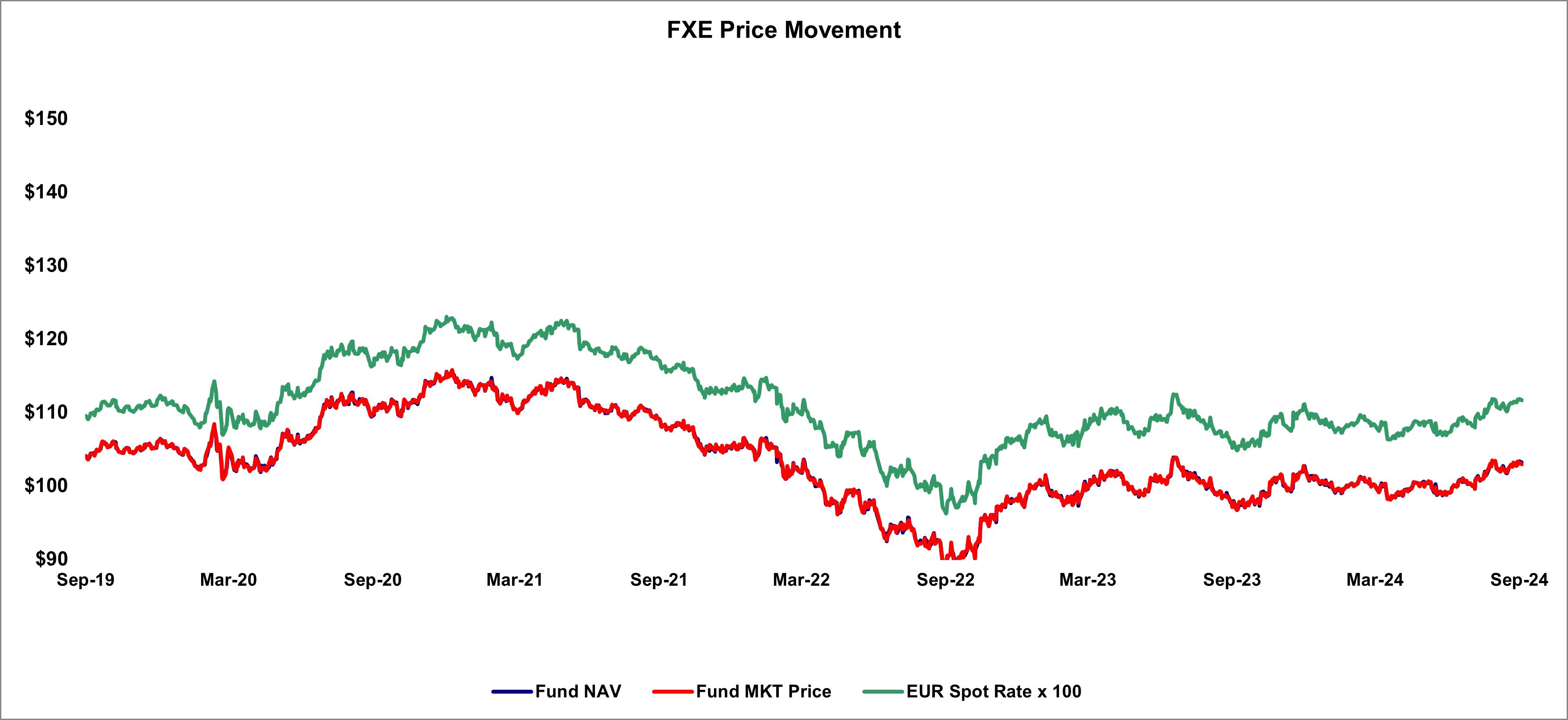

The following chart illustrates the movement in the price of the Shares based on (1) NAV per Share, (2) the “bid” and “ask” midpoint offered on NYSE Arca and (3) the Closing Spot Rate, expressed as a multiple of 100 euro:

11

Liquidity and Capital Resources

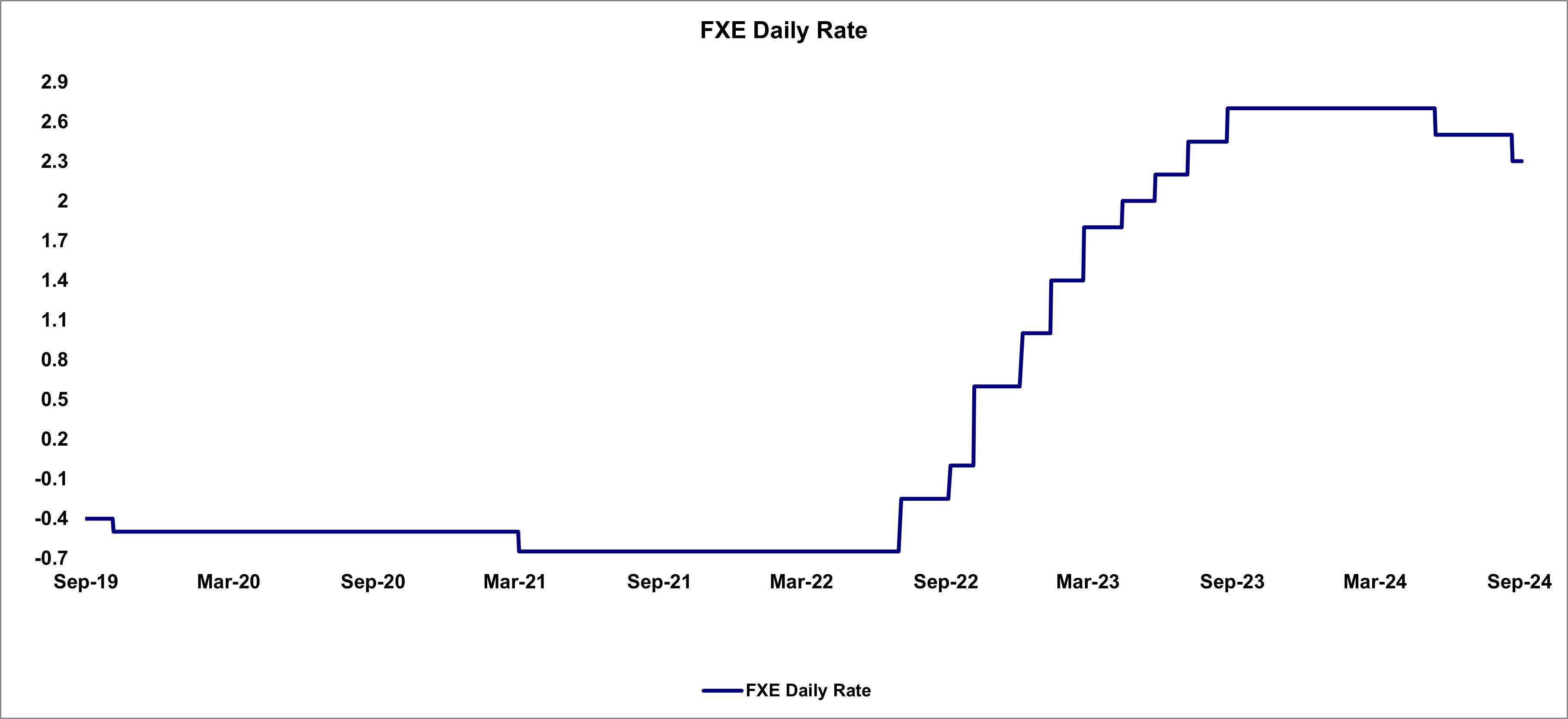

The Trust does not have any material cash requirements as of the end of the latest fiscal period. The Sponsor is not aware of any known trends, demands, commitments, events or uncertainties that will result in, or are reasonably likely to result in, material changes to the Trust’s liquidity and capital resources needs. The Trust’s Depository, JPMorgan Chase Bank, N.A., London Branch, maintains two deposit accounts for the Trust, a primary deposit account that may earn interest and a secondary deposit account that does not earn interest. Interest on the primary deposit account, if any, accrues daily and is paid monthly. The interest rate in effect as of September 30, 2024 was an annual nominal rate of 2.30%. The following chart provides the daily rate paid by the Depository since September 30, 2019:

In exchange for a fee, the Sponsor bears most of the expenses incurred by the Trust. As a result, the only ordinary expense of the Trust during the period covered by this report was the Sponsor’s fee. Each month the Depository deposits into the secondary deposit account accrued but unpaid interest, if any, and the Trustee withdraws euro from the secondary deposit account to pay the accrued Sponsor’s fee for the previous month plus other Trust expenses (including, without limitation, expenses resulting from negative interest rates), if any. When the interest deposited, if any, exceeds the sum of the Sponsor’s fee for the prior month plus other Trust expenses, if any, the Trustee converts the excess into USD at the prevailing market rate and distributes the USD as promptly as practicable to Shareholders on a pro-rata basis (in accordance with the number of Shares that they own). Distributions paid during the current reporting period follow (annualized yield reflects the estimated annual yield an investor would receive if a monthly distribution stayed the same for the entire year going forward, and is calculated by annualizing the monthly distribution and dividing

by the Trust NAV for the dates listed below):

FXE Distribution History |

||||||||||||

Date |

|

Value |

|

|

NAV |

|

|

Yield |

|

Annualized Yield |

||

7/1/2024 |

|

$ |

0.17945 |

|

|

$ |

99.05 |

|

|

0.18% |

|

2.20% |

8/1/2024 |

|

$ |

0.18097 |

|

|

$ |

100.02 |

|

|

0.18% |

|

2.13% |

9/3/2024 |

|

$ |

0.18478 |

|

|

$ |

102.31 |

|

|

0.18% |

|

2.13% |

Critical Accounting Estimates

The financial statements and accompanying notes are prepared in accordance with U.S. GAAP. The preparation of these financial statements relies on estimates and assumptions that impact the Trust’s financial position and results of operations. These estimates and assumptions affect the Trust’s application of accounting policies. In addition, please refer to Note 3 to the financial statements of the Trust for further discussion of the Trust’s accounting policies and Item 7 – Management’s Discussions and Analysis of Financial Condition and Results of Operations – Critical Accounting Estimates on Form 10-K for the year ended December 31, 2023.

12

Results of Operations

During the three and nine months ended September 30, 2024 and 2023, the Trust’s net comprehensive income (loss) was, in part, impacted by market volatility resulting from expectations around the Federal Reserve (the “Fed”) easing and heightened geopolitical concerns for 2024, and the US banking sector turmoil for 2023 which are considered to be unusual or infrequent events. Although the full and direct impact of Fed easing expectations, rising geopolitical tensions, and the US banking sector turmoil on the Trust’s net comprehensive income (loss) during the three and nine months ended September 30, 2024 and 2023 cannot be known, it is believed that they have each independently impacted the Closing Spot Rate, the interest rate paid by the Depository, and the global economy and markets generally, including the number of Shares created and redeemed by the Trust.

The euro (EUR/USD) ended the third quarter of 2024 higher, supported by a weaker US dollar. The greenback retreated on dovish sentiment leading into the Federal Reserve’s (Fed) first rate cut in September and the surprise hike in Japanese rates, which led to a rapid unwind of the US dollar, Japanese yen carry trade (i.e., borrowing in the Japanese yen and investing it in a higher yielding asset like US treasuries). Disappointing US labor data also briefly reignited US hard landing concerns but there were also worries about sticky inflation and weaker growth in the Eurozone. Markets also became concerned about the US election and its impact on the economy, which further weighed on the US dollar, boosting the pair.

The euro (EUR/USD) ended the third quarter of 2023 in negative territory. In addition to renewed dollar strength, the pair was further pressured by weaker Eurozone economic outlook. Unlike the Fed which has kept to its more hawkish messaging, keeping open chances for further hikes, the European Central Bank (ECB) has already signaled its September hike to be its last. The US economy was also expected to outperform the Eurozone as suggested by the EU’s economic growth forecasts – domestic demand continued to falter amid high inflation and the Eurozone PMI continued to signal a contraction.

The euro (EUR/USD) posted positive performance in the first three quarters of 2024, mainly due to dollar-driven gains in the third quarter. The pair was initially pressured in the first quarter as the Fed’s higher-for-longer rhetoric and stickier-than-expected US inflation repeatedly pushed out expectations for US rate cuts. In comparison, the European Central Bank (ECB) was more dovish given its noticeably weaker economy, officially kicking off its easing cycle in June. However, the US dollar turned sharply lower in the third quarter after the Fed officially kicked off its own easing cycle, the Bank of Japan surprised markets with a rate hike, and concerns about the impact of the US election grew.

The euro (EUR/USD) ended the first three quarters of 2023 slightly lower with US dollar moves accounting for the bulk of the price action though the European Central Bank’s persistently hawkish rhetoric provided some support in the second quarter. The greenback swayed sharply between gains and losses through most of the period as expectations that the Fed will soon start to back down from its aggressive rate hikes grew, and then dimmed repeatedly as a result of the banking sector turmoil, US debt ceiling debacle, inflation prints and Fed comments. This sent the USD, and hence the pair on a mini rollercoaster ride through the first half of the year. The currency pair depreciated in the third quarter, pressured by renewed dollar strength – the Fed’s hawkish-for-longer rhetoric compared to the ECB and US economic resilience helped the dollar rebound to its highest since November 2022.

Additionally, the interest rate paid by the Depository has generally trended upward over the past year, slightly offset by decline in the recent quarter, to the current interest rate of 2.30%, as set forth in the FXE Rate Chart above. As long as the interest income, if any, exceeds the Sponsor's fee and the interest expense on currency deposits, the Trust will incur a net comprehensive income.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

Except as described above with respect to fluctuations in the USD/euro exchange rate and changes in the nominal annual interest rate paid by the Depository on euro held by the Trust, the Trust is not subject to market risk. The Trust does not hold securities and does not invest in derivative instruments.

Item 4. Controls and Procedures.

Under the supervision and with the participation of the management of the Sponsor, including Brian Hartigan, its Principal Executive Officer, and Kelli Gallegos, its Principal Financial and Accounting Officer, Investment Pools, the Trust carried out an evaluation of the effectiveness of the design and operation of its disclosure controls and procedures (as defined in Rules 13a-15(e) or 15d-15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of the end of the period covered by this Quarterly Report, and, based upon that evaluation, Brian Hartigan, the Principal Executive Officer of the Sponsor, and Kelli Gallegos, the Principal Financial and Accounting Officer, Investment Pools, of the Sponsor, concluded that the Trust's disclosure controls and procedures were effective to provide reasonable assurance that information the Trust is required to disclose in the reports that it files or submits with the Securities and Exchange Commission (the “SEC”) under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms, and to provide reasonable assurance that information required to be disclosed by the Trust in the reports that it files or submits under the Exchange Act is accumulated and communicated to management of the Sponsor, including its Principal Executive Officer and Principal Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

13

Changes in Internal Control Over Financial Reporting

There has been no change in internal control over financial reporting (as defined in the Rules 13a-15(f) and 15d-15(f) of the Exchange Act) that occurred during the Trust's quarter ended September 30, 2024 that has materially affected, or is reasonably likely to materially affect, the Trust's internal control over financial reporting.

14

PART II – OTHER INFORMATION

Item 1. Legal Proceedings.

None.

Item 1A. Risk Factors.

There are no material changes from risk factors as previously disclosed in the Annual Report on Form 10-K for the year ended December 31, 2023, filed February 23, 2024.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

(a) There have been no unregistered sales of Shares. No Shares are authorized for issuance by the Trust under equity compensation plans.

(b) Not applicable.

(c) Although the Trust did not redeem Shares directly from its shareholders, the Trust redeemed Baskets from Authorized

Participants during the three months ended September 30, 2024 as follows:

Period of Redemption |

|

Total Number of Shares Redeemed |

|

|

Average Price Paid per Share |

|

||

July 1, 2024 to July 31, 2024 |

|

|

50,000 |

|

|

$ |

100.01 |

|

August 1, 2024 to August 31, 2024 |

|

|

100,000 |

|

|

$ |

101.18 |

|

September 1, 2024 to September 30, 2024 |

|

|

— |

|

|

$ |

— |

|

Total |

|

|

150,000 |

|

|

$ |

100.79 |

|

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Other Information.

During the period covered by this Quarterly Report, no director or officer of the Sponsor

Item 6. Exhibits.

Exhibit No.

|

Description

|

|

|

3.1 |

|

|

|

3.2 |

|

|

|

3.3 |

|

|

|

3.4 |

|

|

|

4.1 |

|

|

|

15

4.2 |

|

|

|

4.3 |

|

|

|

4.4 |

|

|

|

4.5 |

|

|

|

4.6 |

|

|

|

4.7 |

|

4.8 |

|

|

|

10.1 |

|

|

|

10.2 |

|

|

|

31.1 |

|

|

|

31.2 |

|

|

|

32.1 |

|

|

|

32.2 |

|

|

|

101.INS |

Inline XBRL Instance Document – the instance document does not appear in the Interactive Data File because XBRL tags are embedded within the Inline XBRL document. |

|

|

101.SCH |

Inline XBRL Taxonomy Extension Schema With Embedded Linkbase Documents. |

|

|

104 |

The cover page of the Trust's Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, formatted in Inline XBRL. |

16

SIgnatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

Invesco CurrencyShares® Euro Trust |

||

|

|

|

|

|

|

|

By: |

|

Invesco Specialized Products, LLC |

|

|

|

|

its Sponsor |

Dated: November 6, 2024 |

|

By: |

|

/s/ BRIAN HARTIGAN |

|

|

Name: |

|

Brian Hartigan |

|

|

Title: |

|

Principal Executive Officer |

Dated: November 6, 2024 |

|

By: |

|

/s/ KELLI GALLEGOS |

|

|

Name: |

|

Kelli Gallegos |

|

|

Title: |

|

Principal Financial and Accounting Officer, Investment Pools |

17