No Data

.JPXN400 JPX-Nikkei Index 400 (© JPX Market Innovation & Research, Inc., Nikkei Inc.)

- 24868.310

- +122.830+0.50%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Nidec Q3 2024 GAAP EPS $0.08 Beats $0.07 Estimate, Sales $4.278B Miss $4.480B Estimate

The STAR for AI-related stocks continues, temporarily recovering to the 0.04 million yen range.

The Nikkei average rose for the fourth consecutive day, finishing the trade at 39,958.87 yen, up 312.62 yen (estimated Volume of 1.8 billion 70 million shares). In the previous day's USA market, the popularity of Artificial Intelligence (AI) related stocks continued, and the rise of technology stocks was noticeable, which led the Nikkei average to open higher. After the opening, there were moments when the increase narrowed, but the desire for Buy on dips was strong, and as the day progressed, the increase expanded, reaching as high as 40,036.07 yen, marking a return to the 0.04 million yen level for the first time in about two weeks since the 8th.

Afternoon session [Active stocks and traded stocks]

*Sumitomo Electric Industries <5802> 3057 +149 Reports of increased production of optical devices are communicated. *Medikit <7749> 2645 +44 Received sales approval for the dialysis needle "Supercath NEO" in the China market. The upper price is heavy. *GFA <8783> 686 +5 SNS media & consulting led by Takafumi Horie signs an advisory contract. Initially buying, but then losing momentum. *DWTI <4576> 136 +1 Regenerative medicine cell product DWR -2206.

The Nikkei average rose for the fourth consecutive day, driven by defense-related and electric wire stocks, temporarily recovering to the 40,000 yen range.

On the 22nd, the US stock market continued to rise. The Dow Inc closed up by 130.92 points at 44,156.73 dollars, and the Nasdaq finished at 20,009.34, up by 252.56 points. Following the announcement of large-scale AI infrastructure investments by the Trump administration, the rise in the Semiconductors Sector led to an increase after the opening. Strong performance in high-tech stocks, along with buying sentiment driven by positive earnings from major companies, further bolstered the market, which remained robust throughout the day. Due to the strong movement of the Nasdaq in the US market, Tokyo

Shimizu Construction hits a new high [new high and new low stock]

The new high price stocks on the Main Board of Tokyo Stock Exchange are Shimizu Construction <1803> and Kotobuki Spirits <2222> for a total of 23 stocks. The new low price stocks on the Main Board are Meiji Holdings <2269> and NISSIN FOODS Holdings <2897> for a total of 12 stocks. "Main Board" "Standard Board" "Growth Board" New highs New lows New highs New lows New highs New lows 01/2323121575601/2223415610301/211308831001/2076

Stocks that moved or were traded in the first half of the session.

*Haidei Hidaka <7611> 2792 +242 announced Share Buyback and increased dividends. *Mitsubishi Heavy Industries <7011> 2239 +152 is focusing on defense-related matters based on the Japan-U.S. foreign ministers' meeting, etc. *Japan Airport Terminal <9706> 5170 +345 announced an increase in domestic passenger handling facility fees. *Chikara no Minamoto HD <3561> 1135 +74 continues to see movements valuing the expansion of shareholder benefits. *SOFTBANK GROUP CO <9984> 10840 +610 in major U.S. AI infrastructure.

Comments

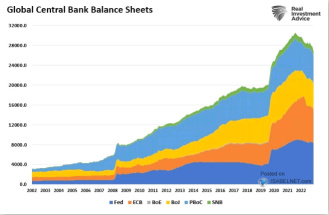

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.