The Consumer Price Index (CPI) Explained For Investors

To be aware of trends in volatile markets, investors often account for macroeconomic conditions like global events and the economic trends of the countries they're investing in.

One useful indicator is the Consumer Price Index (CPI), which is closely linked to inflation and the purchasing power of people in a country.

In this article, let us dive deep into understanding the CPI and what it tells investors.

What Does The Consumer Price Index Measure?

A country's CPI is a percentage that measures the average price changes of a basket of goods and services that consumers pay for. The CPI does not measure the absolute price. Instead, it measures the change in prices over the past few time periods.

How Is The Consumer Price Index Calculated?

The CPI is calculated once every month. For longer time periods like years, the CPI is derived from taking the 12-month average.

In calculating the CPI, the cost of goods and services across a wide range of industries is taken into account. Depending on the country, the exact weight given to each industry can vary.

In the case of Singapore, this can include:

Housing & Utilities

Clothing & Footwear

Communication

Healthcare

Education

Recreation

Culture

Transport

Food

In the case of the United States, this can include:

Food and beverages

Housing

Apparel

Transportation

Medical care

Recreation

Education

Communication

By combining and calculating the overall change in prices across each industry, regulators can get an overall sentiment of what consumers might be feeling about their purchases and the cost of living.

The weightage for each industry can also change slightly over time. For example, the CPI weightage of food for Singapore was 21.7% in 2014 but dropped to 21.1% in 2019 [1]. In Australia, the CPI weight for housing was 24.1% in 2020 but dropped to 23.2% in 2021.[2]

Generally speaking, the CPI only measures the price changes of consumer goods. It does not account for loan repayments, income taxes or the purchase of assets like stocks or real estate.

Why Is The Consumer Price Index Important For Investors?

The CPI is one of the more popular ways of measuring inflation and deflation. By looking at the CPI, investors can gauge whether inflation is under control and how effective the current monetary policies are.

Depending how the CPI changes, regulatory bodies like the Federal Reserve will have to adjust their economic policies. If the CPI remains consistently high, it is possible that countries will raise interest rates.

If the CPI starts dropping, it is possible for countries to lower interest rates in order to stimulate growth in the economy.

Criticisms of the Consumer Price Index

While the CPI can give an overview of the consumer price in a country, it cannot accurately track the financial impact felt by people of different income brackets. For example, a family in the top 20% of a country's income bracket might cope with rising consumer prices far better than a family in the bottom 20%.

Additionally, the CPI does not account for how prices might differ across living areas. For larger countries, the cost of living in one state might be far higher than the cost of living in another state.

Consumer Price Index Trends For The Different Countries

The changes in the CPI might differ across countries. By looking at more than one country, we can get a better perspective of how the current economy looks. This can be a factor to consider in allocating capital for our portfolios.

Across multiple countries, we can observe that CPI and inflation is increasing.

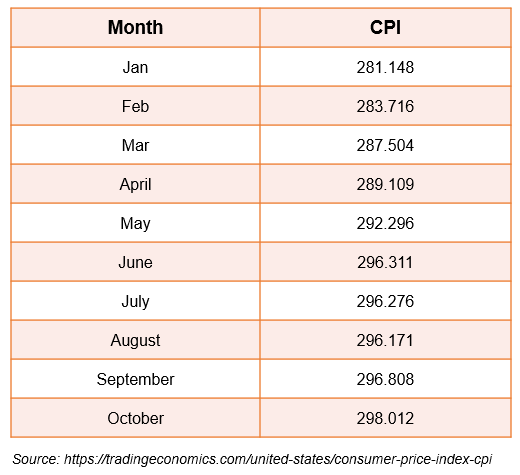

United States

This is the CPI trend for the United States since 2022:

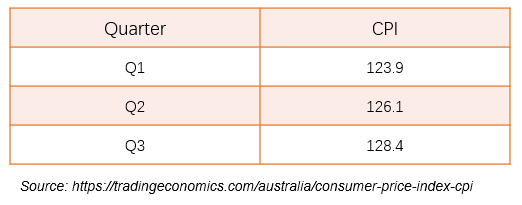

Australia

Australia uses a quarterly CPI indicator. However, it has recently explored a monthly CPI indicator.

The CPI trend for Australia is as follows:

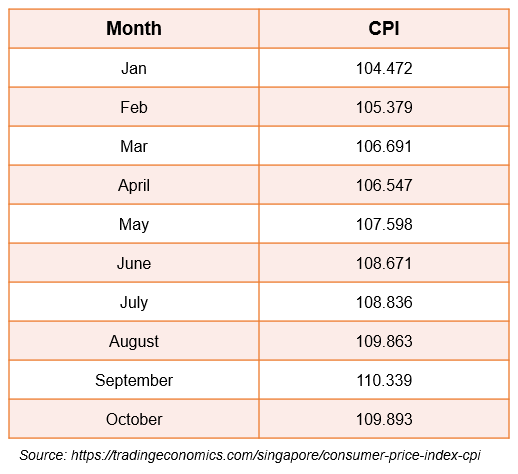

Singapore

For Singapore, the CPI trend is as follows:

Understanding The Consumer Price Index

When it comes to measuring the growth of an economy, similar terms which mean different things can be used. Let us now explore some of the other terms investors look at.

Consumer Price Index versus Inflation

According to the U.S. Bureau of Labor Statistics, the consumer price index is defined as "a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services." [3]

However, inflation is defined as "the overall general upward price movement of goods and services in an economy." [4]

The consumer price index is a key factor used to calculate inflation. In calculating the average change for the CPI, the average price is compared to a predetermined base period. For example, the US uses the time period of 1982 to 1984 for the base period. [5]

By comparing the monthly CPI between two periods of time, we can derive the inflation rate. In other words, the consumer price index is used to calculate the inflation.

Consumer Price Index versus Producer Price Index

According to the U.S. Bureau of Labor Statistics, the producer price index (PPI) is defined as "the average change over time in the selling prices received by domestic producers for their output."

As such, the PPI looks at a different set of goods and services that are not directly related to consumers. This can include industries like natural gas, construction and electricity.

While the goal of the CPI is to track consumer prices, the PPI is meant to track the revenue generated by the producers or businesses. Hence, they can both be used to measure the performance of a country's economy.

Start Investing with the moomoo App

With moomoo, you get 24/7 global news so you can catch up with the latest financial news and trends. This includes the latest announcements on the CPI.

You can download the moomoo app here to get real-time information you need to make better investment decisions.