What Is the Separating Lines Candlestick Pattern?

The Separating Lines candlestick pattern is a kind of pattern that forms during a trend. There are two kinds of separating lines: bullish and bearish. The bullish separating lines form when a bullish candle pattern followed by a bearish candle pattern that opens at the beginning of the previous bar in the downtrend. The bearish separating lines form when a bullish bar followed by a bearish candle that opens at a lower level than the open of the previous candle in an uptrend.

Depending on the direction of the prior trend, this two-candle continuation pattern can be bullish or bearish. It occurs when lines travel in the opposite direction.

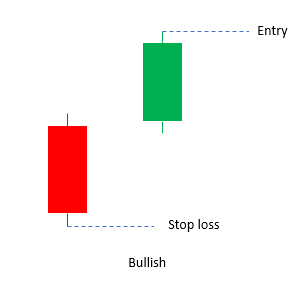

Bullish Separation Lines

A bullish separating lines pattern is a two-candle bullish continuation candlestick pattern that appears during a bullish trend. It indicates that the present positive trend will resume after a minor retracement.

The most prevalent interpretation of a bullish separating line is that it indicates that the present bullish trend will continue after a brief retreat. The pattern consists of two candles, the first of which is bearish and the second of which is bullish. It possesses the following characteristics:

The initial candle is bearish.

The second candle opens exactly at its open position or gaps above the prior candle's body.

The second candle closes higher than it opens.

Separation Lines in the Bearish

The bearish separating line identifies a bearish continuation pattern. The first line is a green candle that appears as a lengthy line in a downtrend. A long, red candle makes up the second line. Both bars will open at the same price before prices begin to diverge. For a bearish pattern to form,

The first candle is bullish and forms in a downward trend.

The second candle is bearish and open below the prior candle's opening.

What information does the Separating Lines provide traders?

Bullish Separation Lines

After an established upswing, during which the bulls dominate the market, the bears temporarily assume control. During the bears' reign, the price falls considerably, although their time in power is brief. On the second day, the price increases significantly so that the day opens in the same position as the day before. Bulls take pleasure in the market's rebound and drive the price much higher. The upward trend is anticipated to continue.

Even though the signal begins with a significant decline, the remainder is a steady ascent. The market experiences a significant increase between the end of the first day and the beginning of the second. The second leap occurs the following day, creating a lengthy white candle. The bullish separating lines candlestick pattern, which exhibits two large jumps, indicates that the current trend is anticipated to continue. It also conveys the trend's strength, demonstrating that the bulls will regain dominance even after a little setback. The pattern is more reliable the longer the candles in the bullish separating line are.

Bearish Separating Lines

The bears are in power, producing a severe downturn until the bulls assume control. The bears regain control on the second day, when the price opens at the same level as the day before. The price then decreases once more as a result of the bears' influence. This downward trend is anticipated to continue.

Even though this signal begins with a price increase on day one, the subsequent decline replicates the downtrend that precedes the pattern. Between the end of the first day and the beginning of the second, price drops dramatically. A further decline occurs on the second day. When these two declines are combined, it is clear why the downward trend is anticipated to continue. The bears' strength is evident; a minor setback will not impede their progress. The greater the duration of the two candles, the more dependable the bearish pattern.

Technical analysis with moomoo

Moomoo stock trading app provides free advanced stock charting tools to help various investors to analyze trends and patterns with 60+ technical indicators and add visuals to charts using 38+ drawing tools. Sign up and download the moomoo app today to access these charting tools!