What are Warrants?

Key Takeaways

Structured warrants track the movements of the underlying asset (share or an index) at a fraction of the underlying’s cost, while offering magnified returns.

Warrants have different levels of gearing available (from 2x to 50x), depending on the investor’s risk profiles.

Warrants require significantly lower outlay compared to shares and can cost as little as $0.01.

What are call and put warrants?

A call warrant moves in correspondence to the underlying they track, and is for investors who think the underlying will increase in value in the short-term. A put warrant moves in the opposite direction from the underlying and is thus, suitable for those who think the underlying will fall in the short-term.

Why trade structured warrants?

Structured Warrants offer some of the highest gearing (or leverage) amongst listed leveraged products in Singapore. They tend to move in greater percentages than the underlying, giving investors potentially higher percentage returns than buying the shares directly.

However, as gearing is a double-edged sword, losses will also be magnified when investors get their view wrong via a warrant. Having said that, the maximum loss from a warrant is limited to the warrant cost price, which are a fraction of the underlying’s price. There are also no margin calls with warrants. Warrants provide investors the opportunity to profit from both share price increases and falls. Put warrants are one of the few instruments that allow retail investors to go short, and may be used as a form of insurance to hedge an existing share portfolio against a falling stock or market.

Finally, warrants are typically very liquid due to the existence of designated market makers, giving investors the ease of buying and selling out of the warrants anytime during trading hours.

How to select a warrant to trade?

1. View on the underlying

A warrant tracks the moves on its underlying. Therefore, the first step to selecting a warrant to trade is to form a view and target entry/exit/cut loss levels in the underlying. The price at which to enter and exit from a warrant is based on your entry and exit levels in the underlying.

For investors who employ technical analysis, make sure you conduct your technical analysis directly on the underlying and not the warrant.

2. Decide on your holding period

As with all leveraged products, warrants are not meant as a long-term investment. This is due to rising holding costs the longer an investor holds onto the product. The holding costs for warrants is known as time decay, where a warrant’s price erodes with time.

You may use Warrant Calculator that will allow you to estimate the time decay on your intended holding period. Generally, investors should avoid warrants expiring in the same month, and choose an expiry longer than your intended holding period.

Warrant Selector tools also help you see the maximum holding period you should hold onto the warrant based on your target underlying entry and exit levels, before the warrant gains are completely eroded by time decay.

3. Select the amount of leverage you are comfortable with

One of the popular reason for trading warrants is due to leverage or gearing they provide.

How much more the warrants move in relation to the underlying depends on their effective gearing level. For example, a warrant with an effective gearing of 8x means if the underlying’s price moved 1% higher, the warrant should move around 8%, 8 times for than the underlying percentage move.

However, the higher the effective gearing level in the warrant, the riskier the warrant, as gearing works both ways. Hence, investors need to be careful, especially selecting a highly geared warrant, typically one with little time left to expiry, all else constant.

4. Avoid warrants on wide spreads.

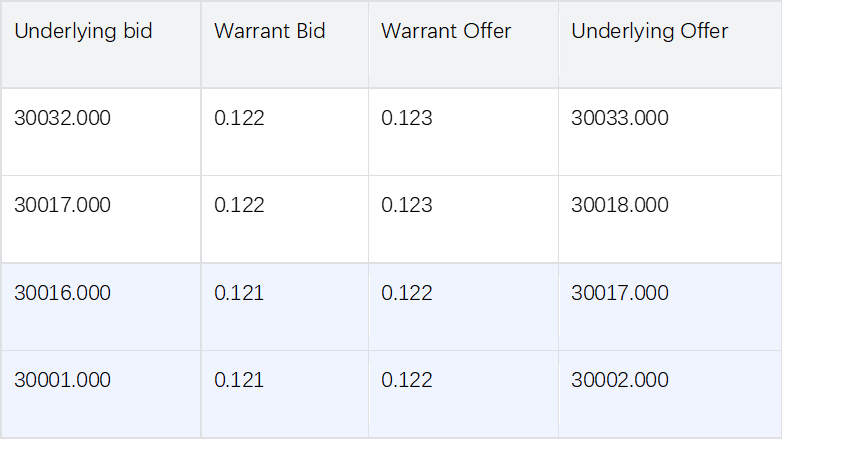

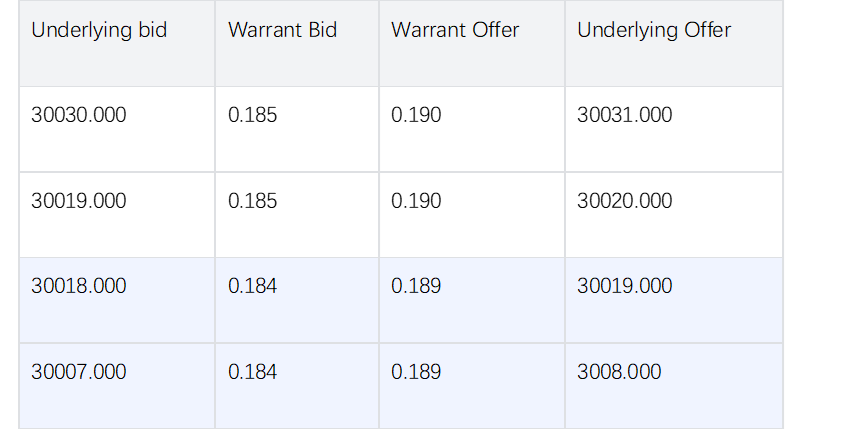

Investors should always pick warrants that are trading on tight spreads. A tight spread means there is only a $0.001 spread between the bid and offer price for warrants priced below $0.20, and $0.005 spread for warrants priced above $0.20.

Example of a warrant on tight spreads:

Example of a warrant on wide spreads (0.005):

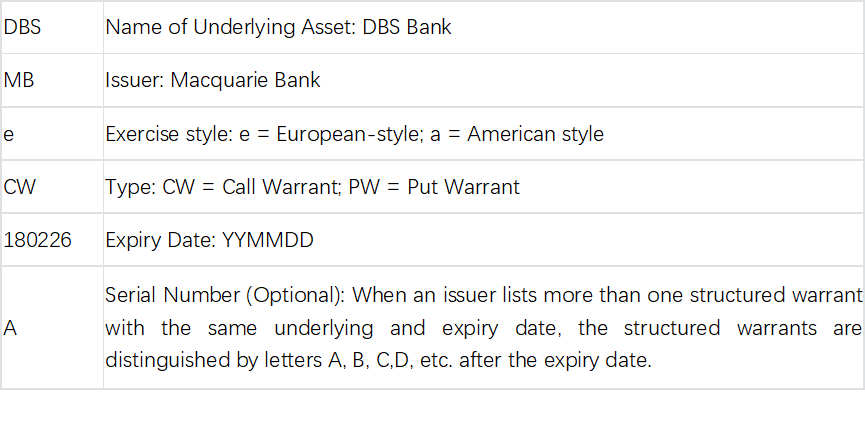

How to Interpret the Name of a Structured Warrant

The structured warrants listed on SGX can be identified by their trading names, which also reveal some important information about the structured warrants.

For a structured warrant issued on a stock, the trading name convention used by SGX is as follows:

E.g.: DBS MB eCW180226 A

References

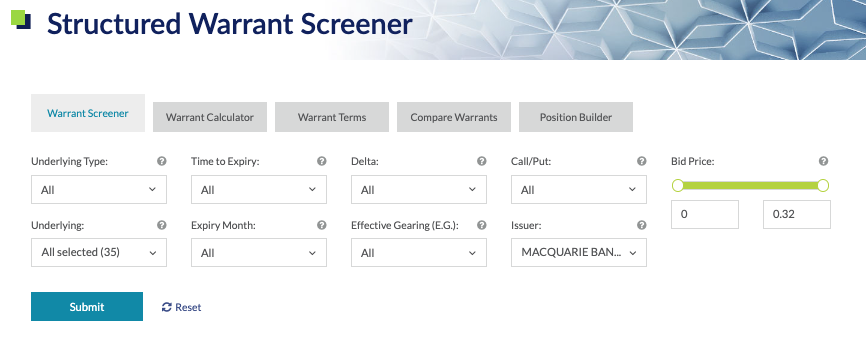

For the quickest selection process, you may consider to reference to SGX's Warrants Screener or Macquarie’s Warrant Search page to use the warrants calculator to estimate the time decay on your inteded holding period; or look out for warrants with the fire icon indicating the trending warrants with high liquidity and tight spreads on through their live matrix page.