What Is Maintenance Margin?

The maintenance margin is the lowest amount of equity an investor must have in an investment account after purchase to avoid a margin call. The current maintenance margin is set at 25% of the total value of securities the account holds per the (FINRA) requirements.

Key Takeaways

● Maintenance margin is the lowest amount of equity an investor must have in an investment account after purchase to avoid a margin call.

● The current maintenance margin is set at 25% of the total value of securities the account holds per the (FINRA) requirements.

● The investor might receive a margin call if the funds in the account are lower than the maintenance margin minimum, which can cause the investor to sell assets to meet the requirement.

Understanding Maintenance Margin

Even though FINRA established a minimum of 25% as the maintenance margin, a lot of brokerage firms set their minimum rate at 30% to 40% of the total value of the securities. Other terms for maintenance margin are maintenance requirement and minimum maintenance.

A margin account is an account that offers investors the privilege to borrow money from the brokerage firm to purchase securities like bonds, stocks, and options Margin accounts are subjected to strict rules and regulations. One of these rules is the maintenance margin – which is the lowest amount of equity an investor must have in their margin account minus the amount borrowed from the brokerage firm. This minimum amount must always be in the account.

This means that if a margin account has $10,000 worth of security, at least $2,500 must be in that margin account at all times. If the value of the security rises, the maintenance margin automatically rises e.g. if the value of the security rises to $15,000, the maintenance margin will also rise to $3,750. The brokerage firm will hit the investor with a margin call if the value of the security decreases to less than the maintenance margin.

To mitigate the possibility of experiencing devastating losses for both investors and brokerages, the federal government and other self-regulatory agencies are the ones regulating margin trading. Today, a plethora of regulators of margin trading exist, however, the most crucial ones are the Federal Reserve Board and FINRA.

Margin Accounts vs. Maintenance Margins

Before opening a margin account, all investors must sign an agreement with the brokerage firm. This agreement stipulates the minimum or initial margin of at least $ 2000 that the account must have in cash or securities before investors can make trades. This agreement is based on the terms of the Federal Reserve Board and the FINRA.

Following the Federal Reserve Board’s Regulation T (Reg T) an investor can borrow only up to 50% of the security’s price. However, certain brokers have set their deposit limits higher than 50%.

As soon as an investor purchases equity on margin, they must make sure to adhere to FINRA’s requirement of having at least 25% of the total market value of this equity in the account as the maintenance margin.

If the value of the security in the margin account decreases below the minimum percentage, the broker puts in effect a margin call so the investor can deposit more funds into the account to sustain the maintenance margin. If the investor is unable to deposit funds the brokerage firm will opt to sell securities to bring the account back to the maintenance margin. The broker may at times sell the securities in a margin account without the consent of the investor to meet the maintenance margin as that is their right. However, the broker will most likely send the investor an initial warning, and only when the investor fails to pay the margin call after multiple warnings, will the broker take action. A Federal Call is a different kind of margin call that only the federal government can issue.

FINRA regulations, maintenance margins, Reg T, and margin calls are all necessary facets of margin trading because of their potential to allow investors to make substantial profits and enormous losses. These losses can cause huge financial risks; without these regulations, they can destabilize the securities market or even disrupt the financial market.

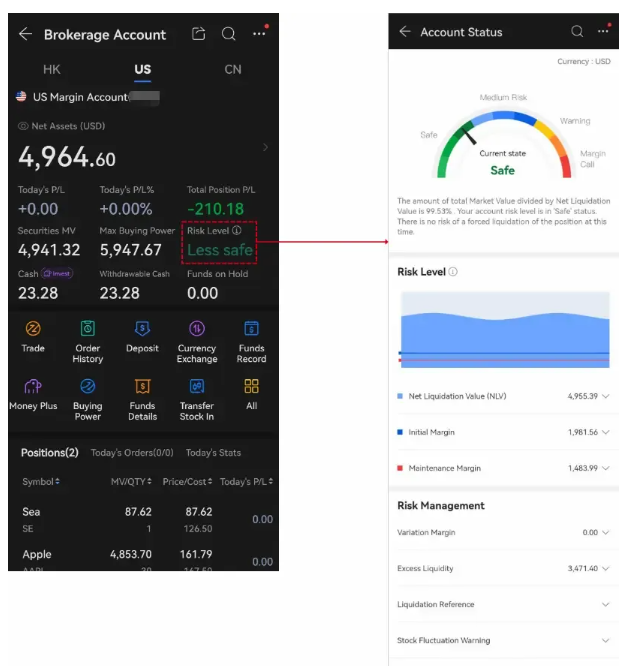

Moomoo app will disclose the risks on each user's account risk details page. The account risk detail page contains your account risks, disposal suggestions, and early warning information on fluctuations of individual stocks. It's easy to find out your risk level of the stock when you margin trade, to be better informed of the dangers in the early stage.