US stock options rolling

1.What's options rolling

Roll your options position by closing an existing position and simultaneously opening a new one with different contract terms, such as a later expiration date or a different strike price. You may choose to roll your options positions in different ways based on your trading strategies.

2.How to roll options

To roll your options in the app:

-

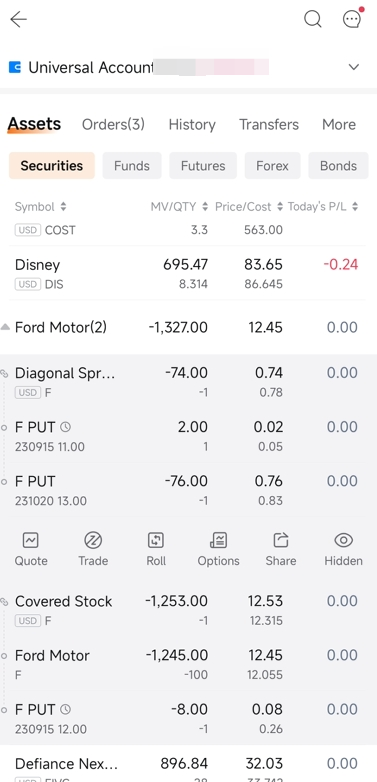

Go to the Assets tab

-

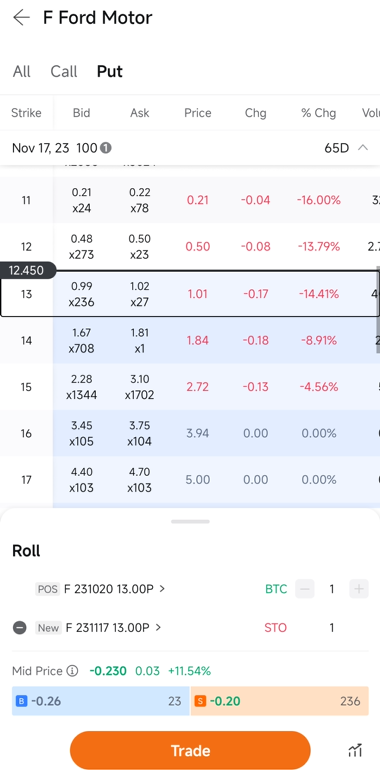

Select the options position you'd like to roll and tap Roll

-

Select the leg(s) you'd like to roll and tap Trade

(Please note that the interface shown in the screenshot may differ from the one on your device if your app version is not up-to-date. Any securities appearing in the screenshot are for illustration only and do not constitute any investment advice.)

3.Why investors roll options

Investors often roll options for a number of reasons, such as securing a profit, minimizing risk, or reducing cost. The approach they take to rolling their options is based on their investment objective.

Rolling out

Rolling out an option involves closing an existing options position while simultaneously opening a new one with the same strike price, but with a later expiration date. Investors do this to earn more premiums, extend the trading duration, or adjust the breakeven point of their positions.

Rolling up/down

Rolling up or down an option involves closing an existing options position while simultaneously opening a new one with the same expiration, but at a higher or lower strike price. Investors do this to earn more premiums, and adjust the breakeven point of their positions.

Examples:

A. To roll up a call option is commonly used to secure profits from the previous call option position.

B. To roll down a put option is commonly used to secure profits from the previous put option position.

C. To roll the option leg in a covered stock strategy is commonly used to earn more premiums and reducing the cost of holding the stock.

Overview

Market Insights

Meet Smarter Moomoo AI Meet Smarter Moomoo AI

ARK ETFs ARK ETFs

The ARK ETFs concept includes several ETFs across different strategies managed by ARK Invest. ARK Invest is an investment firm founded by Cathie Wood. The ARK ETFs concept includes several ETFs across different strategies managed by ARK Invest. ARK Invest is an investment firm founded by Cathie Wood.

Unlock Now

- No more -