What Is the Ichimoku Kinko Hyo?

The Ichimoku Kinko Hyo, sometimes known simply as Ichimoku, is a technical indicator that may be used to evaluate momentum and determine potential support and resistance locations. The technical indicator comprises of five lines collectively referred to as the tenkan-sen, the kijun-sen, the senkou span A, the senkou span B, and the chikou span.

Understanding Ichimoku Kinko Hyo

A Japanese newspaper writer first established the Ichimoku Kinko Hyo indication to consolidate multiple technical tactics into a single indicator that could be executed and read. This was the original intention behind the development of the indicator. Ichimoku literally translates to "one glance" in Japanese, meaning that traders only need to take a single look at the chart to discern momentum, support, and resistance.

Ichimoku may seem quite difficult for new traders who have never seen it before. However, the appearance of complexity may be dispelled once it is understood what the different lines indicate and why they are utilized.

Even though its primary purpose was to serve as a stand-alone indication, the Ichimoku indicator functions more effectively when combined with other methods of technical analysis.

Ichimoku Kinko Hyo Interpretation

The Ichimoku indication is comprised of five primary components, which are as follows:

Tenkan-sen: The tenkan-sen, also known as the conversion line, is determined by first adding the highest high and the lowest low during the most recent nine periods and then dividing the result of this calculation by two. The line produced consequently function as a signal for potential reversals and an essential support and resistance level.

Kijun-sen: The kijun-sen, also known as the baseline, is determined by adding the highest high and the lowest low during the previous 26 periods and then dividing the result of that calculation by two. The line produced consequently serves as a crucial support and resistance level, as well as a confirmation of a shift in trend, and it may be used as a trailing stop-loss point.

Senkou Span A: The senkou span A, also known as the leading span A, is determined by first adding the tenkan-sen and the kijun-sen, then dividing the result of this calculation by two, and then charting the development 26 periods into the future. The resultant line creates one edge of both the Kumo - or cloud. This helps to determine where future pockets of support and opposition may emerge.

Senkou Span B: The senkou span B, also known as the leading span B, is determined by adding the highest high and the lowest low during the most recent 52 periods and dividing that total by two. After that, map the outcome 26 periods into the future. The line produced, consequently, is utilized to build the opposite edge of the Kumo, which is used to locate places of support and resistance that could appear in the future.

Chikou span: the trailing span, is the closing price of the most recent period shown on the chart 26 days earlier than it is now. This line is used to highlight prospective locations of support and opposition.

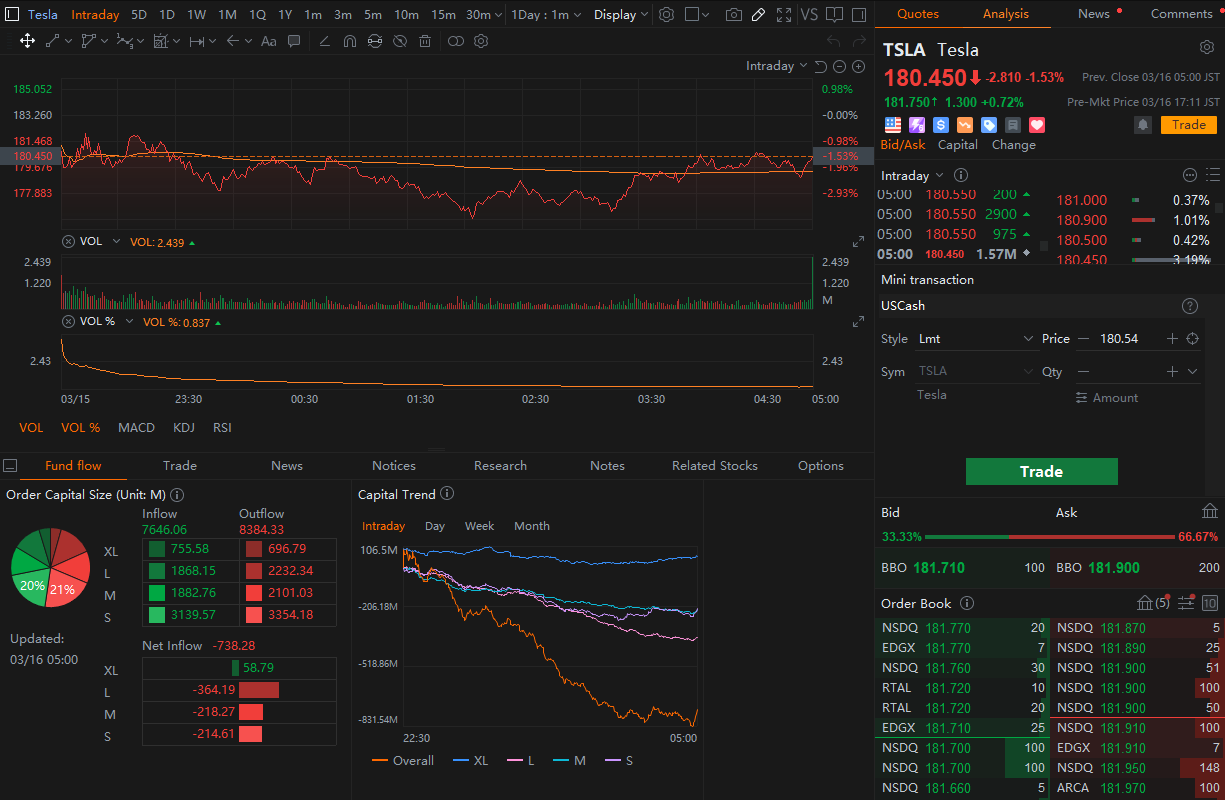

Investing with moomoo stock trading app

With moomoo, you are able to get free 24/7 global news and stock quotes to catch up with the latest financial news and market trends. You can sign up and download the moomoo app to get the real-time information you need to help make better investment decisions.

Images provided are not current and any securities are shown for illustrative purposes only.

*This presentation discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. This article is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. Investing involves risk regardless of the strategy selected and past performance does not indicate or guarantee future results.