US Stock MarketDetailed Quotes

.DJI Dow Jones Industrial Average

- 42052.190

- +288.730+0.69%

Close Nov 1 16:00 ET

42326.310High41869.820Low

41869.820Open41763.460Pre Close531.36MVolume43325.09052wk High19Rise1.09%Amplitude33859.77052wk Low11Fall42098.065Avg Price--Flatline

The market had a busy week with many top companies revealing their earnings, driving fluctuations in key indexes. Despite record highs earlier in the October, all major indexes ended October down:

• $S&P 500 Index (.SPX.US)$ dropped 1.37%,

• $Dow Jones Industrial Average (.DJI.US)$ slipped by 0.15%,

• $NASDAQ 100 Index (.NDX.US)$ fell 1.5%.

Similarly, crude oil $Crude Oil Futures(DEC4) (CLmain.US)$ prices also dropped, down 5% this week after a ...

• $S&P 500 Index (.SPX.US)$ dropped 1.37%,

• $Dow Jones Industrial Average (.DJI.US)$ slipped by 0.15%,

• $NASDAQ 100 Index (.NDX.US)$ fell 1.5%.

Similarly, crude oil $Crude Oil Futures(DEC4) (CLmain.US)$ prices also dropped, down 5% this week after a ...

15

3

Happy weekend investors! Welcome back to Weekly Buzz, where we discuss the top buzzing stock news on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

The market faced the most busy week, with earnings results from hundreds of companies before and after the market traded. We saw results from five of the Mag Seven, and yet there is more still to come. There is just a couple...

Make Your Choice

Weekly Buzz

The market faced the most busy week, with earnings results from hundreds of companies before and after the market traded. We saw results from five of the Mag Seven, and yet there is more still to come. There is just a couple...

+10

66

33

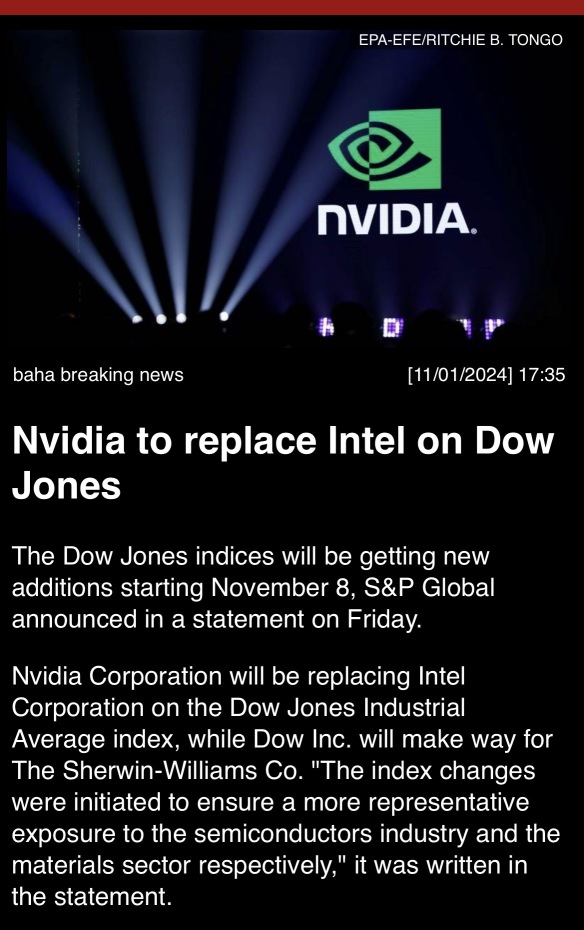

The market climbed to start the month of November despite a shockingly light non-farm labor number- the U.S. added just 12,000 jobs in the past month, 100k lower than estimated. However, the unemployment rate did not rise, and the report mentioned the disruptions caused by hurricanes and strikes as one-time events.

After 4pm ET the $S&P 500 Index (.SPX.US)$ traded +41 bps, the $Dow Jones Industrial Average (.DJI.US)$ clim...

After 4pm ET the $S&P 500 Index (.SPX.US)$ traded +41 bps, the $Dow Jones Industrial Average (.DJI.US)$ clim...

47

6

Good morning, traders. Happy Friday, November 1st. The market climbed despite a shockingly light non-farm labor number- the U.S. added just 12,000 jobs in the past month, 100k lower than estimated. However, the unemployment rate did not rise, and the report mentioned the disruptions caused by hurricanes and strikes as one-time events.

My name is Kevin Travers; here is the news and animal spirits moving markets to...

My name is Kevin Travers; here is the news and animal spirits moving markets to...

30

10

On October 30, I executed a DJT vertical spread with a strike range of $80 to $90, set to expire on November 8. This trade was carefully timed, leveraging both high implied volatility (IV) and the benefits of time decay, while based on an objective analysis of the company’s fundamentals and market sentiment.

The Trade Setup

I sold 9 units of DJT call spreads, securing a total premium of $639. After accounting for p...

The Trade Setup

I sold 9 units of DJT call spreads, securing a total premium of $639. After accounting for p...

13

3

$Dow Jones Industrial Average (.DJI.US)$ Choz Bien Zim Leo = Mad Dog Jump Off The Building 😂

$Nasdaq Composite Index (.IXIC.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$

The FOMC Press Conference is scheduled for November 7 at 2:30 PM ET/November 8 at 3:30 AM SGT&MYT/November 8 at 6:30 AM AEDT. Subscribe to join the live NOW!

Unemployment still remains at low levels by historical standards and the FOMC has expressed confidence in the job market, seeing a return to greater balance, rather than the start of ongoing weakening. Nonetheless, even rel...

The FOMC Press Conference is scheduled for November 7 at 2:30 PM ET/November 8 at 3:30 AM SGT&MYT/November 8 at 6:30 AM AEDT. Subscribe to join the live NOW!

Unemployment still remains at low levels by historical standards and the FOMC has expressed confidence in the job market, seeing a return to greater balance, rather than the start of ongoing weakening. Nonetheless, even rel...

FOMC Press Conference

Nov 7 13:30

Book

Book 6

S&P: 5,705.45 (-1.9%)

DJIA: 41,763.46 (-0.9%)

Nasdaq-100: 19,890.42 (-2.4%)

Eurostoxx: 4,827.63 (-1.2%)

U.S. crude futures: 70.53 (+4.9%)

Whether bullish or bearish, investors may gain leveraged exposure to the US market via Macquarie’s warrants over the SP500, DJIA and NDX!

📌 View the Live Matrix for the focus US index warrants.

DJIA: 41,763.46 (-0.9%)

Nasdaq-100: 19,890.42 (-2.4%)

Eurostoxx: 4,827.63 (-1.2%)

U.S. crude futures: 70.53 (+4.9%)

Whether bullish or bearish, investors may gain leveraged exposure to the US market via Macquarie’s warrants over the SP500, DJIA and NDX!

📌 View the Live Matrix for the focus US index warrants.

2

S&P: 5,705.45 (-1.9%)

DJIA: 41,763.46 (-0.9%)

Nasdaq-100: 19,890.42 (-2.4%)

Eurostoxx: 4,827.63 (-1.2%)

U.S. crude futures: 70.53 (+4.9%)

Overnight, the Nasdaq-100 and S&P 500 tumbled 2.4% and 1.9%, respectively, as Wall Street digested discouraging quarterly reports from megacap technology names, with Microsoft leading the decline as its shares slid 6.1%. Further, Meta Platforms also dropped more than 4% after it missed th...

DJIA: 41,763.46 (-0.9%)

Nasdaq-100: 19,890.42 (-2.4%)

Eurostoxx: 4,827.63 (-1.2%)

U.S. crude futures: 70.53 (+4.9%)

Overnight, the Nasdaq-100 and S&P 500 tumbled 2.4% and 1.9%, respectively, as Wall Street digested discouraging quarterly reports from megacap technology names, with Microsoft leading the decline as its shares slid 6.1%. Further, Meta Platforms also dropped more than 4% after it missed th...

2

No comment yet

️

️

EZ_money : that play i gave it's Cameltoe H. BTW

it's Cameltoe H. BTW

Bear Bear Craig OP EZ_money : Any good one in coming week?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

EZ_money Bear Bear Craig OP : always, scoping the market now.