No Data

.JPXN400 JPX-Nikkei Index 400 (© JPX Market Innovation & Research, Inc., Nikkei Inc.)

- 24789.370

- +246.470+1.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Toyo Suisan --- Continued rise, rated upgrade by European securities evaluating the progress of transformation etc.

Continued increase. UBS Securities has upgraded its investment rating from 'neutral' to 'buy' and raised its target stock price from 10,300 yen to 11,700 yen. It seems to be enhancing its evaluation due to the possibility of the company's transformation not only yielding returns, but also delving into business transformation, and assuming that North America will continue to grow healthily without excessive competition. It has revised upwards the performance forecast from the fiscal year ending March 2026, and also seems to have raised the valuation. They also consider the new medium-term plan for March 2025 as a catalyst.

Kobayashi Pharmaceutical Co., Ltd. - significant increase, upgrading to buy recommendation by domestic securities firms based on the assessment of resolving the red koji issue.

Marked improvement. Mizuho Securities has upgraded its investment rating from 'hold' to 'buy' and raised its target stock price from 6300 yen to 6400 yen. They determine that the red mold issue is heading towards resolution, and anticipate a full-fledged resumption of business activities from December 2025 onwards. They expect management transparency through management restructuring, efficient use of advertising costs, and anticipate new developments. They anticipate an operating profit of 25.4 billion yen for the December 2025 period, a 5.5% increase from the previous period.

Meiji HD --- Selling first, announced the implementation of a stock offering by major financial institutions.

Selling leads. The announcement last weekend included a sale of 12.73 million shares and an additional sale of up to 1.91 million shares due to over-allotment. The sellers are financial institutions, including major shareholders such as Resona Bank, and the sale price will be determined between December 3 and December 6. This is part of a policy to reduce shareholding in order to enable active restructuring of the shareholder composition by providing smooth selling opportunities. Caution is being exercised regarding the short-term supply and demand impact.

Nissho, Nichias etc (additional) Rating

Upgraded - bullish Code Stock Name Brokerage Firm Previous Change After -------------------------------------------------------------- <4967> Kobayashi Pharmaceutical Mizuho "hold" "buy" <6481> THK City "2" "1" <7186> Concordia JPM "Neutral" "OverW" <7202> Isuzu Mizuho "hold" "buy" Downgraded - bearish Code Stock Name Brokerage Firm Previous Change After -----

Mitsui Chemicals - Significant continued growth, positively received the announcement of share buyback and improvements in capital efficiency.

Significant gains. It has announced the implementation of share buybacks last weekend. It aims to acquire up to 3.2 million shares, equivalent to 1.68% of the issued shares, with a cap of 10 billion yen. The acquisition period is from November 25th to February 28th, 25 years. Among them, it plans to conduct buyback commission at a maximum of 2.79 million 1700 shares in off-auction trading today. Progress in reducing policy-held shares is seen as a move towards improving capital efficiency. Furthermore, a management overview session is scheduled for the 26th.

November 25th [Today's Investment Strategy]

[FISCO Selected Stocks] [Material Stock] San-Ai Kaken <4234> 504 yen (11/22) Engaged in packaging materials such as lightweight packaging materials, release paper, adhesive tape base materials. It was announced that they will implement a share buyback of up to 1 million shares, equivalent to 9.5% of the issued shares, and an amount of up to 0.6 billion yen. The acquisition period is from November 25, 24 to October 31, 25. On November 25th, they will entrust the buying in the Tokyo Stock Exchange's off-auction own share buyback trading (ToSTNeT-3) in 24.

Comments

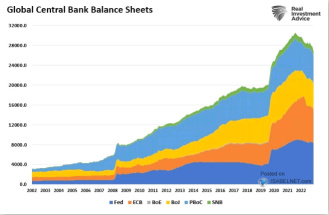

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.