What Is Three Inside Up and Three Inside Down?

The names "three inside up" and "three inside down" represent a pair of candlestick reversal patterns (each including three different candles) that show on candlestick charts. The pattern involves the formation of three candles in a precise order, indicating that the present trend has lost pace and that a reversal may be imminent.

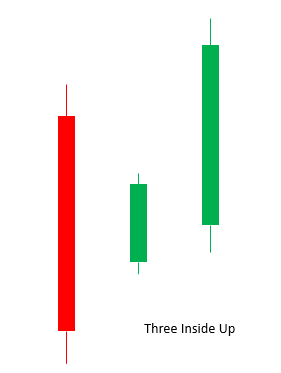

Overview of the Three Inside Up and Three Inside Down Candlestick Patterns

The three inside up version of the pattern is bullish, suggesting that the price decline may end and a climb higher may begin. Following are the pattern's properties.

The market is experiencing a downturn or a decline.

The first candle has a massive real body and is red (down).

The second candle is a green (up) candle with a small real body that opens and closes within the first candle.

The third candle is a green (up) candle that closes over the close of the second candle.

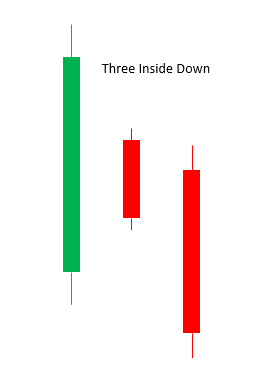

Bearish is the pattern's downward variation. It indicates that the increasing trend of the price is coming to an end and that the price is about to decline. Following are the pattern's properties.

The market is on an uptrend or a move higher.

The first candle is a huge green candle with a real body.

The second candle is a little red candle with a real body that opens and closes within the first candle.

The third candle is a red candle that closes under the close of the second candle.

To a certain extent, the three inside patterns are harami patterns that come with a final confirmation candle, which many traders would wait for with the harami anyway.

Three Inside Patterns and Trader Psychology

Three Inside Up

The downtrend continues on the first candle, with a strong sell-off reaching new lows. This discourages buyers while boosting the confidence of sellers.

The second candle opens within the trading range of the previous candle. Instead of continuing to decline, it closes higher than the previous close and the current open. This price activity raises a red flag, which some short-term short sellers may take as a chance to exit.

The third candle completes a bullish reversal, trapping any lingering short-sellers and luring those interested in starting a long position.

Three Inside Down

On the first candle, the uptrend continues as a big rise reaches new highs. The second candle opens inside the trading range of the previous candle and closes below the prior close and current open. This generates fear among buyers, who may begin to liquidate their long positions.

The third candle completes a bearish reversal, forcing additional long holdings to contemplate selling and allowing short-sellers to enter the market to profit from the decreasing price.

Technical analysis with moomoo

Moomoo stock trading app provides free advanced stock charting tools to help various investors to analyze trends and patterns with 60+ technical indicators and add visuals to charts using 38+ drawing tools. Sign up and download the moomoo app today to access these charting tools!