EXECUTION VERSION EQUITY AND ASSET PURCHASE AGREEMENT by and among ARCTIC WOLF NETWORKS, INC., ARCTIC WOLF NETWORKS INTERNATIONAL, INC., BLACKBERRY LIMITED, and BLACKBERRY UK LIMITED

ii TABLE OF CONTENTS Page 1. Purchase and Sale of Transferred Subsidiary Equity Interests and Transferred Assets. ................. 1 1.1 Purchase and Sale of Transferred Subsidiary Equity Interests .......................................... 1 1.2 Transferred Assets ............................................................................................................. 2 1.3 Excluded Assets ................................................................................................................. 2 1.4 Assumed Liabilities ........................................................................................................... 2 1.5 Excluded Liabilities ........................................................................................................... 2 1.6 Excluded Contracts ............................................................................................................ 3 2. Purchase Price. ................................................................................................................................ 3 2.1 Consideration ..................................................................................................................... 3 2.2 Adjustments to Purchase Price........................................................................................... 4 2.3 Payment of Transfer Taxes and Fees ................................................................................. 7 2.4 Delayed Cash Amount Payment. ....................................................................................... 8 2.5 Withholding ....................................................................................................................... 8 3. Closing ............................................................................................................................................ 8 4. Representations and Warranties of Seller ....................................................................................... 9 4.1 Organization and Qualification .......................................................................................... 9 4.2 Authority and Binding Obligation ..................................................................................... 9 4.3 Capitalization of Transferred Subsidiary ......................................................................... 10 4.4 No Conflicts ..................................................................................................................... 10 4.5 Governmental Approvals and Consents ........................................................................... 10 4.6 Financial Information ...................................................................................................... 10 4.7 No Undisclosed Liabilities ............................................................................................... 11 4.8 Absence of Changes ......................................................................................................... 11 4.9 Contracts and Commitments ............................................................................................ 11 4.10 Taxes ................................................................................................................................ 14 4.11 Privacy and Information Security .................................................................................... 18 4.12 Intellectual Property Rights ............................................................................................. 21 4.13 Real and Personal Property .............................................................................................. 25 4.14 Transactions with Interested Persons ............................................................................... 26 4.15 Insurance .......................................................................................................................... 26 4.16 Litigation .......................................................................................................................... 26 4.17 Compliance with Laws .................................................................................................... 27

iii 4.18 Employees ........................................................................................................................ 29 4.19 Employee Benefit Matters ............................................................................................... 31 4.20 Indebtedness..................................................................................................................... 33 4.21 Customers and Suppliers ................................................................................................. 33 4.22 Tangible Assets ................................................................................................................ 33 4.23 Brokers’ and Finders’ Fees .............................................................................................. 33 4.24 Transferred Subsidiary Operations; Title to Assets; Sufficiency of Assets ..................... 34 4.25 Solvency........................................................................................................................... 34 4.26 EXCLUSIVITY OF REPRESENTATIONS AND WARRANTIES .............................. 35 5. Representations and Warranties of Purchaser ............................................................................... 35 5.1 Organization and Qualification ........................................................................................ 35 5.2 Authority and Binding Obligation ................................................................................... 35 5.3 No Conflicts ..................................................................................................................... 36 5.4 Governmental Approvals and Consents ........................................................................... 36 5.5 Capitalization ................................................................................................................... 36 5.6 Valid Issuance of Shares .................................................................................................. 36 5.7 Offering ............................................................................................................................ 36 5.8 Compliance with Laws .................................................................................................... 36 5.9 Purchaser Financial Statements ....................................................................................... 36 5.10 No Financing.................................................................................................................... 37 5.11 Brokers’ and Finders’ Fees .............................................................................................. 37 6. Covenants ...................................................................................................................................... 37 6.1 Conduct of the Business Pending Closing ....................................................................... 37 6.2 No Solicitation ................................................................................................................. 40 6.3 Confidentiality ................................................................................................................. 40 6.4 Access to Information ...................................................................................................... 42 6.5 Notification of Certain Events ......................................................................................... 43 6.6 Employee Matters ............................................................................................................ 43 6.7 Non-Competition and Non-Solicitation ........................................................................... 45 6.8 Release ............................................................................................................................. 47 6.9 Tax Matters ...................................................................................................................... 48 6.10 Procedure for Certain Assets Not Transferable ............................................................... 51 6.11 Shared Accounts Receivable............................................................................................ 52 6.12 Wrong Pockets ................................................................................................................. 52 6.13 Necessary Efforts; No Inconsistent Action ...................................................................... 52

iv 6.14 Further Assurances .......................................................................................................... 53 6.15 Intercompany Liabilities .................................................................................................. 53 6.16 Bulk Sales ........................................................................................................................ 53 6.17 Closing Deliverables ........................................................................................................ 53 6.18 Audit Support ................................................................................................................... 53 6.19 Transferred Property Guarantee ....................................................................................... 53 6.20 Professional Services Report ........................................................................................... 54 6.21 Additional Agreements .................................................................................................... 54 7. Conditions of the Closing. ............................................................................................................ 54 7.1 Conditions to Seller’s Obligations ................................................................................... 54 7.2 Conditions to Purchaser’s Obligations ............................................................................. 55 8. Survival and Indemnification. ....................................................................................................... 58 8.1 Survival of Representations, Warranties and Covenants ................................................. 58 8.2 Indemnification Provisions .............................................................................................. 58 8.3 Limitations on Liability ................................................................................................... 60 8.4 Indemnification Procedures ............................................................................................. 61 8.5 Determination of Losses .................................................................................................. 63 8.6 Set-Off ............................................................................................................................. 63 8.7 No Contribution ............................................................................................................... 64 8.8 Claims Not Affected by Knowledge ................................................................................ 64 8.9 Exclusive Remedy ........................................................................................................... 64 8.10 No Double Recovery ....................................................................................................... 64 9. Termination; Remedies. ................................................................................................................ 64 9.1 Termination ...................................................................................................................... 64 9.2 Effect of Termination ....................................................................................................... 65 10. Miscellaneous. .............................................................................................................................. 65 10.1 Press Releases and Communications ............................................................................... 65 10.2 Governing Law ................................................................................................................ 65 10.3 Exclusive Jurisdiction ...................................................................................................... 65 10.4 Waiver of Jury Trial ......................................................................................................... 66 10.5 Waivers ............................................................................................................................ 66 10.6 Notices ............................................................................................................................. 66 10.7 Amendments .................................................................................................................... 67 10.8 Specific Performance; Other Remedies ........................................................................... 67 10.9 Expenses .......................................................................................................................... 68

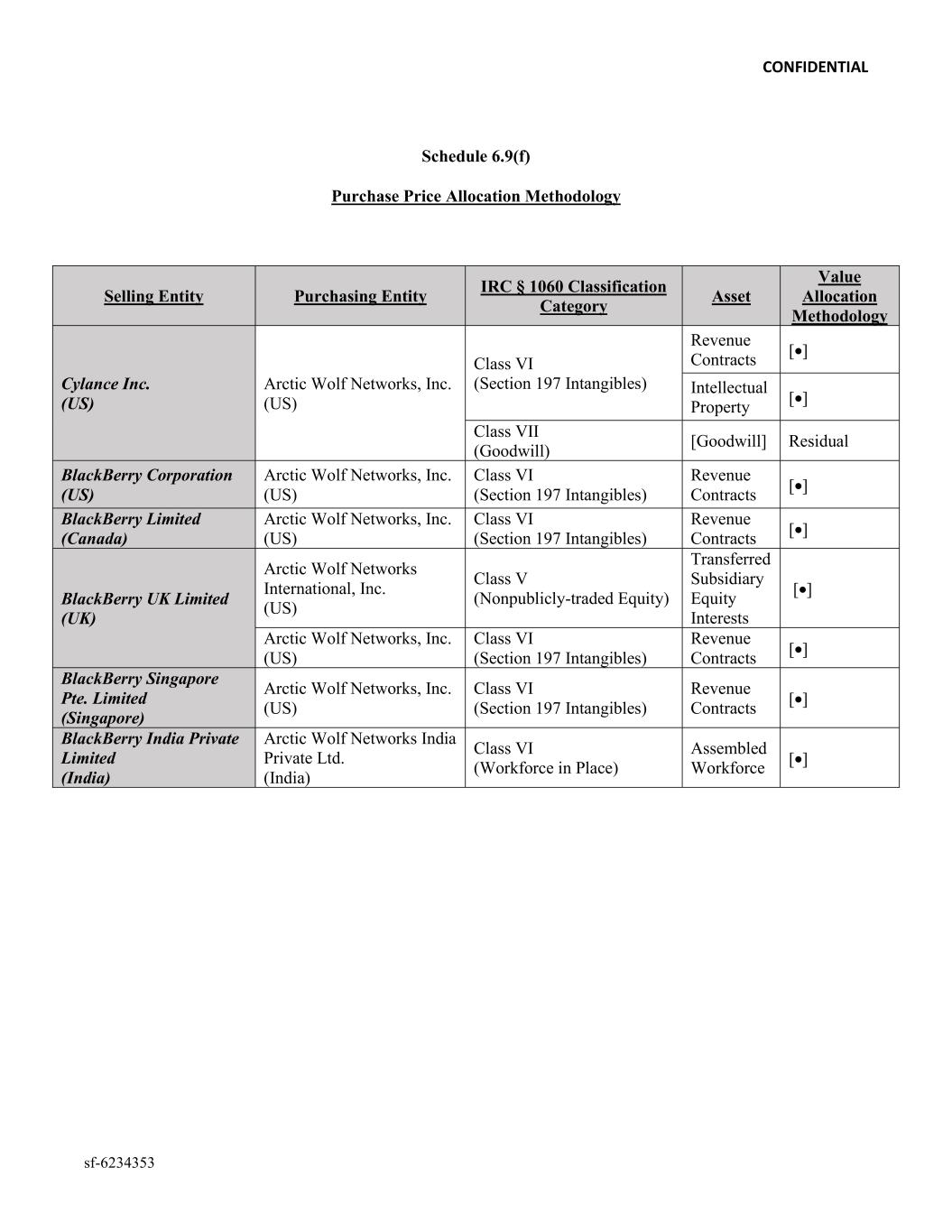

v 10.10 Entire Agreement ............................................................................................................. 68 10.11 Section and Paragraph Headings ..................................................................................... 68 10.12 Counterparts ..................................................................................................................... 68 10.13 Parties in Interest; Assignment ........................................................................................ 68 10.14 Exhibits and Schedules; Interpretation ............................................................................ 68 10.15 Severability ...................................................................................................................... 69 10.16 Attorney-Client Privilege ................................................................................................. 69 10.17 Performance of Obligations by Affiliates ........................................................................ 70 10.18 Disclosure Schedule ......................................................................................................... 70 11. Certain Definitions ........................................................................................................................ 70 ANNEXES, EXHIBITS AND SCHEDULES Exhibit A Form of Patent License Agreement Exhibit B Form of Bill of Sale and Assignment and Assumption Agreement Exhibit C Form of Transition Services Agreement Exhibit D Form of Intellectual Property Assignment Agreement Exhibit E Form of Strategic Customer Support Agreement Exhibit F Form of Side Letter Schedule 1-A Products Schedule 1-B Scheduled Patents Schedule 1-C Other Selling Entities and Other Purchasing Entities Schedule 1.2-A Transferred Assets Schedule 1.2-A(4) Transferred Contracts Schedule 1.2-A(6) Trademarks and Domain Names Schedule 1.2-B Other Transferred Assets Schedule 1.3 Excluded Assets Schedule 1.4 Assumed Liabilities Schedule 1.5 Excluded Liabilities Schedule 5.5 Purchaser Capitalization Schedule 6.6(a) Offered Employees List Schedule 6.9(f) Purchase Price Allocation Methodology Schedule 11.4 Certain Assumed Employee Liabilities Schedule 11.7 Business Service Providers Schedule 11.36 Patent Litigation Matters Schedule 11.37 Permitted Encumbrances

THIS EQUITY AND ASSET PURCHASE AGREEMENT (this “Agreement”) is made as of December 15, 2024 (the “Agreement Date”), by and among Arctic Wolf Networks, Inc., a Delaware corporation (“Purchaser”), Arctic Wolf Networks International, Inc., a Delaware corporation (“Subsidiary Purchaser”), BlackBerry Limited, a corporation incorporated under the Business Corporations Act (Ontario) (“Seller”) and BlackBerry UK Limited, a private limited company organized under the laws of England and Wales (“Transferred Subsidiary Parent”). Purchaser and Seller are referred to herein each as a “party” and collectively, the “parties.” RECITALS WHEREAS, Seller indirectly owns all of the issued and outstanding Securities (the “Transferred Subsidiary Equity Interests”) of Cylance Ireland Limited, a private company limited by shares incorporated in Ireland under the Companies Act 2014 with company registration number 591313 (the “Transferred Subsidiary”) through the Transferred Subsidiary Parent; WHEREAS, Seller is, directly or through one or more Affiliates (including the Transferred Subsidiary), engaged in developing, improving, maintaining, supporting and commercializing the Products (collectively, the “Business”); and WHEREAS, subject to the terms and conditions hereof, Purchaser, Subsidiary Purchaser and each of the Subsidiaries of Purchaser set forth on Schedule 1-C (each Subsidiary of Purchaser set forth on Schedule 1-C and the Subsidiary Purchaser, an “Other Purchasing Entity,” and collectively, the “Other Purchasing Entities,” and Purchaser together with all Other Purchasing Entities, each, a “Purchasing Entity,” and collectively, the “Purchasing Entities”) desire to purchase the Transferred Subsidiary Equity Interests and the Transferred Assets and assume the Assumed Liabilities from Seller, the Transferred Subsidiary Parent and each of the Subsidiaries of Seller set forth on Schedule 1-C (each Subsidiary of Purchaser set forth on Schedule 1-C and the Transferred Subsidiary Parent, an “Other Selling Entity,” and collectively, the “Other Selling Entities,” and Seller together with Transferred Subsidiary Parent and all Other Selling Entities, each, a “Selling Entity,” and collectively, the “Selling Entities”), and the Selling Entities desire to sell, assign, transfer and convey all of the Transferred Subsidiary Equity Interests, Transferred Assets and Assumed Liabilities to the Purchasing Entities, for the consideration specified in this Agreement. NOW, THEREFORE, in consideration of the representations, warranties, covenants and agreements contained in this Agreement, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the parties agree as follows: AGREEMENT 1. Purchase and Sale of Transferred Subsidiary Equity Interests and Transferred Assets. 1.1 Purchase and Sale of Transferred Subsidiary Equity Interests. (a) On the terms and subject to the conditions and other provisions set forth in this Agreement, at the Closing, the Transferred Subsidiary Parent shall sell, assign, transfer, convey and deliver to Subsidiary Purchaser, free and clear of all liens, encumbrances, claims, charges, options, security interests, pledges, rights of first refusal or other restrictions of any kind whatsoever (“Encumbrances”), and Subsidiary Purchaser shall purchase from Transferred Subsidiary Parent, for the amount set forth on the Allocation in cash, the Transferred Subsidiary Equity Interests. For the avoidance of doubt, notwithstanding Section 1.2 and Section 1.4 (but provided that the following statement about indirect transfer of liabilities shall not mean that such liabilities are Assumed Liabilities), all assets and liabilities of

2 the Transferred Subsidiary will be indirectly transferred to the Subsidiary Purchaser through such purchase of the Transferred Subsidiary Equity Interests. (b) Subject to the last sentence of Section 1.1(a), Seller shall cause the [Redacted: Vendor contracts subject to third party confidentiality obligations.] Contract and the [Redacted: Vendor contracts subject to third party confidentiality obligations.] Consulting Agreement SOW to be transferred and assigned to the Transferred Subsidiary prior to the Closing. 1.2 Transferred Assets. On the terms and subject to the conditions and other provisions set forth in this Agreement, at the Closing, Seller shall cause each Selling Entity to, and each such Selling Entity shall, sell, assign, transfer, convey and deliver to the Purchasing Entity listed opposite such Selling Entity on Schedule 1-C, and Purchaser shall cause each such Purchasing Entity to, and each such Purchasing Entity shall, purchase, acquire and accept from such Selling Entity, free and clear of all Encumbrances, except for Permitted Encumbrances, all right, title and interest in and to all of the assets of every kind or nature whatsoever (tangible, intangible or mixed) and wherever located owned by such Selling Entity that are (a) exclusively used or held for use in the operation of the Business as presently conducted, including the assets listed on Schedule 1.2-A, or (b) listed on Schedule 1.2-B (collectively, the “Transferred Assets”). For the avoidance of doubt, Transferred Assets shall not include any assets of the Transferred Subsidiary. Electronic transfer of Transferred Assets that are acquired by Purchaser and that are intellectual property will be situated in California, as the delivery, acceptance and ownership transfer will occur within California. 1.3 Excluded Assets. Notwithstanding anything to the contrary contained in this Agreement, all other assets of the Selling Entities, including those assets set forth on Schedule 1.3, are excluded from the purchase and sale of assets hereunder (the “Excluded Assets”). Seller and the Transferred Subsidiary shall cause any Transferred Subsidiary Excluded Asset held or owned by the Transferred Subsidiary to be transferred to Seller or one of its Affiliates (other than the Transferred Subsidiary) prior to the Closing. 1.4 Assumed Liabilities. On the terms and subject to the conditions and other provisions of this Agreement, at the Closing, Seller shall cause each Selling Entity to, and each such Selling Entity shall, assign to the Purchasing Entity listed opposite such Selling Entity on Schedule 1-C, and Purchaser shall cause each such Purchasing Entity to, and each such Purchasing Entity shall, assume only the Liabilities of Seller and its Subsidiaries set forth on Schedule 1.4 (collectively, the “Assumed Liabilities”). For the avoidance of doubt, Assumed Liabilities shall not include any Liabilities of the Transferred Subsidiary. 1.5 Excluded Liabilities. Except for the Assumed Liabilities, Purchaser and its Affiliates (including, as of the Closing, the Transferred Subsidiary) are not assuming (and nothing in this Agreement shall be construed as causing or requiring Purchaser or any of its Affiliates to assume), and will not be liable for any debts, Liabilities or payables of any kind or nature whatsoever of Seller or its Affiliates (including the Transferred Subsidiary), whether absolute or contingent, liquidated or unliquidated, secured or unsecured, and whether or not accrued, matured, known or unknown, or related to or arising from the Transferred Assets, Excluded Assets or otherwise, and whether arising prior to, on or after, the Closing Date, regardless of when asserted, including the Liabilities set forth on Schedule 1.5 (all of such debts, Liabilities or payables referred to in this Section 1.5, the “Excluded Liabilities”), Seller and its Affiliates (other than the Transferred Subsidiary) shall remain fully and solely liable with respect to, and agree to perform in accordance with their terms, all of the Excluded Liabilities. Seller and the Transferred Subsidiary shall cause any Transferred Subsidiary Excluded Liabilities owed or payable by the Transferred Subsidiary to be transferred to Seller or one of its Affiliates (other than the Transferred Subsidiary) prior to the Closing.

3 1.6 Excluded Contracts. For purposes of this Agreement, “Excluded Contracts” means all Contracts other than the Transferred Contracts set out on Schedule 1.2-A(4). No Excluded Contract shall be transferred or assigned to any Purchasing Entity or to the Transferred Subsidiary after the Closing pursuant to this Agreement. Seller shall cause any Transferred Subsidiary Excluded Contract to be (a) novated, (b) terminated (without any liability to Purchaser) or (c) subject to Purchaser’s prior written consent, otherwise transferred to Seller or one of its Affiliates (other than the Transferred Subsidiary) prior to the Closing. 2. Purchase Price. 2.1 Consideration. The Purchasing Entities shall pay or cause to be paid or issue or cause to be issued the following consideration at the following times, as consideration, together with the assumption of the Assumed Liabilities, for the Transferred Assets and the Transferred Subsidiary. (a) At the Closing, each Purchasing Entity shall pay or cause to be paid to the Selling Entity listed opposite such Purchasing Entity on Schedule 1-C, to an account designated by Seller in writing at least five (5) Business Days prior to the Closing, such Selling Entity’s share (as set forth on Schedule 1-C) of an amount of cash equal to one hundred million dollars ($100,000,000) (the “Upfront Cash Consideration”), plus (i) the Transferred Subsidiary Cash (the “Upwards Purchase Price Adjustment”), minus (ii) any Indebtedness of the Transferred Subsidiary as of immediately prior to the Closing (the “Transferred Subsidiary Indebtedness”), minus (iii) any Transaction Expenses of the Transferred Subsidiary to the extent unpaid as of immediately prior to the Closing (the “Closing Transaction Expenses”), minus (iv) the Transferred Subsidiary Excluded Liabilities to the extent outstanding as of immediately prior to the Closing after giving effect to any transfers in accordance with Section 1.5, minus (v) the Business Prepaid Deferred Revenue, minus (vi) the Receivables Factor (the sum of clauses (ii) through (vi), the “Downwards Purchase Price Adjustment”) (the “Closing Cash Payment”). For Tax purposes, Purchaser intends to treat the share of the Closing Cash Payment and any share of the Delayed Cash Payment paid or caused to be paid by (A) Arctic Wolf Networks Canada, Inc. as (1) first, transferred from Purchaser to Arctic Wolf Networks Canada, Inc. and (2) second, transferred from Arctic Wolf Networks Canada, Inc. to the Selling Entity listed opposite Arctic Wolf Networks Canada, Inc. on Schedule 1-C, (B) Arctic Wolf Networks India Private Ltd as (1) first, transferred from Purchaser to Arctic Wolf Networks International, Inc., (2) second, transferred from Arctic Wolf Networks International, Inc. to Arctic Wolf Networks India Private Ltd and (3) third, transferred from Arctic Wolf Networks India Private Ltd to the Selling Entity listed opposite Arctic Wolf Networks India Private Ltd on Schedule 1-C and (C) Arctic Wolf Networks UK Ltd as (1) first, transferred from Purchaser to Arctic Wolf Networks International, Inc., (2) second, transferred from Arctic Wolf Networks International, Inc. to Arctic Wolf Networks UK Ltd and (3) third, transferred from Arctic Wolf Networks UK Ltd to the Selling Entities listed opposite Arctic Wolf Networks UK Ltd on Schedule 1-C. The parties agree to file all Tax Returns and other filings in accordance with the foregoing treatment, and none of the parties shall take any Tax position that is inconsistent with the foregoing treatment, unless required to do so by applicable Law. (b) Subject to clause (d) below, as promptly as possible after the Closing, and in any event within three (3) Business Days after the Closing Date, Purchaser shall issue or cause to be issued to Cylance Inc. 5,518,763 shares of Purchaser Common Stock (the “Stock Consideration”) valued at [Redacted: Private company valuation of Deemed Issue Price redacted to avoid investor confusion. Fair value will be in Seller’s financial statements.] per share, and the issuance date of the Stock Consideration reflected in Purchaser’s transfer records shall be the Closing Date, which Stock Consideration shall be treated as paid in respect of the assets listed on Schedule 1-C acquired by Purchaser in exchange for such Stock Consideration.

4 (c) Subject to clause (d) and Section 2.4 below, within five (5) Business Days after the Expiration Date, each Purchasing Entity shall pay or cause to be paid to the Selling Entity listed opposite such Purchasing Entity on Schedule 1-C, to an account designated by Seller in writing at least five (5) Business Days prior to the Expiration Date, such Selling Entity’s share (as set forth on Schedule 1- C) of an amount equal to sixty million dollars ($60,000,0000) in cash (the “Delayed Cash Amount”), which amount shall not bear any interest, minus (i) the Determined Seller Losses (to the extent not satisfied via the cancellation of Stock Consideration in accordance with Section 8.4(g)), minus (ii) the aggregate Retained Delayed Cash Amount, minus (iii) the Assumed Employee Liabilities (the difference between the Delayed Cash Amount and the sum of clauses (i) through (iii), the “Delayed Cash Payment”). (d) In the event that the absolute value of the amount by which the Downwards Purchase Price Adjustment exceeds the Upwards Purchase Price Adjustment, if any, is greater than the Upfront Cash Consideration, the amount by which the absolute value of the amount by which the Downwards Purchase Price Adjustment exceeds the Upwards Purchase Price Adjustment is greater than the Upfront Cash Consideration shall first reduce the Delayed Cash Amount, and then, only if the Delayed Cash Amount is reduced to zero, reduce the Stock Consideration, with each share valued [Redacted: Private company valuation of Deemed Issue Price redacted to avoid investor confusion. Fair value will be in Seller’s financial statements.] per share. (e) For the avoidance of doubt, the parties acknowledge and agree that the Transferred Assets include all Specified Accounts Receivable. At the Closing, each Purchasing Entity hereby agrees to sell, assign, transfer, convey and deliver to the Selling Entity listed opposite such Purchasing Entity on Schedule 1-C, and each such Selling Entity hereby agrees to purchase, acquire and accept from such Purchasing Entity, all such Purchasing Entity’s right, title and interest in such Specified Accounts Receivable, for an amount equal to $8,000,000 (the “Receivables Factor”). For the avoidance of doubt, the parties acknowledge and agree that all receivables referenced the definition of “Business Prepaid Deferred Revenue” are Excluded Assets and none of such receivables shall be included in the Specified Accounts Receivable. 2.2 Adjustments to Purchase Price. (a) At least three (3) Business Days prior to the Closing Date, Seller shall deliver to Purchaser a statement (the “Estimated Closing Statement”) setting forth (i) Seller’s good faith calculation of the Closing Cash Payment and (ii) the components thereof, including Seller’s good faith estimates of (A) the cash and cash equivalents of the Transferred Subsidiary as of immediately prior to the Closing (the “Transferred Subsidiary Cash”), (B) any Transferred Subsidiary Indebtedness, (C) any Closing Transaction Expenses, (D) the Transferred Subsidiary Excluded Liabilities, (E) without duplication as between the following clauses (1) and (2), (1) any deferred revenue of the Business (other than in respect of any Specified Excluded Contract) for which cash has been collected prior to Closing or with respect to which an invoice has been issued as of the Closing and which respect to which services or Products will be provided after the Expiration Date and (2) any deferred revenue associated with invoices issued or accounts receivable outstanding, in each case on or prior to the Closing, or cash collected by the Business prior to the Closing solely to the extent such invoices, accounts receivable or cash collected (a) relate to Contracts (other than any Specified Excluded Contract) which include a commencement date, on or after the Closing, for the services of the Business to be performed thereunder, including, for the avoidance of doubt, any renewal of an existing Contract relating to the Business (other than any Specified Excluded Contract) and (b) if such Contract is not exclusively related to the Business, relates solely to the provision of services by the Business (collectively, the “Business Prepaid Deferred Revenue”) and (F) the Assumed Employee Liabilities, each as calculated in accordance with GAAP subject to the definitions set forth in this Agreement.

5 (b) Seller shall (i) provide to Purchaser, together with the Estimated Closing Statement, such supporting documentation, information and calculations, including, for the avoidance of doubt, all books, records and work papers as are reasonably necessary for Purchaser to verify the calculations and amounts set forth in the Estimated Closing Statement (collectively, the “Work Papers”) and (ii) consider in good faith any feedback to the Estimated Closing Statement provided by Purchaser prior to the Closing; provided that in case of any disagreement between the parties, in no case shall such disagreement delay the Closing and the estimates and calculations of Seller set forth in the Estimated Closing Statement shall control. The failure of Purchaser to provide any comments to Seller in connection with Purchaser’s review of the Estimated Closing Statement shall in no way diminish Purchaser’s rights under Article 8 hereof. (c) (i) Within forty-five (45) days after the Closing Date, Seller shall prepare and deliver to Purchaser (A) an updated statement that shall set forth Seller’s good faith calculation of (1) the Final Closing Cash Payment and (2) the components thereof including (a) the Transferred Subsidiary Cash, (b) any Transferred Subsidiary Indebtedness, (c) any Closing Transaction Expenses, (d) the Transferred Subsidiary Excluded Liabilities, (e) the Business Prepaid Deferred Revenue and (f) the Assumed Employee Liabilities, each as calculated in accordance with GAAP, or (B) written confirmation that there are no changes to the Estimated Closing Statement ((A) or (B), as applicable, the “Definitive Closing Statement”. The provisions of Section 2.2(b)(i) with respect to the Estimated Closing Statement shall apply to the Definitive Closing Statement, mutatis mutandis. (ii) Purchaser will have forty-five (45) days after it receives the Definitive Closing Statement and the Work Papers (the “Review Period”) to notify Seller in writing whether it agrees with the Definitive Closing Statement. If Purchaser notifies Seller that it agrees with, or if Purchaser does not send a Dispute Notice (defined below) with respect to, the Definitive Closing Statement within the Review Period, then the Definitive Closing Statement will be deemed agreed and will be conclusive, final and binding on the parties. If Purchaser notifies Seller in writing within the Review Period that it does not agree with the Definitive Closing Statement, which notice must include the amount of and basis for the disagreement and supporting documentation (the “Dispute Notice”), then Seller and Purchaser shall negotiate in good faith to resolve the disagreement, and any matters in the Dispute Notice that are resolved in writing by Seller and Purchaser will be conclusive, final and binding on the parties. Any portion of the Definitive Closing Statement that is not disputed in the Dispute Notice will be deemed agreed and will be conclusive, final and binding on the parties (collectively, the “Resolved Adjustment Matters”). (iii) If Seller and Purchaser do not resolve all of the matters in the Dispute Notice within thirty (30) days after Seller receives the Dispute Notice (or such longer period as they agree) then they shall submit the remaining unresolved matters (the “Open Matters”) to PricewaterhouseCoopers (the “Independent Accountant”) for resolution. If Open Matters are submitted to the Independent Accountant, (A) Seller and Purchaser shall provide to the Independent Accountant such documents and information relating to the Open Matters as the Independent Accountant reasonably requests and will have the opportunity to present the Open Matters to the Independent Accountant (and copies of any materials provided by any party to the Independent Accountant shall be delivered concurrently to the other party); (B) the Independent Accountant shall consider only the Open Matters, shall base its determination solely on the materials submitted by Seller and Purchaser and this Section 2.2(c) and related definitions (and not on an independent review) and may not assign a value to any item greater than the greatest value or less than the smallest value claimed by the parties in the Definitive Closing Statement or the Dispute Notice;

6 (C) Seller and Purchaser shall instruct the Independent Accountant to provide a written determination of the Open Matters within sixty (60) days of their submission, and such determination will be conclusive, final and binding on the parties (except in the case of manifest error or fraud); (D) Seller and Purchaser shall each pay fifty percent (50%) of the fees and costs of the Independent Accountant; and (E) the Independent Accountant shall act as an expert, not as an arbitrator, in determining the Open Matters. (iv) The “Final Closing Statement” shall be (A) in the event that no Dispute Notice is delivered by Purchaser to Seller prior to the expiration of the Review Period, the Definitive Closing Statement delivered by Seller to Purchaser pursuant to this Section 2.2(c), (B) in the event that a Dispute Notice is delivered by Purchaser to Seller prior to the expiration of the Review Period and Purchaser and Seller are able to agree on all matters set forth in such Dispute Notice, the Definitive Closing Statement delivered by Seller to Purchaser pursuant to Section 2.2(c)(i) as adjusted pursuant to the written agreement executed and delivered by Purchaser and Seller with respect to Resolved Adjustment Matters or (C) in the event that a Dispute Notice is delivered by Purchaser to Seller prior to the expiration of the Review Period and Purchaser and Seller are unable to agree on all matters set forth in such Dispute Notice, the Definitive Closing Statement delivered by Purchaser to Seller pursuant to Section 2.2(c)(i) as adjusted by, as applicable: (1) any written agreement executed and delivered by Purchaser and Seller with respect to Resolved Adjustment Matters, or (2) the Independent Accountant and the final determination of the Independent Accountant of the Open Matters in accordance with this Section 2.2(c). The date on which the Final Closing Statement is finally determined in accordance with this Section 2.2(c)(iv) is hereinafter referred to as the “Determination Date.” The Final Closing Statement and all amounts set forth therein shall be final and binding upon the parties hereto. (v) If the Closing Cash Payment set forth in the Final Closing Statement is less than the Closing Cash Payment set forth in the Estimated Closing Statement (such difference, the “Post-Closing Deficit Amount”), the Delayed Cash Amount shall be reduced by the amount of the Post-Closing Deficit Amount. If the Closing Cash Payment set forth in the Final Closing Statement is more than the Closing Cash Payment set forth in the Estimated Closing Statement (such difference, the “Post-Closing Excess Amount”), the Delayed Cash Amount shall be increased by the amount of the Post-Closing Excess Amount; provided that in no event shall the aggregate amount of the Upwards Purchase Price Adjustment that is attributed to the Transferred Subsidiary Cash, whether in connection with the Estimated Closing Statement or the Final Closing Statement, exceed $700,000. Any amount paid pursuant to this Section 2.2(c) will be treated as an adjustment to the purchase price for Tax reporting purposes. (d) For the purposes of this Agreement: (i) “Indebtedness” means, with respect to any Person, collectively, without duplication, each of the following Liabilities or obligations of such Person: (A) all liabilities for borrowed money, including any interest accrued thereon, any change of control premium, and any fees, charges or penalties payable in connection with the pre-payment or repayment of such indebtedness; (B) all obligations for the deferred purchase price of assets, securities, property or services (including any potential future earn-out, milestone, purchase price adjustment, releases of “holdbacks” or similar payments) or deferred rent; (C) all obligations evidenced by notes (convertible or otherwise), bonds, debentures or other similar debt securities or instruments or arising under indentures, and all Liabilities in respect of mandatorily redeemable or purchasable share capital or securities convertible into share capital; (D) all obligations arising out of any financial hedging, swap, derivative or similar arrangements; (E) all obligations in connection with any letter of credit, banker’s acceptance, guarantee, surety, performance or appeal bond or

7 similar credit transaction; (F) all Liabilities associated with capital leases, synthetic leases and sale leasebacks; provided, further, that for the avoidance of doubt, no Transferred Lease Agreement shall be characterized as a capital lease, synthetic lease or sale leaseback that would be considered Indebtedness under this clause (F); (G) any unpaid severance or change in control payments accelerated or required to be made by Purchaser in connection with the Transactions which are not separately accounted for as Transaction Expenses; (H) any Taxes described in clause (c) of the definition of Indemnified Taxes, or, to the extent payable by any Purchasing Entity, clause (b) of the definition of Indemnified Taxes, that are unpaid as of immediately prior to the Closing (other than Transfer Taxes allocated to Purchaser pursuant to Section 2.3); (I) all guarantees of any of the foregoing for the benefit of another Person, including by means of pledging any assets or the granting of lien; (J) the aggregate amount of all prepayment premiums, penalties, breakage costs, “make whole amounts,” costs, expenses and other payment obligations that would arise (whether or not then due and payable) if all such items under clauses (A) through (I) were prepaid, extinguished, unwound and settled in full as of such specified date; (K) any intercompany payable from the Transferred Subsidiary, on the one hand, to Seller or any of its Affiliates (other than the Transferred Subsidiary), on the other hand; in each case provided that in no event will Indebtedness include any Excluded Liabilities, Transaction Expenses or any Assumed Employee Liabilities; and (L) any payables of the Business that are more than fifteen (15) days past due. For purposes of determining any deferred purchase price obligations as of a specified date, such obligations shall be deemed to be the maximum amount of deferred purchase price owing as of such specified date (whether or not then due and payable) or potentially owing at a future date. (ii) “Transaction Expenses” means, collectively, without duplication, each of the following Liabilities of any Person: (A) all out-of-pocket costs and expenses incurred or subject to reimbursement by such Person in connection with this Agreement or the Transactions (including any fees and expenses of legal counsel, financial advisors, current and previous investment bankers, finders, accountants, consultants and other representatives of the Transferred Subsidiary); (B) any fees or expenses of the Transferred Subsidiary associated with obtaining any Consents of any Persons in connection with the Transactions; (C) any fees or expenses associated with obtaining the release and termination of any Encumbrances; (D) all Non- Continuing Employee Expenses; and (E) the Transaction Payroll Taxes; in each case provided that in no event will Transaction Expenses include Excluded Liabilities, Indebtedness or Assumed Employee Liabilities. 2.3 Payment of Transfer Taxes and Fees. (a) All transfer, documentary, sales, use, stamp, value added, excise, goods and services and registration Taxes, and all conveyance fees, recording charges and other similar fees and charges (including any penalties and interest related thereto but only to the extent they are caused by an action or decision of a Purchasing Entity) incurred in connection with the Transactions (“Transfer Taxes”) shall be borne and paid one hundred percent (100%) by Purchaser (including, for the avoidance of doubt, any Irish Stamp Duty arising on the transfer of the Transferred Subsidiary Equity Interests and Tax described in Section 2.3(b)), and the Purchase Price shall be paid without reduction or withholding for such amounts. The Purchasing Entities shall file all necessary Tax Returns and other documentation with respect to all such Transfer Taxes, and, if required by applicable Law, Seller will, and will cause the Selling Entities to, join in the execution of any such Tax Returns and other documentation. (b) For greater clarity, all amounts payable under this Agreement are exclusive of applicable GST/HST. The Purchaser (or the Purchasing Entities) shall be solely liable and responsible for the payment of applicable GST/HST either directly to the Selling Entities (but only upon receipt of a valid tax invoice issued by the Seller or Selling Entities) or to the appropriate Tax Authority as

8 required under applicable Law. If a Selling Entity is required under applicable Law to collect from the Purchaser (or a Purchasing Entity) GST/HST in respect of any amount payable by the Purchaser (or a Purchasing Entity) to a Selling Entity under this Agreement, such Selling Entity shall issue a valid tax invoice to the Purchaser (or the Purchasing Entity, as applicable) and collect and remit such GST/HST to the appropriate Tax Authority in accordance with applicable Law. The tax invoice issued by the applicable Selling Entity shall contain the information required under applicable Law to enable the Purchaser (or the Purchasing Entity, as applicable) to recover such GST/HST. 2.4 Delayed Cash Amount Payment. (a) Subject to the terms and conditions of this Agreement, the Delayed Cash Amount shall be withheld from amounts payable to the Selling Entities at the Closing and shall remain with the Purchasing Entities and be available as security to compensate the Purchasing Entities (on behalf of themselves or any other Indemnified Parties) for Losses pursuant to the indemnification obligations of Seller set forth in Article 8. (b) On or before 5:00 p.m. (New York time) on the Business Day immediately preceding the fifth (5th) Business Day after the Expiration Date, Purchaser shall notify Seller in writing of the amount that Purchaser reasonably determines to be necessary to satisfy all claims for indemnification, compensation or reimbursement that have been asserted in any Notice of Indemnification Claim that was delivered to Seller on or prior to the Expiration Date, but not resolved, at or prior to such time (each such claim, a “Continuing Claim,” and each such amount, a “Retained Delayed Cash Amount”). Promptly following such date, but in any case no later than the fifth (5th) Business Day after the Expiration Date, the Purchasing Entities shall pay the Delayed Cash Payment in accordance with Section 2.1(c) (such date, the “Delayed Cash Payment Date”); provided that if such calculation results in a negative number, no portion of the Delayed Cash Payment shall be released at such time. Any Retained Delayed Cash Amount held following the Delayed Cash Payment Date with respect to Continuing Claims that is not payable by the Indemnified Parties upon the resolution of such claims shall be (promptly after the final resolution thereof) disbursed to the appliable Selling Entity within five (5) Business Days following final resolution of such claims in accordance with the terms of this Agreement. 2.5 Withholding. Each Purchasing Entity, the Transferred Subsidiary and any other applicable withholding agent shall be entitled to deduct and withhold from any payments due pursuant to or contemplated by this Agreement such amounts as it determines are required to be deducted or withheld from such payment(s) under any applicable non-U.S. or any U.S. federal, state or local Law. Purchaser shall provide reasonable prior written notice to Seller of any such deduction or withholding that is required pursuant to applicable Law with respect to any payment made to a Selling Entity pursuant to Section 2.1 in respect of the Transferred Assets or Transferred Subsidiary, and shall provide Seller with a reasonable opportunity to provide any certificates or other documentation as may reduce or eliminate any such withholding. Purchaser and Seller shall cooperate (and shall cause their respective Affiliates to cooperate) in good faith with respect to eliminating or reducing any such deduction or withholding. In the event that any such amounts are so deducted or withheld, the amount deducted or withheld shall be treated as paid to the Person to whom such amounts would otherwise have been paid for all purposes of this Agreement. 3. Closing. Subject to the satisfaction or waiver of all conditions to the Closing set forth in this Agreement, the consummation of the purchase and sale of the Transferred Subsidiary Equity Interests, Transferred Assets and Assumed Liabilities (the “Closing”) shall take place via the electronic exchange of signatures and executed documents on the date that is (a) the later of (i) three (3) Business Days after all conditions set forth in Article 7 are fulfilled or waived (except for those conditions that, by their nature, are to be satisfied at the Closing, but subject to the satisfaction or waiver of such conditions at the Closing),

9 and (ii) February 3, 2025, or (b) on such other date and at such other place or time as Purchaser and Seller may agree upon in writing (the date on which the Closing occurs is referred to herein as the “Closing Date”). 4. Representations and Warranties of Seller. Seller represents and warrants to Purchaser that the statements contained in this Article 4 are true and correct as of the Agreement Date, and will be, as of the Closing Date, true and correct, in each case, except as disclosed in the document of even date herewith and delivered by Seller to Purchaser on the Agreement Date referring to the representations and warranties in this Agreement (the “Disclosure Schedule”). 4.1 Organization and Qualification. (a) Each Selling Entity is duly organized, validly existing and in good standing under the Laws of its jurisdiction of organization. Except where failure to have such power or authority would not be material to the Business, the Selling Entities together have the full power and authority to conduct the Business to the extent now conducted and each Selling Entity has full power and authority to own, use and lease its assets and properties. The Selling Entities are duly qualified to do business and are in good standing in each jurisdiction in which the transaction of the Business makes such qualification necessary, except where the failure to so qualify would not, individually or in the aggregate, have a Business Material Adverse Effect. (b) The Transferred Subsidiary is a private company limited by shares duly incorporated and validly existing under the Laws of the jurisdiction of its formation. The Transferred Subsidiary has full power and authority to conduct its business to the extent now conducted, and to own, use and lease its assets and properties, except where failure to have such power or authority would not be material to the Business. The Transferred Subsidiary is duly qualified to do business and is in good standing (where such concept exists in such jurisdiction) in each jurisdiction in which the transaction of the Business makes such qualification necessary, except where failure to so qualify would not, individually or in the aggregate, be material to the Business. Seller has provided to Purchaser correct and complete copies of the constitutional and organizational documents (including, as applicable, certificate of incorporation, constitution, governing bylaws, operating agreement or similar documents) (each, an “Organizational Document”) of the Transferred Subsidiary, each as amended as of the Agreement Date. 4.2 Authority and Binding Obligation. Each Selling Entity and the Transferred Subsidiary has all requisite corporate power and authority to enter into each Transaction Agreement to which it is a party or will be a party as of the Closing Date and to consummate the Transactions. The execution and delivery of each Transaction Agreement and the consummation of the Transactions have been duly authorized by all necessary action on the part of each Selling Entity and the Transferred Subsidiary, including approval of the board of directors, board of managers or managing member (or equivalent governing body) and equityholders of such Selling Entity or the Transferred Subsidiary, as applicable and to the extent required by such entity’s Organizational Documents or applicable Law, and no other corporate approvals are required. This Agreement has been duly executed and delivered by Seller and the Transferred Subsidiary, and each other Transaction Agreement has been duly executed, or will be as of the Closing Date duly executed, by each Selling Entity and the Transferred Subsidiary that is or will be a party thereto, and in each case assuming the due authorization, execution and delivery thereof by the parties (other than the applicable Selling Entities and Transferred Subsidiary) thereto, constitutes the legal, valid and binding obligations of each Selling Entity or the Transferred Subsidiary, as applicable, enforceable against such Selling Entity or the Transferred Subsidiary, as applicable, in accordance with its terms, except as may be limited by any bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or other similar Laws affecting the enforcement of creditors’ rights generally or by general principles of equity.

10 4.3 Capitalization of Transferred Subsidiary. (a) Section 4.3(a) of the Disclosure Schedule accurately and completely sets forth, for the Transferred Subsidiary, (i) each class and series of Securities of the Transferred Subsidiary, (ii) the aggregate number of shares, units or other interests of each such class and series of Securities that are authorized for issuance, (iii) the aggregate number of shares, units or other interests of each such class and series of Securities that are outstanding and (iv) a list of the names of each record and beneficial owner of such Securities and the number, class, and series of Securities owned by such owner. All such Securities set forth on Section 4.3(a) of the Disclosure Schedule have been duly authorized and validly issued and are fully paid up and nonassessable, and are not subject to, issued or held in violation of any purchase option, call option, trust arrangement, right of first refusal, preemptive right, subscription right or any similar right. The Securities set forth on Section 4.3(a) of the Disclosure Schedule collectively constitute all of the outstanding Securities of the Transferred Subsidiary. There are no options, warrants, convertible securities or other rights, agreements, arrangements or commitments relating to the Securities in the Transferred Subsidiary or obligating Seller or any of its Affiliates to issue or sell any Securities in the Transferred Subsidiary. No Securities are held in treasury by the Transferred Subsidiary. The Transferred Subsidiary does not own, directly or indirectly, beneficially or of record, any Securities of any Person. (b) All of the Transferred Subsidiary Equity Interests are legally and beneficially owned directly by Transferred Subsidiary Parent. Transferred Subsidiary Parent has good and valid title to the Transferred Subsidiary Equity Interests, free and clear of all Encumbrances or other restrictions of any kind whatsoever, other than restrictions on transfer under applicable federal and state securities Laws. Transferred Subsidiary Parent has the sole power and authority to transfer the Transferred Subsidiary Equity Interests as provided in this Agreement. The applicable Purchasing Entities will have, upon giving effect to the Closing, good and valid title to the Transferred Subsidiary Equity Interests, free and clear of all Encumbrances or other restrictions of any kind whatsoever, other than restrictions on transfer under applicable federal and state securities Laws. Seller and its Subsidiaries are not party to any voting trust or other voting agreement with respect to any of the Transferred Subsidiary Equity Interests or to any Contract or Liability relating to the issuance, sale (or restriction thereof), redemption, transfer (or restriction thereof) or other disposition of the Transferred Subsidiary Equity Interests. 4.4 No Conflicts. The execution and delivery of each Transaction Agreement by the Transferred Subsidiary and each Selling Entity party thereto, as applicable, does not or when executed will not, and the consummation of the Transactions will not, conflict with, or result in any violation of, or default under, or give rise to a right of payment, termination, cancellation or acceleration of any material obligation or loss of any material benefit, or result in the imposition of any Encumbrance (other than Permitted Encumbrances) on any Transferred Assets, the Transferred Subsidiary or the Business, under (a) any of the Organizational Documents of any Selling Entity or the Transferred Subsidiary or (b) except as set forth on Section 4.4(b) of the Disclosure Schedule, any Material Contract, or Permit or Law applicable to any Transferred Asset or the Transferred Subsidiary’s properties or assets, except as would not be material to the Business. 4.5 Governmental Approvals and Consents. No Selling Entity or the Transferred Subsidiary is required to file, seek, obtain or deliver any material notice, authorization, approval, order, permit, consent, registration or declaration of, with or to any Governmental Entity in connection with the execution, delivery and performance by the Selling Entities or the Transferred Subsidiary of this Agreement or the other Transaction Agreements to which they are or will be a party, or the consummation of the Transactions, except for compliance as may be required under Antitrust Law. 4.6 Financial Information. Seller has provided true, accurate and complete copies of (a) the stand-alone carve-out balance sheet of the Business as of February 29, 2024 and the related income

11 statement of the Business for the fiscal year ended as of February 29, 2024 (the “Annual Carve-out Financials”), (b) the stand-alone carve-out balance sheet of the Business as of September 30, 2024 (the “Balance Sheet Date”) and the income statement of the Business for the six (6)-month period ended as of August 31, 2024 (the “Interim Carve-out Financials”) and (c) the stand-alone carve-out balance sheet of the Transferred Subsidiary as of the Balance Sheet Date and the related statement of profit and loss of the Transferred Subsidiary for the seven (7)-month period ended as of the Balance Sheet Date (collectively with the Annual Carve-out Financials and the Interim Carve-out Financials, the “Financial Statements”). The Financial Statements were derived from and prepared in good faith based on the books and records (the “Books and Records”) of Seller and its Subsidiaries with respect to the Business applied on a consistent application of accounting principles throughout the periods indicated. The Books and Records for the periods ending before February 29, 2024, from which the Financial Statements were derived fairly present in all material respects the financial position and results of operations of Seller, and to Seller’s knowledge, there are no material modifications that should be made to the Books and Records for the periods ending after February 29, 2024. 4.7 No Undisclosed Liabilities. The Transferred Subsidiary does not have any material Liabilities of any nature (whether absolute, accrued, contingent or otherwise) except for those (a) specifically accrued against, reflected or reserved against in the Financial Statements, (b) incurred since the Balance Sheet Date in the Ordinary Course (none of which is a Liability or obligation for breach of Contract, tort, misappropriation or infringement or a claim or lawsuit), (c) listed in Section 4.7 of the Disclosure Schedule, (d) incurred in connection with the Transactions and (e) that are otherwise included in the calculation of the Closing Cash Payment, and, notwithstanding anything to the contrary in the foregoing, the Transferred Subsidiary, as of the Closing, will not have any Excluded Liabilities. Neither Seller nor the Transferred Subsidiary has any “off-balance sheet arrangements” (as such term is defined in Item 303(a)(4) of Regulation S-K promulgated under the Securities Exchange Act of 1934, as amended) related to the Business. 4.8 Absence of Changes. (a) Since the Balance Sheet Date, the Selling Entities and the Transferred Subsidiary have conducted the Business in the Ordinary Course and have at all times used all commercially reasonable efforts to (i) preserve intact the Business, (ii) preserve its relationships with customers, suppliers and others having dealings with it related to the Business and (iii) maintain the Transferred Assets in their current condition in all material respects, except, with respect to any fixed or tangible assets that are Transferred Assets, for ordinary wear and tear. (b) Since the Balance Sheet Date, except as disclosed in Section 4.8(a) of the Disclosure Schedule, there has not been any Business Material Adverse Effect, and the Selling Entities and the Transferred Subsidiary have not taken any action that, if taken on or after the Agreement Date without the consent of Purchaser, would result in a violation of Section 6.1. 4.9 Contracts and Commitments. (a) Section 4.9(a) of the Disclosure Schedule sets forth a list of all Contracts (i) with customers primarily relating to the Business to which any Selling Entity is a party, (ii) with vendors primarily relating to the Business to which any Selling Entity is a party and (iii) to which the Transferred Subsidiary is a party or by which its assets or properties are bound (in each case including the name of each such Contract, the name of each party to each such Contract and the date of each such Contract) as of December 11, 2024.

12 (b) Section 4.9(b) of the Disclosure Schedule sets forth a list of the following Transferred Contracts and Contracts to which the Transferred Subsidiary is a party or by which its assets or properties are bound (organized by subsection and including the name of each such Contract, the name of each party to each such Contract and the date of each such Contract) as of December 11, 2024: (i) requiring the Transferred Subsidiary to indemnify any person; (ii) granting any exclusive rights to any party with respect to any Transferred Assets or receiving any exclusive rights from any party with respect to the Business; (iii) with any Key Customer; (iv) with any Key Supplier; (v) with any director, manager, officer or affiliate of Seller or the Transferred Subsidiary; (vi) that contains a “most-favored nations” terms of pricing, royalties, license fees or similar clauses with respect to any Transferred Asset or Product or that in any way purports to restrict the Business or to limit the freedom of the Transferred Subsidiary or the Selling Entities (or their respective successors or assigns) to engage in any line of business or to compete with the counterparty to any Contract that is a Transferred Asset in any jurisdiction; (vii) that grant the Transferred Subsidiary or the Selling Entities “most favored nations” status in terms of pricing, royalties or license fees; (viii) providing for the employment of, or the performance of services by, any current Business Service Provider (A) with annual base compensation in excess of $250,000 and (B) that may not be terminated at-will without payment of severance, termination payment or advance notice (or, with respect to Business Service Providers in a jurisdiction that does not recognize at-will employment, upon no more than the minimum severance, termination payment and/or notice required by applicable Law); (ix) (A) pursuant to which Seller or the Transferred Subsidiary is or may become obligated to make any severance, termination, change of control, retention or similar payment to any current or former Business Service Provider or other Person in connection with, or as a result of, the Transactions; or (B) pursuant to which Seller or the Transferred Subsidiary is or may become obligated to make any bonus, commission or similar payment (other than payments constituting base salary) to any current or former Business Service Provider or other Person; (x) (A) relating to the acquisition, issuance, voting, registration, sale or transfer of any Securities of the Transferred Subsidiary, (B) providing any person or entity with any preemptive right, right of participation, right of maintenance or any similar right with respect to any Securities of the Transferred Subsidiary or (C) providing the Transferred Subsidiary or Seller or any of its other Affiliates with any right of first refusal with respect to, or right to repurchase or redeem, any Securities of the Transferred Subsidiary; (xi) containing any grant of any assignment, license, covenant not to sue, consent, coexistence right, release or immunity, in each case with respect to, (A) Business Owned IP Rights, granted by the Transferred Subsidiary to a third party or (B) any Intellectual Property Rights, granted by a third party to the Transferred Subsidiary under a Contract with the

13 Transferred Subsidiary (other than (1) non-exclusive licenses entered into in the Ordinary Course, (2) employee invention assignments or non-disclosure agreements or (3) licenses or agreements for the use of generally commercially available products, services or Technology for a total, enterprise- wide fee of no more than ($500,000 in any year of the Contract)); (xii) creating a partnership, joint venture, research, development, teaming or other similar arrangement in connection with the operation of the Business; (xiii) under which the Transferred Subsidiary or any Selling Entity is a lessor of or permits any third party to hold or operate any personal property owned or controlled by the Transferred Subsidiary or a Selling Entity, that cannot be terminated on sixty (60) days’ notice or less without payment of any material penalty by the Transferred Subsidiary or a Selling Entity, in each case with respect to the Business; (xiv) that are collective bargaining agreements or other similar Contracts with any labor union, works council or other labor organization (each a “Labor Agreement”); (xv) granting powers of attorney or similar authorizations by the Transferred Subsidiary or the Selling Entities to third parties; (xvi) with any Governmental Entity or that relate to the provision of products or services by any of the Selling Entities or the Transferred Subsidiary to any Governmental Entity, with a value in excess of $250,000 annually; (xvii) that is a reseller agreement covering the Products that is not on the standard form reseller agreement used in the Business; (xviii) with respect to (A) the acquisition of the Transferred Subsidiary by Seller and (B) relating to the acquisition of any Transferred Assets and any portion of the Business by Seller or any Subsidiary of Seller, including all purchase agreements, disclosure schedules and ancillary agreements in connection therewith; or (xix) agreements, contracts, plans, arrangements or other transactions between or among a Selling Entity, on the one hand, and any Affiliate or any officer, director or member of a Selling Entity, on the other hand (each, a “Related Party Agreement”). “Material Contract” means any Contract listed on any of Sections 4.9(b)(i) through 4.9(b)(xix) of the Disclosure Schedule. True, correct and complete copies of all Material Contracts, together with all amendments, exhibits, attachments, waivers or other changes thereto, have been made available to Purchaser. (c) With respect to each Material Contract: (i) such Material Contract is legal, valid, binding and enforceable and in full force and effect with respect to the Transferred Subsidiary or the Selling Entity party thereto and, to Seller’s knowledge, is legal, valid, binding, enforceable and in full force and effect with respect to each other party thereto, in either case subject to the effect of bankruptcy, insolvency, moratorium or other similar Laws affecting the enforcement of creditors’ rights generally and except as the availability of equitable remedies may be limited by general principles of equity; (ii) such Material Contract will be legal, valid, binding and enforceable and in full force and effect immediately following the Closing in accordance with its terms as in effect prior to the Closing, subject to the effect of bankruptcy, insolvency, moratorium or other similar Laws affecting the enforcement of creditors’ rights

14 generally and except as the availability of equitable remedies may be limited by general principles of equity; and (iii) neither the Transferred Subsidiary or the Selling Entity party thereto nor, to Seller’s knowledge, any other party is in material breach or default, and no event has occurred that with notice or lapse of time would constitute a material breach or default by the Transferred Subsidiary or the Selling Entity party thereto or, to Seller’s knowledge, by any such other party, or permit termination, modification or acceleration, under such Material Contract. (d) To Seller’s knowledge, no party to a Material Contract has threatened in writing termination, material diminution of benefits to a Selling Entity, or non-renewal of, any Material Contract, nor has the Transferred Subsidiary or Selling Entity received any written notice or written warning of any alleged material nonperformance, material delay in delivery or other material noncompliance by the Transferred Subsidiary or Selling Entity. 4.10 Taxes. (a) All income and other material Tax Returns required to be filed by or with respect to (i) any Selling Entity (insofar as it relates to any of the Business, Transferred Assets or Transferred Subsidiary), (ii) the Transferred Subsidiary or (iii) the Business or the Transferred Assets, in each case, have been timely filed (taking into account properly obtained extensions) with the appropriate Tax Authority. All such Tax Returns are true, complete and correct in all material respects. All income and material amounts of other Taxes required to be paid by or with respect to (i) any Selling Entity (insofar as it relates to any of the Business, Transferred Assets or Transferred Subsidiary), (ii) the Transferred Subsidiary or (iii) the Business or the Transferred Assets, in each case (whether or not reflected on any Tax Return), have been timely paid to the appropriate Tax Authority. The Selling Entities (insofar as it relates to any of the Business, Transferred Assets or Transferred Subsidiary) and the Transferred Subsidiary have made adequate reserves for the payment of all accrued but unpaid Taxes set forth on the face of the most recent Financial Statements, which shall be the Financial Statements issued for the Balance Sheet Date. (b) The Transferred Subsidiary has duly and properly submitted, within applicable time limited, election and disclaimers or any other form of notice which ought to have been made for Tax purposes. The Transferred Subsidiary has obtained, kept and given complete and correct records, invoices and other documents required by Law for Tax purposes. (c) No deficiencies for any material Tax have been threatened, claimed, proposed or assessed against any Selling Entity (insofar as it relates to any of the Business, Transferred Assets or Transferred Subsidiary) or the Transferred Subsidiary, or, to Seller’s knowledge, any of their officers, employees or agents in their capacity as such. None of the Selling Entities (insofar as it relates to any of the Business, the Transferred Assets or the Transferred Subsidiary) nor the Transferred Subsidiary has received written notice from a Tax Authority in a jurisdiction in which any such Selling Entity or Transferred Subsidiary does not file Tax Returns that it is subject to Tax or required to file a Tax Return in such jurisdiction. The Transferred Subsidiary has no, and has never had any, direct or indirect interest in any trust, partnership, corporation, limited liability company or other “business entity” for U.S. federal income tax purposes. (d) There is no agreement, waiver or consent providing for an extension of time with respect to the assessment or collection of any Taxes or the filing of any Tax Returns of any Selling Entity (insofar as it relates to the Business, Transferred Assets or Transferred Subsidiary) or the Transferred Subsidiary. (e) There are no (i) powers of attorney granted by any Selling Entity (insofar as it relates to any of the Business, the Transferred Assets or the Transferred Subsidiary) or the Transferred

15 Subsidiary concerning any Tax matter that are still in effect, (ii) agreements entered into with any Tax Authority that would have a continuing effect on the Transferred Subsidiary, the Business or the Transferred Assets after the Closing or (iii) Encumbrances on the Transferred Subsidiary Equity Interests, any assets of the Transferred Subsidiary or the Transferred Assets relating to or attributable to Taxes (other than Encumbrances for Taxes not yet due and payable). (f) There is no examination, action, suit, proceeding, investigation, audit, claim demand, deficiency or other assessment against any Selling Entity (insofar as it relates to any of the Business, Transferred Assets or the Transferred Subsidiary) or the Transferred Subsidiary currently underway, proposed or pending (or, to Seller’s knowledge, any threat of any of the foregoing) by a Tax Authority with respect to any Tax. No waivers of statutes of limitations have been given with respect to any material Taxes with respect to any Selling Entity (insofar as it relates to any of the Business, the Transferred Assets or the Transferred Subsidiary) or the Transferred Subsidiary. None of the Selling Entities (insofar as it relates to any of the Business, Transferred Assets or Transferred Subsidiary) nor the Transferred Subsidiary has submitted an application or request for, or received, any ruling from any Tax Authority that would have continued effect after the Closing Date. (g) None of the Selling Entities (insofar as it relates to any of the Business, Transferred Assets or Transferred Subsidiary) nor the Transferred Subsidiary has any Liabilities under any agreements or arrangements pursuant to which such Person is liable for Taxes of another Person (other than agreements or arrangements entered into in the Ordinary Course, the primary purpose of which is not the avoidance of Tax). (h) The Transferred Subsidiary uses the accrual method of accounting for income Tax purposes. (i) All material amounts of Taxes required to be withheld or collected by any Selling Entity (insofar as it relates to any of the Business, Transferred Assets or Transferred Subsidiary) or the Transferred Subsidiary have been withheld or collected and paid when due to the appropriate Tax Authority. Each Selling Entity (insofar as it relates to any of the Business, the Transferred Assets or the Transferred Subsidiary) and the Transferred Subsidiary have complied with all information reporting requirements with respect thereto, including the filing of all IRS Forms W-2 and IRS Forms 1099. (j) None of the Assumed Liabilities nor any other payments (whether in cash or property or the vesting of property) or benefits to be made in connection or association with the consummation of the Transactions is a contract, agreement, plan or arrangement, covering any “disqualified individual” (as such term is defined in Treasury Regulation Section 1.280G-1) of Seller or the Transferred Subsidiary that, individually or collectively, could give rise to the payment of any “excess parachute payment” or any amount that would not be deductible pursuant to Section 280G or 4999 of the Code. (k) The Transferred Subsidiary has not been party to, and none of the Assumed Liabilities or Transferred Assets includes, any Tax allocation, Tax indemnification agreement or Tax sharing agreement or any current or potential contractual obligation to indemnify any other Person with respect to any Taxes, and neither Seller nor the Transferred Subsidiary has any obligation to make any gross-up payments to any service provider, or reimburse for, any taxes, interest or penalties, including, those incurred under Section 280G, 409A or 4999 of the Code. The Transferred Subsidiary is not liable for the Taxes of another Person as a transferee, successor or pursuant to any Law, and the Transferred Subsidiary does not have any liability for the Taxes of any Person under Treasury Regulations Section 1.1502-6 (or any corresponding or similar provision of state, local, non-U.S. or other Law) or on an affiliated, combined, consolidated, unitary or other group basis.