TOP 10 Day Trading Strategies for Beginners

Day trading refers to selling and buying a financial instrument within a day. It can turn into a lucrative career if done correctly. However, it is a risky career path for beginners, especially if they don't use the right strategy.

So, if you're thinking of doing day trading, plan first. We can help you do this. In this article, we have described the top 10-day trading strategies for beginners.

Key Takeaways

Proper research and traders' dedication decide the success of day trading.

Day traders must be objective, focused, and dedicated to their work.

Day Trading Strategies

Do research first

Before you start day trading, you must know:

What is day trading?

What are day trading procedures?

Latest news and events that affect stocks in the stock market. For instance, you must know financial, business, and economic news, leading indicator announcements and interest rate plans of the Federal Reserve System.

Make a list of stocks in which you want to trade.

Get information about leading companies. Ensure you've all the information about your selected companies' stocks and general markets.

Keep funds for trading:

The next step is to decide how much you want to invest in day trading. Most traders want to risk minimum capital. States indicate that most successful traders risk only 1%-2% for each trade.

Let's take a simple example to understand this fact. If you want to risk 0.5% on $50,000, you can lose up to $250.

So, set aside extra funds and decide how much you're willing to lose before you start day trading.

Decide Time

Day trading doesn't mean you will invest and wait for the profit. You have to invest your time and effort. So, if you are short on time or don't dedicate enough to invest your time, don't go with day trading.

As a trader, you must identify all opportunities and track market success. So, you must always be available during trading hours.

Start with a small investment

Don't be impatience to earn big profits. Always start with a small investment. Don't go for more than two stocks during a session. Never think that you will have fewer opportunities with fewer stocks. Instead, it will become easier for you to track and find opportunities with a few stocks.

Most traders prefer to go with fractional shares. It will help you identify the minimum amount you must invest initially.

Suppose the value of Amazon shares is $3,500. Many brokers will suggest you buy a fractional share of less than 1% or as low as $25.

Avoid Penny Stocks

Most traders look for low prices. There's nothing bad in it. But it doesn't mean you would accept the penny stocks. These stocks are illiquid and can't help you earn a significant profit.

Major stock exchanges don't allow stock trading under $5. You must also avoid such penny stocks until you've done your homework and see a real opportunity.

Time orders to make profits

Many orders start executing with the market opening in the morning. As a result, there will be higher price volatility.

An expert can identify the opening orders of stocks and give them time to make stocks. On the other hand, new players must be patient enough to wait for at least 15-20 minutes to understand the market trends.

Typically, the market is less volatile in the middle hours and will speed up while moving towards closing. Indeed, rush hours bring a lot of opportunities. But, you must not invest in these rush hours if you're a beginner.

Trade with Limit Orders to reduce losses

The next step is to decide the type of orders through which you want to do trading. There're two types of orders:

Market orders: it refers to trade at the current best available price of the market. Market orders are helpful when you want to do immediate trading.

Limit orders: It refers to executing trades at the desired price. Therefore, limited order doesn't ensure execution. However, it boosts your confidence to do trading on your own terms.

Moreover, you can maintain your position even if the market doesn't reach your desired price at a specific time. So, a limit order can help you reduce the losses. Isn't that good news? Learn more about trailing stop limit order.

Be Realistic About Profits

Not all strategies bring profit for you. Most of the time, traders are successful in only 50-60% of their trades. However, they have an excellent strategy. The strategy is to lose less and win more. Moreover, they ensure clearly defined entry and exit methods and a limited risk on each trade.

9. Stay calm

Indeed, day trading is a game of nerves. But you shouldn't be afraid of outcomes. Moreover, you should be logical rather than emotional while making trading decisions.

10. Follow your Plan

A right and well-planned strategy helps you to do hassle-free trading. It will be possible only if you follow your trading strategy correctly.

Most traders abandon their strategy because they think it's not working. However, the reality is different. Sticking to the right strategy doesn't mean you will be a billionaire within days. Instead, you need to be patient, persistent and dedicated to making significant profits.

Why Is It Challenging to Do Day Trading?

Day trading demands knowledge and experience. Besides these, some other factors make day trading challenging. For instance,

Competition with professionals:

If you're a beginner, you have to compete with trading experts. These experts use industry connections and, most importantly best technology. Both these factors make them successful traders. As a result, day trading will become challenging for you.

Taxes:

The federal government requires you to pay taxes no matter how slim your profits are. You have to pay taxes

- On your profits

- On investments that are on hold for one year

Emotions

Psychological and emotional biases are another challenge at the start of your day trading career. Just imagine you're losing money on your first investment; you will feel mentally shattered.

On the other hand, expert traders can overcome such challenges easily.

Basic Day Trading Techniques

Day trading comes with many benefits and challenges. Let's find some interesting techniques that you can use for effective day trading.

Follow the market trends: A trend follower buys with the decrease in prices and sells with the increase in prices. A wise trader follows the market trend and assumes that continuously falling and rising prices will continue.

Contrarian investing: It refers to a reversal in the rise in prices. Traders following this strategy assume that this reverse trend will change soon.

Trading the news: it refers to a strategy in which traders invest with the announcement of good news. On the other hand, bad news will cause the trader to short-sell. As a result, volatility will increase, leading to higher losses and profits.

Scalping: It refers to a strategy in which a trader exploits price gaps. The bid-ask spread primarily creates such price gaps. In this technique, traders enter and exit a position within seconds.

Another great strategy is to combine a series of strategies to make big profits. It's not essential to always follow these techniques. You can also find your trading style and work accordingly. While determining your trading style, you must be clear about your goals.

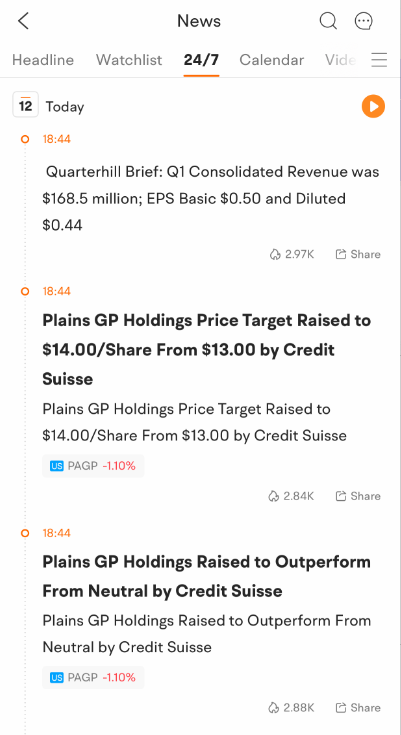

moomoo app provides 24/7 real-time global news for traders and investors. The news feeds from authoritative news agencies such as Dow Jones, Benzinga and more to help investors collate the latest information from around the world. So as to get a quick overview of the latest market trends and catch the potential investing opportunities. Sign up today to get the global 24/7 real-time news!

Final Thoughts…!!

Day trading is challenging. You must be skillful, disciplined and dedicated enough before starting day trading. Most importantly, day trading requires you to invest time. But it doesn’t mean you shouldn’t start day trading. You can make it a profitable business by following the above-mentioned effective strategies combined with proper knowledge of the stock market.

The knowledge and expertise of day traders make the markets alive. So, be consistent and continue tracking your performance to increase the chances of profitable trading.