Index Options

XSP® vs SPY®

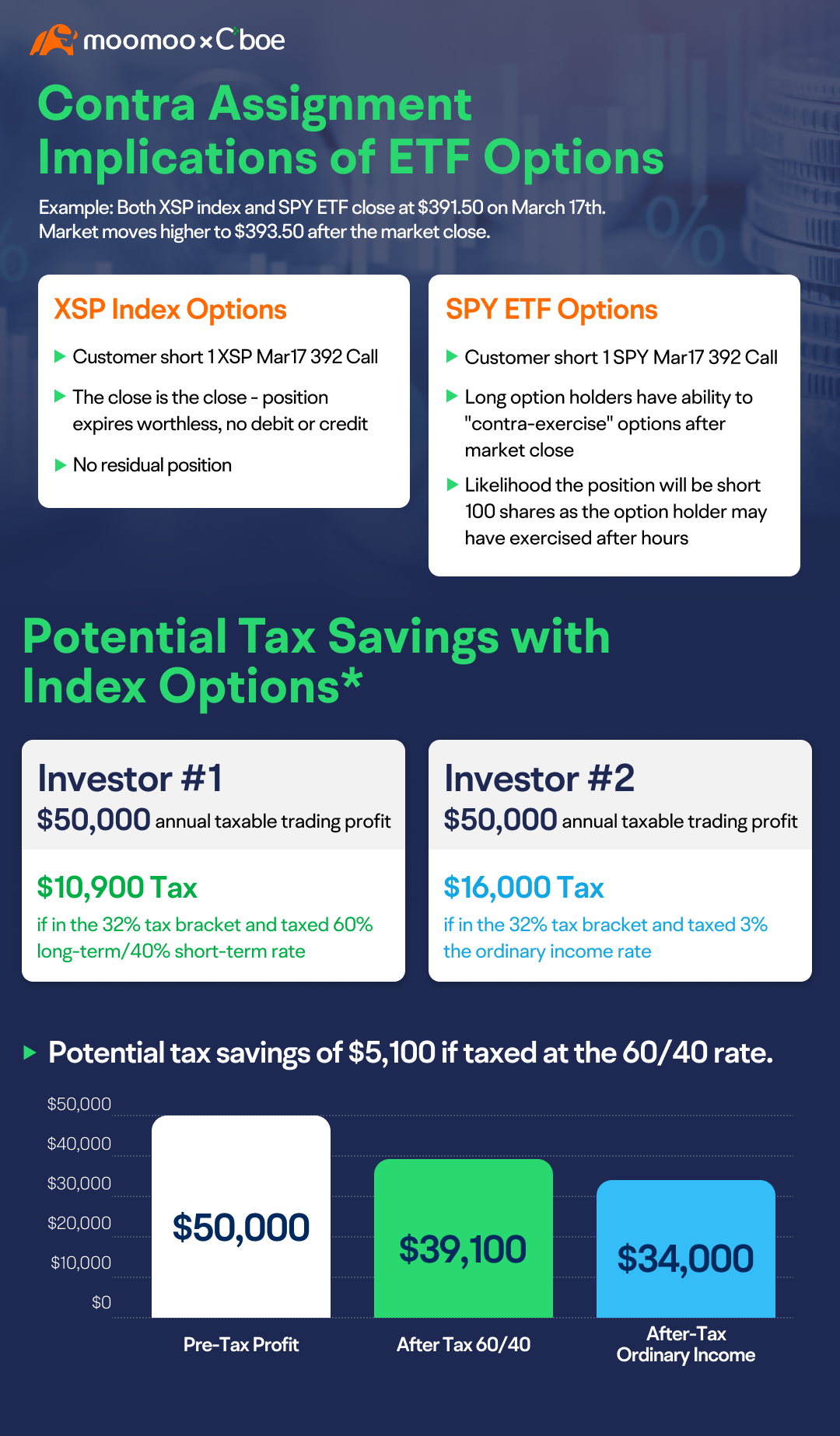

Index options and ETF options—especially those that track broad market indices like the S&P 500-are very similar.

With one trade, market participants can gain broad market exposure, hedge their portfolios, or execute a variety of trading strategies.

At 1/10th the size of SPX, XSP offers very similar notional size, weekly expirations, and PM-settlement to SPY, but with even more potential benefits.

Disclosures:

* Under section 1256 of the Tax Code profit and loss on transactions in certain exchange-traded options, including SPX Options, are entitled to be taxed at a rate equal to 60% long-term and 40% short-term capital gain or loss, provided that the investor involved and the strategy employed satisfy the criteria of the Tax Code. Investors should consult with their tax advisors to determine how the profit and loss on any particular option strategy will be taxed. Tax laws and regulations change from time to time and may be subject to varying interpretations.

** Global Trading Hours (GTH) The trading hours for options on the SPX, SPXW (SPX Weeklys and SPX End-of-Month), and XSP (Mini-SPX) begin at 8:15 p.m. Eastern time and end at 9:15 a.m. Eastern time. Curb session begins at 4:15 p.m. Eastern time and ends at 5:00 p.m. Eastern time. Please visit the Global Trading Hours page for more details.