No Data

.JPXN400 JPX-Nikkei Index 400 (© JPX Market Innovation & Research, Inc., Nikkei Inc.)

- 24552.070

- -187.210-0.76%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Risk Assets Endure Ongoing Setbacks: When Will They Finally Bounce Back?

The sudden drop of Fast Retailing is a burden.

The Nikkei average has fallen for three consecutive days, closing down 414.69 yen at 39,190.40 yen (estimated Volume 1.7 billion 30 million shares), below the psychological threshold of 39,500 yen. The operating profit for Fast Retailing <9983> for the September-November 2024 period announced the previous day fell below market Financial Estimates, causing the company's stock to drop nearly 8% at one point. The decline widened toward the middle of the morning session, reaching as low as 39,166.05 yen. However, due to the consecutive declines, there was buying aimed at a rebound in the afternoon session.

Afternoon session [Active stocks and traded stocks]

*7&I HD <3382> 2490 +115.5 surged sharply in the afternoon. Apollo, a U.S. investment firm, is considering an investment of up to 1 trillion 500 billion yen in MBO. *Speee <4499> 4965 -685 announced that it is necessary to sufficiently reach consensus on the Digital Payment methods (stablecoins) related business. *Oowel <7670> 953 +35 introduced equipment with a large surface riblet-shaped coating on international flights for the first time in the world. *Vitz <4440> 1052 +27 in the first quarter.

The Nikkei average has fallen for three consecutive days, influenced by a significant drop in Fast Retailing.

On the 9th, the US Stocks market was closed for the state funeral of former President Carter. The exchange rate remained stable around 158 yen per dollar. Although the US market was closed, the Nikkei average started trading down for the third consecutive day due to concerns about future sales in China reigniting after Fast Retailing <9983> announced its first-quarter financial results and saw a significant drop. Although Advantest <6857> reached a record high since its listing, the decline in the Nikkei average was more than 300 yen due to Fast Retailing alone, along with new buy materials.

Stocks that moved or were traded in the first half of the session.

*Kyukoh Pharmaceutical <4530> 4610 +566 Profit increase significantly expanded due to upward revision of earnings. *Sankyo Gosei <7888> 675 +69 The significant profit increase in the first half is highly regarded. *Sansan <4443> 2345 +146 Today, some small and medium-sized growth stocks are stable with Earnings Reports expected after the holiday. *Round One <4680> 1221 +6412 The stock price drop received in December is viewed as an overreaction. *Warabeya Nichiyo <2918> 2109 +1079 The operating profit increased in the November period.

Unicharm Corporation Sponsored ADR, Seria, ETC (additional) Rating

Downgrade - Bearish Code Stock Name Brokerage Firm Previous After -------------------------------------------------------------- <2678> Askul JPM "Neutral" "Underweight" <6146> Disco Macquarie "Outperform" "Neutral" Target Price Change Code Stock Name Brokerage Firm Previous After ------------------------------------

Comments

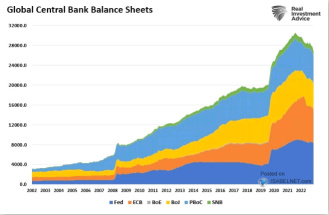

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.