Understanding the Basics of Japanese Stock Market

01 A Century of Ebb and Flow: lessons from the history of the Japan stock market

In the span of just two years, Japan's stock market has emerged as one of the global capital market's star performers. Since the beginning of 2023, the Nikkei 225 index has soared from around 26,000 points to a peak of over 40,000 points, a stunning rise of more than 50%, outpacing all other major global indices. This explosive growth has caught the attention of investors worldwide.

What's driving this impressive performance? Warren Buffett's decision to up his investment in Japan's top trading firms has played a pivotal role. This move signaled a strong vote of confidence in the resilience and future prospects of Japanese businesses, attracting foreign capital that has bolstered the rising stock prices.

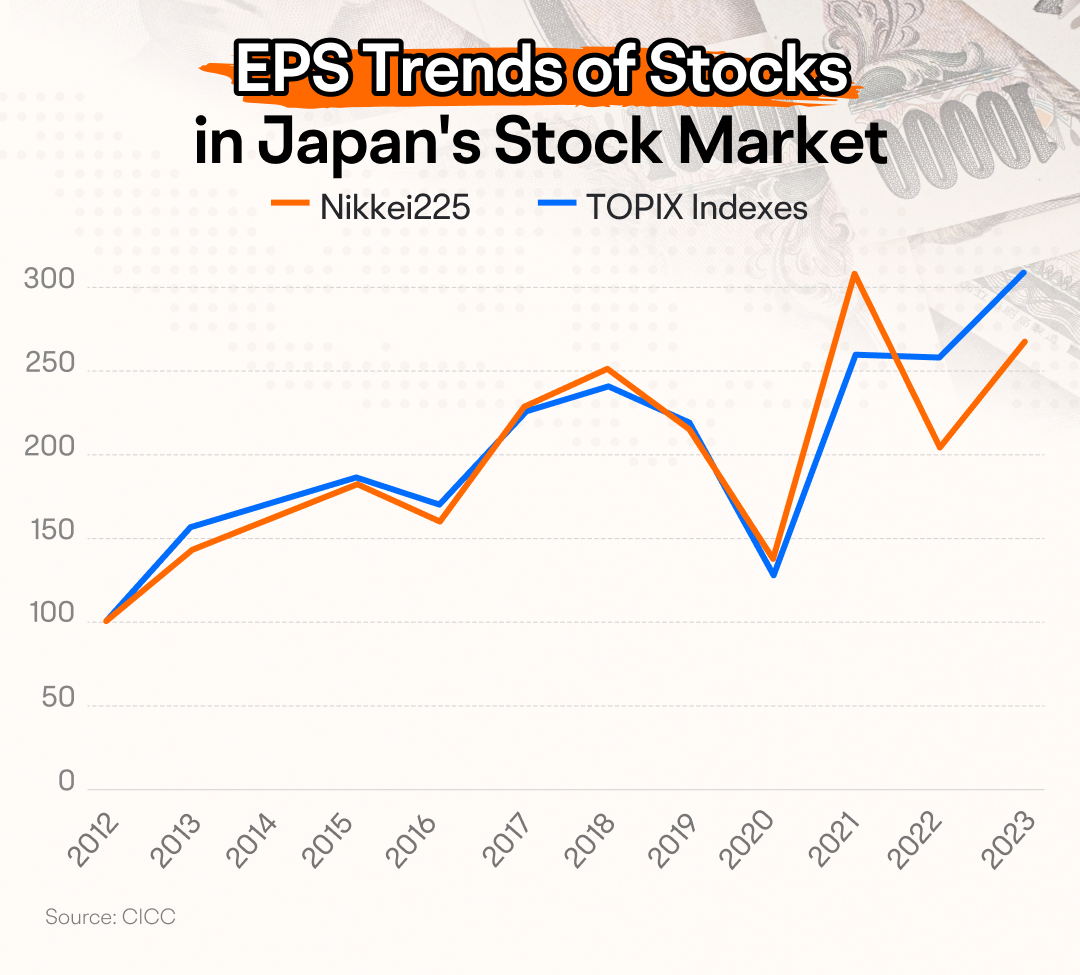

Another fundamental factor is the robust earnings growth among Japan's publicly traded companies. A report from China International Capital Corporation (CICC) highlights a nearly 10% annual increase in earnings per share among Nikkei index members from 2012 to 2023, fueling the meteoric rise in stock prices.

The market's momentum has also been boosted by generous dividend payouts. In recent years, following reforms at the Tokyo Stock Exchange and more stable corporate management, many Japanese firms have substantially raised their dividend yields. These dividends act like cash bonuses distributed to the market, serving as an important way for companies to reward shareholders and significantly increase their attractiveness to investors.

The Japanese stock market's rise underscores essential practices for investors seeking a global exposure: monitoring the moves of industry leaders, assessing a company's financial health for its stock potential, and targeting dividend-rich stocks.

As we witness Japan's stock market reach new heights, it's also a time to reflect on the market's storied past, a mix of triumphs and challenges. Exploring the historical events that have shaped Japan's financial landscape can offer invaluable insights for the future.

1. The Emergence and Turbulent Growth (1878-1945)

The origins of the Japanese stock market can be traced back to the Meiji Restoration, when, in 1878, the Meiji government established the "Stock Exchange Ordinance." This led to the founding of the Tokyo and Osaka Stock Exchanges, marking the official birth of Japan's stock market. In its early days, the market experienced a rapid growth phase due to Japan's booming economy. The Nikkei 225 Index began from a low base and grew at an impressive rate, multiplying several times by the early 1920s.

However, the global economic depression of 1929 dealt a severe blow to the Japanese stock market. Within a year, the Nikkei 225 Index plummeted by nearly 50%, resulting in massive losses for many investors. In an effort to rescue the market, the Japanese government enacted the Securities and Exchange Law in 1934, tightening market regulation and introducing a series of market support measures. These efforts somewhat stabilized the market and laid the groundwork for its eventual recovery.

2. Post-WWII to the Bubble Economy: Revival and Prosperity (1945-1990)

After World War II, Japan's economy quickly rebounded, breathing new life into its stock market. In 1949, the Tokyo Stock Exchange reopened, and the Nikkei 225 began its gradual ascent from post-war lows. With substantial government support, Japan experienced a period of rapid economic growth known as the 'economic miracle,' which saw the stock market thrive. Despite this overall prosperity, the market still experienced typical fluctuations.

In the aftermath of the 1974 oil crisis, Japan's economy moderated from its high growth rates, with GDP growth decreasing from around 10% to about 4%. Despite this slowdown, Japan swiftly restructured its industrial sector, transitioning from resource-intensive to energy-efficient, technology-driven, and high-value-added industries. The country advanced from a focus on heavy and chemical industries to excel in manufacturing steel, automobiles, electrical equipment, home appliances, and precision instruments. Concurrently, Japan's economy pivoted from domestic consumption to an export-oriented model, making "Made in Japan" a globally recognized mark of quality. This successful economic shift fueled a 16-year bull market in Japanese stocks.

The 1985 Plaza Accord, which led to a significant rise in the yen's value, further boosted the Japanese stock market into a period of exceptional growth. By the late 1980s, the Nikkei 225 Index approached the 40,000-point threshold. The stock market's total value soared to nearly 150% of Japan's GDP, signaling an extreme asset bubble.

To tackle the bubble's growth, the Japanese government rolled out stringent monetary policies in 1989, including interest rate hikes aimed at curbing speculative trading. From May 1989, the central bank increased the discount rate five times in a row. This aggressive tightening of monetary policy triggered a liquidity crunch, leading to a steep decline in the stock market. By the early 1990s, the Nikkei 225 Index plummeted by almost 60% within two years, marking a prolonged stock market downturn that would last for two decades.

This period in Japan's stock market history serves as a stark reminder to investors about the importance of understanding market dynamics, the perils of irrational speculation, and the enduring value of sensible investing and risk management.

3. Post-Bubble Economy Collapse: Japan's Lost Two Decades (1990-2010)

After the economic bubble burst, Japan faced a severe downturn with widespread corporate bankruptcies and a prolonged slump in both the economy and the stock market, lasting twenty years.

To revive the market, the government implemented a series of measures. In 1997, the "Tokyo Revival Plan" was launched, stimulating economic growth through increased public investment and tax cuts.

The government also intensified financial reforms, reshaping the regulatory system. A new financial regulatory framework was established: the Financial Services Agency was set at its core, with an independent central bank, a deposit insurance corporation, and local financial bureaus for entrusted supervision. Efforts were made to address non-performing loans thoroughly. After initial difficulties, the ratio of bad loans rapidly decreased from 8% in 2001 to below 2% after 2005. Additionally, the government reformed antitrust laws and liberalized the securities industry, moving away from the previous oligopoly of four firms.

Despite numerous robust measures by the government, the stock market remained sluggish due to difficulties in economic structural adjustments and changes in the domestic and international economic environment. The Nikkei 225 index even fell to a record low of under 7,000 points during the 2008 financial crisis.

The economic bubble burst in Japan underscored a crucial lesson for investors: navigate downturns with careful risk management, continuously improve investment acumen, seek out undervalued opportunities, and maintain patience for the eventual market upturn.

4. Early 21st Century to Present: Stock Market Recovery and Policy Support (2010-Present)

After the darkest moments of 2008, the Japanese stock market experienced years of volatility, with the Nikkei 225 index lingering around 10,000 points. At the end of 2012, with Prime Minister Abe's second term, the government introduced bold monetary easing, flexible fiscal policies, and a growth strategy aimed at attracting private investment, known as the "three arrows." These policies put Japan back on a growth path, with nominal GDP growth positive for seven consecutive years.

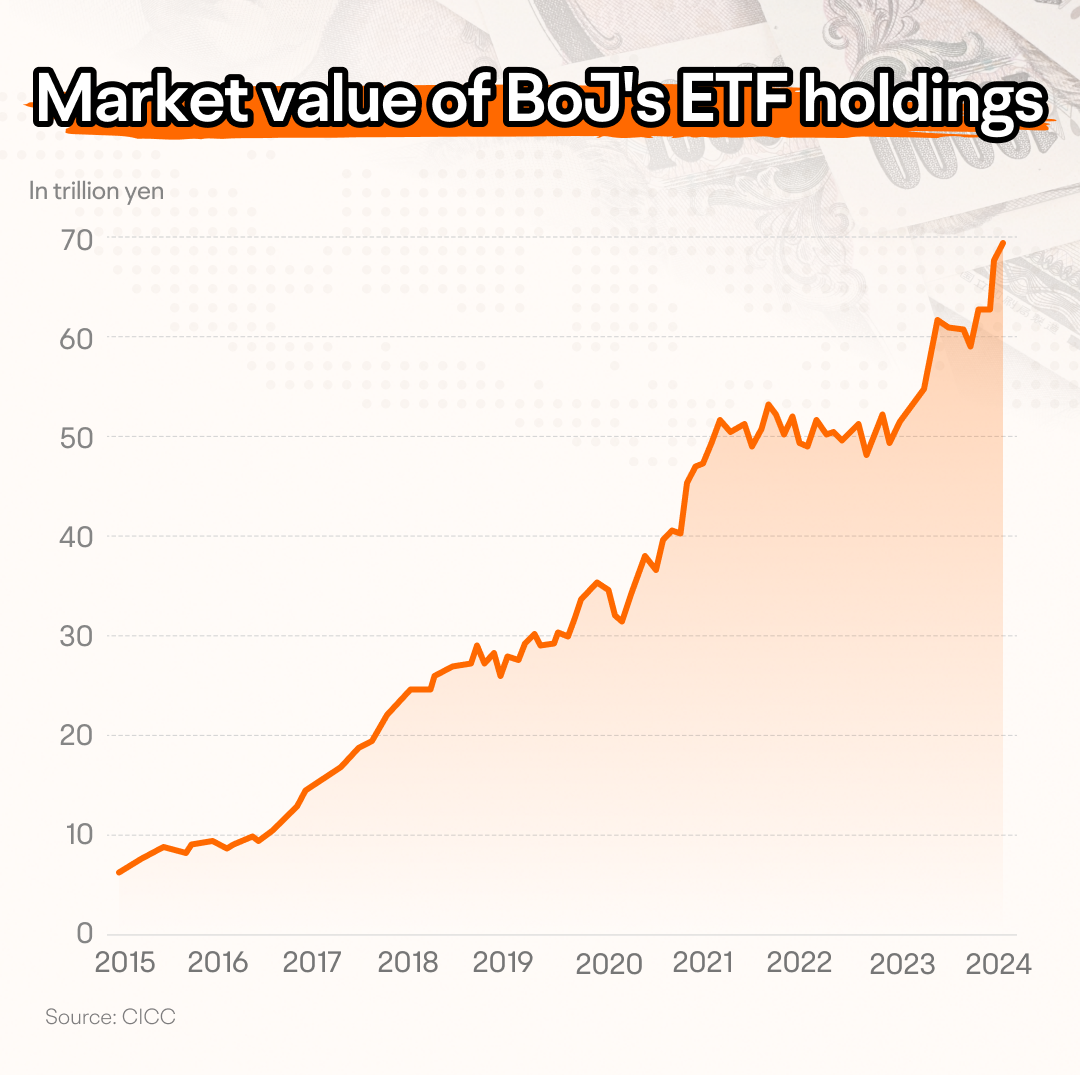

In parallel, the Bank of Japan (BoJ) began purchasing ETFs in October 2010 to stabilize stock prices. By February 1, 2024, the BoJ's ETF holdings were valued at approximately 70 trillion yen, accounting for 7.4% of the total Japanese stock market value, making it the market's largest buyer over the past decade, according to CICC.

Additionally, the government encouraged the Government Pension Investment Fund (GPIF) to enter the stock market. As of the third quarter of 2023, GPIF's domestic stock assets reached 55.8 trillion yen, comparable to the BoJ's ETF holdings, making the pension fund a significant stabilizing force in the market.

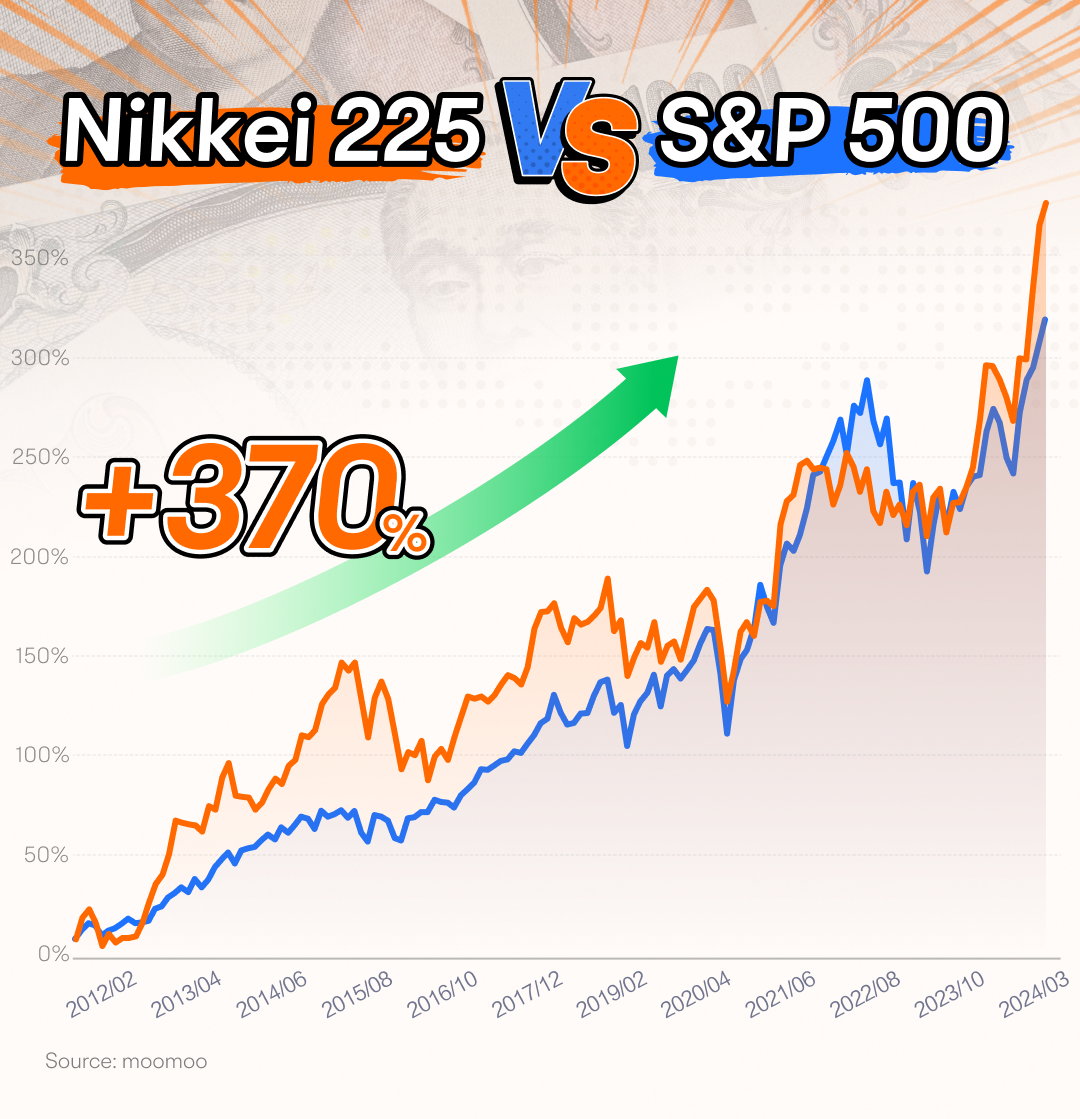

Spurred by government policies and solid investment inflows, coupled with the growth in corporate earnings, the Japanese stock market has experienced a slow but steady bull run for over a decade since 2012. The Nikkei 225 index saw a near fourfold increase during this period, even outpacing the S&P 500's threefold gain.

On February 22, 2024, the Nikkei 225 rose 2.19%, closing at 39,098 points, surpassing its 1989 peak and marking Japan's exit from the "lost twenty years," ushering in a new era.

The last decade in the Japanese stock market demonstrates the effectiveness of following long-term trends instead of attempting to time peaks and troughs. Investors who engage early and remain patient tend to achieve superior returns. It's essential, however, to practice robust risk management and ensure a diversified investment portfolio to mitigate overconcentration.

Over a century of Japan's stock market history, from post-war recovery to the economic bubble, through the "lost twenty years" to the recent revival, clearly shows how closely tied the markets are to macroeconomic policies, corporate performance, and global financial trends.

Studying Japan's market history highlights the need for logical analysis, adaptability to market changes, and a dedication to long-term investing. The ups and downs of the past offer vital lessons for investors, helping to inform better asset allocation decisions for consistent growth.

Japan Stock Trading is now available on moomoo! Want to invest in the best of Japan?