The difference between warrants and options

What is the difference between Warrant and option? Many investors probably donot understand . From a broad perspective, the warrants canbe said to be a special form of options; however, in HongKong, there are many differences between warrants and exchange-listed options.

Regardless of whether it is a stockoption listed on the Stock Exchange or a futures option listed on the Futures Exchange, the corresponding assets (such as underlying stocks or futures indexes) , validity period, and exercise price are all set by the exchange.On the contrary, subject to compliance with HKEx regulations,they may issue a single Call or Put warrent of different assets, period of validity and exercise price, a basket of Shares or even X warrent( special warrants) in response to market demand. In addition, the exchange also requires the option market to implement the "banker" system. The banker must, upon the request of the client, issue the purchase price and ask price of an option inquired by the latter.There is no "official" banker in the warrant market, but those investment banks that often issue the warrant are also actively involved in the purchase and sale of the warrant in order to maintain the reasonable price and circulation of the stock warrants under their ownership, which objectively plays the role of banker.

In Hong Kong, the trading volume of options has always been lower than that of the warrants, so the spread of options is larger than that of warrants. Options investors often have to pay higher trading costs, which in turn further reduces the appetite of retail investors to buy and sell options. On the other hand, warrants are traded in the same way and with the same convenience. Higher trading volumes and lower bid-ask spreads make them more popular with investors.

Of course, the warrants is not unlimited. For example, an option strategy can be Buy Call or Short sell, sell Put. But for investors, there is only one way to buy the Call warrents instead of selling the short Put warrents, which has certain limitations. In other words, options retail investors in need can be with the banker 'swap positions'; But warrant investors cannot 'turn themselves into' issuers.

Be careful, the 'convenient' of options doesn't necessarily benefit retail investors who are not expertise, and don't have capital and hedging strategies ,because the benefit of short selling options is just get a finite number of the Premium , but there is a risk that the losses on the option may not be capped. Therefore, it can be seen that no matter what kind of investment vehicle has its advantages and disadvantages, investors shouldn't 'following the fashion' to speculate in all derivatives unfamiliar to them.

Overall, the differences between warrants and options are as follows:

1. Warrants Vs. Options

1.1 Warrants demonstrate higher liquidity than options in the HK market

The trading volume of the warrants tends to be higher than that of options.

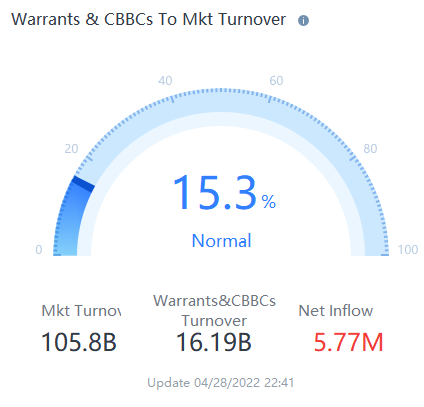

For example, on April 28, the market turnover was about HK$105.8 billion, of which about HK$16.2 billion was contributed by warrants & CBBCs, accounting for 15.3% of the toal.

1.2 Leverage

Both warrants and options involve leverage, meaning that less principal will be used in trading options and warrants than in trading underlying stocks. On the one hand, using leverage can magnify returns. On the other hand, using leverage could pose higher risks.

1.3 Some degree of risk control

The maximum potential loss for warrants is your principal. In options trading, a seller of put options can receive the option premium at the begining, but there is no upper limit for the maximum potential loss.

1.4 Exemption of stamp duty

Trading warrants is not subject to any stamp duty, but investors still need to pay tradings fees and brokerage commissions.

2. Risks

2.1 Limited warrant strategies available

You can only buy warrants (buy call or put warrants).

By contrast, in options trading, you can either buy or sell call/put options. Therefore, various option strategies can be formed, such as straddle and butterfly strategies.

2.2 Warrants cannot be exercised at any time

The warrants trading at HKEX are European warrants, which means that investors can only trade the warrants in the market or hold them until maturity.

By contrast, apart from supporting warrant trading in the market and excercising warrents upon expiration, American warrants can be exercised at any time prior to expiration.

3. Other differences

3.1 Account requirements

Options trading requires an options account, whereas warrants can be traded directly using the stock trading account.

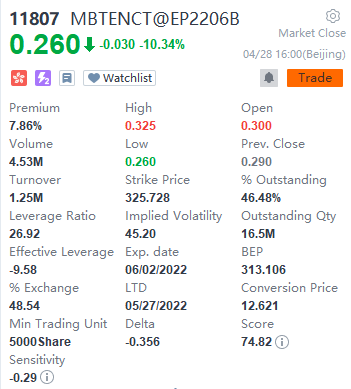

3.2 Expiration date

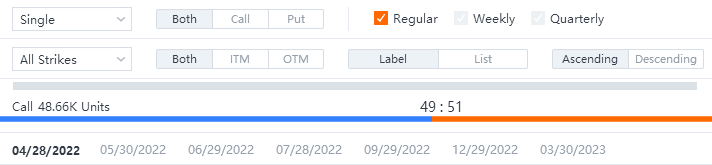

For warrants, the expiration date tends to be more diverse. As to options in the HK market, the expiration date is usually at the end of a month.

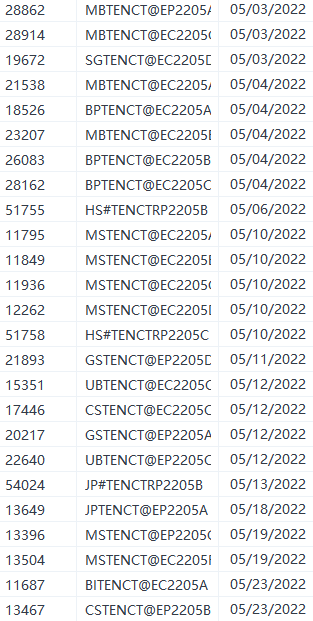

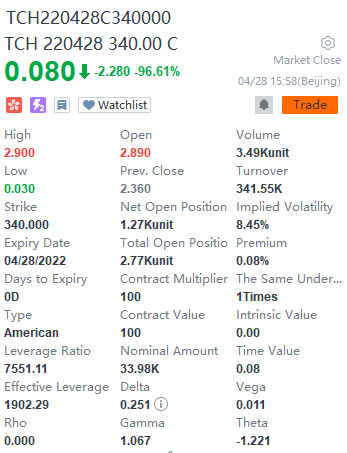

Tencent warrants

Tencent options

3.3 Code

A warrant code is a five-digit number, just like a stock code. By comparison, options are not identified by codes. Instead, investors identify options by terms such as maturity date and strike price.

Risk Disclosure This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose of the above content.