No Data

.JPXN400 JPX-Nikkei Index 400 (© JPX Market Innovation & Research, Inc., Nikkei Inc.)

- 24433.610

- +174.500+0.72%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

The willingness to buy on dips is strong when prices fall below 38,000 yen.

The Nikkei average rebounded for the first time in three days. It closed at 38,349.06 yen, up 214.09 yen (volume approx. 1.68 billion shares) at the end of trading. Selling pressure dominated from the beginning due to the previous day's decline in US stocks, causing the index to drop to 37,801.62 yen shortly after the start of trading. Subsequently, moves to buy back tech shares intensified, especially triggered by reports from US media that "US semiconductor regulations on China will not be stricter than before", leading to a turnaround in the market and an expansion of gains towards the afternoon session.

Nikkei average rebounds for the first time in 3 days, turning around with the rise of Toshiba Electronics.

On the 27th, the US stock market fell back. The dow inc averaged a decline of $138.25 to end at $44,722.06, while the nasdaq dropped 115.10 points to finish at 19,060.48. It opened softly due to caution near the past high. The dow showed a temporary rise, boosted by strong earnings from some retail companies, but selling emerged out of concerns about the economic and corporate performance impact from the additional tariff plan proposed by the next president, Trump, leading to a decline. The nasdaq faced excessive expectations regarding AI.

Haseko Corporation has set a new high.

The new high update stocks on the Tokyo Stock Exchange main board include 13 stocks such as Haseko Corporation <1808> and Dai-do Group Holdings <2590>. The new low update stocks on the main board include 31 stocks such as Tama Home <1419> and Meiji Holdings <2269>. "Tokyo Stock Exchange main board" "Tokyo Stock Exchange standard" "Tokyo Stock Exchange growth" New highs New lows New highs New lows New highs New lows 11/28 1331 1328 6911/27 2358 1829 7211/26 27.

Obayashi Corporation, Kajima, etc. (additional) Rating

Upgrade - bullish Code Stock Name Brokerage Firm Previous Change After ------------------------------------------------------ <1803> Shimizu Corporation Nomura "Neutral" "Buy" Downgrade - bearish Code Stock Name Brokerage Firm Previous Change After ------------------------------------------------------ <1801> Taisei Corporation Nomura "Buy" "Neutral"

T&D HD etc. continue to rank high, and there are expectations for enhanced shareholder returns following the briefing session.

T&D HD <8795> has ranked in (as of 10:32). There is a significant rebound. A briefing session was held the previous day, leading to expectations for strengthened shareholder returns. Regarding excess capital, which has not been specifically mentioned before, it is now stated to be approximately 330 billion yen, aiming to utilize it effectively through growth investments and shareholder returns. An increase in share buybacks is anticipated. Volume change rate ranking [as of November 28, 10:32] (average volume over the last 5 days.

"Hidden real estate stocks," hedge funds are frantically seizing "undervalued Japanese stocks."

In recent years, real estate prices in japan have skyrocketed, and companies owning real estate can reap huge profits from the difference between book value and market value, with goldman sachs estimating that there are 25 trillion yen in unrealized gains waiting to be unlocked.

Comments

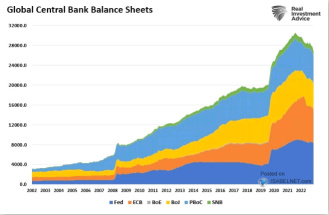

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.