美国

证券交易委员会

华盛顿特区20549

表格

or

委托文件编号:001-39866

(根据其章程规定的注册人准确名称)

|

||

(国家或其他管辖区的 |

|

(IRS雇主 |

公司成立或组织) |

|

唯一识别号码) |

Bitwise投资顾问有限责任公司

(

(注册人主要执行办公室的地址,包括邮政编码和电话号码,包括区号)

每类股票名称: |

|

交易标志 |

|

注册交易所的名称: |

|

|

根据该法案第12(g)节登记或将要注册的证券:无。

请勾选以表示注册人(1)在过去的12个月内(或注册人被要求提交这些报告的较短时间内)已提交1934年证券交易法第13或15(d)条所要求提交的所有报告,并且(2)在过去90天内一直受到此类提交要求的约束。☒

请用勾选符号表示,是否提交了根据S-t规则405条规定需提交的所有互动数据文件,以往12个月(或注册人需要提交此类文件的更短期间)。 ☒

请用选中的方式指示登记者是否为大型加速提交人、加速提交人、非加速提交人、较小的报告公司或新兴成长公司。请参阅《交易所法》第12b‑2条中对“大型加速提交人”、“加速提交人”、“较小的报告公司”和“新兴成长公司”的定义。

大型加速存取器 |

☐ |

|

加速存取器 |

☐ |

|

|

|

|

|

|

|

☒ |

|

较小报告公司 |

|

||

|

|

|

|

|

|

新兴成长公司 |

|

|

|

|

如果是新兴成长型公司,请在此处打勾,以示公司选择不使用《交易所法》第13(a)条规定的任何新的或修订的财务会计准则的延长过渡期。

请勾选表示公司是否为空壳公司(如《交易所法》第12b-2条规定)。 ☐ 是

截至2024年5月17日,申报人共有

关于前瞻性声明的声明

本季度Form 10-Q报告(以下简称“季度报告”)涉及比特币etf(以下简称“trust”)的财务状况、经营业绩、计划、目标、未来业绩和业务的“前瞻性声明”。在某些情况下,您可以通过术语如“可能”、“或许”、“将”、“应该”、“期望”、“计划”、“预期”、“相信”、“估计”、“预测”、“潜在”或“继续”,以及这些术语的否定形式和其他类似表达来识别前瞻性声明的部分。本季度报告中包含的所有陈述(除了历史事实的陈述)涉及未来可能发生的活动、事件或发展,包括加密资产市场的变动、trust的运营、Bitwise投资顾问有限责任公司(以下简称“赞助方”)的计划,以及对trust未来成功的参考和其他类似事项,都属于前瞻性声明。这些陈述仅为预测。实际事件或结果可能与这些陈述有实质性差异。这些陈述基于赞助方对历史趋势、当前状况和预期未来发展的看法,以及其他适用情况下的因素所做的某些假设和分析。

实际结果和发展是否符合赞助商的期望和预测取决于各种风险和不确定性,包括但不限于本季度报告表格10-Q中描述的任何风险因素第II部分,第1A条。本信托的年度报告10-k中的风险因素或其他部分中描述的风险因素,该年度报告已于2023年12月31日向证券交易委员会(简称“SEC”)提交,提交日期为2024年3月27日。

可能对信托的业务、财务状况或经营业绩以及未来前景产生重大不利影响,或可能导致实际结果与信托预期大相径庭的因素包括但不限于:

All the forward-looking statements made in this Quarterly Report are qualified by these cautionary statements, and there can be no assurance that the actual results or developments the Sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects on, the Trust’s operations or the value of the Shares.

Should one or more of these risks discussed in the section entitled “Risk Factors” or other uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those described in forward-looking statements. Forward-looking statements are made based on the Sponsor’s beliefs, estimates and opinions on the date the statements are made, and neither the Trust nor the Sponsor is under a duty to update any of the forward-looking statements to conform such statements to actual results or to reflect a change in the Sponsor’s expectations or predictions, other than as required by applicable laws. Investors are therefore cautioned against relying on forward-looking statements.

EMERGING GROWTH COMPANY STATUS

The Trust is an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act (the “JOBS Act”) and, as such, may elect to comply with certain reduced reporting requirements. For as long as the Trust is an emerging growth company, unlike other public companies, it will not be required to:

The Trust will cease to be an “emerging growth company” upon the earliest of (i) when it has $1.235 billion or more in total annual gross revenues during its most recently completed fiscal year; (ii) when it is deemed to be a large accelerated filer under Rule 12b-2 promulgated pursuant to the Securities Exchange Act of 1934; (iii) when it has issued more than $1.0 billion of non-convertible debt over a three-year period; or (iv) the last day of the fiscal year following the fifth anniversary of its initial public offering.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933 for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies; however, the Trust is choosing to “opt out” of such extended transition period, and as a result, the Trust will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that the Trust’s decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Bitwise Bitcoin ETF

Table of Contents

PART I – FINANCIAL INFORMATION:

Item 1. Financial Statements (Unaudited)

BITWISE BITCOIN ETF

STATEMENTS OF ASSETS AND LIABILITIES

(Amounts in thousands, except Share and per-share amounts)

|

|

September 30, 2024 |

|

|

December 31, 2023* |

|

|

||

|

|

(unaudited) |

|

|

|

|

|

||

Assets |

|

|

|

|

|

|

|

||

Investment in bitcoin, at fair value (cost $ |

|

$ |

|

|

$ |

|

|

||

Bitcoin sold receivable |

|

|

|

|

|

|

|

||

Cash |

|

|

|

|

|

|

(1) |

||

Total assets |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

Liabilities |

|

|

|

|

|

|

|

||

Capital shares payable |

|

|

|

|

|

|

|

||

Sponsor Fee payable |

|

|

|

|

|

|

|

||

Total liabilities |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

Net Assets |

|

$ |

|

|

$ |

|

(1) |

||

|

|

|

|

|

|

|

|

||

Shares issued and outstanding, |

|

|

|

|

|

(2) |

|||

Net asset value per share (3) |

|

$ |

|

|

$ |

|

(2) |

||

*

(1)

(2)

(3)

The accompanying notes are an integral part of the Financial Statements.

1

BITWISE BITCOIN ETF

SCHEDULE OF INVESTMENT

(Amounts in thousands, except quantity of bitcoin and percentages)

September 30, 2024 (Unaudited)*

|

|

Quantity |

|

|

|

|

|

|

|

|

Percentage of |

|

|

||||

|

|

of bitcoin |

|

|

Cost |

|

|

Fair Value |

|

|

Net Assets |

|

|

||||

Investment in bitcoin^ |

|

|

|

|

$ |

|

|

$ |

|

|

|

|

% |

||||

Total Investment |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||

Liabilities in excess of other assets |

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

||

Net Assets |

|

|

|

|

|

|

|

$ |

|

|

|

|

% |

||||

*

^

The accompanying notes are an integral part of the Financial Statements.

2

Bitwise Bitcoin ETF

Statements of Operations

(Amounts in thousands)

|

|

Three months ended September 30, 2024 |

|

|

For the period |

|

||

|

|

(unaudited) |

|

|

(unaudited) |

|

||

Investment income |

|

|

|

|

|

|

||

Investment income |

|

$ |

|

|

$ |

|

||

Expenses |

|

|

|

|

|

|

||

Sponsor Fee |

|

|

|

|

|

|

||

Total Expenses |

|

|

|

|

|

|

||

Less: Waivers and Reimbursement |

|

|

( |

) |

|

|

( |

) |

Net Expenses |

|

|

|

|

|

|

||

Net investment loss |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

||

Net realized and unrealized gain (loss) |

|

|

|

|

|

|

||

Net realized gain (loss) on investment in bitcoin transferred to pay Sponsor Fee |

|

|

|

|

|

|

||

Net realized gain (loss) on investment in bitcoin sold for redemptions |

|

|

( |

) |

|

|

( |

) |

Net change in unrealized appreciation (depreciation) on investment in bitcoin |

|

|

|

|

|

|

||

Net realized and unrealized gain (loss) |

|

|

|

|

|

|

||

Net increase (decrease) in net assets resulting from operations |

|

$ |

|

|

$ |

|

||

*

The accompanying notes are an integral part of the Financial Statements.

3

Bitwise Bitcoin ETF

Statements of Changes in Net Assets

(Amounts in thousands, except change in Shares issued and redeemed)

|

|

Three months ended September 30, 2024 |

|

|

For the period |

|

|

||

|

|

(unaudited) |

|

|

(unaudited) |

|

|

||

Increase (decrease) in net assets resulting from operations |

|

|

|

|

|

|

|

||

Net investment loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

Net realized gain (loss) on investment in bitcoin transferred to pay Sponsor Fee |

|

|

|

|

|

|

|

||

Net realized gain (loss) on investment in bitcoin sold for redemptions |

|

|

( |

) |

|

|

( |

) |

|

Net change in unrealized appreciation (depreciation) |

|

|

|

|

|

|

|

||

Net increase (decrease) in net assets resulting from operations |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

Increase (decrease) in net assets from capital share transactions |

|

|

|

|

|

|

|

||

Creations for Shares issued |

|

|

|

|

|

|

|

||

Redemptions for Shares redeemed |

|

|

( |

) |

|

|

( |

) |

|

Net increase (decrease) in net assets resulting from capital share transactions |

|

|

|

|

|

|

|

||

Total increase (decrease) in net assets from operations and capital share transactions |

|

|

|

|

|

|

|

||

Net assets |

|

|

|

|

|

|

|

||

Beginning of period |

|

|

|

|

|

|

(1) |

||

End of period |

|

$ |

|

|

$ |

|

|

||

|

|

|

|

|

|

|

|

||

Shares issued and redeemed |

|

|

|

|

|

|

|

||

Shares issued |

|

|

|

|

|

|

|

||

Shares redeemed |

|

|

( |

) |

|

|

( |

) |

|

Net increase (decrease) in Shares issued and outstanding |

|

|

|

|

|

|

|

||

*

(1)

The accompanying notes are an integral part of the Financial Statements.

4

Bitwise Bitcoin ETF

Statement of Cash Flows

(Amounts in thousands)

|

|

For the period |

|

|

|

|

(unaudited) |

|

|

Cash flow from operating activities |

|

|

|

|

Net increase (decrease) in net assets resulting from operations |

|

$ |

|

|

Adjustments to reconcile net increase in net assets resulting from operations to net |

|

|

|

|

Purchases of bitcoin |

|

|

( |

) |

Proceeds from bitcoin sold |

|

|

|

|

Net realized (gain) loss from investment in bitcoin transferred to pay Sponsor Fee |

|

|

( |

) |

Net realized (gain) loss from investment in bitcoin sold for redemptions |

|

|

|

|

Net change in unrealized (appreciation) on investment in bitcoin |

|

|

( |

) |

Increase (Decrease) in Sponsor Fee payable |

|

|

|

|

Net cash provided by (used in) operating activities |

|

|

( |

) |

|

|

|

|

|

Cash flow from financing activities |

|

|

|

|

Creations for Shares issued |

|

|

|

|

Redemptions for Shares redeemed |

|

|

( |

) |

Net cash provided by (used in) financing activities |

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash |

|

|

|

|

Cash, beginning of period (1) |

|

|

|

|

Cash, end of period |

|

$ |

|

|

|

|

|

|

|

Supplemental disclosure of noncash operating activities |

|

|

|

|

Transfer of bitcoin to pay for Sponsor Fee |

|

$ |

|

|

*

(1)

The accompanying notes are an integral part of the Financial Statements.

5

BITWISE Bitcoin ETF

Notes to Financial Statements

September 30, 2024 (Unaudited)

1. Organization

Bitwise Bitcoin ETF (the “Trust”), formerly Bitwise Bitcoin ETP Trust, is an investment trust organized on August 29, 2019, under Delaware law pursuant to a Declaration of Trust and Trust Agreement (the “Trust Agreement”). The Trust’s investment objective is to seek to provide exposure to the value of bitcoin held by the Trust, less the expenses of the Trust’s operations, generally just the sponsor’s management fee. In seeking to achieve its investment objective, the Trust’s sole asset is bitcoin. The Trust is an Exchange Traded Product (“ETP”) that issues common shares of beneficial interest (“Shares”) that are listed on the NYSE Arca, Inc. (the “Exchange”) under the ticker symbol “BITB,” providing investors with an efficient means to obtain market exposure to the price of bitcoin.

Bitwise Investment Advisers, LLC (the “Sponsor”) serves as the Sponsor for the Trust. The Sponsor arranged for the creation of the Trust and is responsible for the ongoing registration of the Shares for their public offering in the U.S. and the listing of Shares on the Exchange. The Sponsor develops a marketing plan for the Trust, prepares marketing materials regarding the Shares, and operates the marketing plan of the Trust on an ongoing basis. The Sponsor also oversees the additional service providers of the Trust and exercises managerial control of the Trust as permitted under the Trust Agreement. The Sponsor has agreed to pay all normal operating expenses of the Trust (except for litigation expenses and other extraordinary expenses) out of the Sponsor’s unitary management fee (the “Sponsor Fee”) and may determine in its sole discretion to assume legal fees and expenses of the Trust in excess of $

Delaware Trust Company acts as the trustee of the Trust (the “Trustee”) for the purpose of creating a Delaware statutory trust in accordance with the Delaware Statutory Trust Act (“DSTA”) which requires that the Trust have at least

The Trust purchases and sells bitcoin directly and it creates or redeems its Shares in cash-settled transactions in blocks of

The Trust's registration statement on Form S-1 relating to its continuous public offering of Shares was declared effective by the U.S. Securities and Exchange Commission on January 10, 2024 and the Shares of the Trust were listed on the Exchange on January 11, 2024.

The statements of assets and liabilities and schedule of investment as of September 30, 2024, and the statements of operations, cash flows, and changes in net assets for the period ended September 30, 2024, have been prepared on behalf of the Trust and are unaudited. In the opinion of management of the Sponsor of the Trust, all adjustments (which include normal recurring adjustments) necessary to present fairly the financial position and results of operations for the period ended September 30, 2024, and for all interim periods presented have been made. In addition, interim period results are not necessarily indicative of results for a full-year period.

Prior to the commencement of operations on January 10, 2024, on November 9, 2023, BAM purchased

6

as a statutory underwriter in connection with the initial purchase of the Seed Baskets. On January 11, 2024, BIM sold all of its

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Trust in the preparation of its financial statements.

Basis of presentation

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Trust is an investment company and follows the specialized accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC” or “Codification”) Topic 946, Financial Services—Investment Companies.

Use of Estimates

The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of these financial statements. Actual results could differ from those estimates.

Cash

Generally, the Trust does not intend to hold any cash. Cash includes non-interest bearing non-restricted cash with one institution. Cash in a bank deposit account, at times, may exceed U.S. federally insured limits. The Trust has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such bank deposits. On December 31, 2023, the Trust held $

Investment Transactions and Revenue Recognition

The Trust records its investment transactions on a trade date basis and changes in fair value are reflected as net change in unrealized appreciation or depreciation on investment in bitcoin. Realized gains and losses are calculated using the specific identification method. Realized gains and losses are recognized in connection with transactions including settling obligations for the Sponsor Fee in bitcoin.

Investment Valuation - Principal Market NAV

U.S. GAAP defines fair value as the price the Trust would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The Trust’s policy is to value investments held at fair value.

For financial statement reporting, the Trust identifies and determines the bitcoin principal market (or in the absence of a principal market, the most advantageous market) for U.S. GAAP purposes consistent with the application of the fair value measurement framework in FASB ASC Topic 820. A principal market is the market with the greatest volume and activity level for the asset or liability. The Principal Market NAV and the Principal Market NAV per-share are calculated using the fair value of bitcoin based on the price provided by this exchange market, as of 4:00 p.m. ET on the measurement date for U.S. GAAP purposes. The Trust determines its principal market (or in the absence of a principal market the most advantageous market) on a quarterly basis to determine which market is its Principal Market for the purpose of calculating fair value for the creation of quarterly and annual financial statements.

Specifically, the Trust utilizes a third-party valuation vendor, Lukka, Inc., to identify publicly available, well established and reputable crypto asset exchanges selected by Lukka, Inc. in their sole discretion, including Binance, Bitfinex, Bitflyer, Bitstamp, Bullish, Coinbase, Crypto.com, Gate.io, Gemini, HitBTC, Huobi, itBit, Kraken, KuCoin, LMAX, MEXC Global, OKX and Poloniex, and then calculating, on each valuation period, the highest volume exchange during the 60 minutes prior to 4:00 p.m. ET for bitcoin. The Sponsor then identifies that market as the principal market for bitcoin during that period, and uses the price for bitcoin from that venue

7

at 4:00 ET as the principal market price. In evaluating the markets that could be considered principal markets, the Trust considered whether the specific markets were accessible to the Trust, either directly or through an intermediary, at the end of each period.

The Principal Market and the Principal Market Price for bitcoin, which comprised the majority of the Trust’s assets for the three-month period ended September 30, 2024, was Coinbase with a price of $

Various inputs are used in determining the fair value of assets and liabilities. Inputs may be based on independent market data (“observable inputs”) or they may be internally developed (“unobservable inputs”). These inputs are categorized into a disclosure hierarchy consisting of three broad levels for financial reporting purposes. The level of a value determined for an asset or liability within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement in its entirety. The three levels of the fair value hierarchy are as follows:

Level 1: Unadjusted quoted prices in active markets for identical assets or liabilities;

Level 2: Inputs other than quoted prices included within Level 1 that are observable for the asset or liability either directly or indirectly, including quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not considered to be active, inputs other than quoted prices that are observable for the asset or liability, and inputs that are derived principally from or corroborated by observable market data by correlation or other means; and

Level 3: Unobservable inputs, including the Trust's assumptions used in determining the fair value of investments, where there is little or no market activity for the asset or liability at the measurement date.

The cost basis of the investment in bitcoin recorded by the Trust for financial reporting purposes is the fair value of bitcoin at the time of transfer. The cost basis recorded by the Trust may differ from proceeds collected by the Authorized Participant from the sale of the corresponding Shares to investors.

Given that bitcoin is actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

||||

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Investment in bitcoin, at fair value |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

* No comparative period presented as the Trust commenced operations on January 10, 2024.

Calculation of Net Asset Value (NAV) and NAV Per-Share

On each business day, as soon as practicable after 4:00 p.m. ET, the NAV of the Trust is obtained by subtracting all accrued fees and other liabilities of the Trust from the fair value of the bitcoin and other assets held by the Trust. The Bank of New York Mellon (the “Administrator”) computes the NAV per-share by dividing the NAV of the Trust by the number of Shares outstanding on the date the computation is made.

Income Taxes

The Trust is classified as a “grantor trust” for U.S. federal income tax purposes. As a result, the Trust itself is not subject to U.S. federal income tax. Instead, the Trust’s income and expenses “flow through” to the shareholders, and the Administrator reports the Trust’s income, gains, losses, and deductions to the Internal Revenue Service on that basis. The Sponsor has analyzed applicable tax laws and regulations and their application to the Trust, and does not believe that there are any uncertain tax positions that require recognition of a tax liability as of September 30, 2024.

The Trust is required to determine whether its tax positions are more likely than not to be sustained on examination by the applicable taxing authority, based on the technical merits of the position. Tax positions not deemed to meet a more likely than not threshold would be recorded as a tax expense in the current year. As of September 30, 2024 and December 31, 2023, the Trust has determined that

8

expect that its assessment related to unrecognized tax benefits will materially change over the next 12 months. However, the Trust’s conclusions may be subject to review and adjustment at a later date based on factors including, but not limited to, the nexus of income among various tax jurisdictions; compliance with U.S. federal, U.S. state, and tax laws of jurisdictions in which the Trust operates in; and changes in the administrative practices and precedents of the relevant authorities. The Trust is required to analyze all open tax years. Open tax years are those years that are open for examination by the relevant income taxing authority. As of September 30, 2024, all tax years since inception remain open for examination. There were no examinations in progress at period end.

Organizational and offering costs

The costs of the Trust’s organization and the initial offering of the Shares are borne directly by the Sponsor. The Trust is not obligated to reimburse the Sponsor.

3. Fair Value of bitcoin

As of September 30, 2024,* the Trust held a net closing balance of

The following represents the changes in quantity of bitcoin and the respective fair value for the period from January 10, 2024 to September 30, 2024*:

|

|

Quantity of bitcoin |

|

|

Fair Value |

|

||

Beginning balance as of January 10, 2024 (commencement of operations) |

|

|

|

|

$ |

|

||

Purchases |

|

|

|

|

|

|

||

Sales for the redemption of Shares |

|

|

( |

) |

|

|

( |

) |

Bitcoin transferred for Sponsor Fee |

|

|

( |

) |

|

|

( |

) |

Net realized gain (loss) on investment in bitcoin transferred to pay Sponsor Fee |

|

|

— |

|

|

|

|

|

Net realized gain (loss) on investment in bitcoin sold for redemptions |

|

|

— |

|

|

|

( |

) |

Change in unrealized appreciation (depreciation) on investment in bitcoin |

|

|

— |

|

|

|

|

|

Ending balance as of September 30, 2024* |

|

|

|

|

$ |

|

||

*

4. Related Party Transactions and Agreements

The Trust pays the Sponsor Fee of

The Sponsor Fee is paid by the Trust to the Sponsor as compensation for services performed under the Trust Agreement and Sponsor Agreement. After the period during which all or a portion of the Sponsor Fee was waived, the Sponsor Fee has been accruing daily, since July 11, 2024, and is payable in bitcoin monthly in arrears. The Administrator calculates the Sponsor Fee on a daily basis by applying a

9

The Trust may incur certain extraordinary, non-recurring expenses that are not assumed by the Sponsor, including but not limited to, taxes and governmental charges, any applicable brokerage commissions, financing fees, Bitcoin network fees and similar transaction fees, expenses and costs of any extraordinary services performed by the Sponsor (or any other service provider) on behalf of the Trust to protect the Trust or the Shareholders (including, for example, in connection with any fork of the Bitcoin blockchain, any Incidental Rights and any IR Asset, any indemnification of the Cash Custodian, Bitcoin Custodian, Prime Execution Agent, Transfer Agent, Administrator or other agents, service providers or counterparties of the Trust, and extraordinary legal fees and expenses, including any legal fees and expenses incurred in connection with litigation, regulatory enforcement or investigation matters.

See Note 1 for further discussion on related party capital transactions. As of September 30, 2024, the Sponsor owned no Shares of the Trust.

5. Creation and Redemption of Shares

When the Trust creates or redeems its Shares, it does so only in Baskets (blocks of

The Transfer Agent will facilitate the settlement of Shares in response to the placement of creation orders and redemption orders from Authorized Participants. The Trust has entered into the Cash Custody Agreement with BNY Mellon under which BNY Mellon acts as custodian of the Trust’s cash and cash equivalents. The Trust only creates or redeems its Shares at NAV.

Authorized Participants are the only persons that may place orders to create and redeem Baskets. Authorized Participants must be (1) registered broker-dealers or other securities market participants, such as banks and other financial institutions, that are not required to register as broker-dealers to engage in securities transactions described below, and (2) DTC Participants. To become an Authorized Participant, a person must enter into an Authorized Participant Agreement. The Authorized Participant Agreement provides the procedures for the creation and redemption of Baskets and for the delivery of the cash or Shares required for such creation and redemptions. The Authorized Participant Agreement and the related procedures attached thereto may be amended by the Trust, without the consent of any Shareholder or Authorized Participant. Authorized Participants must pay the Transfer Agent a non-refundable fee for each order they place to create or redeem one or more Baskets. The transaction fee may be waived, reduced, increased or otherwise changed by the Sponsor in its sole discretion. Authorized Participants who make deposits with the Trust in exchange for Baskets receive no fees, commissions or other form of compensation or inducement of any kind from either the Trust or the Sponsor, and no such person has any obligation or responsibility to the Sponsor or the Trust to effect any sale or resale of Shares.

Each Authorized Participant is required to be registered as a broker-dealer under the Securities Exchange Act of 1934, as amended, and a member in good standing with FINRA, or exempt from being or otherwise not required to be licensed as a broker-dealer or a member of FINRA, and is qualified to act as a broker or dealer in the states or other jurisdictions where the nature of its business so requires. Certain Authorized Participants may also be regulated under federal and state banking laws and regulations. Each Authorized Participant has its own set of rules and procedures, internal controls and information barriers as it determines is appropriate in light of its own regulatory regime.

6. Concentration of Risk

Substantially all the Trust’s assets are holdings of bitcoin, which creates a concentration risk associated with fluctuations in the price of bitcoin. Accordingly, a decline in the price of bitcoin will have an adverse effect on the value of the Shares of the Trust. The trading prices of bitcoin have experienced extreme volatility in recent periods and may continue to fluctuate significantly. Extreme volatility in the future, including substantial, sustained, or rapid declines in the trading prices of bitcoin, could have a material adverse effect on the value of the Shares and the Shares could lose all or substantially all of their value. Factors adversely impacting the value of bitcoin and the Shares may include an increase in the global bitcoin supply or a decrease in global bitcoin demand; market conditions of, and overall sentiment towards, the crypto assets and blockchain technology industry; trading activity on crypto asset exchanges, which, in many cases, are largely unregulated or may be subject to manipulation; the adoption of bitcoin as a medium of exchange, store-of-value or other consumptive asset and the maintenance and development of the open-source software protocol of the bitcoin network, and their ability to meet user demands; manipulative trading activity on crypto asset exchanges, which, in many cases, are largely unregulated; and forks in the bitcoin network, among other things.

Coinbase Custody Trust Company, LLC serves as the Trust’s custodian for bitcoin for which qualified custody is available (the “Bitcoin Custodian”). The Bitcoin Custodian is subject to change in the sole discretion of the Sponsor. At September 30, 2024, bitcoin

10

with a market value of $

7. Financial Highlights*

Per-share Performance (for a Share outstanding throughout the periods presented)

|

|

Three months ended September 30, 2024 |

|

|

For the period |

|

|

||

Net asset value per-share, beginning of period |

|

$ |

|

|

$ |

|

|

||

Net investment loss 1 |

|

|

( |

) |

|

|

( |

) |

|

Net realized unrealized gain (loss) 2 |

|

|

|

|

|

|

|

||

Net change in net assets from operations |

|

|

|

|

|

|

|

||

Net asset value per-share, end of period |

|

$ |

|

|

$ |

|

|

||

|

|

|

|

|

|

|

|

||

Total return, at net asset value 2 |

|

|

|

% |

|

|

% |

||

|

|

|

|

|

|

|

|

||

Ratios to average net assets 3 |

|

|

|

|

|

|

|

||

Net investment loss |

|

|

( |

) |

% |

|

( |

) |

% |

Gross expenses |

|

|

|

% |

|

|

% |

||

Net expenses |

|

|

|

% |

|

|

% |

||

*

8. Recently Issued Accounting Pronouncements

In December 2023, the FASB issued Accounting Standards Update (“ASU”) 2023-08, Intangibles—Goodwill and Other—Crypto Assets (Subtopic 350-60): Accounting for and Disclosure of Crypto Assets (“ASU 2023-08”). ASU 2023-08 is intended to improve the accounting for certain crypto assets by requiring an entity to measure those crypto assets at fair value each reporting period with changes in fair value recognized in net income. The amendments also improve the information provided to investors about an entity’s crypto asset holdings by requiring disclosure about significant holdings, contractual sale restrictions, and changes during the reporting period. ASU 2023-08 is effective for annual and interim reporting periods beginning after December 15, 2024. Early adoption is permitted for both interim and annual financial statements that have not yet been issued. The Trust adopted this new guidance with no material impact on its financial statements and disclosures as the Trust uses fair value as its method of accounting for Bitcoin in accordance with its classification as an investment company for accounting purposes.

9. Indemnifications

In the normal course of business, the Trust enters into contracts and agreements that contain a variety of representations and warranties and which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred. The Trust expects the risk of any future obligation under these indemnifications to be remote.

10. Subsequent Events

In preparing these financial statements, the Sponsor has evaluated events and transactions for potential recognition or disclosure through the date these financial statements were issued. Management has determined that there were no additional material events that would require disclosure other than that which has already been discussed in these Notes to Financial Statements.

11

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read together with, and is qualified in its entirety by reference to, our unaudited financial statements and related notes included elsewhere in this Quarterly Report, which have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). The following discussion may contain forward-looking statements based on assumptions we believe to be reasonable. Our actual results could differ materially from those discussed in these forward-looking statements.

Trust Overview

Bitwise Bitcoin ETF (the “Trust”) is a Delaware statutory trust formed on August 29, 2019. The Trust continuously issues common shares (“Shares”), representing units of undivided beneficial ownership of the Trust. The Shares are listed on the NYSE Arca Inc. (the “Exchange”) under the ticker symbol “BITB.” The Trust’s commencement of operations was January 10, 2024. Bitwise Investment Advisers, LLC (the “Sponsor”) serves as the sponsor of the Trust.

The Trust’s investment objective is to seek to provide shareholders of the Trust (“Shareholders”) with exposure to the value of bitcoin held by the Trust that is reflective of the actual bitcoin market in which investors can purchase or sell bitcoin, less the expenses of the Trust’s operations and other liabilities. In seeking to achieve its investment objective, the Trust holds bitcoin and establishes its net asset value (“NAV") by reference to the CME CF Bitcoin Reference Rate - New York Variant (“BRRNY”). The BRRNY was designed to provide a daily, 4:00 p.m. ET reference rate of the U.S. dollar price of one bitcoin and is calculated by CF Benchmarks Ltd. (the “Benchmark Provider”) based on an aggregation of executed trade flow of major bitcoin trading platforms (“Constituent Platforms”).

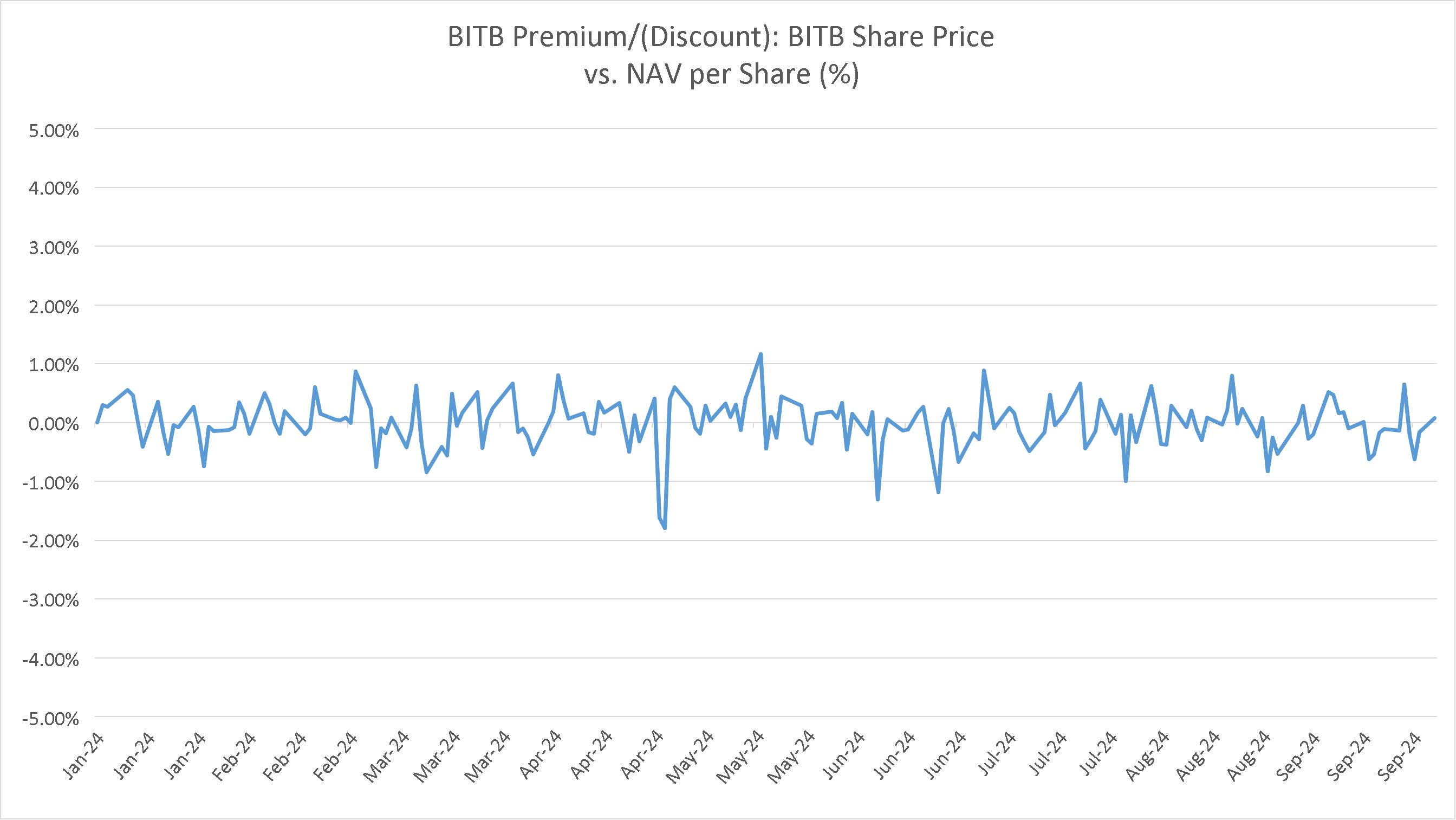

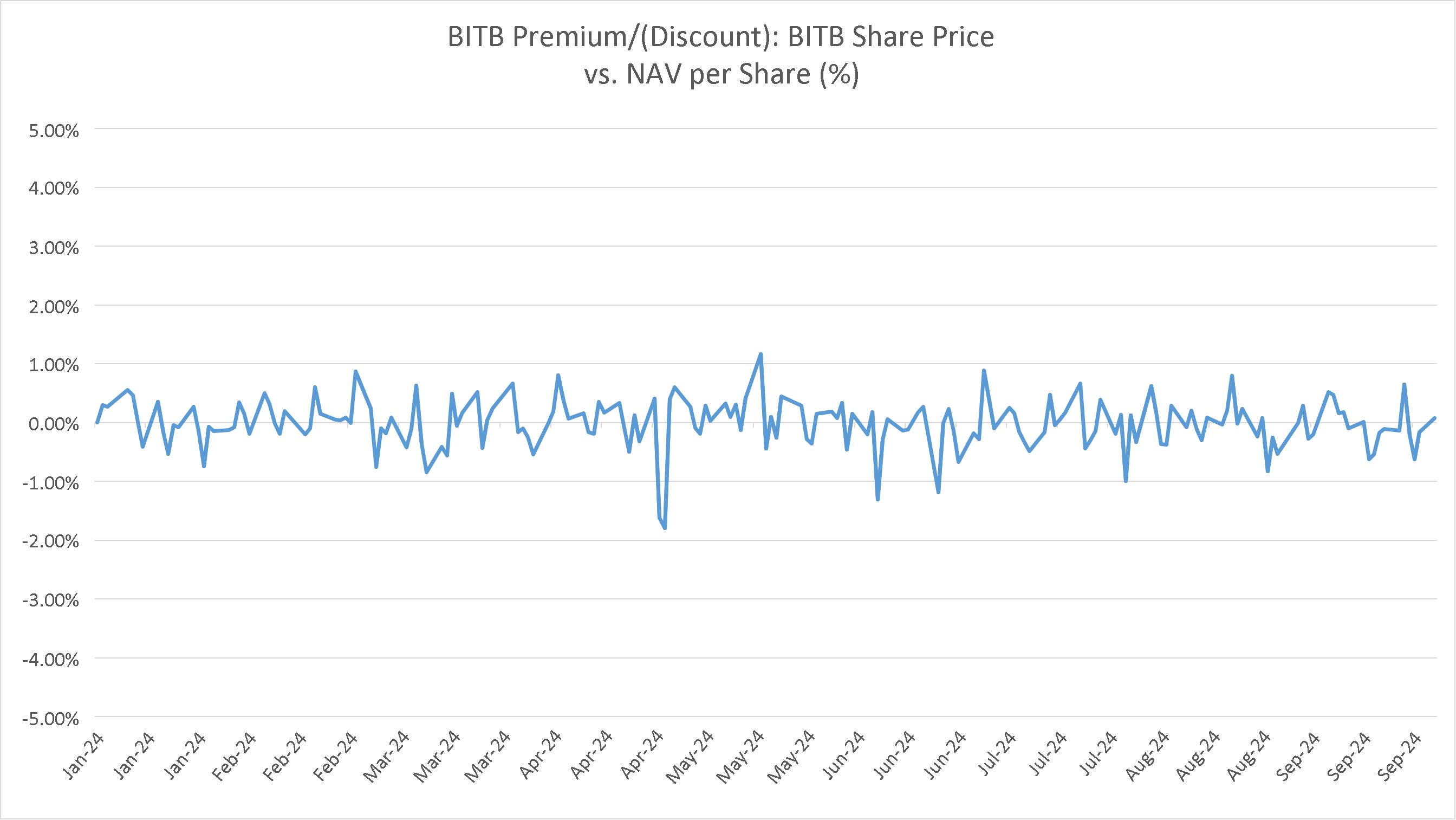

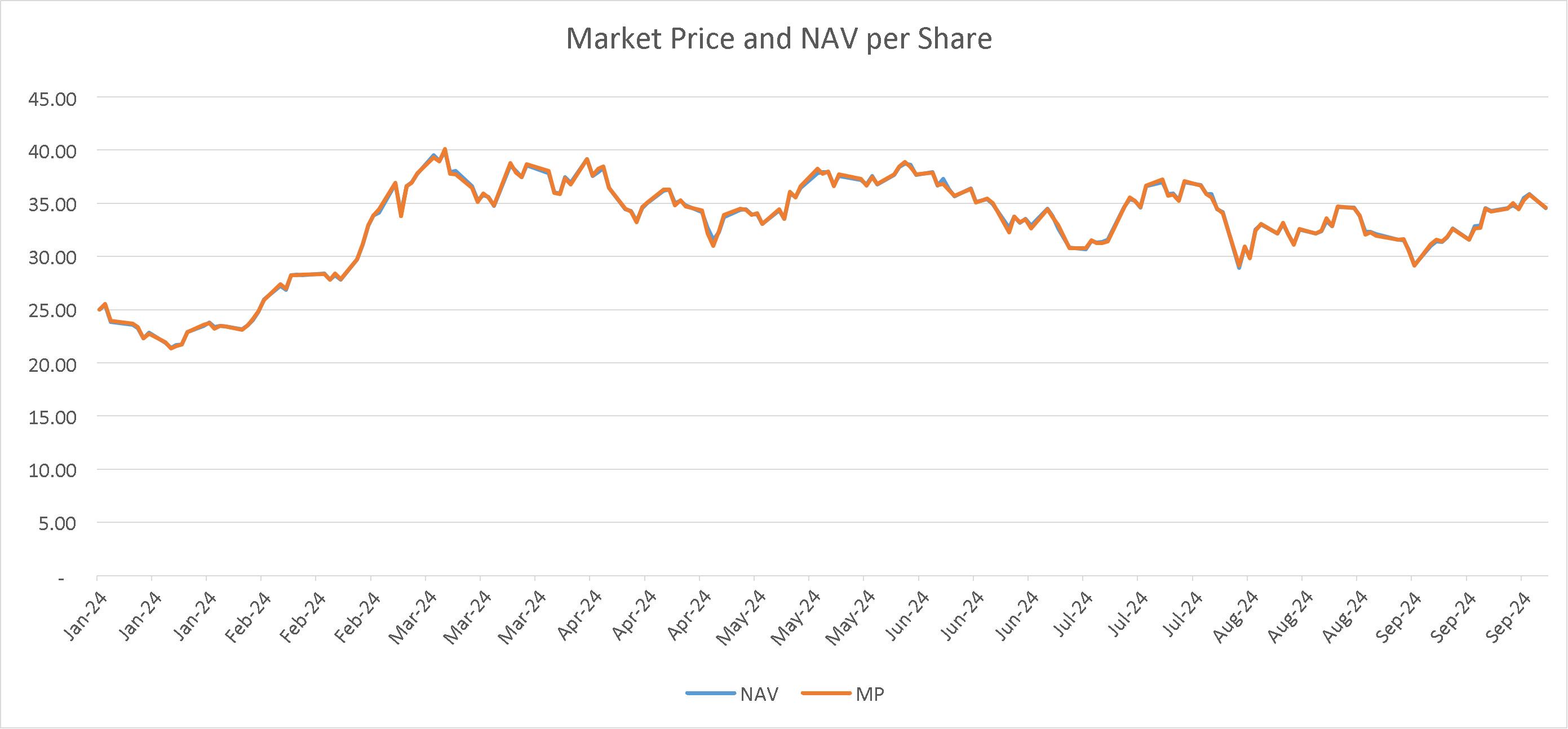

The Shares may trade at a premium over, or a discount to, the NAV per-share as a result of price volatility, trading volume and closings of the exchanges on which the Sponsor purchases bitcoins on behalf of the Trust due to fraud, failure, security breaches or otherwise, and the fact that supply and demand forces at work in the secondary trading market for Shares are related, but not identical, to the supply and demand forces influencing the market price of bitcoin. As a result of the foregoing, the price of the Shares as quoted on the Exchange has varied from the value of the Trust’s NAV per-share since the Shares were approved for quotation on January 11, 2024.

The following charts show the percentage of Premium/(Discount) of the Shares as quoted on the Exchange and the Trust’s NAV and a comparison of the NAV of the Trust vs the market price as quoted on the Exchange.

12

From January 11, 2024 to September 30, 2024, the Shares of the Trust traded at an average discount, based on closing prices at 4:00 p.m. ET, and estimated, unaudited, NAV per-share of 0.02%. During that same period, the highest premium was 1.17% on May 20, 2024, and the lowest premium was 0.01% on January 18, 2024. During that same period, the highest discount was 1.79% on May 1, 2024, and the lowest discount was 0.002% on June 25, 2024.

13

The following chart shows the price of bitcoin for the period January 1, 2023 through September 30, 2024, as quoted by the Benchmark Provider, using the BRRNY.

Results of Operations

As of September 30, 2024,* the Trust held a net closing balance of 39,435.5408 bitcoin with a total market value of $2,500,633,274 based on the BRRNY price of $63,410.65, used to determine the Trust's NAV. The total market value of the Trust's bitcoin held was $2,502,767,131 based on the price of bitcoin (Lukka Prime Rate) in the principal market (Coinbase) of $63,464.76, used to determine the Trust's Principal Market NAV.

* No comparative period presented as the Trust commenced operations on January 10, 2024.

For the Three Months Ended September 30, 2024*^

Net realized and unrealized gain on investment in bitcoin for the three months ended September 30, 2024, was approximately $135,282 which includes a realized gain of $359 on the sale of bitcoins to pay the Sponsor Fee, net realized loss on investment in bitcoin sold for redemptions of $49,002 and net change in unrealized appreciation on investment in bitcoin of approximately $183,925. Net realized and unrealized gain on investment in bitcoin for the period was driven by bitcoin price appreciation from $60,330.17 per bitcoin as of June 30, 2024 to $63,410.65 per bitcoin as of September 30, 2024. Net increase in net assets resulting from operations was approximately $134,167 for the three months ended September 30, 2024, which consisted of the net realized and unrealized gain on investment in bitcoin of $135,282, offset by the Sponsor Fee of $1,115. Net assets increased to approximately $2,502,396 on September 30, 2024, a 5.82% increase in NAV for the period. The increase in net assets primarily resulted from the aforementioned bitcoin price appreciation, net capital share transactions of approximately $118,571, and a net increase resulting from operations of $134,167.

For the Period from January 10, 2024 (Commencement of Operations) to September 30, 2024*^

Net realized and unrealized gain on investment in bitcoin for the period from January 10, 2024 to September 30, 2024, was approximately $361,735 which includes a realized gain of $593 on the sale of bitcoins to pay the Sponsor Fee, net realized loss on investment in bitcoin sold for redemptions of $73,204 and net change in unrealized appreciation on investment in bitcoin of approximately $434,346. Net realized and unrealized gain on investment in bitcoin for the period was driven by bitcoin price appreciation from $45,852.66 per bitcoin

14

as of January 10, 2024 to $63,410.65 per bitcoin as of September 30, 2024. Net increase in net assets resulting from operations was approximately $359,793 for the period from January 10, 2024 to September 30, 2024, which consisted of the net realized and unrealized gain on investment in bitcoin of $361,735, less the Sponsor Fee of $1,942. Net assets increased to approximately $2,502,396 on September 30, 2024, a 38.28% increase in NAV for the period. The increase in net assets primarily resulted from the aforementioned bitcoin price appreciation, net capital share transactions of approximately $2,142,603, and a net increase resulting from operations of $359,793.

* No full nine-month period or comparative period presented as the Trust commenced operations on January 10, 2024.

^ Amounts displayed are in the '000s, except for per-share/coin references

Liquidity and Capital Resources

The Trust agreed to pay the unitary Sponsor Fee of 0.20% per annum of the Trust’s bitcoin holdings. The Sponsor contractually waived the Sponsor Fee on the first $1 billion of Trust assets through July 10, 2024, and has been accruing at an annual rate of 0.20% of the Trust’s net assets since then. As a result, the only ordinary expense of the Trust is expected to be the Sponsor Fee. In exchange for the Sponsor Fee, the Sponsor has agreed to assume and pay the normal operating expenses of the Trust, which include the Trustee’s monthly fee and out-of-pocket expenses, the fees of the Trust’s regular service providers (Cash Custodian, Bitcoin Custodian, Prime Execution Agent, Marketing Agent, Transfer Agent and Administrator), exchange listing fees, tax reporting fees, SEC registration fees, printing and mailing costs, audit fees and up to $500,000 per annum in ordinary legal fees and expenses. The Sponsor may determine in its sole discretion to assume legal fees and expenses of the Trust in excess of $500,000 per annum. The Sponsor also agreed to pay the costs of the Trust’s organization.

The Trust may incur certain extraordinary, non-recurring expenses that are not assumed by the Sponsor, including but not limited to, taxes and governmental charges, any applicable brokerage commissions, financing fees, Bitcoin network fees and similar transaction fees, expenses and costs of any extraordinary services performed by the Sponsor (or any other service provider) on behalf of the Trust to protect the Trust or the Shareholders (including, for example, in connection with any fork of the Bitcoin blockchain, any Incidental Rights and any IR Asset), any indemnification of the Cash Custodian, Bitcoin Custodian, Prime Execution Agent, Transfer Agent, Administrator or other agents, service providers or counterparties of the Trust, and extraordinary legal fees and expenses, including any legal fees and expenses incurred in connection with litigation, regulatory enforcement or investigation matters.

The Trust does not hold a cash balance except in connection with the creation and redemption of Baskets (blocks of 10,000 Shares) or to pay expenses not assumed by the Sponsor. To pay for expenses not assumed by the Sponsor that are denominated in U.S. dollars, the Sponsor, on behalf of the Trust, may sell the Trust’s bitcoin as necessary to pay such expenses. The cash proceeds of the sale will be sent to the Sponsor to pay the expenses. Any remaining cash will be distributed back to the Cash Custodian. The Sponsor expects that the Trust will have an immaterial amount of cash flow from its operations and that its cash balance will be insignificant at the end of each reporting period. The Trust’s only sources of cash are proceeds from the sale of Baskets and bitcoin. The Trust will not borrow to meet liquidity needs.

The Trust is not aware of any trends, demands, conditions or events that are reasonably likely to result in material changes to its liquidity needs.

15

Off-Balance Sheet Arrangements and Contractual Obligations

As of December 31, 2023, the Trust has not used, nor does it expect to use in the future, special purpose entities to facilitate off-balance sheet financing arrangements and have no loan guarantee arrangements or off-balance sheet arrangements of any kind other than agreements entered into in the normal course of business, which may include indemnification provisions related to certain risks service providers undertake in performing services which are in the best interests of the Trust. While the Trust’s exposure under such indemnification provisions cannot be estimated, these general business indemnifications are not expected to have a material impact on a Trust’s financial position.

Sponsor Fee payments made to the Sponsor are calculated as a fixed percentage of the Trust’s NAV. As such, the Sponsor cannot anticipate the payment amounts that will be required under these arrangements for future periods as NAVs are not known until a future date.

No material changes have occurred during the period ended September 30, 2024.

Critical Accounting Policies

Principal Market and Fair Value Determination

The Trust’s periodic financial statements are prepared in accordance with the Financial Accounting Standards Board Accounting Standards Codification Topic 820, “Fair Value Measurements and Disclosures” (“ASC Topic 820”) and utilize an exchange-traded price from the Trust’s principal market for bitcoin on the Trust’s financial statement measurement date. The Sponsor determines in its sole discretion the valuation sources and policies used to prepare the Trust’s financial statements in accordance with U.S. GAAP. The Trust has engaged a third-party vendor to obtain a price from a principal market for bitcoin, which will be either the market the Trust normally transacts in for bitcoin or, if the Trust does not normally transact in any market or such market suffers an operational interruption and is unavailable, determined and designated by such third-party vendor daily based on its consideration of several exchange characteristics, including oversight, and the volume and frequency of trades. Under U.S. GAAP, such a price is expected to be deemed a Level 1 input in accordance with the ASC Topic 820 because it is expected to be a quoted price in active markets for identical assets or liabilities.

Investment Company Considerations

The Trust is an investment company for U.S. GAAP purposes and follows accounting and reporting guidance in accordance with the FASB ASC Topic 946, Financial Services – Investment Companies. The Trust uses fair value as its method of accounting for bitcoin in accordance with its classification as an investment company for accounting purposes. The Trust is not a registered investment company under the Investment Company Act of 1940. U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts in the financial statements and accompanying notes. Actual results could differ from those estimates and these differences could be material.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

As a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934, as amended, the Trust is not required to provide the information required by this item.

Item 4. Controls and Procedures.

Disclosure Controls and Procedures

The Trust maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in its Exchange Act reports is recorded, processed, summarized and reported within the time periods specified in the SEC rules and forms, and that such information is accumulated and communicated to the Principal Executive Officer and Principal Financial Officer of the Sponsor performing functions equivalent to those a principal executive officer and principal financial officer of the Trust would perform if the Trust had any officers, as appropriate to allow timely decisions regarding required disclosure.

16

Under the supervision and with the participation of the Principal Executive Officer and the Principal Financial Officer of the Sponsor, the Sponsor conducted an evaluation of the Trusts disclosure controls and procedures, as defined under Exchange Act Rule 13a-15(e). Based on this evaluation, the Principal Executive Officer and the Principal Financial Officer of the Sponsor concluded that, as of September 30, 2024, the Trust’s disclosure controls and procedures were effective.

There are inherent limitations to the effectiveness of any system of disclosure controls and procedures, including the possibility of human error and the circumvention or overriding of the controls and procedures.

Changes in Internal Control over Financial Reporting

There were no changes in the Trust’s internal control over financial reporting that occurred during the quarter ended September 30, 2024, that have materially affected, or are reasonably likely to materially affect, the Trust’s internal control over financial reporting.

17

PART II – OTHER INFORMATION:

Item 1. Legal Proceedings

None.

Item 1A. Risk Factors

As a smaller reporting company, the Trust is not required to provide the information required by this item.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

Period |

|

Total Shares Redeemed |

|

|

Average Price Per Share |

|

||

July 1, 2024 – July 31, 2024 |

|

|

4,590,000 |

|

|

$ |

35.89 |

|

August 1, 2024 – August 31, 2024 |

|

|

6,240,000 |

|

|

$ |

33.04 |

|

September 1, 2024 – September 30, 2024 |

|

|

3,740,000 |

|

|

$ |

31.99 |

|

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Other Information

No executive officers or directors of the Sponsor have

Asset Purchase Transactions

As previously disclosed in the Trust’s Current Report on Form 8-K filed with the SEC on August 30, 2024, the Trust, the Sponsor, Osprey Bitcoin Trust (the “Osprey Trust”) and Osprey Funds, LLC, the sponsor of the Osprey Trust, entered into an Asset Purchase and Contribution Agreement (the “Asset Purchase Agreement”), pursuant to which the Osprey Fund will sell and the Trust will purchase all of the bitcoin owned by the Osprey Fund (the “Acquired Bitcoin”), and the Trust will issue an amount of Shares (the “Consideration Shares”) with a combined NAV equal to the value of the Acquired Bitcoin as determined by reference to the BRRNY (the “Asset Purchase”).

Consummation of the Asset Purchase is subject to the satisfaction or waiver of closing conditions that are contained in the Asset Purchase Agreement. These include, among others, (i) the effectiveness of the registration statement on Form S-1 the Trust filed with the SEC on October 8, 2024; (ii) Osprey Trust’s adoption of a Plan of Dissolution and Liquidation that provides for the dissolution and liquidation of the Osprey Trust following the sale of the Acquired Bitcoin to the Trust (the “Liquidating Distributions”); (iii) the receipt of a legal opinion regarding the tax-free nature of the Asset Purchase and the Liquidating Distributions; (iv) the receipt of approval for listing and trading the Consideration Shares on the Exchange; and (v) other customary conditions.

The Trust and the Sponsor expect the Asset Purchase to close in the fourth quarter of 2024.

18

Item 6. Exhibits.

Listed below are the exhibits, which are filed as part of this quarterly report on Form 10‑Q (according to the number assigned to them in Item 601 of Regulation S-K of the 1933 Act):

|

|

|

Exhibit Number |

|

Description of Document |

3.1 |

|

|

3.2 |

|

|

3.3 |

|

|

3.4 |

|

|

10.1 |

|

|

31.1 |

|

|

31.2 |

|

|

32.1* |

|

|

32.2* |

|

|

101.INS |

|

Inline XBRL Instance Document. The instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

101.SCH |

|

Inline XBRL Taxonomy Extension Schema Document |

104 |

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

* These exhibits are furnished with this Quarterly Report on Form 10-Q and are not deemed filed with the SEC and are not incorporated by reference in any filing of Bitwise Bitcoin ETF under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof, and irrespective of any general incorporation language contained in such filings.

19

GLOSSARY OF DEFINED TERMS

The following terms may be used throughout this Quarterly Report, including the consolidated financial statements and related notes.

1933 Act: The Securities Act of 1933.

Administrator: BNY Mellon.

Advisers Act: The Investment Advisers Act of 1940.

Agent Execution Model: The model whereby the Prime Execution Agent, acting in an agency capacity, conducts bitcoin purchases and sales on behalf of the Trust with third parties through its Coinbase Prime service pursuant to the Prime Execution Agreement.

Authorized Participant: One that purchases or redeems Baskets from or to the Trust.

BAM: Bitwise Asset Management, Inc., the parent company of the Sponsor.

Basket: A block of 10,000 Shares used by the Trust to issue or redeem Shares.

Basket Amount: The quantity of bitcoin attributable to each Share of the Trust (net of accrued but unpaid expenses and liabilities) multiplied by the number of Shares comprising a Basket (10,000)

Benchmark Provider: CF Benchmarks Ltd.

bitcoin (lowercase): The native unit of account and medium of exchange on the Bitcoin network.

Bitcoin (uppercase): The software protocol and peer-to-peer network used for the creation, transfer and possession of bitcoin, as recorded on the Bitcoin blockchain.

Bitcoin Custodian: Coinbase Custody Trust Company, LLC, a New York New York State limited liability trust company.

Bitcoin Custody Agreement: The custody agreement between the Bitcoin Custodian and the Trust pursuant to which the Trust Bitcoin Agreement is established.

Bitcoin Trading Counterparty: The bitcoin trading counterparties that have been approved by the Sponsor.

Bitlicense: The license required by NYSDFS for virtual currency business activity conducted in New York State. The term often is used to describe the regulations promulgated under the New York Banking Law that authorize such licensing process.

BNY Mellon: The Bank of New York Mellon, a national association bank in New York that serves as the Administrator and Transfer Agent.

BRR: CME CF Bitcoin Reference Rate.

BRRNY: CME CF Bitcoin Reference Rate - New York Variant, calculated by CF Benchmarks Ltd.and published by the CME Group, is the CF Bitcoin-Dollar US Settlement Price that determines the U.S. dollar price of one bitcoin as of 4:00 p.m. ET daily, based on aggregated executed trade flows from major bitcoin trading platforms.

Business Day: Any day other than a day when the Exchange or the New York Stock Exchange is closed for regular trading.

Cash Custodian: BNY Mellon.

Commodity Exchange Act: Commodity Exchange Act of 1936.

20

CFTC: Commodity Futures Trading Commission, an independent agency with the mandate to regulate commodity futures and options in the U.S.

CME: The Chicago Mercantile Exchange.

CME Bitcoin Real Time Price: The CME CF Bitcoin Real Time Index, a pricing index continuously published by the CME Group at one second intervals that calculates the U.S. dollar price of one bitcoin on constituent crypto asset trading platforms.

Code: Internal Revenue Code of 1986.

Constituent Platform: The major bitcoin trading platforms that serve as the pricing sources for the calculation of the CME CF Bitcoin Reference Rate – New York Variant and CME CF Bitcoin Real Time Index.

Cryptocurrency: A token such as bitcoin that is the native asset of a crypto asset network.

Crypto asset: A token, such as a cryptocurrency, that is the native asset of or issued on a digital asset network and secured using public private key cryptography or similar cryptographic credentials.

DTC: The Depository Trust Company, the securities depository for the Shares.

DTC Participant: An entity that has an account with DTC.

DSTA: Delaware Statutory Trust Act.

ERISA: Employee Retirement Income Security Act of 1974.

EST: Eastern Standard Time.

Exchange: NYSE Arca, Inc.

Exchange Act: The Securities Exchange Act of 1934.

FDIC: Federal Deposit Insurance Corporation.

FinCEN: The Financial Crimes Enforcement Network, a bureau of the U.S. Department of Treasury with the mandate to regulate financial institutions such as money services businesses in the U.S.

FINRA: Financial Industry Regulatory Authority, formerly the National Association of Securities Dealers.

Forked Asset: The crypto asset resulting from a “hard fork” that is not bitcoin, as determined by the Sponsor in its discretion as set forth in the Trust Agreement. The holder of bitcoin at the time of a Network Fork may use its Bitcoin network private key to access the Forked Asset on the new network, typically through the use of the modified version of the Bitcoin network software that created the Network Fork (or the legacy version of the Bitcoin network software if the new version is determined to be Bitcoin).

GAAP: The generally accepted accounting principles of the United States.

Incidental Right: A right to receive a benefit of a fork or airdrop.

Indemnified Person: The Trustee or any officer, affiliate, director, employee, or agent of the Trustee, for the purposes of indemnification provisions of the Trust Agreement.

Indirect Participants: Banks, brokers, dealers and trust companies that clear through or maintain a custodial relationship with a DTC Participant, either directly or indirectly.

21

Insignificant Participation Exception: An exception to the designation of certain assets under the Plan Asset Rules, where the investment by all benefit plan investors relating to such assets is not significant or other exceptions apply.

Investment Company Act: Investment Company Act of 1940.

IRA: An individual retirement account that is a tax-qualified retirement plan under the Code.

IR Asset: Any crypto asset acquired through an Incidental Right.

IRS: U.S. Internal Revenue Service.

ITV: Indicative Trust Value.

JOBS Act: The Jumpstart Our Business Startups Act.

Listing Application: The application for approval of a proposed rule change to list and trade Shares of the Bitwise Bitcoin ETP Trust under NYSE Arca Rule 8.201-E, as filed with the SEC by the Exchange on June 28, 2023, and subsequently amended on September 25, 2023 and January 5, 2024.

Losses: The losses, claims, taxes, damages, reasonable expenses, and liabilities (including liabilities under State or federal securities laws) of any kind and nature whatsoever of an Indemnified Person or Sponsor Indemnified Party, as applicable, that are eligible for indemnification pursuant to the Trust Agreement.

Marketing Agent: Foreside Financial Services, LLC.

NAV: Net asset value of the Trust, which is a Non-GAAP metric and is determined each business day by valuing the Trust’s bitcoin using the BRRNY, less the Trust’s accrued but unpaid expenses.

Network Fork: A proposed change to the open-source software and protocols of the Bitcoin network that results in the creation of two versions of the Bitcoin network – the version running the unmodified software and the version running the modified version. To the extent that a Network Fork creates Bitcoin networks or Bitcoin blockchains that are not interoperable, the Network Fork is referred to as a “hard fork” and results in separate Bitcoin networks with independent bitcoin assets and Bitcoin blockchains that diverge from the point of adoption of the Network Fork.

NYSDFS: The New York State Department of Financial Services, a state agency that regulates financial institutions under New York Banking Law.

OFAC: The Office Foreign Assets Control.

OTC: Over-the-counter, which refers to transactions that occur bilaterally between a purchaser and a seller, rather than through an exchange or clearing house.

Plan: An “employee benefit plan” as defined in, and subject to the fiduciary responsibility provisions of, ERISA or of a “plan” as defined in and subject to Section 4975 of the Code.

Plan Asset Rules: Rules promulgated pursuant to ERISA for determining when an investment by a Plan in an entity will result in the underlying assets of such entity being assets of the Plan for purposes of ERISA and Section 4975 of the Code.

Plan Fiduciaries: Fiduciaries with investment discretion over a Plan.

Prime Execution Agent: Coinbase Inc., an affiliate of the Bitcoin Custodian.

Prime Execution Agreement: The agreement between Coinbase Inc. and the Trust that sets forth the terms and conditions pursuant to which Coinbase Inc., and its affiliates, agree to open and maintain a prime broker account and provide services relating to trade execution.

22

Principal Market NAV: The net asset value of the Trust determined on a GAAP basis.

Publicly-Offered Security Exception: An exception to the designation of certain assets under the Plan Asset Rules, where such assets are publicly-offered securities.

Purchase Order: An order to purchase one or more Baskets.

Purchase Order Cut-Off Time: The time at which Purchase Orders must be placed on a Business Day for that Business Day to constitute the Purchase Order Date.

Purchase Order Date: The Business Day on which a Purchase Order is accepted by the Transfer Agent.

Redemption Order: An order to redeem one or more Baskets.

Redemption Order Cut-Off Time: The time at which Redemption Orders must be placed on a Business Day for that Business Day to constitute the Redemption Order Date.

Redemption Order Date: The Business Day on which a Redemption Order is accepted by the Transfer Agent.

Register: The record of all Shareholders and holders of the Shares in certificated form kept by the Transfer Agent.

SEC: The U.S. Securities and Exchange Commission, an independent agency with the mandate to regulate securities offerings and markets in the U.S.

Seed Shares: The four (4) Shares used to seed the Trust.

Seed Capital Investor: Bitwise Asset Management, Inc.

Shares: Common shares representing units of undivided beneficial ownership of the Trust.

Shareholders: Holders of Shares.

Sponsor: Bitwise Investment Advisers, LLC, a Delaware limited liability company, which controls the investments and other decisions of the Trust.

Sponsor Agreement: The agreement between the Sponsor and the Trust.

Sponsor Bitcoin Account: The custody account in the name of the Sponsor held with the Bitcoin Custodian, in which the Sponsor receives payment in bitcoin of its management fee from the Trust Bitcoin Account.

Sponsor Indemnified Party: The Sponsor and its shareholders, members, directors, officers, employees, Affiliates and subsidiaries, for the purposes of indemnification under the Trust Agreement.

Sponsor Fee: The unitary management fee of 0.20% per annum of the Trust’s bitcoin holdings the Trust agreed to pay to the Sponsor.

Trade Credit: The Trust may borrow bitcoin or cash as a credit on a short-term basis from the Trade Credit Lender pursuant to the Trade Financing Agreement.

Trade Credit Lender: Coinbase Credit, Inc.

Trade Financing Agreement: The Coinbase Post-Trade Financing Agreement.

Transfer Agent: BNY Mellon.

Trust: The Bitwise Bitcoin ETF.

23

Trust Agreement: The Amended and Restated Declaration of Trust and Trust Agreement of Bitwise Bitcoin ETF, entered into by the Sponsor and the Trustee.

Trust Bitcoin Account: The custody account in the name of the Trust held with the Bitcoin Custodian, in which Trust Bitcoin Account the Trust’s bitcoin assets are held.

Trust-Directed Trade Model: The model whereby the Sponsor purchases and sells bitcoin through the use of a Bitcoin Trading Counterparty.

Trustee: Delaware Trust Company, a Delaware trust company.

U.S.: The United States of America.

U.S. Treasury Department: The United States Department of the Treasury.

You: The owner or holder of Shares.

24

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Quarterly Report to be signed on its behalf by the undersigned in the capacities* indicated thereunto duly authorized.

Bitwise Investment Advisers, LLC, as Sponsor of Bitwise Bitcoin ETF |

|

|

|

By: |

/s/ Hunter Horsley |

|

Hunter Horsley |

|

President |

|

(Principal Executive Officer)* |

|

|

|

|

|

|

By: |

/s/ Paul Fusaro |

|

Paul Fusaro |

|

Chief Operating Officer |

|

(Principal Financial Officer and Principal Accounting Officer)* |

Date: November 8, 2024

* The registrant is a trust and the persons are signing in their capacities as officers or directors of Bitwise Investment Advisers, LLC, the Sponsor of the registrant.

25