US Stock MarketDetailed Quotes

.DJI Dow Jones Industrial Average

- 42992.210

- -333.590-0.77%

Close Dec 27 16:00 ET

43238.850High42761.560Low

43142.370Open43325.800Pre Close376.96MVolume45073.63052wk High2Rise1.10%Amplitude37122.95052wk Low28Fall43000.205Avg Price--Flatline

Good morning mooers! Here are things you need to know about today's market:

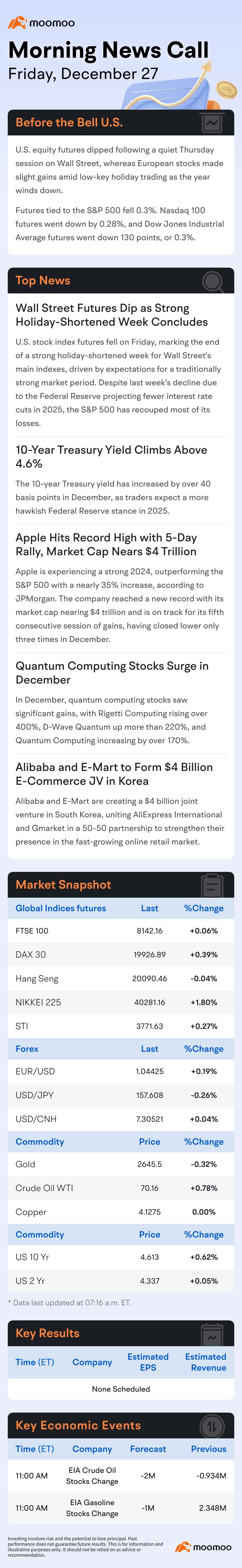

The US market decisively fell Friday, with the indexes pulling back.

The FBM KLCI climbed, fueled by ongoing robust window-dressing activities.

Stocks to watch: Swift,Asia Poly

- Moomoo News MY

Wall Street Summary

$S&P 500 Index (.SPX.US)$ 5970.84(-1.11%)

$Dow Jones Industrial Average (.DJI.US)$ 42992.21(-0.77%)

$Nasdaq Composite Index (.IXIC.US)$ 19722.03(...

The US market decisively fell Friday, with the indexes pulling back.

The FBM KLCI climbed, fueled by ongoing robust window-dressing activities.

Stocks to watch: Swift,Asia Poly

- Moomoo News MY

Wall Street Summary

$S&P 500 Index (.SPX.US)$ 5970.84(-1.11%)

$Dow Jones Industrial Average (.DJI.US)$ 42992.21(-0.77%)

$Nasdaq Composite Index (.IXIC.US)$ 19722.03(...

22

1

13

Columns AU Morning Wrap | ASX 200 opens lower with a cautious market sentiment as 2024 comes to an end

G'day, mooers! Check out the latest news on today's stock market!

• U.S. markets were driven lower by tech giants.

• Australian stocks open slightly lower.

• Stocks to watch: STO, WDS, etc.

Wall Street Summary

On Friday, the stock market experienced a significant decline across major indexes. Despite $Apple (AAPL.US)$reaching a record high of $260 per share on Thursday, just shy of a $4 trillion market capi...

• U.S. markets were driven lower by tech giants.

• Australian stocks open slightly lower.

• Stocks to watch: STO, WDS, etc.

Wall Street Summary

On Friday, the stock market experienced a significant decline across major indexes. Despite $Apple (AAPL.US)$reaching a record high of $260 per share on Thursday, just shy of a $4 trillion market capi...

5

1

Global markets

US indices closed sharply lower, DJ (-0.77%), S&P500 (-1.11%) and Nasdaq (-1.49%).

The higher the VIX, the worse the risk settlement. Powell hawkish language 10 days ago pushed VIX to almost 30% and then VIX subsided to sub-15 level whereby market only price in 1.5 times rate cut of 25 bps in year 2025. Last Friday, VIX rebounded to 18 level due to risk off mode before retreating to 15.92%.

Bloomberg source: VIX graph

Malaysia markets

Local...

US indices closed sharply lower, DJ (-0.77%), S&P500 (-1.11%) and Nasdaq (-1.49%).

The higher the VIX, the worse the risk settlement. Powell hawkish language 10 days ago pushed VIX to almost 30% and then VIX subsided to sub-15 level whereby market only price in 1.5 times rate cut of 25 bps in year 2025. Last Friday, VIX rebounded to 18 level due to risk off mode before retreating to 15.92%.

Bloomberg source: VIX graph

Malaysia markets

Local...

+2

News Highlights

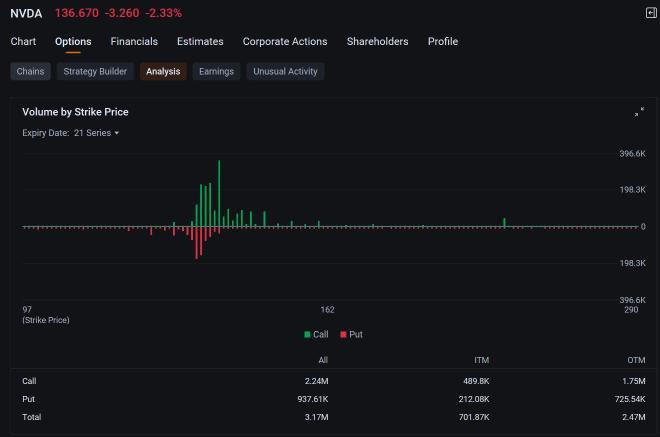

1. Shares of $NVIDIA (NVDA.US)$ slid 2.09% to $137.01 Friday, on what proved to be an all-around rough trading session for the stock market, with the $S&P 500 Index (.SPX.US)$ falling 1.11% to 5,970.84 and $Dow Jones Industrial Average (.DJI.US)$ falling 0.77% to 42,992.21.

This was the stock's second consecutive day of losses.

Nvidia closed $15.88 short o...

1. Shares of $NVIDIA (NVDA.US)$ slid 2.09% to $137.01 Friday, on what proved to be an all-around rough trading session for the stock market, with the $S&P 500 Index (.SPX.US)$ falling 1.11% to 5,970.84 and $Dow Jones Industrial Average (.DJI.US)$ falling 0.77% to 42,992.21.

This was the stock's second consecutive day of losses.

Nvidia closed $15.88 short o...

+2

38

8

11

Happy weekend investors! Welcome back to Weekly Buzz where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

The week was slow in terms of news and trade volume, but that did not stop investors from pushing $Apple (AAPL.US)$ to new records, a rally that fizzled out by the end of the week. After multiple down sessions, it looks like...

Make Your Choice

Weekly Buzz

The week was slow in terms of news and trade volume, but that did not stop investors from pushing $Apple (AAPL.US)$ to new records, a rally that fizzled out by the end of the week. After multiple down sessions, it looks like...

+7

72

33

5

The market decisively fell Friday, with the indexes pulling back. On Thursday, $Apple (AAPL.US)$ hit an all-time high of $260, just below the $4 T market cap. Friday, the market pulled back, with other big tech names joining Apple in pilling down indices. It is looking bleak for a "Santa Clause Rally" that sees the last seven sessions or so of the trading year end in an overall gain.

After the 4 pm close, the $Dow Jones Industrial Average (.DJI.US)$ fell 0.77...

After the 4 pm close, the $Dow Jones Industrial Average (.DJI.US)$ fell 0.77...

37

7

7

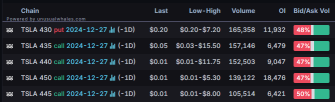

$NVIDIA (NVDA.US)$, $Tesla (TSLA.US)$, $Apple (AAPL.US)$, $Palantir (PLTR.US)$ and $Advanced Micro Devices (AMD.US)$ attracted the heaviest trading volume among stock options as holders exit zero-days-to-expiration (0DTE) options.

Mega cap tech fell Friday, dragging the $Nasdaq Composite Index (.IXIC.US)$ and the $S&P 500 Index (.SPX.US)$ as liquidity thins amid a holiday-shortened trading week. Nvidia's decline also weighed on...

Mega cap tech fell Friday, dragging the $Nasdaq Composite Index (.IXIC.US)$ and the $S&P 500 Index (.SPX.US)$ as liquidity thins amid a holiday-shortened trading week. Nvidia's decline also weighed on...

79

14

11

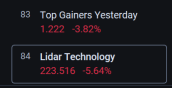

Happy Friday, December 27th. The market decisively fell Friday morning, with the indexes pulling back. Thursday, $Apple (AAPL.US)$ hit an all-time high price of $260, just below $4T market cap.

The market turned around, and mag seven stocks were leading the Dow lower Friday. Ten out of 11 S&P 500 sectors were lower.

Within industry themes tracked by moomoo, Lidar Technology was leading the market lower, followed by "Top Gainers Yester...

The market turned around, and mag seven stocks were leading the Dow lower Friday. Ten out of 11 S&P 500 sectors were lower.

Within industry themes tracked by moomoo, Lidar Technology was leading the market lower, followed by "Top Gainers Yester...

23

3

3

$Dow Jones Industrial Average (.DJI.US)$ short until 20 jan 2025. This is based on analysis and let me know those want further details

2

No comment yet

103353896 : ok