Investment Portfolio Strategy during Recession

Economic cycles refer to the fluctuation between growth and recession. Although the recession period is usually not as long as the expansion period, its costs can be expensive to investors. In recession-related drawdowns, the S&P 500 has lost an average of 32% during recessions between 1937 and 2020.

One can't prevent these losses. But it's possible to prepare for potential portfolio losses during the recession using some key strategies.

Key Takeaways

A recession refers to a significant and extended decrease in economic activities worldwide.

Investors can't predict the effects of a recession. However, they could preserve their portfolio positions.

What Is a Recession?

A recession refers to a significant and extended decline in economic activity that often lasts for months.

The media defines it as negative GDP growth in two consecutive quarters. GDP stands for Gross Domestic Product and is the market value of a country's total services and goods.

Symptoms of recession:

Recession symptoms include:

Dwindling confidence in businesses and consumers

The decline in real incomes

Decrease in production and sales

Weakening employment

All these symptoms indicate an environment that leads to declines in stock prices and investor confidence.

Fast Fact: The National Bureau of Economic Research measures recession from the peak phase of economic growth to the economic decline's trough. According to this definition, the start of recovery brings the news that the recession is ending.

Can the Stock Market Predict a Recession?

Paul Samuelson, an economist, claimed that the stock market predicted nine the out of last 5 economic recessions. He made this statement in 1966.

Recession-related bear markets tend to grow and decline faster than economic activity. Moreover, the effects of the bear market last longer.

However, one can't predict the intensity or duration of stock decline before it occurs.

It might not be wise to respond to every recession signal because the span of the economic expansion is often longer than the recession.

How do different asset classes perform in Recessions?

Recessions do not happen very often. But they can leave portfolios and economies at risk of decline. The tendency of companies and investors to avert risk will also decline. The asset classes with less reliant returns perform the best.

The assets that performed best during recessions are investment-grade corporates, the U.S. government and Gold and bonds. On the other hand, high-yield commodities and bonds, alongside stocks, suffered the most during recessions.

Even experienced investors can not be sure if their investments are going to grow or lose.

Is it safe to invest in during a recession?

It's not safe to invest during the recession is not necessarily true. Still, some investors invest during the downturn but carefully.

So, the key things to remember before investing during the recession are:

Consider the companies if they have healthy cash flows and strong balance sheets. Companies with healthy cash flows and strong balance tend to perform better during a recession.

2. You may want to avoid a decline in their products' demands and carrying heavy debts.

A recession doesn't generally affect consumer staples because consumers buy these products regardless of their financial situation. Consumer staples include household goods, beverages, food, tobacco, alcohol and toiletries.

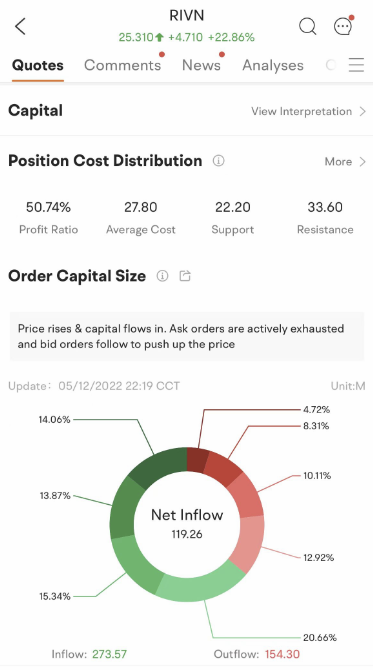

moomoo trading app provides traders and investors with the real-time view of capital flows on a daily, weekly, and monthly basis. You can easily track the capital movement of funds in the stock market to find investment opportunities.

Besides, the stock comparison function of moomoo will allow you to compare different indicators of 6 stocks on a graphical basis to get an overview of information, like cash flow, net margin, etc. You could learn from the company's financial reports and determine if these companies have healthy cash flows, low debt, and generating profit before making your investment decision.

Images provided are not current and any securities are shown for illustrative purposes only.

Investing for Recovery

Monetary and fiscal policies to combat recessions in countries can help encourage recoveries. However, economies recover once the recession-causing imbalances are not there.

Once the recovery periods start, recession risk factors, such as reliance on economic momentum and high operating leverage, can become opportunities, especially for small-cap stocks.

Increased demand for risk in fixed-income markets can make mortgage-backed securities and corporate debts appealing.

Higher economic activity increases the demand for raw materials. As a result, the recovery phase can be a positive growth phase for commodities. Since trading of these commodities occurs worldwide, it not only impacts the U.S. economy.

Final thoughts

It's important not to panic when a recession hits. Instead, companies can focus on the long-term risk factors and capital to invest in a recovery phase.

Since investors can't predict the recession, avoiding it is impossible. However, investors can hold their assets with the help of prior planning and prudent diversification.

The moomoo app is designed for serious traders and investors. Get access to free advanced technical charting tools featuring 62 technical indicators and 37 drawing tools across mobile and desktop. Sign up for free. Enjoy free stocks when you fund your account. Get started now and see how moomoo can help you build your investment portfolio.