The Investment Strategy of Warren Buffett

Many beginner investors are taken aback by how straightforward the Oracle of Omaha's investing strategy is. In a nutshell, Buffett seeks outstanding companies that are selling for prices that are below their "intrinsic values," and then he maintains his investments in such companies for as long as they continue to be great enterprises.

It should be no surprise that there is more to the tale than that. This article aims to go more into Buffett's investing strategy, illustrate how he has put his concept into practice, and present a list of the specific companies he does (and does not) invest in.

The 8 investing philosophy from Warren Buffett

We do not have access to a significant portion of Buffett's investing process, which is why we do not know precisely how he investigates potential investments. The following is a list of some of the essential investing ideas that Warren Buffett has stated that you could implement into your own investment strategies:

1. Analyze and think about it

Buffett regularly spends extended periods in his workplace in Omaha, Nebraska. His quiet, solitary lifestyle frequently shocks his investors, who assume he is always on the go. According to what he has been cited as saying, "I insist on a lot of time being spent, almost every day, to just sit and think."

Buffett considers the information to be something that improves with age, and he believes that a significant portion of his accomplishments may be credited to gathering as much financial information as is physically possible.

2. Try to find a margin of safety

Buffett's investing strategy is based on placing a premium on maintaining a comfortable margin of safety. In simpler terms, a safety margin refers to an investment's qualities that shield shareholders from the risk of incurring a financial loss. For instance, if a stock share is trading at $10 per share, but the firm's assets are really worth $12 per share, then there is a $2 margin of safety in the investment. It is reasonable to expect that the inherent worth of the company's assets will keep the stock price from falling by an excessive amount.

In every investment, Buffett seeks to pay less than the underlying worth of the firm. He says, "A too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments."

3. Get an understanding of the fundamentals of value investing

There is an agreement among financial experts that Warren Buffett is the most successful value investor in the world. Value investing is a kind of investing that places a premium on purchasing assets at prices that are below their inherent worth.

The primary objective of a value investor is to purchase $100 worth of a company's shares at a value lower than $100, preferably much lower. Value investors are interested in finding businesses with intrinsic values much higher than the enterprise values represented by the prices at which the stocks of such businesses trade and then invest their money in those businesses. Worth investors anticipate that the marketplace will ultimately realize the true value of a presently undervalued firm, which will result in a rise in the price of the company's stock and a return for value investing, such as Buffett.

4. Pay close attention to quality

The famous investor Warren Buffett does not put his money in the trash. It is not usual for him to invest in failed enterprises, regardless matter how inexpensive they get. One of the most important pieces of advice that Warren Buffett has ever given to prospective investors is this: "It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

5. Don't worry about market downturns and crashes

The apparent objective of stock trading is to buy cheap and sell high. Yet, the nature of human beings sometimes pushes us to behave in the exact opposite manner. When we notice that all of our other friends are earning money, we start to feel like we should invest some of our own money into the venture. In addition, we tend to sell our stocks before they fall any more when the market crashes.

Buffett likes dropping stock prices because they provide him with opportunities to purchase shares at reduced rates. Would you freak out and leave your favorite store if you discovered while there that the prices of everything in the store had been reduced by twenty percent all of a sudden? Obviously not. Buffett likes price reductions on his favorite stocks and said, "Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble."

6. Never go with the wind

Here is another bit of information from Warren Buffett that is highly crucial for beginning investors, particularly on Reddit discussion boards: You shouldn't purchase specific stocks just because everyone else is doing it. However, you should not make it your goal to go opposite to the herd and sell the stocks that everyone else is purchasing. As Buffett has shown, the ideal strategy for investing is to completely disregard conventional wisdom in favor of independently identifying and acting on opportunities.

Additionally, he explains, "The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd."

7. Have a long-term perspective while making investments

When it comes to stocks, one of the most insightful pieces of advice you can take from Warren Buffett is, "If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes."

It is not enough for him to believe that the prices of the stocks he invests in will go up this week, this month, or even this year for him to decide to purchase them. Buffett invests in equities because he intends to maintain ownership of the companies he has invested in for many years. Even though he continues to sell equities regularly and for a wide range of reasons, he approaches most of his assets with the mentality that he will hold them forever. Furthermore, Buffett has said that a set-it-and-forget-it investment, such as an S&P 500 index fund, is the greatest investment most individuals can make if they cannot adopt a "forever" attitude with their stock holdings.

8. If the situation changes, you shouldn't be scared to sell anything you have

A famous phrase attributed to Warren Buffett comes from an interview in which he was questioned about an investment he had chosen to sell at a loss. Buffett responded that the essential thing to do if you find yourself in a hole is to stop digging.

Even if he intends to hold on to every stock he purchases for the rest of his life, the fact is that perspectives change with time. It may come as a surprise to find that Warren Buffett purchased a sizeable stake in the mortgage provider Freddie Mac (OTC: FMCC). He concluded that the lender's leadership had begun to take needless risks with the company's capital a few years before the onset of the financial crisis, and he decided to sell. After a few years, and the financial crisis began, it became abundantly evident that Buffett had made a wise decision.

Which companies' shares does Warren Buffett buy and sell?

Buffett personally chose the majority of the holdings in Berkshire Hathaway's (NYSE: BRK.A) and Berkshire Ha thaway's (NYSE: BRK.B) stock holdings, which contribute to Berkshire Hathaway's (NYSE: BRK.A) and Berkshire Hathaway's (NYSE: BRK.B) Although the Berkshire Hathaway investment portfolio has over 45 separate stock investments, roughly 70% of the company's equity is focused in just four companies. Additional details on each of these top holdings can be found as follows:

Apple (AAPL): The stock of the IT titan is, by a significant margin, the biggest investment that Berkshire Hathaway has in its portfolio. As of Jun 30th, 2022, Berkshire owned 5.57% of Apple's shares, with a market value of more than $150 billion. Apple has what Buffett refers to as "sticky" customers, and it's hard to envision a corporation with a more devoted client base. However, Apple also has pricing power, and its leadership is among the best in the business.

Bank of America (NYSE: BAC): As of Jun 30th, 2022, Berkshire Hathaway owned 12.57% of the outstanding shares of Bank of America, making it the firm's second-largest stock holding behind Apple. Buffett has a great deal of respect for Brian Moynihan, the Chief Executive Officer of Bank of America, and the rest of the management team at the bank. The firm's stock trades consistently at an implied valuation that, in comparison to its assets' book value, is consistently lower than that of the firm's big-bank competitors. In addition, Bank of America Corporation is an amazing dividend stock; the company places a high priority on repurchasing its own shares; and during the last several years, the company has seen growth that is among the quickest among its competitors.

American Express (NYSE: AXP): At the time of Jun 30th, 2022, Berkshire Hathaway held 20.22% of American Express's total shares, equivalent to almost $21.29 billion at the market price. This investment represents one of Berkshire's most significant holdings in terms of ownership percentage. Berkshire Hathaway's investment portfolio has included American Express shares for the last three decades due to Buffett's admiration for the firm's prestigious brand name and the fact that it operates in its business dealings as both a payments system and a lender.

Coca-Cola (NYSE: KO): When this article was published, Berkshire had a 9.25% stake in the beverage giant's shares, valued at $25.57 billion. (Jun 30th, 2022) This made Berkshire one of the company's most significant shareholders. In the late 1980s, Buffett began amassing his Coca-Cola stock holdings, which would become one of his most profitable long-term investments. Buffett is a dedicated user of Coca-Cola, but he also admires the company's brand strength and huge distribution network, which provide it with the comparative edge over would-be competitors.

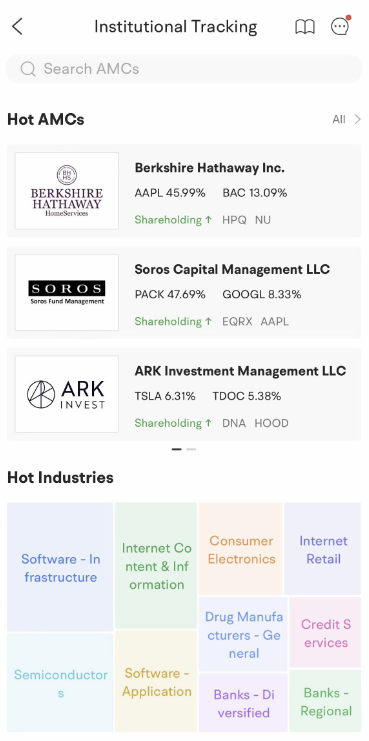

In addition, if you want to know more about the company shares that Buffett buys and sells, you can try moomoo's institutional tracking function. The Integrated, updated, and visualized institutional holdings will help you to discover investment opportunities.

Which companies does Warren Buffett not invest in?

Buffett maintains a strategic distance from investments above his level of expertise. Because of this primary factor, Berkshire Hathaway's stock portfolio does not include a significant number of high-growth technology businesses or biotech equities. Buffett is conscious of the areas where he excels as a value investor. This does not mean that the companies he invests in operate poorly or are overpriced.

Another thing to remember is that just because Buffett stays away from a certain market or industry does not imply that you have to do the same. You can invest by sticking to what you understand like Buffett.