No Data

.JPXN400 JPX-Nikkei Index 400 (© JPX Market Innovation & Research, Inc., Nikkei Inc.)

- 24679.450

- +299.190+1.23%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

The Nikkei average rebounds, reacting to the GPIF's policy to raise its investment yield target.

At the end of trading on the US market on November 29, the dow inc rose by 188.59 points to 44,910.65, and the nasdaq increased by 157.69 points to 19,218.17. After the presidential election, the small business confidence index rose, and it was revealed that the soon-to-be President Trump had constructive dialogues with the leaders of Canada and Mexico regarding tariff policies. Concerns eased, improving investor sentiment, leading to buying and a rise after the opening. On the day after Thanksgiving, Black Friday, retail stores offered discount sales.

Active and newly listed stocks during the morning session.

*Sanken Electric <6707> 6248 +693 received the official announcement of a large-scale share buyback. *Plus Alpha Consulting <4071> 1799 +156 announced the implementation of its own stock acquisition. *Ceres <3696> 2481 +195 cryptocurrency-related assets are generally solid today. *SBI Global Asset Management <4765> 656 +40 DMM bitcoin transferred its entrusted assets to SBIVC Trade. *Dai-ichi Life HD <875

Safe, BASE etc. (additional) Rating

Upgraded - bullish Code Stock Name Securities Company Previous After Change ----------------------------------------------------- <4912> Lion Daiwa "3" "2" <9682> DTS Daiwa "3" "2" Downgraded - bearish Code Stock Name Securities Company Previous After Change ----------------------------------------------------- <3436> SUMCO Nomura "

shiseido company,limited sponsored adr - significant decline, even though management strategy presentation held, goals viewed negatively.

Significant decline continues. A management strategy briefing was held last weekend. As quantitative targets, the average annual growth rate of revenue from the fiscal year ending December 2024 to the fiscal year ending December 2026 is set at 3%, the core operating margin for the fiscal year ending December 2026 is 7%, and ROE is 7%, etc. Additionally, the core operating profit for the fiscal year ending December 2025 is estimated to be around 35 billion yen. It is perceived that the planned figures have been lowered from previous targets, falling short of market expectations and highlighting the harshness of the current business environment.

Stocks that hit the daily limit up or down in the morning session.

■ Limit Up <1982> Hibiya General Equipment <2590> Dai-Doo Group Holdings <2726> Pal Group Holdings <3245> deere & co Life <3563> FOOD & LIFE COMPANIES <3837> Adsol Nisshin <4681> Resort Trust <5805> SWCC <5838> Rakuten bank <6080> M&A Capital Partners ■ Limit Down <1419> Tama Home <2752> Fujio Food Group

12/2 [Strengths and Weaknesses Materials]

[Bullish/Bearish Factors] Bullish factors: Dow Jones Industrial Average is up at 44910.65 (+188.59), Nasdaq Composite Index is up at 19218.17 (+157.69), Chicago Nikkei Futures is up at 38300 (+130), SOX Index is up at 4926.56 (+73.55), VIX Index is down at 13.51 (-0.39), US long-term interest rates are down, active share buybacks, request for enhancing corporate value by TSE. Bearish factors: Nikkei Average is down at 38208.03 (-141.03)

Comments

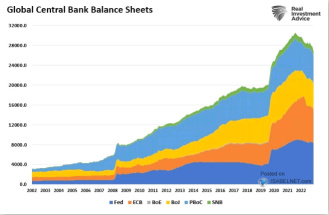

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.