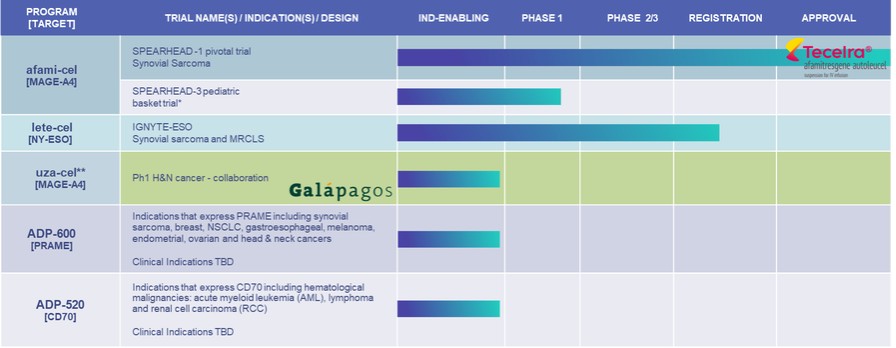

Clinical and Pre-clinical Pipeline

*Synovial sarcoma, Malignant Peripheral Nerve Sheath Tumor (MPNST), Neuroblastoma, Osteosarcoma, Temporary suspension of enrolment as per protocol in SPEARHEAD-3 trial

**uzatresgene autoleucel, formerly ADP-A2M4CD8; SURPASS Ph 1 and SURPASS-3 trials are no longer enrolling. Adaptimmune and Galapagos to conduct a clinical proof-of- concept trial to evaluate the safety and efficacy of uza-cel produced on Galapagos’ decentralized manufacturing platform in patients with

head & neck cancer

We have a pediatric trial ongoing in the US in tumors expressing the MAGE-A4 antigen. Enrollment in this trial has been temporarily suspended as per protocol. Enrollment in our other ongoing clinical trials has ceased or been closed including the SURPASS-3 Phase 2 Trial in ovarian cancer.

We are currently focusing our preclinical pipeline on the development of T-cell therapies directed to PRAME (ADP-600) and CD70 (ADP-520).

| ● | PRAME is highly expressed across a broad range of solid tumors including ovarian, endometrial, lung and breast cancers. We are developing TCR T-cells directed to PRAME, with the initial candidate (ADP-600) currently in preclinical testing and next-generation candidates being developed over the longer term. |

| ● | The CD70 program targets the CD70 antigen which is expressed across a range of hematological malignancies (acute myeloid leukemia and lymphoma) and solid tumors (renal cell carcinoma). We are using TRuC technology to develop a T-cell therapy (ADP-520) against CD70, with membrane bound IL-15 to enhance persistence. ADP-520 is currently in pre-clinical testing. |

Corporate News

On September 23, 2024, we announced the entry into the Mutual Release Agreement between Adaptimmune and Genentech Inc and F. Hoffmann-La Roche Ltd. This Agreement amongst other things resolves and releases each party from any and all past, present and future disputes, claims, demands and causes of action, whether known or unknown, related to the Genentech Collaboration Agreement in any way. Under the terms of the Mutual Release Agreement the Collaboration Agreement is terminated and Genentech will pay $12.5 million.

On May 14, 2024, we entered into the Loan Agreement with several banks and other financial institutions or entities and Hercules Capital for a Term Loan of up to $125.0 million. The Tranche 1 advance of $25.0 million was drawn on the closing date of the Loan Agreement. The Tranche 2 advance was received on August 13, 2024 following the receipt of FDA approval for Tecelra.

28