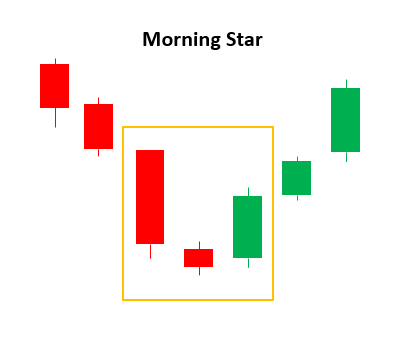

What Is a Morning Star?

Technical experts view the morning star as a bullish indicator since it consists of three candlesticks. The formation of a morning star after a declining trend symbolizes the beginning of an ascent. It indicates a change in the prior price trend. Traders may watch for the formation of a morning star and then use additional indications to establish that a reversal is occurring.

What Does the Morning Star Indicate?

A morning star is a visual pattern, so no specific computations are required. The low point of a morning star occurs on the second candle in a three-candle pattern. However, the low point is not visible until the third candle has burned out.

The low point of a morning star occurs on the second candle in a three-candle pattern. However, the bottom point is not obvious until the third candle closes.

Other technical indicators, such as whether the price movement is nearing a support zone or whether the relative strength indicator (RSI) indicates that the stock or commodity is oversold, can assist anticipate whether a morning star is emerging.

Here is an example of a morning star pattern:

Important to note about the morning star is that the middle candle could be black or white (or red or green) as the session progresses and buyers and sellers begin to equal out.

What Is the Morning Doji Star?

Morning Doji Star is a three-candle bullish reversal pattern. During a downtrend, the initial candle is a long dropping candle, followed by a Doji candle that closes below the previous low. The third candle is a lengthy growing candle that closes above the first candle's middle. During a decline, the Doji pattern of indecision occurs. This indicates that the current trend is weakening, and the next candle will confirm this. The third one launches a bullish movement that may cause a price reversal. This candlestick pattern typically results in a bullish price reversal, so signaling a buy in your trading plan.

What Separates a Morning Star from a Doji Morning Star?

The morning star pattern has a little variant. A doji is formed when the price action in the middle candlestick is essentially flat. This is a miniature candlestick with no visible wicks, similar to the plus symbol. The doji morning star displays market uncertainty more effectively than a morning star with a larger middle candle.

The development of a doji after a black candle is typically accompanied by a more aggressive volume rise and a correspondingly longer white candle, as more traders are able to recognize the formation of a morning star.

Restrictions of Utilizing the Morning Star Design

Trading based solely on visual patterns might be dangerous. A morning star is most effective when it is supported by volume and another indicator, such as a support level. Otherwise, it is straightforward to recognize the formation of morning stars anytime a little candle appears during a downtrend.

Technical analysis with moomoo

Moomoo stock trading app provides powerful stock charting tools to meet various investors' technical analysis needs and help to make investing decisions. Moomoo stock charting tools consist of 63+ technical indicators, 38 types of charts, support for saving and synchronization of charts, and customized color patterns, etc. Download the moomoo app today to get access to these free charting tools!