No Data

.JPXN400 JPX-Nikkei Index 400 (© JPX Market Innovation & Research, Inc., Nikkei Inc.)

- 25296.100

- +73.890+0.29%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

At the end of the term, Institutions are mainly focused on rebalancing.

The Nikkei Average rebounded for the first time in four trading days, closing at 37,780.54 yen, up 172.05 yen (with an estimated Volume of 1.6 billion shares). Following the rise in the USA market, buying was led by semiconductor stocks and export-related stocks, which temporarily widened gains to 38,115.65 yen. However, at the recent resistance level, conflicting sentiments emerged, and after the initial wave of buying, the market gradually became more stagnated. Advantest <6857>, which started with buying, turned to decline early on, and as the afternoon session began, it widened its losses.

Yomeishu Manufacturing is updating to a new high [New high and new low update stocks].

The new high update stocks on the Tokyo Stock Exchange Main Board include Nippon Steel & Sumitomo Metal Mining <1515> and Daiwa House Industry <1925> for 31 stocks. The new low update stocks on the Tokyo Stock Exchange Main Board include Shindengen Holdings <6844> and Anbis Holdings <7071> for 2 stocks. "Tokyo Stock Exchange Main Board" "Tokyo Stock Exchange Standard" "Tokyo Stock Exchange Growth" new highs new lows new highs new lows new highs new lows 03/2531232212603/2444456115303/2187342414303/19622360

Nikkei Rises 0.5%, Led by E-Commerce, Videogame Stocks -- Market Talk

Japanese Shares Edge Higher On Easing Tariff Fears

Stocks that moved and those that were traded in the front market.

*Mimaki Engineering <6638> 1649 +178 announced an increase in Dividends financial estimates. *Double Scope <6619> 249 +18 is looking at the good earnings from China's BYD and the rise in Tesla stocks, among others. *Intermestic <262A> 1770 +112 there are no particular materials observed, but it might be re-evaluated as a recent IPO stock with a weak price. *MonotaRO <3064> 2854.5 +154.5 it seems that a Shareholder meeting is being held today. *Nomura M

Disclosure of materials regarding the JIG-SAW business plan and growth potential.

On the 24th, JIG-SAW <3914> disclosed materials related to its business plan and growth potential, clarifying that its growth strategy focuses on further expansion in the area of data control centered on IoT and generative AI. Over the past decade, the company has experienced 40 consecutive quarters of year-on-year growth in monthly subscription sales, maintaining robust profit retention and utilizing it for future growth investment. From 2023 onwards, it is positioned in the 'EXG (Index ETF Growth)' phase, aiming for 2024.

Comments

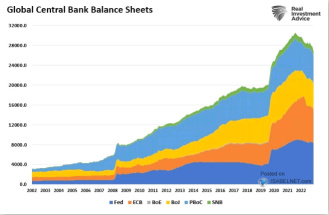

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.