What is Book Value per Share (BVPS)?

Key Takeaways

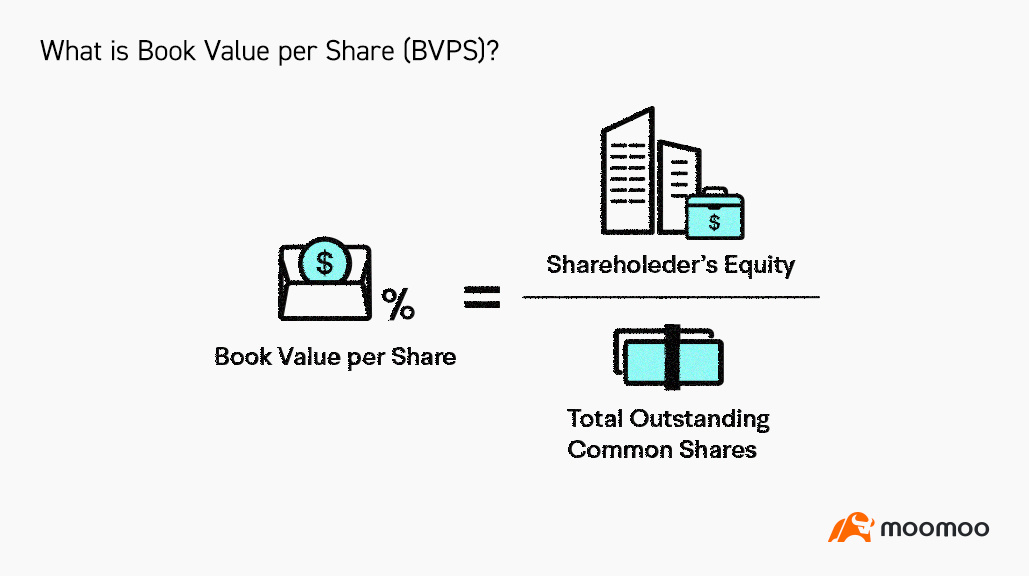

Book value per share (BVPS) is the ratio of equity available to common shareholders divided by the average number of outstanding shares during a specific period

BVPS measures the book value of a firm on a per-share basis

BVPS is a more conservative way for investors to measure the value of a company's stock compared to the market value per share

Understanding BVPS

Book value per share (BVPS) is the ratio of equity available to common shareholders divided by the average number of outstanding shares during a specific period.

The formula for calculating BVPSis given as follows:

(We used the "average number of shares outstanding" for a specific period because the closing period amount may distort results in case there was a stock issuance or major stock buyouts.)

BVPS measures the book value of a firm on a per-share basis.

Market Value Per Share vs. Book Value Per Share

The book value per share and the market value per share are tools used to evaluate the value of a company's stock.

The market value per share is the current price of a company's shares, and it is the price that investors are willing to pay for common stocks. The market value is a forward-looking metric and reflects a company's earning ability in the future. If the company's expected growth and profitability increase, the market value per share is generally expected to rise.

On the other hand, book value per share is an accounting-based tool calculated using historical costs. Unlike the market value per share, the metric is not forward-looking, and it does not represent the actual market value of a company's shares.

The BVPS is a more conservative way for investors to measure the value of a company's stock. Value investors prefer using the BVPS as an indicator to analyze if a stock's price is undervalued when future growth and earnings projections are less stable.