How to Trade Options: Moomoo Features Guide

Options Seller Dashboard:Quickly Find High-ROI Options Contracts

Ⅰ. What is the Options Seller Dashboard?

The Options Seller Dashboard is a valuable tool for options traders, offering an ROI-based ranking of selling opportunities.

Its diverse filtering options help investors quickly identify contracts that match their criteria.

The dashboard also provides clear visuals of total premiums, potential ROI, and the probability of options expiring worthless (OTM).

This empowers users to make more informed trading decisions.

You can find this feature by navigating to Markets> Options> US Stock/HK Stock> Scroll down to Seller Dashboard.

Please keep in mind that some filters, such as "ROI", and "OTM Probability", are estimates based on model assumptions and does not guarantee future results. Actual results may differ.

This information should not be relied upon as a primary basis for any investment decision.

II. How to use this feature

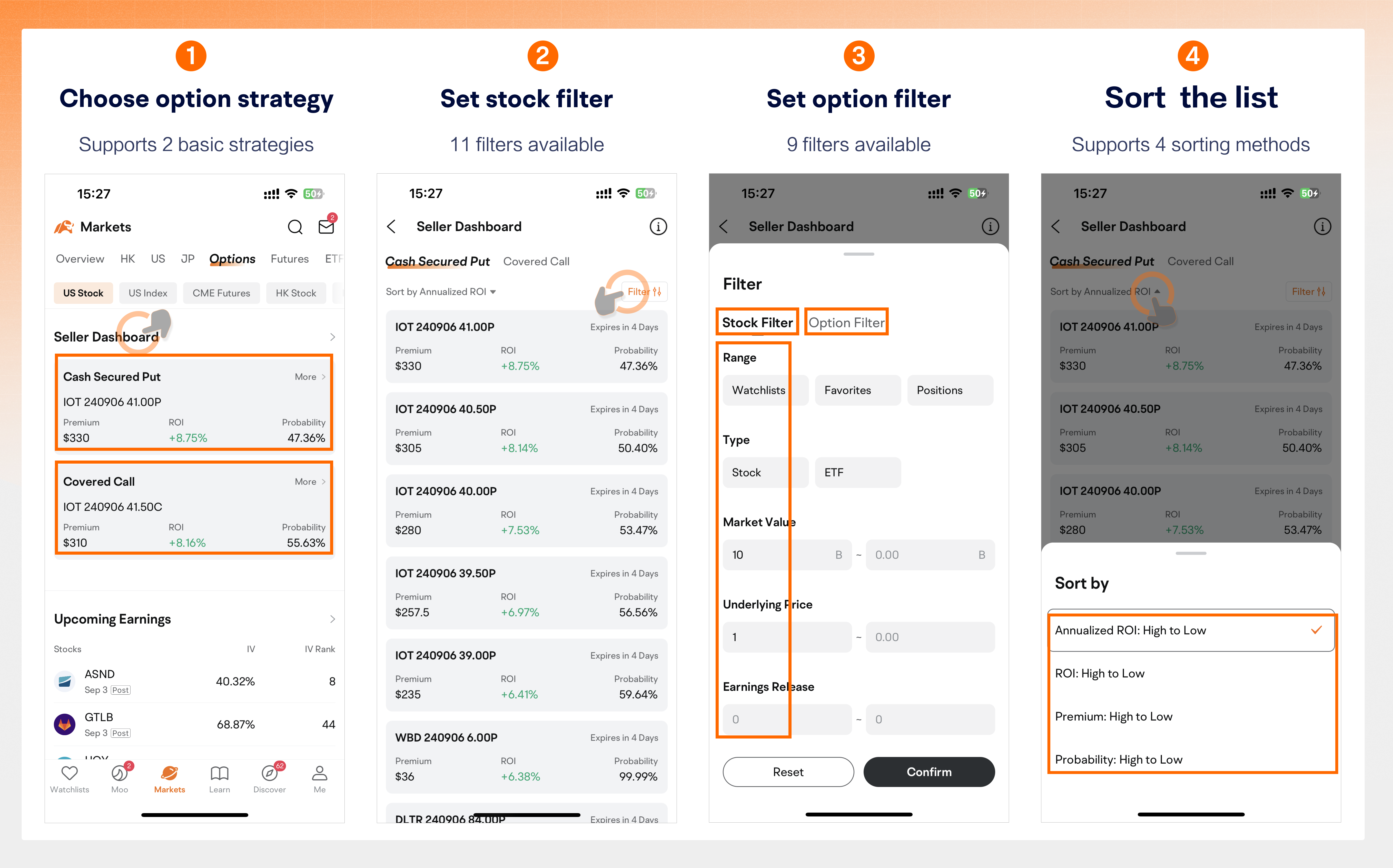

Steps:Choose an option strategy > Set a stock filter > Set an option filter > Switch the sorting of the list > Choose an option contract

![Options Seller Dashboard:Quickly Find High-ROI Options Contracts -2]() Step 1: Choose an option strategy

Step 1: Choose an option strategy

This tool currently supports two basic option selling strategies:

![Options Seller Dashboard:Quickly Find High-ROI Options Contracts -3]() Step 2: Set a stock filter

Step 2: Set a stock filter

Selecting the right underlying asset is crucial in options trading. Consider these scenarios when filtering stocks:

a) Trading on owned stocks: Filter from your existing holdings.

b) Earnings season opportunities: Choose stocks with upcoming earnings announcements for potential arbitrage.

c) High volatility preference: Select stocks with higher total implied volatility (IV), which may favor option sellers.

d) Assessing market interest: Filter by volume and open interest to gauge trading activity and liquidity.

Available Filters:

1) Stock-Specific:

Range: Watchlist, favorites, or holdings

Type: Stocks or ETFs

Market Value: Company size

Price: Current share price range

Earnings: Upcoming earnings releases

2) Option-Related (across all options for a stock):

IV/IV Rank/IV Percentile: Implied volatility levels

Historical Volatility (HV): Past price fluctuations

Volume and Open Interest: Liquidity and market activity

![Options Seller Dashboard:Quickly Find High-ROI Options Contracts -4]() Step 3: Set an option filter

Step 3: Set an option filter

After selecting your stocks, you can refine your option contract choices. Consider these scenarios:

a) Higher premiums: Look for contracts with higher premiums and longer expiration dates.

b) Minimizing assignment risk: Select options further out-of-the-money (OTM).

c) Ensuring liquidity: Filter for options with higher trading volume and open interest.

Available Filters:

Days to Expiration:Choose between nearer or further expiration dates

Premium: Set a range for option premiums

OTM%/OTM probability: Balance between OTM and ITM options

Implied Volatility: Assess if the option price appears to be reasonable

ROI/Annualized ROI: Evaluate potential earnings

Volume/Open Interest: Gauge option liquidity

![Options Seller Dashboard:Quickly Find High-ROI Options Contracts -5]() Step 4: Switch the sorting of the list

Step 4: Switch the sorting of the list

After applying your filters, all qualifying option contracts will be displayed. Choose from four sorting methods to quickly identify the contracts that fit your criteria:

A. ROI (Return on Investment)

- Cash-secured Put: Premium / (Strike Price * Option Multiplier - Premium)

- Covered Call: Premium / (Stock Price * Option Multiplier - Premium)

B. Annualized ROI

- Cash-secured Put: [Premium / (Strike Price * Option Multiplier - Premium)] * (365 / Days to Expiry)

- Covered Call: [Premium / (Stock Price * Option Multiplier - Premium)] * (365 / Days to Expiry)

C. Total Premium

- Premium per Share * Option Multiplier

D. OTM Probability

- Higher probability indicates a better probability of keeping the premium without contract assignment (favorable for sellers)

![Options Seller Dashboard:Quickly Find High-ROI Options Contracts -6]() Step 5: Choose an option contract

Step 5: Choose an option contract

After filtering and sorting, choose your preferred option contract:

1. Click on the contract to open the trading interface.

2. Review detailed strategy information, including:

- Potential profit and loss analysis

- Risk assessment

- Key contract details

3. Use this information to make an informed decision about whether to execute the trade.