UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to ______________

Commission File Number:

(Exact Name of Registrant as Specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|||

|

☑ |

|

Smaller reporting company |

|

||

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of November 5, 2024, the registrant had

Table of Contents

|

|

Page |

PART I. |

FINANCIAL INFORMATION |

|

Item 1. |

1 |

|

|

Condensed Consolidated Balance Sheets as of September 30, 2024 and December 31, 2023 |

1 |

|

2 |

|

|

3 |

|

|

5 |

|

|

6 |

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

24 |

Item 3. |

38 |

|

Item 4. |

38 |

|

PART II. |

OTHER INFORMATION |

|

Item 1. |

39 |

|

Item 1A. |

39 |

|

Item 2. |

39 |

|

Item 3. |

39 |

|

Item 4. |

39 |

|

Item 5. |

39 |

|

Item 6. |

40 |

|

41 |

||

i

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

Erasca, Inc.

Condensed Consolidated Balance Sheets

(In thousands, except share and par value amounts)

(Unaudited)

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2024 |

|

|

2023 |

|

||

Assets |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|||||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

||

Short-term marketable securities |

|

|

|

|

|

|

||

Prepaid expenses and other current assets |

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

||

Long-term marketable securities |

|

|

|

|

|

|

||

Property and equipment, net |

|

|

|

|

|

|

||

Operating lease assets |

|

|

|

|

|

|

||

Restricted cash |

|

|

|

|

|

|

||

Other assets |

|

|

|

|

|

|

||

Total assets |

|

$ |

|

|

$ |

|

||

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

|

|

$ |

|

||

Accrued expenses and other current liabilities |

|

|

|

|

|

|

||

Operating lease liabilities |

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

||

Operating lease liabilities, net of current portion |

|

|

|

|

|

|

||

Other liabilities |

|

|

|

|

|

|

||

Total liabilities |

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

Stockholders' equity: |

|

|

|

|

|

|

||

Preferred stock, $ |

|

|

|

|

|

|

||

Common stock, $ |

|

|

|

|

|

|

||

Additional paid-in capital |

|

|

|

|

|

|

||

Accumulated other comprehensive income |

|

|

|

|

|

|

||

Accumulated deficit |

|

|

( |

) |

|

|

( |

) |

Total stockholders' equity |

|

|

|

|

|

|

||

Total liabilities and stockholders' equity |

|

$ |

|

|

$ |

|

||

The accompanying notes are an integral part of these condensed consolidated financial statements.

1

Erasca, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except share and per share amounts)

(Unaudited)

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

||||||||||

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Operating expenses: |

|

|

|

|

|

|

|

|||||||||

Research and development |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

In-process research and development |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Loss from operations |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Interest income |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Other income (expense), net |

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Total other income (expense), net |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Net loss per share, basic and diluted |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Weighted-average shares of common stock used in computing net loss per share, basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Unrealized gain on marketable securities, net |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Comprehensive loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

Erasca, Inc.

Condensed Consolidated Statements of Stockholders’ Equity

(In thousands, except share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

Additional |

|

|

Other |

|

|

|

|

|

Total |

|

||||||

|

|

Common Stock |

|

|

Paid-in |

|

|

Comprehensive |

|

|

Accumulated |

|

|

Stockholders' |

|

|||||||||

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Income (Loss) |

|

|

Deficit |

|

|

Equity |

|

||||||

Balance at December 31, 2023 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||||

Exercise of stock options |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Vesting of early exercised stock options |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Unrealized loss on marketable securities, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

Balance at March 31, 2024 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

||||

Issuance of common stock in private placement, net of $ |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||||

Issuance of common stock in underwritten offering, net of $ |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||||

Exercise of stock options |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Issuance of common stock under the Employee Stock Purchase Plan |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Vesting of early exercised stock options |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Unrealized gain on marketable securities, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Balance at June 30, 2024 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

||||

Issuance of common stock in ATM offering, net of $ |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||||

Exercise of stock options |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Vesting of early exercised stock options |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Unrealized gain on marketable securities, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Balance at September 30, 2024 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||||

3

Erasca, Inc.

Condensed Consolidated Statements of Stockholders’ Equity - Continued

(In thousands, except share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

Additional |

|

|

Other |

|

|

|

|

|

Total |

|

||||||

|

|

Common Stock |

|

|

Paid-in |

|

|

Comprehensive |

|

|

Accumulated |

|

|

Stockholders' |

|

|||||||||

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Income (Loss) |

|

|

Deficit |

|

|

Equity |

|

||||||

Balance at December 31, 2022 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

||||

Exercise of stock options |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Vesting of early exercised stock options |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Unrealized gain on marketable securities, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Balance at March 31, 2023 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

||||

Exercise of stock options |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Issuance of common stock under the Employee Stock Purchase Plan |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Vesting of early exercised stock options |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Unrealized loss on marketable securities, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

Balance at June 30, 2023 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

||||

Exercise of stock options |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Vesting of early exercised stock options |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Unrealized gain on marketable securities, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Balance at September 30, 2023 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Erasca, Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

|

Nine Months Ended September 30, |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

||

Depreciation and amortization |

|

|

|

|

|

|

||

Stock-based compensation expense |

|

|

|

|

|

|

||

In-process research and development expenses |

|

|

|

|

|

— |

|

|

Accretion on marketable securities, net |

|

|

( |

) |

|

|

( |

) |

Impairment charge on operating lease assets and property and equipment |

|

|

|

|

|

— |

|

|

Impairment charge on investment in equity securities |

|

|

|

|

|

— |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

||

Prepaid expenses and other current and long-term assets |

|

|

( |

) |

|

|

( |

) |

Accounts payable |

|

|

|

|

|

|

||

Accrued expenses and other current and long-term liabilities |

|

|

|

|

|

( |

) |

|

Operating lease assets and liabilities, net |

|

|

( |

) |

|

|

|

|

Net cash used in operating activities |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

||

Cash flows from investing activities: |

|

|

|

|

|

|

||

Purchases of marketable securities |

|

|

( |

) |

|

|

( |

) |

Maturities of marketable securities |

|

|

|

|

|

|

||

In-process research and development |

|

|

( |

) |

|

|

( |

) |

Payment made for investment in equity securities |

|

|

( |

) |

|

|

— |

|

Purchases of property and equipment |

|

|

( |

) |

|

|

( |

) |

Net cash used in investing activities |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

||

Cash flows from financing activities: |

|

|

|

|

|

|

||

Proceeds from issuance of common stock in private placement, net of fees and expenses |

|

|

|

|

|

— |

|

|

Proceeds from issuance of common stock in underwritten offering, net of discounts and offering costs |

|

|

|

|

|

— |

|

|

Proceeds from issuance of common stock in ATM offering, net of commissions and expenses |

|

|

|

|

|

— |

|

|

Proceeds from the exercise of stock options |

|

|

|

|

|

|

||

Proceeds from issuance of common stock under the Employee Stock Purchase Plan |

|

|

|

|

|

|

||

Net cash provided by financing activities |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Net decrease in cash, cash equivalents and restricted cash |

|

|

( |

) |

|

|

( |

) |

Cash, cash equivalents and restricted cash at beginning of the period |

|

|

|

|

|

|

||

Cash, cash equivalents and restricted cash at end of the period |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

Supplemental disclosure of noncash investing and financing activities: |

|

|

|

|

|

|

||

Amounts accrued for purchases of property and equipment |

|

$ |

— |

|

|

$ |

|

|

Vesting of early exercised options |

|

$ |

|

|

$ |

|

||

Obligation accrued for investment in equity securities |

|

$ |

|

|

$ |

— |

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Erasca, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Note 1. Organization and basis of presentation

Organization and nature of operations

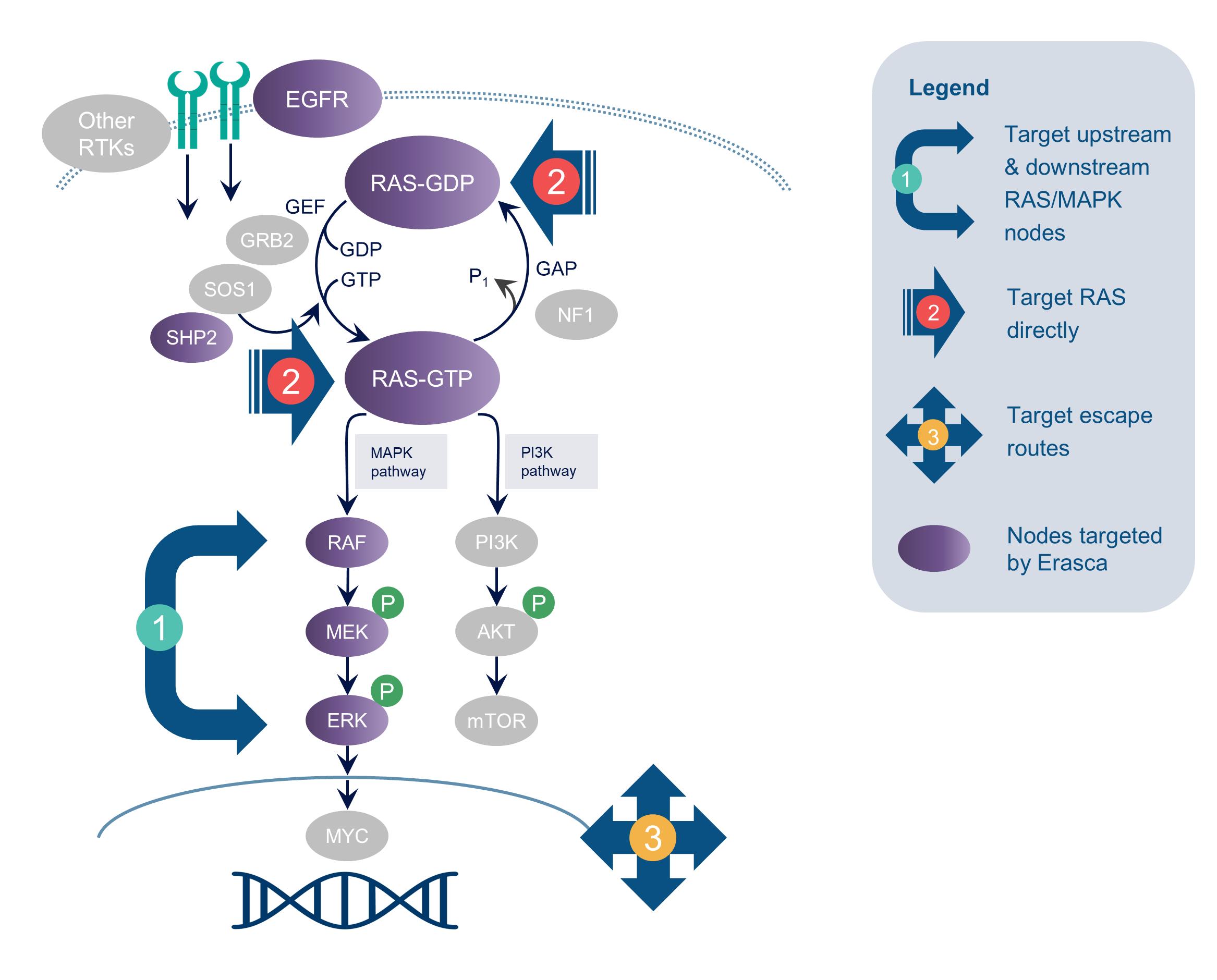

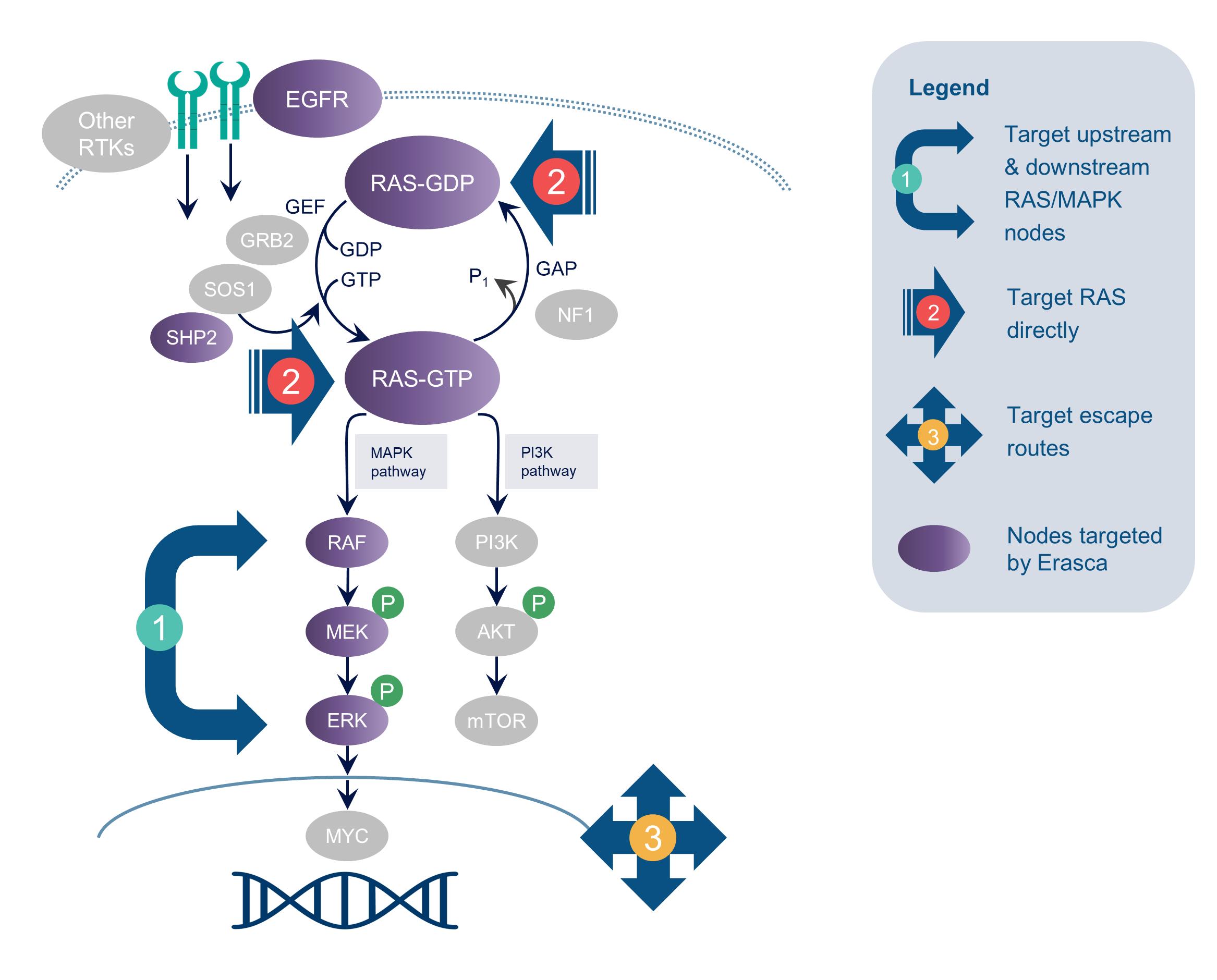

Erasca, Inc. (Erasca or the Company) is a clinical-stage precision oncology company singularly focused on discovering, developing, and commercializing therapies for RAS/MAPK pathway-driven cancers. The Company has assembled a wholly-owned or controlled RAS/MAPK pathway-focused pipeline comprising modality-agnostic programs aligned with its three therapeutic strategies of: (1) targeting key upstream and downstream signaling nodes in the RAS/MAPK pathway; (2) targeting RAS directly; and (3) targeting escape routes that emerge in response to treatment. The Company was incorporated under the laws of the State of Delaware on July 2, 2018, as Erasca, Inc., and is headquartered in San Diego, California. In September 2020, the Company established a wholly-owned Australian subsidiary, Erasca Australia Pty Ltd (Erasca Australia), in order to conduct clinical activities in Australia for its development candidates. In November 2020, the Company entered into an agreement and plan of merger with Asana BioSciences, LLC (Asana) and ASN Product Development, Inc. (ASN) (the Asana Merger Agreement), pursuant to which ASN became the Company's wholly-owned subsidiary. In March 2021, the Company established a wholly-owned subsidiary, Erasca Ventures, LLC (Erasca Ventures), to make equity investments in early-stage biotechnology companies that are aligned with the Company’s mission and strategy.

Since inception, the Company has devoted substantially all of its efforts and resources to organizing and staffing the Company, business planning, raising capital, identifying, acquiring and in-licensing the Company’s product candidates, establishing its intellectual property portfolio, conducting research, preclinical studies, and clinical trials, establishing arrangements with third parties for the manufacture of its product candidates and related raw materials, and providing general and administrative support for these operations. As of September 30, 2024, the Company had $

The Company expects to use its cash, cash equivalents, and marketable securities to fund research and development, working capital, and other general corporate purposes. The Company does not expect to generate any revenues from product sales unless and until the Company successfully completes development and obtains regulatory approval for any of its product candidates, which will not be for at least the next several years, if ever. Accordingly, until such time as the Company can generate significant revenue from sales of its product candidates, if ever, the Company expects to finance its cash needs through equity offerings, debt financings, or other capital sources, including potential collaborations, licenses or other similar arrangements. However, the Company may not be able to secure additional financing or enter into such other arrangements in a timely manner or on favorable terms, if at all. The Company’s failure to raise capital or enter into such other arrangements when needed would have a negative impact on the Company’s financial condition and could force the Company to delay, limit, reduce or terminate its research and development programs or other operations, or grant rights to develop and market product candidates that the Company would otherwise prefer to develop and market itself. The Company believes its cash, cash equivalents, and marketable securities as of September 30, 2024 will be sufficient for the Company to fund operations for at least one year from the issuance date of these condensed consolidated financial statements.

2024 ATM offering

During the three months ended September 30, 2024, the Company sold

6

2024 underwritten offering

In May 2024, the Company completed the sale and issuance of

2024 private placement

In March 2024, the Company entered into a stock purchase agreement with the purchasers named therein for the private placement of

Basis of presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with US generally accepted accounting principles (US GAAP) for interim financial information and pursuant to Form 10-Q and Article 10 of Regulation S-X of the Securities and Exchange Commission (SEC). Accordingly, they do not include all of the information and notes required by US GAAP for complete financial statements. Any reference in these notes to applicable guidance is meant to refer to US GAAP as found in the Accounting Standards Codification (ASC) and Accounting Standards Updates (ASU) promulgated by the Financial Accounting Standards Board (FASB). The Company’s condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, Erasca Australia, ASN, and Erasca Ventures. All intercompany balances and transactions have been eliminated.

Note 2. Summary of significant accounting policies

Use of estimates

The preparation of the Company’s condensed consolidated financial statements in conformity with US GAAP requires the Company to make estimates and assumptions that impact the reported amounts of assets, liabilities, expenses, and the disclosure of contingent assets and liabilities in the condensed consolidated financial statements and accompanying notes. Accounting estimates and management judgments reflected in the condensed consolidated financial statements include, but are not limited to, the accrual of research and development expenses, stock-based compensation expense, the fair value of long-lived assets, the fair value of equity investments and the incremental borrowing rate for determining the operating lease asset and liability. Management evaluates its estimates on an ongoing basis. Although estimates are based on the Company’s historical experience, knowledge of current events, and actions it may undertake in the future, actual results may ultimately materially differ from these estimates and assumptions.

Unaudited interim financial information

The accompanying condensed consolidated balance sheet as of September 30, 2024, the condensed consolidated statements of operations and comprehensive loss for the three and nine months ended September 30, 2024 and 2023, the condensed consolidated statements of stockholders’ equity for the three and nine months ended September 30, 2024 and 2023 and the condensed consolidated statements of cash flows for the nine months ended September 30, 2024 and 2023 are unaudited. The unaudited condensed consolidated interim financial statements have been prepared on the same basis as the audited annual consolidated financial statements and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary for the fair statement of the Company’s condensed consolidated financial position as of September 30, 2024 and the condensed consolidated results of its operations and cash flows for the three and nine months ended September 30, 2024 and 2023. The condensed consolidated financial data and other information disclosed in these notes related to the three and nine months ended September 30, 2024 and 2023 are unaudited. The condensed consolidated results for the three and nine months ended September 30, 2024 are not necessarily indicative of results to be expected for the year ending December 31, 2024, any other interim periods, or any future year or period. These unaudited condensed consolidated financial statements should be read in conjunction with the Company's audited consolidated financial statements included in its Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on March 27, 2024.

7

Concentration of credit risk and off-balance sheet risk

Financial instruments which potentially subject the Company to significant concentration of credit risk consist of cash and cash equivalents and marketable securities. The Company maintains deposits in federally insured financial institutions in excess of federally insured limits. The Company has not experienced any losses in such accounts, and management believes that the Company is not exposed to significant credit risk due to the financial position of the depository institutions in which those deposits are held. The Company’s investment policy includes guidelines for the quality of the related institutions and financial instruments and defines allowable investments that the Company may invest in, which the Company believes minimizes the exposure to concentration of credit risk.

Cash, cash equivalents and restricted cash

Cash and cash equivalents include cash in readily available checking and savings accounts and money market funds. The Company considers all highly liquid investments with an original maturity of three months or less from the date of purchase to be cash equivalents.

The Company had deposited cash of $

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the condensed consolidated balance sheets that sum to the total of the same amounts shown in the condensed consolidated statements of cash flows (in thousands):

|

September 30, |

|

|||||

|

2024 |

|

|

2023 |

|

||

Cash and cash equivalents |

$ |

|

|

$ |

|

||

Restricted cash |

|

|

|

|

|

||

Total cash, cash equivalents and restricted cash |

$ |

|

|

$ |

|

||

Marketable securities and investments

The Company classifies all marketable securities as available-for-sale, as the sale of such securities may be required prior to maturity. Management determines the appropriate classification of its marketable securities at the time of purchase. Marketable securities with original maturities beyond three months at the date of purchase and which mature at, or less than 12 months from, the balance sheet date are classified as short-term marketable securities. Available-for-sale securities are carried at fair value, with the unrealized gains and losses reported as accumulated other comprehensive income (loss) until realized. The amortized cost of available-for-sale debt securities is adjusted for amortization of premiums and accretion of discounts to maturity. Such amortization and accretion are included in interest income. The Company regularly reviews all of its marketable securities for declines in fair value. The review includes the consideration of the cause of the impairment, including the creditworthiness of the security issuers, the number of securities in an unrealized loss position, the severity of the unrealized loss(es), whether the Company has the intent to sell the securities and whether it is more likely than not that the Company will be required to sell the securities before the recovery of their amortized cost basis. If the decline in fair value is due to credit-related factors, a loss is recognized in net income; whereas, if the decline in fair value is not due to credit-related factors, the loss is recorded in other comprehensive income (loss). Realized gains and losses on available-for-sale securities are included in other income or expense. The cost of securities sold is based on the specific identification method. Interest and dividends on securities classified as available-for-sale are included in interest income.

Through its wholly-owned subsidiary, Erasca Ventures, the Company has also invested in equity securities of a company whose securities are not publicly traded and whose fair value is not readily available (see Notes 3 and 14). This investment is recorded using cost minus impairment, plus or minus changes in its estimated fair value resulting from observable price changes in orderly transactions for the identical or a similar investment of the same issuer. Investments in equity securities without readily determinable fair values are assessed for potential impairment on a quarterly basis based on qualitative factors. This investment is included in other assets in the Company's condensed consolidated balance sheets.

8

Fair value measurements

Certain assets and liabilities are carried at fair value under US GAAP. Fair value is defined as an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or liability. Financial assets and liabilities carried at fair value are classified and disclosed in one of the following three levels of the fair value hierarchy, of which the first two are considered observable and the last is considered unobservable:

Level 1—Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities.

Level 2—Quoted prices for similar assets and liabilities in active markets, quoted prices in markets that are not active, or inputs which are observable, either directly or indirectly, for substantially the full term of the asset or liability.

Level 3—Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (i.e., supported by little or no market activity).

Recently issued accounting pronouncements not yet adopted

From time to time, new accounting pronouncements are issued by the FASB or other standard setting bodies that the Company adopts as of the specified effective date. The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (JOBS Act) and has elected not to “opt out” of the extended transition related to complying with new or revised accounting standards, which means that when a standard is issued or revised and it has different application dates for public and nonpublic companies, the Company can adopt the new or revised standard at the time nonpublic companies adopt the new or revised standard and can do so until such time that the Company either (i) irrevocably elects to “opt out” of such extended transition period or (ii) no longer qualifies as an emerging growth company.

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which is intended to provide enhancements to segment disclosures, even for entities with only one reportable segment. In particular, the standard will require disclosures of significant segment expenses regularly provided to the chief operating decision maker and included within each reported measure of segment profit and loss. The standard will also require disclosure of all other segment items by reportable segment and a description of its composition. Finally, the standard will require disclosure of the title and position of the chief operating decision maker and an explanation of how the chief operating decision maker uses the reported measure(s) of segment profit or loss in assessing segment performance and deciding how to allocate resources. The standard is effective for annual periods beginning after December 15, 2023, and interim periods within annual periods beginning after December 15, 2024. Early adoption is permitted. Retrospective application to all prior periods presented in the financial statements is required. The Company is currently evaluating the impact of the standard on the presentation of its consolidated financial statements and related disclosures.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which is intended to provide enhancements to annual income tax disclosures. In particular, the standard will require more detailed information in the income tax rate reconciliation, as well as the disclosure of income taxes paid disaggregated by jurisdiction, among other enhancements. The standard is effective for the Company in its annual period beginning after December 15, 2025 and early adoption is permitted. The standard allows for adoption on a prospective basis, with a retrospective option. The Company is currently evaluating the impact of the standard on the presentation of its consolidated financial statements and related disclosures.

In November 2024, the FASB issued ASU No. 2024-03, Income Statement - Reporting Comprehensive Income - Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses, which is intended to improve the disclosures of expenses by providing more detailed information about the types of expenses in commonly presented expense captions. The standard is effective for annual reporting periods beginning after December 15, 2026, and interim reporting periods beginning after December 15, 2027. Early adoption is permitted. The standard can be applied either prospectively or retrospectively. The Company is currently evaluating the impact of the standard on the presentation of its consolidated financial statements and related disclosures.

9

Note 3. Fair value measurements

The following tables summarize the Company’s financial assets measured at fair value on a recurring basis and their respective input levels based on the fair value hierarchy (in thousands):

|

|

|

|

|

Fair value measurements as of September 30, 2024 using |

|

||||||||||

|

|

|

|

|

Quoted prices in |

|

|

Significant |

|

|

Significant |

|

||||

|

|

|

|

|

active markets |

|

|

other |

|

|

unobservable |

|

||||

|

|

September 30, |

|

|

for identical |

|

|

observable |

|

|

inputs |

|

||||

|

|

2024 |

|

|

assets (level 1) |

|

|

inputs (level 2) |

|

|

(level 3) |

|

||||

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Money market funds(1) |

|

$ |

|

|

$ |

|

|

$ |

— |

|

|

$ |

— |

|

||

Commercial paper(1) |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

||

US treasury securities(2) |

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

||

US government agency securities(2) |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

||

Corporate debt securities(2) |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

||

Commercial paper(2) |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

||

US treasury securities(3) |

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

||

US government agency securities(3) |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

||

Total fair value of assets |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

— |

|

|||

|

|

|

|

|

Fair value measurements as of December 31, 2023 using |

|

||||||||||

|

|

|

|

|

Quoted prices in |

|

|

Significant |

|

|

Significant |

|

||||

|

|

|

|

|

active markets |

|

|

other |

|

|

unobservable |

|

||||

|

|

December 31, |

|

|

for identical |

|

|

observable |

|

|

inputs |

|

||||

|

|

2023 |

|

|

assets (level 1) |

|

|

inputs (level 2) |

|

|

(level 3) |

|

||||

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Money market funds(1) |

|

$ |

|

|

$ |

|

|

$ |

— |

|

|

$ |

— |

|

||

US treasury securities(2) |

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

||

US government agency securities(2) |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

||

Corporate debt securities(2) |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

||

Commercial paper(2) |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

||

US treasury securities(3) |

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

||

Total fair value of assets |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

— |

|

|||

10

The carrying amounts of the Company’s financial instruments, including cash, prepaid expenses and other current assets, accounts payable and accrued expenses and other current liabilities, approximate fair value due to their short maturities. As of September 30, 2024 and December 31, 2023, the Company held $

Cash equivalents consist of money market funds and commercial paper, short-term marketable securities consist of US treasury securities, US government agency securities, corporate debt securities and commercial paper, and long-term marketable securities consist of US treasury securities and US government agency securities. The Company obtains pricing information from its investment manager and generally determines the fair value of marketable securities using standard observable inputs, including benchmark yields, reported trades, broker/dealer quotes, issuer spreads, two-sided markets, and bid and/or offers.

Note 4. Marketable securities

The following tables summarize the Company’s marketable securities accounted for as available-for-sale securities (in thousands, except years):

|

|

September 30, 2024 |

|

|||||||||||||||

|

|

Maturity |

|

Amortized |

|

|

Unrealized |

|

|

Unrealized |

|

|

Estimated |

|

||||

|

|

(in years) |

|

cost |

|

|

gains |

|

|

losses |

|

|

fair value |

|

||||

US treasury securities |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

US government agency securities |

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

||||

Corporate debt securities |

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

||||

Commercial paper |

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

||||

US treasury securities |

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

||||

US government agency securities |

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

||||

Total |

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||

|

|

December 31, 2023 |

|

|||||||||||||||

|

|

Maturity |

|

Amortized |

|

|

Unrealized |

|

|

Unrealized |

|

|

Estimated |

|

||||

|

|

(in years) |

|

cost |

|

|

gains |

|

|

losses |

|

|

fair value |

|

||||

US treasury securities |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

US government agency securities |

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

||||

Corporate debt securities |

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

||||

Commercial paper |

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

||||

US treasury securities |

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

||||

Total |

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||

11

The following tables present fair values and gross unrealized losses for those available-for-sale securities that were in an unrealized loss position as of September 30, 2024 and December 31, 2023, aggregated by category and the length of time that the securities have been in a continuous loss position (in thousands):

|

|

September 30, 2024 |

|

|||||||||||||||||||||

|

|

Unrealized losses less than 12 months |

|

|

Unrealized losses 12 months or greater |

|

|

Total |

|

|||||||||||||||

|

|

Fair value |

|

|

Unrealized losses |

|

|

Fair value |

|

|

Unrealized losses |

|

|

Fair value |

|

|

Unrealized losses |

|

||||||

US treasury securities |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

||

US government agency securities |

|

|

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

( |

) |

||

Corporate debt securities |

|

|

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

( |

) |

||

Commercial paper |

|

|

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

( |

) |

||

Total |

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|||

|

|

December 31, 2023 |

|

|||||||||||||||||||||

|

|

Unrealized losses less than 12 months |

|

|

Unrealized losses 12 months or greater |

|

|

Total |

|

|||||||||||||||

|

|

Fair value |

|

|

Unrealized losses |

|

|

Fair value |

|

|

Unrealized losses |

|

|

Fair value |

|

|

Unrealized losses |

|

||||||

US treasury securities |

|

$ |

|

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

$ |

( |

) |

||

US government agency securities |

|

|

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

( |

) |

||

Corporate debt securities |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

||

Commercial paper |

|

|

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

( |

) |

||

Total |

|

$ |

|

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

$ |

( |

) |

||

As of September 30, 2024, there were

As of September 30, 2024 and December 31, 2023, unrealized losses on available-for-sale securities are not attributed to credit risk. The Company believes that an allowance for credit losses is unnecessary because the unrealized losses on certain of the Company’s available-for-sale securities are due to market factors and changes in interest rates. Additionally, the Company does not intend to sell the securities nor is it more likely than not that the Company will be required to sell the securities before recovery of their amortized cost basis.

Accrued interest on the Company’s available-for-sale securities was $

12

Note 5. Property and equipment, net

Property and equipment, net consisted of the following (in thousands):

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2024 |

|

|

2023 |

|

||

Laboratory equipment |

|

$ |

|

|

$ |

|

||

Furniture and fixtures |

|

|

|

|

|

|

||

Leasehold improvements |

|

|

|

|

|

|

||

Computer equipment and software |

|

|

|

|

|

|

||

Property and equipment |

|

|

|

|

|

|

||

Less accumulated depreciation and amortization |

|

|

( |

) |

|

|

( |

) |

Property and equipment, net |

|

$ |

|

|

$ |

|

||

Depreciation and amortization expense related to property and equipment was $

Note 6. Accrued expenses and other current liabilities

Accrued expenses and other current liabilities consisted of the following (in thousands):

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2024 |

|

|

2023 |

|

||

Accrued research and development expenses |

|

$ |

|

|

$ |

|

||

Accrued compensation |

|

|

|

|

|

|

||

Unvested early exercised stock option liability |

|

|

— |

|

|

|

|

|

Accrued professional services |

|

|

|

|

|

|

||

Accrued property and equipment |

|

|

— |

|

|

|

|

|

Other accruals and current liabilities |

|

|

|

|

|

|

||

Total |

|

$ |

|

|

$ |

|

||

Note 7. Asset acquisitions

The following purchased assets were accounted for as asset acquisitions as substantially all of the fair value of the assets acquired were concentrated in a group of similar assets, and the acquired assets did not have outputs or employees. Because the assets had not yet received regulatory approval, the fair value attributable to these assets was recorded as in-process research and development expenses in the Company’s condensed consolidated statements of operations and comprehensive loss.

Asana BioSciences, LLC

In November 2020, the Company entered into the Asana Merger Agreement, pursuant to which ASN became its wholly-owned subsidiary. Asana and ASN had previously entered into a license agreement, which was amended and restated prior to the closing of the merger transaction (the Asana License Agreement, and collectively with the Asana Merger Agreement, the Asana Agreements), pursuant to which ASN acquired an exclusive, worldwide license to certain intellectual property rights relating to inhibitors of ERK1 and ERK2 owned or controlled by Asana to develop and commercialize ERAS-007 and certain other related compounds for all applications.

13

Under the Asana Merger Agreement, in 2020, the Company made an upfront payment of $

Note 8. License agreements

Novartis Pharma AG

In December 2022, the Company entered into an exclusive license agreement (as amended, the Novartis Agreement) with Novartis Pharma AG (Novartis) under which the Company was granted an exclusive, worldwide, royalty-bearing license to certain patent and other intellectual property rights owned or controlled by Novartis to develop, manufacture, use, and commercialize naporafenib in all fields of use. The Company has the right to sublicense (through multiple tiers) its rights under the Novartis Agreement, subject to certain limitations and conditions, and is required to use commercially reasonable efforts to commercialize licensed products in certain geographical markets.

The license granted under the Novartis Agreement is subject to Novartis’ reserved right to: (i) develop, manufacture, use, and commercialize compounds unrelated to naporafenib under the licensed patent rights and know-how, (ii) use the licensed patent rights and know-how for non-clinical research purposes, and (iii) use the licensed patent rights and know-how to the extent necessary to perform ongoing clinical trials and perform its obligations under existing contracts and under the Novartis Agreement.

Under the Novartis Agreement, the Company made an upfront cash payment to Novartis of $

Guangzhou Joyo Pharmatech Co., Ltd

In May 2024, the Company entered into an exclusive license agreement (the Joyo License Agreement) with Guangzhou Joyo Pharmatech Co., Ltd. (Joyo) under which the Company was granted an exclusive, worldwide (except mainland China, Hong Kong, and Macau), royalty-bearing license to certain patent and other intellectual property rights owned or controlled by Joyo to develop, manufacture, and commercialize certain pan-RAS inhibitors in all fields of use. The Company has an option to expand the territory of the license to include mainland China, Hong Kong and Macau by making a $

The license granted under the Joyo License Agreement is subject to Joyo’ reserved right to develop, manufacture, use, and commercialize licensed products in mainland China, Hong Kong and Macau, unless the Company exercises its option to expand the license to include mainland China, Hong Kong and Macau.

14

Under the Joyo License Agreement, the Company made an upfront cash payment to Joyo of $

The Joyo License Agreement will expire upon the last to expire royalty term, which is determined on a licensed product-by-licensed product and country-by-country basis, and is the later of: (i) ten years from the date of first commercial sale for the licensed product in such country, (ii) the last to expire valid claim within the licensed patent rights covering such licensed product, or (iii) the expiration of all regulatory exclusivity for the licensed product in such country. Upon expiration of the Joyo License Agreement, on a licensed product-by-licensed product and country-by-country basis, the license granted to the Company with respect to such product in such countries shall be deemed to be fully paid-up, royalty-free, non-terminable, irrevocable and perpetual.

The Joyo License Agreement may be terminated in its entirety by either party in the event of an uncured material breach by the other party or in the event the other party becomes subject to specified bankruptcy, insolvency, or similar circumstances. Joyo may terminate the Joyo License Agreement in the event that the Company or its affiliates or any of its or their sublicensees institutes, prosecutes or otherwise participates in any challenge to the licensed patents. The Company may terminate the Joyo License Agreement in its entirety at any time upon the provision of prior written notice to Joyo.

Upon termination of the Joyo License Agreement for any reason, all rights and licenses granted to the Company will terminate. In addition, the licenses granted to Joyo under certain patent and other intellectual property rights owned or controlled by the Company to develop, manufacture, use, and commercialize the licensed products in mainland China, Hong Kong and Macau will survive the termination of the Joyo License Agreement for any reason, unless the Company exercises its option to expand the license to include mainland China, Hong Kong and Macau, in which case such licenses to Joyo will terminate automatically; and Joyo has an option to negotiate a license under any patent rights, know-how, or other intellectual property rights relating to the licensed products that are owned or controlled by the Company for the purpose of developing, manufacturing and commercializing the licensed products in the Company’s territory on terms to be negotiated between the parties.

Medshine Discovery Inc.

In May 2024, the Company entered into an exclusive license agreement (the Medshine License Agreement) with Medshine Discovery Inc. (Medshine) under which the Company was granted an exclusive, worldwide, royalty-bearing license to certain patent and other intellectual property rights owned or controlled by Medshine to develop, manufacture, and commercialize certain pan-KRAS inhibitors in all fields of use. The Company has the right to sublicense (through multiple tiers) its rights under the Medshine License Agreement, subject to certain limitations and conditions, and is required to use commercially reasonable efforts to commercialize licensed products in certain geographical markets.

Under the Medshine License Agreement, the Company made an upfront cash payment to Medshine of $

The Medshine License Agreement will expire upon the last to expire royalty term, which is determined on a licensed product-by-licensed product and country-by-country basis, and is the later of: (i) ten years from the date of first commercial sale for the licensed product in such country, (ii) the last to expire valid claim within the licensed patent rights covering such licensed product, or (iii) the expiration of all regulatory exclusivity for the licensed product in such country. Upon expiration of the Medshine License Agreement, on a licensed product-by-licensed product and country-by-country basis, the license granted to the Company with respect to such product in such countries shall be deemed to be fully paid-up, royalty-free, non-terminable, irrevocable and perpetual.

The Medshine License Agreement may be terminated in its entirety by either party in the event of an uncured material breach by the other party or in the event the other party becomes subject to specified bankruptcy, insolvency, or similar circumstances.

15

Medshine may terminate the Medshine License Agreement in the event that the Company or its affiliates or any of its or their sublicensees commences or actively and voluntarily participates in any challenge to the licensed patents. The Company may terminate the Medshine License Agreement in its entirety at any time upon the provision of prior written notice to Medshine.

Upon termination of the Medshine License Agreement for any reason, all rights and licenses granted to the Company will terminate. In addition, upon termination of the Medshine License Agreement by Medshine for cause, Medshine has an option to negotiate a license under any patent rights, know-how, or other intellectual property rights relating to the licensed products that are owned or controlled by the Company for the purpose of developing, manufacturing and commercializing the licensed products on terms to be negotiated between the parties.

Katmai Pharmaceuticals, Inc.

In March 2020, the Company entered into a license agreement (the Katmai Agreement) with Katmai Pharmaceuticals, Inc. (Katmai) under which the Company was granted an exclusive, worldwide, royalty-bearing license to certain patent rights and know-how controlled by Katmai related to the development of small molecule therapeutic and diagnostic products that modulate EGFR and enable the identification, diagnosis, selection, treatment, and/or monitoring of patients for neuro-oncological applications to develop, manufacture, use, and commercialize ERAS-801 and certain other related compounds in all fields of use.

Under the Katmai Agreement, the Company made an upfront payment of $

NiKang Therapeutics, Inc.

In February 2020, the Company entered into a license agreement (the NiKang Agreement) with NiKang Therapeutics, Inc. (NiKang) under which the Company was granted an exclusive, worldwide license to certain intellectual property rights owned or controlled by NiKang related to certain SHP2 inhibitors to develop and commercialize ERAS-601 and certain other related compounds for all applications.

Under the NiKang Agreement, in 2020, the Company made an upfront payment of $

As of September 30, 2024 and December 31, 2023, no milestones are accrued for any license agreements as the underlying contingencies are not probable or estimable.

16

Note 9. Stock-based compensation

In July 2021, the Company’s board of directors adopted and the Company’s stockholders approved the Company’s 2021 Incentive Award Plan (the 2021 Plan), which became effective in connection with the IPO. Upon the adoption of the 2021 Plan, the Company ceased making equity grants under its 2018 Equity Incentive Plan (the 2018 Plan). Under the 2021 Plan, the Company may grant stock options, restricted stock, restricted stock units, stock appreciation rights, and other stock or cash-based awards to individuals who are then employees, officers, directors or non-entity consultants of the Company. A total of

Subsequent to July 2021,

Options granted are exercisable at various dates as determined upon grant and will expire no more than

Stock options

A summary of the Company’s stock option activity under the 2021 Plan and 2018 Plan is as follows (in thousands, except share and per share data and years):

|

|

|

|

|

|

|

|

Weighted- |

|

|

|

|

||||

|

|

|

|

|

Weighted- |

|

|

average remaining |

|

|

Aggregate |

|

||||

|

|

|

|

|

average |

|

|

contractual |

|

|

intrinsic |

|

||||

|

|

Shares |

|

|

exercise price |

|

|

term (years) |

|

|

value |

|

||||

Outstanding at December 31, 2023 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

||||

Granted |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Exercised |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|||

Canceled |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|||

Outstanding at September 30, 2024 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

||||

Options exercisable at September 30, 2024 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

||||

The weighted-average grant date fair value of options granted for the three and nine months ended September 30, 2024 was $

17

Prior to the Company's IPO, certain individuals were granted the ability to early exercise their stock options. The shares of common stock issued from the early exercise of unvested stock options are restricted and continue to vest in accordance with the original vesting schedule. The Company has the option to repurchase any unvested shares at the original purchase price upon any voluntary or involuntary termination. The shares purchased by the employees and non-employees pursuant to the early exercise of stock options are not deemed, for accounting purposes, to be outstanding until those shares vest. The cash received in exchange for exercised and unvested shares related to stock options granted is recorded as a liability for the early exercise of stock options on the accompanying condensed consolidated balance sheets and will be transferred into common stock and additional paid-in capital as the shares vest. As of September 30, 2024 and December 31, 2023, there were

The assumptions used in the Black-Scholes option pricing model to determine the fair value of the employee and nonemployee stock option grants were as follows:

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

||||

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

Risk-free interest rate |

|

|

|

|

||||

Expected volatility |

|

|

|

|

||||

Expected term (in years) |

|

|

|

|

||||

Expected dividend yield |

|

|

|

|

||||

Effective May 21, 2024, and in accordance with the terms of the 2021 Plan, the Company's board of directors approved a stock option repricing (the Option Repricing) whereby the exercise price of each Repriced Option (as defined below) was reduced to $

To the extent a Repriced Option is exercised prior to the Premium End Date (as defined below), the eligible employee will be required to pay the original exercise price per share of the Repriced Options in connection with any exercise of the Repriced Option. The “Premium End Date” means the earliest of (i) May 21, 2026; (ii) the date of a change in control of the Company; (iii) the date of the eligible employee’s death or disability; or (iv) the date of the eligible employee’s termination without cause, provided that such termination without cause occurs after May 21, 2025. Except for the reduction in the exercise prices of the Repriced Options as described above, the Repriced Options will retain their existing terms and conditions as set forth in the 2021 Plan and the applicable award agreements. All repriced options will retain their original vesting schedule.

The Option Repricing resulted in $

18

Employee stock purchase plan

In July 2021, the Company’s board of directors adopted and the Company’s stockholders approved the Company's 2021 Employee Stock Purchase Plan (the ESPP), which became effective in connection with the IPO. The ESPP permits participants to contribute up to a specified percentage of their eligible compensation during a series of offering periods of

The assumptions used in the Black-Scholes option pricing model to determine the fair value of the stock to be purchased under the ESPP were as follows:

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

||||

|

|

2024(1) |

|

2023(1) |

|

2024 |

|

2023 |

Risk-free interest rate |

|

|

|

|

||||

Expected volatility |

|

|

|

|

||||

Expected term (in years) |

|

-- |

|

-- |

|

|

||

Expected dividend yield |

|

|

|

|

||||

Stock-based compensation expense

The allocation of stock-based compensation for all stock awards was as follows (in thousands):

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

||||||||||

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Research and development |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Common stock reserved for future issuance