Straits Times Index (STI) in Singapore

What is the STI?

The Straits Times Index (STI) is a stock market index that represents the performance of the top 30 companies listed on the Singapore Exchange (SGX). The STI is a leading indicator of the Singaporean stock market and is widely followed by investors and market analysts.

The STI was first introduced in 1966 and has since become one of the most widely recognized stock market indices in Singapore. The index is calculated using a free-float market capitalization-weighted methodology, which means that the larger companies have a greater impact on the overall index value.

The companies included in the STI are chosen based on certain criteria, such as market capitalization, liquidity, and sector representation. To be eligible for inclusion in the index, a company must have a minimum market capitalization of S$300 million and a minimum trading liquidity of S$50 million.

Investors can gain exposure to the STI through a variety of means, such as purchasing individual stocks, mutual funds, or exchange-traded funds (ETFs) that track the index. Many financial advisors recommend including exposure to the STI as part of a well-diversified investment portfolio.

The Straits Times Index is a widely followed stock market index that represents the performance of the top 30 companies listed on the Singapore Exchange. The composition of the index is managed by the Singapore Press Holdings as well as the FTSE Group. It serves as the leading indicator of the Singaporean stock market and is often used as a benchmark for investment performance.

Why Do Investors Pay Attention to the STI?

Investors generally invest in the STI because it provides a wide range of benefits. To begin, the STI includes 30 large publicly traded companies from a variety of industries, providing investors with diversification across sectors and helping to mitigate risk. It is also made up of highly liquid companies, meaning that it is relatively easy to buy and sell shares in these companies. This makes the index accessible to a wide range of investors.

The STI is also highly accessible to Singaporeans, where they can invest via brokerages or regular savings plans that are facilitated by local banks. Furthermore, investing in an STI index fund or ETF is generally less expensive than investing in actively managed funds, as there are no management fees or research costs associated with tracking the index. This makes the STI an attractive option for cost-conscious investors.

Historical Performance of the STI

The Straits Times Index (STI) has a long history of performance, with the index first being introduced in 1966. The STI has delivered strong returns for investors over the past decade, with a total return of 61% compared to 41% for indexes such as the Dow Jones, Hang Seng, Nikkei 225, and FTSE 100.

However, it is important to note that the stock market is inherently volatile and the value of the STI can fluctuate significantly over shorter time periods. The STI, like all stock market indices, is subject to market risks such as changes in economic conditions, interest rates, and political developments that can affect the performance of individual stocks and the index.

In recent years, the STI has experienced a series of ups and downs. In the late 1990s and early 2000s, the index reached all-time highs, fuelled by strong economic growth and favourable market conditions. However, the index was hit hard by the global financial crisis in 2008, declining by over 50% from its peak.

Since the financial crisis, the STI has recovered and has continued to deliver strong returns for investors. In the past decade, the index has experienced steady growth, apart from a few periods of market volatility.

Annual Dividends Generated by the STI

The STI pays out a relatively high dividend, with a dividend yield of 4% annually. Comparatively, other indexes such as the S&P500 pays out only 1.5% per year. Having a higher annual dividend yield may favour investors who are looking to generate a consistent passive income stream. The high dividend yields from the STI can be attributed to the strong dividend stocks in that the STI comprises, such as DBS, OCBC, and Keppel.

Largest Components of the STI

The ten largest components of the STI (as of 5 January 2023) are:

DBS Group Holdings Limited (20.2% weightage)

Oversea-Chinese Banking Corp (11.8% weightage)

United Overseas Bank Limited (11.6% weightage)

Singtel (6.2% weightage)

Jardine Matheson Holdings Limited (4.6% weightage)

CapitaLand Investment Limited (4.5% weightage)

Keppel Corporation Limited (4.0% weightage)

CapitaLand Integrated Commercial Trust Target (3.0% weightage)

Singapore Exchange Limited (2.9% weightage)

Mapletree Pan Asia Commercial Trust Target (2.7% weightage)

The composition of the STI is periodically reviewed and updated, which means that the list of largest components of the STI may change over time. Additionally, the price movements of each individual financial asset can also lead to changes in their respective weightages, which means that it is possible for the list of largest components of the STI to change even without any external interference.

Investing in the STI via moomoo

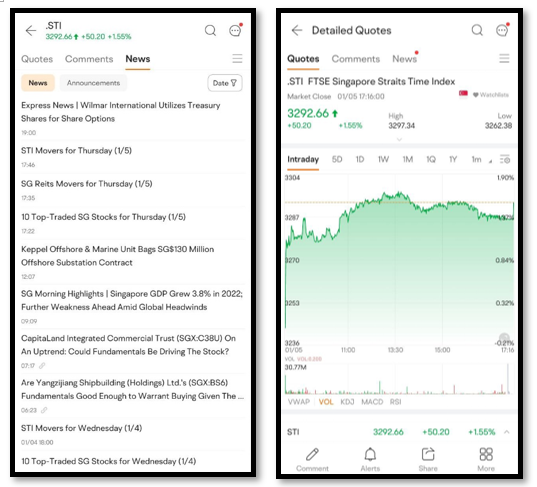

You can start investing in the STI via moomoo. To start, click on the ‘Markets’ tab and navigate to the SG section. You will then be presented with a list of popular indexes in Singapore, such as the STI, the FTSE Straits All-Share Index, and the FTSE Straits Mid-Cap Index. You can then click on the STI option, which will provide you with more detailed information about the index. By scrolling down, you will be able to view the list of companies that the index is comprised of. You will also be able to obtain an overview of their individual intraday performances as seen on the screenshot on the bottom left.

Following that, you can click on the ‘News’ tab to look at the relevant news updates relating to the Singaporean economy. These news reports generally contain information that will impact the price movements of the index. Hence, accessing these articles will help you to understand the short-term market outlook for Singapore’s economy, which can help you to make a more informed investment decision.

You will also be able to click on the ‘Comments’ section which will display a list of comments left by other moomoo users. These comments are related to the stock, which can provide you with more information about the general sentiment regarding the expected performance of the stock. Sign up and download moomoo stock trading app today to get the news and information about the STI index now!