美国

证券交易委员会

华盛顿特区 20549

表格

根据1934年证券交易法第13条或第15(d)项的年度报告 |

截至财政年度:

或

根据1934年证券交易法第13或15(d)条款的过渡报告 |

在过渡期间从_到_

委员会档案编号:

(依凭章程所载的完整登记名称)

|

||

(依据所在地或其他管辖区) 的注册地或组织地点) |

|

(国税局雇主 识别号码) |

(总办事处地址,包括邮递区号)

(

(注册人电话号码,包括区号)

根据法案第12(b)条规定注册的证券:

每种类别的名称 |

交易 标的 |

每个注册交易所的名称 |

根据登记的证券

根据法案第12(g)条:无

用勾选符号表示,申报人是否为《证券法》第405条规定的知名成熟发行人?

请以勾选表示,证券登记人根据法案第13条或第15(d)条的规定不需要提交报告。是 ☐

请用勾选标记指示注册人是否:(1) 在过去的12个月内(或注册人被要求提交此类报告的较短期间内)根据1934年证券交易法第13条或第15(d)条提交了所有必要的报告,以及 (2) 在过去90天内是否受到了此类提交要求。

请在核对号勾选方块以指出是否在过去12个月(或注册人所需提交此类档案的较短期间内)按照Regulation S-t的405条款的规定,已电子方式提交所需提交的每个互动数据档案。

请标示出通过勾选标记表明是否该申报人是大型加速存取者、加速存取者、非加速存取者还是较小型报告公司。 请参见交易法120亿2条中“大型加速存取者”、“加速存取者”和“较小型报告公司”的定义。

☑ |

加速汇编申报人 |

☐ |

非加速文件提交者 |

☐ |

小型报告公司 |

||

|

|

|

|

|

|

新兴成长型企业 |

如果一家新兴成长型公司,请用勾选标记表示该申报人已选择不使用根据证交所法案13(a)条款提供的任何新的或修订过的财务会计准则的延长过渡期。 ☐

请以勾选方式表示,登记人是否根据萨班斯-豪利法第404(b)条(美国15 U.S.C. 7262(b)条)要求,由准备或发布其审计报告的注册公众会计师对其内部控制效能进行评估并作出证明。

如果证券根据本法案第12(b)条注册,请在方框内打勾,以指示登记者在文件中包含的财务报表是否反映了对先前发行的财务报表的错误进行了更正。

请在方框内勾选是否有任何这些错误修正是需要根据§240.10D-1(b)进行的激励性补偿的回收分析的重新陈述,该补偿是由任何注册公司在相关回收期间的高层管理人员所收到的。 ☐

请勾选是否申报公司为空壳公司(按照法规定义第120亿2条)。是 ☐ 没有

非关联方持有的我们表决权股票的总市值约为$

参考文件

与2025年股东年会相关的最终委托书声明的部分内容被引用至第三部分。 2025年股东年会(2025年的委托书) 已被引用至第三部分。

ptc inc.

2024财年第10-k表格年度报告

目录 内容

|

|

页面 |

|

|

|

项目 1。 |

||

项目1A。 |

||

项目10亿。 |

||

项目1C。 |

||

项目2。 |

||

项目3。 |

||

项目4。 |

||

|

|

|

项目5。 |

||

第6项。 |

||

第7项。 |

||

第7A项。 |

||

第8项。 |

||

第9项。 |

||

第9A条款。 |

||

项目 90亿。 |

||

项目9C。 |

||

|

|

|

第10项。 |

||

项目11。 |

||

项目12。 |

||

第13项 |

||

第14项 |

||

|

|

|

项目 15。 |

||

第16项。 |

||

|

|

|

|

独立注册会计师事务所的报告 (普华永道会计师事务所,波士顿,麻萨诸塞州,PCAOb ID: |

|

|

||

|

||

|

|

|

关于前瞻性陈述的警语

本年度报告中包含根据1933年证券法第27A条和1934年证券交易法第21E条修订案的前瞻性陈述。我们打算使这些前瞻性陈述受到1995年私人证券诉讼改革法中关于前瞻性陈述安全港条款的保护。特别是,非历史事实的陈述,包括但不限于有关我们预期的财务结果、资本发展和增长、股份回购、我们的环保母基倡议以及我们产品、市场和员工队伍的发展的陈述,属于前瞻性陈述。这些前瞻性陈述通常透过使用「相信」、「预期」、「打算」、「期待」、「估计」、「预测」或类似的用语,无论是正面还是负面,来明确识别。前瞻性陈述基于我们目前的计划、期望和假设,并不是对未来绩效的保证。可能导致我们实际结果与这些陈述有实质不同的因素包括但不限于本年度报告中的「风险因素」以及其他地方讨论的风险和不确定性。这些因素等,可能对我们的业务、营运和财务状况产生实质不利影响。我们提醒读者切勿过度依赖任何前瞻性陈述,这些陈述仅于之前的日期具有效力。我们不承诺更新任何前瞻性陈述以反映该陈述发出之日后出现的事件或情况。

除非另有说明,所有提及的年份均反映截至9月30日结束的财政年度。

网站参考

本年度报告中提及我们PTC.com网站以及我们将于2025年初发布的2024年影响报告,仅供方便查阅。 除非明确说明,PTC.com上的内容和我们2024年影响报告的内容未纳入本年度报告。

第I部分

项目 1. 商务业务

我们的业务

PTC是一家全球软体公司,可以帮助制造商和产品公司在数位转型中重新设计、制造和维护全球所依赖的实体产品。总部位于马萨诸塞州波士顿,PTC拥有超过7,000名员工,并在全球支援超过30,000名客户。

我们主要服务于以下行业板块的客户:

我们的客户致力于在全球竞争和产品复杂度增加的情况下提升竞争力,我们的软体套件提供是实现这一目标及数位转型计划的战略推动者。我们帮助客户建立坚实的产品数据基础,并利用该基础推动跨部门合作,加速新产品的推出周期,提供更高的产品质量。

我们的产品包括用于产品数据编辑的CAD(计算机辅助设计)解决方案,以及用于产品数据管理和流程协调的PLM(产品生命周期管理)解决方案。

1

在整体PLm类别中,我们的产品还包括ALm(应用程式生命周期管理)和SLm(服务生命周期管理)。

鉴于我们的产品组合范围广泛且开放,我们可以支持端到端的数位线索计划,这些计划利用设计、制造业、服务和最终重用过程中连接的产品数据流。数位线索使产品公司能够打破信息孤岛,简化工作流程,并通过单一的真实版本实现部门、职能和系统之间的互操作性。它还确保了产品相关数据的质量、一致性和可追溯性,确保数据是最新的、可访问的、可靠的和可行动的。有了数位线索,正确的数据能在正确的时间和正确的上下文中,传递给价值链中的正确人员。

我们的业务基于订阅模式,2024年的93%营业收入具有持续性。与永久授权模式相比,我们的订阅模式自然能够推动更高的客户参与度和留存率,并提供更佳的业务预测性。这反过来使我们能够进行稳定且持续的投资,以追求中长期的增长机会。

我们的主要产品和服务

PLm软体产品用于产品数据管理和流程管控

我们的 风冷® PLm应用程式组合管理从概念到服务和生命周期结束的所有产品开发生命周期方面。Windchill提供实时信息共享、动态数据可视化和跨地理分布团队合作的能力,让制造商提升其产品开发、制造、现场服务和生命周期流程。

我们 Codebeamer® 和 pure::variantsTm 应用程式生命周期管理 (ALM) 解决方案使公司能加速开发包含软体的产品,这些产品包括需在产品生命周期内创建和更新多个软体变体的软体定义产品。

我们的 ServiceMax® 服务生命周期管理 (SLM) 解决方案使企业能够通过优化的现场和远程服务提高资产正常运行时间,利用最新的移动工具提升技术人员的生产力,并提供可靠的数据来支持决策。

我们 服务物流® 服务零部件管理解决方案使企业能够有效管理其服务零部件库存,从而优化设备可用性和正常运行时间,并提高客户满意度。

我们的 竞技场® 软体即服务(saas-云计算)PLm解决方案让产品团队能随时随地进行虚拟协作,更容易与内部团队和供应链合作伙伴分享最新的产品和品质信息,从而更快地向客户交付创新产品。我们的Arena品质管理系统软体将品质和产品设计融入一个系统,以简化监管遵循。

用于产品数据创建的CAD软体产品

我们的 Creo® 3D CAD科技使数位设计、测试及修改产品模型成为可能。凭借其设计模拟、增材制造及生成设计的创新,我们使客户能够最先进入市场,推出差异化产品。在从最初的概念板块到设计、模拟和分析的过程中,Creo为设计师提供了创新的工具,以高效地创造更好的产品,并加快速度。

2

我们的 Onshape® saas-云计算产品开发平台结合了计算机辅助设计、数据管理、协作工具及实时分析。这是一个云原生的多租户解决方案,能够在几乎任何计算机或移动设备上即时部署,Onshape使团队能够从几乎任何地方一起工作。实时设计评审、评论和同时编辑使得协作工作流程成为可能,让多个设计迭代可以并行完成并合并到最终设计中。

推动科技

我们的主要产品和服务透过一系列的先进技术得以增强,包括我们的saas-云计算版本的 Creo® CAD和 Windchill® PLm软体、人工智能软体,以及我们的 ThingWorx® 物联网软体,以及我们的 Vuforia® 增强现实软体。这些技术的主要重点是为我们的主要产品和服务提供附加价值的能力,例如改善saas-云计算平台的安防和协作环境;利用人工智能提升生产力;使用物联网在工程、制造业及服务之间更快地传输产品数据;或自动分析制造产品的质量,使用增强现实。

我们的市场及我们如何应对

我们的策略旨在为客户创造价值,提高我们的年运行率(ARR)和现金流量,并为股东提供长期价值。我们将资源集中在以下五个解决方案上,我们认为可以创造最大的客户价值:

我们的增长主要是由现有客户驱动,他们持续扩大他们在PTC的影响力,这在很大程度上与他们通过数字转型提高竞争力的关注有关。在较小程度上,我们的增长也受到新客户和价格上涨的支持。

我们大约75%的业务来自由我们的业务销售团队直接向最终用户客户销售的产品和服务。其余的产品和服务销售通过第三方经销商进行。我们的业务销售团队专注于大户,而我们的经销商渠道提供一种经济高效的方式来覆盖中小型企业市场。我们的战略经销商和软体合作伙伴使我们能够扩大市场覆盖范围,提供更广泛的解决方案,并为我们的产品增加具有说服力的技术。我们的战略服务合作伙伴提供服务方案,帮助客户实施我们的产品方案并转向saas-云计算。

有关我们国际和国内业务的额外财务信息,可以在 附注 3. 来自客户的合同营业收入 的基本报表附注中找到,本信息已纳入本年度报告的引用中。

竞争

我们与众多公司竞争,这些公司的产品涵盖我们解决方案所涉及的一个或多个特定功能领域。对于企业CAD和PLm解决方案,我们与欧特克、达索系统SA和西门子(adr)等大型知名公司竞争。对于我们的ALm产品,我们与IBm、Jama Software, Inc.和西门子(adr)竞争。对于我们的SLm产品,我们与甲骨文、SAP和IFS Ab等企业软体公司以及提供专案解决方案的公司竞争。

3

专有权利

我们的软体产品和相关技术专有知识,以及我们的商标,包括我们的公司名称、产品名称和标志,皆具专有性。我们依赖版权、商标、专利和普通法保护等途径来保护这些项目的知识产权权利。这些法律保护的性质和程度部分取决于知识产权权利类型和相关司法管辖区。在美国,通常我们能够保持我们的商标注册,只要商标仍在使用中,并能保持我们的专利长达自最早有效申请日起的20年。我们还使用授权管理和其他防盗版技术措施,以及合约限制,以阻止未经授权使用和分发我们的产品。

我们的专利权受到项目1A描述的风险和不确定性的影响。 风险因素 下面所述的内容已纳入本节。

环保母基

在PTC,我们致力于为全球货币的去碳化和循环经济做出贡献。虽然我们有一个气候行动计划,承诺减少我们公司的「足迹」,但我们认为从我们的软体产品所带来的「手印」将产生更大的好处。我们的软体解决方案使制造商能够以更可持续的方式设计、建造和维护他们的产品。

足迹

我们的减排计划于2024年9月获得科学基准目标倡议(SBTi)的认证。我们的短期承诺是在2030年前,将范畴1(由拥有/控制的业务产生的直接排放)和范畴2(间接能源使用)的排放量减少50%,并与2022年的基准相比,将范畴3 - 类别1(购买商品和服务)的排放量减少25%。我们的长期净零排放承诺是到2050年实现所有范畴排放的净零,范畴1至3的绝对减少超过90%,并根据需求为剩余10%(或更少)提供经认证的碳去除抵消。

我们已经开始实施项目并追求减少排放和碳足迹的举措,包括:

手印

环保母基的可持续性是我们产品提供的重要部分。通过我们的软件,制造商可以在可持续发展和合规性方面提供支持,包括使用更少的材料进行设计、增强产品的可修复性和循环性、提高工厂效率以及实现远程服务。

4

人民与文化

在我们的工作环境中,我们寻求建立一个公平和包容的文化,使所有员工都能蓬勃发展。这是我们人才策略的一个关键方面。我们的做法专注于促进灵活的文化、提升归属感、参与的工作环境以及高效的团队。

5

PTC 一览

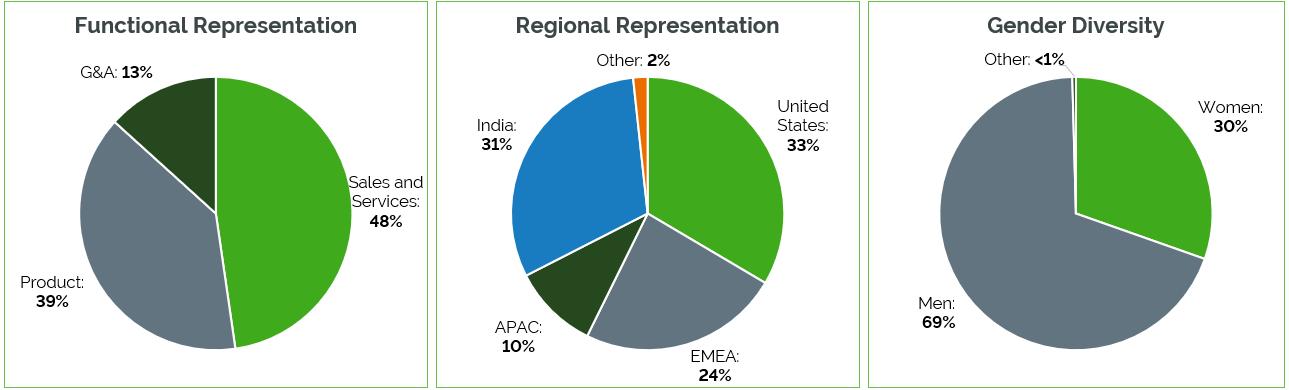

截至2024年9月30日,PTC拥有7501名全职员工。我们的员工结构在地理上多元化,为一个地理多元的客户和合作伙伴网络提供服务。

全球员工代表

美国员工代表

6

薪酬和福利

PTC提供全面且具竞争力的薪酬和福利方案,旨在吸引、留住、激励和培养全球人才,包括基本薪酬以及对符合条件的角色提供的奖励和股权报酬。员工也有机会通过我们的员工股票购买计划以优惠价购买PTC股票。

我们的福利方案旨在满足全球员工及其家庭的需求。由于文化规范、市场动态和法律要求的不同,各国的具体方案各有不同,但我们提供多种核心健康和财务计划,如医疗保健、生命和残疾保险、员工援助计划、养老储蓄和退休金福利计划,以及慷慨的家庭带薪假和假期。

人才培养与员工参与

随著我们专注于提升员工体验,我们正在加大对员工的投资,以创造有意义的课堂机会,让他们成长、发展和推进职业生涯。我们有特定的发展计划和辅导计划,以及许多其他自我主导的学习路径。多样化的期权意味著员工能够专注于对他们最有意义的发展路径。

多样性、公平性和包容性(DEI)

我们对价值观和多样性在我们的员工队伍中的承诺得到了各种持续努力的支持。我们通过指导经理和领导人来减轻偏见,帮助创造心理上安全的环境。我们还根据来自员工脉搏调查的反馈和参与分数来审查和修改我们的流程。我们将公平的实践融入到我们吸引、选拔、培养和保留人才的计划和执行中。与此同时,我们的DEI大使与业务功能保持一致,以增强并加强我们在这些领域的努力。最后,为培养一个归属感社区,我们的11个员工资源组织促进包容性文化,并为员工提供安全空间,以应对社会问题和挑战。

关于我们员工倡议的附加资讯

您可以在我们2024年影响报告中找到有关我们员工倡议的更多信息,我们预计将于2025年初发布该报告。

可用信息

我们在网站 www.ptc.com 上免费提供以下报告,并在合理可行的情况下,于电子提交或提供给美国证券交易委员会(SEC)后尽快上线:我们的年度报告(Form 10-K);我们的季度报告(Form 10-Q);我们的即时报告(Form 8-K);以及根据1934年证券交易法第13(a)或15(d)条提交或提供的修订报告。我们的股东大会委任书及第16条交易报告的SEC表格3、4和5也可在我们的网站上查阅。

企业信息

PTC于1985年在麻萨诸塞州成立,总部设在麻萨诸塞州波士顿。

7

ITEm 1A. Ri风险因素

我们已确定以下是可能影响我们证券投资的重要因素。您在评估对PTC证券的投资时应仔细考虑这些因素,因为这些因素可能导致实际结果与历史结果或任何前瞻性声明存在重大差异。以下所描述的风险并不是我们面临的唯一风险。还有一些额外的风险和不确定性,这些风险和不确定性目前对我们而言是未知的,或我们目前认为无关紧要的,也可能对我们的业务、财务控制项、运营结果及前景造成重大不利影响。

I. 关于我们业务运营和行业板块相关的风险

我们面临著激烈的竞争,如果我们无法成功竞争,可能会对我们的业务、财务状况、营运成果和前景产生不利影响。

我们产品和解决方案的市场正迅速变化,面临激烈竞争、破坏性科技发展、不断演变的分销模式以及进入障碍日益降低的情况。如果我们无法提供符合客户需求、以及竞争对手所提供的产品和解决方案般的产品和解决方案,或者不能对其定价、授权和交付模式与客户偏好相符,我们可能失去客户和/或未能吸引新客户,进而对我们的业务、财务状况、营运结果和前景产生不利影响。

例如,对于 saas概念 的客户需求正在增加。虽然我们的Arena、ServiceMax和Onshape解决方案是云端原生的 saas概念,并且我们已经推出了Windchill+、Creo+和Kepware+ saas概念,但客户可能不会像我们预期的那样采用它们。如果我们无法成功与提供 saas概念 的竞争对手竞争,我们可能会失去客户以及/或者无法吸引新客户,这可能会对我们的业务、财务状况、经营结果和前景造成不利影响。

我们目前及潜在的竞争对手的区间从大型和成熟的公司到新兴的初创企业。我们的一些竞争对手和潜在竞争对手在我们所服务的市场上具有更高的知名度,以及更强的财务、技术、销售和行销及其他资源,这可能限制我们获得客户认可和信恳智能于我们的产品和解决方案的能力,并成功卖出我们的产品和解决方案,这可能对我们的业务增长能力造成不利影响。

我们的产品或电脑系统,或我们第三方服务供应商的安全漏洞,可能会损害我们产品的完整性,导致数据丢失,损害我们的声誉,产生额外的责任,并对我们的业务、财务状况、经营成果及前景产生不利影响。

我们已经实施并持续实施旨在维护我们产品、原始码和IT系统安全和完整性的措施。随著企图进行的网络攻击和入侵的范围、数量、强度和复杂程度不断增加,安全漏洞或系统中断的可能性也急剧增加-特别是设计用于访问和外泄信息、干扰并锁定系统以要求赎金支付目的的网络攻击和入侵。我们无法消除成功进行网络攻击或入侵的风险;实际上,我们经常处理安全问题,不时遭遇安全事件。因此,存在网络攻击或入侵将取得成功的风险,并且该事件将具有重大影响。

此外,我们向客户提供saas-云计算业务和一些产品,包括我们的SaaS产品,是由第三方服务提供商托管的,这会让我们面临额外的风险,因为客户专有数据的存储库可能成为攻击目标,使得网路攻击或入侵有可能成功并造成重大损失。数据变速器的截取、盗用或修改、数据的损坏以及对我们服务提供商的攻击可能对我们的产品或产品和服务交付造成不利影响。对我们或我们的服务提供商未检测到的恶意程式码、病毒或漏洞可能会导致我们的业务运营发生中断,对我们在云环境中开发和提供的产品产生不成比例的影响。

8

尽管我们投入资源以维护我们产品和系统的安防与完整性,以及对我们的第三方服务供应商进行适当尽职调查,但仍然发生过对我们的业务或我们客户未造成重大影响的安全漏洞,而我们将继续面对网络安全概念的威胁和暴露。对我们的产品或系统,或我们第三方服务供应商的安防和/或完整性发生重大违规,无论是故意还是由于我们员工或其他人的人为错误,都可能会干扰我们的业务运营或客户的业务运营,可能会阻止我们的产品正常运行,可能会使访问我们客户的敏感、专有或机密信息,或使访问我们自身的敏感、专有或机密信息。这可能需要我们承担重大调查、修复和/或付款赎金的成本;损害我们的声誉;使客户停止购买我们的产品;并使我们面临诉讼和潜在责任,这些都可能对我们的业务、财务状况、营运结果和前景产生重大不利影响。

我们拥有庞大的生态系统,包括策略伙伴、科技伙伴和软体伙伴及系统整合商,这使我们能够提升我们的产品和服务,扩展市场触及范围,并加速客户的数字转型旅程。这些伙伴的失败或关系的终止可能会对我们的业务、财务控制项、经营结果和前景造成不利影响。

我们与其他公司有许多战略、科技和软体合作伙伴及系统整合商关系,这些公司提供我们将嵌入解决方案中的技术和软体,提供给我们的客户实施服务,与我们合作提供互补的解决方案和服务,以及市场推广和卖出我们的解决方案。如果这些公司未能如我们期望的表现,或若有一家公司终止或实质变更关系条款,我们可能会遇到产品开发的延误、销售减少或延迟、客户不满意、额外费用,而我们的业务、财务状况、营运结果和前景可能会受到重大不利影响。

我们越来越依赖第三方的云基础建设服务提供商,以便在我们的平台上向用户数提供我们的产品,而对这些服务的任何中断或干扰都可能对我们的业务、财务控制项、经营结果和前景产生不利影响。

我们持续增长的一部分取决于现有和潜在客户能否在合理时间内使用和访问我们的云服务或网站,以便下载我们的软体或软体的加密访问密钥。我们使用许多我们无法控制的第三方服务提供商来提供我们基础设施的关键元件,特别是开发和交付我们基于云的产品。使用这些服务提供商使我们在高效地提供更加量身定制、可扩展的客户体验方面具有更大的灵活性,但也让我们承受额外的风险和漏洞。第三方服务提供商运营他们自己的平台,我们访问这些平台,因此容易受到他们的服务中断的影响。由于我们第三方服务提供商基础设施出现问题,我们可能会不时遇到服务和可用性中的中断、延迟和故障。此基礂设施缺乏可用性可能是由于多种潜在原因所致,包括技术故障、自然灾害、诈骗或我们无法预测或防止的安全攻击。这种中断可能会对我们的业务、财务状况、营运结果和前景产生不利影响。

如果我们无法按商业合理条件续订与云服务提供商的协议,或任何协议被提前终止,或需要新增云服务提供商以增加容量和运作时间,我们可能会遇到中断、停机、延误和与转移到和提供新平台相关的额外费用。上述任何情况或事件均可能损害我们的声誉和品牌,降低我们平台的可用性或使用率,并损害我们吸引新用户的能力,任何这些均可能对我们的业务、财务状况、营运结果和前景产生不利影响。

9

我们可能无法招聘或留住拥有必要技能的员工来运营和发展我们的业务,这可能会对我们的竞争能力造成不利影响,并对我们的业务、财务控制项、经营结果和前景产生不利影响。

我们的成功取决于我们吸引和留住高技能员工来研发和卖出我们的产品和解决方案,以及营运和拓展我们的业务。在我们的行业中,全球对这些员工的竞争十分激烈。

如果我们无法吸引和留住具备必要技能的员工以开发和卖出我们的产品与解决方案,或是来指导、操作和支持我们的业务,我们可能无法成功竞争,这将对我们的业务、财务状况、营运结果及前景产生不利影响。

我们取决于离散制造业板块内的销售,如果制造业活动不增长、收缩,或者制造商受其他宏观经济因素的不利影响,我们的业务可能会受到不利影响。

我们的大部分销售量来自离散制造业板块的客户。 全球制造商持续面临关于全球宏观环境的不确定性,原因包括早期和持续的供应链干扰效应、高利率和通胀、波动的汇率期货以及美元汇率当前相对强势,以及美国政府专注于与非美国实体的科技交易。 由于这些挑战和担忧,客户可能因此延迟、减少或放弃购买我们解决方案,这可能不利影响我们的业务、财务状况、营运结果和前景。

如果我们未能成功转变业务以支持saas概念的销售并开发具竞争力的saas概念,我们的业务和前景可能会受到不利影响。

将我们的业务转型为提供和支持saas概念,需要对我们的组织进行相当大量的额外投资。我们能否成功并实现我们的业务和财务目标,取决于风险和不确定因素,包括但不限于:我们进一步发展和扩展制造行业的能力,我们将功能和可用性纳入这些提供中以满足客户需求的能力,我们以及我们的合作伙伴将现有客户实施过渡到saas的能力,客户需求,附加和续订率,渠道采用率和成本。如果我们无法成功建立这些新的提供并顺利转型我们的业务,我们的业务、财务状况、营运结果和前景可能会受到不利影响。

由于我们的销售和运营遍布全球,我们面临额外的合规风险,任何合规失败都可能对我们的业务和前景造成不利影响。

我们在许多法律和实践各异且可能受到意外变更的国家,销售和交付软体及服务,并维持压力位操作。管理这些地理分散的业务需要大量的关注和资源,以确保遵守这些国家和美国对我们在非美国国家的活动的法律要求。

这些法律包括但不限于反腐败法律和法规(包括美国《境外腐败行为法》(FCPA)和英国《2010年贿赂法》)、数据隐私法律和法规(包括欧盟的《一般数据保护条例》)、交易和经济制裁法规(包括由美国财政部外国资产控制办公室、美国国务院、美国商务部、联合国安全理事会及其他制裁机构执行的法律)。由于我们业务的市场进入方式主要依赖合作伙伴生态系统,所营运的一些国家存在更高的腐败和诈骗业务行为风险,我们向政府和国有企业卖出商品,全球各地法律的执行力度也大为提升,因此我们的合规风险更加显著。

10

因此,尽管我们努力维护全面的合规计划,但员工、代理商或业务伙伴可能违反我们的政策或美国或其他适用法律,正如过去发生过的情况,或者我们可能不慎违反这些法律。对涉嫌违反这些法律的调查可能既昂贵又具破坏性。违反这些法律可能导致民事和/或刑事起诉、巨额罚款和其他制裁,包括撤销我们继续某些业务操作的权利,也会造成业务损失和声誉损害,进而可能不利影响我们的业务、财务状况、营运结果和前景。

我们和我们的客户面临越来越多与可持续性相关的法律法规,遵守这些法律法规可能会对我们的业务、财务状况、经营业绩和前景产生不利影响。

我们受到越来越多来自多个国家和司法管辖区的法律法规的制约,这些法律法规要求我们对可持续发展话题进行新的和广泛的披露,并在某些情况下进行不良影响的补救,这将增加我们的合规成本,并使我们面临与合规相关的风险。

这些法律法规包括根据欧盟的企业可持续性报告指令(“CSRD”)及其企业可持续性尽职调查指令(“CSDDD”)颁布的规定。CSRD要求提供与可持续性风险和机遇相关的新和扩展的披露。CSDDD将要求我们进行尽职调查,以识别、防范、减轻及记载我们自身运营及价值链中对人权和环境产生的实际和潜在的不利影响,并对任何此类不利影响进行补救。遵守这些指令需要对资源进行大量投资,包括实施新的报告系统、数据收集流程和尽职调查程序。

由于我们许多客户和潜在客户,特别是在德国及其他欧盟国家的客户,也需遵守这些法律和指令,这些公司将越来越需要评估我们的可持续发展努力和影响;如果我们无法令人满意地满足他们对信息或其他可持续发展相关请求的要求,则与这些公司的合同期限可能会延长,或者这些公司可能选择使用其他供应商或交换供应商,这可能会对我们的业务、财务状况、经营业绩和前景产生不利影响。

可持续性的监管环境不断演变和扩展,引入额外的法律或监管要求可能导致进一步的遵循负担并进一步增加我们的合规成本。我们致力于满足现有和未来的监管要求;然而,现行和未来法律法规的财务和运营影响仍存在不确定性,而且可能对我们的业务、财务状况、营运结果和前景产生重大不利影响。

对环保母基、社会及治理(“esg”)事项的加强审查和期望可能需要我们承担额外费用,或否则不利地影响我们的声誉、业务和前景。

我们的利益相关者,包括投资者、客户、供应商和员工,对我们的esg表现和透明度越来越重视。这种对esg事宜,特别是可持续性事宜的利益相关者关注和期望的增加,以及我们对此的回应,可能会导致更高的成本(包括与合规、利益相关者参与和合同有关的更高成本),对我们的声誉造成不利影响,或在其他方面对我们的业务表现和前景产生负面影响。

我们对于可持续发展、环保和人力资本计划和目标,以及对这些目标的进度的陈述,可能是基于仍在发展中的衡量进展标准、持续演进的内部控制和流程,以及可能变动的假设。如果我们相关的数据、处理和报告不完整或存在错误,或者如果我们无法如期达成我们所述的目标或计划,我们的业务、财务状况、营运结果和前景可能会受到不利影响。

11

II. 与我们的知识产权相关的风险

我们可能无法充分保护我们的专有权利,这可能会对我们的业务和前景产生不利影响。

我们的软体产品是专有的。我们通过依赖版权、商标、专利和普通法保护等措施来保护这些项目中的知识产权,其中包括商业秘密保护,以及我们与其他方面的协议中包含的披露和转让限制。尽管我们采取了这些措施,但所有相关司法管辖区的法律可能无法给予我们的产品和其他知识产权足够的保护。此外,我们经常遭遇个人和公司尝试盗版我们的软体。如果我们保护知识产权的措施失败,其他人可能能够使用这些权利,这可能会降低我们的竞争力并对我们的业务、财务状况、营运结果和前景产生不利影响。

此外,我们可能提起或参与的任何法律行动以保护我们的知识产权,可能会产生高昂的成本,分散管理层对日常运营的注意力,并可能导致对我们的额外索赔,而我们可能无法成功,所有这些都可能对我们的业务、财务控制项、经营结果和前景产生不利影响。

对我们可能提出知识产权侵权索赔,这可能耗费庞大支出来进行辩护,可能导致对所宣称的知识产权使用的限制,并可能不利影响我们的业务和前景。

软体行业板块的特征是经常涉及关于版权、专利及其他智慧财产权的诉讼。我们不时会面临这类诉讼。任何此类索赔都可能会给我们带来巨额的费用,并使我们的技术和管理人员的努力分散。我们无法确定自己能够在任何此类主张中胜诉。如果我们未能胜诉,我们可能会被禁止使用所主张的智慧财产,或被要求签订版税或授权协议,而这些协议可能无法以我们可以接受的条款获得。除了可能针对我们专有产品的索赔外,我们的一些产品还包含由第三方开发并授权的科技,我们同样可能受到针对这些第三方科技的侵权索赔。

12

III. 与收购相关的风险

我们收购的业务可能无法产生我们预期的销售和收益,并可能对我们的业务和前景产生不利影响。

我们已经收购了,并打算继续收购新的业务和技术。如果我们未能成功整合和管理我们收购的业务和技术,或者如果某项收购不能进一步支持我们的业务策略或如我们预期的那样带来销售额,或者如果我们收购的业务存在意外的法律或财务负债,我们的业务、财务状况、营运成果和前景可能会受到负面影响。

在整合和运营收购业务时,我们可能会遇到的问题类型包括:

此外,如果我们未能实现预期的投资回报,可能会影响我们在收购中记录的无形资产和商誉,这可能需要我们对这些资产的价值进行减记。

我们可能会承担大量债务或发行大量的债务或股权证券来融资收购,这可能会对我们的运营灵活性、业务和前景产生不利影响。

如果我们需要承担大量债务——无论是透过我们的信用设施借款或其他方式,或是发行新债券——以资助收购,我们的利息支出、债务服务要求和杠杆将大幅增加。这些支出和我们的杠杆的增加可能会限制我们的运作能力,或者借贷更多的资金,并可能对我们的业务、财务状况、运营结果和未来展望产生不利影响。

如果我们在收购中发行大量股权证券,现有股东将会被稀释,并且我们的股价可能会下跌。

13

IV. 与我们的负债相关的风险

我们庞大的负债可能对我们的业务、财务状况、营运结果和前景产生不利影响,以及影响我们履行债务支付义务的能力。

我们有相当多的负债。截至2024年11月14日,我们的总未偿债务约为1,668美元。 其中有10亿美元与2020年2月发行的3.625%高级票据和4.000%高级票据(统称“高级票据”)有关,分别于2025年和2028年到期,并且是无抵押品;其中有17700万美元是在2028年1月到期的信用设施循环授信中借入的;另有49100万美元是在2024年3月开始摊销的信用设施定期贷款中借入的。所有在信用设施和高级票据下的未偿金额将在各自的到期日全部到期和偿还。截至2024年11月14日,我们在信用设施下有约107300万美元的未使用承诺。PTC Inc和我们的一家外国附属公司符合信用设施的借款条件,某些其他外国附属公司将来可能成为我们信用设施的借款人,须符合一定条件。

具体来说,我们的债务水平可能:

上述任何因素均有可能对我们的业务、财务状况、营运结果和前景产生不利影响,并影响我们履行债务协议下的付款义务能力。

尽管我们目前的负债水平,我们和我们的子公司可能会承担更多的债务和其他义务。 这可能进一步加剧上述我们业务、财务状况和前景的风险。

我们及我们的子公司将来可能承担重大的额外负债和其他负担,包括有担保的债务。尽管管理我们授信设施的信贷协议对额外负债的承担设有限制,但这些限制受到许多限制和例外的条件的影响。根据这些限制合规性所承担的额外负债可能是相当可观的。此外,管理我们到期日为2025年和2028年的高级票据的信贷协议和债券不会阻止我们承担不构成负债的负担。如果新增的

14

若我们增加债务水平,或承担其他义务,则我们目前面临的相关风险可能会增加。

我们可能无法产生足够的现金来偿还所有的债务,并可能被迫采取其他行动来满足我们在债务下的义务,这些行动可能不会成功,并可能损害我们的业务和前景。

我们有能力按期支付或再融资债务,取决于我们的财务状况和营运表现,这受到当前经济和竞争环境以及某些财务、业务、立法、监管和其他因素的影响,其中有些是我们无法控制的。我们可能无法维持来自营运活动的现金流量水平,使我们有能力支付我们的负债的本金,溢价(如果有的话)以及利息。

如果我们的现金流和资本资源不足以支持我们的债务支付义务,我们可能面临重大流动性问题,可能被迫减少或延迟投资和资本支出,或出售重要资产或业务,寻求额外的债务或股权资本,或重组或再融资我们的债务。我们可能无法以商业上合理的条件或根本无法采取任何这样的替代措施,即使成功,这些替代措施可能无法使我们履行预定的债务支付义务。我们的债务协议限制我们处置资产和使用这些处置所得的收益,也可能限制我们筹集用于偿还其他到期债务的债务或股权资本的能力。到期时,我们可能无法完成这些处置或获得足够的款项以满足当时到期的任何债务支付义务。

我们无法产生足够的现金流以满足我们的债务偿还,或无法以商业上合理条件或完全重新筹资我们的债务,将会显著不利地影响我们履行债务的能力。

如果我们无法按计划偿还债务,我们将会违约,贷款机构根据我们的信贷设施可能会终止他们的贷款承诺,贷款机构可能会对担保其借款的资产进行没收,我们的高级票据持有人可能会宣布所有未偿还的本金、溢价(如果有的话)和利息到期并需支付,而我们可能会被迫进入破产或清算。这些事件可能导致您的投资损失。

我们必须遵守我们债务协议下的某些财务和营运契约。任何不遵守这些契约的情况都可能导致借款金额立即到期且需支付,并且/或者阻止我们在信贷设施下借款。

我们必须遵守我们债务协议下指定的财务和经营契约,并按约定偿还债务,这限制了我们按照其他方式运营业务的能力。我们未能遵守任何这些契约或未满足任何债务偿还义务可能会导致违约事件的发生,若未得以治愈或豁免,则所有未偿金额,包括任何应计利息和/或未支付费用,将立即到期并应予偿还。如果这些义务被提前要求偿还,我们可能没有足够的营运资金或流动性来满足任何偿还义务。此外,如果我们在希望借贷资金时未遵守信贷设施下的财务和经营契约,我们将无法借贷资金以推进某些企业计划,包括战略性收购,这可能会对我们的业务和前景产生不利影响。

15

五、与我们普通股相关的风险

我们的股价一直波动不定,这可能使得在有利的时间和价格重新出售股份变得更加困难。

软体公司证券的市场价格通常波动性较大,并且可能受到与这些公司的业务表现无关或不成比例的重大波动的影响。因此,软体公司的股票以及我们公司的交易价格和估值可能无法预测。公众对软体公司、PTC或我们所服务市场的前景的负面看法变化,可能会使我们的股票价格下跌,尽管我们的业务结果良好。

此外,我们的普通股份大部分由机构投资者持有。这些投资者对我们的普通股的购买和卖出可能对我们的股价产生重大影响。

如果我们的营运结果未达市场或分析师的期望,我们的股价可能会下跌。

我们的季度营运结果因许多因素波动,包括ASC 606对我们提供的贵公司软体订阅的营业收入认定的影响,我们订阅产品提供的开始控制项日期的变动性,合约期限和续约,以及季度中的重大意外费用。因此,我们的季度结果难以预测,且在该季度结束前,我们可能无法确认或调整对于该季度营运结果的期望。如果我们的季度营运结果未达到市场或分析师的预期,我们的股价可能会下跌。

VI. 一般风险因素

我们的国际业务存在经济和营运风险,可能会对我们的业务和前景产生不利影响。

我们预期我们的国际业务将继续扩大并占我们总营业收入的重要部分。由于我们在各种外币中进行业务交易,汇率的波动已对我们的营业收入、费用、现金流和营运业绩产生过且将来可能会产生重大不利影响。

我们国际业务所面临的其他风险包括但不限于以下:

16

我们可能会承担额外的税务责任,我们的有效税率可能会增加或波动,这可能会增加我们的所得税支出,降低我们的净利润,并增加我们的税务支付义务。

作为一家跨国组织,我们在美国和各个外国司法管辖区都需缴纳所得税以及非所得税。在确定我们的全球所得税费用和其他税务负债时需要做出重大判断。在开展全球业务的正常过程中,存在许多跨公司交易和计算,最终税务确定具有不确定性。我们的税务申报需接受各种征税机构的审查。虽然我们认为我们的税务估计是合理的,但税务审查或税务争议的最终决定可能有别于我们报告的所得税费用和应计项。

我们的有效税率和税务支付义务可能会受到多个因素的不利影响,其中许多是我们无法控制的,包括:

17

ITEm 10亿. 未解决的Staff 意见

无。

1C项目。网络安全概念

我们的业务面临各种网络安全概念风险。 有关我们与网络安全概念相关的风险的更多信息,请参见本年报第1A项中标题为「与我们的业务运营和行业板块相关的风险」的部分。

我们的方法

PTC采取全面、多层次的网络安全和隐私方法,将传统的军工股方法与下一代的Zero Trust原则相结合。在今天全球互联的世界中,我们认为攻击面上的每个入口都至关重要,并且我们的目标是保护我们控制的点。在制定我们的网络安全风险管理计划时,我们参考行业基准和标准,包括美国国家标准和技术研究所(NIST)所创建的网络安全框架。此外,我们还拥有各种与安全相关的认证和授权,包括ISO 27001、SOC 2 Type II和FedRAMP,适用于我们的某些产品和服务。

人员PTC认识到单靠科技还不能完全消除所有安防威胁,因此我们专注于开发我们最关键的资源:我们的人才。安防是PTC所有员工的责任,与部门隶属无关。PTC的企业网络安全概念意识活动结合整个企业和部门特定工具以及强制性的员工培训,为所有受雇于PTC的人提供知识和资源,以支援我们消除安防威胁的努力。

处理. 受过教育的员工需要一个治理框架来指导和监督其活动。PTC有相关的流程和政策,旨在预测安防风险,并促进对适用的合约义务、法规和标准的遵守,同时处理任何事件或违规行为。PTC专注于持续改进,并不断完善其流程,以跟上快速演变的网络安全概念威胁环境。

科技. PTC寻求自动化这些流程,并在可行的范围内消除人为错误的潜在可能性,通过实施科技解决方案。从基本的安防到我们软体产品的开发,再到保护客户数据在云端的安全,PTC旨在维持一个安全的制造行业,并持续监控可能的威胁。

这三个关键元素——人、流程和科技——紧密相互交织,以支持我们确保环境和数据安全的目标。

治理

网络安全概念是一个风险领域,受到组织最高层的监督,包括执行层和董事会层级。整体运营计划由网络安全概念策略委员会主导,这是一个由高层管理人员和专业领域专家组成的跨职能团队,包括我们的首席产品安全官、首席信息安全官和首席合规官。网络安全概念策略委员会监督「三条线模型」的运营、风险监控和监督,以及审计,以有效应对网络安全概念、风险管理和控制。所有网络安全概念、风险和内部审计功能均向PTC执行领导团队报告。

18

PTC的网络安全概念计划在所有层面都受到坚实的流程和程序的支持。我们的矩阵式网络安全概念组织受行业标准框架的管理,为确保其执行,我们让执行领导团队、网络安全概念策略委员会,以及业务单元的安防主管和网络安全概念分析师参与涵盖整个企业的工作。我们定期向董事会的网络安全概念委员会提供我们的网络安全概念战略计划、项目和倡议的最新资讯,以及漏洞和相关的补救措施,每年在其定期举行的四次会议上。我们的事件应变计划提供通知,及时继续更新,以及向网络安全概念委员会提供有关适用事件的持续更新。持续进行计划评估以监测进展并确定增长机会。

风险评估

PTC每年进行网络安全概念成熟度评估。我们定期聘请第三方安防顾问公司进行企业安防成熟度评估。这项独立评估为我们的当前风险状况提供了基准机制,并使我们能够衡量在改进计划过程中的进展。识别出的网络安全概念风险由网络安全概念策略委员会进行审查,以确保设立风险容忍度并合理管理风险。

第三方供应商风险管理

我们的供应商风险管理(VRM)计划支持PTC满足其网络安全概念、隐私、监管和合规义务,并管理与有权访问PTC IT系统和数据的第三方厂商相关的风险。在将外包或允许第三方访问PTC或客户系统、知识产权或数据之前,与此类活动相关的风险需明确识别和记录。选择第三方厂商的过程包括对该厂商服务或产品的尽职调查。使用PTC设施或访问PTC的IT系统的第三方公司需接受PTC的VRM审查,并在访问任何PTC IT系统或数据之前,必须证明已采取适当的安防措施。所有此类厂商须经PTC的VRM流程批准,并在合约上约束维持适当的网络安全技术和组织措施,并保护他们可能访问的PTC数据。

事件响应

PTC保持严谨的网络安全概念事件应对政策,以应对网络安全概念事件。该政策定期进行测试,包括通过定期桌面练习进行持续改进项目。网络安全概念事件处理由拥有网络安全概念责任的单位负责管理,并由相关公司功能监督/指导。根据此政策制定的所有网络安全概念事件应对计划均基于行业标准,例如NISt 计算机安全事件处理指南-特别出版物800-61。

管理层在评估和管理我们面对网络安全概念威胁中的角色

我们的网络安全概念计划由我们的执行领导团队中的高层主管监督,并由我们的网络安全概念策略委员会管理,包括我们的高级副总裁、首席信息安全官(CISO),他向我们的执行副总裁、首席数位官(CDO)报告。我们的CISO负责日常风险管理活动,包括与信息安全团队的专业人士通过定期沟通和报告保持信息更新,并使用技术工具和软体来监控预防、检测、缓解和修复工作。我们的CDO负责我们更广泛的IT计划,包括PTC在网络安全事件中进行修复和恢复的能力,同时减少对业务和运营的影响。我们的CDO和CISO定期直接向董事会的网络安全概念委员会报告我们的网络安全概念计划及其防止、检测、缓解和修复问题的努力。此外,我们有一个升级流程来通知高层管理和网络安全概念委员会及董事会的重要问题。

19

管理经验

我们的首席数据官(CDO)和首席信息安全官(CISO)在评估和管理网络安全计划和网络安全风险方面具有丰富经验。我们的CDO于2022年1月加入PTC担任首席数字官,负责PTC的全球资讯科技(IT)团队,监督PTC的数字基础设施,并与业务领导者合作指导PTC的数字流程优化策略。他拥有逾两个多年的IT和运营领导经验。在加入PTC之前,他曾担任Avaya的全球副总裁兼首席信息官,在那里他带领一支遍布全球的1,200名IT专业人员团队,支持整个全球的Avaya企业。在加入Avaya之前,他曾在Arise Virtual Solutions Inc.、Oracle和科罗拉多学院担任过科技领导职位。

我们的CISO于2022年4月加入PTC担任网路资讯安全官,加入PTC之前,他曾任Alorica的北美和欧洲资讯技术副总裁,带领Alorica为9万名全球远程和混合模式员工转型为安全的端点架构。

项目2. 房地产Properties

我们目前在美国及海外拥有75个办公地点用于业务运营,主要作为销售和/或压力位办公室,以及进行研究与开发的工作。在我们总计约1,060,000平方英尺的租赁设施中,约有401,000平方英尺位于美国,包括约250,000平方英尺的总部设施位于麻萨诸塞州的波士顿,约268,000平方英尺位于印度,这里进行了大量的研究与开发工作。

法律专业进行中

无。

项目 4. 矿山安全 披露

不适用。

部分 II

项目5. 登记人普通股、市场及相关股东事宜发行人购买股票证券

我们的普通股在纳斯达克全球货币选择市场以"PTC"标的进行交易。

截至2024年9月30日,即我们财政年度的结束日,以及截至2024年11月12日,我们的普通股由884位和877位股东持有。

项目 6. [保留][保留]

20

项目7. 管理层对财务状况及经营业绩的讨论与分析财务状况及经营业绩的分析

营运及非一般公认会计原则财务指标

我们对结果的讨论包括我们的ARR(年运行率)操作指标、非GAAP财务指标的讨论,以及我们在固定货币基准下披露我们的结果。ARR和我们的非GAAP财务指标,包括我们使用这些指标的原因,于下文中描述。 经营结果 - 操作指标 和 经营结果 - 非GAAP财务指标 分别提到。计算固定货币披露所使用的方法论于 经营结果 - 外汇对经营结果影响。 您应该阅读这些部分以了解我们的操作指标、非GAAP财务指标和固定货币披露。

执行概观

尽管整体需求环境长期来一直具挑战性,但截至FY'24结束时,ARR相较于FY’23达到22.5亿美元,按固定货币计算增长14%(12%按固定货币计)

营运活动提供的现金在FY'24年较FY'23年增长23%至$75000万。自由现金流在FY'24年较FY'23年增长25%至$73600万。我们现金流增长归因于我们订阅业务模式和运营纪律带来稳固的营收增长。利息支付在FY'24年比FY'23年高出$4700万,主要是由于支付$3000万的拟估利息用于我们在2023年收购ServiceMax时的递延收购付款,以及FY'23年和FY'24年借款所产生的增量利息费用。我们在FY'24年结束时现金及现金等价物为$26600万,总债务为17.5亿,这笔债务承担了赖5.1%的加权平均利率。

营业收入于FY'24相较于FY'23增长10%(恒常货币增长9%)。我们在Q2'23初收购了ServiceMax,贡献了FY'24的营业收入增长。根据ASC 606,面向客户端订阅营收的入帐时机可能会有显著差异,对报告的营业收入和增长率产生影响。

业务结果

下表显示我们认为是业务绩效最重要的指标。除了提供根据 GAAP 计算的营业收入、营业利润、稀释每股盈利以及营运现金外,我们还提供报告期间的 ARR 营运指标和非 GAAP 营业收入、非 GAAP 营业利润、非 GAAP 稀释每股盈利和自由现金流。我们还以固定货币为基础提供实际结果的视图。我们的非 GAAP 财务指标不包括下文所述项目 非 GAAP 财务指标 下面。投资者应该仅与我们的 GAAP 结果一并使用我们的非 GAAP 财务指标。

21

有关我们2023财年的业绩讨论及与2022财年的业绩比较,请参阅 管理层对财务状况及业务结果的讨论与分析 于我们截至2023年9月30日的年度报告10-K表格中。

(单位:百万美元,每股资料除外) |

|

年度截至九月三十日。 |

|

|

百分比变动 |

|

||||||||||

|

|

2024 |

|

|

2023 |

|

|

实际 |

|

|

恒定货币(1) |

|

||||

ARR |

|

$ |

2,254.7 |

|

|

$ |

1,978.6 |

|

|

|

14 |

% |

|

|

12 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

总循环收入(2) |

|

$ |

2,134.0 |

|

|

$ |

1,907.9 |

|

|

|

12 |

% |

|

|

12 |

% |

永久许可证 |

|

|

32.2 |

|

|

|

38.6 |

|

|

|

(17 |

)% |

|

|

(16 |

)% |

专业服务 |

|

|

132.2 |

|

|

|

150.5 |

|

|

|

(12 |

)% |

|

|

(12 |

)% |

总营业收入 |

|

|

2,298.5 |

|

|

|

2,097.1 |

|

|

|

10 |

% |

|

|

9 |

% |

总营业成本 |

|

|

444.8 |

|

|

|

441.0 |

|

|

|

1 |

% |

|

|

1 |

% |

毛利率 |

|

|

1,853.7 |

|

|

|

1,656.0 |

|

|

|

12 |

% |

|

|

12 |

% |

营运费用 |

|

|

1,265.6 |

|

|

|

1,197.6 |

|

|

|

6 |

% |

|

|

6 |

% |

营业收入 |

|

$ |

588.1 |

|

|

$ |

458.5 |

|

|

|

28 |

% |

|

|

27 |

% |

非GAAP营业收入(1) |

|

$ |

894.3 |

|

|

$ |

758.9 |

|

|

|

18 |

% |

|

|

17 |

% |

营业利润率 |

|

|

25.6 |

% |

|

|

21.9 |

% |

|

|

|

|

|

|

||

非公认营业利润率(1) |

|

|

38.9 |

% |

|

|

36.2 |

% |

|

|

|

|

|

|

||

稀释每股盈利 |

|

$ |

3.12 |

|

|

$ |

2.06 |

|

|

|

|

|

|

|

||

非通用会计原则稀释每股盈利(1) |

|

$ |

5.08 |

|

|

$ |

4.34 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

营业活动产生的现金 |

|

$ |

750.0 |

|

|

$ |

610.9 |

|

|

|

|

|

|

|

||

资本支出 |

|

|

(14.4 |

) |

|

|

(23.8 |

) |

|

|

|

|

|

|

||

自由现金流 |

|

$ |

735.6 |

|

|

$ |

587.0 |

|

|

|

|

|

|

|

||

外汇兑换对业务营运的影响

我们约有50%的营业收入和35%的支出以美元以外的货币进行交易。因为我们的营运结果是以美元报告的,货币兑换,特别是欧元、日元、以色列新舍克尔和印度卢比相对美元的变动,对我们的报告结果产生影响。外币汇率的变动对24财政年度的财务报表结果有轻微的正面影响。ARR因货币兑换率的改善而受到积极影响,尤其是2024年9月30日相对于2023年9月30日的欧元兑美元汇率。

上述表格的业务运作结果,以及下面关于各业务线和产品组的营业收入表格和讨论,均呈现了年增率的实际百分比变化和以固定货币计算的百分比变化。我们的固定货币披露是通过将FY'24和FY'23的当地货币结果乘以截至2023年9月30日的汇率计算得出的。如果将FY'24的报告结果按截至2023年9月30日的汇率转换为美金,ARR将会减少4700万美元,营业收入将会减少2200万美元,支出将会减少1000万美元。如果将FY'23的报告结果按截至2023年9月30日的汇率转换为美金,ARR将保持不变,营业收入将会减少1700万美元,支出将会减少1200万美元。

22

营业收入

根据ASC 606,任何给定期间开始或续订的合同类型(压力位,saas-云计算,本地订阅)的成交量、组合和持续时间可能对该期间的营业收入产生实质影响,因此可能影响报告的营业收入在各个期间之间的可比性。我们在向客户交付许可证时,通常在开始日期时,对本地订阅合同的许可证部分上即时确认营业收入,而对本地订阅合同和独立支援合同的支援部分则在合同期间内按比例确认营业收入。我们继续将现有支援合同转换为本地订阅,导致在转换期间内,本地订阅许可证的营业收入将上即时确认,而相较于永久支援合同的按比例确认。我们的云服务(主要是saas-云计算)合同的收入按比例确认。我们预计随著时间的推移,我们的营业收入中将有更高的部分以按比例的方式确认,这是因为我们扩大了saas-云计算产品的供应,向我们的产品释放了更多的云功能,并将客户从本地订阅迁移至saas-云计算。考虑到在任何期间内新合同和续约合同的不同组合、持续时间和成交量,逐年或连续的营业收入可能会有显著变化。

业务按线路的营业收入

(金额以百万美元计算) |

|

年度截至九月三十日。 |

|

|

百分比变动 |

|

||||||||||

|

|

2024 |

|

|

2023 |

|

|

实际 |

|

|

恒定 |

|

||||

许可证(1) |

|

$ |

806.9 |

|

|

$ |

747.0 |

|

|

|

8 |

% |

|

|

8 |

% |

压力位和云端服务(2) |

|

|

1,359.4 |

|

|

|

1,199.5 |

|

|

|

13 |

% |

|

|

13 |

% |

软体营业收入 |

|

|

2,166.2 |

|

|

|

1,946.6 |

|

|

|

11 |

% |

|

|

11 |

% |

专业服务 |

|

|

132.2 |

|

|

|

150.5 |

|

|

|

(12 |

)% |

|

|

(12 |

)% |

总营业收入 |

|

$ |

2,298.5 |

|

|

$ |

2,097.1 |

|

|

|

10 |

% |

|

|

9 |

% |

软体营业收入 FY'24年的增长主要是由PLm推动,其中包括了从Q2'23初收购的ServiceMax()和CAD的贡献。

财政年度'24的许可证收入增长主要是由欧洲和亚太地区的CAD和PLm增长驱动,部分抵销了美洲特别是在PLm方面的许可证收入下降。财政年度'24销售比例较高的是saas-云计算,这对美洲和欧洲的许可证收入增长产生了不利影响。

FY'24年度支援与云端服务营业收入增长主要是由美洲和欧洲的PLm(其中包括了ServiceMax的贡献)所驱动。

专业服务营业收入 在2024财年中,随著我们持续执行利用合作伙伴提供服务的策略,而非自己承包提供服务,营业收入下降。

23

产品组别的软体营业收入

(美元金额以百万计) |

|

截至九月三十日止年度 |

|

|

百分比变化 |

|

||||||||||

|

|

2024 |

|

|

2023 |

|

|

实际 |

|

|

恒定 |

|

||||

普尔姆 |

|

$ |

1,333.4 |

|

|

$ |

1,186.0 |

|

|

|

12 |

% |

|

|

12 |

% |

加拿大元 |

|

|

832.8 |

|

|

|

760.6 |

|

|

|

9 |

% |

|

|

10 |

% |

软件收入 |

|

$ |

2,166.2 |

|

|

$ |

1,946.6 |

|

|

|

11 |

% |

|

|

11 |

% |

PLM 软体营业收入在FY'24主要受欧洲增长和ServiceMax的贡献(在Q2'23初收购)的拉动。FY'24 PLm软体营业收入同比增长,不包括Q1'24 ServiceMax营业收入,将达9%(9%恒定货币)。

PLm ARR从2023年9月30日到2024年9月30日增长了15%(按固定货币计算为13%)。

百万 FY'24的软体营业收入增长主要受到欧洲和亚太地区营业收入增长的驱动。

从2023年9月30日到2024年9月30日,CAD ARR增长了13%(恒定货币下为10%)。

毛利率

(金额以百万美元计算) |

|

年度截至九月三十日。 |

|

|

|

|

||||||

|

|

2024 |

|

|

2023 |

|

|

百分比变动 |

|

|||

许可证毛利率 |

|

$ |

760.0 |

|

|

$ |

693.8 |

|

|

|

10 |

% |

许可证毛利率百分比 |

|

|

94 |

% |

|

|

93 |

% |

|

|

|

|

压力位及云端服务毛利率 |

|

$ |

1,084.8 |

|

|

$ |

954.5 |

|

|

|

14 |

% |

压力位及云端服务毛利率百分比 |

|

|

80 |

% |

|

|

80 |

% |

|

|

|

|

专业服务毛利率 |

|

$ |

8.9 |

|

|

$ |

7.7 |

|

|

|

15 |

% |

专业服务毛利率百分比 |

|

|

7 |

% |

|

|

5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

总毛利率 |

|

$ |

1,853.7 |

|

|

$ |

1,656.0 |

|

|

|

12 |

% |

总毛利率百分比 |

|

|

81 |

% |

|

|

79 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

非GAAP毛利率(1) |

|

$ |

1,913.6 |

|

|

$ |

1,712.6 |

|

|

|

12 |

% |

非GAAP毛利率百分比(1) |

|

|

83 |

% |

|

|

82 |

% |

|

|

|

|

(1) 非公认会计原则(Non-GAAP)财务指标与公认会计原则(GAAP)结果进行调整 非依据通用会计准则的财务指标 以下。

许可证 在2024财年,毛利率的增长速度高于许可证营业收入,主要是由于无形资产摊销费用较低。排除无形资产摊销费用后,许可证的毛利率百分比与去年持平。

压力位和云端服务 24财政年度的毛利率增长与压力位和云服务营业收入增长保持一致。24财政年度的支援和云服务成本以与营业收入类似的速度增长,原因是较高的无形摊销费用、补偿费用和特许权费用。

专业服务 在FY'24财年,相较于FY'23财年,毛利率上升,主要是因为外部服务成本降低,部分被专业服务营业收入减少所抵消。专业服务营业收入和成本的减少是因为我们持续执行利用伙伴提供服务而非自己承包提供服务的策略。

24

营运费用

(金额以百万美元计算) |

|

年度截至九月三十日。 |

|

|

|

|

||||||

|

|

2024 |

|

|

2023 |

|

|

百分比变动 |

|

|||

销售和市场推广 |

|

$ |

559.0 |

|

|

$ |

530.1 |

|

|

|

5 |

% |

总营业收入百分比 |

|

|

24 |

% |

|

|

25 |

% |

|

|

|

|

研发 |

|

|

433.0 |

|

|

|

394.4 |

|

|

|

10 |

% |

总营业收入百分比 |

|

|

19 |

% |

|

|

19 |

% |

|

|

|

|

一般及行政费用 |

|

|

232.4 |

|

|

|

233.5 |

|

|

|

(0 |

)% |

总营业收入百分比 |

|

|

10 |

% |

|

|

11 |

% |

|

|

|

|

收购无形资产的摊销 |

|

|

42.0 |

|

|

|

40.0 |

|

|

|

5 |

% |

总营业收入百分比 |

|

|

2 |

% |

|

|

2 |

% |

|

|

|

|

重组及其他贷款抵免款项,净额 |

|

|

(0.8 |

) |

|

|

(0.5 |

) |

|

|

74 |

% |

总营业收入百分比 |

|

|

0 |

% |

|

|

0 |

% |

|

|

|

|

营业费用总额 |

|

$ |

1,265.6 |

|

|

$ |

1,197.6 |

|

|

|

6 |

% |

截至2023年9月30日至2024年9月30日期间,总人数增加了4%。

到 FY'24 年的营业费用比 FY'23 年增加主要是由于以下原因:

部分地抵消:

25

利息费用

(美元金额以百万计) |

|

截至九月三十日止年度 |

|

|

|

|

||||||

|

|

2024 |

|

|

2023 |

|

|

百分比变化 |

|

|||

利息支出 |

|

$ |

(119.7 |

) |

|

$ |

(129.4 |

) |

|

|

(8 |

)% |

利息费用包括我们信贷及2025年和2028年到期的Senior Notes之利息。FY'23的利息费用亦包括$3,000万的利息,为与ServiceMax收购相关的延迟支付所致。与FY'23相比,FY'24的利息费用减少主要是由于负债总额和延迟支付负责负债余额较低所致。

其他收入

(美元金额以百万计) |

|

截至九月三十日止年度 |

|

|

|

|

||||||

|

|

2024 |

|

|

2023 |

|

|

百分比变化 |

|

|||

利息收入 |

|

$ |

4.4 |

|

|

$ |

5.4 |

|

|

|

(19 |

)% |

其他费用(净额) |

|

|

(3.8 |

) |

|

|

(1.9 |

) |

|

|

(103 |

)% |

其他收入净额 |

|

$ |

0.6 |

|

|

$ |

3.5 |

|

|

|

(84 |

)% |

与FY'23相比,FY'24的其他收入净额较低,这是由于与可供出售的债务安防相关的200万损失造成的。

所得税

(美元金额以百万计) |

|

截至九月三十日止年度 |

|

|

|

|

||||||

|

|

2024 |

|

|

2023 |

|

|

百分比变化 |

|

|||

所得税前所得 |

|

$ |

469.0 |

|

|

$ |

332.6 |

|

|

|

41 |

% |

所得税预约 |

|

|

92.6 |

|

|

|

87.0 |

|

|

|

6 |

% |

实际所得税率 |

|

|

20 |

% |

|

|

26 |

% |

|

|

|

|

2024财年的实际税率低于2023财年的实际税率。在2024财年,该税率受到美国税务法院在Varian Medical Systems, Inc.诉Commissioner案中的裁决影响,此裁决于2024年8月26日作出。该裁决涉及税法过渡年(我们的2018财年)中被视为外国分红的美国税收。因此,我们记录了1440万美元的额外外国税收抵免的好处,这些抵免现在可供我们使用。此外,我们的税率还包括440万美元的净好处,这是由于国税局(IRS)的程序指导要求对之前自动变更的会计方法给予同意而产生的。国税局的程序指导变更大幅提高了截至2024年9月30日的年度估算应税收入,结果导致与全球无形低税收入和外国衍生无形收入相关的扣除估算税收利益的增加。如果我们获得国税局对这些扣除的处理变更的同意,则将在未来的财政期间撤销这些来自国税局程序指导变更的好处。这些好处被与外国司法管辖区的税收储备相关的460万美元税费抵消。2023财年包括与我们目前正在审计的外国司法管辖区关于转让定价的不确定税务状况相关的2180万美元税费。我们的2023财年税率还受到630万美元税费的影响,该税费与收购ServiceMax的延迟支付相关的不可扣除的推算利息有关。

在正常的业务过程中,PTC及其子公司会受到各种税务机构的检查,包括美国的国税局。我们定期评估税务机构额外评估的可能性,并根据需要为这些事项做出准备。目前,我们在德国、爱尔兰和意大利等几个地方的税务机构下进行审计。税务机构的审计通常涉及对某些永久性项目的可扣税性、转让定价、净营运亏损的限制以及税收抵免的检查。

26

流动性和资本资源

(以百万计) |

|

九月三十日 |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

现金及现金等值 |

|

$ |

265.8 |

|

|

$ |

288.1 |

|

限制现金 |

|

|

0.7 |

|

|

|

0.7 |

|

总计 |

|

$ |

266.5 |

|

|

$ |

288.8 |

|

(以百万计) |

|

截至九月三十日止年度 |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

经营活动所提供的现金净额 |

|

$ |

750.0 |

|

|

$ |

610.9 |

|

投资活动使用的现金净额 |

|

$ |

(124.8 |

) |

|

$ |

(866.1 |

) |

融资活动提供(用于)的现金净额 |

|

$ |

(650.7 |

) |

|

$ |

268.3 |

|

现金、现金等价物和受限制现金

我们将现金投资于评级高的金融机构。现金及现金等价物包括原本到期不超过三个月的高流动性投资。

由于我们订阅模式稳定以及年度前期订单的一致性,我们的目标是保持较低的现金余额。 我们的现金中有相当大部分是在美国以外赚取和持有的。 截至2024年9月30日,我们在美国有3600万的现金及现金等价物,在欧洲有12700万,在亚太地区(包括印度)有8600万,在其他非美国国家有1700万。 我们在美国有重大的现金需求,但我们相信,我们现有的美国现金及现金等价物、我们可用的循环信用额度下的现金、未来美国营运现金流量,以及我们将资金遣返美国的能力将足以满足我们在美国的持续营运费用和已知资本需求。

营运活动提供的现金流量

营运活动所提供的现金在FY'24相比FY'23增加了$13910万。这一增长主要受到更高的收款驱动(包括ServiceMax的贡献),但部分被更高的薪资相关和利息支付所抵消。FY'24的利息支付约比FY'23高出$4720万,包括支付$3000万的ServiceMax延期收购款项的估计利息。

投资活动使用现金

在2024财年的投资活动中,现金使用受到于2024年第一季度收购pure-systems所驱动,金额为9350万美元。在2023财年的投资活动中,现金使用是由于在2023年第二季度与收购ServiceMax相关的82820万美元支付所驱动。2024财年的资本支出低于2023财年,因为我们更倾向于投资于云端而非本地的软体。

融资活动中提供(或使用)的现金

2024财年的融资活动使用的现金包括支付62000万美元以结清与我们收购ServiceMax相关的延迟收购付款,2024年第一季度借款73980万美元以资助该付款和纯系统收购,以及随后的债务净付款69390万美元。

2023财年的融资活动提供的现金主要与新借款净额$77100万(包括$50000万的定期贷款和$27100万的增量循环信贷)有关,用于资助ServiceMax的收购,以及对新循环信贷的净还款$42800万。

27

未偿还债务

(以百万为单位) |

|

九月三十日, |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

4.000% 2028年到期高级票据 |

|

$ |

500.0 |

|

|

$ |

500.0 |

|

3.625% 2025年到期高级票据 |

|

|

500.0 |

|

|

|

500.0 |

|

信贷融资循环贷款 |

|

|

262.0 |

|

|

|

202.0 |

|

信贷融资定期贷款 |

|

|

490.6 |

|

|

|

500.0 |

|

总负债 |

|

|

1,752.6 |

|

|

|

1,702.0 |

|

尚未摊销的高级票据发行成本 |

|

|

(4.1 |

) |

|

|

(6.2 |

) |

总债务,扣除发行成本 |

|

$ |

1,748.6 |

|

|

$ |

1,695.8 |

|

|

|

|

|

|

|

|

||

信用设施循环贷款下尚未提用的额度 |

|

$ |

988.0 |

|

|

$ |

1,048.0 |

|

可用于借贷的信用设施循环贷款下尚未提用的额度 |

|

$ |

972.1 |

|

|

$ |

384.6 |

|

截至2024年9月30日,我们遵守了信贷设施和债券的所有财务和运营契约。截至2024年9月30日,信贷设施循环信用额度和定期贷款的年度利率分别为7.0%和6.9%。

除了上表所示的债务外,截至2023年9月30日,我们还有一笔62000万美元的延期收购支付负债,与2023年10月为ServiceMax收购支付的65000万美元分期款项的公允价值相关。其中,支付的6.5亿美元中,6.2亿美元被记录为融资流出,另有3000万元的隐含利息被记录为营运现金流出。

我们的信贷设施和高级票据,包括金融和经营契约及派息的限制,如下所述, 附注9. 债务 在本年报的合并基本报表附注中。

股份回购授权

我们的公司章程授权我们发行最多50000万股普通股。我们的董事会已授权我们在2024年10月1日至2027年9月30日期间回购最多20亿美元的普通股。我们可以利用营运现金和信用贷款的借款来进行任何此类回购。所有回购的普通股自动恢复为授权但未发行的状态。

我们的长期目标是通过股票回购将大约50%的自由现金流返还给股东,同时考虑利率环境以及战略性措施和收购,这些都可能使我们减少、暂停或停止回购。我们目前打算在FY'25回购约30000万美元的普通股票。

对2025年的期待

我们相信,现有的现金及现金等价物,加上营运产生的现金和可用于信贷设施的金额,将足以满足我们至少在接下来十二个月内的营运资金和资本支出需求,包括在2025年2月赎回3.625%的高级票据,并满足我们已知的长期资本需求。

我们预期的现金用途和来源可能会改变,我们的现金状况可能会减少,并且如果我们养老其他债务、参与战略交易或回购股票,我们可能会承担额外的债务义务,这些行为可以随时开始、暂停或完成。任何此类回购或债务养老都将取决于当前的市场条件、我们的流动性要求、合约限制和其他因素。任何债务养老或发行、股份回购或战略交易所涉及的金额可能是重大的。

28

合约义务

截至2024年9月30日,我们未来的契约义务涉及债务、租约、养老金责任、未认知税收优惠和采购义务。请参阅本年度报告中有关这些义务的基本报表附注9.债务、附注17.租赁、附注14.养老金计划,这些基本报表附注已纳入本节。我们的采购义务约为16320万美元,其中预期在FY'25支付8820万美元,其后再支付7500万美元。采购义务代表因向第三方所承诺的最低承诺,包括版税合同、研究和开发合同、电信合同、支援内部使用软体和硬件的信息科技维护合同、融资租赁、原始期限少于12个月的营运租赁,以及其他行销和咨询合同。对于我们承诺是变量的或基于量的而没有固定最低数量的合同,以及可以在不支付罚金的情况下取消的合同,上述的采购义务金额中均不包括在内。以上提及的采购义务金额是额外的,不包括在2024年9月30日我们的基本报表中纪录的流动负债和预付费用金额。 详见年度报告中基本财务报表的附注9.债务、附注17.租赁、附注14.养老金计划等有关信息。这些附注已纳入本节。 和 看看年度报告的基本财务报表附注8.所得税。 有关这些义务的资料,请查阅此年报中个体财务报表的基本报表注释部分。这些注释已纳入本节。我们的采购义务约为16320万美元,预计在FY'25支付8820万美元,其后支付7500万美元。采购义务代表因向第三方承担的最低承诺,包括版税、研究和开发、电信、支援内部使用软体和硬件的信息技术维护、融资租赁、原始期限少于12个月的营运租赁,以及其他行销和咨询合同。我们的承诺是基于变量或基于量而没有固定最低数量的合同,以及可以无须支付罚金取消的合同均不包含在上述采购义务金额中。上述采购义务金额另外计算,不包括我们截至2024年9月30日基本报表中记录的流动负债和预付费用数额。

截至2024年9月30日,我们累积的信用证和银行保证金约为1560万美元(其中60万美元已抵押)。

29

营运指标

ARR

ARR(年运行率)代表截至报告期末,我们的活跃订阅软体、saas-云计算、寄宿和压力位合约的年化价值。我们的ARR计算如下:

我们认为ARR是一个有价值的营运指标,用于评估订阅业务的健康状况,因为它与我们在年度基础上向客户开具发票的金额相一致。通常我们会对客户进行年度结算,涉及目前合同年度的发票。一个一年期合同的客户通常会在合同期限的开始时收到合同总值的发票,而一个多年期合同的客户则会在合同每年的开始时收到每年的发票。

ARR是指在报告期间开始的活动合约的年化价值增加,而在报告期间到期的合约的年化价值则减少。

由于ARR并不是年化经常性营业收入,因此它并不是根据已认列或未认列的营业收入来计算,并且不会受到ASC 606下营业收入时间变化的影响,特别是在本地授权订阅中,合同总价值的相当一部分是在软体可用或订阅期开始时的某一时刻被认列为营业收入。

ARR应独立查看,不应与已认可和未赢取的营业收入相混淆,也不应取代这两项。投资者仅应将我们的ARR营运指标与我们的GAAP财务结果一起考虑。

非依据通用会计准则的财务指标

在我们营运结果讨论中提出的非依照美国通用会计准则计量的财务指标,以及相应最直接可比的按照美国通用会计准则计量的指标为:

30

自由现金流是从营运活动净现金流中扣除资本支出获得的现金流,资本支出是指用于物业和设备的支出,主要包括设施改善、办公设备、计算机设备和软体。我们认为自由现金流与营运现金流一起,是一个有用的流动性指标,因为资本支出是持续运营的必要组件。自由现金流并不是可供自由支配支出的现金量。

根据适用情况,除自由现金流以外的非一般公认会计原则财务指标不包括:股票基础补偿费用;收购无形资产的摊销;包括在一般及管理费用中的收购及交易相关费用;重组及其他费用(收入),净额;非经营性费用(收入),净额;以及所得税调整。

股票酬劳是与颁发给执行长、员工和外部董事的股票奖励相关的非现金费用,包括受限股票。我们将这项费用排除在外,因为这是一笔非现金费用,我们评估我们的内部运营时不考虑此费用,并相信这有助于与我们所在行业其他公司的绩效进行比较。

取得无形资产摊提是一项非现金费用,受到我们收购时间和规模的影响。我们认为,除去这些成本评估我们的运营是相关的,并与行业板块中其他公司的表现进行比较。

一般及行政费用中包括的并购和交易相关费用是与潜在和已完成收购,以及收购整合活动相关的直接成本,包括交易费用、尽职调查成本、离职福利和专业费用。后续对我们对特定收购相关的条款考量的初始估计金额进行调整的费用也包括在并购和交易相关费用内。其他交易费用包括与结构合并和收购交易有关的第三方成本,不属于正常业务运营的费用。我们在内部审查营运结果时不包括这些成本。这些费用的发生和金额取决于收购和交易的时间和规模。

重组及其他费用(收益),净额包括过剩设施的重组费用(收益);与退出设施的租赁资产相关的减值及增值费用;来自之前减值设施的转租收入;因大规模裁员行动而产生的遣散费;以及与我们的业务策略修改相关的第三方专业顾问费用。这些成本可能会根据我们的重组计划而有所不同。

非营运费用(信贷),净额是与资产或负债的出售或价值变动相关的收益或亏损,一般属于投资或融资性质,并不代表我们正在进行的日常营运活动。在2024财年,我们认定了与可供出售债务证券相关的减损费用。在2023财年,我们认定了与我们收购ServiceMax相关的一项债务承诺协议的融资费用。

所得税调整包括上述事项的税收影响。此外,我们在内部审查营运结果时不包括其他重大税务事项。例如,在FY'24年,调整包括与之前年度在外国司法管辖区的税款储备有关的费用。FY'23年的调整包括与外国司法管辖区的不确定税务立场相关的费用。

我们使用这些非GAAP财务指标,并相信它们有助于我们的投资者进行期间对期间的营运表现比较,因为它们提供了我们营运结果的一个视角,排除了我们认为不符合我们核心营运结果的项目。我们相信这些非GAAP财务指标有助于说明我们业务的潜在趋势,我们使用这些指标来制定预算和营运目标(向内外部沟通)。

31

管理我们的业务并评估我们的表现。我们相信提供非依据美国通用会计准则(GAAP)的财务指标,也能让投资者更容易将我们的营运结果与采用类似财务指标补充其GAAP结果的行业板块中其他公司的结果进行比较。

非公认会计原则(non-GAAP)财务衡量指标中排除的项目通常对我们的财务结果有重大影响,其中某些项目是重复性的,其他此类项目也常常再次出现。因此,本年度报告中包含的非GAAP财务衡量指标应该被视为对根据公认会计原则(GAAP)编制的可比较指标的补充,而不是替代或优于这些可比较指标。下列表格将每一项非GAAP财务衡量指标与我们基本报表中最接近的GAAP指标进行对照。

(金额以百万为单位,每股金额的单位是美元) |

|

年度截至九月三十日。 |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

GAAP毛利率 |

|

$ |

1,853.7 |

|

|

$ |

1,656.0 |

|

基于股票的薪酬 |

|

|

21.4 |

|

|

|

20.9 |

|

并购无形资产摊销已包含在营业成本中 |

|

|

38.5 |

|

|

|

35.7 |

|

非GAAP毛利率 |

|

$ |

1,913.6 |

|

|

$ |

1,712.6 |

|

GAAP营业收入 |

|

$ |

588.1 |

|

|

$ |

458.5 |

|

基于股票的薪酬 |

|

|

223.5 |

|

|

|

206.5 |

|

收购无形资产的摊销 |

|

|

80.5 |

|

|

|

75.7 |

|

并购和与交易有关的费用 |

|

|

3.1 |

|

|

|

18.7 |

|

重组及其他贷款抵免款项,净额 |

|

|

(0.8 |

) |

|

|

(0.5 |

) |

非GAAP营业收入 |

|

$ |

894.3 |

|

|

$ |

758.9 |

|

根据GAAP计算的净利润 |

|

$ |

376.3 |

|

|

$ |

245.5 |

|

基于股票的薪酬 |

|

|

223.5 |

|

|

|

206.5 |

|

收购无形资产的摊销 |

|

|

80.5 |

|

|

|

75.7 |

|

并购和与交易有关的费用 |

|

|

3.1 |

|

|

|

18.7 |

|

重组及其他贷款抵免款项,净额 |

|

|

(0.8 |

) |

|

|

(0.5 |

) |

非营运支出,净额(1) |

|

|

2.0 |

|

|

|

5.1 |

|

所得税调整(2) |

|

|

(71.2 |

) |

|

|

(33.5 |

) |

非GAAP净利润 |

|

$ |

613.4 |

|

|

$ |

517.6 |

|

根据通用会计原则稀释每股盈利 |

|

$ |

3.12 |

|

|

$ |

2.06 |

|

基于股票的薪酬 |

|

|

1.85 |

|

|

|

1.73 |

|

收购无形资产的摊销 |

|

|

0.67 |

|

|

|

0.63 |

|

收购和交易相关费用 |

|

|

0.03 |

|

|

|

0.16 |

|

重组及其他贷款抵免款项,净额 |

|

|

(0.01 |

) |

|

|

— |

|

非营运性费用、净额(1) |

|

|

0.02 |

|

|

|

0.04 |

|

所得税调整(2) |

|

|

(0.59 |

) |

|

|

(0.28 |

) |

非通用会计原则稀释每股盈利 |

|

$ |

5.08 |

|

|

$ |

4.34 |

|

|

|

|

|

|

|

|

||

营业活动产生的现金 |

|

$ |

750.0 |

|

|

$ |

610.9 |

|

资本支出 |

|

|

(14.4 |

) |

|

|

(23.8 |

) |

自由现金流 |

|

$ |

735.6 |

|

|

$ |

587.0 |

|

非依纳税前净利润调整对营业利润率的影响:

|

|

年度截至九月三十日。 |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

GAAP营业利润率 |

|

|

25.6 |

% |

|

|

21.9 |

% |

基于股票的薪酬 |

|

|

9.7 |

% |

|

|

9.8 |

% |

收购无形资产的摊销 |

|

|

3.5 |

% |

|

|

3.6 |

% |

并购和交易相关费用 |

|

|

0.1 |

% |

|

|

0.9 |

% |

重组及其他贷款抵免款项,净额 |

|

|

(— |

)% |

|

|

(— |

)% |

非公认营业利润率 |

|

|

38.9 |

% |

|

|

36.2 |

% |

32

关键的会计政策和估计

我们根据美国一般公认会计原则编制了合并基本报表。在编制我们的基本报表时,我们进行了估计、假设和判断,这些可能对我们报告的收入、营运结果和净利润,以及我们资产负债表上某些资产和负债的价值产生重大影响。这些估计、假设和判断是基于我们的历史经验和我们认为在当前情况下合理的其他假设进行的。随著新事件的发生或获得更多信息,这些估计可能会改变,我们可能会定期面临不确定性,其结果超出我们的控制范围,并且可能需要较长时间才能得知。

我们编制基本报表所使用的会计政策、方法和估计一般在 附注2。 主要会计政策摘要 在本年度报告的合并基本报表附注中说明。我们在编制基本报表时所作的最重要的会计判断和估计包括:

关键的会计政策是对于我们的基本报表呈现具有重要性,并且需要我们做出主观或复杂的判断,这可能对我们的财务控制项和营运结果产生重大影响。关键的会计政策要求我们对于在估算时尚不确定的事项作出假设,而我们可能使用的不同估算,或合理可能发生的估算变化,可能对我们的财务控制项或营运结果产生重大影响。由于在财务报告过程中使用估算是固有的,实际结果可能与这些估算有所不同。

与我们的关键会计政策和估计相关的会计政策、指南和解读通常受到多个权威指导来源的影响,并经常由会计准则制定者和监管机构重新检讨。这些制定规则的人和/或监管机构可能发布解读、指引或法规,可能导致我们会计政策的变更,这可能对我们的财务状况和营运成果产生重大影响。

收入确认

我们按照ASC 606提供的指引记录营业收入, 客户合同的营业收入。欲了解我们营收会计政策的详细说明,请参阅 附注2。重大会计政策摘要,该资讯包含在本年度报告的基本报表附注中。

我们的营业收入来源包括:(1)订阅,(2)永久许可证,(3)对永久许可证的压力位支持,以及(4)专业服务。订阅包括基于期限的本地许可证及相关的压力位支持、saas-云计算和主机服务。

33

判断和估计

业务履约义务的判断。 我们的订阅通常作为一组产品和服务销售,通常将本地期限软体许可与压力位配对,对于某些产品,也包括相同期间的云服务。对于这些打包产品和服务,判断业务履约义务时使用了重大的判断。本地软体通常被认为是一项独特的业务履约义务,因此与压力位和云元件分开确认。本地软体的营业收入通常在软体可供客户使用的时候确认,而压力位和云软体的营业收入元件是根据合同的期限按比例确认。在订阅中包含云功能和本地软体的情况下,已进行评估以判断云服务是否与本地软体区分开来。在绝大多数情况下,云服务为客户提供了增量功能,并被认为是独特的,与本地软体分开确认。这项评估可能会对收入确认的时间产生重大影响,并可能随著我们的产品提供而改变。

交易价格的分配。 我们估计每个识别的履约义务的单独售价,并利用该估计在这些履约义务之间分配交易价格。单独售价的估计是使用我们可以合理获得的所有信息进行确定的,包括市场条件和其他可观察的输入。 在确定我们订阅产品的本地许可证、压力位和云元件的单独售价时,需要进行重要判断。这些估计可能会随着我们产品的变化而变化,并可能由于本地许可证与压力位和云的收入确认时机的不同而产生重大影响。

交换的权利。 我们的多年不可撤销订阅合同为客户提供了在原始订阅中将软件与其他软件交换的年度权利。当它适用于本地许可时,我们将此权利视为一种负债。对于大多数合同,我们使用预期价值法来判断与这一权利相关的负债,适用于合同组合。在合同规模、较长的合同期限或其他独特的合同条款导致合同不在标准合同组合之外的情况下,我们使用最可能金额法来判断每个单独合同的负债。在这两种情况下,交易价格都根据我们的估计进行了限制,这影响了确认的营业收入金额。这些估计的变化可能会对任何给定时期的营业收入产生重大影响。

所得税会计

在准备我们的合并基本报表的过程中,我们需要根据各个辖区的应纳税所得计算我们的所得税费用。许多交易和计算的最终税收结果存在不确定性;因此,我们的计算涉及管理层的估算。这些不确定性的一部分是由于相关实体之间的收入分享、成本偿还和转让定价安排所引起的,以及各个辖区之间对收入和成本项目的不同税收处理。如果税务机关迫使我们对我们的安排进行修订或以不同方式入账,该修订可能会影响我们已记录的税务负债。

所得税会计流程还涉及估算我们当前的实际税务负债,并评估因税务和会计目的对项目的不同处理而产生的暂时性差异。这些差异导致了递延税款资产和负债,这些都包含在我们的合并资产负债表中。接下来,我们必须评估我们的递延税款资产从未来应税收入中恢复的可能性,并且,如果我们认为我们的所有或部分递延税款资产不太可能实现,我们必须设立一个估值备抵,作为所得税费用的支出。

34

截至2024年9月30日,我们有未确认的税收利益为6500万。尽管我们认为我们的税务估算是合适的,但税务审计的最终决定和任何相关诉讼可能会导致我们的估算出现有利或不利的变化。我们相信,在接下来的12个月内,与多司法管辖区税务立场的解决相关的未确认税收利益的金额可能会减少最多2700万,因为审计结束和诉讼时效到期。

截至2024年9月30日,我们在美国的净递延税资产上有1740万美元的估值备抵,并且在某些外国法域的净递延税资产上有440万美元的估值备抵。美国记录的估值备抵与我们预期在到期前无法实现收益的马萨诸塞州税收抵免结转有关。

针对某些外国管辖区的净递延税资产记录的估值备抵主要是为我们的资本损失结转而设,其中大多数是不会过期的。然而,使用这些资本损失会受到一定的限制,这可能会进一步限制任何税收利益的确认。我们将继续在每个财务报告期重新评估我们的估值备抵要求。

在美国税法通过之前,我们声称我们所有外国子公司未分配的收益大部分被视为无限期投资,因此没有提供递延税款。根据美国税法的规定,这些收益被征收了一次性过渡税,因此不再与未分配收益相关的重大累积基础差异。我们坚持将这些收益永久再投资于美国以外的地方,除非可以在基本上免税的情况下进行汇回,台湾子公司除外。如果我们决定在未来汇回任何额外的非美国收益,我们可能需要为这些收益建立递延税负债。未确认的未分配收益的递延税负债金额不会重大。

在正常的业务过程中,PTC及其子公司会受到各类税务机关的审查,包括美国的国税局(IRS)。我们定期评估税务机关进行额外评估的可能性,并在适当的情况下为这些事项提供准备。目前我们在多个地区接受税务机关的审计。税务机关的审计通常涉及对某些永久性项目的可扣除性、转移定价、净经营损失和税收抵免的限制进行审查。虽然我们相信我们的税务估算是合理的,但最终税务审计的决定及任何相关的诉讼可能会导致我们估算的重大变化。

Valuation of Assets and Liabilities Acquired in Business Combinations

In accordance with business combination accounting, we allocate the purchase price of acquired companies to the tangible and intangible assets acquired and liabilities assumed based on their estimated fair values. Determining these fair values requires management to make significant estimates and assumptions, especially with respect to intangible assets.

Our identifiable intangible assets acquired consist of purchased software, trademarks, customer lists and contracts, and software support agreements and related relationships. Purchased software consists of products that have reached technological feasibility and the combination of processes, inventions and trade secrets related to the design and development of acquired products. Customer lists and contracts and software support agreements and related relationships represent the underlying relationships and agreements with customers of the acquired company’s installed base. We have generally valued intangible assets using discounted cash flow models. Critical estimates in valuing certain of the intangible assets include but are not limited to:

35

此外,我们根据预期从相关无形资产中获得经济利益的时间,估计我们的无形资产的有效使用年限。

净有形资产是指有形资产的公允价值减去所承担的负债和义务的公允价值。除了递延收入外,净有形资产通常是根据被收购公司记录的相应账面价值进行评估的,前提是我们认为其账面价值在收购日时接近其公允价值。收购的递延收入反映了根据ASC 606,在收购日期应递延的金额。

此外,与业务合并相关的不确定税务事项和税务相关的估值准备最初会在收购日期进行估算。我们每季度重新评估这些项目,并在测量期内(从收购日期起最长为一年)记录对初步估算的任何调整至商誉,同时我们继续收集信息以判断它们的估计价值。在测量期结束后或我们最终确定不确定税务事项或税务相关估值准备的估计价值时(以先发生者为准),这些不确定税务事项和税务相关估值准备的变化将影响我们在合并运营报表中的所得税准备。

我们对于公允价值的估计基于当时认为合理的假设,但这些假设本质上是不确定和不可预测的。假设可能不完整或不准确,可能会发生意想不到的事件和情况,这可能影响这些假设、估计或实际结果的准确性或有效性。

当事件或情况的变化表明有限寿命无形资产的账面价值可能不可收回时,我们会对该资产进行潜在减值的评估。该评估基于资产剩余寿命内的未来现金流量的预计未折现总额。如果资产的账面价值超过其未折现现金流量,我们将记录减值损失,等于账面价值与使用资产预计折现未来现金流量确定的公允价值之间的差额。

近期会计公告

根据最近发布的会计公告,我们将需要遵守某些会计规则和法规的变化。请参阅 附注2. 重要会计政策摘要,包含在本年度报告的合并基本报表附注中,特此引用,关于所有最近发布的会计公告,预计没有哪个会对财务产生重大影响。

资产负债表外安排

我们没有创建,也不参与任何特殊目的或离表实体,以便筹集资本、承担债务或运营我们未合并(在我们所有权利范围内)的业务部分。我们没有与未合并实体进行任何交易,我们在其中的保留权益、衍生工具或其他或有安排,使我们面临重大持续风险、或有负债,或任何其他义务,这些义务是在对未合并实体的 变量 利益下提供融资、流动性、市场风险或信用风险 压力位。

36

ITEM 7A. Quantitative and Qualitative Disclosures about Market Risk

We face exposure to financial market risks, including adverse movements in foreign currency exchange rates and changes in interest rates. These exposures may change over time as business practices evolve and could have a material adverse impact on our financial results.

Foreign currency exchange risk

Our earnings and cash flows are subject to fluctuations due to changes in foreign currency exchange rates. Our most significant foreign currency exposures relate to Eurozone countries, Japan, Sweden, Switzerland, China and India. We enter into foreign currency forward contracts to manage our exposure to fluctuations in foreign exchange rates that arise from receivables and payables denominated in foreign currencies. We do not enter into or hold foreign currency derivative financial instruments for trading or speculative purposes.

Our non-U.S. revenues are generally transacted through our non-U.S. subsidiaries and typically are denominated in their local currency. In addition, expenses that are incurred by our non-U.S. subsidiaries typically are denominated in their local currency. Approximately 50% of our revenue and 35% of our expenses were transacted in currencies other than the U.S. Dollar. Currency translation affects our reported results because we report our results of operations in U.S. Dollars. Historically, our most significant currency risk has been changes in the Euro and Japanese Yen relative to the U.S. Dollar. Based on current revenue and expense levels (excluding restructuring charges and stock-based compensation), a $0.10 change in the USD to EUR exchange rate and a 10 Yen change in the Yen to USD exchange rate would impact operating income by approximately $38 million and $6 million, respectively.

我们对外币汇率波动的风险部分来自内部交易,大多数内部交易发生在一家美元功能货币实体和一家外币计价实体之间。内部交易通常以非美元功能货币子公司的当地货币计价,以集中外币风险。此外,PTC(母公司)和我们的非美国子公司与客户和供应商的交易可能使用不同于其功能货币的货币(交易风险)。此外,由于我们非美子公司的财务结果和余额需转换为美元,我们还面临外汇汇率波动的风险(翻译风险)。如果对美国以外的客户销售增加,我们对外币汇率波动的风险将会增加。

我们的外汇风险管理策略主要旨在减轻由于货币兑换汇率变化而导致的外币计价资产在未来的潜在财务影响。我们的外汇对冲计划使用远期合同来管理作为我们持续业务运营的一部分所存在的外币风险。这些合同主要以欧元、瑞士和瑞典克朗计价,期限通常不超过四个月。

我们大多数的外汇远期合约并未被指定为会计目的的对冲,因此这些工具的公允价值变动会立即计入收益。由于我们仅将这些衍生合约作为经济对冲,因此基础的外币余额的任何收益或损失通常会被衍生合约的损失或收益所抵消。这些衍生品及外币计 denominated 的应收和应付款项的损益包含在其他收入净额中。

37

截至2024年和2023年9月30日,我们有未指定为对冲工具的衍生品的未偿付远期合同,名义金额等于以下内容:

|

|

九月三十日 |

|

|||||

货币对冲 (以千为单位) |

|

2024 |

|

|

2023 |

|

||

欧元/美元 |

|

$ |

781,398 |

|

|

$ |

383,227 |

|

英镑/美元 |

|

|

24,810 |

|

|

|

6,058 |

|

以色列谢克尔 / 美元 |

|

|

12,535 |

|

|

|

11,852 |

|

日币 / 美元 |

|

|

42,340 |

|

|

|

4,770 |

|

瑞士 / 美元 |

|

|

74,939 |

|

|

|

32,766 |

|

瑞典克朗 / 美元 |

|

|

48,596 |

|

|

|

35,085 |

|

人民币 / 美元 |

|

|

32,124 |

|

|

|

16,660 |

|

新台币 / 美元 |

|

|

16,368 |

|

|

|

11,855 |

|

其他 |

|

|

25,368 |

|

|

|

21,363 |

|

总计 |

|

$ |

1,058,478 |

|

|

$ |

523,636 |

|

债务

除了我们2025年和2028年高级票据到期的10亿美元外,截至2024年9月30日,我们在信贷机构下尚有75300万元未偿还。信贷机构下的贷款利率为利率期货,利率每30天到180天根据我们选择的利率和期限进行重置。这些贷款受到利率风险的影响,因为在每次到期日,利率会根据未偿还金额的情况进行调整。截至2024年9月30日,信贷机构贷款的加权平均年利率为6.9%。根据截至2024年9月30日的未偿借款和有效利率,每年利率调整100个基点在一年内将对年度收益和现金流产生800万元的影响。

现金及现金等价物

截至2024年9月30日,现金等价物投资于购买时到期在三个月或更短的高度流动性投资。我们将现金投资于北美、欧洲和亚太地区的高评级金融机构,以及多样化的国内和国际货币市场共同基金。截止2024年9月30日,我们在美国的现金及现金等价物为3600万美元,在欧洲为12700万美元,在亚太地区(包括印度)为8600万美元,以及在其他非美国国家为1700万美元。考虑到截至2024年9月30日投资组合持有的短期到期和投资级质量,假设利率变化10%,将不会对我们的现金及现金等价物的公允价值产生重大影响。

我们所投资的现金受利率波动的影响,并且对于非美国的业务,面临外币汇率风险。在利率下降的环境中,我们将经历利息收入的减少。在利率上升的环境中,则情况正好相反。在过去几年中,美国联邦储备委员会、欧洲中央银行和银行英格兰已经改变了一些基准利率,这导致市场利率的下降和上升。这些市场利率的变化导致我们所持有的现金及现金等价物所赚取的利息收入出现波动。利息收入将根据市场利率的变化和可供投资的现金水平继续波动。相对于美元的外币变化对我们在FY'24和FY'23年的合并现金余额分别产生了320万和290万的有利影响。FY'24年的影响特别是由于巴西雷亚尔、瑞典克朗、中国人民币和新台币的变化。

38

ITEM 8. Financial Statements and Supplementary Data

The consolidated financial statements and notes to the consolidated financial statements are attached as APPENDIX A.

项目9. 会计和财务披露方面的变化与会计师的分歧

无。

ITEm 9A. 控制和程序

信息披露控制和程序的评估

我们的管理层维护按照《1934年证券交易法》(经修订)(“交易法”)第13a-15(e)和15d-15(e)条款定义的披露控制和程序,这些程序旨在提供合理保证,确保根据交易法提交或报告的文件中要求披露的信息在SEC的规则和表格所规定的时间内被处理、记录、汇总和报告,并且这些信息会被汇总并传达给我们的管理层,包括首席执行官和首席财务官(我们的主要执行官和主要财务官),以便及时作出有关所需披露的决策。

在管理层的监督和参与下,包括我们的首席执行官和信安金融官,我们评估了截至本年度报告所覆盖期末时,我们的信息披露控制和程序的设计与事件控件的有效性。基于这一评估,我们认为截至2024年9月30日,我们的信息披露控制和程序在合理保证水平上是有效的。

Management’s Annual Report on Internal Control over Financial Reporting

我们的管理层负责建立和维护对财务报告的有效内部控制。根据交易所法第13a-15(f)和15d-15(f)条的定义,财务报告的内部控制是由我们的首席执行官和首席财务官设计或在其监督下进行的一个过程,是由我们董事会、管理层及其他人员实施的,旨在提供合理的保证,确保财务报告的可靠性以及根据公认会计原则为外部目的编制基本报表,并包括以下政策和程序:

39

由于其固有的局限性,内部控制对财务报告的管理可能无法防止或发现错误陈述。对任何评估有效性的未来时期的预测都面临着风险,因为控制措施可能由于条件变化而变得不足,或者对政策或程序的遵守程度可能会下降。

我们的管理层在2024年9月30日评估了我们财务报告内部控制的有效性,依据的是特雷德韦委员会(COSO)制定的标准, 内部控制-综合框架(2013)根据这一评估和这些标准,我们的管理层得出的结论是,截至2024年9月30日,我们的财务报告内部控制是有效的。

截至2024年9月30日,我们财务报告内部控制的有效性已由普华永道会计师事务所(PricewaterhouseCoopers LLP)审计,具体内容见他们的报告,该报告出现在第8项下。

财务报告内部控制的变更

截至2024年9月30日的季度内,我们的财务报告内部控制没有发生任何变化,这些变化对我们的财务报告内部控制没有实质性影响,或者在合理的可能性下不会对我们的财务报告内部控制产生实质性影响。

条款90亿。其他信息

对PTC章程的修订

2024年11月14日,针对公司治理事务的定期审查以及证券交易委员会规则和马萨诸塞州公司法(“MBCA”)的某些近期变更,PTC的董事会(“董事会”)批准并采纳了公司章程(经修订后的“修订和重述章程”)的修正案,该修正案在批准后生效。修订和重述章程对章程进行了全面的修订和重述,内容包括但不限于: (i) 允许只进行虚拟的股东会议; (ii) 修订章程的提前通知条款,以扩大与股东提案和股东董事提名相关的股东提议者和董事候选人的信息和其他要求; (iii) 处理与经过修订的1934年证券交易法第14a-19条规则相关的事项; (iv) 提供股东寻求召集特别股东会议的流程和程序,以及董事会在应对此类请求和会议进行时的义务和权利; (v) 说明弃权和经纪人未投票在确定是否存在股东法定人数及投票事项的股份数量时的处理方式; (vi) 规定任何向其他股东征求委托的股东必须使用白色以外的委托卡,白色委托卡仅供董事会专用; (vii) 规定董事会可以采纳董事会认为适当的规章和程序来主持任何股东会议; (viii) 澄清和确认董事会,除依法另有规定以及在法律允许的范围内,可以限制其根据董事会批准的协议行使公司的权力; (ix) 规定董事的罢免只能在召集的旨在罢免该董事的会议中进行,会议通知必须说明会议的目的或一个目的为罢免该董事; (x) 在各处进行各种更新,使其符合MBCA,并进行文书更改、澄清和其他符合性修订。

上述对经修订和重述的章程的描述并不声称是完整的,并且受限于完整的经修订和重述的章程,后者的副本作为附件3.2提交于本表10-K,并在此通过引用纳入。

40

董事和执行官在2024年第四季度采用、修改或终止10b5-1计划

Our Section 16 officers and directors may enter into plans or arrangements for the purchase or sale of our securities that are intended to satisfy the affirmative defense conditions of Rule 10b5-1(c) of the Exchange Act. Such plans and arrangements must comply in all respects with our insider trading policies, including our policy governing entry into and operation of 10b5-1 plans and arrangements.

During the quarter ended September 30, 2024, the following Section 16 officers adopted Rule 10b5-1 trading arrangements (as defined in Item 408 of Regulation S-K of the Exchange Act). All plans adopted covered only sales of PTC common stock. No plans were

Name and Title of Director or Section 16 Officer |

|

Date of Adoption, Modification, or Termination |

|

Duration of the Plan

|

|

Aggregate Number of Shares of Common Stock that may be Sold under the Plan |

|

|

Ends |

|

|||

|

|

Ends |

|

|||

General Counsel |

|

|

Ends |

|

ITEM 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections

Not applicable.

41

PART III

ITEM 10. Directors, Executive Officers and Corporate Governance

The information required by this item not set forth below may be found under the headings “Corporate Governance and the Board of Directors," “Insider Trading Policies and Procedures,” "Our Executive Officers," “Delinquent Section 16(a) Reports,” and “Transactions with Related Persons” appearing in our 2025 Proxy Statement. Such information is incorporated herein by reference.

Code of Ethics for Senior Executive Officers

We have adopted a Code of Ethics for Senior Executive Officers that applies to our President and Chief Executive Officer, Chief Financial Officer, and Chief Accounting Officer, as well as others. The Code is embedded in our Code of Business Conduct and Ethics applicable to all employees. A copy of the Code of Business Conduct and Ethics is publicly available on our website at www.ptc.com. If we make any substantive amendments to, or grant any waiver from, including any implicit waiver, the Code of Ethics for Senior Executive Officers to or for our President and Chief Executive Officer, Chief Financial Officer or Chief Accounting Officer, we will disclose the nature of such amendment or waiver in a current report on Form 8-K.

Changes to Shareholder Director Nomination Procedures

As described in Item 9B of this Annual Report, our By-Laws were amended and restated on November 14, 2024 to, among other things, revise the advance notice provisions of the By-Laws to expand the informational and other requirements for shareholder proponents and director nominees in connection with shareholder director nominations. Those provisions are set forth in Section 2.3 of the Amended and Restated By-Laws filed as Exhibit 3.2 to this Annual Report and incorporated herein by reference.

ITEM 11. Executive Compensation

Information with respect to director and executive compensation may be found under the headings “Director Compensation,” “Compensation Discussion and Analysis,” “Compensation Tables,” “Compensation Committee Report,” and “Pay Ratio Disclosure” appearing in our 2025 Proxy Statement. Such information is incorporated herein by reference.

42

ITEM 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

Information about our common stock ownership may be found under the heading “Information about PTC Common Stock Ownership” appearing in our 2025 Proxy Statement. Such information is incorporated herein by reference.

EQUITY COMPENSATION PLAN INFORMATION

as of September 30, 2024

Plan Category |

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

|

|

Weighted-average exercise price of outstanding options, warrants and rights |

|

|

Number of securities remaining available for future issuance under equity compensation plans |

|

|||

Equity compensation plans approved by security holders: |

|

|

|

|

|

|

|

|

|

|||

2000 Equity Incentive Plan(1) |

|

|

2,061,934 |

|

|

|

— |

|

|

|

6,064,590 |

|

2016 Employee Stock Purchase Plan(2) |

|

|

— |

|

|

|

— |

|

|

|

2,036,133 |

|

Total |

|

|

2,061,934 |

|

|

|

— |

|

|

|

8,100,723 |

|

ITEM 13. Certain Relationships and Related Transactions, and Director Independence

Information with respect to this item may be found under the headings “Independence of Our Directors,” “Review of Transactions with Related Persons” and “Transactions with Related Persons” appearing in our 2025 Proxy Statement. Such information is incorporated herein by reference.

ITEM 14. Principal Accounting Fees and Services

Information with respect to this item may be found under the headings “Engagement of Independent Auditor and Approval of Professional Services and Fees” and “PricewaterhouseCoopers LLP Professional Services and Fees” in our 2025 Proxy Statement. Such information is incorporated herein by reference.

43

PART IV

ITEM 15. Exhibits and Financial Statement Schedules

(a) Documents Filed as Part of Form 10-K

1. |

Financial Statements |

|

|

Report of Independent Registered Public Accounting Firm (PricewaterhouseCoopers LLP, Boston, MA, PCAOB ID: |

|

|

Consolidated Balance Sheets as of September 30, 2024 and 2023 |

|

|

Consolidated Statements of Operations for the years ended September 30, 2024, 2023 and 2022 |

|

|

||

|

Consolidated Statements of Cash Flows for the years ended September 30, 2024, 2023 and 2022 |

|

|

||

|

||

2. |

Financial Statement Schedules |

|

|

Schedules have been omitted since they are either not required, not applicable, or the information is otherwise included in the Financial Statements per Item 15(a)1 above. |

|

|

|

|

3. |

Exhibits |

|

|

The list of exhibits in the Exhibit Index is incorporated herein by reference. |

|

(b) Exhibits

We hereby file the exhibits listed in the attached Exhibit Index.

(c) Financial Statement Schedules

None.

ITEM 16. Form 10-K Summary

None.

44

EXHIBIT INDEX

|

|

|

|

|

|

Incorporated by Reference |

||||||

Exhibit Number |

|

Description |

|

Filed Herewith |

|

Form |

|

Filing Date |

|

Exhibit |

|

SEC File No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.1 |

|

|

|

|

10-K |

|

November 23, 2015 |

|

3.1 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.2 |

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.1 |

|

|

|

|

8-K |

|

February 13, 2020 |

|

4.1 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.2 |

|

|

|

|

8-K |

|

February 13, 2020 |

|

4.2 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.3 |

|

|

|

|

8-K |

|

February 13, 2020 |

|

4.3 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.4 |

|

Description of Securities Registered under Section 12 of the Securities Exchange Act of 1934 |

|

|

|

10-K |

|

November 18, 2019 |

|

4.4 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

10.1* |

|

|

|

|

8-K |

|

February 21, 2023 |

|

10.1 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.1-1* |

|

Form of Restricted Stock Unit Certificate (Non-Employee Director) |

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.1-2* |

|

|

|

|

10-K |

|

November 18, 2016 |

|

10.1.11 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.1-3* |

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.1-4* |

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.1-5* |

|

|

|

|

10-K |

|

November 20, 2023 |

|

10.1.12 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.1-6* |

|

Form of Restricted Stock Unit Certificate (U.S. Section 16 and U.S. EVP) |

|

|

|

10-K |

|

November 20, 2023 |

|

10.1.13 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

10.1-8* |

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.1-9* |

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.2* |

|

|

|

|

8-K |

|

February 21, 2023 |

|

10.2 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.3-1* |

|

Executive Agreement by and between the Company and James Heppelmann dated September 30, 2020 |

|

|

|

8-K |

|

October 6, 2020 |

|

10.1 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

10.3-2* |

|

|

|

|

8-K |

|

February 21, 2023 |

|

10.3 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.4-1* |

|

Offer Letter dated July 24, 2023 by and between the Company and Neil Barua |

|

|

|

8-K |

|

July 26, 2023 |

|

10.1 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

10.4-2* |

|

Executive Agreement between the Company and Neil Barua dated July 24, 2023 |

|

|

|

8-K |

|

July 26, 2023 |

|

10.2 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

10.5* |

|

|

|

|

10-K |

|

November 20, 2023 |

|

10.5 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.6* |

|

Executive Agreement dated November 16, 2023 by and between Michael DiTullio and PTC Inc. |

|

|

|

10-K |

|

November 20, 2023 |

|

10.6 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

10.10 |

|

|

|

|

8-K |

|

September 7, 2017 |

|

10 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.11 |

|

|

|

|

8-K |

|

November 29, 2017 |

|

10.23 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.16 |

|

|

|

|

8-K |

|

January 3, 2023 |

|

4.4 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45

10.17 |

|

|

|

|

8-K |

|

October 7, 2024 |

|

10.1 |

|

0-18059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19.1 |

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19.2 |

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21.1 |

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23.1 |

|

Consent of PricewaterhouseCoopers LLP, an independent registered public accounting firm |

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31.1 |

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31.2 |

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32** |

|

Certification of Periodic Financial Report Pursuant to 18 U.S.C. Section 1350 |

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

97.1 |

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

101.INS |

|

Inline XBRL Instance Document – the instance document does not appear in the interactive data file because its XBRL tags are embedded within the inline XBRL document |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

101.SCH |

|

Inline XBRL Taxonomy Extension Schema with Embedded Linkbase Documents |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

104 |

|

The cover page of the Annual Report on Form 10-K formatted in Inline XBRL (included in Exhibit 101) |

|

|

|

|

|

|

|

|

|

|

* Identifies a management contract or compensatory plan or arrangement in which an executive officer or director of PTC participates.

** Indicates that the exhibit is being furnished with this report and is not filed as a part of it.

46

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized on the 14th day of November, 2024.

|

PTC Inc. |

|

|

By: |

/s/ NEIL BARUA |

|

|

Neil Barua President and Chief Executive Officer |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the Registrant and in the capacities indicated below, on the 14th day of November, 2024.

Signature |

|

Title |

(i) Principal Executive Officer: |

|

|

/s/ NEIL BARUA |

|

President and Chief Executive Officer |

Neil Barua |

|

|

|

|

|

(ii) Principal Financial Officer: |

|

|

/s/ KRISTIAN TALVITIE |

|

Executive Vice President and Chief Financial Officer |

Kristian Talvitie |

|

|

|

|

|

(iii) Principal Accounting Officer: |

|

|

/s/ ALICE CHRISTENSON |

|

Chief Accounting Officer |

Alice Christenson |

|

|

|

|

|

(iv) Board of Directors: |

|

|

/s/ JANICE CHAFFIN |

|

Chair of the Board |

Janice Chaffin |

|

|

|

|

|

/s/ NEIL BARUA |

|

President and Chief Executive Officer |

Neil Barua |

|

|

|

|

|

/s/ MARK BENJAMIN |

|

Director |

Mark Benjamin |

|

|

|

|

|

/s/ ROB BERNSHTEYN |

|

Director |

Rob Bernshteyn |

|

|

|

|

|

/s/ AMAR HANSPAL |

|

Director |

Amar Hanspal |

|

|

|

|

|

/s/ MICHAL KATZ |

|

Director |

Michal Katz |

|

|

|

|

|

/s/ PAUL LACY |

|

Director |

Paul Lacy |

|

|

|

|

|

/s/ CORINNA LATHAN |

|

Director |

Corinna Lathan |

|

|

|

|

|

/s/ JANESH MOORJANI |

|

Director |

Janesh Moorjani |

|

|

|

|

|

/s/ ROBERT SCHECHTER |

|

Director |

Robert Schechter |

|

|

47

APPENDIX A

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders of PTC Inc.

Opinions on the Financial Statements and Internal Control over Financial Reporting

We have audited the accompanying consolidated balance sheets of PTC Inc. and its subsidiaries (the "Company") as of September 30, 2024 and 2023, and the related consolidated statements of operations, of comprehensive income, of stockholders’ equity and of cash flows for each of the three years in the period ended September 30, 2024, including the related notes (collectively referred to as the "consolidated financial statements"). We also have audited the Company's internal control over financial reporting as of September 30, 2024, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of September 30, 2024 and 2023, and the results of its operations and its cash flows for each of the three years in the period ended September 30, 2024 in conformity with accounting principles generally accepted in the United States of America. Also in our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of September 30, 2024, based on criteria established in Internal Control - Integrated Framework (2013) issued by the COSO.

Basis for Opinions