Guru Guides

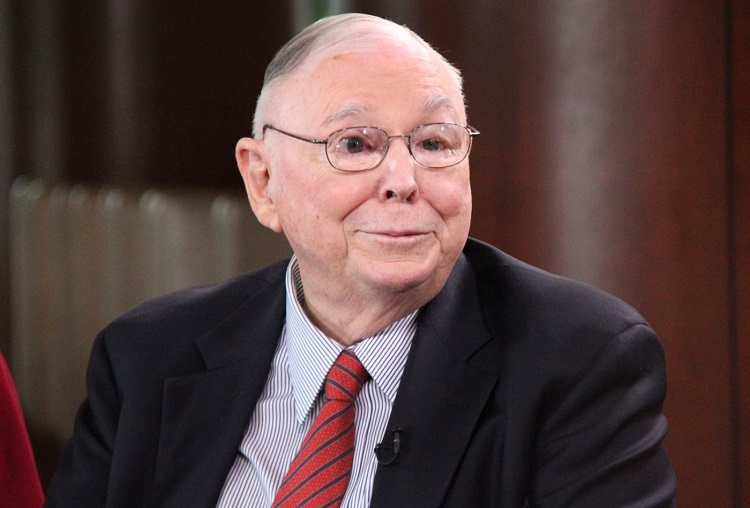

Charlie Munger: The big money is in the waiting

Charlie Munger is one of the great minds of the 20th century. He is perhaps best known as the Vice-Chairman of Berkshire Hathaway, Inc. People usually call him Buffett's right-hand man.

There is an inspirational quote from Charlie Munger:

The big money is not in the buying and the selling, but in the waiting.

- Charlie Munger

Using $Apple Inc(AAPL.US)$ as an example. Well-chosen stocks are always worth the wait. While waiting for others to fear, buying well-chosen stocks will bring "big money" to us easier.

Well-chosen stocks can rise many times in value. But it takes time. The ability to sit and wait for these gains to materialize is crucial to generating truly life-changing returns in the stock market.

A lot of people with high IQs are terrible investors because they've got terrible temperaments. And that is why we say that having a certain kind of temperament is more important than brains. You need to keep raw irrational emotion under control. You need patience and discipline and an ability to take losses and adversity without going crazy. You need an ability to not be driven crazy by extreme success.

- Charlie Munger

To be an investor, high IQs are not a requirement. Don't be afraid to invest. Patience and emotion control is more important. Investment is always accompanying risks.

We have to remember, investment accompanying risks. Wait before you rush to make an irrational and risky decision.

Source: Wikipedia, Markets Insider, The Motley Fool