No Data

.JPXN400 JPX-Nikkei Index 400 (© JPX Market Innovation & Research, Inc., Nikkei Inc.)

- 24542.900

- +123.310+0.50%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Tokio Marine Holdings, Inc. (TKOMY) Q2 2024 Earnings Call Transcript Summary

Expanding while keeping an eye on the movements of the USA market.

The Nikkei index rebounded for the first time in three days, closing at 38,283.85 yen, up 257.68 yen (with an estimated volume of 1.6 billion 80 million shares). Following the rebound of nvidia in the previous day's usa market, more stocks rose in the Tokyo market, particularly in the semiconductors sector. Additionally, buying aimed at a self-rebound in response to the previous day's declines contributed to the rise, and the Nikkei index increased to 38,420.63 yen towards the end of the morning session. However, there are movements to adjust positions ahead of the weekend, and investors want to assess the situation in Russia and Ukraine.

Asahi Kogyo Co., Ltd. is updating its high for the year [stocks with new highs and lows].

The stocks that updated new highs on the main board are Obayashi Corporation <1802> and Asahi Kogyo <1975> among 27 stocks. The stocks that updated new lows on the main board are Askul <2678> and Create SD Holdings <3148> among 12 stocks. "Main Board" "Standard" "Growth" New highs New lows New highs New lows New highs New lows 11/22 271218101491 11/21 342223138811 11/20 292823141061 11/19.

Kaijom and others continue to rank, with ongoing license agreements with Asahi Kasei Pharma serving as a clue.

Kaiom <4583> has ranked (as of 14:32). It has significantly continued to rise. After the market closed on the 20th, the company announced that it had signed an exclusive licensing agreement with Asahi Kasei Pharma for its therapeutic antibody "Humanized Anti-CX3CR1 Antibody (PFKR)," leading to a stop high yesterday. Today, the buy star continues. In addition to receiving a one-time contract fee of 0.2 billion yen, Kaiom will receive milestone payments of up to approximately 24.8 billion yen depending on the future progress of development and sales. Furthermore, after the product launch, the company will receive...

Maruha Nichiro, Chugai Pharmaceutical, etc. (additional) Rating

Upgrades - bullish Code Stock Name Securities Company Previous Change After ------------------------------------------------------- <1802>Obayashi Corporation SMBC Nikko "2" "1" <1808>Haseko Corporation SMBC Nikko "2" "1" Downgrades - bearish Code Stock Name Securities Company Previous Change After ------------------------------------------------------- <3382>

Obayashi Corporation - Firm, expected to be upgraded in domestic securities.

Steady. At SMBC Nikko Securities, the investment rating has been upgraded from '2' to '1', and the target stock price seems to have been raised from 2100 yen to 2400 yen. It appears that they are expecting a medium-term recovery in the construction profit margin, aiming to reduce the policy shareholding and achieve an optimal capital structure in order to strengthen shareholder returns. Additionally, the company's provision for construction losses balance has halved from its peak. It is assumed that after the fiscal year ending March 2027, the impact of unprofitable projects will be substantially eliminated, and the construction profit margin is expected to reach double digits for the first time since the fiscal year ending March 2021.

Comments

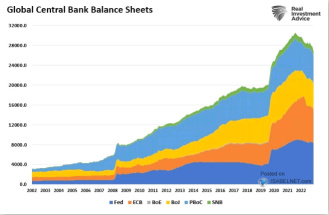

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.