Options position Greeks

Options position Greeks are metrics that assess the risk and sensitivity of an entire options position to various factors. These factors include changes in the underlying asset price, implied volatility, time decay, and interest rates. By analyzing these metrics, investors can make informed decisions about managing their portfolio.

1. Options position Greek definitions

| Options Position Greek | Definition |

| Delta | Measures the profit or loss (P/L) of an options position when the price of the underlying asset changes by 1 unit. |

| Gamma | Measures the change of the position's Delta when the price of the underlying asset changes by 1 unit. |

| Vega | Measures the profit or loss (P/L) of an options position when the implied volatility (IV) changes by 1%. |

| Theta | Measures the profit or loss (P/L) of an options position each day as it approaches the expiration date. |

| Rho | Measures the profit or loss (P/L) of an options position when interest rates change by 1%. |

2. Calculation

How to calculate options position Greeks

Calculating the options position Greeks can be done using the Greek metrics from the related options. Please note that the Greeks of the options are not the same as the Greeks of the options position.

Formula

Options Position Greek = Options Greek * Number of Contracts * Contract Multiplier

Take the Delta of an options position as an example:

Example 1: Single Options

Suppose you have 10 call option contracts for stock XYZ, and each contract has a Delta of 0.75. Delta of the position = 0.75 x 10 x 100 = 750.

This means that if XYZ rises by $1, you will earn $750 on the option position; if XYZ falls by $1, you will lose $750 on the option position.

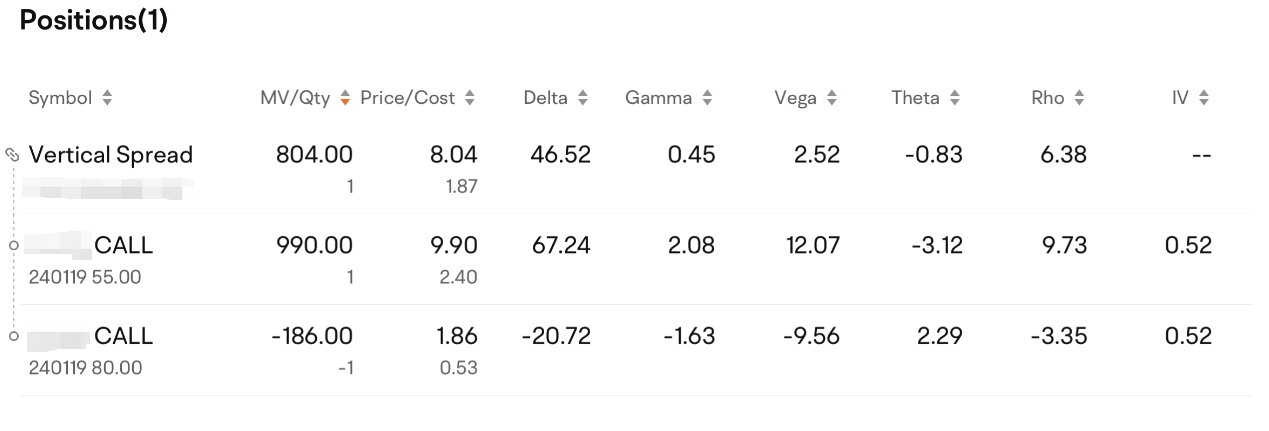

Example 2: Option Strategy

Suppose you hold 15 units of long call spreads for stock XYZ, which consists of buying 15 call options with a strike of $55 and selling 15 call options with a strike of $60.

-

If the Delta of the XYZ call with a $55 strike is 0.61, Delta of the position = 0.61 x 15 x 100 = 915

-

If the Delta of the XYZ call with a $60 strike is 0.29, Delta of the position = -0.29 x 15 x 100 = -435

Therefore, the Delta of the option strategy position = 915 + (-435) = 480. This means that if stock XYZ rises by $1, you will earn $480 on the position.

Notes:

-

The options position Greeks differ from the options Greeks shown on the Detailed Quotes page. The options position Greeks measure the actual risk of holding a position using the formula shown above.

To learn more about the options Greeks on the Detailed Quotes page, click here.

-

For any portfolio that contains products other than underlying stocks and options, such as Hong Kong stock warrants, calculating the options position Greeks is not supported.

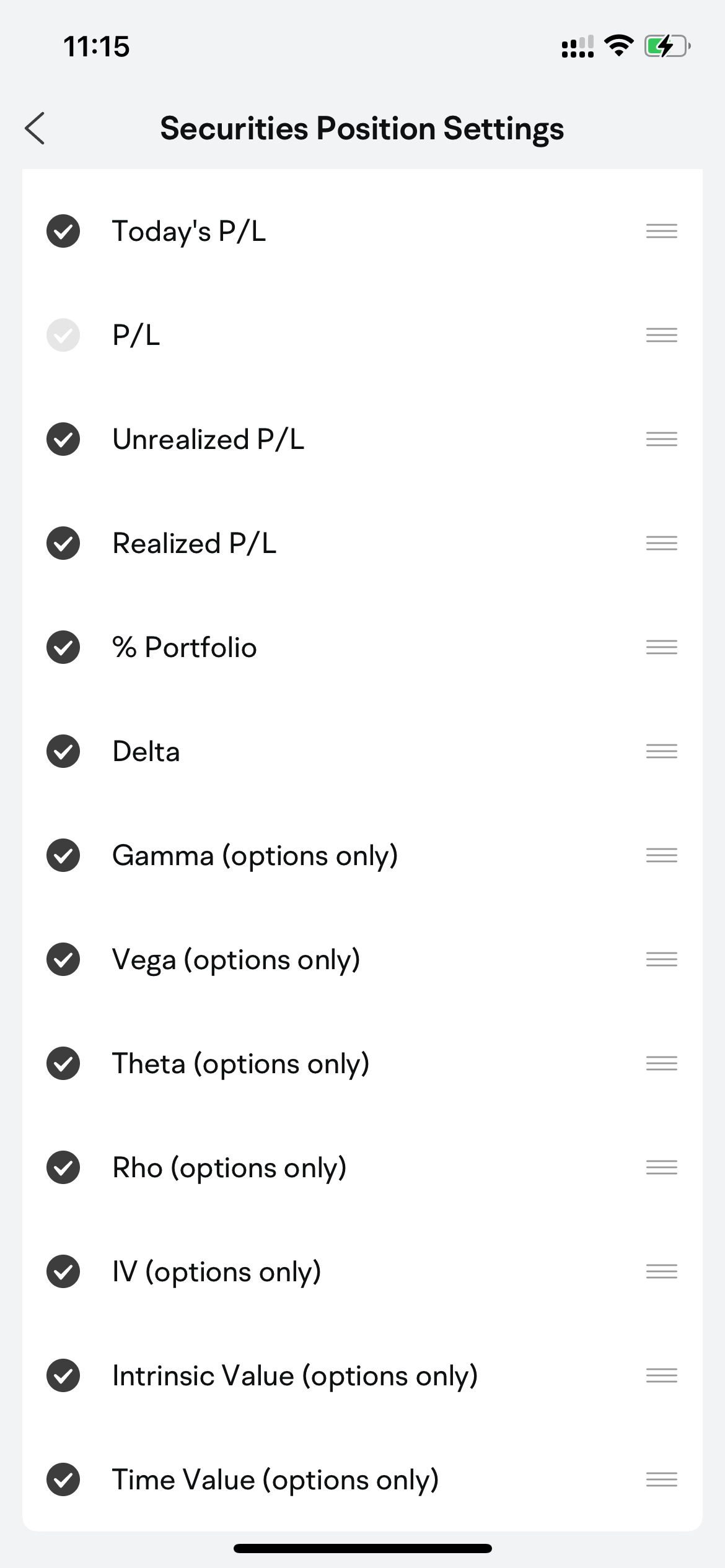

3. How to show or hide options position Greeks

To show or hide the Greeks of your options positions in the app:

Go to Settings > Trade > Position Display > Securities