Options Strategies Explained

Covered Call Strategy

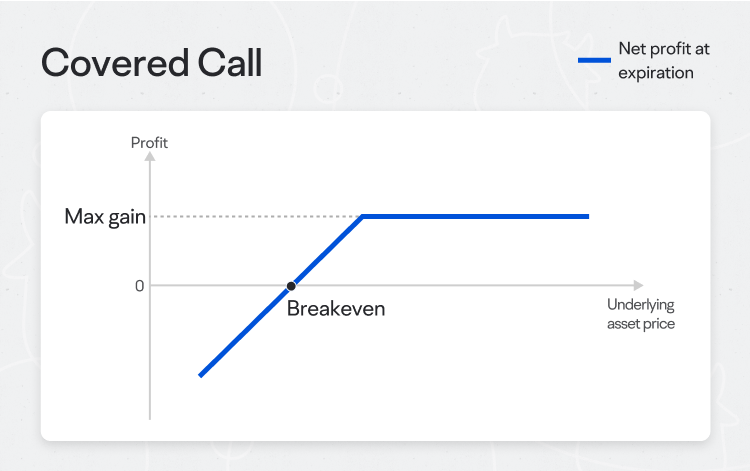

You can use a covered call strategy when you expect a security or asset's price to rise slightly and steadily within a certain range.

Construction of the strategy

A covered call strategy involves two trades.

● Buy a stock

● Sell a call of the stock

The amount of shares bought is equivalent to the amount of call option asset.

Brief description

A covered call involves selling a call covered by an equivalent long stock position.

The short call's main purpose is to earn premium income, which could lower the holding cost of stock and offer downside protection.

The investors who use this strategy choose the price they want to sell the stock as the strike price of calls. Then, if the stock rises to the strike price, they can sell it at the price they had wanted.

Gain & Loss

● Breakeven

Breakeven = Stock Purchase Price – Premium Received

● Max gain

Max Gain = Strike Price – Stock Purchase Price + Premium Received

● Max loss

Max Loss = Stock Purchase Price – Premium Received

Example

Imagine that there is a stock called TUTU on the NASDAQ, and its current stock price is $50. You expect it to rise moderately, so you use a covered call:

● Buy 100 shares of TUTU stock at $50

● Sell a $5 call with a strike of $55

(The following calculations do not include transaction costs.)