No Data

.JPXN400 JPX-Nikkei Index 400 (© JPX Market Innovation & Research, Inc., Nikkei Inc.)

- 24583.160

- -57.730-0.23%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Fuyo Lease --- Implementation of Rechargeable Battery business for the grid in Chikushino City, Fukuoka Prefecture.

Furuyosougou Lease <8424> announced on the 18th a collaboration with Global Engineering (hereinafter referred to as "GL Company"), which is an equity-method affiliate, and the implementation of a grid-connected Rechargeable Battery project in Chikushino City, Fukuoka Prefecture. This is the company's first grid-connected Rechargeable Battery project not reliant on various subsidies or grants, with commercial operation scheduled to begin in July 2025. The project site is the Chikushino Tenzen Rechargeable Battery Station (Chikushino City, Fukuoka Prefecture). The rated output is 1958.4 kW, and the rated capacity is 7833.6.

The immediate stance is to Buy on dips [closing].

The Nikkei Average declined for five consecutive trading days, ending at 38,813.58 yen, down 268.13 yen (estimated Volume of approximately 2.2 billion shares). Following the perception that the results of the USA Federal Open Market Committee (FOMC) were hawkish, the major stock indices in the USA fell the previous day, leading to risk-averse selling. The Nikkei Average dipped to 38,355.52 yen shortly after the market opened. However, as the yen weakened to the mid-154 yen range against the dollar, it provided support for the market, while the Bank of Japan continued its financial measures.

The Nikkei average has fallen for five consecutive days, influenced by the decline in U.S. stocks, but the decrease in value has narrowed due to the "rate hike being put off."

On the 18th, the US Stocks market continued to decline. The Dow Jones Industrial Average fell by 1,123.03 dollars to 42,326.87 dollars, while the Nasdaq dropped by 716.37 points to 19,392.69 points. Ahead of the announcement of the Federal Open Market Committee (FOMC) results, a wait-and-see attitude strengthened, resulting in mixed trading after the opening. While the Dow average, which had been declining until the previous day, saw some buying in major stocks and rose, the Nasdaq started off slightly lower. The FOMC is expected to raise the main policy interest rate by 0.25% as anticipated.

TBS HD, NTV HD, etc. (additional) Rating

Upgraded - Bullish Code Stock Name Securities Company Previous Change After ------------------------------------------------------------ <4676> Fuji HD Nomura "Neutral" "Buy" Downgraded - Bearish Code Stock Name Securities Company Previous Change After ------------------------------------------------------------ <4293> Septeni

And Do Holdings ranks, in a capital and business partnership with Dai-ichi Life HD.

And Do Holdings <3457> has ranked in (as of 9:32 AM). It hit the upper limit. After the previous day's Trading ended, it announced a capital and business alliance with Dai-ichi Life Holdings <8750>, which has become a catalyst for buying. It will conduct a Share Buyback involving the disposal of Shares through third-party allocation. In conjunction with this, it announced a Share Buyback of 1.05 million 3000 shares, which corresponds to 5.29% of the total outstanding Shares, with a maximum amount of 1.4 billion yen. Volume change rate top [As of December 19, 09:32] (Last 5

12/19 [Strength and Weakness Materials]

[Bullish and Bearish Factors] Bullish Factors: 1 dollar = 154.70-80 yen; US crude oil Futures are rising (70.02, +0.37); active Share Buyback; request for corporate value enhancement by the Tokyo Stock Exchange. Bearish Factors: Nikkei Average has fallen (39081.71, -282.97); Dow Jones Industrial Average has dropped (42326.87, -1123.03); Nasdaq Composite Index has decreased (19392.69, -716.37); Chicago Nikkei Futures have declined (38460, -740); SOX Index has fallen (4970.98,

Comments

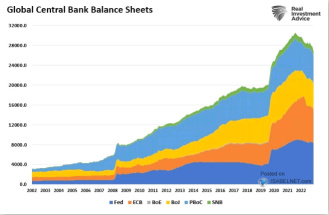

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.