What is Return on Investment (ROI)?

Key Takeaways

Return on investment (ROI) is a commonly used metric for investors to evaluate the profitability of an investment.

ROI is expressed as a ratio, that is, the result of investment gain relative to its cost.

ROI doesn't tell the full story of an investment if we allow for inflation, how long you hold it and related costs, etc.

Understanding return on investment

Karl Marx once quoted in his works that if capital can get 100% profit, it will "trample on all human laws". This judgment does highlight the power of profits, or more accurately, return on investment (ROI).

ROI is a financial metric for evaluating investment performance. It refers to the result of dividing profits from an investment by its cost. Therefore, it is normally expressed as a percentage or a ratio.

The simplified formula is as follows:

ROI = ( Net Profit / Cost of Investment) x 100%

ROI can be used to measure the profitability of an investment and compare different opportunities. Investments can't guarantee profits, but a good ROI generally means positive returns, at least in the long term to beat the market.

Limitations

Investment is subject to a variety of factors. Obviously, the simple formula of profits relative to initial costs can't tell the full story of investments.

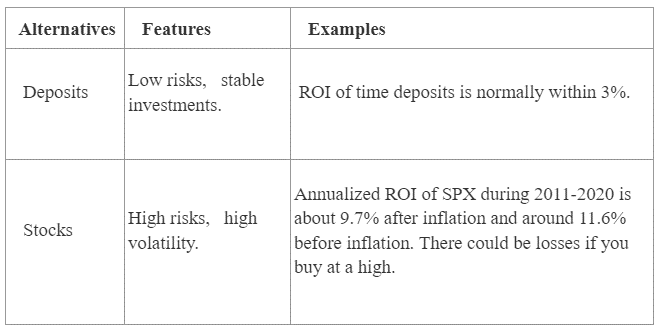

If the investment period, inflation, and stability of returns are considered in the calculation, the result will differ accordingly. The level of risk and related cost from the same and different types of investments are also key factors in their ROI comparisons.

Example

Let's say you buy 50 shares of a stock for $10 per share, with a total cost of $500. One year later, you sell them for $15 per share. In this case, you will receive a total of $750. Based on the simplest formula, the ROI is 50% ($250 / $500).

Assuming that the commission fee is $5 per transaction, your ROI after commission fees will be 48% (($250 - $10)/ $500).