What Is Mirror Trading?

Mirror trading is a type of trade selection most often used in foreign exchange (Forex) markets. It is a method that enables investors to mimic the trades of seasoned forex investors and then execute identical transactions in their own accounts. It is a strategy that can be found in forex trading. Mirror trading was at first exclusively offered to institutional customers, but it has subsequently been made accessible to regular investors via a variety of different channels. Since its debut in the middle to late 2000s, mirror trading has served as an inspiration for various trading tactics that are analogous to it, including copy trading and social trading.

Comprehending the Concept of Mirror Trading

Because of its automated nature, it may assist investors in avoiding making trading choices influenced by their emotions. Mirror traders in the foreign exchange markets often use the trading platform provided by a brokerage to investigate the history and specifics of a variety of trading methods.

After researching on the performance characteristics, the trader selects an algorithmic strategy from available options. This decision takes into account the trader's investment goals, their level of comfort with risk, the amount of investment capital available, and the assets they wish to invest in. For the sake of illustration, a trader who is only willing to take on a little risk can decide to copy a trading method with a limited potential for loss. When strategy creators make trades, those deals are replicated in the accounts of mirror traders using automated software that runs 24 hours a day, five days a week, aiming to produce returns comparable to the actual trades.

Positive Aspects of Mirror Trading

Maintains Control Over Emotions:

Analyzing the data points utilized to generate the transaction is how mirror trading can function. Using this method can help remove the element of emotion from the decision-making process. Lack of emotional self-control is a primary factor contributing to many people's failure to establish successful trading careers.

Convenient and Timesaving:

Trading is a significant investment of both time and effort. Because of the rapid pace at which everything in the stock market may and does change, well-informed trading may only be possible with consistent market analysis. Mirror trading helps to remove a part of this variable, enabling traders to concentrate only on the aspects of the market in which they excel.

Methods are Tested:

Before putting up numerous trading methods for inexperienced traders to copy and paste, the marketplaces and brokerage companies that provide the service of mirror trading undergo testing of such techniques.

Negative Aspects of Mirror Trading

Wrong Trades Also Get Mirrored:

You may trade on your own using the software known as a Mirror Trader rather than working with a Master Trader. However, this does have the potential for downsides since it may increase the likelihood of making bad choices and suffering financial losses. It is essential to remember that mirrored transactions will include not only positive trades, but also prospective trades that have a chance of hitting losses.

No Active Control:

When traders engage in mirror trading, it indicates they do not have control over the trades being carried out. Hence, it is difficult to know whether or not we can trust their positions because it indicates that the algorithm is being utilized to carry them out. It's possible that some people won't mind if other people sit in the driver's seat while they use their codes, but others won't be too thrilled about it.

Conclusion

Mirror trading is one approach for certain novice traders to get their feet wet in real trading. But it also has potential risks since it may increase the likelihood of making bad choices and suffering financial losses.

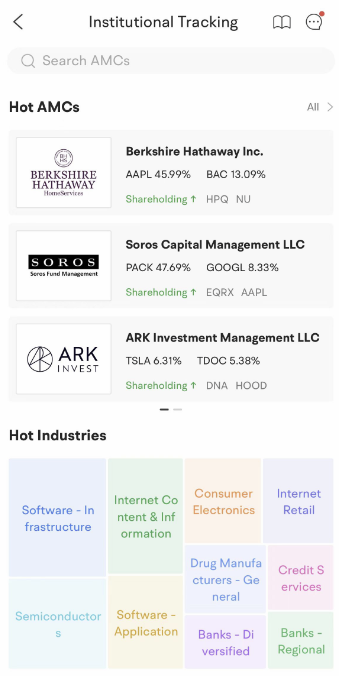

Moomoo stock trading app can provide traders with a collection of position reports from large institutions, providing them with quick access to insightful information, such as Warren Buffett's Berkshire Hathaway Inc. , Tiger Global, High Tide Capital, etc. Sign up and download the moomoo app today to access the visualized holdings and portfolios from institutional funds to help develop your trading strategies.

*Note, this is not related to mirror trading. These are required quarterly position reports that have been provided to the SEC.