ETF Investing in Singapore

What are ETFs?

Exchange-traded funds, more widely referred to as ETFs, have undoubtedly been one of the top investment buzzwords for the last few years. What exactly are ETFs and why have they gained such popularity over the last few years?

To put it simply ‒ ETFs are a type of investment that is pooled and traded on the stock exchange. Think of it as having a mix or basket of different types of stocks or bonds, all in one fund. This basket typically tracks the performance of a selected index, selected by those managing that specific ETF. It is akin to buying many stocks or bonds all at once, purchased as a ‘bundle’.

Over the last few years, ETFs have been getting much more interest and appeal, and have actually surpassed active investing. This is simply because investing in ETFs has been made so simple and convenient, sometimes at the click of a few buttons. It is also a low-entry investment alternative.

In fact, ETFs attract both avid investors as well as novice investors at the start of their investing journey because it is highly diversified and has few restrictions.

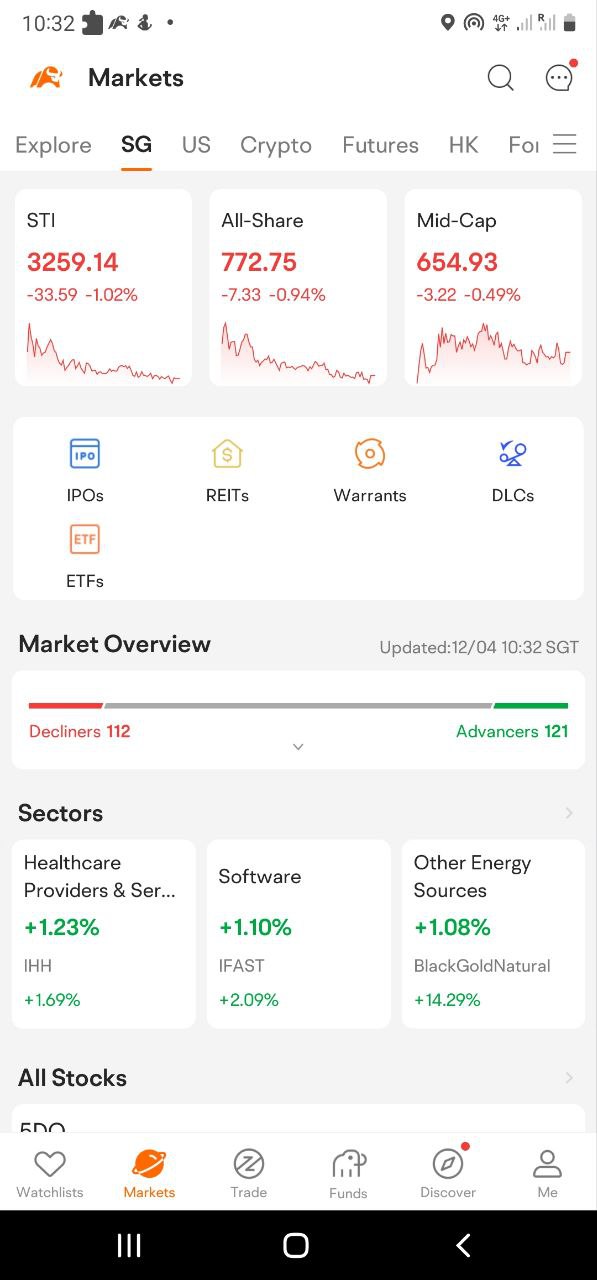

So, this all sounds exciting for an investor looking to dip his/her toes and give ETF investing a shot. But, how does one actually go about doing so? Perhaps one of the simplest ways to get started is to open a stock trading account, also known as a brokerage account with a local bank (for those who may view it as more stable, simply due to the long-standing presence of banks in Singapore). Alternatively, you can invest via non-bank stockbrokers or utilize popular platforms such as moomoo. From there, simply select the ETFs that you are interested in, and place the trade.

Properties of ETFs

As of July 2022, there are more than 9,000 ETFs noted internationally. (Based on data sourced by ETFGI)

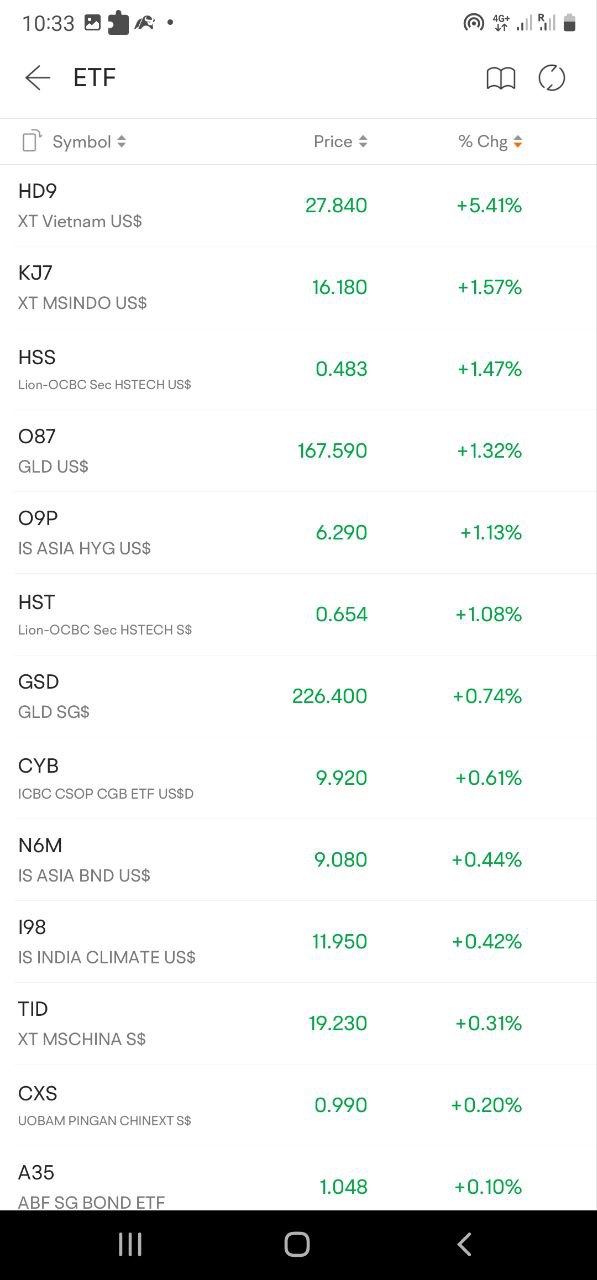

According to the Singapore Exchange (SGX), there are currently 57 ETFs provided in Singapore. To trade ETFs that are more exotic, Singapore-licensed stockbroking entities require local investors to pass the CAR (Customer Account Review) assessment set by SGX. That being said, we are not restricted to local ETFs alone, and can dabble in international exchanges as well. Robo-advisory systems are also gaining much traction and popularity in recent times. The top properties of ETFs that are attracting many investors are their diversity, liquidity and flexibility. The diversity of being able to invest in not only stocks, assets, bonds, or more; the option of efficiently liquidating your funds as and when needed; and the flexibility of deciding when you want to enter or leave your market position.

Pros and Cons of Investing in ETFs

Ask any investor, and they would tell you – there is no investment without risk. Other common sayings such as "high risk, high returns" are not entirely inaccurate when one considers delving into any form of investment. It is therefore prudent to look at the pros and cons of investing in ETFs, to know exactly what one is getting into.

Pros:

1. Relatively inexpensive quantum for starters

With the wide variety of options available to an investor today, platforms have to maintain their competitive edge by keeping costs low. ETFs in general do not have high charges unlike those you see in other investments such as managed funds. This is because index funds similar to ETFs have lower expense ratios and management fees.

2. Little to no barrier to entry

It might not be inaccurate to say that anyone with a mobile device or computer, and some basic “tech-know-how” (such as logging into and linking your internet banking platform), can set up an account and invest in an ETF without any guidance. Also, unlike certain funds that require a minimum investment, or minimum maintenance amount held in the trading account at all times, ETFs do not require a minimum purchase and are hence highly popular for the layperson who just wishes to give it a try.

3. No clue? No problem!

Gone are the days when one has to read up on hundreds of pages of a company’s annual reports or dive deep into the web for information on a company’s financial standing. Investing in ETFs means that one does not get to choose exactly which stock to invest in, and this can allow for quicker decision-making when it comes to making your investment. As such, there is a limit as to how much one can control when choosing to invest in an ETF.

Cons:

1. Are you truly at peace with having no control?

ETFs can work like a double-edged sword. On the one hand, the lack of control means less research and reading to do ‒ probably why it is so well-received by the “trigger-happy” users of today, where everything happens so easily and quickly at the click of a few buttons. However, on the other hand, this lack of control means that an investor does not have any say in the types of stocks selected by the index. So even if, say, you have read some bad news on Company X and would prefer not to have it in your ETF/index, you would still have to bite the bullet and let the ones running the ETF decide.

2. Do not be deceived by the ease of investing!

Sounds too good to be true? It just might be the case for some. After all, if it were that easy, everyone would be rolling in investment returns by now. Despite the appearance of ETFs being generally safer than some other investment options, no investment is risk-free. We have seen this before, and we will see it again, when severe market crashes have affected ETFs and shaken the confidence of investors before, such as the oil price crash (United States Oil Fund), among others.

3. Not the road to earning a quick buck

Generally, ETFs are stable (or at least when compared to single security investments). But, that stability comes with its limits ‒ slower investment returns. Despite the lower entry costs, there are still fees to consider such as a platform’s management fees, percentage cuts, etc. End of the day, when you look at the actualized return on investment (ROI), you may find that putting your cash in the bank versus putting it in an ETF is not altogether an impossibility.

Final thoughts

Are ETFs a viable investment alternative in Singapore? ETFs are a relatively safer choice for investors looking for an easy and quick investment alternative that does not require the commitment of hard research. That said, a certain level of risk always exists, and investors still have to bear this in mind. It is worth a go, but always be clear on your risk appetite and maintain realistic investment goals.

An easy way to get started with investing in ETFs is through moomoo, where you can simply navigate to the ETFs section by clicking on the ‘ETFs’ button on the app’s homepage. A list of ETFs will then be displayed, where you can click on any one of them to look at its quotes, news, summary, and more. This will then help you to get a better understanding of each ETF, which can then help you to make a more informed investment decision.

Images provided are not current and any securities are shown for illustrative purposes only.