No Data

.JPXN400 JPX-Nikkei Index 400 (© JPX Market Innovation & Research, Inc., Nikkei Inc.)

- 24972.010

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

No Data

News

Attention is focused on the reaction to Toh Elec's financial results.

[Stock Opening Comments] On the 13th, the Japanese stock market is likely to develop in a way that emphasizes the firmness after starting with a focus on selling. The U.S. market on the 12th saw the Dow Jones Industrial Average fall by 382 points, while the Nasdaq was down by 17 points. Amid continued buying on expectations of policies by the Trump administration, short-term overheating is being cautious, with profit-taking sales prevailing. The rise in long-term U.S. interest rates backgrounded by improving economic outlooks and easing expectations of rate cuts also became a burden. In addition, the day after, the October U.S. consumer price index.

JFEHD, Japan Catalyst, etc. [List of stock materials from the newspaper]

JFE Engineering, under JFE Holdings<5411>, sets its target for the fiscal year ending March 2028 at the highest level ever, with an order amount of 800 billion yen (Nikkan Kogyo front page) - Agrocane Sho<4955>: Idemitsu Kosan launches a TOB at 23 billion yen to expand its agrochemical business (Nikkan Kogyo page 3) - Toyo Engineering<6330> collaborates with a Thai company to promote decarbonization of plants (Nikkan Kogyo page 3) - Nippon Shokubai<4114> acquires a JSR subsidiary to strengthen waterproof materials, etc. (Nikkan Kogyo page 3) - Tohoku Electric Power<9506>: Higashidori Nuclear Power Plant No. 2

Attention is on Tokyo Electron and SoftBank Group, while Koss Corp and gan ltd may be sluggish.

In the U.S. stock market on the 12th, the dow jones industrial average closed down 382.15 points at 43,910.98, the nasdaq composite index was down 17.36 points at 19,281.40, and the Chicago Nikkei 225 futures closed at 39,260 yen, down 150 yen from the Osaka daytime comparison. The exchange rate was 1 dollar = 154.60-70 yen. In the Tokyo market today, SoftBank Group <9984> extended profits from the first quarter's 225.6 billion yen with pre-tax profit for the upper period of 1 trillion 461.1 billion yen, achieving a 50.5% increase in cumulative operating profit for the third quarter.

List of converted stocks (Part 2) [List of converted stocks for Parabolic Signal]

○ List of stocks to sell and convert in the market Code Company Name Closing Price SAR Tokyo Main Board <1762> Takamatsu G 2903 2979 <1773> YTL6981 <1833> Okumura Group 39254395 <1882> Towa Michi 12371309 <1888> Waku Tsuchi Ken 34953700 <2150> Carenet 648688 <2217> Morozov 45804675 <2384> SBSHD 24082480 <2

List of Conversion Stocks (Part 1) [List of Parabolic Signal Conversion Stocks]

● List of buy conversion stocks market Code Stock name Closing price SAR TOPIX main board <1333> Maruha Nichiro 2970 2855 <1429> Japan Aqua 8137 71 <1433> Bestella 9258 87 <1663> K & O Energy 3095 3035 <1808> Haseko 1809 1882 <1911> Sumitomo Forestry 5867 5505 <2170> LINK & M 5565 37 <2181> Perse

List of stocks with cleared clouds (Part 2) [Ichimoku Kinko Hyo: List of Stocks with Cleared Clouds]

○List of Breakout Stocks in the Market Code Stock Name Closing Price Lead Span A Lead Span B Tokyo Main Board <1882> ToyoDoro 1237 1375.5 1239 <1968> Taihei Den50305341.255032.5<2127> Japan M&A658662.25722<2181> Persol HD243268.25244.5<2229> Calbee31393381.25

Comments

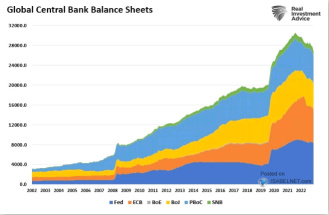

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.