How Can You Calculate Margin Interest?

Margin trading is a common but risky strategy being used in the financial world. Margin refers to the amount investors borrow from a broker to buy or short an asset. Traders pay a specific percentage of the asset's value for margin. Interest is also incurred in the margin.

Trading on Margin

Trading on margin opens the doors of opportunities for investors. It's a useful strategy for investors because the cash to acquire an asset is no more a problem.

Margin interest refers to due interest on the loan you got from your broker on your assets. Let's understand it with an example. Suppose you short-sell a stock. The first thing you have to do is to borrow it on margin and then sell it to the buyer. Purchasing the stocks on margin allows you to use your money to buy more shares.

For instance, you can buy shares of $1000 on a margin of 10% by putting in $100. Here you get $900 extra. This extra money is the margin loan. You have to pay interest on these $900.

A margin account is not easy to manage. You need to understand how to calculate this margin interest. Moreover, you may also need to know how to compute the margin interest manually.

So, you have decided to do calculations. You first need to identify the interest rate broker-dealers in your local market are offering. You can get this information directly from the broker or the company's website. The website contains information about the margin rates, costs and disclosures of fees.

The margin interest rate depends on the assets you have with the broker. The more the value of the assets, the lower the margin interest rate will be.

How to Calculate Margin Interest?

First of all, identify the margin interest rate. Then, take a pencil and calculator and calculate the margin interest rate. Here's a hypothetical example to help you understand how to calculate the margin interest:

Suppose the amount you've borrowed is $50,000 at the 10% interest rate. You want to buy a stock and hold it for 10 days with this amount.

To calculate the borrowing cost, multiply the borrowed amount by the interest rate.

First of all, identify the margin interest rate. Then, take a pencil and calculator and calculate the margin interest rate. Here's a hypothetical example to explain how to calculate the margin interest:

Suppose the amount you've borrowed is $50,000 at the 10% interest rate. You want to buy a stock and hold it for 10 days with this amount.

To calculate the borrowing cost, multiply the borrowed amount by the interest rate.

To calculate the cost of borrowing, firstly take the amount of money being borrowed and multiply it by the rate being charged:

$50,000 x 0.1 (10%) = $5,000

In the next step, divide the number obtained by the number of days in a year. Note: You should use 360 days for a year in the brokerage industry instead of 365 days.

$5,000 / 360 = 13.8

Now, multiply this number by the days for which you have borrowed.

13.8x 10 = $130

So, you will pay a margin interest of $130 if you borrow $50,000 for 10 days. Margin can act in two ways. It can boost the profit amount when the stock prices rise. Likewise, it can also increase the losses when the stock price decrease. An increase in losses leads to the margin call, requiring you to add more cash to your account.

However, the margin interest will remain the same whether you gain or lose on a trade.

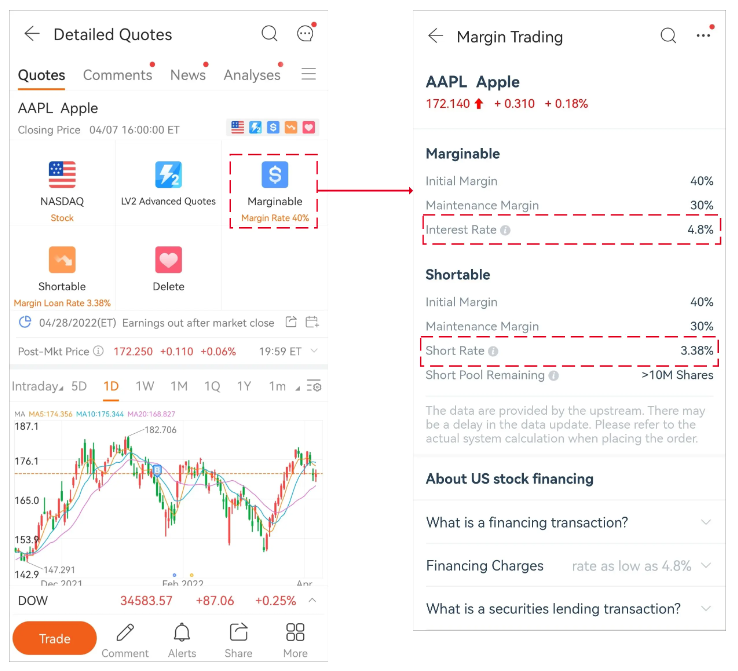

In moomoo trading platform, the margin rate varies according to the daily market supply. You can find it on your statements for actual margin rates. Specific rates are available on the 「Margin Trade」page.

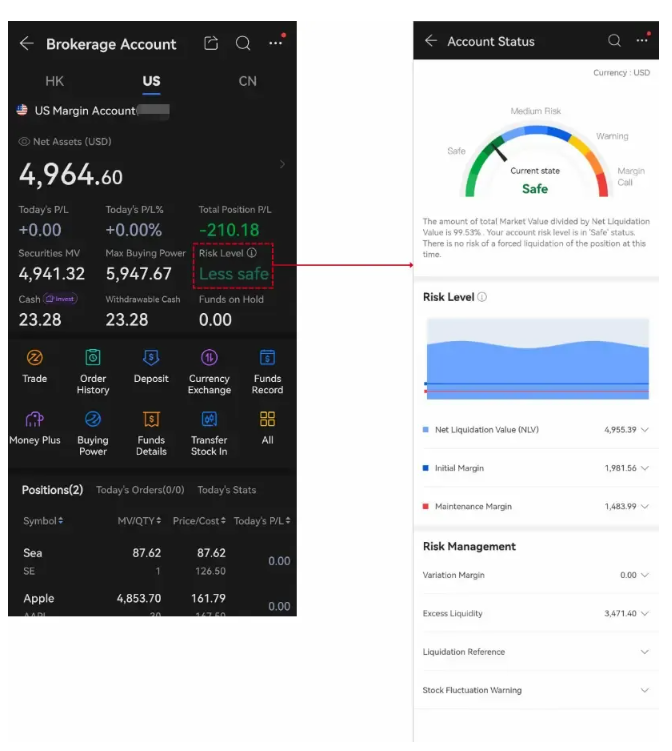

moomoo app also discloses the risks on the user's account risk details page. It contains descriptions of your account risks, disposal suggestions, and early warning information on fluctuations of individual stocks. You could easily find out the risk level of the stock when you do margin trading and be better informed of the dangers in the early stage.

The Bottom Line

Trading on margin is a risky but profitable business. However, you need to be careful while employing this strategy. It also helps in the easy assessment of asset values. Moreover, trading on margin doesn't require traders to put the total cost of an asset. Before you enter a trade on margin, it's better to know how to calculate the true cost of the trade. Determining the true cost will help you depict the profit or loss.