Tesla Stock FY2024 Q1 Third-party Analysts' Forecast & Preview

Table of Content

Part 1: Tesla Stock Latest News

1. Latest TSLA Tesla Stock Price, February 28th, 2024

2. Tesla Stock Price Performance, February 28th, 2024

- - Last 7 Days: +1.18%

- - Last 1 Month: +4.61%

- - Last 6 Months: -22.34%

- - Last 1 Year: -1.50%

- - YTD: -8.91%

Tesla's stock price has declined in 2024 amid concerns over slowing growth and profitability. After slipping over 20% in January following disappointing Q4 2022 earnings results, the stock briefly rallied in February but remains down around 18% for the year as of February 26.

In Q4 2023, Tesla reported a 40% drop in earnings per share along with a decline in gross margins. For full-year 2023, EPS fell 23% while revenue rose 19%. The company warned that vehicle volume growth in 2024 may be "notably lower" than 2023 as it focuses on launching new models.

Analysts have slashed earnings projections for Tesla in 2024 and 2025 due to the disappointing results and outlook. Wall Street now expects a slight decline in EPS for 2024 and only a modest recovery in 2025, a big downgrade from earlier optimistic forecasts.

Some analysts have voiced concerns about waning demand, price cuts eroding margins, and lack of clarity around Tesla's strategic direction. The company continues discounting vehicles globally to spur demand. It remains unclear how pricing and margins will trend in 2024.

After rallying in late 2022 around the Cybertruck unveiling, Tesla's stock has retreated below key support levels in 2023 amid growth concerns. While shares have rebounded somewhat in February, Tesla faces production challenges, tougher competition, and increased regulatory scrutiny. The path to regaining momentum in 2024 looks difficult.

Part 2:Tesla FY2023 Q4 Earnings Report Recap

1. Tesla Key Indicators and Historical Earnings Report

- - Tesla FY2023 Q4 EPS was $2.27, YOY +112.15%

- - Tesla PE Ratio today is 46.45

- - Tesla FY2023 Q4 Revenue was $25.2B, YOY +3.49%

- - Tesla FY2023 Q4 FCF was $2.1B, YOY +45.28%

- - Tesla FY2023 Q4 Current Ratio was 1.73, YOY +12.66%

- - Tesla FY2023 Q4 ROA was 7.90%, YOY +66.47%

- - Tesla FY2023 Q4 ROE was 13.66%, YOY +55.11%

- - Tesla FY2023 Q4 Gross Margin was 17.63%, YOY -25.77%

- - Tesla FY2023 Q4 Net Margin was 31.56%, YOY +107.04%

| Tesla FY2023 Q4 Key Indicators | Value | YOY |

| EPS | $2.27 | +112.15% |

| PE Ratio | 46.45 | / |

| FCF | $2.1B | +45.28% |

| Current Ratio | 1.73 | +12.66% |

| ROA | 7.90% | +66.47% |

| ROE | 13.66% | +55.11% |

| Gross Margin | 17.63% | -25.77% |

| Net Margin | 31.56% | +107.04% |

For more information, such as definitions and explanations of the above technical terms, please view:

Interpretation of Key Indicators >>

Join Moomoo to enjoy all business earning data in one place - we offer brief summaries of financial reports to help you visualize financial data and forecast at a glance. You can simply visualize core estimates in easy-to-read charts while accessing live-streaming earning conference call to stay on top of earning season.

Open account and uncover potential investment opportunities with moomoo >>

2. Tesla FY2023 Q4 Financial Highlights

-

FY2023 Q4:

-

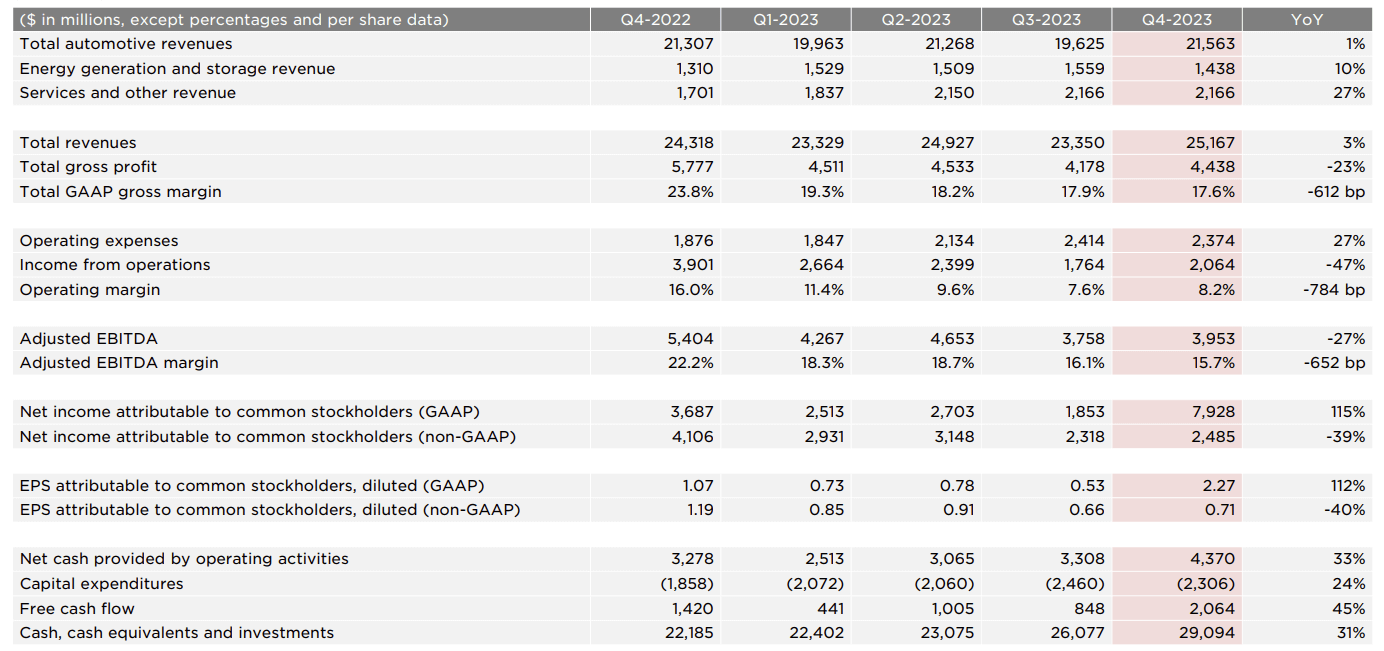

Tesla reported total revenues of $25.2 billion in Q4 2023, up 3% compared to Q4 2022. Automotive revenues grew 1% to $21.6 billion, driven by a 20% increase in vehicle deliveries to 484,507 units. However, automotive revenues were negatively impacted by lower average selling prices due to pricing actions and model mix shifts. Energy generation and storage revenues grew 10% to $1.4 billion, while services and other revenues rose 27% to $2.2 billion. -

Gross profit declined 23% to $4.4 billion in Q4, resulting in a gross margin of 17.6% compared to 23.8% in Q4 2022. The decline in gross margin was attributed to reduced vehicle average selling prices, higher costs related to the Cybertruck production ramp, and lower regulatory credit revenue. However, Tesla noted that cost of goods sold per vehicle declined sequentially in Q4.

-

Operating expenses rose 27% to $2.4 billion, led by higher R&D spending for AI and other projects. As a result, operating income dropped 47% to $2.1 billion, with an operating margin of 8.2% versus 16.0% in Q4 2022. Net income surged 115% to $7.9 billion, boosted by a one-time $5.9 billion tax benefit from the release of valuation allowances on deferred tax assets. Excluding this benefit, net income would have declined 39% year-over-year.

-

Free cash flow was $2.1 billion in Q4, up from $1.4 billion in Q4 2022. Tesla ended Q4 with $29.1 billion in cash and investments, up $3 billion from Q3 2023.

-

FY2023 Full Year:

-

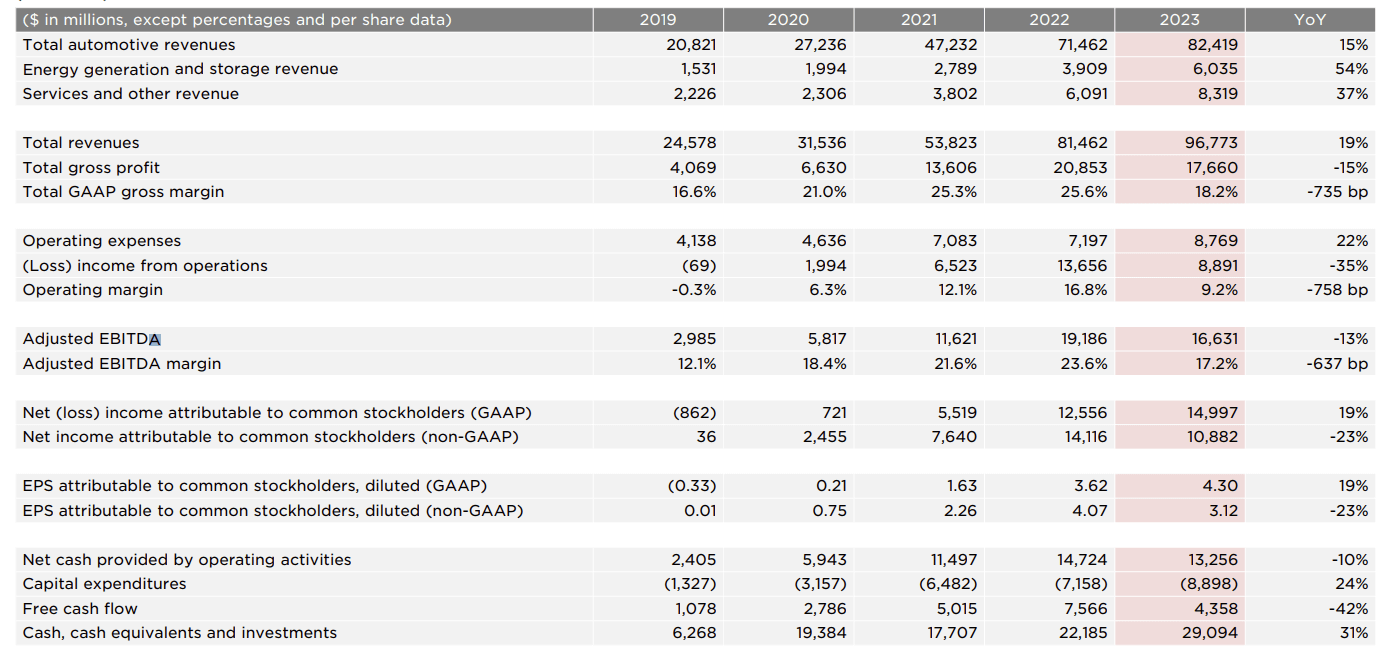

For the full year 2023, Tesla generated revenues of $96.8 billion, up 19% compared to 2022. Automotive revenue grew 15% to $82.4 billion on the back of 38% higher deliveries of 1.81 million vehicles. Gross profit declined 15% to $17.7 billion, resulting in an 18.2% gross margin versus 25.6% in 2022. Lower vehicle margins were a major factor in the gross margin decline. -

Operating income dropped 35% to $8.9 billion, with an operating margin of 9.2% compared to 16.8% in 2022. Excluding the $5.9 billion tax benefit, net income would have declined 23% to $10.9 billion.

-

Despite lower earnings, Tesla generated $13.3 billion in operating cash flow and $4.4 billion in free cash flow for the full year. Capital expenditures reached a record $8.9 billion in 2023 as Tesla invested for future growth. Tesla expects capital spending to remain elevated in 2024 as it continues expanding production capacity globally.

-

In summary, Tesla achieved strong top line growth in 2023 but faced margin pressures. Looking ahead, Tesla expects vehicle delivery growth to moderate in 2024 as it focuses on launching its next generation vehicle platform.

Automotive

● Delivered over 1.2 million Model Ys in 2023, making it the best-selling vehicle globally

● Model Y became the best-selling vehicle globally in 2023

● Model 3/Y production increased 37% in 2023 compared to 2022, reaching 1.78 million

● Total automotive revenues grew 15% year-over-year (YoY) to $82.4 billion in 2023

Energy Generation and Storage

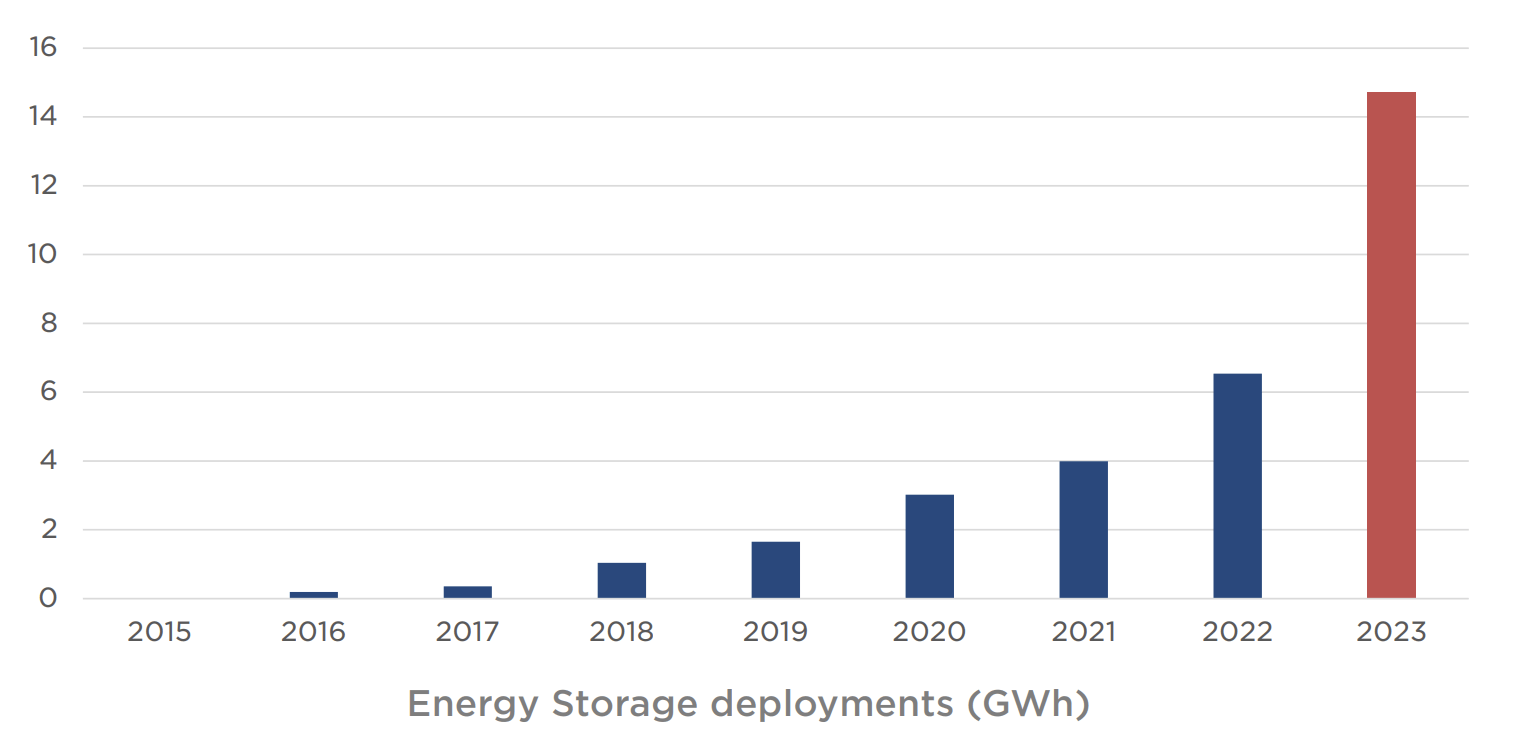

● Energy storage deployment reached 14.7 GWh in 2023, up 125% from 2022

● Energy generation and storage revenue increased 54% YoY to $6 billion in 2023

● Gross profit for energy generation and storage business nearly quadrupled in 2023 compared to 2019

Services and Other

● Services and other revenue increased 37% YoY to $8.3 billion in 2023

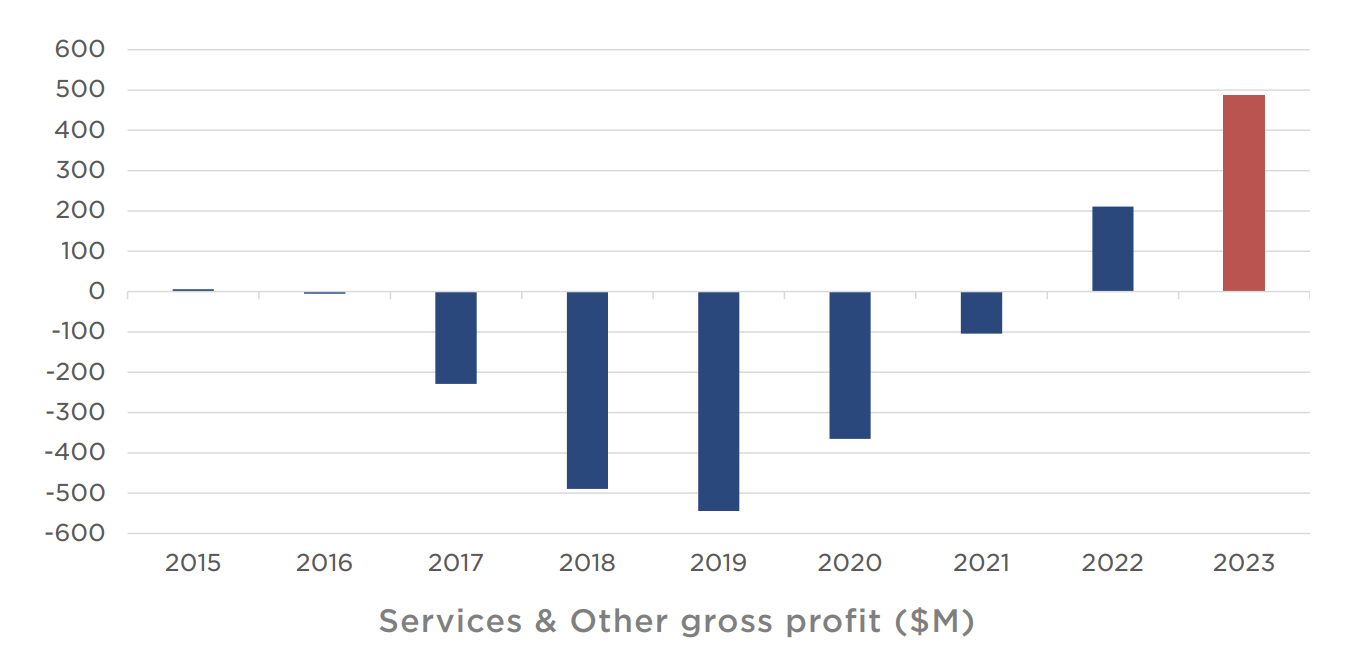

● Gross profit for services and other business swung from a ~$500 million loss in 2019 to a ~$500 million profit in 2023

AI

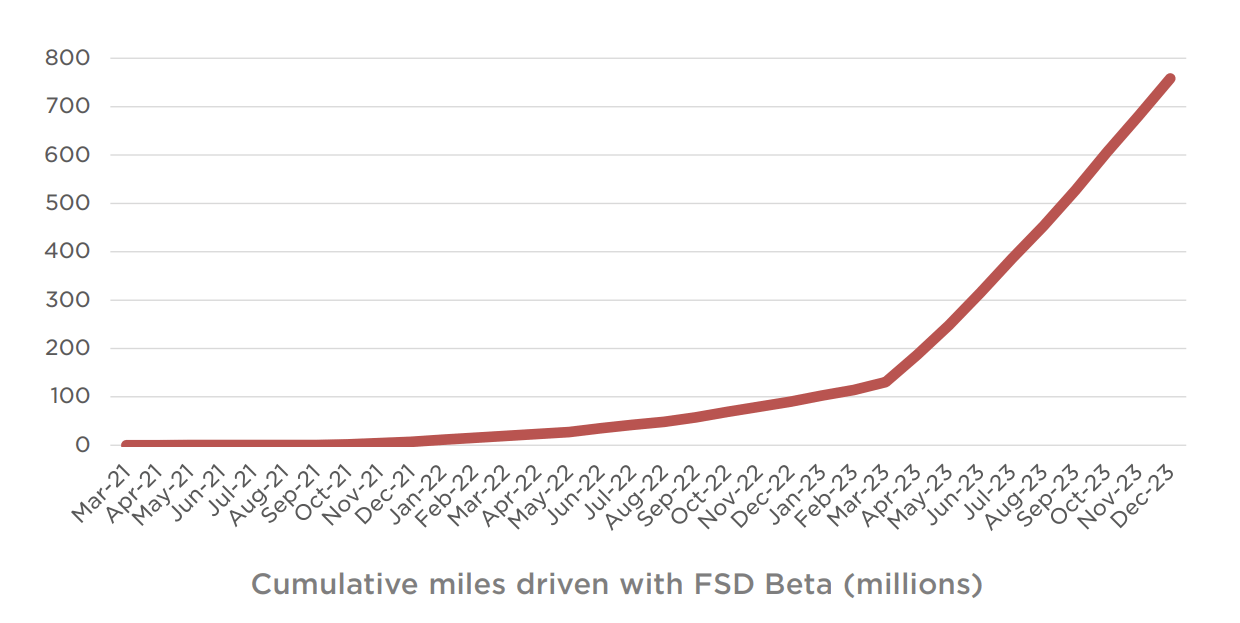

● In late December 2023, Tesla started rolling out FSD Beta V12, which utilizes end-to-end training and AI to influence vehicle controls

● Cumulative miles driven with FSD Beta reached over 800 million by the end of 2023

Part 3:Tesla FY2024 Q1 Earnings Report Forecast & Preview

1. Tesla FY2024 Q1 Forecast By Third Party Analyst Rating, February 28th

Tesla earnings date is coming soon! Following an extensive evaluation of Tesla's financial data, revenue, and stock trends over the last few quarters by more than 35 third-party financial analysts, TSLA Stock has been given a Hold rating. Analysts forecast an average stock price of $223.970 (Average) for the next 12 months.

- Third Party Analyst rating: Hold

- Tesla Target Price: $223.970

- FY2024 Q1 EPS Forecast: $0.591

- FY2024 Q1 Revenue Forecast: $25.5B

- FY2024 Q1 EBIT Forecast: $2.2B

For more information on what the analyst ratings may mean, visit https://pro.benzinga.com/blog/what-do-stock-analyst-ratings-mean/ (Benzinga is not affiliated with Moomoo Technologies Inc., Moomoo Financial Inc., or its affiliates.)

2. Tesla Forecast By Technical Analysis, February 28th, 2024

| Technical Indicators | Value | Signal |

| KDJ | k:70.160 D:67.948 J:74.582 | neutral |

| OSC | OSC:818.900 | bearish |

| BIAS | BIAS1:1.813 BIAS2:2.783 BIAS3:4.310 | bearish |

| RSI(12) | RSI12:52.222 | neutral |

| RSI(24) | RSI24:46.157 | neutral |

| MACD | DIF:-3.508 DEA:-6.181 MACD:5.346 | neutral |

| MA | MA5:196.656 MA10:195.017 MA20:191.541 MA30:195.764 MA60:219.559 | neutral |

| BOLL | MID:191.541 UPPER:202.664 LOWER:180.418 | neutral |

For more information, such as definitions and explanations of the above technical terms, please view:

According to analysts, what is the average 12-month price target for Tesla?

Tesla's 12-month average price target is $223.970, as per TSLA analyst ratings.

What is the third-party analyst rating of Tesla? Should I buy, sell or hold?

Based on 31 analysts giving stock ratings to TSLA in the past 3 months, Tesla's rating is "Hold".

Note:

This article is offered by Moomoo Technologies Inc. All contents such as comments and links posted or shared by uers of the community are the opinion of the respective authors only and do not reflect the opinions, views, or positions of Moomoo Financial Inc., Moomoo Technologies, any affiliates, or any employees of MFI, MTI or its affiliates. Please consult with a qualified financial professional for your personal financial planning and tax situations.

Moomoo may share or provide links to third-party content. Doing so is intended to provide additional perspective and should not be construed as an endorsement or recommendation of any chat room, channel services, products, guidance, individuals, or points of view.

This article is for educational use only and is not a recommendation of any particular investment strategy. Content is general in nature, strictly for educational purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance.

You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. All investing involves risks. This content is also not a research report and is not intended to serve as the basis for any investment decision.

The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. All company analysis information is provided by third parties and is not compiled by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for illustrative purposes. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.